The European market potential for mung beans

The European market for mung beans is still relatively small compared to other pulses, but there is growing potential for expansion. Over the past five years, imports have remained somewhat stable, but the demand for mung beans is gradually increasing. This demand is driven by several factors, including the rising interest in plant-based and high-protein foods, which both governments and health-conscious consumers promote. Increasing awareness of sustainability and environmental issues is influencing consumption, as mung beans are recognised as environmentally friendly crops with a low ecological footprint.

Contents of this page

1. Product description: mung beans

Mung beans, scientifically known as 'Vigna radiata', have been grown for thousands of years. They originated in India and became a staple across South-East Asia. Over the past few decades, their cultivation has spread to countries like Australia, the United States, and some African nations.

Despite not becoming a major commercial crop outside of Asia, the global production of mung beans has seen an increase. The total area dedicated to mung bean cultivation worldwide is approximately 7.3 million hectares, with an average annual production of 5.3 million tonnes. India and Myanmar are the leading producers, each contributing around 30% to global production. China follows with a 16% share, and Indonesia contributes 5%.

Mung beans are a short-duration crop, typically taking between 60 and 120 days to mature and produce seeds, depending on the growing conditions. When stored cool and dry, dried mung beans keep well up to 36 months after harvest. Mung beans are known for their impressive nutritional profile, containing from 17% to 26% protein, which makes them a highly nutritious substitute for animal proteins. They are also rich in essential minerals, provitamin A, and the B-complex vitamins. With their higher digestibility compared to many other pulses, mung beans are particularly beneficial for vulnerable populations such as diabetics, children and the elderly.

The beans may be eaten whole or split, or milled into flour for soups, porridge, snacks, bread and pasta. Fresh sprouts add crunch to salads and sandwiches. This versatility supports both traditional dishes and new product development.

In international trade, dried shelled mung beans, whole, skinned, or split, are classified under the Harmonised System (HS) code 071331. They are sometimes confused with urad beans ('Vigna mungo'), another variety of legume. While both types are similar, they can be distinguished by their colour: mung beans are green on the outside and yellow on the inside, while urad beans are black on the outside and white on the inside.

Figure 1: Mung beans

Source: Globally Cool, July 2025

2. What makes Europe an interesting market for mung beans?

Europe offers a promising market for mung beans, driven by several key trends that align with the demand for plant-based foods. The main driver is the increasing demand for plant-based proteins. Thanks to their high protein and low carbohydrate content, mung beans suit fitness-minded consumers and those reducing carbs. Health-conscious Europeans, including vegetarians, vegans, and flexitarians, have embraced pulses for their protein quality and digestibility.

This trend is supported by environmental concerns and is strongly supported by both the European Union and national governments, such as the Dutch government’s National Protein Strategy, which is actively promoting plant-based eating habits.

European imports of mung beans are steady

Europe is an attractive destination for mung beans because demand remains both large and stable. In 2024, Europe imported more than 33 thousand tonnes of mung beans from non-European suppliers, although this was below the 40 thousand tonne peak seen in 2021.

Most mung beans come directly from developing countries, with 13 of them each exporting over 100 tonnes. In 2024, developing countries exported 31 thousand tonnes of mung beans to Europe. While exports from developing countries peaked at 32 thousand tonnes in 2021, they dipped to about 30 thousand tonnes in 2022 before recovering to 33 thousand tonnes in 2023.

Source: Eurostat Comext and ITC Trademap, June 2025

* Developing countries following the OECD-DAC list of ODA recipients. 'Rest of the world' refers to all other countries.

Plant-based proteins become mainstream: healthy and sustainable

The demand for plant-based and healthy foods has risen worldwide in recent years, as consumers look for products that benefit their health and the environment. This trend is particularly strong in Europe. A 2024 study shows that retail sales volumes of plant-based food are growing. This trend is driving the growth of mung beans.

The global mung bean market is projected to grow by nearly 4% between 2024 and 2032, driven by several key trends:

- Rising demand for plant-based proteins, as more consumers seek alternatives to animal products;

- Increasing numbers of vegans, vegetarians and flexitarians, boosting interest in legumes like mung beans;

- Health benefits: Mung beans are rich in protein, fibre, and antioxidants, with growing awareness of their nutraceutical and nutritional properties;

- More food manufacturers are adding plant-based protein sources, including mung beans, to meet consumer demand;

- Mung beans require relatively little water, land, and energy to grow, making them an environmentally friendly crop;

- Governments are encouraging the shift toward plant-based eating through policy initiatives.

All of these drivers are equally relevant in the European context, contributing to a positive outlook for mung beans in Europe. Trends and drivers in the European market are discussed in detail in the trends section.

Tips:

- To learn more about European consumers' plant-based eating trends, read reports by the Smart Protein project: Evolving appetites: an in-depth look at European attitudes towards plant-based eating. Either select the overall report on the European level or look into country-specific reports (11 EU countries available). You can also watch Smart Protein Project webinars, either on the European level or country-specific webinars.

- To gain more insights into how to enter the European market, read CBI’s study on Entering the European market for mung beans.

- Read CBI’s tips for doing business with European buyers of grains, pulses, and oilseeds to understand how to conduct business in the European market.

3. Which European countries offer the most opportunities for mung beans?

Mung beans have never been an ingredient for traditional European cooking; classic dishes do not use them. Even so, they are entering European diets in two main ways: through modern food innovation and through ethnic cuisines. Europe’s colonial ties and later immigration introduced South Asian, Southeast Asian and African dishes, bringing mung beans with them.

This particularly holds true for the United Kingdom, which imported almost 17 thousand tonnes of mung beans from developing countries in 2024. The Netherlands follows at almost 6 thousand tonnes, offering substantial scale and an annual growth rate of about 5% between 2020 and 2024. Italy and France each imported just under 2 thousand tonnes in 2024, but their appeal lies in dynamic growth, averaging 13% and 9% per year, respectively. Italy’s imports rose by 44% in 2024, and France’s by 48%, making them the fastest-expanding markets in the region. By contrast, Germany and Belgium have seen volumes go down in recent years.

In addition to traditional bean consumption, growth can be expected from the increase in demand for healthy food, vegetarian/vegan food, and plant-based proteins. For example, in the Netherlands, the government promotes plant-based proteins and boosts bean consumption with the #BEANMEAL initiative.

Source: Eurostat Comext and ITC Trademap, June 2025

Source: Eurostat Comext and ITC Trademap, June 2025

United Kingdom: the largest market for mung beans in Europe

Historically, the United Kingdom is a major importer of pulses and remains the largest market for mung beans in Europe. Total imports reached over 18 thousand tonnes in 2024, of which a relatively stable share of more than 90% comes from developing countries.

The United Kingdom’s diverse population, including large South Asian and East Asian communities, drives the consumption of mung beans, often split as moong dal, especially in ethnic markets. The growing interest in vegan and vegetarian diets has also made mung beans popular in mainstream supermarkets.

India is the largest supplier of mung beans to the United Kingdom, providing almost 40% of total imports. Argentina followed Myanmar, with 4 thousand tonnes and 1.7 thousand tonnes in 2024, respectively. Nigeria’s exports rose from virtually zero to almost 900 tonnes in 2024. Over the 2020–2024 period, this equals a compound annual growth rate of more than 300%, highlighting the rapid expansion potential of its trade. Other substantial volumes come from China, Venezuela, Tanzania, Turkey, Australia and Uzbekistan.

In the 'Rest of the world' category, the United Arab Emirates has been a somewhat variable supplier: after exporting under 1,000 tonnes in 2020 and more than 2,000 tonnes in 2023, it now holds around 4.9% of the UK market. The United Arab Emirates is a trade hub for beans from mainly India and Eastern Africa.

British consumers are increasingly embracing plant-based diets, which has driven demand for mung beans, particularly dried beans used as a versatile source of plant protein. Supermarkets like Tesco offer a range of mung bean products, including dried beans and sprouting seeds, while Sainsbury’s and RAYA only stock dried mung beans. These legumes can also be found in organic online shops like BuyWholefoodsOnline, Forest Whole Foods and Planet Organic, as well as ethnic shops specialised in African, Caribbean, and South-Asian cuisines. Such wide availability reflects and supports the UK’s diverse culinary traditions and multicultural population.

British companies that supply these beans are often specialised in ethnic foods. For example, TRS is a leading supplier of ethnic foods in the United Kingdom and supplies mung beans to ethnic stores. Other British companies include Natco and world food wholesale specialist Surya Foods (Laila brand).

Figure 5: Mung beans in an organic webshop in the United Kingdom

Source: Globally Cool, July 2025

The push for plant proteins has led European companies to innovate with mung beans. One example is a €13 million partnership between the UK-based Vegan Food Group and Eat Just to produce the mung bean-based JUST Egg in Europe. This collaboration will significantly expand the availability of mung-bean egg alternatives across the continent.

The Netherlands: hub for mung bean sprouts

The Netherlands is a global trade hub and a large producer of mung bean sprouts. In 2024, total imports reached nearly 6 thousand tonnes, with developing countries supplying 90% of that volume. The peak in import volumes in 2021 was primarily due to an unusual peak in net imports of 4.7 thousand tonnes. Uncertainties during the COVID-19 and post-COVID-19 period, coupled with the changing political situation in Myanmar, made Dutch companies buy more mung beans than necessary. The following year, 2022, saw a much lower net import volume, only 2.5 thousand tonnes.

The Netherlands imports most of its mung beans from Myanmar (2.8 thousand tonnes, 43% of total imports in 2024) and Uzbekistan (860 tonnes, 13% in 2024), then redistributes a large portion of this supply across Europe. Other substantial volumes come from India (700 tonnes in 2024), China (490 tonnes), the United Arab Emirates (270 tonnes), and Venezuela (230 tonnes).

Mung bean sprouts, known in Dutch as 'taugé', hold a firm place in Dutch cooking thanks to long-standing Indonesian and Chinese influences. They appear in many Asian dishes popular in the Netherlands, and today’s focus on healthy, plant-based diets means fresh sprouts are on sale in every supermarket. Fresh sprouts are also exported to neighbouring markets in Belgium, Germany, Denmark, France, and the United Kingdom.

Some initiatives have been taken to develop mung bean production in the Netherlands. For example, since 2024, an EFRO East-funded project has been testing how best to grow mung beans in the Netherlands and how to use them in new food products.

In addition to sprouts, dried and cooked mung beans are sold through various retail stores in the Netherlands. The mainstream supermarket chain Albert Heijn offers canned mung beans, while the organic Ekoplaza chain offers 500-gram packs of dried mung beans. Stores with extensive ethnic-food sections, whether they are dedicated ethnic retailers or mainstream retailers with a large ethnic section, stock dried varieties as well. Valle del Sole is a Dutch brand with many packed dried and canned beans, including dried mung beans.

Webshops focused on world/ethnic foods or natural/health ingredients typically also offer mung beans. Examples are Asian Foodlovers, Tjin’s International Foodstore, and De Kruidenbaron for the ethnic and world food market, and De Notenshop and Pit & Pit for the health ingredients market. Organic retailers, such as Udea (Ekoplaza shops), also stock dried mung beans.

Products containing mung beans are available: Ochama lists a mung-bean ice cake, while Glutenvrijewebshop offers mung bean chips. Mung beans are sometimes also sold under the name 'Katjang Idjoe' and are dedicated to the large Indonesian diaspora in the Netherlands.

Figure 6: Mung beans on display on the shelves of an ethnic food store in the Netherlands

Source: Globally Cool, July 2025

Within the European Union, the Netherlands dominates the import of organic mung beans, with a total of between 480-800 tonnes per year. The supply is dominated by China (more than 60% of supply), though volumes from China declined after 2020 (550 tonnes) and stabilised at lower levels. Türkiye emerged as the second-largest supplier, peaking in 2021 (300 tonnes) before declining steadily to 100 tonnes by 2024. Smaller but growing contributions came from Uzbekistan (176 tonnes in 2023) and India (between 20-60 tonnes per year), while Argentina supplied small, irregular volumes.

Italy: plant-based trends boost mung bean consumption

Italy has steadily increased its imports of mung beans, becoming the third-largest European importer of the legume. Imports have grown from 1.7 thousand tonnes in 2020 to 2.4 thousand tonnes in 2024, a compound annual growth rate of 8.7%. In 2024, just over 81% of these imports came from developing countries, with Myanmar supplying 22% (540 tonnes) and Venezuela 17% (420 tonnes) of total imports. Argentina has also played a role, providing a steady but modest supply, fluctuating between 300 and 400 tonnes over the past few years. The United Arab Emirates, acting as a re-exporter of mung beans from Asia, saw a sharp increase in supply in 2021 (539 tonnes), but its exports have since decreased significantly. Smaller volumes come from Tanzania, Uzbekistan and Madagascar.

Together with the Netherlands, Italy is one of two EU countries that import organic mung beans. Italy’s import volume is ten times smaller than the Dutch import volume. Like the Netherlands, Italy’s supply is also dominated by China. Other suppliers are Argentina, Türkiye, Uzbekistan, and Ukraine; however these countries have not become a regular supplier to Italy yet.

Mung beans are not part of Italy’s traditional cuisine, as Italians have historically preferred other beans and lentils in their cooking. However, the growing interest in plant-based and health-conscious diets has driven a rise in mung bean consumption, mainly due to their impressive nutritional profile.

Food producers are already responding to this trend. Felicia, for example, sells gluten-free pasta with mung bean flour to attract protein-conscious shoppers. Another example is Germogliamo, a company cultivating mung bean sprouts on a commercial scale. In addition, WeCup offers Mediterranean Fagioli Mung, an instant meal that combines local culinary traditions with the rising demand for plant-based, protein-rich and gluten-free products.

This shows that food producers are adapting to trends and incorporating mung beans into Italy’s food culture. While mung beans remain a niche ingredient in Italy, their growing use in pasta and health-focused products suggests that demand will continue to rise in the coming years.

France: demand driven by rising interest in plant-based foods

France has shown steady growth in mung bean imports, increasing from 2.3 thousand tonnes in 2020 to almost 3 thousand tonnes in 2024, an average annual growth rate of 5.5%. Imports rose moderately in 2021 and 2022 (2.4% and 3.0%, respectively), before declining by 20% in 2023 due to a sharp reduction in imports from India and Italy. French mung bean imports bounced back in 2024 with a 48% increase, indicating that the long-term upward trend in consumption is continuing.

Developing countries have become key suppliers of mung beans to France, with a 66% share of French imports in 2024. Myanmar stands out as a key supplier, providing 1.5 thousand tonnes of mung beans and showing a fast growth of 27% per year. Thailand is the second-largest developing country supplier (291 tonnes), while other developing countries supply relatively small volumes to France. Important suppliers of re-exported mung beans are the Netherlands (419 tonnes), Portugal (331 tonnes), and Spain (96 tonnes).

France’s growing demand for mung beans is largely driven by rising interest in plant-based and organic foods. Mung beans are becoming more common in ethnic dishes such as salads, soups and stir-fries. According to mainstream media, such as Vogue France, their popularity is also boosted by their versatility in international cuisine and support from well-known advocates of plant-based diets. As awareness grows, mung beans are increasingly seen as a sustainable, healthy choice, contributing to their spread across diverse food applications, especially in France’s health-focused market.

Major supermarket chains in France, such as Carrefour, stock a range of mung bean products, including sprouted mung beans in glass jars and mung bean vermicelli. Auchan also offers canned sprouted mung beans. Organic dried mung beans from the French brand Markal, which specialises in natural and organic foods, are available in physical and online shops. Meanwhile, Primeal produces mung bean sprouts, catering to the rising demand for locally sourced, organic and sustainable products.

Germany: rising demand for mung beans

Germany’s mung bean market shows signs of recovery in 2024, with total imports increasing by more than 11% compared to 2023. This shift comes after several years of decline and suggests renewed interest in mung beans among German consumers and food businesses. While overall volumes remain lower than in previous years, the growth in 2024 signals fresh potential for market expansion in one of Europe’s largest economies.

Exporters from developing countries are particularly well-positioned to benefit from this shift. Although total import volumes from developing country suppliers fell from 1.7 thousand tonnes in 2020 to just under 950 tonnes in 2024, their share of the German market rose to almost 50%. This increase comes as imports from traditional sources, particularly within the EU, have declined more steeply, creating new space for non-EU exporters.

In 2024, Asian suppliers are gaining ground. India expanded its exports to 240 tonnes, and Vietnam nearly doubled its shipments to 130, demonstrating strong progress. This reflects growing interest in sourcing diversity and the rising competitiveness of developing country producers in this recovering market. While some exporters, such as Myanmar, experienced declines, the overall shift in supply dynamics offers promising opportunities for Asian and non-EU suppliers.

Germany is Europe’s largest market for organic-certified food products. Specialist retailers such as Alnatura carry dried mung beans and products with mung beans and sprouts as ingredients, such as spring rolls filled with mung bean sprouts in their assortment. Other online food retailers like the health food ingredients specialist KoRo Drogerie, organic webshop Pikantum, and e-Biomarkt also stock dried mung beans. KoRo’s and Pikantum’s product information describes the product's primary use for making sprouts at home.

The growing emphasis on healthy and sustainable eating is fuelling innovation in mung bean-based products. One example is Pastazeit’s mung bean fusilli, which caters to the rising demand for plant-based protein. As interest in organic, plant-based foods continues to grow, Germany’s leadership in the organic market positions it as a growing market for both whole and processed mung bean products.

Belgium: from trade hub to niche market

Belgium’s mung bean imports have moved up and down sharply over the past five years. Imports surged from 5.4 thousand tonnes in 2020 to 10 thousand tonnes in 2021, a sharp, short-lived demand and price spike caused by COVID-19 and the unstable situation in Myanmar. Since then, volumes have declined yearly: dropping to just under 4 thousand tonnes in 2022, falling again to around 2 thousand tonnes in 2023, and reaching 1.3 thousand tonnes in 2024. Across the 2020–2024 period, this represents an average annual decline of about 30%.

Most of Belgium’s current supply still comes from developing countries, accounting for about 65% of total imports. One of the most remarkable changes came from Venezuela, which supplied almost no mung beans until 2023. Exports then suddenly rose to around 220 tonnes and remained stable in 2024. Once a key supplier, Myanmar peaked at 680 tonnes in 2023, but sharply declined to under 200 tonnes the following year. Similarly, Argentina experienced fluctuations. After a drop in 2023, its exports partially recovered to 151 tonnes in 2024.

Most mung beans imported into Belgium are not consumed locally, but are re-exported, often after being processed into bean sprouts. Several specialist sprout producers operate in Belgium, including Culivair and Greenyard’s fresh produce arm, Univeg Belgium. In addition, Belgium hosts major frozen vegetable companies that feature mung bean sprouts in their product lines. Greenyard Frozen (formerly known as Pinguin) supplies bulk frozen mung bean sprouts, serving the growing demand for convenience products in the European food service and retail sectors.

Domestic demand for dried mung beans in Belgium remains modest; most shoppers buy them only in Asian grocery stores and/or for specific recipes. By contrast, sprouted mung beans, sold locally as 'sojascheuten' or 'soja', have become an essential of the fresh produce aisle. Colruyt lists organic sprouted mung beans as a stand-alone item, while Delhaize stocks them in ready-to-cook mixes and also sells Bonduelle’s canned mung beans, giving consumers an alternative to fresh sprouts for salads or soups.

Figure 7: Canned mung beans in the Belgian market

Source: Globally Cool, July 2025

Tips:

- Visit the websites of major European supermarkets to see whether mung bean products are available and what types are offered. Identify the brands currently on the shelves; this can provide useful insights into market demand and help you identify potential trade channels and buyers. Leading supermarket chains include Tesco (the United Kingdom), Delhaize (Belgium), Albert Heijn (the Netherlands), Edeka (Germany), Coop (Italy), and Carrefour (France).

- Attend international trade fairs such as SIAL, Anuga and Biofach to stay informed about market trends across Europe and to connect with potential buyers of mung bean products.

4. Which trends offer opportunities or pose threats in the European mung bean market?

Like other pulses, mung beans are now seen as both healthy and sustainable. They meet the rising demand for plant-based, protein-rich foods among consumers who prioritise health and the environment. The trends outlined below offer both opportunities and challenges for the European mung bean market.

Rise of plant-based and healthy foods

Demand for plant-based, protein-rich products is rising steadily across Europe, driven by growing health awareness. As more consumers reduce their meat intake to pursue healthier lifestyles, interest in alternative protein sources, such as mung beans, is increasing.

Mung beans are a strong fit for this trend, offering a rich source of plant-based protein that appeals to a wide range of consumers, particularly vegetarians, vegans, and flexitarians. The number of vegans in the EU alone is projected to grow from approximately 6.62 million in 2023 to 8.25 million by 2033, further reinforcing the market potential for products like mung beans. This shift is supported by government policies across Europe. For example, the Netherlands aims to ensure that by 2030, at least 50% of the average diet comes from plant-based protein sources.

High-protein diets are also gaining traction, especially among fitness enthusiasts and health-conscious consumers. Mung beans are well-suited to meet this demand, offering a rich source of plant-based protein that supports muscle development and overall wellness. Research increasingly confirms that plant-based proteins, such as those found in mung beans, are just as effective as animal proteins for supporting health and fitness, challenging the misconception that animal proteins are superior.

Social and environmental sustainability

The popularity of plant-based diets is driven not only by health goals, but also by growing awareness of environmental sustainability. Mung beans, like other legumes, require less water, land, and energy to produce than animal-based proteins, making them a more sustainable option. As European consumers become more mindful of the environmental footprint of their food, demand is increasing for plant-based products with a lower ecological impact.

Mung beans offer several environmental advantages. Their cultivation generates fewer greenhouse gas emissions, uses less water, and leaves a smaller carbon footprint compared to livestock farming. In addition, mung beans can thrive in various climates and contribute to soil health through nitrogen fixation, which reduces the need for synthetic fertilisers.

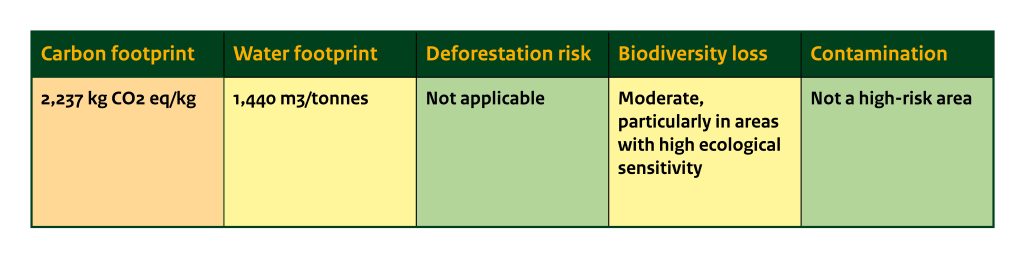

Figure 8: Environmental risks for mung beans (green = low risk, yellow = moderate risk, orange = relatively high risk)

Source: ScienceDirect, 2025. Comparative analysis of environmental impact and energy consumption in sesame and mung bean production using life cycle assessment and data envelopment analysis.

Organic mung beans

Most mung beans sold in Europe are not organic. Organic mung beans are a small part of the market, usually less than 10%. This follows a similar pattern seen with other pulses. Within Europe, the largest organic markets for mung beans are the United Kingdom, the Netherlands, and Germany.

Cono Agriculture from Argentina has successfully used its sustainability profile to access European niche markets. As part of its wider sustainability efforts, the European Commission is encouraging greater self-sufficiency in protein-rich crops among EU member states. This includes promoting the consumption of pulses, such as mung beans, within the EU’s broader agricultural strategy.

Mung beans are a natural fit for these goals, thanks to their low environmental impact and rising popularity as a plant-based protein source. While increased local production could bring more competition, Europe still relies on imports to meet demand, and it shows a clear preference for suppliers with sustainable practices.

Popularity of ethnic and world foods

Across Europe, demand for ethnic and world foods is growing rapidly. Analysts project that the region’s ethnic food sector will be worth around $25 billion by 2030. Within this segment, Asian cuisine is a major growth driver. A recent market review highlights strong interest in authentic flavours from China, Japan, India, Thailand, Korea and Vietnam. The increasing availability of key ingredients in both mainstream supermarkets and specialist stores supports this.

Mung beans are well-positioned to benefit from this trend, as they are a core ingredient in many of these cuisines. Popular dishes like Indian moong dal curry, Thai pad Thai, and Vietnamese pho rely on whole mung beans or bean sprouts. As more European households explore these meals at home, mung beans are shifting from niche items to everyday staples.

This presents a twofold opportunity for suppliers. First, baseline demand is rising as global dishes become part of everyday European diets. Second, distribution channels are expanding, not only through a growing number of Asian supermarkets, but also via major retail chains now offering dried mung beans, canned varieties, and fresh sprouts.

Together, these trends point to sustained and diversified growth in European demand for mung beans and related products over the coming years.

New opportunity: mung beans in animal feed

An emerging opportunity is using mung beans in animal nutrition. While this is not yet common in Europe, mung bean by-products (broken or weather-damaged beans) are fed to poultry and pigs in Asia as a high-protein feed. Europe hasn’t used mung beans in feed significantly, mostly due to availability and cost. However, with a push for sustainable feed and alternative protein in animal diets, interest is growing in using new, more sustainable protein sources, including mung beans.

Researchers have found that legumes could work well in animal feed. European feed producers might consider importing lower-quality mung beans for animal feed, such as those with imperfections or that don't meet food-grade standards. This would help avoid waste and make good use of beans that would otherwise be thrown away.

This idea also fits the wider goals of reducing food waste and using resources more wisely. As the need for sustainable animal feed grows, European companies may explore mung beans as a cost-effective and eco-friendly option. This could open a new market for mung bean producers by allowing them to sell beans that cannot be used for human food.

Threats in the European market

While the growing interest in plant-based proteins presents opportunities for mung beans, there are also threats in the European market. One primary challenge is the high level of competition from other plant-based proteins, such as soy, pea, and chickpea. These crops are well-established in the European market and have a strong consumer base. To gain market share, mung beans must differentiate themselves through innovation, convenience, and sustainability.

Additionally, while demand for organic mung beans is increasing, organic certification remains challenging in some European markets. The production of organic mung beans is still limited, particularly in regions where conventional farming dominates. As European consumers demand more organic products, mung bean producers will need to consider expanding their organic offerings to meet this demand.

Tips:

- Stay updated on news and innovations in the plant protein market. For example, visit the website New Protein, which focuses on alternative proteins.

- Find out more about sustainability in our tips to go green in the grains, pulses and oilseeds sector.

- Read about social sustainability in our tips on how to become a socially responsible exporter of grains, pulses and oilseeds.

- Learn about trends in the CBI study Which trends offer opportunities or pose threats on the European grains, pulses and oilseeds market?

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research