Entering the European market for mung beans

Demand for mung beans and mung bean products is growing across Europe. This is driven by the rising popularity of healthy, organic and plant-based diets. Mung beans have become a key ingredient for European sprout growers. They are also used in a range of processed foods. Local production is still limited. This means Europe relies on imports from Myanmar and India to meet its supply needs. To compete with these established exporters, it is important to demonstrate that you can offer a consistent, high-quality product that meets buyers’ expectations.

Contents of this page

1. What requirements and certifications must mung beans meet to be allowed on the European market?

To export mung beans to Europe, you need to follow general regulations for grains, pulses and oilseeds. The main requirements are meeting food safety standards, ensuring good product quality and staying within strict limits for pesticide residues, particularly chlorpyrifos.

What are mandatory requirements?

To export dried mung beans to Europe, you need to meet mandatory requirements related to food safety, product quality, packaging and labelling.

Official food controls: non-compliance leads to stricter requirements

Food products entering the European Union (EU) are inspected regularly. These inspections can be carried out upon import (at the border) or later on in the value chain (for example on the importer's premises). These checks ensure that food products comply with EU food legislation.

If a product does not meet European standards, it is flagged through the Rapid Alert System for Food and Feed (RASFF). In 2024, one mung bean alert was reported. Methamidophos and acephate pesticide residues in a shipment of beans from Brazil exceeded EU maximum residue limits (MRLs). This triggered a serious alert. In 2023, an information notice was issued for fosetyl-Al in beans from Uzbekistan.

If a country repeatedly fails to meet EU food standards, the EU increases the frequency of official checks on imports from there. These countries and the product are listed in Annex 1 of the regulation on the temporary increase of official controls and emergency measures. There is currently no mung bean exporting country subject to an increased number of official checks.

Tip:

- Use the My Trade Assistant tool on Access2Markets to find more information about market access requirements for mung beans per country, using HS code 071331.

Stricter requirements for mung beans for sprouting

The European Food Safety Authority (EFSA) decided that sprouted seeds are ‘ready-to-eat’ foods after a serious E. coli outbreak in Germany in 2011 from a facility that produced seed sprouts. This means they pose a big health risk if they contain harmful bacteria. Since then, exporters from outside the EU have to prove they follow Regulation (EC) No 852/2004 and apply good hygiene and manufacturing practices and HACCP principles. They need a special document as proof: the Certificate for the Import of Sprouts or Seeds Intended for the Production of Sprouts for human consumption, following Regulation (EU) No 2020/2235.

This certificate is only issued if the full supply chain (farmers, collectors, processors, exporters) is inspected. A national authority needs to do these checks. This authority must be approved under Regulation (EC) No 2017/625, which covers official food safety controls. Besides following EU laws, each country must also set up its own national laws to control the safety of sprouting seeds.

Mung bean exporters cannot sell directly to European sprout producers. Their products must first be certified through an EU-approved system. This system requires trained staff, proper national-level inspections and ongoing training at every stage of the supply chain. Countries that have these systems in place and export mung beans for sprouting to Europe are Myanmar, China, India, Thailand, Vietnam and Pakistan.

Control of pesticide residues

The EU Regulation on maximum residue levels (MRLs) of pesticides sets the legal limits for pesticide residues in or on food products. There is a general default limit of 0.01 mg/kg if no specific MRL is listed for a product. Any product that contains pesticide residues above the allowed level is removed from the European market.

Recent issues with mung beans have involved pesticide residues that exceed legal limits. Methamidophos and acephate in particular have a maximum allowed level of 0.01 mg/kg, and fosetyl-Al has a limit of 2.0 mg/kg.

Tips:

- To view the relevant MRLs, use the EU pesticide database and select your product (‘beans without pods’ or code 0260020) or the pesticide you use.

- You can reduce pesticide levels by using integrated pest management (IPM). This approach combines natural pest control methods with limited use of chemical sprays to manage pests more sustainably.

Quality requirements

To export mung beans to Europe, you need to meet common quality standards. The best approach is to follow your buyer’s specifications and refer to the FAO International Standard for Certain Pulses in the Codex Alimentarius. It contains quality criteria for mung beans (Vigna radiata (L.)). See Table 1 below for more details.

Table 1: General quality standards for mung beans according to the Codex Alimentarius

| Characteristic | Quality standards |

|---|---|

| General |

|

| Purity and defects |

|

| Moisture |

|

| Discolouration |

|

Source: FAO/Codex Alimentarius Standard for Certain Pulses, July 2025

Use correct labelling and packaging

Food imported into the EU must adhere to EU food labelling legislation. For bulk packaging, labels must include the following information:

- Name and variety of the product, e.g. ‘mung beans’;

- Batch or lot code;

- Net weight, expressed in the metric system;

- Shelf life or best-before date, along with recommended storage conditions;

- Country of origin;

- Name and address of the manufacturer, packer, distributor or importer.

An identification mark may be used instead of the lot code and full contact details of the manufacturer, packer, distributor or importer. A label may also give optional details, such as brand name, drying method or harvest date. Batch information can also be included in the Technical Data Sheet. Organic or genetically modified products must carry extra labelling, in line with EU legislation.

For food-grade shipments, mung beans are usually packed in 25 kg or 50 kg polypropylene bags. Smaller bags or multi-layer paper bags are also used. These were originally used more for organic beans, but are increasingly used for conventional beans too.

All packaging needs to protect the product effectively and comply with Regulation (EC) No 1935/2004, which covers materials intended to come into contact with food.

Tips:

- Have your clients confirm any specific packaging needs or preferences.

- Check if your product is pre-packed for retail. Additional labelling requirements are outlined in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on providing food information to consumers in the EU.

What additional requirements and certifications do buyers often have?

European buyers often have requirements in addition to legal obligations. These usually focus on food safety and sustainable and ethical business practices.

Certification as a guarantee for food safety

Food safety is essential in the European market. Legislation covers many potential risks, but it is not enough on its own. As a result, importers often prefer to work with producers and exporters that have a food safety certificate recognised by the Global Food Safety Initiative (GFSI).

For mung bean exporters, the most widely adopted programme is the Food Safety System Certification (FSSC 22000). FSSC 22000 is based on ISO standards. It offers a clear and structured framework for managing food safety. Some large buyers of mung beans may ask for British Retail Consortium Global Standards (BRCGS) or International Featured Standards (IFS). Exporters that hold FSSC 22000 and one of these retailer-focused certifications have the greatest access to the European market.

Sustainability compliance

European buyers increasingly want social and environmental responsibility. This often means you need to agree to buyers’ codes of conduct or follow a recognised third-party code. Alternatively, you may choose to obtain independent certification through schemes like B Corp and SMETA. These are managed by the Supplier Ethical Data Exchange (Sedex).

Tips:

- Ask your buyer which certification scheme is most suitable for your target market.

- For more detailed information on the benefits of certification, read about buyer requirements for grains, pulses and oilseeds.

Organic certification

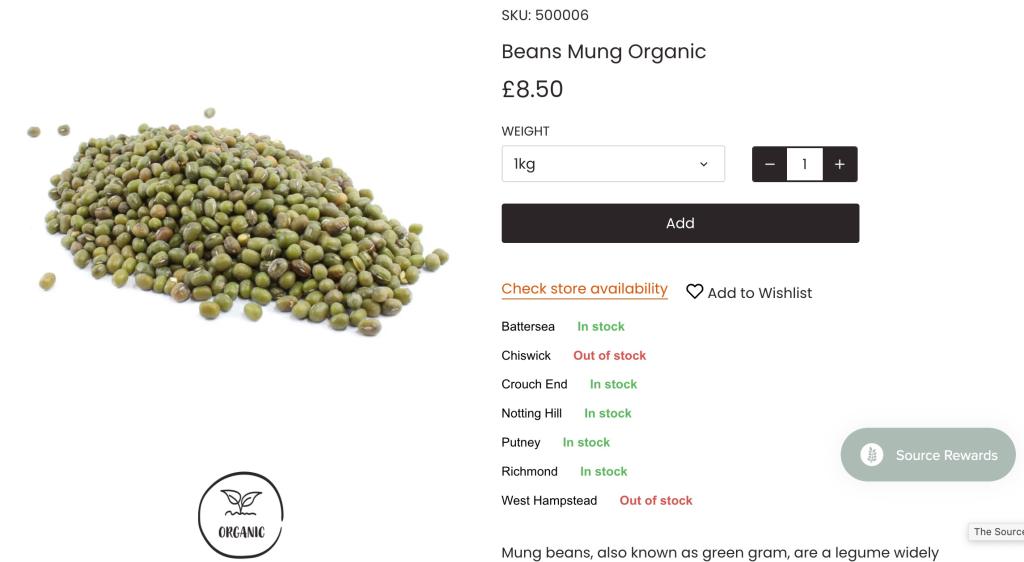

Organic-certified food products are common in many European supermarkets, particularly in countries such as Germany, the Netherlands, the United Kingdom and the Nordic region. Most organic-certified mung beans in Europe are offered by brands that focus specifically on the organic market. They are mainly sold through specialist organic retailers.

Figure 1: Organic mung beans from China in a British organic bulk food retail chain

Source: Globally Cool, July 2025

To export organic mung beans to Europe, you need to comply with Regulation (EU) 2018/848. It sets the rules for organic production and labelling. Organic mung beans have to be free from any chemical residues.

What are the requirements for niche markets?

The high level of ethnic consumption of mung beans in Europe makes obtaining Kosher and Halal certifications worthwhile. These are important for specific consumer groups. These certifications can also apply to final processed products that contain mung beans as an ingredient.

Tips:

- Consider applying for organic certification if your circumstances and location allow it. Keep in mind that setting up organic production and getting certified can be costly. You must be ready to follow the full organic process to sell your products as organic.

- Read about buyer requirements for grains, pulses and oilseeds for more detailed guidance on the process of organic certification.

- Explore the ITC Standards Map to learn about different voluntary sustainability and social standards, and check which ones are available in your country.

2. Through which channels can you get mung beans on the European market?

In Europe, imported mung beans are distributed through three main channels. A large amount is delivered directly to specialist sprouting companies, mainly in the Netherlands, Belgium and Germany. In these locations, the beans are sprouted and supplied as fresh or packaged sprouts to supermarkets, restaurants and catering services. Another share is cleaned and packed into consumer-sized bags or bulk packs for the food service sector and sold as dried mung beans through retailers and wholesalers. The rest goes to processors that cook and can the beans or their sprouts, selling them in jars or tins as ready-to-eat products.

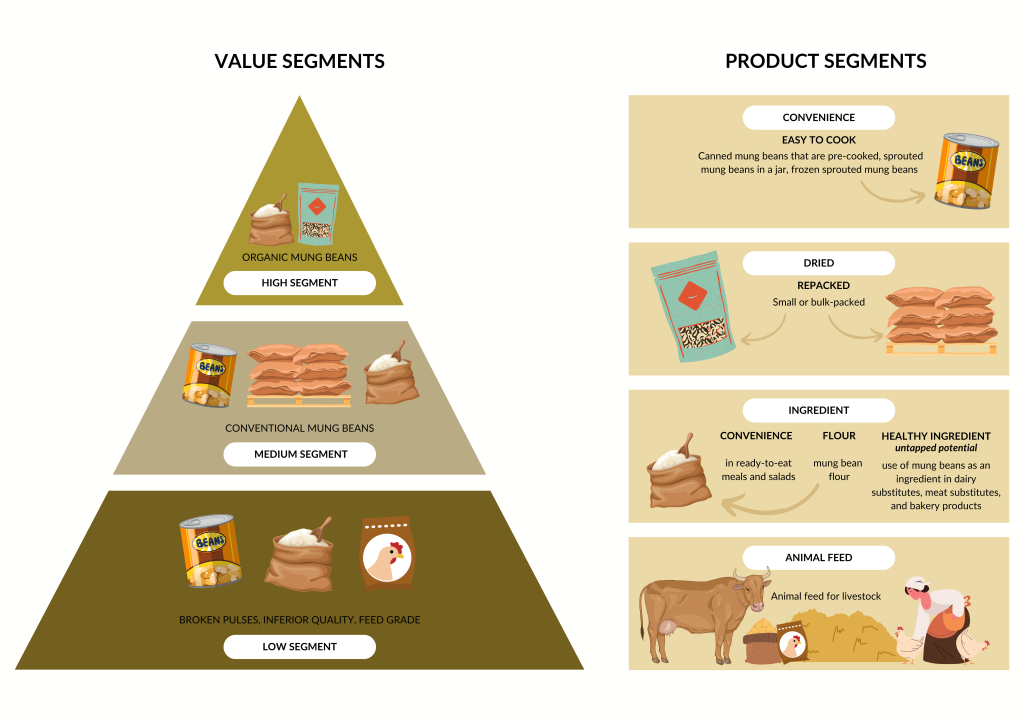

How is the end market segmented?

The European mung bean market can be divided into high, mid and low-end segments and different product categories. Figure 2 provides an overview of the different value and product segments. These are explained in more detail in the sections below.

Figure 2: Market segments for mung beans in Europe

Source: Globally Cool, July 2025

Convenience

The convenience segment is important in the European market. Many consumers lead busy lives and have limited time for cooking. Dried mung beans require longer preparation and cooking times, so shoppers want quicker alternatives.

To meet this demand, supermarkets offer pre-cooked whole and sprouted mung beans in cans or jars. These can be used immediately. More recently, single-serve cups of pre-cooked mung beans have been introduced. These can be added to meals or enjoyed directly as a quick and healthy snack.

Dried

Ethnic consumers, particularly those from Asian backgrounds, are the main users of dried mung beans, as they are familiar with traditional ways of cooking and preparing them.

Ingredient

Processing companies often use sprouted mung beans as an ingredient in ready-convenience foods, catering to modern consumers with busy lifestyles who want quick yet healthy food options.

Mung bean flour has long been used in Asian cuisines as a gluten-free thickener for soups, sauces and gravies. It is also used as a base for traditional snacks like bean cakes. In Europe, it is still a niche product. However, its technical qualities, such as neutral colour, high protein content and strong water-binding ability, make it an appealing functional ingredient for brands developing clean-label convenience foods.

Rising demand from health-conscious and eco-minded consumers is driving producers of baked goods, snacks and ready meals to explore mung bean flour as a gluten-free alternative to wheat. This opens new opportunities for mung bean products.

Another product further up the value chain is mung bean protein concentrate or isolate. Mung bean protein is gaining attention for its ability to form stable gels and emulsions. This makes it well-suited for dairy alternatives like plant-based milks, yoghurts and even liquid egg substitutes like JUST Egg.

Animal feed

Although mung beans are mainly used for human consumption, they can also be used as livestock feed. This is valuable for lower-grade beans that are not suitable for the food market.

Conventional versus organic mung beans

Most mung beans sold in Europe are conventional and are sold in the mainstream mid-market segment. Organic mung beans represent a smaller but growing share. They are seen as premium products and are usually sold in the higher-end segment.

Tip:

- Watch USA Pulses’ webinars to learn how pulse ingredients and proteins can be used in value-added food products.

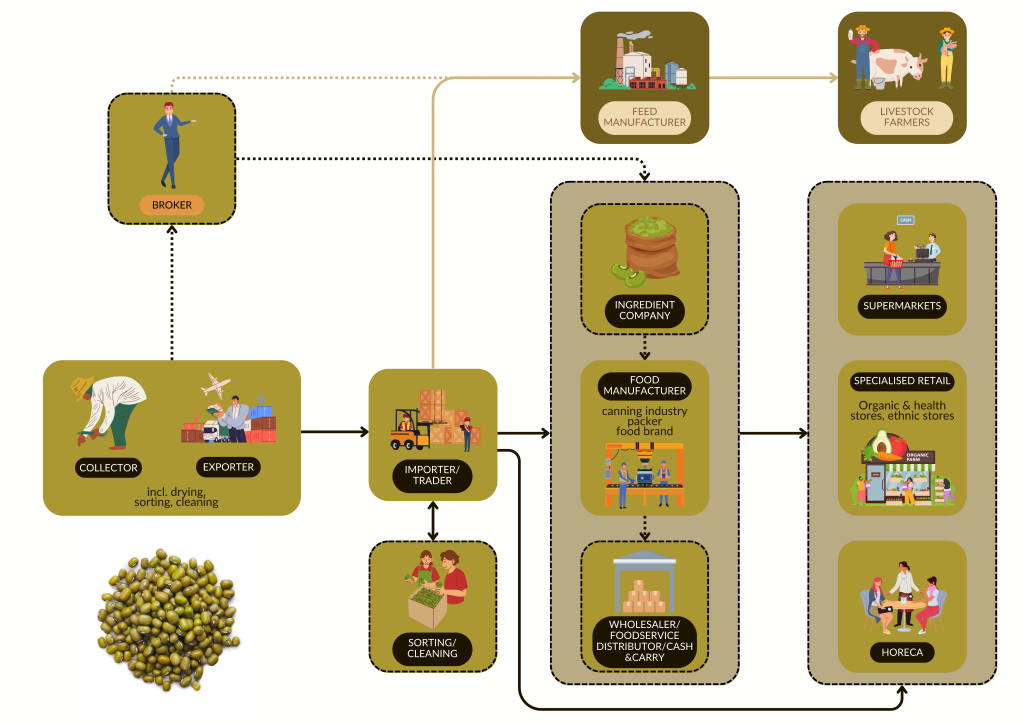

Through which channels do products end up on the end market?

Mung beans can reach the European market through several channels. Figure 3 outlines these channels, beginning with the exporter in the country of origin and ending with the final market. The main market channels are described in more detail in the sections below.

Figure 3: European market channels for mung beans

Source: Globally Cool, July 2025

Importers and traders

European importers and traders are key to bringing mung beans to the European market. Importers that source mung beans are often specialists that trade in dried pulses, grains and seeds. Sometimes they also trade in nuts and dried fruit. Their main task is to ensure a high-quality and dependable supply of mung beans. This includes managing the balance between supply and demand, safeguarding food safety and quality, overseeing logistics and ensuring compliance with sustainability standards.

Importers can supply mung beans in bulk and retail packaging, and under their own brand or as a private label, depending on the client’s needs. Some handle the packaging in-house. Others choose to outsource it. For example, Brandwijk Holland has modern packaging lines and weighing facilities and offers products in big bags, bulk bags (such as 10 kg and 25 kg) and small packages (e.g. 500 g and 1 kg). Chelmer Foods works with packers and processors to offer their customers tailor-made products.

Importers give you access to a wide range of end markets. They supply a broad customer base. This includes food processors, manufacturers, packagers, distributors, wholesalers, cash & carry outlets, trading companies, the food service sector, and retailers, from supermarkets and independent shops to ethnic grocery stores. Some importers, such as Brandwijk Holland, Skane Group and AgriFoodTrade, serve both the food and feed industries. Others specialise in the ethnic food market, like Fresh Tropical in Italy and Lotus Foods Trading Company in the United Kingdom.

Only a few importers are dedicated to organic produce. However, there are more conventional produce importers that also import organic mung beans. Vehgro is an example of a mainstream importer that offers organic mung beans in addition to regular mung beans, while DO-IT is a specialised organic importer.

Brokers

Brokers act as middlemen in the trade process. They do not take ownership of the product but earn a commission for each successful sale. Smaller companies often fill this role. For example, Agriprime is a broker that specialises in grains, pulses, cereals and animal feed products. The French company Cogeser is another example of a broker.

Food manufacturers

Food manufacturers add value to mung beans by re-packing them or processing them into various products. A large part of Europe’s imports goes to specialist sprouting companies, particularly in the Netherlands, Belgium and Germany. These companies germinate the beans and supply fresh sprouts to supermarkets, restaurants and catering services.

Another portion is cleaned and packed into consumer-sized sachets and catering packs for sale as dried beans. The remaining volume is sent to processors that cook and can the beans or sprouts. They then offer the beans and sprouts as ready-to-eat products in jars and tins. Mung beans are also used in a growing range of plant-based foods, including convenience meals, gluten-free pasta and flours.

Evers Specials in the Netherlands, Culivair and Greenyard (frozen sprouts) in Belgium, Sprossenmanufaktur in Germany, Germogliamo in Italy and Heng Sieng in France are examples of sprouting companies.

Smaller manufacturers often buy from importers to ensure reliable and consistent quality. Larger companies may deal with exporters directly. Once processed, value-added products reach the market through manufacturers’ distribution channels or wholesalers that serve the retail and food service sectors.

Ingredient companies

Ingredient companies produce intermediate products used by the food processing industry, such as ready-made concentrates. With the growing demand for plant-based and protein-rich foods, there is increasing interest in using pulses in other products. As noted earlier, some companies and research institutions are exploring the use of mung bean flour and protein concentrate. These ingredients have potential applications in the alternative dairy, bakery and meat substitute sectors.

Although this is not yet a major channel for exporters, you should keep an eye on new product developments and innovations. As the market changes, this segment could offer valuable opportunities.

Tips:

- Familiarise yourself with market channels for canned mung beans by reading our study on entering the European market for canned beans.

- Visit the Food Ingredients Europe trade fair to get insights into the latest trends in the use of pulses as an ingredient.

What is the most interesting channel for you?

The most effective route for small and medium-sized exporters to enter the European market is working with traders, importers and brokers that specialise in pulses. These buyers are the main gateway for getting mung beans into Europe. Their focus means they have deep knowledge of the European pulses market and well-established networks across at least one sales channel. They are always on the lookout for reliable suppliers.

When selecting a trader or importer, it is important to understand which market channels they serve. You should choose one that is well-connected to your target market. Some larger importers, such as Brandwijk Holland, have a broad customer base and supply pulses to wholesalers, processors, retailers and the food service sector. Others, like Jaggoe Import, focus on ethnic shops. This difference means it is key to align your offer with the right partner.

European buyers mainly select suppliers based on their compliance with EU regulations and the quality of the product. For instance, AgriFoodTrade inspects incoming goods based on several food safety criteria. These include pesticide residues, mycotoxins and heavy metals. Buyers also place great importance on product availability and supply reliability. If you want to enter the European market, it is essential to understand what your buyers need and to ensure you can meet their expectations and requirements.

Tips:

- When searching for and selecting importers to partner with, evaluate which partner aligns with your target market best. Importers can have specific client bases, so select the one that matches your product.

- Connect with buyers by visiting relevant trade fairs, such as SIAL (France), Anuga (Germany) and BIOFACH (Germany, organic).

- Find potential buyers through sector association member lists. For example, the member area of the Global Pulse Confederation contains 24 national associations and more than 600 private sector members.

- Read our tips for finding buyers on the European grain, pulses and oilseeds market for more guidance on finding buyers in Europe.

3. What competition do you face on the European mung beans market?

Mung beans originated in India and became a staple throughout South-East Asia. Asian countries like Myanmar and India are the world’s largest producers. You should also expect competition from Argentina, China, Venezuela and Uzbekistan.

Which countries are you competing with?

Myanmar and India dominate supply. Myanmar is still the leading supplier of mung beans to Europe. The country experienced a significant peak in 2020, followed by a relatively steady decline over the past four years. India’s supply has varied over the years, but shows a clear upward export volume to Europe.

Source: Eurostat Comext and ITC Trade Map (June 2025)

* The EU, Switzerland, Norway and the United Kingdom

Emerging suppliers like Argentina are starting to play a larger role in the European mung bean market. The country has shown steady growth, with a noticeable increase in 2022. Other countries play a more limited role, contributing lower or inconsistent volumes over time. The exception is Uzbekistan, which has supplied quite a stable volume over the years.

Myanmar: Mung bean is a key export crop

There was a gradual decline in Myanmar’s mung bean exports to Europe between 2020 and 2024, despite a brief recovery in 2023. Exports dropped from 13,000 tonnes in 2020 to 10,000 tonnes in 2024. This represents an average annual decrease of 5.1%. While Myanmar is still a key supplier to the European market, this downward trend in a slightly growing market (imports from developing countries grew by 1.1% per year) underlines their shrinking market share. This is due to increased competition from other countries, predominantly India, combined with ongoing national instability.

In 2024, most mung bean exports to Europe were directed to the United Kingdom, the Netherlands, France, and Italy. Myanmar is a leading supplier. Despite its presence, Europe is still a relatively small market for Myanmar’s mung beans.

SATHAPANA is an organisation involved in agricultural education in Myanmar. It reported that mung beans are one of the country’s key export crops. The report went on to state that pulses and beans account for around 33% of Myanmar’s total agricultural output, with black beans, mung beans and pigeon peas making up approximately 72% of pulse production. Most of these exports are shipped to Asian markets, particularly China.

India: The world’s largest producer, growing exports to Europe

Indian mung bean exports to Europe are increasing, rising from 3,000 tonnes in 2020 to 12,000 tonnes in 2023. Indian exporters benefited from surpluses thanks to strong harvests in 2021/22 and 2022/2023 and the relaxing of export restrictions for mung beans. Political turmoil and export difficulties after the coup in 2021 in Myanmar have helped Indian exporters to gain market share.

Although there was a slight decline in 2024, with exports falling to 8,000 tonnes, India is still a major supplier to the European market. Despite the 2024 drop, the compound annual growth rate was still 27%. India's main European markets are the United Kingdom (42%) and Germany (14%).

India is the world’s largest producer of mung beans. It contributes around 70% of global production. The crop is mainly grown in Rajasthan, Uttar Pradesh, Madhya Pradesh, Maharashtra, Gujarat, Andhra Pradesh and Tamil Nadu. Mung beans are usually planted during the kharif season (monsoon) and harvested in winter.

To support research and development in the pulse sector, the Indian Council of Agricultural Research (ICAR) established the Indian Institute of Pulses Research (IIPR) in Kanpur, Uttar Pradesh. The Indian Pulses and Grains Association (IPGA) is the leading organisation for India’s pulses and grains industry. Representing over 10,000 stakeholders involved in farming, processing, warehousing and import, the IPGA plays a central role in shaping the Indian pulse value chain.

Argentina: Focusing on dried beans for cooking

Argentina’s mung bean exports to Europe have grown steadily from 2,000 tonnes in 2020 to almost 4,000 tonnes in 2022. Although exports dipped slightly to 3,000 tonnes in 2023, the outlook for 2024 was stable. Despite this minor fluctuation, Argentina recorded an average annual growth rate of 9.3% over the period, strengthening its position as an emerging supplier to the European market. As some traditional exporters face market volatility, Argentina’s consistent performance highlights its potential to grow its presence in Europe.

In 2024, Argentina’s main European market was the United Kingdom. It accounted for 10% of its exports and ranked as the third-largest supplier to the UK. Italy followed, receiving 15% of Argentina’s mung bean exports, also placing Argentina as the third most important supplier. This export destination profile also shows Argentina’s focus on dried beans for cooking instead of sprouting.

The Argentine government has introduced several assistance measures to support agricultural exports. One key initiative is its export incentive programme, which gives exporters access to favourable exchange rates. This helps improve the competitiveness of Argentine mung beans in international markets.

Uzbekistan: Stable annual growth

Uzbekistan’s mung bean exports to Europe were stable at approximately 1,000 tonnes annually until 2023. In 2024, exports jumped to 1,400 tonnes, resulting in a 7.1% average increase per year. In 2024, Uzbekistan became the second-largest supplier to the Netherlands, accounting for 14% of the country’s total mung bean imports. According to preliminary national data, Uzbekistan exported 123,400 tonnes of mung beans globally in 2024. China, Kazakhstan and Russia are the top destinations. Uzbek mung beans are intended for cooking, not for sprouting.

Uzbekistan benefits from duty-free access to the EU under the GSP+ scheme. This scheme has been in effect since April 2021. This preferential trade status helps Uzbek mung beans enter the European market at competitive prices, reinforcing their presence even as export volumes remain modest.

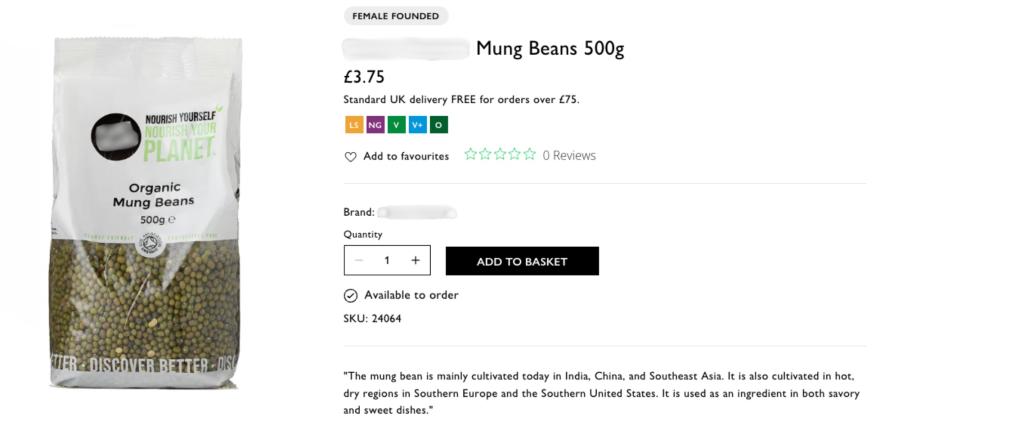

Figure 5: Organic mung beans from Uzbekistan in a British organic retail chain

Source: Globally Cool, July 2025

On the production side, research from the International Centre of Agricultural Research in Dry Areas (ICARDA) highlights a sustainable farming system where Uzbek growers fit mung beans into wheat-based rotations. Wheat is harvested in early summer, followed by mung bean planting. The beans are ready to harvest within 70–110 days, improving soil fertility through nitrogen fixation, increasing farm income and reducing fallow periods.

Together, these trade advantages and agronomic benefits explain why Uzbekistan’s position in the European mung bean market is improving, despite relatively small export volumes.

Tip:

- Stay up to date on developments in competing countries by reading relevant news articles. Pulse Pod, for example, publishes the latest news on the global pulse industry.

Which companies are you competing with?

Your main competitors are exporters from Myanmar, India and Argentina. Below are brief profiles of companies from these countries that supply mung beans to the European market.

Pyei Phyo Aung: Focused on beans for the Asian market and beyond

Myanmar-based Pyei Phyo Aung is a trading company that specialises in exporting agricultural products. Its primary focus is the Asian market, such as Japan, China, and Korea. However, the company also exports to the United States and Europe. Pyei Phyo Aung is committed to delivering high-quality products that meet international food safety standards. The company is certified under GMP/HACCP and holds ISO 9001 certification.

Yesraj Agro Export: Diverse agricultural exports with a global reach

Based in Maharashtra, India, Yesraj Agro Export is a leading exporter of a wide range of agricultural and food products. The company serves customers across Europe, the USA, the Middle East and Southeast Asia, offering products that meet global quality and safety standards.

Yesraj Agro focuses on organic and conventional pulses, fruits, vegetables, herbs, and other agro-based products. The company is committed to quality assurance and hygiene. Its operations are certified under ISO 9001, FSSAI, APEDA and USDA Organic.

With strong sourcing capabilities and an emphasis on sustainable agriculture, Yesraj Agro Export positions itself as a reliable partner for international buyers that want high-quality Indian mung beans and other food products.

Desdelsur: Integrated pulse exporter from Argentina

Desdelsur is a fully integrated pulse specialist located in Salta Province, northwest Argentina. The company manages 60,000 hectares of farmland. It also operates two cleaning and colour-sorting facilities near Tartagal, along with its own warehouse at the Port of Zárate. Recognised as one of Argentina’s leading pulse exporters, Desdelsur accounts for around 10% of the national pulse trade. Its food safety systems are certified according to FSSC 22000 standards.

For the European market, Desdelsur supplies whole mung beans in addition to other pulses and oilseeds. Approximately 95% of its production is exported to more than 40 countries. The company regularly exhibits at key EU-focused trade shows like SIAL Paris and Gulfood. It promotes Argentine mung beans as a GMO-free, reliably graded ingredient suitable for canning, repacking and sprouting.

Nomad Agro: High-quality and certified mung beans from Uzbekistan

Nomad Agro is a producer and exporter based in Uzbekistan. It specialises in mung beans (locally known as ‘mash’), as well as other pulses and dried fruits. The company sources its beans from major cultivation regions in Uzbekistan. It carries out cleaning, sizing and colour sorting in-house to meet food-grade standards.

Nomad Agro places strong emphasis on pesticide control and biologically pure cultivation. It collaborates with certified laboratories to conduct residue testing and ensures full traceability across its operations. The company participates in trade fairs like Gulfood (United Arab Emirates) to expand its reach and showcase its products.

Tip:

- Take part in trade fairs, such as Anuga and SIAL. This is important to promote your business and connect with potential buyers in Europe. These events are also a valuable chance to observe your competitors. See how they present themselves, identify their unique value propositions (UVPs) and think about how you can differentiate your offering in the market.

Which products are you competing with?

As European consumers increasingly seek convenient food options, dried mung beans face competition from pre-cooked whole or sprouted mung beans. These ready-to-use products save time and add convenience for the consumer.

Mung beans can establish a unique niche alongside more familiar pulses like chickpeas and lentils if several key advantages are emphasised. They contain slightly more protein than chickpeas, are rich in lysine (a nutrient often lacking in cereal-based diets) and offer bioactive compounds such as flavonoids, giving them added appeal as a functional food.

Unlike most pulses, mung beans germinate easily. This allows retailers to offer them as both dried beans and fresh sprouts. The sprouts provide a crunchy, vitamin-rich option that other pulses mostly cannot. This sprouting ability, combined with other properties like light colour and mild flavour, makes them a unique bean type for which European buyers are willing to pay a premium.

From an agricultural perspective, mung beans are efficient in nitrogen fixation, adapt well to short growing cycles and require relatively little water. These benefits support a strong sustainability narrative that aligns well with European buyers’ values.

Tips:

- Clearly set mung beans apart from more common pulses like chickpeas by promoting them as a high-quality source of plant-based protein.

- Consider positioning mung beans as a versatile alternative to lentils, using recipe ideas and examples that show where mung beans offer better performance, such as in sprouting, or certain textures and flavours in dishes.

4. What are the prices of mung beans in the European market?

Consumer prices vary widely. There are several factors that influence consumer prices. Import prices can be calculated based on import values and volumes. From there, an indicative price breakdown can be made to show how margins are divided through the value chain.

Consumer prices show wide range

Consumer prices for dried mung beans in large European supermarkets vary between €2.31 and €14.95 per kilogram. They are the lowest in the United Kingdom.

Table 2: Indication of consumer prices of mung beans in large European supermarkets

| Country | Dried mung beans (price in €/kg) | Mung bean sprouts sold fresh or in a jar (price in €/kg) |

|---|---|---|

| United Kingdom | €2.31–8.66 | €2.16–16.10 |

| Netherlands | €6.58 | €7.92–15.90 |

| Italy | €8.10 | €3.98–20 |

| France | €7.50–14.95 | €2.63–17.09 |

| Germany | €7.18–7.48 | €6.03–23.92 |

| Belgium | €7.98 | €4.34–15.50 |

Source: Globally Cool, July 2025

Package size affects the final consumer price per kilogram. Organic certification or added value processing typically add to the price. Price is also affected by the mung beans’ origin and the type of retail outlet. Prices tend to be lower than average in ethnic retail outlets.

Figure 6: Mung flour in an Italian webshop

Source: Globally Cool, July 2025

Importers, traders and wholesalers

The main point of entry into Europe is through importers or traders. Some importers also act as wholesalers to food processors. Among such importers are companies that supply to clients across the whole of Europe, such as AGT Foods Europe and Agrifood Ingredients based in the Netherlands and CIACAM in France, and companies that focus more on a single market, such as the British companies Lupa Foods, AGT Poortman and Brusco Food Group.

Food processors and distributors

Suppliers

- Low-cost origins included India, Myanmar and Argentina. Their prices typically ranged between €1,000 and 1,400/tonne. Argentina and Venezuela consistently offered the lowest prices (even below €1,000/tonne in some years). India was competitive despite strong domestic demand.

- China and Thailand were high-cost origins, often exceeding €2,000/tonne in 2021 and 2022, with Sweden and Germany paying the highest prices.

- Emerging suppliers Uzbekistan, Tanzania, Türkiye and Venezuela provided middling prices (€1,000–1,300/tonne), helping them to broaden Europe’s supply base after 2021.

Markets

- United Kingdom: paid a stable €1,100–1,200/tonne, benefiting from Argentina and India’s low-cost offers. China and Malaysia supplied at much higher prices.

- Netherlands: prices went up from €1,114/tonne in 2020 to €1,399/tonne in 2024. As a hub, it imports from high-price origins (Thailand, China) and low-price origins (Argentina, Uzbekistan).

- German buyers paid relatively high prices for mung beans, averaging €1,600/tonne in 2024.

- Belgium and Spain imported more from Argentina and Venezuela, keeping their averages close to €1,050–1,100/tonne by 2024.

- France and Italy: prices are lower than in Northern Europe, as India, Myanmar, and Argentina dominate imports. France shows notable volatility (India achieved €842/tonne in 2021 versus €1,763/tonne in 2024).

Price breakdown

Figure 7 shows how the price of dried mung beans is built up from the exporter to the final retail price in Europe. The beans cost about €1.40 per kg when they arrive in Europe, and they are sold to consumers for around €10 per kg. The largest part of the price comes from the retail margin (€5.00) and repacking and distribution (€2.00). The producer/exporter receives €1.20 per kg. Other costs include shipping, import handling and taxes.

Source: Globally Cool, July 2025

Tip:

- Check the online stores of major supermarkets in your target European markets. For example, you can look at Tesco (United Kingdom), Albert Heijn (Netherlands), Famila (Italy), Carrefour (France), and REWE (Germany) to find consumer prices for dried and sprouted mung beans.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research