What is the demand for grains, pulses and oilseeds on the European market?

Grains, pulses and oilseeds are major commodities widely cultivated and traded within Europe. The market for major staple food and feed is mainly supplied by nearby producing countries and multinational companies. Organic crops, products with specific nutritional benefits – including ancient grains – and those targeting specific ethnic groups, offer the best opportunities for small and medium-sized suppliers from developing countries.

Contents of this page

1. What makes Europe an interesting market for grains, pulses and oilseeds?

Market size and dependence on external suppliers make Europe an attractive target market for suppliers from developing countries. The European countries that present the most opportunities overall are Spain, Italy, the UK, the Netherlands, Germany and France.

Although Europe is home to the production of certain types of grains, pulses and oilseeds, the region still needs to import a lot of other types. The dependence on imports, combined with the shift towards sustainable and nutritional crops, make Europe an interesting market for nearby producers of staple crops as well as for suppliers with a unique product that meets European demand.

Scope of products and regions

This study covers the sectors of grains, pulses and oilseeds. Within the grains and oilseeds sector, the focus is on products that are used in the food sector, i.e. meant for human consumption. For this reason, a few commodities, such as soybeans, maize and barley, are not included in the product selection for this study.

The selected products still have a range of uses wider than the food sector only, from feed (for example, sorghum and some oilseeds) to industrial uses like biofuels.

'Europe' in this study refers to the countries of the European Union, plus the United Kingdom and the EFTA countries (including Switzerland, Norway, and more).

'Developing countries' are all the countries on the OECD-DAC list.

Europe's mature and diversified market offers stability for suppliers

Europe is a mature and diverse market for grains, pulses and oilseeds. It is home to:

- 3 of the 10 largest importing countries of grains in the world: Italy, the Netherlands and Germany.

- 3 of the 10 largest importing countries of pulses in the world: Italy, Germany and Spain.

- 6 of the 10 largest importing countries of oilseeds in the world: the Netherlands, Bulgaria, Germany, Spain, Italy and France.

Since several of the large markets in the world have their own large-scale production of grains, pulses and oilseeds (such as the USA) and therefore import relatively low volumes, Europe is among the largest importing regions worldwide. The largest importing regions however are outside Europe: East Asia for grains and oilseeds, and Southeast Asia for pulses. Europe as a whole is good for 22% of the world's grains imports, 42% of oilseeds imports, and 19% of the global pulses trade.

Figure 1 shows that imports from East and Southeast Asia take a considerable share of the global market. This is mostly because the countries in those regions don't have a lot of their own wheat production and therefore need to import wheat from abroad.

Source: GloballyCool, based on UN Comtrade (September 2024)

Grains – local European supply dominates

Most of the grains imported by European countries are produced locally within Europe. Over the years, import volumes have varied. This was mainly caused by fluctuations in European production volumes, which determine how much needs to be imported to satisfy the demand. Such fluctuations in production volumes – and thus also in trade volumes – are present in individual countries as well (see for example figure 10). In 2019, European imports were the lowest at approximately 50 million tonnes. They rose to a record high of almost 53 million tonnes in 2020, before dropping to 52 million tonnes in 2021 and 2022. The year 2023 set a new record with a total import volume of more than 58 million tonnes.

The share of European imports from developing countries has been rather stable, at 7-9% per year until 2021, but went up to 14% in 2022 and further increased to 19% in 2023. This was caused by:

- an increase in Spanish and Italian imports of wheat from Ukraine in 2022-2023. This was due to a sharp decline in local wheat production, caused by extreme drought and heat in 2022. Local production remained low in 2023, with only a modest recovery.

- strong growth in Italian durum wheat imports from Türkiye and Kazakhstan in 2023, due to a 10% lower production output in Italy that year, caused by challenging weather conditions.

- a peak in rice imports from Myanmar in 2022 by Spain and Italy, due to low rice production in these countries that year.

Source: GloballyCool, based on UN Comtrade (September 2024)

European imports of grains are dominated by Italy and Spain in Southern Europe and the Netherlands, Germany, and Belgium in Western Europe. Together, these five countries represent 68% of European imports.

Many European countries share the same top-3 products of imports from developing countries, including wheat and durum wheat, rice, wheat flour, and millet. However, there are a few interesting exceptions: the third-largest imported product of Switzerland, Austria, Denmark, and Ireland is ‘other cereals’. This is mostly quinoa imported from Peru and Bolivia, as well as amaranth imported from India.

Pulses – dried peas are the largest product group

Pulses come from both local production in Europe and imports from outside of Europe. The largest product in this subsector is dried peas, accounting for 40% of total European imports. The products that follow in second and third place, dried broad beans and dried kidney beans, make up 25% of European imports.

From 2019 to 2023, most striking were the declining imports of pulses from developing countries (‑5.3% per year on average). The share of developing countries in European imports stood at 22% in 2019 but went down to 15% in 2023. This was caused by a gradual decline in European imports of peas from Ukraine between 2019 and 2022. Imports of peas from Ukraine reached a record low of 31,000 tonnes in 2022 but slightly recovered in 2023 to reach 58,000 tonnes.

Growth in the imports of pulses from other developing countries was not able to compensate for the large decline in imports of peas from Ukraine. Most notably, growth was recorded by Türkiye (lentils, chickpeas and peas), India (chickpeas, lentils, beans, legumes, and kidney beans) and Egypt (kidney beans and frozen pulses).

Source: GloballyCool, based on UN Comtrade (September 2024)

Trade from “rest of the world” recorded a huge boost between 2019 and 2023 (+17% per year). This was mainly due to a huge increase in peas and chickpeas imports from Russia by Spain and Italy.

Oilseeds – sunflower seeds dominate trade

Until 2022, around 70% of the oilseeds imported by Europe came from local production within Europe. Since the largest oilseed commodity, soybeans, is not covered in this survey, the largest commodity in this subsector is sunflower seeds, accounting for between 60-70% of total European imports.

This largest commodity was also the reason for the remarkable growth of the developing country share in total imports in 2022. This share showed a slight upward trend between 2018 and 2021, but went up considerably in 2022, reaching 45%. This was related to the war in Ukraine, which led to a large disruption of the traditional export routes of Ukrainian sunflower oil in 2022. One of the effects of that disruption was a large growth of Ukrainian exports of sunflower seeds to Europe, from only 63 thousand tonnes in 2021 to a peak of 1.9 million tonnes in 2022. In 2023 this import flow came down (506 thousand tonnes) but remained at a higher level than pre-2022.

Source: GloballyCool, based on UN Comtrade (September 2024)

The second-largest commodity in this subsector is groundnuts, typically imported from developing countries. The other important product in this subsector that mostly comes from developing countries is sesame seeds.

Europe’s largest importing country of oilseeds from developing countries is the Netherlands, mainly because of its large import volume of groundnuts. Other large importing countries for oilseeds in Europe are those countries that import large volumes of sunflower seeds: Romania and Bulgaria. Germany’s and Spain’s import volumes are also sizeable however more diversified: Germany imports a lot of groundnuts and sesame seeds, while Spain imports sunflower seeds and groundnuts. Greece's position as the largest importer of sesame seeds in Europe is also striking.

Forecast and recent developments: import volumes may grow slightly

Overall, for the foreseeable future, Europe will remain dependent on imports of various grains and oilseeds from developing countries, as production volumes are forecast to remain stable. This is in spite of EU policies that prioritise self-sufficiency and sustainable production of, for example, protein crops. The new agricultural policy of the EU (CAP) entered into force in 2023 and includes the sustainability goals of the European Green Deal as well as the Farm to Fork and biodiversity strategies.

For pulses, the short and medium-term outlook is the same, however in the longer-term EU pulses production will go up, most likely at the cost of grain production. The main driving force will be EU policy incentives to support an increase in plant proteins and to boost the income of farmers who produce protein crops.

Niche products that are not produced in Europe and that fit into the trend of healthy and more sustainable foods will remain in particularly high demand. Popular products that predominantly come from developing countries include quinoa, teff, fonio and dried Adzuki beans. The largest market impact in the short-to-medium term will be related to crop failures in large production countries, caused by drought. In 2023, for example, the drought in Argentina resulted in lower production and exports of kidney beans and Adzuki beans than in previous years.

More important is the development in recent years of prices going up due to higher production costs in origin countries and in European destination markets. Inflation in European end-markets has had a particularly serious impact on the European consumption of grains, pulses and oilseeds. For consumers in the European Union, bread and cereals were on average 10% more expensive in August 2023 than in October 2022. Recent Eurostat figures on inflation show that this figure stabilised in 2024 – bread and cereals were only 0.8% more expensive in August 2024 than in October 2023.

The high inflation in 2022-2023 has had a negative impact on products that are in the high-end segment, such as organic-certified grains, pulses and oilseeds, products with added value such as teff, quinoa and fonio, and those that were produced and packed in the origin country.

Figure 5: Organic-certified gluten-free puffed quinoa in a Dutch health food store (September 2023)

Source: GloballyCool (July 2023)

The main determining factor for European imports of grains, pulses and oilseeds is the level of European production. The poor weather conditions in Spain and Italy in 2023 had a serious impact on production output in both countries that year. In 2024, the weather conditions in Spain in particular were once again challenging which will likely result in an ongoing relatively low production of grains and pulses.

For products for which Europe depends on supply from external sources, European imports are likely to increase at moderate rates in the upcoming years. After a slowdown in 2023, the EU economy is expected to grow by 1.0% in 2024 and further improve by 1.7-1.8% in 2025. At the same time, average inflation levels will drop to 2.7% in 2024 and 2.2% in 2025. Although the EU economy is forecast to pick up growth, growth rates are expected to remain lower than in the United States, China, and India.

Tips:

- Read the OECD-FAO Agricultural Outlook 2024-2033. These reports give interesting ideas for the world's demand, production concentration and trade as a share of demand by 2033. They are available for many different commodities, including cereals, oilseeds and pulses.

- Watch out for a potential overreaction in the event that there is a year with insufficient supply. Farmers may try to increase their production following such a year to a level that will result in an oversupply. This ripple effect may turn around market perspectives dramatically.

- See what trends offer opportunities or pose threats on the European grains, pulses and oilseeds market.

- Inform yourself about the European market’s strict rules by finding out which requirements grains, pulses and oilseeds must comply with.

- Stay up to date by browsing the data and analysis of the USDA Foreign Agricultural Service, follow news on World-grain.com, and check out the European Commission's short-term and medium-term outlook.

Above-average import growth for sustainably produced grains, pulses and oilseeds

The largest organic food markets in Europe are Germany, France, Italy, and Switzerland. Some specific statistics for organic grains, pulses and oilseeds are available: the most traded and consumed organic-certified products in this category are soybeans, followed by cereals, oilseeds, and flours.

The latest report on imports of organic products in Europe shows the recent performance of EU imports of organic food products, including grains, pulses and oilseeds. For many organic products, import volumes went down in recent years due to lower consumption caused by high inflation:

- Imports of organic cereals dropped by 13% to a volume of 105,000 tonnes in 2023, which was also lower than 2021’s import volume (113,000 tonnes).

- Organic rice imports declined by 4.1% in 2023, reaching 89,000 tonnes. Despite this decline, the volume remained higher than the volume recorded in 2021.

- Imports of organic oilseeds (other than soybeans) again registered a sharp annual decline (-10% in 2023 to 83,000 tonnes) after the 36% decline in 2022.

In the period 2019-2022, the organic cereals and rice market showed above-average growth. This is in line with the trend in Europe of consumers turning more towards organic food products. Almost every year over the past decade, the organic grains, pulses and oilseeds market has grown faster than the conventional market. The years 2022 (partly) and 2023 were different: due to high inflation, consumers bought less expensive products. The improved economic outlook for 2024 and 2025 will lead to good conditions for imports of organic ingredients to go up again.

As an indication of the export potential to individual European countries, figure 6 shows the number of organic‑certified importers of grains, pulses and oilseeds for use in food in the most important European countries. Germany and Italy have by far the highest number of organic-certified importers.

Source: GloballyCool, based on the EU Commission database (November 2024)

*For each product, the total number of companies with import activity is included. Companies that cover several products are counted more than once and up to five times.

**Switzerland and the United Kingdom are not included, since their markets are not part of the European Union and therefore do not require EU Organic Certification.

A large number of organic-certified importers in a country indicates market opportunities for organic produce, since importers need to be certified in order to trade in organic produce. Therefore, the best opportunities for organic produce exports are in the EU markets displayed in figure 6.

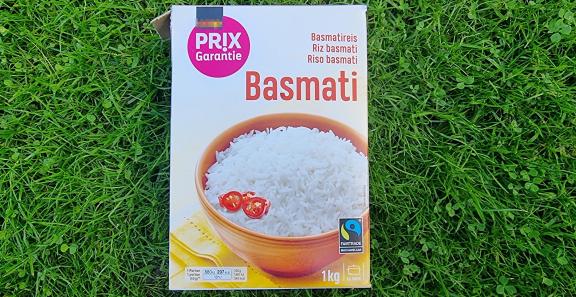

In addition to organically-produced food, there is also a growing commitment of consumers to ethically and sustainably produced food. The most important certification scheme with this focus is Fairtrade. As this market is based on the certification scheme, traders can only trade Fairtrade-certified products if they have a certification too. Fairtrade-certified products are usually found in the medium-to-high-end food retail segment, but Switzerland and also some British retail chains have low-to-medium-end products with a Fairtrade certificate.

Figure 7: The Swiss market as exception – Private-label products with a Fairtrade certification – Basmati rice

Source: GloballyCool (July 2023)

The largest markets for Fairtrade products are Germany and Switzerland. One important Fairtrade-certified cereals and oilseeds trader in Germany is EcoTerra.

Source: GloballyCool, based on the Fairtrade database (November 2024)

Germany and Switzerland have the highest number of Fairtrade-certified traders (30 traders each), followed by Italy (20 traders) and France (13 traders). These countries offer the most potential for exporters of Fairtrade-certified grains and oilseeds.

Tips:

- Consider organic as a speciality. If your region is not suitable for organic production, focus on the cleanest produce possible and consider other sustainability standards.

- Read about organic legislation in CBI's study on European buyer requirements for grains, pulses and oilseeds.

- Read about developments in Fairtrade in the Fairtrade Annual Report 2023.

2. Which European markets offer most opportunities for grains, pulses and oilseeds?

The main European markets for grains, pulses and oilseeds providing opportunities for exporters from developing countries are Spain, Italy, the UK and the Netherlands, as these countries import large volumes from developing countries. Two other countries that import less from developing countries but are interesting in terms of opportunities are Germany and France.

These six markets combine certain characteristics – mainly sizeable imports of grains, pulses and oilseeds from developing countries, total market size, and relevance of organic or Fairtrade market segments.

Figure 9 shows the import volume of grains, pulses and oilseeds per European focus country (the previously mentioned six countries) for imports coming from developing countries between 2019 and 2023, and figure 10 shows how their import volumes are segmented (2023).

Source: GloballyCool, based on UN Comtrade (September 2024)

UNComtrade (September 2023)

Tips:

- Study your options in the large import markets of Spain, Italy, the United Kingdom, the Netherlands, Germany, and France. A good way to reach a decision regarding these markets is to visit European trade fairs. Start with the leading trade fairs in Europe: Anuga in Cologne (Germany), Sial in Paris (France) and Biofach in Nuremberg (Germany). Another trade fair where you may find good trading partners is Fi Europe in Frankfurt (Germany), which is dedicated to food ingredients.

- Diversify your markets to spread risk, so try to focus on at least a few countries from different regions.

- Find out who the major food retailers are in each European country at Retail-index.com. Use our tips on how to find buyers to learn how to find the right entry into the European market.

Spain: largest importer from developing countries

Spain is Europe’s leading importer of grains, pulses and oilseeds from developing countries. Legumes play an integral role in Spain's traditional mediterranean diet. Dry legumes dominate the market, compared to jarred or canned products; however, canned legumes have registered a steady growth over time, most likely due to changing eating habits towards ready-to-eat products. The growing interest in plant-based diet trends and the limited domestic supply of dry beans open opportunities for exporters.

Spain is a net importer and the largest importer and market for pulses in the EU, but the share of direct imports from developing countries has been down year on year and reached a share of only 8% in 2023. A sharp decline in imports of peas from Ukraine is the main explanation of this development. The share of grains, on the other hand, went up to a record of 40%. Spain's total grains production has been relatively low for three years (2021-2023), leading to more imports of wheat, mainly from Ukraine. Grain production is expected to recover in 2024.

Spain is the top importer of grains, pulses and oilseeds from developing countries as the country holds top-3 positions for several products, as shown in table 1.

Table 1: Products of developing-country origin for which Spain has a top-3 import position in Europe

| Grains | Pulses | Oilseeds |

| sorghum, maize flour and other processed maize, wheat, durum wheat, rye, buckwheat | dried peas, dried chickpeas, dried kidney beans, dried broad beans | cotton seeds and miscellaneous oilseeds |

Source: GloballyCool, based on UNComtrade (September 2024)

Spain is an important trade partner of Portugal and France, which also contributes to its high ranking as an importing country.

Table 2: Products of CBI countries origin for which Spain is a leading European destination

| Product | Country and Volume |

| Maize starch | Egypt (13 thousand tonnes) |

| Dried broad beans | Egypt (6.8 thousand tonnes) |

| Dried kidney beans | Ethiopia (2.0 thousand tonnes), Egypt (1.4 thousand tonnes) |

| Rice | Morocco (2.9 thousand tonnes) |

| Sesame seeds | Egypt (2.2 thousand tonnes), Nigeria (1.9 thousand tonnes) |

| Wheat - groats and meal | Egypt (2.1 thousand tonnes), Morocco (0.7 thousand tonnes) |

| Miscellaneous oilseeds | Ethiopia (0.9 thousand tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

Smaller but still considerable volumes can be seen for two nearby-origins/products:

- Egypt: frozen peas, beans, and other legumes (510 tonnes), sunflower seeds (450 tonnes)

- Morocco: dried broad beans (340 tonnes)

Spain is also becoming a producer of some specialty grains, including quinoa and teff. The Spanish company Salutef, for example, sells different 'made in Spain' organic-certified teff products. Nevertheless, some of the products do indicate that they are not produced in the EU, like in the case of amaranth flour. Companies like Salutef might want to add complementary healthy products to their range, by buying imported goods. This can be an opportunity for producers of speciality grains with added value.

Spain is a small market for organic-certified and Fairtrade-certified products. This is also reflected in its low number of certified organic and Fairtrade traders (11 and 2, respectively). Most organic-certified products are sold in organic supermarkets like Veritas.

Italy: foremost destination for durum wheat and pulses from developing countries

Italy is among Europe's largest importers of grains and pulses. A small portion (about 10%) of these products are re‑exported. Italy is the second-largest importer of grains, pulses and oilseeds from developing countries, following Spain. This is mostly due to leading positions for (durum) wheat and several types of pulses, as shown in Table 3.

Table 3: Products of developing-country origin for which Italy has a top-3 import position in Europe

| Grains | Pulses | Oilseeds |

| durum wheat, sorghum, wheat | dried kidney beans, dried broad beans, dried adzuki beans, dried peas, dried chickpeas, dried cow peas, dried Bambara beans, dried lentils | Cotton seeds |

Source: GloballyCool, based on UNComtrade (September 2024)

Italy is by far the largest rice producer in the EU, accounting for between 50-55% of production. The country also produces soybeans. Renowned for its pasta, Italy is a significant consumer of durum wheat, but pasta producers are increasingly using other ancient, gluten-free grains and even pulses for their pasta production. Due to challenging weather conditions and low production volumes in 2022 and 2023, the average share of imports from developing countries went up to a record share of 16% in 2023 due to a large growth in grains imports from Ukraine, Türkiye and Kazakhstan.

Figure 11: Chickpea spaghetti, product of the Italian specialised gluten-free pasta producer Andriani

Source: GloballyCool (July 2023)

Italy is an important trade partner of France, which also contributes to its high ranking as an importing country. Italy’s imports from CBI countries are rather concentrated with Egypt as the dominating supplier:

Table 4: Products of CBI countries origin for which Italy is a leading European destination

| Product | Country and Volume |

| Dried kidney beans | Ethiopia (24.7 thousand tonnes), Egypt (6.7 thousand tonnes) |

| Dried broad beans | Egypt (11.6 thousand tonnes), Morocco (2.8 thousand tonnes), Tunisia (1.1 thousand tonnes) |

| Oilseeds other | Ethiopia (6.7 thousand tonnes) |

| Rice | Bangladesh (4.9 thousand tonnes), Sri Lanka (2.3 thousand tonnes) |

| Durum wheat | Lebanon (3.2 thousand tonnes) |

| Sunflower seeds | Egypt (2.1 thousand tonnes) |

| Sesame seeds | Egypt (1.6 thousand tonnes), Nigeria (1.0 thousand tonnes), Ethiopia (0.7 thousand tonnes) |

| Frozen peas, beans, and other legumes | Egypt (1.6 thousand tonnes) |

| Groundnuts | Egypt (1.4 thousand tonnes) |

| Maize starch | Egypt (1.1 thousand tonnes) |

| Other cereal flours | Senegal (1.1 thousand tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

Smaller but still considerable volumes can be seen for a few origins/products: Egypt with dried peas (600 tonnes), dried lentils (400 tonnes), and cereals other (400 tonnes), Ethiopia with dried mung beans (450 tonnes), Senegal with millet (680 tonnes), and Uganda with dried kidney beans (320 tonnes).

The size of the gluten-free market also provides opportunities for alternative grains, such as quinoa, teff and fonio. Fonio was authorised as a food by the European Union after the Italian company Obà applied for it.

Italy is a large market for organic-certified grains, pulses and beans, but not important for Fairtrade-certified products. This is also reflected in the high number of organic-certified and low number of Fairtrade importers in Italy. Most organic-certified products can be found in the health food segment on the shelves of organic retail chains like Bio c' Bon and NaturaSì.

United Kingdom: highly diversified imports from developing countries

The growing trend of 'clean eating' and veganism in the United Kingdom, coupled with the large population of people from diverse cultural backgrounds, has led to an increase in the need for pulses, lentils, peas and beans. Products such as chickpeas and kidney beans are only produced in limited volumes in the country, so food companies import a lot of pulses (more than 100,000 tonnes in 2023) every year for products including standalone tins, pouches of cooked chickpeas and packets of dried pulses.

The United Kingdom is among Europe's largest importers of grains and pulses. About 40% of these products are re‑exported, either directly (transit trade) or after processing. While the share of imports from developing countries in total imports went down from 23% to 17% between 2019 and 2021, the share has gone up again since then to a record 24% in 2024 since imports from developing countries went up slightly (+2.1% per year) and imports from within Europe went down by 0.7% per year. Brexit in 2020 was a main contributor to this development.

The United Kingdom is a leading market in Europe for several products from developing countries, as shown in Table 5.

Table 5: Products of developing-country origin for which the United Kingdom has a top-3 import position in Europe

| Grains | Pulses | Oilseeds |

| rice, wheat, maize, and other cereal flours, maize - groats and meal, millet, wheat gluten | dried beans, dried leguminous vegetables, dried Bambara beans, dried adzuki beans, dried lentils, dried cow peas, frozen peas, beans, and other legumes, dried peas, dried chickpeas | copra, groundnuts |

Source: GloballyCool, based on UNComtrade (September 2024)

The United Kingdom is an important trade partner of Ireland and the Netherlands, which also contributes to its high ranking as an importing country. The United Kingdom is a leading European destination for the following products from CBI countries:

Table 6: Products of CBI countries origin for which the United Kingdom is a leading European destination

| Product | Country and Volume |

| Dried kidney beans | Ethiopia (14.7 thousand tonnes) |

| Oilseeds other | Ethiopia (5.2 thousand tonnes), Ghana (3.7 thousand tonnes), Lebanon (0.8 thousand tonnes) |

| Rice | Sri Lanka (3.6 thousand tonnes), Bangladesh (2.3 thousand tonnes), Morocco (2.0 thousand tonnes) |

| Dried leguminous vegetables | Uganda (2.4 thousand tonnes) |

| Frozen peas, beans, and other legumes | Ghana (2.3 thousand tonnes), Egypt (1.3 thousand tonnes), Kenya (0.8 thousand tonnes) |

| Dried mung beans | Ghana (1.7 thousand tonnes), Nigeria (0.9 thousand tonnes) |

| Dried lentils | Nigeria (1.7 thousand tonnes), Sri Lanka (1.6 thousand tonnes), Lebanon (0.8 thousand tonnes) |

| Sunflower seeds | Egypt (1.6 thousand tonnes) |

| Dried cow peas | Ghana (1.1 thousand tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

Smaller but still considerable volumes can be seen for several origins/products, which shows how diversified the United Kingdom’s imports from developing countries are:

Table 7: CBI countries and products with substantial exports to the United Kingdom

| Product | Country and Volume |

| Sri Lanka | dried mung beans (680 tonnes), other cereal flours (520 tonnes), dried chickpeas (390 tonnes), dried legumes (440 tonnes) |

| Ethiopia | dried peas (400 tonnes), other cereals (most likely teff, 390 tonnes), other cereal flours (most likely teff, 390 tonnes) |

| Senegal | groundnuts (580 tonnes) |

| Egypt | dried broad beans (570 tonnes), groundnuts (420 tonnes), dried kidney beans (360 tonnes), sesame seeds (340 tonnes) |

| Uganda | miscellaneous oilseeds (560 tonnes) |

| Nigeria | sesame seeds (550 tonnes), dried kidney beans (420 tonnes) |

| Ghana | dried kidney beans (510 tonnes) |

| Lebanon | sesame seeds (480 tonnes) |

| Benin | dried kidney beans (470 tonnes) |

| Bangladesh | frozen peas, beans, and other legumes (360 tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

The United Kingdom is an especially good market for Fairtrade-certified oilseeds. There are 11 Fairtrade-certified importers in the country. The organic market in the UK is also rather developed, with good opportunities for exporters from developing countries. WholeFoods and PlanetOrganic are two specialised organic retail chains in the United Kingdom.

Tips:

- Keep up to date on non-EU free-trade agreements with the UK on the GOV.UK website. Another page gives updates on the EU-UK trade agreement.

- Find potential clients in the organic market through the Organic Tradeboard.

The Netherlands: important trade hub

The Netherlands holds a significant role in the European food product supply chain, functioning as a hub for the wholesale distribution of goods. It is among Europe's largest importers of grains and oilseeds. Many of these products are re‑exported, either directly (transit trade) or after processing. The Netherlands is in the top 5 largest importers of grains, pulses and oilseeds from developing countries. This is mostly due to leading positions for the products, as shown in table 8.

Table 8: Products of developing-country origin for which the Netherlands has a top-3 import position in Europe

| Grains | Pulses | Oilseeds |

| Miscellaneous cereals (such as quinoa) and wheat gluten | dried mung beans, soya bean flour and meal | groundnuts, sesame seeds and miscellaneous oilseeds |

Source: GloballyCool, based on UNComtrade (September 2024)

The Netherlands is an important trade partner for its neighbouring countries Belgium and Germany, which also contributes to its high ranking as an importing country. The Netherlands is a leading European destination for the following products from CBI countries:

Table 9: Products of CBI countries origin for which the Netherlands is a leading European destination

| Product | Country and Volume |

| Groundnuts | Egypt (13.7 thousand tonnes) |

| Sesame seeds | Nigeria (10.4 thousand tonnes), Uganda (10.2 thousand tonnes), Ethiopia (3.3 thousand tonnes), Burkina Faso (2.4 thousand tonnes), Egypt (1.1 thousand tonnes) |

| Oilseeds other | Uganda (3.1 thousand tonnes) |

| Sunflower seeds | Egypt (2.4 thousand tonnes) |

| Dried kidney beans | Ethiopia (1.5 thousand tonnes) |

| Other cereal flours | Senegal (0.9 thousand tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

Smaller but still considerable volumes can be seen for several origins/products:

Table 10: CBI countries and products with substantial exports to the Netherlands

| Product | Country and Volume |

| Kenya | miscellaneous oilseeds (670 tonnes), sesame seeds (410 tonnes) |

| Egypt | sorghum (670 tonnes) |

| Ethiopia | miscellaneous oilseeds (610 tonnes), dried mung beans (440 tonnes) |

| Indonesia | rice (490 tonnes), maize starch (440 tonnes) |

| Sri Lanka | rice (330 tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

With a lot of international trade experience and strong European distribution networks, Dutch companies are good prospects for businesses aiming to enter the European market with niche products. The country is a prominent trader of lesser-known grains and oilseeds. It is the third-largest importer in Europe of sesame and niche oilseeds like chia seeds from developing countries, and plays a significant role in the trade of ancient grains such as quinoa, teff and fonio with Tradin Organic, Do-It Organic and Rhumveld as important players for such products.

The Netherlands is a small but growing market for organic-certified and Fairtrade-certified grains, pulses and oilseeds. Organic‑certified grains, pulses and oilseeds are sold in organic and health retail chains like Odin and Ekoplaza, and increasingly in mainstream supermarkets like Albert Heijn, Jumbo and Poiez.

Germany: largest European market for organic and Fairtrade-certified food products

Germany has the largest economy and the largest population of all European countries. It is the world's biggest producer of rye and is both a large consumer of speciality grains with added value and a key exporter of these products. In 2023, total German imports reached 8.7 million tonnes. After the record volume in 2020 (8.7 million tonnes), imports declined in 2021 and 2022, due to high inflation that resulted in lower spending on food. Imports recovered in 2023 and reached a new record of 8.8 million tonnes, mainly due to record import volumes coming from neighbouring countries Poland and Czechia.

Germany is among Europe's largest importers of oilseeds. For example, the country is the second-largest importer of sesame seeds. Many of these products are re‑exported, either directly (transit trade) or after processing. Germany is not currently among the leading EU importers of grains, pulses and oilseeds from developing countries, and the share of imports from developing countries has been dropping slightly in recent years to 5.1% in 2023. However, there is good potential in the market, especially for organic-certified products. Germany is already an important destination for several products from developing countries, as shown in the following table.

Table 11: Products of developing-country origin for which Germany has a top-3 import position in Europe

| Grains | Pulses | Oilseeds |

| millet, wheat starch, maize - other processed types, wheat - groats and meal, cereals other, cereals - processed, maize and other cereal flour | dried lentils, dried Bambara beans, dried mung beans, dried adzuki beans | mustard seeds, soya bean flour and meal, sesame seeds, groundnuts, canary seeds, miscellaneous oilseeds |

Source: GloballyCool, based on UNComtrade (September 2024)

Germany is an important trade partner of several European countries, including the Netherlands, Belgium, the United Kingdom, France and Austria. Germany is a leading European destination for the following products from CBI countries:

Table 12: Products of CBI countries origin for which Germany is a leading European destination

| Product | Country and Volume |

| Sesame seeds | Nigeria (38.5 thousand tonnes), Uganda (16.0 thousand tonnes), Egypt (8.3 thousand tonnes), Chad (4.1 thousand tonnes), Ethiopia (3.1 thousand tonnes), Burkina Faso (2.2 thousand tonnes), Mali (0.7 thousand tonnes) |

| Oilseeds miscellaneous | Ethiopia (13.9 thousand tonnes), Uganda (4.7 thousand tonnes), Egypt (3.4 thousand tonnes), Kenya (1.3 thousand tonnes) |

| Groundnuts | Egypt (3.2 thousand tonnes) |

| Rice | Sri Lanka (2.7 thousand tonnes) and Lebanon (1.3 thousand tonnes) |

| Dried kidney beans | Ethiopia (1.7 thousand tonnes) and Morocco (1.0 thousand tonnes) |

| Sunflower seeds | Egypt (1.6 thousand tonnes) |

| Frozen peas, beans, and other legumes | Egypt (1.1 thousand tonnes) |

| Dried broad beans | Jordan (0.7 thousand tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

Smaller but still considerable volumes can be seen for several origins/products:

Table 13: CBI countries and products with substantial exports to Germany

| Product | Country and Volume |

| Nigeria | sunflower seeds (631 tonnes) |

| Lebanon (mainly re-exports) | dried lentils (540 tonnes), oilseeds other (442 tonnes), dried broad beans (429 tonnes), wheat - groats and meal (392 tonnes), sunflower seeds (337 tonnes) |

| Egypt | dried broad beans (398 tonnes) |

| Ethiopia | other cereal flours (348 tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

Germany is the largest market in Europe for organic and Fairtrade-certified food products. It is home to a lot of organic-certified importing companies (150, but some companies may be counted twice) of grains, pulses and oilseeds. Germany also has the largest number of Fairtrade-certified importing companies (9 for cereals and 21 for oilseeds). There are several organic retail groups in Germany, such as Biomarkt, DM and Alnatura.

Tip:

- Check out the product range of German organic retailers. For example, use the search function of Alnatura organic retail group to find the range of organic products that interest you.

France: second-largest importer of rice

For rice, France depends on imports, making it the second-largest market for rice imports in Europe, after the United Kingdom. Because production volumes are expected to stabilise in 2024 following the droughts of 2022 and a partial recovery in 2023, import volumes will remain on the level of 2023. The share of imports from developing countries is stable to slightly negative and reached 17% in 2023.

The pulses market in France, including lentils, chickpeas, and peas, has seen increasing attention due to growing consumer demand for plant-based proteins and environmental benefits of pulse cultivation (e.g., nitrogen-fixing properties). While pulses remain a smaller segment compared to grains, their cultivation is expanding as part of sustainable agricultural initiatives. France is an important destination for several products from developing countries, as shown in the following table.

Table 14: Products of developing country origin for which France has a top-3 import position in Europe

| Grains | Pulses | Oilseeds |

| other cereals and their flours, maize - other processed types, buckwheat, wheat flour, rice | frozen peas, beans, and other legumes, dried legumes | mustard seeds |

Source: GloballyCool, based on UNComtrade (September 2024)

France is among the largest European producers of wheat, barley, corn, rapeseed, and sunflower seeds and also exports these products to other European countries. This makes France an important trade partner of many European countries: Spain, Italy, Germany, the Netherlands, Belgium, the United Kingdom, and Portugal. This contributes to its high ranking as an importing country. France is a leading European destination for the following products from CBI countries:

Table 15: Products of CBI countries origin for which France is a leading European destination

| Product | Country and Volume |

| Frozen peas, beans, and other legumes | Egypt (9.0 thousand tonnes), Kenya (3.9 thousand tonnes) |

| Sesame seeds | Mali (6.6 thousand tonnes), Nigeria (2.3 thousand tonnes), Uganda (1.8 thousand tonnes), Burkina Faso (1.4 thousand tonnes), Egypt (1.3 thousand tonnes) |

| Dried kidney beans | Ethiopia (2.8 thousand tonnes) |

| Other cereal flours | Mali (2.1 thousand tonnes), Senegal (1.0 thousand tonnes) |

| Rice | Sri Lanka (1.2 thousand tonnes) |

| Wheat - groats and meal | Morocco (1.0 thousand tonnes) |

| Dried broad beans | Egypt (1.0 thousand tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

Smaller but still considerable volumes can be seen for several origins/products:

Table 16: CBI countries and products with substantial exports to France

| Product | Country and Volume |

| Egypt | dried kidney beans (640 tonnes), wheat flour (360 tonnes) |

| Ethiopia | sesame seeds (590 tonnes) |

| Senegal | sesame seeds (570 tonnes) |

| Mali | cereals other (550 tonnes) |

| Morocco | dried broad beans (480 tonnes) |

| Tunisia | wheat - groats and meal (370 tonnes), other cereal flours (330 tonnes) |

| Sri Lanka | dried lentils (370 tonnes), other cereal flours (310 tonnes) |

| Côte d'Ivoire | oilseeds other (350 tonnes), groundnuts (340 tonnes) |

| Algeria | cereals - processed (350 tonnes) |

Source: GloballyCool, based on UNComtrade (September 2024)

In 2023, high inflation in food prices lowered consumer spending. However, as inflation is projected to decline to 2.5% in 2024 and further to 2.0% in 2025, household purchasing power is expected to recover. This will likely increase grains, pulses, and oilseeds consumption in France and support the import of products from developing countries.

There is a small market for Fairtrade-certified products in France, however it is much smaller than the organic market. Most of these products are available in outlets of specialised organic retail formulas, including Biocoop, Naturalia, La Vie Claire, Les Comptoirs de la Bio, Bio C’Bon and NaturéO.

3. Which products from developing countries have the most potential in the European grains, pulses and oilseeds market?

This chapter highlights six promising products to give you an idea of their potential in the European market: cereal flours, adzuki beans, mung beans, rice, kidney beans, and rolled or flaked grains. This product selection is based on the performance of European (EU27 + United Kingdom + Switzerland) import volumes from developing countries, combined with a review of market trends.

Opportunities in the European grains, pulses and oilseeds market

The specific opportunities for your grains, pulses and oilseeds will strongly depend on your supply capacities, including volume, quality, pricing and certification. These aspects will define your target market and market segment. If we look at the European import volumes from developing countries, the grains, pulses and oilseeds with a strong performance in 2019-2023 are:

- Rolled or flaked grains of other cereals than oats

- Cereal flours not made of wheat or maize

- Dried lentils

- Semi-milled or wholly-milled rice

- Dried mung beans

- Dried cow peas

An important opportunity is also due to the fact that the number of supplying countries for certain grains, pulses and oilseeds and their quality levels may be too limited for certain European buyers. These buyers may therefore be open to new alternatives that could help spread supply risks. Although several countries are important suppliers of grains, pulses and oilseeds, most individual countries supply only a limited range.

Table 17: High-potential grains and pulses imported by Europe* from developing countries, import volume, in thousand tonnes (2019-2023)

| 2019 | 2020 | 2021 | 2022 | 2023 | CAGR** | |

| semi-milled or wholly-milled rice | 872.5 | 948.3 | 790.3 | 1,201.5 | 1,270.7 | 9.9% |

| dried lentils | 52.9 | 75.4 | 59.2 | 56.3 | 79.0 | 10.6% |

| dried mung beans | 22.7 | 27.3 | 27.0 | 28.6 | 32.0 | 9.0% |

| other cereal flours | 11.5 | 13.2 | 15.8 | 17.2 | 19.1 | 13.5% |

| dried cowpeas | 8.6 | 9.3 | 8.5 | 12.4 | 9.8 | 3.4% |

| cereals - rolled or flaked | 2.3 | 2.9 | 2.7 | 2.4 | 4.1 | 15.7% |

Source: GloballyCool, based on UN Comtrade (September 2024)

*Europe = EU27 + United Kingdom + Switzerland + Norway

**CAGR = compound annual growth rate

Tip:

- Read CBI's market studies on several other potential products: chia seeds, chickpeas, fonio, quinoa, and sunflower seeds. There are many opportunities for developing-country suppliers of many grains, pulses and oilseeds, simply because Europe depends on imports.

Semi-milled or wholly-milled rice (white rice)

Europe rice production in eight countries located in the Mediterranean region is good for approximately 50% of European demand. The rest is imported from Asian countries. While whole-grain rice is considered healthier due to its higher fibre and nutrient content, the preference for white rice in Europe is largely influenced by culinary traditions and consumer preferences.

Figure 12: White rice from Vietnam

Source: GloballyCool (July 2023)

European imports of white rice from developing countries reached 1.3 million tonnes in 2023. The import volume has increased by 9.9% annually since 2019. The United Kingdom and France were the top importing countries (185,000 and 181,000 tonnes respectively) in 2023. They were followed by the Netherlands, Italy, and Spain (139,000, 129,000 and 97,000 tonnes).

Table 18: Top developing countries supplying white rice to Europe

| Supplying country | Export volume (thousand tonnes) | CAGR 2019-2023 |

| Myanmar | 257.7 | 11.7% |

| Thailand | 239.2 | 1.6% |

| Cambodia | 230.5 | 8.0% |

| India | 198.6 | 14.2% |

| Pakistan | 192.2 | 12.0% |

| Vietnam | 110.8 | 29.0% |

| China | 22.1 | 32.3% |

| Argentina | 4.1 | 49.2% |

| Suriname | 2.8 | -0.6% |

| Guyana | 2.3 | -31.5% |

Source: UN Comtrade (September 2024)

Since rice is a very common product in Europe, it is also one for which organic-certified products are more easily available, especially in the food retail segment. Mainstream supermarkets in Western Europe often have one or several organic‑certified rice SKUs (stock-keeping units) in their range: Albert Heijn, from the Netherlands, has a total of 8 SKUs online (in physical outlets this number is typically lower).

Overall, the best opportunities for organic-certified rice are in Western Europe, mostly in Germany, Switzerland, France and the Netherlands. The most important Fairtrade markets for rice are the United Kingdom, Switzerland and Germany.

Tip:

- Read more about the European market potential in the CBI study on specialty rice.

Dried lentils

Lentils are among the most popular pulses in the European market. Imports of lentils from developing countries have gone up by 11% per year, due to rising consumer demand for plant-based proteins and more interest in health-conscious diets. Lentils are used in various traditional European dishes, such as soups and stews, particularly in countries like Italy, Germany, and France. The European market relies heavily on imports due to limited domestic production, especially in countries like Germany and Italy.

Canada dominates the European lentil market, accounting for nearly half of Europe’s imports. Türkiye and the United States are also significant suppliers and, together with Canada, make up around 75% of the total imports to Europe. However, Türkiye's previous export restrictions on red lentils have opened up opportunities for other supplying countries.

The United Kingdom imports significant volumes of lentils (21.4 thousand tonnes in 2023) because lentils are a staple food in South Asian and Middle Eastern cuisines, which are popular across various ethnic communities. While the United Kingdom had the highest growing lentils imports registered (23% per year), Germany is a more stable market with a 6.6% annual import growth. Germany is a major market for organic lentils, with demand driven by health-conscious consumers and a growing trend toward plant-based diets. Italy has a strong tradition of lentil consumption, both in local cuisine and through its large canning industry.

Developing countries like India, Kazakhstan, and Türkiye have increased their exports to Europe. These suppliers are leveraging Europe's growing demand for organic and sustainably-sourced lentils, particularly as health‑conscious consumers drive market trends.

Table 19: Top developing countries supplying dried lentils to Europe (2023)

| Supplying country | Export volume (thousand tonnes) | CAGR 2019-2023 |

| Türkiye | 50.3 | 7.0% |

| India | 14.2 | 58.0% |

| Kazakhstan | 4.4 | 14.9% |

| China | 3.8 | -11.3% |

| Ukraine | 1.7 | 4.4% |

| Sri Lanka | 0.7 | 19.7% |

| Lebanon | 0.6 | 30.5% |

| Nigeria | 0.6 | 16.5% |

| Myanmar | 0.5 | 14.8% |

Source: UN Comtrade (September 2024)

With the continued shift among consumers toward plant-based proteins and organic food, the demand for lentils is expected to rise, creating opportunities for both established exporters and new suppliers from developing markets.

Organic dried lentils are commonly available in Europe as consumers seek healthier and more sustainable options. Most organic kidney beans are sold in special organic supermarkets like Ekoplaza and Odin in the Netherlands, Biomarkt, DM and Alnatura in Germany, WholeFoods and PlanetOrganic in the UK, Veritas in Spain and Bio c' Bon and NaturaSì in Italy. In the past few years, the organic range of mainstream supermarkets (like Albert Heijn in the Netherlands) has also grown considerably, and their share in total organic beans sales has gone up.

Tip:

- Read more about the European market potential in the CBI study on dried lentils.

Dried mung beans (Vigna radiata)

Europe does not cultivate mung beans due to their need for warm growing conditions, which are primarily found in Eastern Asia. Consequently, Europe depends on imports to satisfy demand. Mung beans are a rich source of plant-based protein, which is important for people on vegetarian and vegan diets. As the number of vegetarians/vegans (and flexitarians, consumers who do not eat meat every day anymore) grows every year, the demand for plant-based protein sources like mung beans is set to increase in the next few years.

Table 20: Top developing countries supplying mung beans to Europe

| Supplying country | Export volume (thousand tonnes) | CAGR 2019-2023 |

| India | 11.8 | 41.0% |

| Myanmar | 10.1 | -1.9% |

| Argentina | 2.6 | 14.1% |

| China | 2.3 | -15.4% |

| Uzbekistan | 0.9 | 26.8% |

| Venezuela | 0.8 | 91.6% |

| Thailand | 0.7 | 0.1% |

| Türkiye | 0.7 | 23.3% |

| Vietnam | 0.3 | 12.7% |

Source: UN Comtrade (September 2024)

EU imports of dried mung beans from developing countries amounted to 32,000 tonnes in 2023. The import volume has increased by 9.0% per year since 2019. The United Kingdom is the top importer (19,100 tonnes), accounting for almost 60% of the European import volume, followed by the Netherlands (6,500 tonnes).

The United Kingdom is home to a diverse population from various cultural backgrounds, plus the largest diaspora of South Asians in Europe: predominantly Indians, Pakistani and Bangladeshi people. Many of these cultures (mainly Indian) incorporate mung beans into their traditional recipes. Therefore, the import of mung beans helps meet the needs of the country's different ethnic communities.

Sprouting companies are the most important part of the trade channel in the EU. They import green mung beans, produce sprouts, pack and sell them – mostly to the retail segment, but also to the food service segment.

Within the retail segment, about half is sold through mainstream retailers like Ahold Delhaize (Albert Heijn and several other brands in the Netherlands, Belgium, Luxembourg, Czechia, Greece, Portugal and Romania), Edeka (Germany), Carrefour (France) and Tesco (UK).

The other half is sold through ethnic Asian supermarkets like the retail chains Wing Yip (United Kingdom), Tanger Markt (Netherlands, France and Spain), Amazing Oriental (Netherlands), GoAsia in Germany, and many smaller, independent stores.

Tip:

- Read more about the European market potential in the CBI study on dried mung beans.

Cereal flours not made of wheat and maize

Flours of cereals like quinoa, teff, oats, sorghum, barley, millet and rye offer opportunities for exporters from many different developing countries. In 2023, direct imports from developing countries to Europe totalled 19,100 tonnes. The import volume has increased by 14% annually since 2019.

The United Kingdom (3,600 tonnes), Spain (3,000 tonnes) and France (2,800 tonnes) form the top-3 destinations, with a total share of more than 60% of European imports. Germany, the Netherlands, Italy and Belgium import smaller quantities (2,100, 1,800, 1,100 and 1,100 tonnes, respectively).

Gluten-free flours are made of oat, sorghum, millet, teff, fonio, and quinoa, for example. These flours are a key ingredient of gluten-free products, which are essential for individuals with gluten-related disorders, such as celiac disease, wheat allergy, and non-celiac gluten sensitivity. Europe is one of the world’s largest markets for gluten-free flours and the market will continue to grow in the next five years, as every year many Europeans are diagnosed with celiac disease.

The gluten-free market has a relatively low concentration. Within Europe, there are a few brands with region-wide distribution (such as Schar from Italy and Orgran from Australia), but most brands produce mostly for their domestic market. Virtually every European country is home to producers of gluten-free products, resulting in more high-quality gluten-free items readily available in Europe than ever before.

Table 21: Top developing countries supplying cereal flours to Europe

| Supplying country | Export volume (in thousand tonnes) | CAGR 2019-2023 |

| Thailand | 5.7 | -1.0% |

| India | 4.6 | 35.5% |

| Brazil | 2.6 | From zero in 2021 |

| Cambodia | 0.9 | 65.5% |

| Ukraine | 0.8 | 24.4% |

| Senegal | 0.7 | 6.8% |

| Vietnam | 0.6 | 3.1% |

| Mali | 0.5 | 9.0% |

| Myanmar | 0.3 | -26.8% |

Source: UN Comtrade (September 2024)

Tip:

- Read more about the European market potential in CBI’s studies about value-added grains, pulses and oilseeds or healthy snacks.

Dried cowpeas

Southern European countries such as Portugal, Italy, and Greece lead in cowpea consumption, due to traditional dishes that incorporate cowpeas, like Salada de Feijão Frade in Portugal and Fasolada in Greece. European imports of dried cow peas from developing countries reached 9,800 tonnes in 2023. The import volume has grown by 3.4% annually since 2019. Portugal was the top importing country (3,000 tonnes) in 2023, contributing to one-third of total EU imports from developing countries. The United Kingdom takes second place (2,200 tonnes), followed by Italy (1,700 tonnes) and Greece (700 tonnes).

The main supplying countries to Europe (see table 22) are using their agricultural strength and expanding exports to meet Europe’s growing demand. However, exporters face challenges related to compliance with European requirements, especially concerning pesticide residues. Some countries, like Madagascar, have faced increasing inspections due to non-compliance with food safety regulations related to pesticides.

Table 22: Top developing countries supplying cowpeas to Europe

| Supplying country | Export volume (thousand tonnes) | CAGR 2019-2023 |

| Myanmar | 3.0 | 12.0% |

| Brazil | 2.4 | 13.8% |

| Madagascar | 2.2 | -8.6% |

| Argentina | 0.7 | 84.9% |

| Peru | 0.5 | -15.9% |

| India | 0.3 | 24.7% |

| Türkiye | 0.2 | 5.1% |

| Benin | 0.1 | 44.6% |

Source: UN Comtrade (September 2024)

The outlook for cowpeas in Europe is positive, driven by the growing demand for plant-based, high-protein foods and government initiatives promoting protein-rich crops. This creates opportunities for developing countries to increase their market share by improving quality control and offering organic or sustainably-produced cowpeas.

Tip:

- Read more about the European market potential in the CBI study on dried cowpeas.

Rolled or flaked grains of cereals (other than oats)

Rolled and flaked cereals are often considered healthy breakfast options. In many European countries, rolled and flaked cereals have been a part of traditional breakfasts for generations.

Figure 13: Teff flakes in a 750-gr pouch available in a Dutch webshop

Source: GloballyCool (July 2023)

European imports of rolled or flaked grains of cereals from developing countries reached 4,100 tonnes in 2023. The import volume has increased by 16% annually since 2019. The UK is the top importing country with 1,400 tonnes in 2023, contributing to over 40% of total European imports from developing countries.

Table 23: Top developing countries supplying rolled or flaked grains to Europe

| Supplying country | Export volume (tonnes) | CAGR 2019-2023 |

| India | 2,121 | 17.4% |

| Ukraine | 1,114 | 11.2% |

| Brazil | 526 | 28.2% |

| China | 90 | 10.4% |

| Türkiye | 60 | 24.2% |

| Nepal | 36 | 14.8% |

| Peru | 29 | 2.0% |

| Bolivia (Plurinational State of) | 22 | -10.7% |

Source: UN Comtrade (September 2024)

Tip:

- Read more about the European market potential in CBI’s studies about value-added grains, pulses and oilseeds or healthy snacks.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research