Entering the European market for fresh garlic

The European market for garlic is very competitive. China is very large in the market. Off-season supply comes from Argentina, Egypt and a few other countries. Differentiate yourself by providing off-season supply, quality, variety, sustainability or organic garlic. Comply with all the legal and buyer requirements in the European market.

Contents of this page

1. What requirements and certifications must garlic comply with to be allowed on the European market?

Fresh garlic should comply with the general requirements for fresh fruit and vegetables. You can find these in the general study buyer requirements for fresh fruit and vegetables. You can also use Access2Markets' My Trade Assistant tool. This tool provides an overview of the requirements for garlic per country.

What are mandatory requirements?

If you want to export garlic to the European Union (EU), your product needs to meet strict food safety and quality laws. These rules cover things like pesticide limits, contamination control, packaging and labelling. You can find a summary of the main legal points to keep in mind for garlic below.

Import licence and certificate of origin

To ship garlic into the EU, you need an import licence and a certificate of origin. EU Regulation 341/2007 and Regulation (EU) 2020/760 set out the rules. They set the yearly tariff quota, explain how licences are issued and state what paperwork is needed for farm products that come from outside the EU.

Control of pesticide residues

The EU has rules about how much pesticide is allowed in food. These are called maximum residue levels (MRLs). They are set under Regulation (EC) No 396/2005. Your garlic might be banned from entering the EU market if it contains more pesticides than allowed.

Check the EU Pesticides Database for garlic. Garlic is included under the product code 0231010. This helps you see which limits apply to your product.

Garlic that does not meet MRLs may be flagged in the Rapid Alert System for Food and Feed (RASFF). This system helps EU food safety authorities act quickly when unsafe food is found.

Tips:

- Use the EU Pesticides Database to look up garlic MRLs;

- Apply integrated pest management (IPM). It helps keep crops healthy with fewer pesticides by using natural solutions.

Control of contaminants

Contaminants are unwanted substances that can get into garlic during farming, processing or packaging. The EU sets rules for these under Commission Regulation (EU) 2023/915.

The main concern for garlic is the heavy metal cadmium, for which the maximum allowed level is 0.05 mg/kg (measured in fresh weight after cleaning).

Tip:

- Visit the European Commission website for updates on food contaminant limits.

Plant health and phytosanitary regulation

Garlic needs to be inspected before it can be shipped to and enter the EU. This is required under Regulation (EU) 2019/2072. Your garlic needs a phytosanitary certificate from the plant health authority in your country.

This certificate confirms that:

- The garlic was inspected properly;

- It is free from serious plant pests;

- It meets the EU’s plant health rules.

Tips:

- Contact your country’s National Plant Protection Organisation (NPPO) to get the certificate;

- See Annex V of Regulation (EU) 2016/2031 to view a sample certificate.

Product quality requirements

Garlic exported to Europe has to comply with general quality standards in the European market. There are several aspects that determine the quality of garlic. These are set out in product standards for garlic. One important set of product standards is the UNECE standard for garlic.

The UNECE standard has three classes: ‘Extra’ Class, Class I and Class II. ‘Extra’ Class garlic can be recognised by its size, as its minimum diameter should be 45 mm, versus 30 mm for Classes I and II. Class I garlic must be good quality and characteristic of the variety or commercial type. Slight defects are allowed, such as minor tears in the outer skin or slight shape defects, as long as they do not affect the general appearance, quality, keeping quality or presentation.

In terms of tolerances, for Class I garlic, a total tolerance of 10% by number or weight is allowed for produce that does not satisfy the requirements of the class but does meet those of Class II. Within this 10%, no more than 1% in total can consist of produce that does not satisfy either the requirements of Class II or the minimum requirements, or of produce affected by decay. Additionally, within this tolerance, no more than 1% by weight of bulbs may have cloves that have externally visible sprouts. No more than 25% of the bulbs by number or weight can show slight staining on the outer skin, provided it does not cover more than a quarter of the bulb surface.

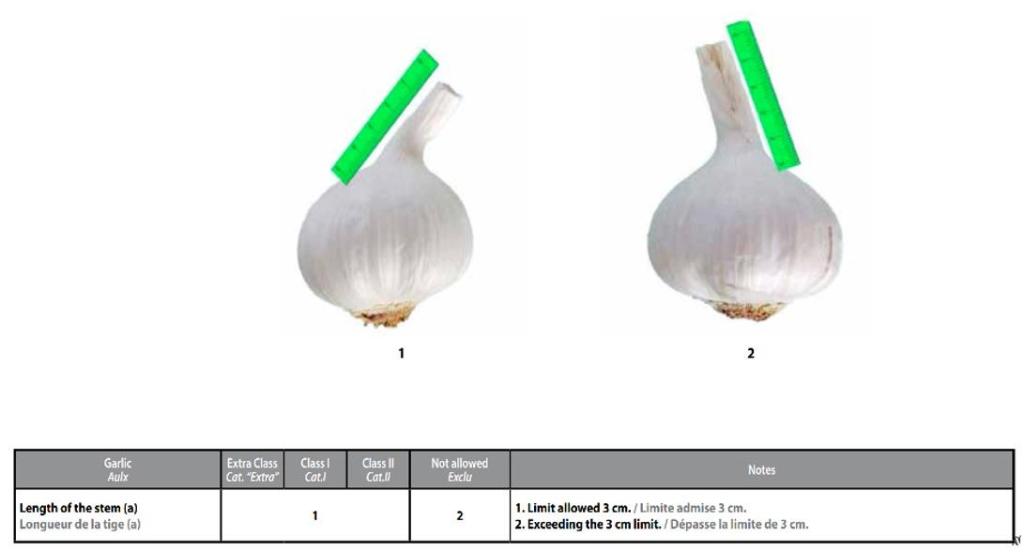

Figure 1: Example of what is allowed for garlic: length of the stem

Source: OECD (2017), Garlic, International Standards for Fruit and Vegetables, OECD Publishing

Tip:

- You can find more example images of garlic of different classes in the OECD International Standard for garlic.

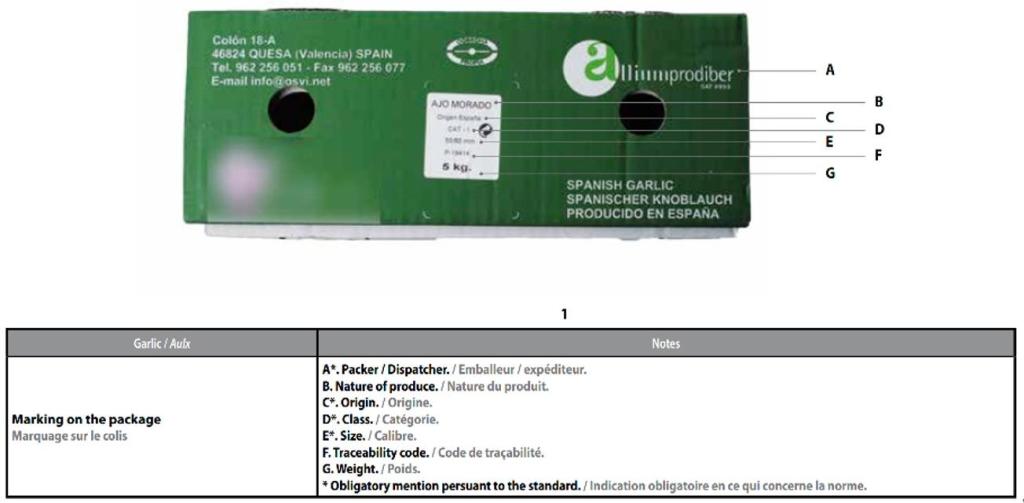

Packaging and labelling requirements

All relevant requirements for packaging and labelling are explained in the UNECE standard for garlic, or alternatively the Codex standard for garlic. Figure 2 gives an example of a cardboard box of garlic, which explains all the labelling elements the UNECE standard requires. The UNECE standard is aligned with the international Codex standard for garlic.

Figure 2: Example of a cardboard box of garlic with indication of required labelling elements

Source: OECD (2017), Garlic, International Standards for Fruit and Vegetables, OECD Publishing

Tips:

- Discuss specific packaging requirements and preferences with your European buyers;

- Read our study on buyer requirements for fresh fruit and vegetables for more information about packaging and labelling requirements.

What additional requirements and certifications do buyers often have?

European legal rules are only the start. Most buyers also ask for proof of safe farming, fair labour and care for the environment.

Food safety certificates

Supermarket suppliers nearly always want GLOBALG.A.P. certification, certainly in Northern and Western Europe. This scheme shows your farm follows good agricultural practices. Selling garlic to large retailers is almost impossible without it.

Social and environmental checks

Buyers want to know that workers are treated well and that farming harms the environment as little as possible. They may give you their own code of conduct or ask for one of these schemes:

- GRASP – an add-on to GLOBALG.A.P. that audits worker welfare;

- Sedex/SMETA – a system and audit tool that lets firms share social and environmental reports.

Some large, mainly British retail chains use tailored add-ons, such as Tesco Nurture and Marks & Spencer Field to Fork.

Tips:

- Adopt at least one social and one environmental standard (see the SIFAV Basket of Standards for options);

- Read CBI’s guide on organising the export of fresh fruit and vegetables for advice on payment and delivery terms.

Organic garlic

Organic garlic is a small but growing niche. It mainly applies to white garlic grown in Europe or other countries outside the season, mostly Argentina. To sell it, you must meet Regulation (EU) 2018/848 on organic farming and labelling. One supplier active in this field is Dynamis France.

Tip:

- Weigh the demand and price premium before you invest in organic certification, as organic certification costs a lot.

2. Through which channels can you get garlic on the European market?

Most garlic is conventional, consumed at home and bought at supermarkets, specialised food and vegetable stores and street markets.

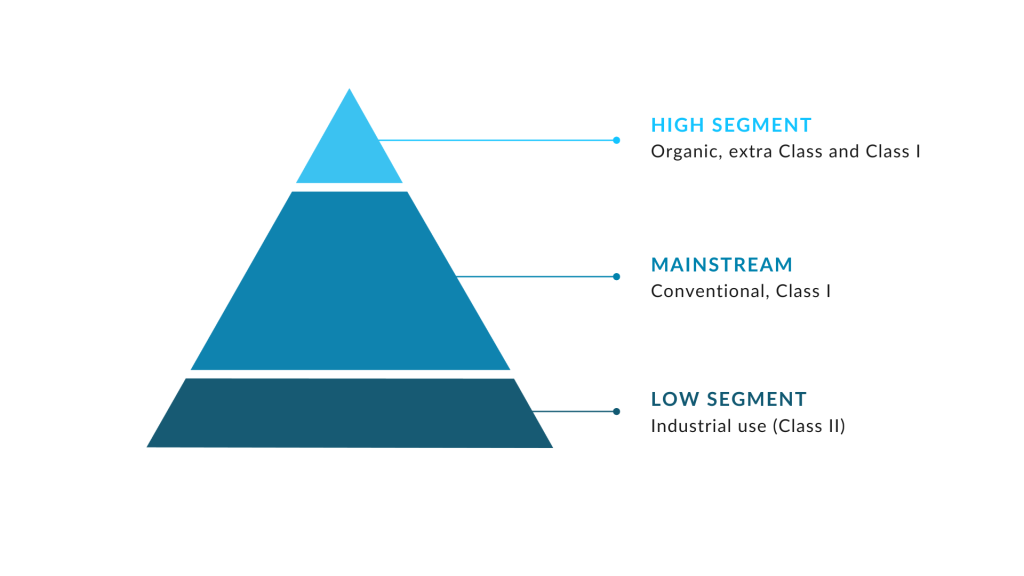

How is the end-market segmented?

The market for garlic can be divided into three segments: the high, mainstream and low segments (Figure 3).

Figure 3: Market segments for fresh garlic in Europe

Source: Globally Cool (June 2025)

High segment: organic and beyond

Garlic in the high segment is often coloured. Rocambole, Purple Stripe (e.g. Ajo Morado) and Porcelain are key sub-types. This garlic is typically Extra-Class, with a premium look and without defects. Organic can be Class I and sometimes Class II. Examples of niche markets in this top segment are:

- Organic-certified garlic in organic supermarkets, premium aisles in mainstream supermarkets and in meal kits;

- Coloured organic bulbs, such as purple garlic, are a niche for gourmet retail and chefs. Gourmet retailers favour two-bulb flow-wrap or 150 g nets; chefs often buy individual 5 kg cartons;

- Biodynamic certified garlic; this is a tiny but profitable market in health food stores or box schemes.

Many coloured lines are sold under European geographical labels, such as Ail Rose de Lautrec and Ajo Morado de Las Pedroñeras, which boost the story and price. Price levels can be up to 50% higher than mainstream market prices. Coloured varieties account for less than 10% of the European garlic market volume, so buyers accept short gaps in supply.

Mainstream segment: Class I + conventional = core of supermarket sales

White garlic dominates Europe’s shelves because it can be stored for eight to ten months, and it ships well in 10 kg cartons and 250 g nets. Supermarkets and large food service distributors buy the bulk of this mid-price mainstream segment. Their standard spec is UNECE Class I: 45–70 mm bulbs, good shape, clean skins and minor cosmetic defects. Pesticide residues must be at or below EU MRLs. Many chains ask for GLOBALG.A.P. and GRASP. Discount and ethnic retailers accept the same grade but focus on 50–60 mm sizes to keep costs down.

Figure 4: Chinese Class I garlic (60 mm) available in an Asian retail outlet in Germany

Source: Globally Cool (February 2025)

Low segment: Class II + conventional = input for processors

Class II conventional garlic is the main raw material for processors in Europe. It feeds peeling plants, chopping/dicing lines, dehydrators for powder and flakes, and black-garlic fermenters, for which outsides do not matter. When Class II is sold in retail, it is usually sold in bargain 500 g or 1 kg nets aimed at price-sensitive shoppers. Class II bulbs also move through wholesale spot markets (Rungis, Mercabarna) to caterers and professional kitchens that only need flavour, not appearance.

Variations per EU region

Note that the shares and offer of garlic differ per European region. In Eastern Europe, there is little organic garlic available in supermarkets. In Southern Europe, more organic garlic is available, especially in specialised organic retail stores. However, far more organic-certified garlic is available in food retail channels in Western and Northern Europe, in Germany, Switzerland, France, the Netherlands, Sweden, Denmark and the United Kingdom.

Tip:

- Aim to ship Class I garlic. Class II earns lower returns and is mainly viable for organic lines.

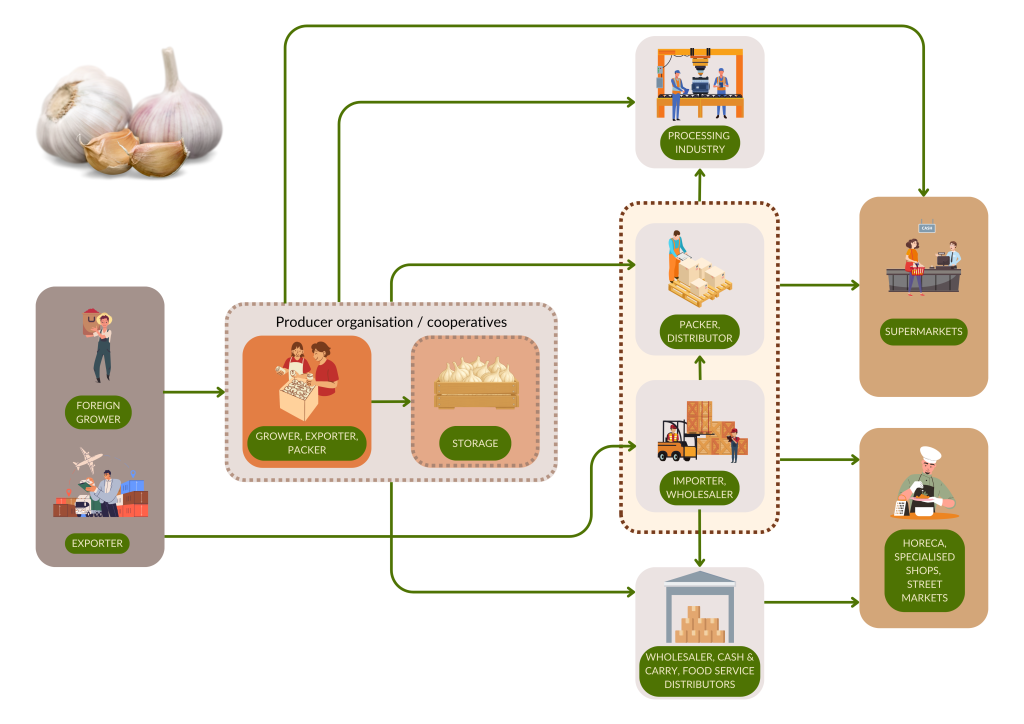

Through which channels does garlic end up on the end-market?

Garlic ends up on the European market through different channels (see Figure 5). The most important channels are explained in more detail.

Figure 5: Market channels for fresh garlic to Europe

Source: Globally Cool (June 2025)

Importers and packers

Dedicated fresh produce import houses smooth out seasonal fresh produce shortages for retailers and processors. For example, Dutch trader Roveg sources fresh produce from more than 60 countries. For organic lines of fresh produce, supermarkets rely on specialists like Eosta - Nature & More or, in some cases, import organic garlic themselves.

Importers and packers secure year-round supply by switching between Spain, China, Egypt and southern-hemisphere harvests from South America. They typically require GLOBALG.A.P. certification and often GRASP or SMETA audits. They also have colour, bulb size and residue limits. Residue limits are usually in line with EU legal MRLs.

Producer organisations

Large European grower groups dominate the main European summer/autumn season, and they export too. European groups like these often produce in one country, supply retail programmes directly and top up gaps with imported bulbs. Volume and traceability requirements are high, but they only buy externally during short windows of one or two months, which may differ per European country. Producer organisations sell to supermarkets, peeling plants, wholesalers and food processors.

For example, in Spain, the window is typically during spring. In France, no local coloured garlic is available between August and September, so it comes from Spain or Egypt in this period.

Examples of producer organisations are:

- Cooperativa San Isidro ‘El Santo’ in Spain grows, stores, grades, packs and ships purple, pink and white garlic to European supermarket chains with an annual volume of 15–20,000 tonnes;

- Ajos La Veguilla is a Spanish group that handles every step, from the field to export. It markets several varieties, including white and purple garlic, with an annual volume of more than 30,000 tonnes;

- French BCO-France Allium is a group that produces, sells and markets garlic, onions and shallots with 50 growers. Its products are conventional and (EU) organic. They have GLOBALG.A.P. certification, and IFS food safety certification is in progress.

French group Coopérative Alinéa/Top Alliance is GLOBALG.A.P.- and IFS-certified for its production of garlic, onions and shallots. It sells these to food retailers (60% of sales, for example E.Leclerc in France), wholesalers and food service (20%), the processing industry (5–15%) and exports (5–15%).

Tips:

- Study the EU garlic calendar and target shipments for April–May or August–September, when local stocks are low;

- Match UNECE Standard FFV-18 Class I size, shape, firmness standards and defect limits before you approach a cooperative;

- Certify your farm with GLOBALG.A.P. and add GRASP or another social audit to satisfy retailer demands;

- Grade bulbs by size and colour (white, purple, pink) so buyers can put them straight into their retail packs.

Wholesale hubs

Large wholesale hubs let traders top up supplies at short notice. Companies that trade in these hubs resell to market stallholders, ethnic stores, caterers and independent shops.

The Marché de Rungis in Paris, for example, hosts specialists like Paris Ail and Gervais, both focused on garlic, onions and shallots, and generalists, like Novagrim. In Spain, Mercabarna in Barcelona gathers over 700 companies that trade local and imported fresh produce year-round, such as Grupo Fernández.

Rungismarket in France, Germany’s Grossmarkt Hamburg, SogeMi Mercato Agroalimentare Milano in Italy and New Spitalfields Market in the United Kingdom are all hubs. Garlic specialists, such as Paris Ail and Gervais, buy local ‘Castilian white’ (garlic from Spain) in summer and switch to Chinese containers in winter. These markets supply ethnic shops, market stalls, caterers and small processors. Prices fluctuate daily. Newcomers can sell small, mixed and speciality lots here.

Tips:

- Partner with a wholesaler that trades in a wholesale hub. Develop a seasonal plan with the wholesaler; promise steady weekly pallets, not one-off loads;

- Use EU-based importers that have a garlic import licence. These companies will also arrange phyto checks and pay duties. Give them the packing list, commercial invoice and phytosanitary certificate. The load will be refused at the gate without paperwork;

- Check price bulletins (e.g. Mercabarna Stats, select group ‘BULBS’ and then product ‘GARLIC FRESCH’) to pick the best shipping month.

Food service distributors

Hotels, restaurants and caterers buy garlic through wholesale hubs or food service/delivery wholesalers. The largest players in this segment are METRO, which has more than 600 cash & carry and delivery hubs in 30 plus countries, Transgourmet and Bidfood Europe, which has a presence in 13 countries.

Transgourmet is part of Switzerland’s Coop Group. It runs more than 200 depots in seven European countries and leads the German food-service wholesale sector. Its produce list covers conventional, organic and convenience-grade garlic. Branches pick local garlic in season and order off-season volumes via Transgourmet’s central buying office.

Food service buyers like peeled cloves or 1 kg nets of Class I quality and full cold-chain documentation. Peeled cloves come from garlic processing specialists, like the Spanish Big Garlic and the Dutch Garlic Solutions. Garlic Solutions peels four million cloves per week, using only Spanish garlic. It also ships ready-to-use packs to catering chains and meal box firms.

Food service buyers need consistent sizing. They often prefer peeled or diced formats in 1 kg pouches or vacuum packs. Volumes are smaller than in retail, but margins are slightly higher.

Specialised root vegetable traders

A special category of importers consists of smaller but specialised traders, such as Germany’s Jersa, British First-Chartered and Pan United, and Dutch Sawari Fresh International and Rida Trade. These traders specialise in garlic and a few other vegetables (often root vegetables) and/or fruits. Jersa, for example, specialises in Spanish and Chinese garlic in different packaging sizes. It holds buffer stocks for regional wholesalers. They also offer garlic from China and green garlic from selected producers in Germany, Argentina, Spain, the Netherlands and Egypt. Rida Trade is more focused on one origin (China), leaving few opportunities for exporters from other countries.

A few European companies focus mainly on garlic, such as Paris Ail, a French wholesaler dedicated to garlic, onions and shallots. Paris Ail combines its own 100 hectares of French production with imports and supplies retailers, market vendors and catering buyers in France and surrounding countries. A company that transformed from producer to trader is Cervati from Italy.

Figure 6: Solo garlic in a 250 g basket (Chinese origin), offered by Jersa

Source: Jersa (June 2025)

Spot importers are useful when supermarkets need an urgent top-up or when a processor is short on a specific variety. Niche bio-dynamic or heirloom varieties also move through these traders into farm shops and online boxes. Their market share is small, but they offer new exporters a first step towards entry with smaller container volumes.

Tips:

- Familiarise yourself with the European garlic season. The sharpest ‘demand gaps’ that trigger emergency buying from outside Europe fall just before the new EU harvest (April–May) and at the tail of the storage season (August). That is when co-ops and supermarket importers turn to Egypt, Argentina and China for fresh garlic;

- Offer Class I, low-residue bulbs. EU buyers will pay more to refill shelves quickly with compliant products;

- Book freight early for March and September discharge slots – ports can get congested as more traders try to catch the gap;

- Be aware of your EU importer’s inventory updates; flexible sailing dates help you fill any sudden deficit quickly, without overstocking.

What is the most interesting channel for you?

Import packing specialists give access to supermarket programmes. This makes them the preferred channel for large volume exporters. Companies like Roveg handle year-round sourcing from several origins, regrade garlic in their Dutch hub and forward the bulbs to retail and processors. Import packing specialists buy full container loads, demand GLOBALG.A.P. and GRASP certification and pay stable prices when quality is reliable.

Wholesale markets or spot trade can be interesting for smaller volumes, as big city hubs absorb seasonal peaks and speciality lots. Exporters can place smaller volumes, coloured varieties or late-harvest Chinese/Egyptian garlic here to reach ethnic shops, caterers and independent retailers. Pricing is volatile, but payment is typically fast.

European producer organisations usually cover the summer harvest, but import to bridge shortfalls. Deliveries must match their Class I spec 45–70 mm bulbs as well as EU legal residue limits. The window is short but profitable for exporters that can ship fresh bulbs in April to May or September. The short window also means decision-making is fast; when stock is tight, cooperatives confirm spot deals quickly.

Exporters from developing countries that can ship fresh, certified garlic during these windows – especially from Egypt, Argentina or China’s early Shandong crop – have a good chance of becoming the ‘gap supplier’ for producer organisations.

Food service wholesalers serve hotels, restaurants and caterers across many EU countries, and source both whole and peeled garlic. Volumes are smaller than in retail. However, margins are higher, and demand for convenience products, such as ready-to-use peeled cloves, is growing. Access is easiest through their central buying offices or approved import partners.

Tips:

- Search the business directories of wholesale markets, such as the Rungismarket business directory (France) or the Mercabarna company search (Spain), to find relevant wholesalers;

- Attend trade fairs to connect with European buyers, such as Fruit Logistica (Berlin, Germany) and Fruit Attraction (Madrid, Spain). For more tips, read CBI’s tips to find buyers on the European fresh fruit and vegetables market;

- Split shipments: send main volumes to an importer, and send a trial pallet to a licensed wholesaler to test price and feedback before you scale up.

3. What competition do you face on the European garlic market?

European countries, namely the Netherlands and Spain, dominate the garlic market for most of the year. While China is Europe’s high (although quota-restricted) volume supplier of cheap garlic, there is also supply in the off-season from countries in the Southern Hemisphere, mainly Argentina and Egypt.

Which countries are you competing with?

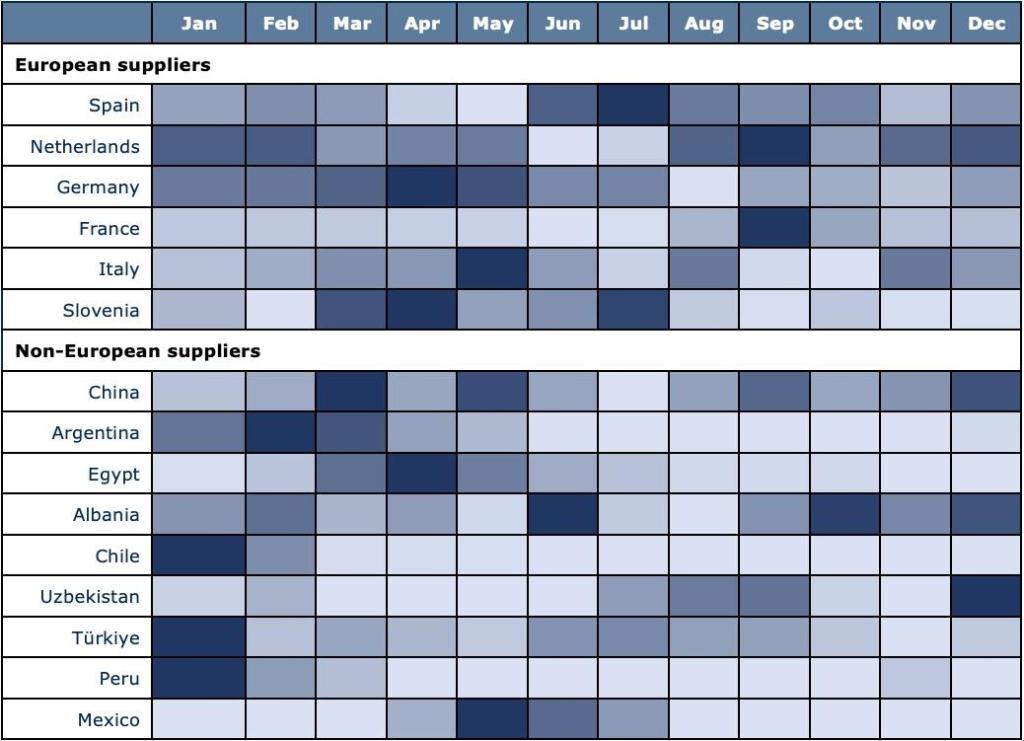

You will mainly compete with European countries, most importantly with Spain. Spain is the biggest garlic supplier to Europe year-round, but it does present a gap in April–May. Non-European suppliers, especially China, Argentina and Egypt, have important seasonal roles. China peaks in March, May, September and December, showing strong off-season supply capability. Argentina is important from January to April, but it disappears mid-year, returning only slightly in December. Egypt peaks from March to May.

This pattern reveals clear seasonal windows. When EU production is low (mainly during winter and early spring), buyers turn to developing countries. Exporters from these countries should aim to fill off-season gaps. For example, Egypt can target March–May, and Argentina January–April. Smaller players like Peru, Mexico and Türkiye also have brief openings. Figure 7 shows the months in which these countries export garlic to Europe. The dark blue colour shows the months in which the exported values to Europe were highest.

Figure 7: Indicative supply calendar for garlic in Europe, European countries compared to main non-European supplying countries (based on monthly export values in 2024)

Source: Globally Cool, based on Trade Map monthly data for 2024

Looking at the non-European suppliers, China is the largest exporter of garlic to Europe by far. Argentina, Egypt, Albania, Türkiye, Chile and Peru are important competing countries to consider. Figure 8 offers more detail about these suppliers and the trend during the 2020–2024 period.

Source: UN Comtrade (May 2025)

China: reliable, price-competitive white garlic giant

China is the main non-EU supplier. It shipped about 73,400 tonnes of fresh garlic to Europe in 2023, roughly 70% of extra-EU imports. Deliveries follow the tariff-quota cycle. In practice, this means most containers arrive in September, December and March. The Chinese season usually starts at the end of May, after a short off-season. The Netherlands is the main destination (60% of the total), followed by the United Kingdom (25%) and Spain (5.9%). The most striking destination in China’s top seven is Norway, in sixth place with 850 tonnes. Norway rarely imports such large volumes of fruit or vegetables from origin countries directly.

The prices of Chinese garlic are usually quite low, but they are affected by shipping costs. For example, in June 2024, shipping from Qingdao Port to ports in Northwestern Europe was about $6,700–7,000 per tonne. This increased the price significantly. Coloured varieties, such as purple garlic, are typically sold at higher prices (e.g. about $1,200 per tonne) than white garlic (e.g. $1,100 per tonne). Other Chinese varieties include the premium purple garlic variety Red General and Pure White Garlic.

Anti-dumping duties and strict licence ceilings limit further growth of Chinese garlic exports to Europe. However, buyers keep choosing China for its uniform bulb size and sharp pricing. Chinese farms with GLOBALG.A.P. and GRASP certification plus low-residue protocols have the best supermarket contracts.

How the EU and UK tariff-rate quotas (TRQs) for Chinese fresh garlic work

The EU manages 58,870 tonnes of annual TRQ for CN 07032000 garlic under Regulation 341/2007. China receives 33,700 tonnes, released in four equal sub-periods (June–Aug, Sept–Nov, Dec–Feb, Mar–May).

Imports inside the quota only pay the normal customs duty (9.6%). Once the sub-period quantity has been used up, Chinese garlic faces the full MFN duty of 9.6% + €1,200/tonne and an anti-dumping surcharge. This makes out-of-quota shipments uneconomical for most traders.

Importers must hold ‘A’ licences: 70% of each sub-period volume is reserved for traditional licence-holders, 30% for newcomers.

Table 1: Annual EU fresh garlic tariff-rate quota (TRQ) under Regulation (EC) 341/2007, in tonnes per season

| Allocation | Annual volume* | Share of 58,870 tonnes of TRQ | Order no. for licence | Notes |

|---|---|---|---|---|

| China | 33,700 | 57% | 09.4105/09.4100 | Spread over four three-month sub-periods. Separate windows for traditional (70%) and new (30%) licence-holders. |

| Argentina | 19,147 | 33% | 09.4104/09.4099 | All volume falls in the third and fourth sub-periods (Dec–May). Separate windows too. |

| Other countries | 6,023 | 10% | 09.4106/09.4102 | Any non-EU exporter (e.g. Egypt, Türkiye, Peru) may compete for this pool. Separate windows too. |

Source: EUR-Lex (May 2025)

After Brexit, the United Kingdom incorporated the EU mechanism into its own TRQ (order 05.4105), which is managed by the Rural Payments Agency. The yearly volume is about 10,127 tonnes (four sub-periods of 2,530 tonnes each). The TRQ available to other countries than China and the EU is 2,312 tonnes per year. While the TRQ for China is almost 100% overbooked every quarter, the TRQ for other countries is applied for less.

Out-of-quota entries pay the MFN duty plus the UK-continued anti-dumping amount, so licence access is very important to British importers. Importers have to prove prior trade (at least 25 tonnes in each of the two preceding years), provide a £60/tonne security and apply for licences in May for the quota year starting 1 June. At the start of each season there is a new Notice toTraders. The latest notice was published in April 2025.

Egypt: early-season purple and white bulbs

Egypt supplied 9,800 tonnes of garlic to Europe in 2024, with an above average growth of 8.2% per year. Exports of purple and white cultivars start as early as February, bridging the spring gap before Spain’s harvest. Egypt’s hub to Europe is Slovenia. It accounts for almost 55% of the total volume in 2024. Italy receives 1,600 tonnes (17% share), followed by the Netherlands (9.3%).

FAO data put Egyptian garlic production at about 396,000 tonnes in 2022, up from about 319,000 tonnes in 2019. The cropped surface rose from roughly 12,000 hectares in 2017 to a peak of almost 19,000 hectares in 2021, dropping to under 18,000 hectares in 2022. Some industry sources mentioned crop area being reduced by about 30% in 2023 and 2024. Sowings in 2025, meanwhile, were much higher than in previous low-planting years.

Short sea transit and freedom from quota duties make Egypt a go-to source when European stocks dip, but stable curing is essential to avoid sprouting claims. Fluctuations in the Egyptian pound's exchange rate and export permit changes may disrupt supply schedules in the future.

Argentina: Southern Hemisphere gap player

Argentina’s exports to Europe reached a new record in 2024, when 13,700 tonnes of garlic were exported. This was up from 3,700 tonnes in 2023. Argentinian garlic mainly arrives in Europe between January and May. Timing in the Southern Hemisphere allows importers to fill empty cold stores just before the new EU crop, at the most beneficial tariff-rate quota of 9.6%. Spain and the Netherlands were the top destinations in 2024 (both just over a 40% share), while Italy and France follow with 8.2% and 3.4%.

Between January and May, Argentinian garlic fills the gap with white garlic, large 55–70mm bulbs and the popular Morado variety. With a virtually non-existent quota barrier, Argentinian exporters can enter 9.6% duty-paid whenever EU spot prices justify freight. Argentina is Europe’s number one supplier of organic garlic from outside Europe. Its main destinations are the Netherlands (760 tonnes in 2024), Italy (400 tonnes) and Spain (180 tonnes).

Spain: Europe’s garlic powerhouse

Spain harvested about 270,000 tonnes and exported 142,000 tonnes of garlic in 2024. More than 70% of these sales stayed within Europe, with large volumes going to Germany, the United Kingdom, Italy, France and Portugal. Spain largely controls European supermarket shelves from July to February. When Spanish stocks are at their lowest from April to May and again in late August, buyers turn to Egypt, China or Argentina.

Although PGI (Protected Geographic Origin) labels like Ajo Morado de Las Pedroñeras command a gourmet premium, they represent only a small share of the Spanish volume. Spain is the largest player in the European market. Spain and China’s price moves are the key drivers of European import demand.

Tips:

- Contact Spanish prospects using the member database of the Spanish Association of Garlic Growers and Traders;

- Inform your buyers about real-time acreage signals regularly. This is important because garlic plantings are highly cyclical and can swing sharply from one year to the next, such as in Egypt;

- Find an EU importer that holds an ‘other-origin’ licence for the relevant sub-period if you are a garlic exporter not from China or Argentina. Any garlic that lands after the quota pool is filled can still clear customs, but it will be charged the extra-specific duty of €1,200 per tonne. This charge likely removes most of the price advantage.

Which companies are you competing with?

Outside Europe, the main competitors for garlic are in China, Egypt and Argentina. Examples of some companies that supply garlic to the European market are given below. Quality, certifications, sustainability and counter-season production are key in exporting garlic to the European market.

Jinxiang Fenduni Foodstuff from China – one of Shandong’s many garlic specialists

Jinxiang Fenduni is based in China’s ‘garlic capital’. It exports more than 50,000 tonnes of fresh, peeled and frozen garlic per year, as well as dehydrated onion, ginger and carrot. The company is GLOBALG.A.P.-certified. Its packhouse has BRCGS and ISO 22000 food safety system certification. Jinxiang Fenduni runs over 5,000 tonnes of controlled-atmosphere cold stores, and is a medium-sized player in Shandong. For comparison, the large Chinese groups operate 30,000–50,000 tonnes of cold space and ship over 200,000 tonnes per year.

Gezira United from Egypt – solar-powered, Nile Delta garlic specialist

Gezira United is a family-owned grower-packer that focuses on premium Egyptian garlic and a few companion crops, including onions, sweet potatoes, oranges and pomegranates. Its 5,000 square meter warehouse and packhouse near Damietta port is FDA-registered (for export to the USA) and fitted with a solar-powered garlic-and-onion sorting line. This emphasises the firm’s sustainability goals.

Purple and red-skinned bulbs are graded into size codes 5–9 and loaded into 25–28 tonne, 40-foot containers, with private-label or 5 kg retail cartons on request. The season runs from February to August, allowing Gezira United to ship fresh Class I garlic to Europe well before the Spanish crop starts.

American Garlic Products – counter-season garlic expert from Argentina

American Garlic Products (AGP) is headquartered in the garlic heartland of Guaymallén, Mendoza, Argentina. The company grows, packs and ships a range of all-year garlic formats: fresh bulbs, organic garlic, paste and dehydrated flakes. Its location in the Southern Hemisphere allows it to supply markets off-season (from March to May), weeks before the new Spanish crop.

The firm controls the entire chain, with its own fields, a dedicated packhouse, cold storage and processing lines for paste and powder. It regularly sends full-container shipments of 10 kg boxes to Europe. Top clients include Dutch and Italian importers.

AGP highlights high-altitude cultivation in the Uco Valley. This produces bulbs with higher dry matter and strong flavour. Size grades run up to 66–70 mm for supermarket nets, with colour options in white, red and the popular purple or Morado type. Some of the company’s farms are organic certified for the American, Canadian and Japanese markets, but not for Europe.

Tips:

- Study your global rivals and pinpoint the edge you have over them;

- Stand out in the European market with a clear value offer. Use benefits such as off-season supply, shorter transport time, unique varieties, higher quality or stronger sustainability credentials.

Which products are you competing with?

Fresh garlic is a staple in Europe. It is at the heart of various cuisines, sold in every retail and food service channel and eaten year-round. True substitutes are rare. Competition comes mainly from other garlic types and from convenience formats developed to save labour or reduce odour.

Each variety has its own flavour profile and best use. White bulbs give the classic pungent kick for everyday cooking. Purple-stripe or Morado garlic tastes sweeter and is popular for roasting and speciality dishes. Wet (spring) garlic is harvested early. It has a tender white bulb and edible green top, ideal for salads and garnishes. Solo (single-clove) garlic offers ease of peeling and a milder bite.

New product ideas also compete for shelf space. Black garlic is made by slow-fermenting fresh bulbs at low heat. It offers a sweet, umami note and appears in gourmet aisles. Plant breeders are trialling low-odour lines that keep flavour but reduce after-smell. These are aimed at office workers and ready-meal brands.

For convenience, shoppers swap fresh cloves for processed options: peeled vacuum packs for quick preparation, frozen diced garlic with a long storage life, garlic paste or purée for sauces, and garlic powder or granules for seasoning blends. These formats extend garlic’s reach into snack foods, meat rubs and ready meals, and they pull some demand away from whole bulbs.

Garlic can be substituted as a flavour enhancer in recipes by ingredients such as onion powder, chilli flakes and herb blends.

Tip:

- Learn about the main garlic types on the European market and understand their flavour, typical uses and price points.

4. What are the prices of garlic on the European market?

Consumer prices vary widely because several factors influence them. Import prices can be calculated based on import values and volumes. From there, a price breakdown can be made to show how margins are divided throughout the value chain.

Consumer prices vary

Shelf prices differ by garlic type, pack, period and country. In February 2025, German ethnic Asian food retailers offered Class 1 Chinese white garlic at €6/kg, while purple Class I fetched about €8/kg at wholesale markets in Paris and Lyon in May 2025. Spring (wet) garlic, sold in 100 g bunches, is the top-priced fresh format with prices of €12–25/kg in European supermarkets.

On average, organic garlic has a 40–60% premium over conventional bulbs in retail, depending on the variety and country. In practice, this means a conventional shelf price of €9.00/kg often increases to €12.50–14.50/kg for the same size and variety with the EU organic logo.

Import values keep climbing

Import data converted by Globally Cool show average European CIF prices in the six focus markets rising from €1.5–2.4/kg in 2020 to 2–4.7/kg in 2024. This reflects the rising costs of production, logistics and distribution in the European market.

Source: Globally Cool (June 2025)

Prices can change throughout the year due to several factors. For example, in the first months of 2025, garlic wholesale quotes increased by up to 20% due to empty Spanish stocks, a wet French harvest and Red Sea delays that added 15–20 days to Chinese transit times, raising spoilage risks and freight surcharges.

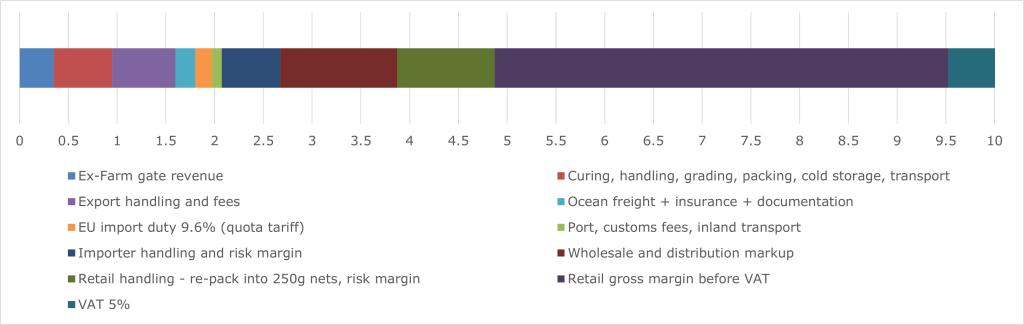

Price breakdown

Margins differ based on factors like the type of garlic, its origin, international and regional market dynamics, and whether the garlic is conventional or organic. Figure 10 shows an indicative value chain split for Argentinian white garlic (50mm) exported to the Netherlands and sold in European supermarkets. In the case of Argentina, European importers sometimes compete with buyers from Brazil, who usually offer better conditions. This leads to much higher prices for European exports.

Figure 10: Indicative price breakdown for fresh garlic from Argentina to Europe, in € per kg

Source: Globally Cool (June 2025)

Tip:

- Check prices for different garlic types. For example, for the Spanish market, check Mercabarna (in Stats, select Group ‘BULBS’ and then Product ‘GARLIC FRESCH’).

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research