The European market potential for fresh garlic

Fresh garlic is an essential for European cooks. It is used in all kinds of dishes, from quick stir-fries to gourmet aioli. Imports hit 281,000 tonnes in 2024. Developing countries supplied one-third of the market as Spanish growers shifted towards colourful varieties. China exports the most white garlic, while Argentina and Egypt are major counter-seasonal partners. Prices have risen, but demand keeps growing. This is helped by new convenience packs, organic lines and peaks in off-season imports.

Contents of this page

1. Product description: garlic

This study focuses on fresh garlic export (HS 070320 – ‘garlic, fresh or chilled’) to the European market. Fresh garlic is here defined as any whole, recognisable bulb that is sold either as:

- Semidried table garlic – the popular three-bulb mesh nets, often 250 grams, and other retail or food service packs (e.g. flow wrap singles, plastic-free paper nets, clamshells, braided strings) that still qualify as ‘fresh/chilled’ under HS 070320;

- Super fresh ‘green’ garlic – harvested early, with the tender stem still attached and kept refrigerated. This product is almost exclusively sourced in Europe.

Figure 1: Semi-dried table garlic in 250 g nets in a Swedish supermarket

Source: GloballyCool (May 2025)

Garlic (botanical name Allium sativum) is prized for its flavour in cooking. It is used throughout Europe, both as a main flavour and a subtle enhancer. Culinary applications include:

- Sauces, soups and stews;

- Sautéed, roasted or confit vegetables, meat and fish;

- Marinades and dressings;

- Stir-fries, pasta and rice dishes;

- Dips (aioli, hummus) and spreads;

- Pickling and fermenting (e.g. kimchi, garlic in vinegar).

European consumers buy garlic mainly as an ingredient to be chopped, crushed, grated or roasted whole. However, demand is also growing for peeled cloves, purees and other value-added fresh formats.

Table 1: Garlic varieties, description and use in the European market

| Variety (commercial type) | Description | Typical use in Europe | Main supplying countries* (season dependent) |

|---|---|---|---|

| White garlic, known in China as ‘Pure White’ and ‘Normal White’, in Spain as ‘Spring Blanco’ and ‘Spring Violeta’ and in Argentina as ‘Chino Blanco’ and ‘Chino Morado’. | Compact bulb with papery white skin; long shelf life and many small to medium-sized cloves. Mild when young, pungent when mature. | All-purpose variety for raw and cooked dishes; most common retail net‐pack garlic. | China, Spain, Argentina, Egypt |

| Purple/Morado garlic, called ‘Morado’ in Spain and ‘Colorado’ in Argentina. | Violet-striped skin, fewer but larger cloves; stronger, more complex flavour. Scape (flower stalk) forms in spring. | Favoured by chefs and speciality retailers; excellent roasted or sliced raw for colour contrast. | Spain, Argentina, Brazil |

| Green (wet) garlic | Immature plants harvested with soft stem and undeveloped bulb; flavour is mild, reminiscent of garlic chive. Needs refrigeration. | Seasonal delicacy sautéed whole, sliced into salads, soups and omelettes. | All European countries that produce garlic: e.g. Spain, France, Italy, the Netherlands. Most supply from outside Europe comes from Egypt. |

| Elephant garlic (A. ampeloprasum) | Very large bulb, 3–4 enormous mild cloves; botanically closer to leek. | Roasted whole, sliced in carpaccio, or used where a subtle garlic note is desired. | Spain, France, United Kingdom |

Source: GloballyCool (May 2025)

2. What makes Europe an interesting market for garlic?

The volume of European imports has been fairly stable for the last five years. Overall, there has been a slight positive compound annual growth rate (CAGR) of 1.2% over the whole period. Imports of fresh garlic were about 268,000 tonnes in 2020. They climbed to almost 281,000 tonnes in 2024.

European growers (intra-EU) lost their share. Their sales dropped from 205,000 to 177,000 tonnes (-3.6%). Developing countries almost doubled shipments to 102,000 tonnes (+14%). They now hold roughly one-third of the market. Supplies from other developed countries stayed small, under 2,000 tonnes each year, so they hardly count in terms of total import volumes.

*Developing countries following the OECD-DAC list of ODA recipients. ‘Rest of the world’ refers to all other countries.

Source: UN Comtrade and Eurostat Comext (June 2025)

Spain was the largest supplying country to Europe. However, Spanish export volumes to Europe fell from 128,661 tonnes in 2020 to 105,155 tonnes in 2024. Their share fell year-on-year. An important reason for this was reduced production, challenging weather and ongoing competition from China and other non-European countries.

China grew most in absolute volume, increasing sales to 73,434 tonnes, with a 10% annual growth rate. Argentina grew fastest, jumping from 2,693 tonnes to 13,694 tonnes. Egypt rose to 9,834 tonnes. Chile and Türkiye grew from under 500 tonnes to over 1,400 tonnes.

China’s average price (CIF Europe) increased from 1.49 €/kg to 2.34 €/kg. Across all sources, the European import price rose from 1.95 €/kg to 2.57 €/kg, showing solid demand that absorbs higher values. Growing volumes and higher prices (which also reflect rising costs of production, processing and transport) show that there are a lot of opportunities for growth on the European market for exporters in developing countries.

Opportunities for developing countries

Even though Europe produces a lot of garlic, there is still need for imported garlic, depending on the European harvest and stocks. This is mainly because of counter-seasonal imports, as gaps appear during the year that need to be filled.

These shifts create opportunities for price-competitive developing-country exporters. As EU suppliers retreat, buyers need diverse, near-shore and counter-seasonal sources to meet their demands.

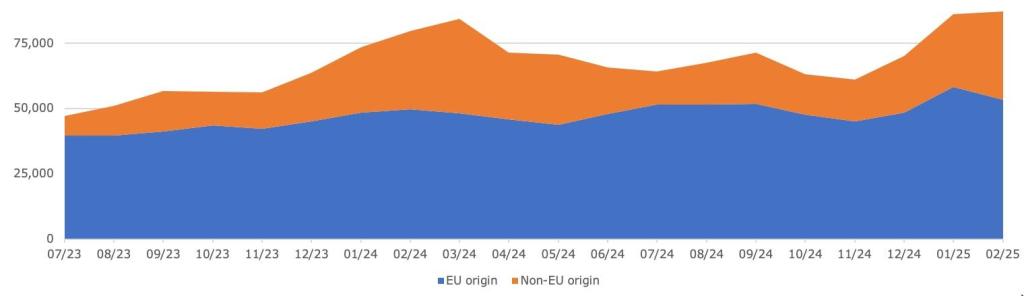

Figure 3: European imports of garlic by main origins (in thousand €) per month (July 2023 – February 2025)

Source: GloballyCool, based on Trade Map statistics (May 2025)

A distinction is made between imports of garlic from EU countries and imports from non-EU countries, so that the window of opportunities for developing countries can be seen (see Figure 3). Imports of garlic from non-EU countries peak in January, February, March and September. Imports from European countries are comparable in some periods. This is mainly because some European countries, once they have imported garlic from non-EU countries, re-export it to other parts of Europe.

Exporting garlic during the off-season, when European countries need to fill the shortfall, offers the best opportunities for suppliers from developing countries. This means it is essential to look at the European supply window.

Tips:

- Read CBI's Tips for finding buyers on the European fresh fruit and vegetables market and Tips for doing business with European buyers of fresh fruit and vegetables;

- Although the off-season for garlic in European countries is relatively short, it is worth checking when there is a window of opportunity to supply garlic to the European market. You can use the seasonal calendar made by the Import Promotion Desk (IPD). Keep track of prices in the market. Imported garlic becomes more competitive in periods when garlic reaches the highest prices.

3. Which European countries offer the most opportunities for garlic?

Together, the Netherlands, the United Kingdom, Germany, Italy, France and Spain imported about 193,000 tonnes of fresh garlic in 2024. This was equal to about 70% of all European imports. Since 2020, their combined volume has grown by 1% per year, mainly because of a significant growth of 18% in 2024.

This section offers more details on the European import of garlic from developing countries. The figures shown in Figure 4 are analysed further. They are key in the selection of priority markets for garlic suppliers from developing countries. There is a close relationship between European production and import volume. In years with poor harvests, import volumes usually go up.

Source: UN Comtrade and Eurostat Comext (June 2025)

The Netherlands: hub for garlic from outside Europe

Dutch garlic imports rose from 41,300 tonnes in 2020 to 54,350 tonnes in 2024. This represents a solid 7.1% yearly gain. Supply is overwhelmingly from developing countries. Deliveries climbed to 47,600 tonnes, giving them an 87% share. Spain held a small but steady slice at about 3,000 tonnes per year. However, intra-European volumes almost halved to 6,000 tonnes: they now cover just 11% of total imports. This affected supply from Germany, France, Greece, Denmark, Italy, Austria and the United Kingdom.

China supplies the majority, growing to almost 41,000 tonnes in 2024. Argentina has moved into second place, jumping from 1,770 to 5,630 tonnes, with a yearly increase of 34%. Supply from Egypt has gone up and down. It peaked in 2021 at 1,540 tonnes, then dropped to 770 tonnes in 2023, before increasing again in 2024 (890 tonnes).

Non-European, non-DAC origins stayed small, but jumped to 870 tonnes. This was almost entirely because imports from Chile grew in 2024, after two years with low imports. Chile’s rise suggests the Dutch market will keep favouring competitive exporters from outside Europe that can guarantee volume and quality.

The Netherlands occupies a strong second place as a fresh garlic exporter in Europe behind Spain. Dutch exports grew from 27,800 tonnes in 2020 to 39,800 tonnes in 2024. This represents a 9.4% annual increase and roughly 22% of the European total. Much of this volume is re-exported garlic originally imported from China. Dutch exporters serve many markets, led by neighbouring Germany (10,150 tonnes) and France (7,300 tonnes). Sales to Spain surged to 6,500 tonnes, while Italy (4,700 tonnes) and Romania (4,200 tonnes) imported a lot.

The Dutch market focuses more on convenience than average. This can be seen in the large range of pre-cut fresh fruit and vegetables in supermarkets and the relatively large market for meal kits. Meal kits are sold by specialists like HelloFresh and supermarket labels such as Albert Heijn’s Allerhande Box. Peeled garlic is not as common in food retail as it is in food service. Bidfood is an example of a food service wholesaler that offers peeled garlic in 1 kg cans. One retailer that already offers fresh-cut garlic is Jumbo.

Local growers are few, yet retailers stress ‘grown in Holland’ where possible and focus on green garlic from companies like Biesheuvel Knoflook. In turn, several local producers have launched a promotion of locally grown fresh garlic.

Organic garlic imports from outside Europe hold a 2.3% share of the import volume, making up about 1,100 tonnes in 2024. This was still down from the record years 2020–2022, but much higher than the 750 tonnes in 2023. Organic garlic is mostly sourced from Argentina (over 65%), while China makes up most of the rest. Egypt also exported organic garlic to the Netherlands with a peak in 2022 (45 tonnes), but this has faded since.

If you want your garlic to end up on the Dutch market, you need to consider the season and type of garlic. For example, the Dutch supermarket chain Jumbo offers garlic from Dutch, Chinese and Spanish origins year-round. It also sources garlic from Malta in April, May and June.

Some Dutch fresh fruit and vegetable traders have an import licence for garlic, including Marni Fruit, Roveg Fruit, Bud Holland, Aartsen Fruit and Vegetables and Kraaijeveld Groente en Fruit. A few Dutch fresh produce importers mainly focus on supplying ethnic markets in and outside the Netherlands. Exotimex Europe is one of them. It offers garlic, plantains, cassava, sweet potatoes and yams as core products and predominantly sources garlic from China.

GDP (Gross Domestic Product) in the Netherlands is forecast to grow by 1.3% in 2025 and 1.2% in 2026 (spring 2025 forecast). Import volumes should increase by about 2% per year, assuming that import demand grows roughly 1.5 times faster than GDP.

United Kingdom: recovering from the Brexit market shake-up

The United Kingdom’s garlic imports fell from 43,000 tonnes to 35,000 tonnes over the 2020–2024 period, reporting a 4.9% annual decline despite a modest rebound in 2024. Developing-country suppliers strengthened their position, boosting shipments to 17,600 tonnes and making up 50% of the total supply. Intra-European trade weakened significantly: volumes dropped from 33,400 to 17,500 tonnes. Other origins remain very small. With no domestic growers and fewer EU suppliers, British importers offer interesting opportunities for reliable producers from developing countries.

China overtook Spain as the leading garlic supplier in 2024, rising to 17,400 tonnes with 17% growth. Meanwhile, Spanish deliveries fell to 17,000 tonnes. Smaller volumes come from France and Egypt. Both import less than 250 tonnes. German and Dutch re-exports are shrinking too. The British market is becoming a contest between Spain and China, with other countries playing a minor role.

Although there has been growth since the dip in 2021, import levels are still not as high as in 2019, with imports from developing countries at 19,000 tonnes in that year. In January 2020, the United Kingdom left the EU. This led to a drop in fresh garlic imports from developing countries in 2020 and in fresh garlic from Europe in 2020 and 2021. However, apparent consumption per capita (0.51kg) is the highest of all European countries (behind Spain and France), but without significant local production.

British consumers know garlic very well. On the list of the most popular vegetables in 2025, garlic ranked seventh behind potatoes, carrots, new potatoes, onions, peas and cherry tomatoes. Garlic is now treated as a staple in Britain, helped by TV cooking programmes and recipe boxes. The United Kingdom is one of Europe’s three leading markets for meal kits, with players like HelloFresh, Gousto, Mindful Chef, SimplyCook, Abel & Cole, Grubby and supermarket brands like COOK by ASDA fighting for market share.

Figure 5: Organic garlic offered by a mainstream British supermarket

Source: GloballyCool (May 2025)

Organic food market turnover climbed by 7% in 2024, which is faster than non-organic food. The organic fresh fruit and vegetables segment grew even faster, at 10%. Despite high growth, the share of organic in the total food market remains small (around 2%).

The Office for Budget Responsibility expects the United Kingdom’s real GDP growth to reach 1% in 2025 and 1.9% in 2026 (spring 2025 forecast). Import volumes grow between 1.2–1.5 times faster than GDP, which means imports will likely grow by roughly 2.5% in 2025 and 2.3% in 2026.

Tips:

- Consider focusing on the British market as competition from other suppliers is still limited. Be aware that the United Kingdom has its own tariff-rate quota (TRQ);

- Plan market entry carefully. There is a new notice on tariff-rate quota to traders at the start of each season. The latest notice was published in April 2025;

- Select British importers that have a licence to import under the TRQ, such as the garlic, ginger and onion specialist First Chartered. Contrary to the EU TRQ scheme, there is no official list of licensed companies published.

Germany: huge jump for imports from developing countries in 2024

German demand remained stable, close to 31,000 tonnes. Other European countries supplied 29,600 tonnes in 2024, representing 95% of all imports. However, volumes from developing countries, while small, saw more than a threefold increase to 1,700 tonnes, raising their share to 5.4%, growing 36% per year. German exports are modest, with only 1,300 tonnes exported in 2024 to a few European countries, including Finland, France and the Czech Republic.

Spain remained the leader in the German market with 16,500 tonnes. However, the Netherlands grew to 8,200 tonnes, increasing its share. China’s sales increased eightfold in 2024 to 1,500 tonnes, breaking into the top five. Austria, Greece and Poland also posted significant gains from small volumes. German imports are still euro-centric and dependent on European supplies. However, distant suppliers are edging in as buyers look for lower prices.

Figure 6: Fresh garlic of Italian origin in a German organic supermarket, February 2025

Germany’s annual per capita intake of fresh garlic is just under 0.4 kg per year, making it the third-largest European country without significant production. Germany is further characterised by its large organic food market, its large meal-kit market and a sizeable ethnic population of predominantly Turkish people.

- Germany is Europe’s largest organic food market, with organic-certified food holding a 7% share of total grocery spending;

- HelloFresh, Marley Spoon and Every (a plant-based ready meals specialist) compete on convenience, vegan menus and low-carbon deliveries. Supermarkets such as REWE and EDEKA sell ready-to-cook meal-kits ‘REWE Deine Küche’ and ‘EDEKA Kochbox’ online. A large base of young professionals and widespread e-grocery use keep demand high, making Germany Europe’s biggest market for meal-kits after the United Kingdom;

- The large Turkish community of about three million people, and thousands of döner outlets, keep bulk garlic nets moving through wholesale markets fast. Other groups, such as the almost one million Syrians in Germany, consume relatively large amounts of fresh garlic for traditional recipes (such as shawarma, falafel and toum sauce);

- Brigitte Flachmeyer Knoblauchland is a specialised importer and German license holder for the import of garlic from outside Europe.

German GDP is expected to remain stable in 2025 and increase by 1.1% in 2026. Fresh garlic imports tend to grow slightly faster than GDP. They are forecast to grow by 0.1–0.2% in 2025 and 1.2–1.4% in 2026.

Fresh garlic demand normally grows a little faster than GDP. With an elasticity of 1.1, imports should increase by about 0.3% in 2025 and 1.2% in 2026.

Italy: imports fill the off-season and low-yield years

Italy’s imports dropped from a record volume of 31,300 tonnes to 24,000 tonnes in 2022, but recovered to reach 30,700 tonnes in 2024, resulting in an overall decline of just 0.5%. Spanish garlic supplies remained dominant, with a share in Italian imports of over 60% throughout the period. The Netherlands is Italy’s second-largest supplier, with 4,200 tonnes of Chinese-origin garlic in 2024, down by 2.3% per year on average since 2020.

Developing country supplies to Italy almost tripled to 3,500 tonnes, increasing their share to 11% and growing by 28% annually. With total import volumes now close to 2020 levels and with European supply less stable, further gains for developing country exporters are likely. Italy’s economy is set to grow by 0.7% in 2025 and 0.9% in 2026. Fresh garlic imports are expected to benefit, with a growth of about 1.0% per year in 2025 and 2026.

Egypt’s shipments of garlic to Italy have more than doubled to 1,700 tonnes. Argentina went from zero to 1,100 tonnes within two years. Greece and Slovenia also supplied more than 1,000 tonnes in 2024. Italian buyers now mix Iberian, Mediterranean and long-haul origins to secure year-round stock. Almost 2% of the Italian import volume from outside Europe is organic-certified, making Italy the second-largest importer of organic garlic behind the Netherlands. 85% of the garlic comes from Argentina, and the rest comes from Egypt.

Italy exported 6,600 tonnes in 2024, down from 9,300 tonnes in 2020. This marks a decline of 8.3% per year. Germany remains the top buyer with 2,800 tonnes. The real mover is Greece, where volumes increased to 1,701 tonnes (16 times the 2020 level). Austria, Slovenia, France and Switzerland each take between 250 and 700 tonnes. However, most of these other destinations have seen a decrease.

Italy’s local production reached about 28,000 tonnes in 2023/2024 and is made up of 100% PDO/PGI (Protected Designation of Origin/Protected Geographical Indication) garlic (Aglio Bianco Polesano, Aglio Rosso di Nubia, ‘Aglione‘, etc.). It covers roughly half of the Italian demand, while imports fill the off-season and low-yield years. This makes Italians considerable consumers of garlic. With a consumption of 0.85 kg per capita, Italy remains far behind Spain’s consumption of 2 kg+ per capita. However, it clearly ranks ahead of France and the United Kingdom.

Garlic’s per-capita consumption shows it is a staple in Italian households. For example, garlic is a key ingredient in the classic soffritto and sauces like aglio-olio-peperoncino.

Organic food made up about 3.5% of retail spending in 2023. Licensed importers include the garlic specialist Cervati Import Export, Suriani (garlic and onions) and Duoccio (garlic, onions, ginger and turmeric). Cervati offers a good impression of packaging options for the Italian market.

France: market for reliable suppliers of fresh garlic

French imports dropped from 31,600 tonnes in 2020 to 25,000 tonnes in 2024, a 5.7% yearly drop from a peak in 2021. Intra-European supplies fell sharpest and are down to 20,900 tonnes, making up 84% of the supply. Developing countries remained stable at 4,000 tonnes in 2024, equal to a 16% share. The drop in European volumes and France’s constant need for fresh garlic offer competitive growers from developing regions a good opening.

Spain’s significance decreased from 21,100 tonnes in 2020 to 16,100 tonnes in 2024, but it still represents over 60% of French imports. The Netherlands comes second, making up roughly 4,400 tonnes in 2024. China’s supplies to France decreased in 2021–2022, but have recovered since 2023.

Argentina and Mexico exported more garlic to France, reaching 460 and 370 tonnes in 2024, respectively. Supply from Egypt shows a downward trend with a 14% annual decline, reaching 200 tonnes in 2024. This shows that France offers potential openings for reliable overseas growers. Condichef is an example of a French specialised garlic and onion importer.

France is also a large exporter of garlic produced locally by companies such as Jardins du Midi and France Allium. The country exports a steady 8–9,000 tonnes yearly and ranks third in Europe, behind Spain and the Netherlands. In 2024, it exported 8,600 tonnes, almost the same amount as in 2020. A quarter of that went to Switzerland (2,200 tonnes), but the Netherlands, the United Kingdom, Italy and Germany are also important destinations.

France’s domestic production, mainly the PGI (Protected Geographic Origin) Ail Rose de Lautrec and Ail Blanc de Lomagne grown in Occitanie, more than doubles the country’s apparent consumption figure. It increases per capita consumption from 0.23 kg to 0.53 kg, ahead of the British, but behind the Italians. When French (local) garlic is in season, retailers such as Carrefour support local production. They emphasise French garlic in their stores and inform customers when local garlic is in season (see Figure 7).

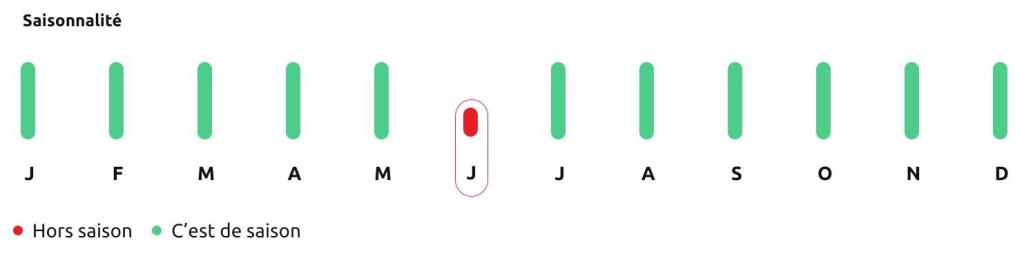

Figure 7: Seasonality of French garlic*

*Green: in season, red: out of season

Source: Carrefour (May 2025)

The EU expects French GDP to grow by 0.6% in 2025 and 1.3% in 2026. This will support a slight growth in imports of about 0.7% in 2025 and 1.5% in 2026.

Spain: Europe’s heavyweight garlic market

Spain is the standout growth market. Imports more than doubled from 7,700 tonnes in 2020 to 16,800 tonnes in 2024, a robust annual growth of 22%. Developing-country supplies led the increase, growing to 11,100 tonnes and maintaining a 66% share of imports in 2024. European supplies also rose, reaching 5,200 tonnes and a 31% share. Other origins remain less significant. With volumes setting records in 2023 and 2024, and with the rising share of developing countries, Spain offers a dynamic opportunity for exporters that can meet its quality and supply requirements.

Argentina is the most significant importer, growing strongly from 360 tonnes to 5,800 tonnes and overtaking China. In 2020, Argentina mainly supplied organic garlic to Spain. However, the largest share is now made up of conventional bulbs. Organic import volumes from outside Europe stabilised in the 2020–2024 period, despite the boom in the conventional market. The stabilisation in volume resulted in a declining share, reaching 1% of total import volume in 2024.

Chinese import volumes also rose to 4,200 tonnes. The Netherlands grew by 50% per year to 3,300 tonnes. Egypt’s supply bottomed in 2022 but recovered, reaching 550 tonnes in 2024 (+5.5%). Chile is another overseas supplier that has benefited from lower Spanish harvests, exporting 470 tonnes to Spain in 2024. The strong growth of overseas imports shows Spanish traders need foreign garlic for processing, re-export and off-season demand.

Spain is also a large producer of garlic. Fruit Logistica’s European Statistics Handbook states that Spain produced 240,000 tonnes of garlic in 2024. The record year for Spanish production was 2021, with 316,000 tonnes. Production dipped in 2022 at 178,000 tonnes. Despite the growing costs of production, it increased from then on. Light crop years have the most direct effect on the availability of material for local garlic processors. However, in the medium to long term, they have an upward effect on imports.

Its large production also makes Spain by far the main European exporter of fresh garlic. In 2024, it shipped more than 120,000 tonnes, about two-thirds of all European exports. Volumes dropped by 3.8% per year since 2020, yet the country still sends sizeable volumes to Germany (almost 24,000 tonnes), the United States (more than 18,000 tonnes), Morocco, the United Kingdom and Italy (each about 15,000 tonnes) and France (more than 13,000 tonnes).

For garlic, Spain is the frontrunner in every respect. Even in terms of per-capita consumption, the country dominates Europe. Only in light crop years, such as in 2022, does the per capita consumption return to average European levels (in 2022: below 0.4kg). In 2024, apparent consumption reached 2.4 kg per capita. This reflects the large size of the Spanish garlic processing industry and its deep culinary tradition, in which garlic is a popular ingredient.

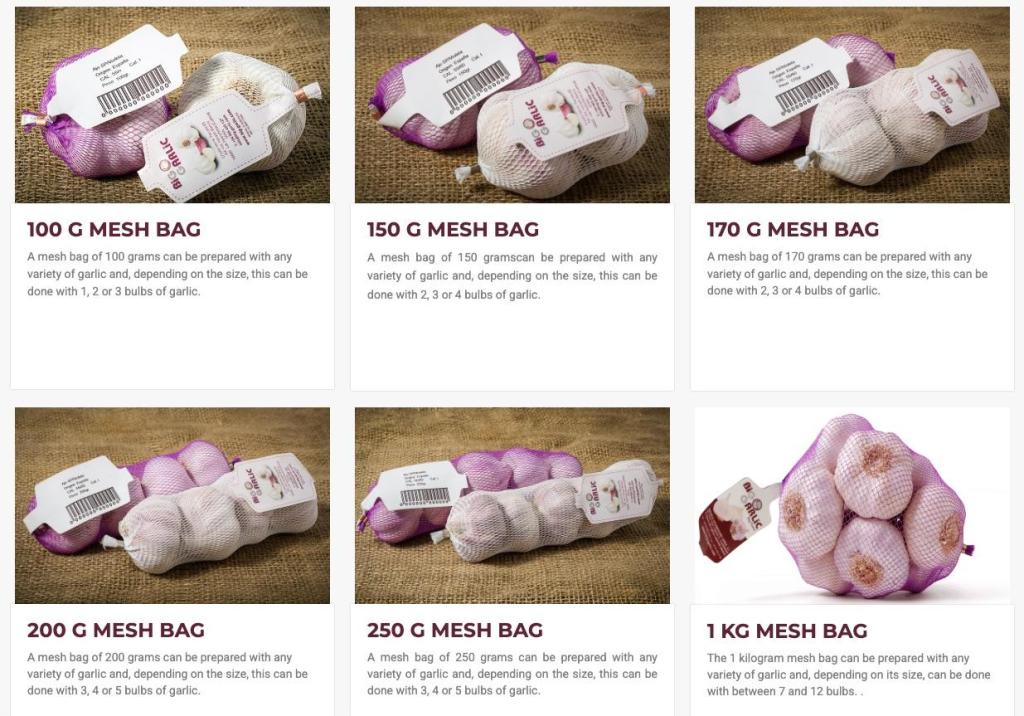

Figure 8: Packaging formats of fresh garlic nets by Big Garlic

Source: Big Garlic (June 2025)

Spain is home to several garlic specialists. Several of them produce and process garlic.

- Big Garlic is a garlic specialist that offers tailor-made packaging for fresh and peeled garlic with a year-round supply. Big Garlic has also developed lines of IQF frozen garlic cloves, minced and whole cloves, garlic purée and roasted garlic;

- The Garlic Factory processes garlic into all kinds of derivates, and claims that only Spanish garlic is used as raw material;

- Diego Martínez is a prominent importer of garlic from China;

- Murcia Antonio López trades garlic, onions and potatoes. In addition to local garlic, the company imports normal white and pure white varieties from China, spring violet and spring white from Argentina, and spring violet from Chile;

- Peregrin One Garlic is a Spanish producer of garlic and onions;

- Sybaris Market specialises in garlic, onions and citrus. It claims 100% is grown in Spain.

Spain will keep buying more foreign garlic, as local production will continue to be affected by challenging weather conditions. As the EU expects Spanish GDP to grow by 2.6% in 2025 and 2.0% in 2026, fresh garlic imports should increase between 2.5 and 3.5% per year in 2025 and 2026.

Tips:

- Focus on Dutch and British traders first if you want to enter different European markets. They have extensive experience in trading and/or importing garlic in the European market, and extensive market knowledge about preferences in different markets. They also import relatively large volumes of garlic directly from developing countries. Use EU lists of licensed operators to find potential garlic importers. These lists are not available for the United Kingdom;

- Find French importers at the Rungis market through the Rungis database;

- Stay up to date on the latest news on garlic. For example, check Freshplaza’s global market garlic article and East Fruit;

- Search Google for available organic market publications or presentations held at the world’s largest organic event, BIOFACH. The presentation on the Italian organic market, for example, gives a lot of market insights.

4. Which trends offer opportunities or pose threats in the European garlic market?

Zero-residue, organic and convenience formats are important factors in the European garlic market.

Organic and zero-residue show potential

Organic food is no longer a small market. Retail sales of organic food in Europe reached about €54 billion in 2023. Supermarkets now lead the organic food category. Greater shelf space means shoppers can now find organic garlic next to standard nets in Carrefour, Albert Heijn, Lidl and ALDI, and not just in specialist organic stores. Today, most big chains carry at least one organic SKU (stock-keeping unit). There are still price gaps, with a clear premium of at least €1 per kg. However, higher overall food inflation may have made the difference feel smaller for many consumers.

Germany still tops organic food spending at about €16 billion, but Spain and Denmark posted higher growth in 2023.

Figure 9: Organic and conventional garlic next to each other in a European mainstream supermarket, May 2025

Source: GloballyCool (May 2025)

Consumers also like the ‘no residues’ and climate labels shown on organic packs. Industry experts believe the ‘zero-residues’ claim or segment to have the most potential for fresh garlic. Given that most of the garlic in the European market is semi-dried, and that potential critical residue levels decrease over time, overseas suppliers can easily meet European MRL (maximum residue level) legislation, even if they apply pesticides that are not allowed in Europe. The growth of the zero-residue market would definitely benefit overseas suppliers who are able to limit their pesticide use.

Convenience formats boom – peeled cloves in demand

European shoppers want food that saves time. Busy lives push them towards easy-to-use, value-added items. Many are happy to pay more if the product is quick to use and tastes good. For garlic, this means growing sales for ready-to-use options such as peeled cloves, diced portions, frozen cubes and dried flakes.

Demand for convenience is strongest in the United Kingdom and the Netherlands. Supermarkets focused on convenience formats dominate those markets and fill their shelves with pre-cut and ready-to-eat fruit and vegetables, garlic included.

Figure 10: Fresh-cut garlic available at a Dutch supermarket, May 2025

Source: GloballyCool (May 2025)

Home cooks and line cooks value labour-saving produce. Food-service giants like METRO and Transgourmet list peeled garlic SKUs. This also contributes to the peeled garlic market's forecast growth of 5–8% per year on average over the next five years.

Tips:

- Read CBI’s study on trends that offer opportunities or pose threats on the European fresh fruit and vegetables market to get more insights into European market trends;

- Consider European processors of peeled garlic and other convenience products as clients;

- Prove stewardship: zero-residue production is the way forward and will help suppliers stand out from their competitors;

- Push for niche, certified and sustainable production. Purple or organic garlic can still command higher prices if weather trims European supply. GLOBALG.A.P. plus GRASP or organic certification can also help non-European suppliers enter the market if European prices spike.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research