Which trends offer opportunities or pose threats on the European fresh fruit and vegetables market?

Europe’s fresh fruit and vegetables market is shaped by various trends, from tightened environmental regulations to cost-of-living pressures. Exporters who adapt to these trends will discover meaningful opportunities: higher-value niches, deeper buyer partnerships, expanded e-commerce channels and the chance to build a strong reputation as a sustainable and socially responsible supplier.

Contents of this page

- Sector transformations are based on sustainability and strategic partnerships

- Environmental sustainability means more accountability

- Social sustainability – stop human rights violations

- Inflation keeps threatening high-value fruit and vegetables

- Geopolitics and nationalism are affecting trade flows

- Sustainable sourcing has become mainstream

- Health consciousness triggers clean consumption

- Convenience gains importance

- E-commerce keeps on growing

- Hybrid consumption offers opportunities for product innovations

- Technology is becoming a priority in today’s fresh trade

- Supply chain integration requires partnerships

1. Sector transformations are based on sustainability and strategic partnerships

The long-term visions of retailers and global produce companies often highlight sustainability as a central priority. In the future, many expect farmers to carefully manage their water footprints, minimise pesticide residues and for all logistical steps to be fine-tuned to cut carbon emissions. Many European companies have embraced similar goals. By 2030, they want lower pesticide usage, smaller carbon footprints and more socially responsible labour conditions and, with these factors, a more sustainable fresh sector.

End consumers, particularly those in Northern and Western Europe, demand higher quality produce, even during off-season months. This requires more advanced greenhouse farming within Europe and creates the expectation that international suppliers will supplement seasonal gaps or introduce unique and exotic items that cannot be produced locally. Trade watchers also anticipate that integrated supply chains will keep expanding, so major importers and distributors will develop direct ties with selected farms, potentially funding improvements in irrigation, energy use and post-harvest technology.

For exporters outside Europe, these forces pose threats and opportunities. Producers that cannot adapt to increasingly strict requirements, whether in terms of water, pesticides or social compliance, will lose access or be dependent on price-sensitive segments with lower margins. However, those that embrace sustainability, advanced farming techniques, traceability tools and strategic partnerships can earn a place in the European market.

2. Environmental sustainability means more accountability

Consumers, NGOs and governments in Europe focus on accountability in environmental performance more than ever before. This trend is partly driven by the intensifying effects of climate change, which have led to droughts in Southern Europe, flooding in Central Europe and record-breaking heat waves in traditionally temperate regions. It is also a direct result of heightened consumer awareness, civil society advocacy and new regulations and proposals, such as the Corporate Sustainability Due Diligence Directive (CSDDD).

The Directive on Corporate Sustainability Due Diligence (Directive 2024/1760) entered into force on 25 July 2024. However, the European Commission, the European Parliament and the Council are still negotiating its conditions. Whatever is decided, the CSDDD aims to push accountability beyond the EU’s borders into countries that regularly bring fresh produce onto the European market. Even though these obligations may not cover smaller companies directly, they will feel their after-effects; large corporations will expect compliance from all suppliers, big or small.

In practical terms, the emphasis on environmental accountability translates into deeper scrutiny into how farmers use water, manage pesticides, handle soil fertility and protect biodiversity. Production that depends on unsustainable irrigation is likely to come under pressure. Excessive or inappropriate use of fertilisers and plant protection products will lead to warnings or rejections. The carbon footprint of logistics is also becoming a topic of discussion.

Figure 1: Eosta’s Organic Raingrown Avocado, promotional and educational video by Nature & More

Source: NatureandMore@YouTube, April 2025

Possible impacts on specific crops:

- Avocados in arid regions: these have often been criticised for their high water consumption. As water usage data becomes more transparent, producing countries that cannot guarantee sustainable irrigation practices may not be able to maintain volumes or get fair prices. In fact, rain-grown avocados may receive priority;

- Stone fruits that require heavy irrigation: countries must be able to demonstrate improvements in water management. This could mean investing in drip irrigation, rainwater harvesting or new desalination technologies;

- Long-distance air-freighted exotics: with decarbonisation goals, air freight may face increased costs or environmental taxes, making shipping new long shelf-life varieties or improved reefer solutions by sea increasingly attractive.

High-value certifications tied to sustainability

Major retailers and specialised importers often encourage or require suppliers to adopt sustainability-related certificates. GLOBALG.A.P. has included environmental criteria for many years with specific add-ons, such as SPRING (Sustainable Program for Irrigation and Groundwater Use), which helps verify responsible water management.

Additionally, the GGN label – also issued by GLOBALG.A.P. – provides consumer-facing evidence that fresh produce is produced using verified sustainable practices. It fosters transparency by linking every product to a unique identification number, enabling full traceability back to the certified farm. This emphasis on traceability and accountability covers environmental factors as well as social and safety aspects. The Peruvian fresh fruit exporter Verfrut is one such GGN label-verified company.

Figure 2: Explanation of the GGN-certified farming label

Source: GGN, February 2025

New and more general initiatives like B Corp certification measure companies’ holistic social and environmental impact. B Corp might not be widespread in the fresh fruit and vegetables sector yet, but it exemplifies the broader trend of verifying sustainability credentials using metrics beyond pesticide and water footprints. One example of a company that recently obtained B Corp certification is the fresh berries producer Vitafoods from Chili.

Tips:

- Conduct a thorough environmental impact assessment of your operations. Evaluate your water usage, the pesticide you apply, your carbon footprint and biodiversity impact;

- Use tools available online, such as the Carbon Footprint Calculator, to evaluate your environmental impact;

- Explore technological solutions for precision farming, such as irrigation sensors. Check out best practices and horticulture technology platforms like Australia’s Horticulture Industry Networks and this guideline for irrigation management for stone fruit;

- Partner with NGOs to develop responsible land and water management practices. In the long run, these partnerships can protect your market position;

- Investigate certification schemes beyond the standard GLOBALG.A.P. IFA if you want to build your brand identity around sustainability or reach high-end segments.

3. Social sustainability – stop human rights violations

Fruit and vegetable supply chains can have problematic labour conditions, especially at farm level. Issues like child labour, underpayment and unsafe working conditions are concerns in many sectors. European buyers worry about reputational damage if they are found to source from suppliers accused of human rights abuses.

Legislation is an important driver of change. Some EU member states have already implemented laws that require companies to investigate their supply chains for child or forced labour. Germany enacted the Supply Chain Due Diligence Act (Lieferkettensorgfaltspflichtengesetz), which demands more robust oversight. France has its Duty of Vigilance law, which requires large companies to address human rights and environmental risks. These laws push businesses to trace problems deep in their supply chains and correct them.

The broader CSDDD is on the horizon at the EU level. It seeks to harmonise due diligence requirements across member states. The CSDDD requires large companies to systematically review suppliers for potential labour violations. This makes it likely that social sustainability certifications or at least recognised audit protocols, such as SMETA (Sedex Members Ethical Trade Audit), will become standard requirements for suppliers seeking stable relationships with European clients.

Fair pricing and living wages

Consumers in wealthier European countries have become more sensitive to the economic wellbeing of farmers and plantation workers. The Fairtrade system has long focused on minimum prices and additional premiums for community development, but interest in broader living wage initiatives is also rising. The Rainforest Alliance, for instance, includes some elements for living wage commitments in its revised standard. The principle is that the price paid for produce must, at the very least, cover the cost of decent living conditions, not just allow for minimal survival.

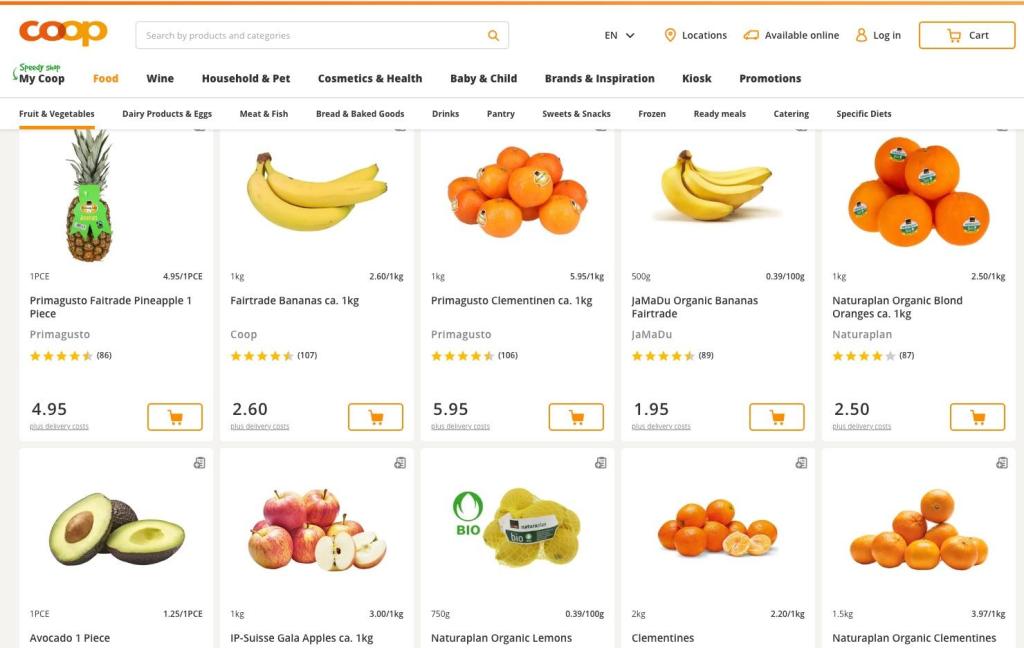

Figure 3: Fairtrade-certified fresh produce available in the Swiss mainstream supermarket COOP

Source: GloballyCool, March 2025

Although it is difficult to implement living wage strategies in complex, fragmented supply chains, the debate has begun. In the coming years, more buyers may ask for proof that farmworkers earn a wage sufficient to meet local living standards. This might involve paying a price premium or supporting projects that reduce workers’ living expenses, for example by providing housing or health services. Lidl Netherlands is one of the first European retailers that completely closed the wage gap for 10,000 workers in banana plantations spread across four countries.

Tips:

- Familiarise yourself with the main social compliance audits used in the fresh fruit and vegetable sector. The most important is GLOBALG.A.P. GRASP. A small investment in these systems can open more market opportunities;

- Engage with employees and local communities to identify gaps in working conditions. Improving labour practices often starts with understanding the specific context and needs;

- Communicate with importers openly. Show them your efforts in raising wages or providing training opportunities. Transparency can give you a competitive advantage over suppliers that pay less attention to social matters;

- Follow developments in living wage pilot projects, such as Living Wage Avocados of the Dutch importer Eosta and the Banana Retail Commitment on Living Wage in the Netherlands. If your region has initiatives that focus on fair pricing, consider joining, as this can improve your reputation and help you stay ahead of any requirements;

- Watch Fairtrade International’s introduction video to learn how the Fairtrade system works. Find a Fairtrade-certified trader of your product and get in contact to find out more about Fairtrade certification.

4. Inflation keeps threatening high-value fruit and vegetables

Rising inflation and economic uncertainties in Europe have left many consumers reevaluating their purchasing decisions. Food inflation soared in 2022 and 2023, sometimes surpassing general inflation. This has put significant pressure on household budgets. While fruit and vegetables are deemed essential, certain categories, such as high-value exotics and premium organic produce, are more vulnerable to cutbacks.

Costs are rising throughout the supply chain as well. Fertilisers, packaging, energy and logistics have all become more expensive. Various factors have contributed to these cost hikes, from the war in Ukraine to the lingering impacts of the COVID-19 pandemic. Even though container shipping rates have eased since their peak in 2022, also coming down from the higher levels of 2024, overall supply-chain costs remain elevated.

Continued pressure on household budgets

Fruit and vegetables are still essential items in shoppers’ baskets. However, higher-value categories like tropical exotics, premium organics and specialist imports are more vulnerable to consumer cutbacks. While some regions of Europe have seen real wages move upward, many households still feel the impact of increased utility and mortgage costs, along with the continuing effects of supply-chain disruptions. As a result, buyers may choose conventionally grown or lower-priced produce.

Consumption patterns show a range of characteristics, which can be summarised as follows:

- Trading down: households with tighter budgets tend to trade down from premium or organic labels, seeking cheaper products. Discounters such as Aldi Nord and Lidl benefit from this trend, attracting more cost-conscious shoppers and offering price promotions and own-label alternatives;

- Resilient premium niche: more wealthy consumers show sustained interest in specialised or 'clean label' items with unique flavours, guaranteed sustainability or proven health benefits. Even with persistent inflation, this group is still willing to pay for better quality and distinct eating experiences.

Although reduced pressure on shipping costs may offer some relief, energy prices and labour costs still drive up retail prices. Many supermarkets try to keep prices competitive for the mass market while maintaining premium lines for more wealthy segments.

Figure 4: Ready-to-eat Hass avocado at Aldi in Germany, February 2025

Source: GloballyCool, February 2025

Most forecasts suggest that European cost of living will continue to ease slowly but not enough to eliminate financial pressure on mid-income households. This means high-value fruits and vegetables will likely retain a small yet stable share. Discount retailers, meanwhile, will further expand their market presence. Producers and exporters that emphasise consistent quality, sustainability and clear traceability can still appeal to the premium niche. At the same time, cost efficiency and competitive pricing will remain critical to Europe’s fresh produce suppliers to secure mainstream and budget-segment sales.

Implications for suppliers from developing countries

In an inflationary environment, streamlining operations is critical for survival. Exporters must optimise production, reduce their losses through better post-harvest handling and ensure that shipments meet buyers’ expectations exactly. Working capital management is also crucial, as delayed payments from importers or extra time in customs can cause problems. Further impact depends on supplier’s products and capacities.

- High-value or niche fruits: Mangos, avocados, berries and certain tropical specialties often come at higher price points. In periods of economic difficulty, these products can experience slower turnover or downward price pressure;

- Organic produce: While organic remains a growing segment in the long term, short-term price hikes can dampen sales, making it tougher for producers who rely on premium price differentials. For example, the French organic fruit market experienced a few years of decline due to high inflation. It has only started to recover recently;

- Private label lines: Retailers sometimes respond to inflation by focusing on private-label items, which can be priced lower. This might constrain branded suppliers but can create opportunities for cost-efficient producers if they can scale to meet private-label volumes.

Tips:

- Be proactive with cost management. Evaluate your supply chain from field to port to identify inefficiencies, such as redundant packaging or gaps in the cold chain;

- Focus on reliability and quality. Retailers that see your product as consistent and trouble-free may come to prefer your produce, even if there are cheaper options. This is because unpredictability leads to waste and lost sales;

- Diversify where possible. If you normally only supply premium lines, consider adding some mid-range options to provide a buffer against shrinking demand at the high end;

- Monitor macroeconomic indicators in your target markets, such as unemployment, disposable income levels and inflation data. This helps you anticipate consumer shifts. Use resources like Eurostat Inflation Indicators and the European Central Bank Economic Bulletin.

5. Geopolitics and nationalism are affecting trade flows

Europe’s fresh produce market has become increasingly interconnected with global supply lines. However, recent geopolitical developments have disrupted traditional routes and forced businesses to find alternatives. The war in Ukraine, the lingering after-effects of Brexit and broader protectionist trends have put new pressures on producers and traders alike.

War in Ukraine and reduced trade with Russia

Before the conflict, suppliers in Eastern Europe and Central Asia exported fruit and vegetables to Russia and Ukraine. Now, with sanctions and logistical challenges, many suppliers have started to look to Western Europe for alternative outlets. At the same time, shipping through Black Sea ports has become less predictable, leading to trade flows being rerouted.

Competition in Western Europe has intensified for certain products that used to be sent to Russia. This can suppress prices or push suppliers to differentiate themselves through providing higher quality, traceability or certificates.

Brexit’s long tail

The United Kingdom remains a key consumer market in Europe. Historically, it imported large volumes of fruit and vegetables from the Netherlands and other EU countries. Brexit, however, introduced new customs checks, documentation requirements, and occasionally diverging product standards. Consequently, imports from the EU dropped from 3.2 million tonnes in 2019 to 2.4 million tonnes in 2021.

Over the long term, it will likely become easier for exporters from non-EU countries to export to the United Kingdom directly, bypassing the complexities of re‑exports from the EU. Meanwhile, the United Kingdom is closing trade deals with non-European countries, such as Madagascar, which could further shift trade patterns for tropical fruits or certain vegetables.

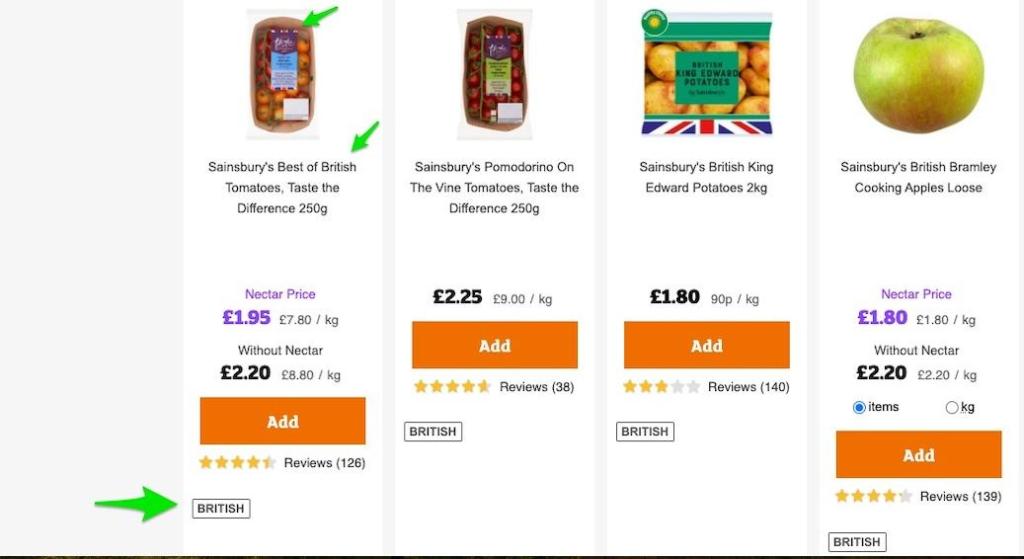

Figure 5: Fresh produce in Sainsbury with clear 'British origin' marking

Source: GloballyCool, February 2025

Nationalism and local sourcing trends

During the COVID-19 pandemic, some governments and citizens started to purchase more local products, encouraging short supply chains to minimise vulnerability to global disruptions. Some consumers shifted towards local and seasonal produce to ensure food security and reduce carbon footprints, especially in Western Europe. While this local-first mindset is not universal, it complicates market entry for certain products that can be grown or stored in Europe for most of the year.

Nevertheless, local production often focuses on common items, such as apples, pears, potatoes, greenhouse tomatoes, cucumbers and sweet peppers. The marking of local produce in supermarkets and food service channels is visible in many European countries, including the United Kingdom (e.g. Sainsbury), France, Germany, Switzerland, Belgium, Netherlands and Sweden.

Tips:

- Keep track of changes in trade policies, import duties and inspections. Regularly check official portals like Access2Markets (European Commission) and the UK government’s official guidance for up-to-date procedures;

- Investigate direct shipping routes to the United Kingdom if the cost or complexity of routing through continental Europe is too high. GBLGP (London Gateway Port) is the main reefer terminal in the United Kingdom;

- Differentiate your product if you are facing new competition from Eastern European suppliers. This might mean offering organic or other certifications that relate to superior taste or emphasise sustainability practices;

- Prepare for future disruptions and diversify your geographic market portfolio as much as possible. The conflict in Ukraine and potential new geopolitical tensions mean that stable trade corridors can shift rapidly.

6. Sustainable sourcing has become mainstream

Although environmental accountability and social responsibility both reflect broader sustainability concerns, the notion of 'sustainable sourcing' itself has turned into a standard part of many buyer negotiations. Ten years ago, the idea of sustainable or 'green' produce was still quite niche, often limited to the organic segment. Nowadays, mainstream supermarkets across Europe have entire departments dedicated to sustainability strategies.

Retailers like Carrefour in France, Migros and Coop in Switzerland, Rewe in Germany, Ahold Delhaize in the Netherlands and Waitrose in the United Kingdom incorporate sustainability metrics in their supplier evaluations. They look at water usage, carbon footprints, packaging materials, the presence of child labour and how to provide incentives to suppliers. Rewe, for example, plans to introduce an innovative early payment solution with sustainability incentives in 2025, in collaboration with SAP’s daughter company Taulia, provider of working capital management solutions.

Meanwhile, membership groups, such as the Sustainability Initiative Fruit and Vegetables (SIFAV), bring together retailers, traders and NGOs to unify approaches. SIFAV’s 2025 goals include reducing carbon footprints, curbing food loss, and lowering water use for priority crops. These targets are integrated into supply agreements. This means you have to meet them for your business relationships.

Companies in the middle of the supply chain have these targets too. This includes importers, packers and ripeners. They need to show strong sustainability credentials to keep supply contracts with major supermarket chains. Some importers have even set up dedicated farmland or partnered with local producers to control processes directly. In the long run, the overarching goal is to create more stable supply chains that do not degrade local ecosystems or exploit local communities.

Local sourcing and seasonal eating

Thanks to sustainability, local sourcing and seasonal eating have become more popular among European consumers. Many mainstream retailers and food service companies highlight local produce, especially during peak seasons. This is popular in countries in Western and Northern Europe, where consumers appreciate the 'local' or 'regional' label on fruit and vegetables.

Examples of European retailers that run 'local products first' programmes are Migros from Switzerland with 'From the region, for the region', German Rewe with 'REWE Regional', French E.Leclerc with 'Our regions have talent' and Dutch Jumbo with 'Products from Close By'. Some retailers have a dedicated portal where small local suppliers can apply to become suppliers, such as Sweden’s ICA Order Portal for Local Suppliers.

When local produce is out of season, retailers still need overseas suppliers. However, they might prefer to source from areas closer to them to control logistical costs and reduce carbon emissions.

Exporters further away from Europe can still succeed, especially with tropical or exotic items that Europe cannot grow itself. However, they have to be able to describe how the product has been cultivated and transported. Major shipping lines and logistics providers also experiment with greener solutions, such as biofuel blends for ocean freight and other technologies that make sea freight more attractive. Demonstrating your involvement in these efforts can offer a competitive advantage.

Tips:

- Learn from supplier evaluation reports and standards of European retailers, such as Migro’s supplier evaluation report, Ahold’s Guidance Document on Supplier Evaluation and other initiatives that encourage suppliers to improve their ESG performance and practices throughout the supply chain;

- If your production is located far from Europe, highlight your unique value. It can be a distinctive flavour, a climate that enables year-round supply or a heritage product with cultural significance. A good example of the last kind is the Indian Alphonso mango, which has protected Geographical Indication (GI) status;

- Investigate membership in multi-stakeholder initiatives like SIFAV. This can help you understand and adopt best practices for water, carbon and social standards;

- Stay informed about local production cycles in your target markets. For a good example, see Figure 7 in CBI’s Fresh Fruits and Vegetables demand study. Identify the months when demand for imported fruit or vegetables is higher, then position your marketing accordingly.

7. Health consciousness triggers clean consumption

Europeans have long viewed fruit and vegetables as essential for a balanced diet. However, health consciousness has changed to a more holistic understanding of 'clean eating'. Consumers want low pesticide residue levels but also look at how produce is cultivated, processed and packaged. With rising obesity rates and related diseases, many national health authorities encourage fruit and vegetable intake as part of public policy. This has a direct impact on demand, although the specifics vary depending on the market segment.

Clean labels and minimal processing

The idea of 'clean labels' means fewer artificial additives, less chemical input and, ideally, a transparent supply chain. Although fresh fruit and vegetables are basically unprocessed, buyers often worry about synthetic post‑harvest treatments or waxes being used to extend shelf life. Organic products have grown in popularity partly because they align with these consumer ideals.

Even though inflation can slow market growth (as seen in 2022–2023), the long-term trend is still upward. Countries like Denmark, Germany and Sweden show higher organic market shares for fresh produce. Others, like Italy and Poland, have smaller but rapidly growing organic segments.

Figure 6: Fresh fruits and vegetables in German organic supermarket Alnatura

Source: GloballyCool, February 2025

Specialty health niches

Some fruits have gained popularity as 'superfoods' thanks to their high vitamin, antioxidant or fibre contents. Examples include berries (blueberries, raspberries, goji berries), pomegranates, ginger and turmeric. Marketing these products with health claims is difficult. This is because European regulations are strict about what can be claimed. However, consumers with disposable income pay more for nutrient-dense produce, particularly in Northern and Western Europe.

Another emerging niche is the plant-based movement. Although fruit and vegetables are inherently plant-based, the rise of veganism or flexitarian diets has boosted interest in new forms of plant-based proteins and meat substitutes made from peas, beans, lentils and mushrooms. Exporters who supply raw materials for these products can engage with specialised manufacturers and supermarket lines.

Tips:

- Emphasise natural production and minimal chemical intervention. Invest in integrated pest management (IPM) or organic farming if you can;

- Check your local regulations before making any health-related statements. The European Commission’s Nutrition and Health Claims database lists permissible claims;

- If you supply niche 'superfoods', be consistent about quality. Consumers paying a premium for health benefits expect near-perfect product appearance and high nutritional value;

- Maintain strong relationships with importers who serve the organic retail segment and specialised health stores. Niche distribution channels often prefer stable, long-term collaboration with reliable suppliers.

8. Convenience gains importance

The modern European lifestyle often leaves consumers with little time to prepare meals from scratch. As a result, there is growing demand for products that save time and effort in the kitchen. For fruit and vegetables, this can include ready-to-eat avocados and mangos, pre-washed salad mixes, pre-cut fruit and single-portion packs of snack vegetables.

Retailers driving the convenience market

Major supermarket chains in Western Europe, like Albert Heijn (Netherlands), Marks & Spencer (United Kingdom) and Edeka (Germany), have innovated extensively in convenience food. They offer fresh-cut fruit cups, meal kits, fresh-cut vegetables and small containers of snack vegetables for busy lifestyles. As online shopping grows, convenience products also fit well with platforms that deliver groceries. These items often have higher margins, meaning retailers and processors develop more lines that meet consumer demand.

For suppliers of tropical fruits like mango and pineapple, the convenience trend presents opportunities and challenges. On the one hand, providing ready-to-eat or fresh-cut products at the source can capture more value and open direct relationships with retailers that want to differentiate. For example, Blue Skies has been successfully running a company with pre-cut and packaging operations for pineapple, mango, coconut and papaya in Ghana, Egypt, South Africa, Benin, Brazil and the United Kingdom.

On the other hand, fresh-cut products require strict cold‑chain logistics, special packaging and compliance with microbiological safety rules. Any slip-ups in temperature control can cause quick deterioration, leading to major losses. Further, fresh-cut operations at origin can result in quite a large carbon footprint if air-freight is used.

Rising interest in healthy snacking

Smaller portion sizes and snack-oriented products are popular amongst European consumers who want healthy alternatives to chips, sweets and heavily processed foods. This is visible in the availability of mini-carrots, bite-size cucumbers and small containers of blueberries. The concept of fruit and vegetables as snacks has settled, although it remains more prominent in countries with higher disposable incomes, such as the Netherlands, Denmark and Germany.

Figure 7: Driscoll’s snack berries displayed at Fruitlogistica, 2025

Source: GloballyCool, February 2025

Tips:

- Evaluate whether you have the infrastructure and expertise to process fruits and vegetables at origin. If not, consider partial processing, such as sorting, washing or pre-cooling, leaving the final slicing and packing to a European partner;

- Monitor emerging packaging technologies. Consumers appreciate innovative, compostable and easily recyclable materials for convenience produce;

- Ensure your product’s shelf life and appearance remain as good as they can despite extra handling steps. Conduct thorough quality trials to find the best packaging, shipping temperatures and post-harvest treatments;

- Explore strategic relationships with companies that specialise in ripening and fresh-cut processing. You can access higher-value segments by aligning with their schedules and standards.

9. E-commerce keeps on growing

Online grocery shopping in Europe is getting more popular. Even though physical stores are still dominant, e‑commerce is no longer niche. Several leading platforms and retailers now operate hybrid models, combining click-and-collect services, home delivery and in-store shopping. There are roughly three models of online grocery shopping.

- Conventional supermarkets: Chains like Tesco (United Kingdom), Albert Heijn (Netherlands), Carrefour (France) and Edeka (Germany) integrate e-commerce into their main business. Shoppers can order online for delivery or pick-up at the store;

- Purely online players: These companies have no physical outlets but rely on centralised warehouses and delivery vehicles. They often highlight fresh produce quality as a core advantage. Examples include Picnic and Crisp in the Netherlands, Ocado in the United Kingdom, Rohlik in the Czech Republic and its foreign operations Sezamo in Romania and Spain, Knuspr in Germany and Everli in Italy;

- Subscription meal kits or fruit and vegetable boxes: HelloFresh and Gousto and other meal-kit providers supply fresh produce in pre‑measured portions. This is a direct channel for specific categories of fruit and vegetables used in curated recipes. The British company Abel & Cole is a fresh produce boxes provider.

Since 2021, Amazon Fresh has been active in the European market. It has its own delivery activities in selected cities in the United Kingdom, Spain and Italy. It also has partnerships with Wm Morrison Supermarkets (United Kingdom), Día (Spain), Unes (Italy), Monoprix (France) and with Knuspr and Tegut in Germany.

Online sellers prioritise consistent appearance and extended shelf lives because online customers cannot select individual pieces of fruit or vegetables. Instead, they rely on photos and product descriptions. If an e-grocer delivers poor-quality produce, consumers may switch to another platform. This leads online platforms to work closely with suppliers that can meet strict quality criteria and maintain perfect cold-chain management.

The digital environment also allows for direct consumer feedback, complaints and returns of money. Reviews and ratings can affect product demand. This can present opportunities for suppliers whose products provide distinctive quality or taste, but it also poses a risk if quality is inconsistent. E-commerce can encourage a narrower range of well-known, consistently performing varieties, unless the platform specialises in unique or exotic offerings.

Opportunities to differentiate online

Some retailers are open to marketing stories about the origin of produce, the farmers, and sustainability certifications. A small but growing number of European importers provide supplier information with product details and farm biographies. This might appeal to conscious consumers who want deeper insights. Exporters who have strong narratives about social responsibility, climate-smart practices or high-end varieties can benefit from this extra space to communicate. Examples include:

- Eosta’s 'Nature & More' label showcases detailed grower profiles from countries such as Ghana, South Africa, Peru and Burkina Faso. Every farm and cooperative has an online 'passport' that provides information about its sustainability journey, community impact and agricultural practices. Major retailers in Western Europe sometimes put QR codes on produce packaging that link directly to these farmer stories. In December 2024, Eosta launched rain-grown avocado from Kenya and Tanzania under this label to help fight excessive water use in avocado production;

- Banelino is a Fairtrade-certified cooperative of small-scale banana farmers in the Dominican Republic. It exports bananas to Europe, mainly through Fairtrade channels. Retailers and e-commerce platforms such as British Abel & Cole spotlight Banelino’s community initiatives, education programmes and focus on sustainable farming methods as part of their fair-trade product listings.

Tips:

- Develop strong relationships with importers and local distribution partners that handle e-commerce accounts. These partners must manage near-perfect packing and distribution;

- Provide excellent photos, product descriptions and traceability data. E-retailers use digital platforms that highlight the story behind the produce. If you supply more detail, you can strengthen your brand and consumer engagement;

- Use protective and innovative packaging that can withstand home-delivery handling. This might differ from standard supermarket packaging;

- Monitor consumer reviews or importer feedback, when possible. Resolve quality issues quickly, as negative feedback can spread quickly.

10. Hybrid consumption offers opportunities for product innovations

The rise of hybrid consumers in Europe presents an exciting opportunity for product innovation. These consumers balance their grocery shopping by purchasing affordable staples for everyday meals and premium, ethical and flavour-exploration items to enhance their dining experience.

Personalisation and flavour exploration

Younger consumers, particularly Millennials and Gen Z, are eager to experiment with new flavours and food experiences. Influenced by social media platforms like Instagram and TikTok, they seek exotic and health-conscious fruits and vegetables, such as ginger and turmeric, hybrid fruits like pluots and nectaplums, and super-spicy chili peppers. This trend drives the demand for fresh produce, which can become mainstream, similar to the success of blueberries and avocados in Europe.

Club varieties gaining popularity

Club varieties of mainstream fruits like apples, pears and grapes are becoming increasingly popular in Western and Northern Europe. These fruits, marketed for their consistent quality and distinct taste, target the premium segment. By restricting production to licensed growers, they guarantee high-standard products that justify higher prices, especially in retail outlets that want to offer exclusive, high-quality fresh produce.

Figure 8: Promotion of the Tessa club apple at FruitLogistica

Source: GloballyCool, February 2025

Tips:

- Watch social media platforms like TikTok and Instagram, and keep an eye on food trends for clues about emerging consumer interest in new fruits or vegetables. Quick adaptation can help you become an early mover;

- Explore the possibility of licensing or partnering with club variety developers if you grow apples, pears or grapes. The premium that these programmes command might offset licensing fees or stricter production protocols;

- Engage in marketing that tells a story about flavour, aroma or unique textures. Hybrid consumers want to feel like they are discovering something special. For example, check out this Mavuno Kenya promotional page about passion fruit.

11. Technology is becoming a priority in today’s fresh trade

As competition and requirements grow, so does European fresh trade investment in technology, from fields to ports, from warehouses to consumers’ doorsteps. High labour costs, labour shortages and consumer demands for consistent quality push businesses towards automation and data-driven solutions.

Precision farming and data-driven decisions

Precision agriculture is transforming production all over the world. By collecting real‑time field data on weather, soil composition, pests and plant health, farmers can minimise inputs like water and pesticides while maximising yields. Although advanced tools like drones and AI-driven analytics may seem out of reach for smallholder farmers, simpler versions (e.g. moisture sensors, basic weather stations) are increasingly affordable. These tools often improve yields and quality, making exports more competitive.

Post-harvest tech

Advanced post-harvest technology and maintaining the cold chain is crucial to preserving the freshness of produce exported to Europe. Technological solutions that serve these objectives include:

- Automated sorting and grading lines: Cameras with machine learning can detect problems and sort produce by size and ripeness;

- Smart reefer containers: These can remotely monitor and adjust temperature, humidity and atmospheric compositions (controlled atmosphere or modified atmosphere);

- Smart transport packaging solutions that keep fruit in better condition.

Figure 9: Perfotec’s LinerBag smart packaging for transport and storage of fruits and vegetables

Source: PerfoTec@YouTube

Suppliers should invest carefully

Investments in technology can boost your reputation with European buyers. Reliable data on temperature logs, pesticide usage or yields improves trust and can help differentiate you from competitors.

However, adopting technology requires careful analysis in terms of Return-on-Investment. Exporters with small production volumes must ensure that the new equipment or software pays off. Further, once you have invested in digital tools, training staff to use the digital tools is essential. A partially implemented solution may fail if employees do not understand or trust it.

Tips:

- Read our tips to go digital in the fresh fruit and vegetable sector to learn what technologies are accessible and useful for your company;

- Look for technology that suits your farm and budget. A small moisture sensor system might be more practical than a full-scale drone fleet;

- Collaborate with local universities, NGOs or extension services that support digital transformation in agriculture. They can provide guidance or trial programmes for new tech;

- Consider joint investments with buyers, especially if the buyer wants consistent volumes that justify advanced monitoring or automation;

- Use digital traceability platforms, such as FarmerConnect and TransGenie. They can easily share data with importers. This transparency often streamlines negotiations and helps loyalty.

12. Supply chain integration requires partnerships

This trend connects many of the previous points: stronger integration in the supply chain is often achieved through long-term partnerships. As the European market demands strict traceability, consistent quality, sustainability assurances and year-round availability, stand-alone exporters find it tougher to thrive without forming deeper relationships.

Importers have become service providers

Importers increasingly act as service providers. Many have advanced ripening facilities, packaging operations and quality labs. They offer integrated solutions to retailers, who, in turn, want one-stop shops. Working with them can be beneficial for exporters, but these importers prefer to rely on producers that can deliver stable volumes and meet high standards. If you are a small exporter, forming alliances with other producers or being part of a producer association can help you grow.

Joint ventures and specialised sourcing platforms

There is also growth in specialised sourcing companies that own farmland overseas or form joint ventures with local producers. By doing so, they mitigate supply risks, ensure compliance with European standards and keep a closer eye on farm practices. Examples include African and Latin American production sites that are partially owned by European importers. These integrated models often lead to stable markets, although they can limit smaller, independent exporters if they cannot match the scale or meet necessary conditions.

The advantages of partnerships for suppliers from developing countries are varied:

- Better market visibility: Working closely with importers helps you forecast demand and plan production, minimising surpluses or shortages;

- Easier investment: Partnerships can facilitate access to finance, equipment and expertise that would otherwise be impossible;

- Risk reduction: Long-term contracts may protect against price volatility. They also encourage open communication, so problems like shipping delays and pest outbreaks can be managed together;

- Deeper branding possibilities: Partnerships allow co-branding and storytelling that covers the entire journey of the product, from farm to shelf. This can make the produce more appealing to consumers and lead to higher rewards.

Tips:

- Identify potential strategic partners by attending major industry fairs, like Fruit Logistica (Berlin) and Fruit Attraction (Madrid). Find out who wants direct farm relationships or has expanded operations in your region;

- If you are small, consider forming a regional alliance with other growers to share volumes and certifications as much as possible. This can attract bigger clients;

- Be transparent about your strengths and weaknesses. Partnerships work best when both sides share real numbers, production challenges and future ambitions;

- Plan for the long term. Quick, one-off deals rarely justify major investments or technology adoption. A multi-year contract or a robust partnership can.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research