The Spanish market potential for coffee

Spain is a large country with a disposable income below the European average. Most imported coffee is Robusta, and price remains a key factor in the Spanish market. However, the market is slowly shifting. The demand for Torrefacto coffee (coffee roasted with sugar) is declining, and the markets for certified coffee and specialty coffee are growing. Spain hosts numerous coffee festivals. It is also Europe’s main market for decaffeinated coffee.

Contents of this page

1. Country description

Spain is located in Southwestern Europe. With a population of around 47 million people, it is one of the most populous countries in Europe. The Spanish economy is significant, ranking as the fourth-largest in the Eurozone. Key industries in Spain include manufacturing, textiles and apparel (fashion), automotive, tourism and services. The country is renowned for its luxury brands, particularly in fashion and traditional crafts. Spain has a GDP of about €27.5 thousand per capita, which is slightly below the EU average.

Spain shares borders with France, Andorra and Portugal, making it a pivotal link between Europe and the Mediterranean. Its major ports (including Barcelona, Valencia, Bilbao and Algeciras) play crucial roles as maritime trade gateways. Spanish is the official language, although regional languages (like Catalan, Basque and Galician) are also spoken in specific regions.

The Spanish café culture is iconic, with coffee shops playing a central role in social life. Spaniards cherish their coffee. It is typically served in small, strong doses similar to Italian espresso, but with unique preparation styles. Typical Spanish coffees include café con leche (coffee with milk) and Torrefacto coffee (coffee roasted with sugar).

This study focuses mostly on non-decaffeinated green coffee (HS code 090111), as it is by far the most traded product. It also discusses decaffeinated green coffee (HS code 090112), non-decaffeinated roasted coffee (HS code 090121) and decaffeinated roasted coffee (HS code 090122).

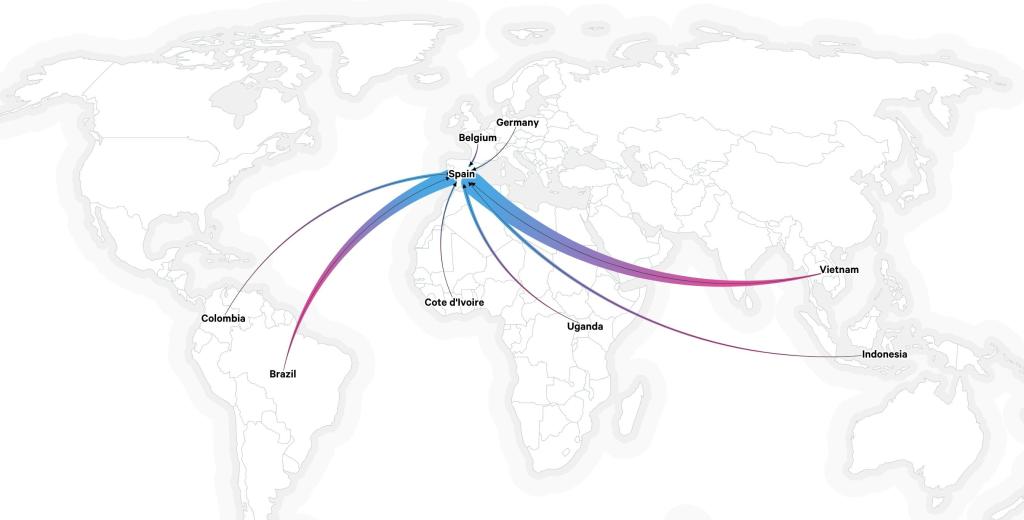

Figure 1 shows the largest trade flows for green coffee to Spain. Broader arrows indicate larger trade flows.

Figure 1: Main green-coffee export flows to Spain, 2022

Source: Resource trade

Tips:

- Find more information on the website of the Spanish Coffee Association (AECafé). The association publishes sector news and national events.

- Learn about the main European markets by reading the CBI country studies. They include the German market, the Belgian market, the French market, the Swiss market and many others. These studies provide insights that are valuable across a variety of European contexts, including Spain.

- Visit the websites of the Port of Barcelona and the Port of Valencia to learn about these key trade hubs and discover potential coffee business partners. This reflects the pivotal role of these ports in Spain’s trade and economy.

- Activate your browser’s translation function to access studies in your native language. Because many resources are in Spanish, this will help you to understand the information better. For instructions how to do this in your browser (for example in Chrome), visit the Google Support website.

2. What makes Spain an interesting market for coffee?

Spain offers one of Europe’s most interesting coffee markets. The country has a large base of coffee consumers and is home to an important roasting industry. While Spain has historically had a very high demand for low-priced coffee beans, the market is evolving, and interest in higher-quality and specialty coffee is increasing.

Spain is Europe’s fourth-largest importer of green coffee

Spain is Europe’s fourth-largest import market for green coffee. In 2023, Spanish imports of green coffee beans reached a volume of 306 thousand tonnes. To put this in perspective, Europe’s largest importer, Germany, imported 986 thousand tonnes of green coffee in the same year.

Source: Eurostat

Between 2018 and 2022, Spain’s coffee imports increased by a yearly average of 4.2%. In 2023, however, imports dropped by 11.8%. This is slightly more than the average decline for Europe as a whole. This was largely due to high inflation rates and increased coffee prices.

More than 81% of Spain’s coffee imports come directly from coffee-producing countries. Vietnam is the main supplier of green coffee, providing 124 thousand tonnes, followed by Brazil (55 thousand tonnes). Spain also sources significant quantities of green coffee from Germany (32 thousand tonnes) and Belgium (17 thousand tonnes).

Tip:

- For coffee-market statistics on other European countries, read our study on the demand for coffee in the European market.

The role of Spain as a trade hub in Europe is significant

Spain is the fourth-largest re-exporter of green, non-decaffeinated coffee beans in Europe. In 2023, Spain accounted for 5.7% of all European re-exports, with a total volume of 26.8 thousand tonnes. Between 2019 and 2023, these re-exports nearly doubled. In 2019, the export volume amounted to 14.1 thousand tonnes.

Most green-coffee exports from Spain were destined for the following countries:

- Germany (11.2 thousand tonnes)

- Portugal (5.5 thousand tonnes)

- Belgium (3.5 thousand tonnes)

- France (2.6 thousand tonnes)

The outlook for the Spanish coffee market is moderately positive

Spain’s coffee-import volumes are expected to remain relatively stable in the coming years. The market is expected to increase slightly in terms of market value, mostly because of an increasing demand for higher-quality beans.

Spain’s vibrant coffee event scene

In Spain, drinking coffee is a social phenomenon. Partly because of this, it hosts many coffee events. The following are several examples:

- Madrid Coffee Festival. An important event featuring international and local experts, including cuppings and conferences.

- Coffee Fest. An international coffee festival focusing on the broader coffee community, hosted in Madrid.

- Barcelona Coffee Awards. A trendy, consumer-focused festival showcasing the best Spanish roasters.

- Naked Festival (Madrid). Initially focusing on the Aeropress Championship, it has evolved into a broader celebration of coffee and its flavours.

- Forum Café. Organised by the French equivalent of Collectif Café.

- Valencia is Coffee. A new festival, with its first edition taking place from 31 May to 2 June 2024.

Spanish consumers mainly seek low-priced coffee

In 2022, 95% of all Spaniards consumed coffee. This rate is higher than that in either France or Germany (89% each).

In Spain, the average spending per coffee drinker is relatively low, with per capita spending of €26.80 for roasted coffee. This is significantly lower than in Italy (€69.10) and Germany (€51.80). This spending level might reflect differences in purchasing power or coffee pricing. In 2023, Spanish households spent €1.48 billion on coffee and infusions, which is €31.65 per household. Older and wealthier citizens tend to spend more on coffee. In 2022, the total coffee expenditures amounted to €1.43 billion. Spanish coffee consumption is expected to increase, due to rising income levels.

Many Spanish consumers (especially older men) prefer Torrefacto coffee, which involves adding a sugar layer to the beans before roasting. The sugar caramelises, giving the coffee a stronger, more bitter flavour. This is usually done with lower-quality beans. Of all coffee consumed in Spain, 12.5% is Torrefacto coffee.

3. Which coffees offer the most opportunities on the Spanish market?

Given Spain’s strong demand for low-priced beans, the country offers opportunities for suppliers of low-quality and average-quality beans. Spain is also Europe’s largest market for decaffeinated coffee. The markets for specialty and certified coffee continues to expand.

Efficient production of large volumes offers opportunities

Spanish consumers prefer affordable coffee. Spanish traders import mainly low-priced Arabica and Robusta beans, which dominate the market.

Supplying this market is not ideal, as profit margins are low. Many exporters and producers are not in a position to sell premium or speciality coffees. For those exporters, Spain offers a stable market.

Spain especially has a very high demand for green Robusta. In 2021, almost 59% of all coffee imports were Robusta beans. This is in sharp contrast to other European countries. According to ICCO, Robusta accounted for an average of only 36% of all European imports. Despite rising Robusta prices, it is still cheaper than Arabica.

Spain is Europe’s largest market for decaffeinated coffee

Spain is quickly becoming the world’s largest market for decaffeinated coffee. In 2021, about 20% of all coffee consumed in Spain was decaffeinated. This growth is driven by a focus on healthy products and individual lifestyle choices (like dining out late and avoiding caffeine in the evening). Spanish consumers are more open to decaffeinated coffee than they are in other Mediterranean countries.

In 2023, Spain imported 28.5 thousand tonnes of green decaffeinated coffee, accounting for 10% of all green-coffee imports. Spanish imports far outpaced those of the second-largest importer, Switzerland (10 thousand tonnes).

In 2023, 61% (17 thousand tonnes) of Spain’s decaffeinated coffee came from Vietnam. Other large suppliers are re-exporters, including Germany (9 thousand tonnes) and the Netherlands (1.4 thousand tonnes). It is unclear how much of this re-exported coffee originally came from Vietnam.

One of the main Vietnamese exporters of decaffeinated green coffee is Nestlé Vietnam. The company opened a decaffeination facility in 2015 and expanded it recently. Other companies with decaffeination facilities in Vietnam are the Neumann Gruppe and Massimo Zanetti.

Based on expert interviews, the demand for decaffeinated coffee is expected to continue growing slowly.

Tips:

- Reduce competition by focusing on a niche market, such as the market for decaffeinated speciality coffee or decaffeinated organic coffee.

- Focus on quality. Decaffeinated coffee of higher quality offers better margins.

Spain offers a small market for coffee roasted at origin

The market for coffee that is roasted at origin is very small, compared to green-coffee imports. Exporters of roasted coffee should expect fierce competition. In 2023, Spain imported 176 tonnes of roasted coffee directly from producing countries. This amounts to only 0.06% of all green-coffee imports. However, there are some opportunities within the niche market of roasted coffee.

With 43% of retail sales, Spain has a relatively high demand for private-label coffee, which is sold mainly in supermarkets. In the private-label market, branding is less important. This offers opportunities for exporters of competitively priced coffee in the Spanish coffee market.

A second opportunity has to do with the Latin American diaspora community’s preference for products from their home countries. These products are sold online or in supermarkets/ hypermarkets that target specific diaspora communities. The following are a few examples:

- Torrecafe Aguila Roja & Cia originates from Colombia. The company also sells its products through Tu Tienda Latina, targeting the Colombian community in Spain.

- LatínCor, a supermarket in Barcelona (Spain), sells Juan Valdez coffee to Latin American customers.

- Juan Valdez café, caters to the out-of-home market in Madrid and other cities.

A third opportunity is emerging in the growing market for coffee capsules. The Spanish capsule market (hard pods and soft pads combined) accounts for about 15% of the total market in volume. This is just below the European average of 16%. In terms of retail value, however, the coffee-capsule market accounted for 60% of total coffee sales in 2023. This is far above the European average of 38%. Spain is the third-largest European capsule market in terms of retail value.

Source: European Coffee Report 2023-2024

Producing coffee capsules can be difficult. They have a longer shelf life, however, which reduces some of the challenges when exporting roasted coffee. Several exporters from producing countries are tapping into this market, including the following:

- Pilão is a Brazilian roaster owned by JDE Peet’s. It offers all kinds of coffee. Pilão produces mostly for Brazil’s domestic market. Its single-serve options include capsules and pods.

- Hermanos Colombian Coffee Roasters in Colombia offers fully compostable coffee capsules.

- Aroma Group is a company from Thailand that produces coffee capsules for local and international markets.

Tips:

- Read our study on exporting roasted coffee to Europe.

- Participate in the World Coffee Challenge. This challenge is open only to suppliers of coffee roasted at origin. The tasting takes place in Madrid.

- Make a careful decision before entering the Spanish market for roasted coffee. Although exporting roasted coffee can offer higher margins, the market is highly competitive and difficult to enter.

The Spanish specialty coffee market is booming in large cities

The Spanish specialty-coffee culture is booming, especially in the large cities of Madrid and Barcelona.

There are no official statistics on the Spanish imports of specialty coffee. One indicator of interest, however, is the use of ‘specialty coffee’ as a search term in Google. Figure 4 shows the growing use of this keyword in the six European countries importing the most green coffee. Based on Google search queries, Spaniards seem to be very interested in specialty coffee. You should not read Figure 3 as a measure of market size, but merely as an indication of consumer interest.

Source: Google Trends

The main importers of green specialty coffee include Xorxios, MareTerra Coffee, Ally Coffee and Kona Specialty Coffee. Spanish specialty roasters also receive their specialty coffee through internationally operating importers (such as Trabocca, Nordic Approach and Sucafina).

Based on expert interviews, Madrid and Barcelona have the most active markets for specialty coffee. Barcelona has more roasters, and Madrid hosts more cafés. For a few years, Valencia, Andalusia and Galicia have also been embracing the speciality-coffee trend.

Tips:

- For more information on specialty coffee, refer to our study on exporting speciality coffee to Europe.

- Search for buyers on websites that list Spanish specialty-coffee roasters. Examples include Coffee Insurrection, Coffee Roast and European Coffee Trip.

Spain’s market for certified coffee is small, but growing

In 2023, Spain imported 8,200 tonnes of coffee with Rainforest Alliance certification — a decline of 3% from 2022. This is far less than the average decline of 11.8% for Spanish green-coffee imports. This indicates a relative increase in the share of Rainforest Alliance-certified imports. Despite the relative growth, imports of coffee with Rainforest Alliance certification comprised only 2.7% of the all green-coffee imports. In Germany (Europe’s largest market), this share was 14.4% in the same year.

There are no publicly available data on imports of Fairtrade-certified coffee to Spain. In 2021, the total retail value of Fairtrade-certified coffee was €22 million, accounting for around 1.5% of all coffee sales. By comparison, Fairtrade coffee made up 5% of sales in Germany.

According to TRACES data, Spain imported 3.9 thousand tonnes of organic coffee in 2023. This is 1.3% of the total volume of green coffee imports. Although this share is relatively small (to compare, this figure was 5.9% for Germany), it is growing rapidly. In contrast to the decline in green-coffee imports (11.8%), imports of organic coffee grew by 34% in 2023. Since 2018, organic-coffee imports have increased by 134%.

Overall, imports of certified coffee to Spain remain low. These numbers are expected to continue growing, due to rising income and increasing consumer awareness.

Tips:

- Read our studies on organic coffee, certified coffee and multi-certified coffee to learn how to export these products to the European market.

- Try establishing direct trade relationships with small traders and roasters if you want to export specialty coffee to the Spanish market. You can meet potential buyers at trade shows, like the International Coffee Festival.

4. Which trends offer opportunities or pose threats on the Spanish coffee market?

The Spanish coffee market is very mature. We therefore do not expect any major changes in the near future. The market is slowly evolving, however, in response to the increasing demand for certified, decaffeinated coffees and premium specialty coffees. At the same time, the consumption of the traditional Torrefacto coffee is decreasing.

Several trends are driving these changes. Spain’s economy is doing well, and the average income is increasing. At the same time, popular interest in sustainable consumption and personal health are increasingly driving consumption decisions.

With rising income levels and growing concern for sustainability and health, Spain is becoming more closely aligned with other European countries. Although many Northern European countries (such as Germany, the United Kingdom and the Netherlands) have higher disposable income and greater willingness to buy certified products, Spain is gradually catching up.

Spanish consumers enjoy spending power

Spanish household finances have improved significantly in recent years, with growth in disposable income outpacing household spending and inflation. The Spanish economy is doing well. In 2023, disposable income in that country rose by 10.6% in one year, as compared to the increase of 6.4% disposable income for all countries in the Eurozone. A robust labour market is supporting this growth.

The economic outlook for Spain is also positive. According to forecasts, Spain’s gross domestic product (GDP) will grow by 1.9% in 2024, 2.1% in 2025 and 1.8% in 2026. In contrast, GDP growth for other major European economies (such as Germany, France and the United Kingdom) is expected to remain below 1% in 2024.

Although Spain’s GDP and disposable income are still well below the European average, the country’s economy is growing, and these figures are catching up. This means that Spanish consumers will be able to spend more on coffee with sustainability certification and higher quality.

Spanish consumers are becoming more conscious about sustainability

Sustainability and health are becoming increasingly important to Spanish consumers. This applies especially to food and beverages.

Since the pandemic, 53% of Spaniards report being more conscious of the environmental effects of their purchases. This increased awareness is having direct impact on buying habits. Spanish consumers are increasingly willing to pay more for sustainable options. This is particularly evident in the food and beverage sector, where consumers are willing to pay 9% more for more sustainable options. Furthermore, reducing food waste is an essential action that half of the population takes to live more sustainably. This indicates a direct link between environmental concern and food consumption.

This trend extends to coffee consumption as well. The share of coffee with Rainforest Alliance and Organic certification has grown in recent years. Spain’s share of certified coffee imports is still well below the European average. In light of the stagnation in certified imports throughout Europe, however, the Spanish market is showing positive momentum in this area.

Spanish consumers prioritise their health

Spanish consumers are increasingly prioritising health when buying food-products. For example, 72% of all Spaniards are now more concerned about the quality of their food than was the case five years ago.

The consciousness of the health effects is also affecting coffee consumption. In the Spanish culture, many people consume their coffee late in the evening. With the increasing knowledge of the effects of caffeine on sleep, more Spanish consumers are opting for decaffeinated coffee.

Some consumers are looking for more alternative coffees to boost their health. One example is mushroom coffee, which is currently in high demand in Spain. This blend of coffee and mushrooms reportedly offers health benefits beyond those of its reduced caffeine content. Mushroom coffee is generally costly, with a retail price of around €200 per kilogram.

Although many internet sources emphasise the health benefits of organic coffee, health is not the main reason that consumers have for buying organic coffee. The main reason that leads Spanish consumers to buy organic coffee is concern for the environment.

Tips:

- Target the Spanish market with specialty coffee or organic-certified coffee. The market is expected to grow, offering opportunities for new suppliers.

- Engage small (experimental) Spanish roasters with beans that have health benefits. For example, emphasise the low amount of caffeine.

- Target the Spanish market with efficiently produced beans. Despite the changes in the market, Spain will remain a large market for affordable coffee. Even if your coffee is not certified, try to increase your sustainability, as this is an important aspect of any type of coffee production. For example, you could start by reading our study on tips to go green in the coffee sector.

- Read our study on trends in the European coffee market to explore general trends, which also apply to the Spanish market.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research