Entering the Spanish market for coffee

Spain represents a huge market for commercial coffee, especially non-certified commercial coffee. Most of the requirements for these types of coffee come from European Union legislation. Robusta varieties account for a large share of all imports. The largest suppliers therefore include Vietnam, Uganda and Indonesia.

Contents of this page

1. What requirements and certifications must coffee comply with to be allowed on the Spanish market?

Exporting to Spain comes with many requirements. Most of these requirements are set by the European Union (EU). Some requirements, however, are set by the Spanish government or by companies themselves. These requirements can be divided into the following categories:

- Mandatory requirements

- Additional company requirements to maximise success in the market

- Requirements for niche markets

The sections below describe the mandatory requirements, additional requirements and the requirements for niche markets. Most requirements are the same for all European markets. In addition to providing a short overview of all requirements, we address the requirements specific to the Spanish market in more detail. For a more extensive and generic description, read our report on requirements for the European coffee market.

What are mandatory requirements?

Requirements on food safety and hygiene

You must follow the European Union legal requirements applicable to coffee. These rules mainly concern food safety, with traceability and hygiene being the most important themes. You should pay special attention to specific sources of contamination with pesticides and mycotoxins/mould, and particularly Ochratoxin-A (OTA).

Tips:

- Consult the EU Pesticide Database for an overview of the maximum residue levels (MRLs) for each pesticide. You can either search for coffee under the product or search for the active ingredient of your pesticide, if you know it. This database shows the MRLs for the active ingredients accepted in the EU.

- Always check with your buyers if they require additional adherence to MRL limits and pesticide use.

- Use your browser (for example, Google Chrome) or an AI translation to auto-translate the information provided on Spanish websites.

Labelling requirements

Labels for green coffee exported to Spain should be written in English, and they should include the following information to ensure the traceability of individual batches:

- Product name

- International Coffee Organization (ICO) identification code

- Country of origin

- Grade

- Net weight in kilograms

- For certified coffee: name and code of the inspection body and certification number

Figure 1: Example of green-coffee labelling

Source: Escoffee

Payment and delivery terms

The payment and delivery terms in Spain are the same as those of buyers in other countries. Payment is generally required when accepting the coffee, or within 30 or 45 days. It is crucial to examine these terms carefully. In general, payment will be earlier if you sell your coffee to a trading company than when you sell it directly to a roaster.

Spanish buyers pay the same prices as other European country buyers for the same product. They thus do not pay any more or less than buyers from other countries do. Your payment and delivery terms will depend on your incoterms. You can read more about this in our tips on how to organise your coffee exports.

Packaging requirements

Green coffee beans are traditionally shipped in bags woven from jute or hessian natural fibre. Jute bags are robust. Some specialty coffee suppliers also use other materials inside jute bags. Examples include GrainPro and Videplast. These materials have added value over traditional packaging. They preserve bean quality, prevent post-harvest loss, reduce solid waste, reduce the farmer’s net carbon footprint and facilitate chemical-free storage. Note that these innovative materials are used mostly for the high-end and upper-end segments.

Other packaging for transporting coffee include:

- Polypropylene super sacks for 1 tonne of coffee

- Polyethylene liners for 21.6 tonnes

- Vacuum-packed coffee

These techniques increase efficiency, in addition to maintaining and preserving quality.

Figure 2: Examples of coffee packaging from left to right: jute bag, container-sized flexi-bag, GrainPro and Videplast liner

Sources: Raad, Bulk Logistic Solutions and GrainPro

Tips:

- Read the CBI study on buyer requirements for coffee in Europe for the full buyer requirements.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on the prevention and reduction of Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009. Use the search tool to find the codes containing information on Ochratoxin A, and select your preferred language.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Learn more about delivery and payment terms for your green-coffee exports by reading our study on organising your coffee exports to Europe.

Sustainability requirements are becoming stricter

The main (mandatory) sustainability requirements come from the European Green Deal, including the European Deforestation Regulation (EUDR) and the European Corporate Sustainability Due Diligence Directive (CSDDD). The European Green Deal (EGD) is the European Union’s (EU) response to the global climate emergency. It is a package of policies that define Europe’s strategy for reaching net-zero emissions and becoming a resource-efficient economy by 2050. In addition to the EGD, the Forced Labour Regulation also affects coffee suppliers exporting to the EU.

The European Deforestation Regulation prohibits coffee that leads to deforestation

One of the laws resulting from the EGD is the EU Deforestation Regulation (EUDR). This legislative measure clearly exerts the most influence on the European coffee industry. The law gives roasters and traders 18 months to implement the new rules. In December 2024, the EU delayed implementation by one year, to 30 December 2025. Micro and small enterprises will have an additional six months. This law makes traceability and technology crucial for exports to the EU market. This will have implications for the coffee-producing industry. The EU provides an information sheet addressing frequently asked questions about this topic.

Certification is one of several tools that you could use to prove that your company complies with the EUDR. This could involve certification schemes that include strict environmental criteria promoting sustainable farming practices. Examples include the Organic and Rainforest Alliance certifications. Although it does provide relevant infrastructure, however, certification alone will never be sufficient.

The CSDDD will increase the requirements for traceability and human rights

Under the new CSDDD regulations, corporations must improve their sustainability performance across their global supply chains and prevent damaging effects on human rights and the environment. Businesses are required to take the following actions:

- Integrate due diligence into their policies.

- Identify actual or potential adverse impacts.

- Prevent and mitigate potential adverse impacts.

- Establish and maintain a complaints procedure.

- Monitor the effectiveness of their due diligence policies and measures.

- Publicly communicate on due diligence.

The directive requires European companies to take responsibility for their full supply chains. It therefore requires your buyers to request proof that you are acting in a way that is socially and environmentally sustainable. The anticipated date for the CSDDD to come into force is around 2025-2026.

The Forced Labour Regulation bans coffee produced with forced labour from the European market

The objective of the Forced Labour Regulation is to ban the production or export of any product made using forced labour.

Based on risk assessments, companies based in the EU will be required to ensure that no forced labour occurs within their supply chains. In April 2024, the EU Parliament granted final approval on the legislation. Companies should be prepared to comply with the Regulation’s requirements beginning in mid-2027. Non-compliant European companies will be fined.

The full effect of the Forced Labour Regulation on exporting companies is still unclear. However, it will mean that European buyers will require more information from their suppliers.

Tips:

- Increase your traceability. European sustainability requirements will become increasingly strict. You cannot provide proof of your sustainable behaviour unless you know where your coffee comes from. Depending on market interest in such schemes, certification could be an interesting tool for improving in this regard.

- If you are unsure about any requirements, consult your buyer.

- Read more about the European Green Deal.

- Read more in our CBI coffee studies on tips to go green or tips on how to become more socially responsible.

What additional requirements and certifications do buyers often have?

Some Spanish buyers may demand extra food-safety requirements for processing, or extra quality requirements.

Additional food safety requirements

You can expect buyers in Spain to request extra food safety guarantees from you. You should consider the following in terms of production and handling processes:

- Implementation of good agricultural practices (GAP): The main standard for good agricultural practices is GLOBALG.A.P., a voluntary standard for the certification of agricultural production processes that provide safe and traceable products. Certification organisations (such as Rainforest Alliance) often incorporate GLOBALG.A.P. into their own standards.

- Implementation of a quality management system (QMS): Buyers are increasingly requiring a system based on Hazard Analysis and Critical Control Points (HACCP) as a minimum standard for the production, storage and handling of green coffee. The implementation of regular checking of residue levels in your green (and roasted) coffee is an example of what could be included in this system. In particular, you should monitor Ochratoxin-A (OTA), polyaromatic hydrocarbons (PAHs) and glyphosate contamination.

Quality requirements

In general, green and roasted coffees undergo physical evaluation to determine their quality. Roasted coffee also undergoes a sensory evaluation.

The quality assessment is usually based on the following criteria:

- Altitude and region

- Botanical variety

- Processing method (wet/washed, dry/natural, honey, pulped naturals)

- Screening size

- Number of defects or imperfections

- Bean density

- Cup quality

In most cases, the assessment includes a moisture check and a water-activity analysis. Inspectors sometimes perform sample roasting to assess the quality and uniformity of the green coffee.

The process of quality assessment is the same for all types of green coffee beans. The exact criteria, however, will differ. For example, both high-end and low-end coffee beans are checked for bean density (mass divided by volume), but high-end coffees require a higher bean density.

Tips:

- Know the coffee you sell. This includes information on the growing process, the processing method and the flavour attributes (fruity, chocolate, etc.). You should also be aware of the quality you are selling. This could help you sell some of your coffee for a higher price.

- Learn about green-coffee quality assessment. In addition to consulting the Specialty Coffee Association for the leading standard, you could read about other ways to assess coffee quality.

What are the requirements for niche markets?

Exporting organic coffee, specialty coffee or roasted coffee comes with additional requirements.

Requirements for organic coffee

Exporting organic coffee comes with extra requirements. To market your coffee as organic in the European market, it must comply with the EU regulations for organic production and labelling. Regulation (EC) 2018/848 sets the rules for organic production and labelling. Regulation (EC) 1235/2008 describes the rules for implementing the EU legislation for imports of organic products from third countries.

Organic coffee is checked at the EU border. To import organic coffee to the European Union, the delivery must include an electronic certificate of inspection (e-COI). The certificate should be set up in the Trade Control and Expert System (TRACES). It must be signed by a control authority in your country before the shipment leaves the country.

Tips:

- Learn more about exporting certified coffee by reading our studies on organic coffee, certified coffee and multi-certified coffee.

- Find importers that specialise in organic products on the Organic-bio website.

- Use this cost calculator to estimate the costs for your organisation to obtain Fairtrade certification. You should also ask for quotations from different certifiers before deciding which one you want to work with. Ask for timelines and an estimate of how many days would be charged. Always discuss potential certification with your buyers before making any investments or decisions in this regard.

- Try to combine audits in case you have more than one certification. This will save time and money. You should also investigate the possibilities for group certification with other regional producers and exporters.

Requirements for specialty coffee

Specialty coffee is graded according to its cupping profile. Fragrance, flavour, aftertaste, balance, acidity, sweetness, uniformity and cleanliness are important factors in the grading process. If you sell specialty coffee, your buyers will need to know the cupping score of your coffee. Including this information with the documentation of the coffee you are exporting can add value. It is very important to be aware of the quality of your coffees. You can learn about this through local cupping experts or by becoming a cupping expert yourself.

In addition to high quality, a high level of transparency is very important. Many buyers are interested in stories about the origins of products. Examples include details of your coffee farm, the coffee growers, how and where you grow your coffee, and your processing facilities. You should therefore know the specific details of your coffee, from soil management to cup, from variety to processing and from external suppliers to farmers. You must also be willing to share this information honestly. In addition, direct trade could require more frequent coffee farm visits, product assessments by your buyers, and long-term business relationships.

Requirements for roasted coffee

Sensory assessment: Coffee cupping

The assessment and scoring of coffee proceeds according to a method known as cupping. Buyers use a variety of protocols and standards to conduct a sensory assessment. However, the SCA recommends protocols and best practices for cupping coffee. The SCA’s Coffee Taster’s Flavor Wheel is the most widely used cupping tool. Some of the quality attributes assessed are flavour, fragrance/aroma, aftertaste, acidity, body, uniformity, balance, cleanliness, sweetness and off-notes.

Be cautious of plastic packaging for roasted coffee

The Spanish plastic packaging tax affects coffee exporters that use non-reusable plastic packaging for products to be sold in Spain. The tax (€0.45 per kilogram) applies to importers. If a coffee exporter exports coffee to Spain in plastic packaging, the importer will be responsible for paying the tax. This is also important for you, as your buyer will probably prefer packaging that does not contain plastics.

Hygiene requirements for roasting

Food imported into the EU is subject to official food controls. These controls include regular inspections that can take place at import (at the border) or later on, once the food is in the EU. The goal is to check whether the products meet the legal requirements.

All roasters must use a procedure based on the Hazard Analysis and Critical Control Points (HACCP) principles. A HACCP plan is a critical element of the quality-management systems of companies aiming to become successful suppliers to the European market. The HACCP for roasted coffee focus on keeping the coffee safe and of good quality. The steps include checking for issues like contamination, setting up points in the process to control these issues, and ensuring the coffee meets safety standards at each point. Monitoring and record-keeping are also important to ensure that the coffee remains safe for consumption.

Trade tariffs

The standard duty that applies to imports of roasted coffee is 7.5%. The duty for decaffeinated roasted coffee is 9%. These duties vary by country. This depends on whether your country has a contract with the EU. Note that the importer is responsible for paying the trade tariff. As an exporter, you do not pay this tariff.

Tips:

- Learn whether any trade duties for roasted coffee apply to your country. Check the Access2Markets website.

- Read our study on exporting roasted coffee to Europe to learn more about this market.

2. Through which channels can you get coffee on the Spanish market?

Most coffee in Spain is sold through supermarkets. Cafés, however, are still accountable for a large market share. Most coffee flows to consumers through a variety of actors in the value chain.

How is the end market segmented?

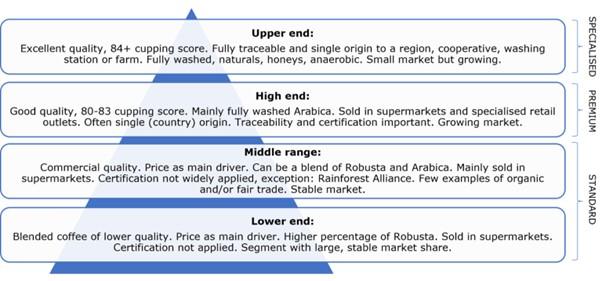

The Spanish end market for coffee can be divided into four segments: the lower end, the middle range, the high end and the upper end.

Figure 3: Coffee end-market segmentation by quality

Source: Profound

The lower-end and middle-range markets are by far the largest in Spain. At the lower end, a large share of coffee is sold as Torrefacto coffee, for which demand is slowly decreasing. The lower-end and middle-range segments are very large, even compared to other European countries.

The Spanish coffee market is expected to grow in value, but not in volume. Consumers spend more on higher-quality coffees. With a growing specialty-coffee segment, the high-end and upper-end are growing. This is especially the case in the large cities (like Madrid and Barcelona). One example of a roaster in the high-end and upper-end segments is Cafés el Magnífico. Based in Barcelona, this roaster sources most of its specialty coffee from specialty-coffee traders. Another example is Café Saula, which focuses on the high-end segment and offers a large range of organic coffees. Two examples of Spanish specialty-coffee traders are MareTerra and Icona Café.

A large share of the coffee in the high-end and upper-end segments enters Spain through traders based in other countries. Examples of specialty-coffee traders supplying Spanish roasters are This Side Up, The Coffee Quest, Trabocca (all in the Netherlands) and Nordic Approach (in Norway).

Although the mandatory requirements are the same for all segments, the upper-end and high-end segments are largely considered niche markets.

Tips:

- Be aware of the quality of the coffee you sell. The higher the quality is, the higher your price should be. If processed well, very high-quality beans can also offer opportunities for direct trade.

- Visit the website of the Specialty Coffee Association (SCA) to learn more about the high-end coffee segment, market trends and main players.

- Explore ways to enhance the quality of the coffee you produce. Certification, good agricultural practices and post-harvest processing can improve the quality (either actual or perceived) of your product.

Through which channels does coffee reach the end market?

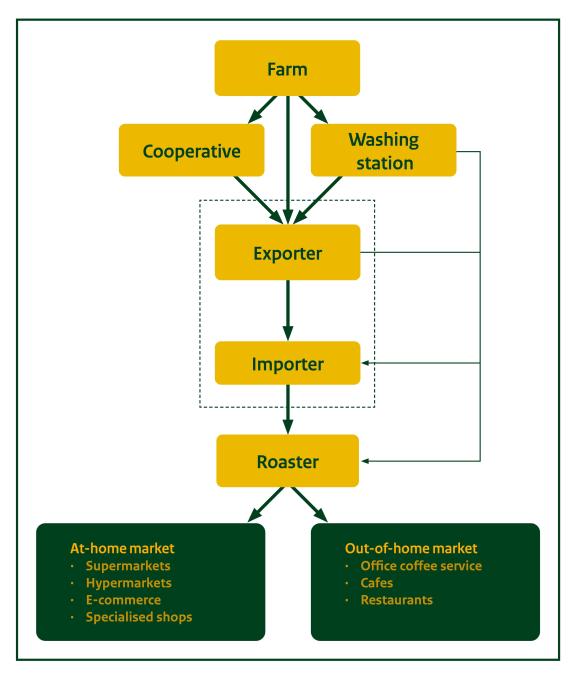

The Spanish supply chain consists of many actors, as shown in Figure 4. Although most coffee flows through all actors in the chain, options to penetrate the Spanish market more directly are emerging.

Figure 4: The Spanish coffee-supply chain

Source: based on Counter Culture Coffee

Importers have important roles in the supply chain

Importers play a vital role in the coffee market. They function as supply-chain managers, maintaining wide portfolios from various origins, pre-financing operations, performing quality control, managing price fluctuations and establishing contact between producers and end buyers (such as roasters). In most cases, the importers and the exporters are the same companies. For example, the Neumann Kafé Gruppe (NKG) has many warehouses in producing countries. Farmers and cooperatives can transport their coffee to a local NKG warehouse, after which it is exported to another NKG warehouse in Europe. As a supplier of a local warehouse, you normally do not know what the destination is.

The following are examples of leading Spanish importers:

- Icona Café (Madrid)

- Coprocafé Ibérica (part of Neumann Kafé Gruppe (Madrid)

- Volcafe Iberia (Madrid)

- Louis Dreyfus Company España (Madrid)

- Guzmán Coffee & Nuts, part of Guzman Minerals (Valencia)

- Tostadores Reunidos (Madrid)

Tip:

- If you are a farmer or cooperative, you should know the global importers that are active in your region. This will improve your access to the market.

Marketplaces facilitate trade

Marketplaces are platforms that connect actors within the chain. In most cases, they connect farmers directly to roasters. The use of marketplaces allows farmers or cooperatives to cut out parts of the chain. This help you to get better prices for your products. Only a very small share of all coffee reaches Spanish roasters through a marketplace. The following are examples of these marketplaces:

A few large roasters dominate the Spanish coffee market

Spain is Europe’s fifth-largest roasting market. Nestlé is by far the largest coffee roaster in Spain, dominating almost one-third of the market. Most dominant roasters are large international companies.

Table 1: Largest Spanish roasters and their market shares

| Company | Market share (%) |

|---|---|

| Nestlé | 29.6 |

| JDE (Jacobs Douwe Egberts) | 9.5 |

| UCC Coffee | 8.2 |

| Silk Outspan Iberia | 7.4 |

| Cafento Group | 5.3 |

Source: Alimarket, cited on Cafesmyway

In addition to these large roasters, Spain is home to a large (and increasing) number of small and micro roasters. In all, there are 250–300 roasters in Spain. The following are examples of smaller roasters:

- Nomad Coffee (Barcelona)

- Right Side Coffee Roasters (Barcelona)

- Toma Café (Madrid)

- Sakona Coffee Roasters (San Sebastián)

- Puchero Coffee Roasters (Valladolid)

Most small roasters buy from local traders

Large roasters dominate the market. Most of the 250–300 roasters based in Spain, however, are small or micro roasters. These smaller roasters mainly supply local hotels, restaurants and catering establishments.

Supermarkets and hypermarkets are the main sales channel

In 2023, 54% of all coffee and infusions were sold through supermarkets, and 20% were sold through hypermarkets.

Supermarkets mainly sell standard-quality coffee products, which form the lower-end and middle-range segments. These segments also include a wide range of the private-label coffee products of retailers. These products are popular, as they offer the same characteristics as branded products, but are usually more affordable.

The five leading supermarket chains in Spain (in 2023) — Mercadona, Carrefour, Lidl, the Eroski Group and DIA — now account for more than half (51%) of all fast-moving consumer goods (FMCG) sold by all retailers. Gruppo Carrefour is the main distribution channel for certified coffees. Table 2 provides an overview of the largest supermarket chains in Spain.

Table 2: Largest supermarket chains in Spain

| Supermarket | Market share in 2023 (in %) | Percentage of all coffee certified in 2021 |

| Mercadona | 26.8 | 2% |

| Gruppo Carrefour | 10.0 | 40% |

| Lidl | 6.6 | 13% |

| Grupo Eroski | 4.2 | 32% |

| Grupo Dia | 3.6 | 12% |

| Consum Coop | 3.4 | Unknown |

| Alcampo | 3.2 | Unknown |

Main source: Kantar and Merbah & Benito-Hernandez (2023)

Spain is home to a relatively large out-of-home coffee market

Spanish consumers are social coffee drinkers. They often enjoy coffee with friends and family. Although most coffee is consumed at home, around 30% is consumed out-of-home. Because Spain is a major tourist destination, the hotel, restaurant and catering sector profits greatly from tourism.

What is the most interesting channel for you?

The channel that is most interesting for you depends on many factors. Most importantly, it depends on your unique selling points. This means you need to know your product.

To sell your coffee to Spanish buyers, your first step is to know its specific characteristics and what sets it apart from the competition. Aspects to consider include the origin of your coffee and its unique flavour notes. Other factors include the genetic profile of your coffee beans, as well as their agro-ecological context, post-harvest practices, quality and impact on communities and nature. Storytelling and traceability are important as well. By telling the right story, you can connect consumers to the origins of your coffee and make coffee consumption a more complete experience.

The second step in selling coffee to Spanish buyers involves knowing your customers (either actual or potential). Successfully selling your coffee to European buyers requires that you understand their preferences and consumption patterns. Work with your buyers to explore specific coffee requirements (like quality and sustainability). Look for buyers who are willing to build long-term relationships. You can do this either directly or through an importer. You can increase your chances of success by analysing market information and identifying key buyers.

If you are an exporter of green mainstream coffee, you should consider entering the Spanish market through large importing companies. Most of these companies have agents or representative offices in producing countries. This can be your first point of contact.

Specialised traders can be interesting if you have evidence of high cupping scores (80 or higher). Many specialised importers prefer to work directly with producers or cooperatives.

Supplying to small roasters could be interesting if you have:

- high-quality coffees;

- micro lots;

- sustainability certification;

- or are willing to engage in long-term partnerships.

As the coffee market changes, it is essential to explore multiple market channels.

Tips:

- Explore selling directly to Spanish roasters.

- Address small-scale roasters in Spanish. These roasters are used to doing business in Spanish with Spanish importers. They are more likely to respond when addressed in their own language.

- Export through marketplaces (such as Algrano, Beyco and Raw Material). You can sell directly to Spanish roasters through these platforms. Try to reduce the length of the chain. If you have high-quality coffees and work through an importer, you could explore direct-trade possibilities and connect with specialised roasters.

- Offer your coffee directly to specialised coffee importers and small coffee roasters. This is possible only if you are a farmer with the financial means and technical expertise to organise export activities.

3. What competition do you face in the Spanish coffee market?

As a coffee supplier, you operate in a global and competitive landscape. For producers and exporters, it is important to understand the market segment in which you operate and the scale at which you work. By identifying these factors, you can determine which other countries you are competing with. Understanding the quality level, volume and positioning of your products can improve your ability to assess your competition and develop strategies to differentiate yourself in the global market. This knowledge is essential for positioning yourself effectively and competing successfully.

Which countries are you competing with?

Competition in the Spanish coffee market is fierce. Your main competitors depend on the product you supply. Vietnam, Uganda, Indonesia and Côte d’Ivoire are Spain’s main Robusta suppliers. Brazil and Colombia focus more on Arabica. Spain sources high quantities of both varieties. Compared to other European markets, Spain imports a relatively high amount of Robusta (almost 60%).

Vietnam is Spain’s main supplier of green coffee

Vietnam is the world’s second-largest coffee producer and the largest Robusta producer. In 2021, more than 96% of all Vietnamese coffee production consisted of Robusta coffees. Vietnam’s coffee production focuses strongly on creating large volumes of standard-quality coffees.

Vietnam’s total coffee exports to Spain reached approximately 123.7 thousand tonnes in 2023. Between 2019 and 2023, these exports decreased by an average of 2.1% per year. Vietnam is also Spain’s largest producing-country supplier of decaffeinated coffee. In 2023, it supplied 17.4 thousand tonnes, accounting for 61.0% of all decaffeinated green coffee imported into Spain.

Examples of large Vietnamese coffee-exporting groups include Simexco Daklak, the Intimex Group, Tin Nghia Corporation and Mascopex.

Vietnam’s coffee production is expected to remain stable in the short term. High coffee prices encourage farmers to invest in the production, which cancels the negative influences of bad weather conditions.

Table 3: Competitive country profile of Vietnam

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Main source: Standard Insights

Brazil is Spain’s second-largest supplier of green coffee

Brazil is the world’s largest producer and exporter of coffee. Although it produces both Arabica (around 70%) and Robusta (around 30%), almost 80% of its exports consist of Arabica. Brazil is also Spain’s second-largest supplier. In 2023, Brazilian exports to Spain reached a volume of 55 thousand tonnes, with an average yearly increase of 2.2% since 2019.

Brazil’s coffee-producing areas are relatively flat. This has intensified the use of mechanical pickers, thereby reducing labour costs in Brazilian coffee production. It has also led to an average decrease in quality, as machines cannot distinguish between ripe and unripe cherries.

Brazil produces mainly natural and pulped natural coffees. Low-grade Brazilian Arabica is used mostly in blends. Demand for these blends is high amongst Spanish roasters, who focus mainly on price.

Despite the lower coffee prices, Brazilian coffee farmers are relatively successful. Factors contributing to their success include the following:

- the scale at which they operate;

- mechanised cherry picking;

- an efficient infrastructure;

- a favourable climate (although climate change is having a drastic impact on several key producing regions in the country).

Brazil is the only large producing country in which the average farmer is able to generate a living income based on coffee farming.

Although Brazil is known mainly for exporting large volumes of standard-quality coffee, the country also has a strong reputation as a producer of specialty coffees. The sector receives considerable institutional support through the Brazil Specialty Coffee Association (BSCA). The association aims to raise quality standards and enhance value in the production and marketing of Brazilian coffees.

Examples of exporters of specialty coffees in Brazil include Burgeon and Bourbon Specialty Coffees.

The 2024/2025 outlook for Brazil is positive, with an expected production increase of 5.4% .

Table 4: Competitive country profile of Brazil

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Uganda’s coffee exports to Spain have grown rapidly

Uganda is another major coffee supplier to Spain. In 2023, Spain imported 16.5 thousand tonnes of coffee from Uganda. Between 2019 and 2023, green-coffee imports from Uganda grew at a yearly rate of 7.0%.

In Uganda, coffee is grown mainly by smallholder farmers, who are organised as part of NUCAFE, the national umbrella organisation of coffee farmers. The organisation’s members include more than 213 farmer cooperatives and associations. Approximately 80% of Uganda’s total coffee production is of the Robusta variety. Uganda has one of the world’s largest areas for the production of organic coffee, with 66 thousand hectares in 2018.

The Uganda Coffee Development Authority (UCDA) helps to promote and guide the development of the Ugandan coffee industry. They do so through quality assurance, research and improved marketing techniques. UCDA works towards achieving the Presidential directive of 20 million 60kg bags of coffee by 2030. UCDA has also encouraged the production and marketing of high-quality Arabica coffees. Private companies have also invested in Uganda, focusing on sustainable production approaches.

The fact that Uganda is the only African country where green coffee is available throughout the year gives the country a strong competitive advantage. Due to climate change, however, disruptions in weather and participation patterns are leading to increased difficulties in the supply chain. Examples of Ugandan exporters include ACPCU and Great Lakes Coffee.

Production in 2024/2025 is expected to remain the same as it was in the 2023/2024 production year.

Table 5: Competitive country profile of Uganda

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: Ethos Agriculture

Colombia: The largest supplier of washed Arabicas

Colombia was the fourth-largest direct supplier of green coffee to Spain in 2023, with volumes amounting to 11.7 thousand tonnes. Between 2019 and 2023, imports of Colombian green coffee to Spain decreased at an average yearly rate of 11.0%. This was mainly the result of the decrease in Colombian coffee production. The outlook for 2024/2025 is positive, however, and Colombian exports are expected to grow in the short term. At the same time, however, the expected growth of 1.6% will not make up for several years of significant decline.

Colombia is the world’s largest producer of washed Arabica coffee. The country has a strong national coffee industry with a high level of technological development. The Colombian Coffee Growers Federation strategically promotes and markets Colombian coffee. The country has an established image and brand for high-quality coffees. Colombian coffee is known for its notes of chocolate, nuts, herbs, fruit and citrus. The main processing technique is washed processing. The country’s best-known coffee varieties include Typica, Bourbon, Caturra and Castillo.

The Café de Colombia brand is a protected trademark. It is registered in eAmbrosia, the register for protected trademarks in Europe. Registration in eAmbrosia is unique amongst coffee-producing countries. The establishment protects the rights of more than 550,000 small-holder families in the country.

The Colombian coffee industry is developing fast. Coffee companies are increasingly investing in capacity-building and product quality. Colombian producers can follow coffee quality and tasting programmes through the Federación Nacional de Cafeteros de Colombia (FNC) to obtain certification. The Coffee Quality Institute (CQI) has a strong presence in Colombia. The institute provides courses in partnership with the National Institute of Professional Training SENA. The country’s coffee has had ongoing success in competitions, including the World Barista Championships.

Production in 2024/2025 production is expected to exceed that of the 2023/2024 production year by 1.6%.

Table 6: Competitive country profile of Colombia

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Indonesia is the world’s second-largest exporter of Robusta

Indonesia produces several types of coffee in different regions. These types include Sumatran, Java, Sulawesi and Bali coffee. In 2023, Spain imported 10.1 thousand tonnes of coffee from Indonesia. Exports to Spain increased by an average of 17.0% per year between 2019 and 2023.

About 90% of Indonesian exports are Robusta, making Indonesia the world’s second-largest exporter of Robusta coffee, following only Vietnam. Domestic consumption is growing rapidly. Indonesia therefore exports only an estimated 46% of its green-coffee production. An estimated 20% of Indonesia’s coffee exports are certified or verified as sustainably produced. Indonesia is one of the world’s largest areas for organic coffee production, with 60 thousand hectares in 2018.

Indonesia experienced a very bad harvest in 2023/2024, due to negative weather conditions. The country is expected to mostly recover in 2024/2025. Production is expected to increase by 41.6% compared to the previous year, although it will still be less than in the 2022/2023 production year.

Table 7: Competitive country profile of Indonesia

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Côte d’Ivoire requires better quality control

Côte d'Ivoire's coffee market has a rich history. It was once one of Africa’s largest producers, particularly of Robusta coffee. Production peaked at 380,000 tonnes in 2000, but has since declined significantly, due to several factors. The civil wars between 2002 and 2011 had a severe impact on coffee production. The current political instability is also having a negative influence. Little investment in post-harvest processing is another major cause.

Spain imported 8.3 thousand tonnes of green coffee from Côte d’Ivoire in 2023. Imports decreased by an average of 5.8% per year between 2019 and 2023. The outlook is unclear.

Table 8: Competitive country profile of Côte d’Ivoire

| Strengths | Weaknesses | Image on the coffee market |

|

|

|

Source: diverse

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them as well.

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee-growing farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and at trade fairs. Quality competitions also provide good opportunities to share your story. Examples include the auctions organised by the Cup of Excellence.

- Are you interested in exporting high-quality coffee? Learn more about grading protocols and best practices on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q Arabica or Q Robusta Grader certificate to be able to cup and score your coffee through smell and taste according to international standards.

- Work with other coffee producers and exporters in your region if your company size or product volume is too small. As a group, you can promote good-quality coffee from your region and be more attractive and more competitive.

- Develop long-term partnerships with your buyers. This includes always complying with their requirements and keeping your promises. See our tips on how to do business with European coffee buyers for more information.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research