Entering the European market for certified coffee

Selling certified coffee gives you an advantage when exporting to the European market. However, it is very important to explore which certification scheme fits your company best. Every certification scheme has its own requirements, although there is a lot of overlap. Certification is most important in the lower and middle parts of the market, although this does not apply to organic coffee. Brazil, Vietnam, Colombia and Honduras are the main suppliers of certified coffee.

Contents of this page

1. What requirements must certified coffee meet to be allowed on the European market?

To export certified coffee to the EU, you must comply with certain standards. As well as requirements for regular coffee, you need to be certified. This section focuses on the requirements of the main certification standards. These are Rainforest Alliance, 4C, Fairtrade and organic.

As well as these requirements, there are regular requirements for certified coffee. Most of these are set by the European Union. We touch on these requirements.

This section is split into three sections:

- Mandatory requirements: legal and non-legal requirements you need to meet to enter the market;

- Additional requirements and certifications: ones you need to comply with to stay relevant;

- Niche requirements: ones that apply to specific markets.

Tips:

- If you need to decide whether or not to get certified, read the first section of our study on entering the European market for multi-certified coffee. The study starts with a list of things to think about when deciding on getting certified.

- For a longer overview of the general requirements, read our study on requirements for the European coffee market.

- Read our study on how to organise your exports to Europe for a better overview of the requirements for exporting coffee.

- Read our study on how to do business with European coffee buyers to learn about specific buyer requirements.

What are mandatory requirements?

Your company needs to be certified to export certified coffee. It also needs to meet legal rules and quality requirements for labelling green coffee.

Organic coffee requirements

To sell organic coffee on the European market, it needs to be certified as such. For this, you need an accredited certifier. They need to check your growing and processing facilities. Check this EU list of recognised control bodies and control authorities to make sure you are working with an accredited certifier. After being audited and getting an organic certificate, you can use the EU organic logo on your products.

The new organic EU Regulation 2018/848 has been applicable since 1 January 2022. This regulation involves several changes. For example, production rules are now more simple, the control system is stronger and producers outside the EU need to comply with the same rules as companies that produce in the EU. The new legislation took full effect on 1 January 2025.

Organic regulation also has rules for shipping. Electronic Certificates of Inspection (e-COIs) need to be issued by control authorities before shipments can be shipped (Article 13 (2) EU 2020/25). If this is not done, your product cannot be sold as organic in the EU. e-COIs can be completed using the European Commission’s electronic Trade Control and Expert System (TRACES).

Getting e-COIs via TRACES is the importers’ responsibility. However, it is important to talk to your buyer about this so that your shipment does not leave before the importer has an e-COI.

Tips:

- Read more about what is needed for organic coffee in our study on exporting organic coffee to Europe.

- Be aware that the transition phase for the 2018/848 Organic Regulation ended on 31 December 2024. The new regulation especially affects farmer groups. Many farmer groups will need to change their legal identity so they can comply with this regulation.

- Study the EU regulation on organic production and labelling, as described in EU Regulation 2018/848.

- Read our tips to go green and our tips to become socially responsible to further improve your sustainability.

Rainforest Alliance requirements

To sell your product as Rainforest Alliance-certified, farmers and farmer groups need to meet the farm requirements part of the 2020 Sustainable Agriculture Standard. This covers many social, environmental and economic issues. It includes mandatory and voluntary requirements.

Some requirements only apply to certain areas, for example countries, risk levels or farm types. There are also policies for specific products, like the requirements for certified coffee production in Honduras. The supporting guidance can be found on the certification programme website.

Trading companies, like export and import companies, need to follow the 2020 Sustainable Agriculture Standard: Supply Chain Requirements. These requirements focus more on documentation and traceability. The 2020 standard also has requirements on supply chain sustainability issues.

Certification authorities authorised by Rainforest Alliance carry out the audits.

Fairtrade International requirements

Fairtrade farmers and farmer groups need to follow the Standard for Small-scale Producer Organisations and the Coffee Product Standard for Small-scale Producer Organisations. These standards cover the production, purchase and sale of coffee beans and processed coffee.

Fairtrade-certified exporters need to follow the Fairtrade Trader Standard. This standard applies to traders that buy and sell Fairtrade products and/or handle Fairtrade prices and premiums.

FLOCERT carries out all Fairtrade audits. It is the global certification authority for Fairtrade. In this study, Fairtrade International is called Fairtrade.

4C requirements

Common Code for the Coffee Community (4C)-compliant coffee is coffee that has been produced in line with the 4C Code of Conduct. This is a set of rules for producing green coffee beans. Like Fairtrade and Rainforest Alliance, 4C requirements focus on environmental, social and economic sustainability.

4C has different standards. It has standards for:

- producers and producer groups;

- intermediary buyers, such as exporters and importers;

- final buyers, such as roasters and instant coffee manufacturers.

Visit the 4C website to learn all about the 4C certification process and how you can get a 4C certificate. The 4C website lists the certification bodies that can perform an audit.

4C is often seen as less standard than Rainforest Alliance, Fairtrade and organic.

Tips:

- Do you represent a farmer organisation that wants to get Rainforest Alliance certified? Read the Rainforest Alliance Guide for Farmers to learn how.

- Do you represent a trader, roaster or retailer that wants to get Rainforest Alliance certified? Read the Rainforest Alliance Guide for Supply Chain certification to learn how.

- Check the International Trade Centre Standards Map to learn about different certification schemes.

- Find out which standards or certifications buyers in your target segment want. Buyers may want a certain label depending on their end clients or distribution channels.

- Try to combine audits if you have more than one certification. This saves time and money. Also look into the possibilities for getting certified with other producers and exporters in your region.

Packaging requirements

The packaging of certified coffee is the same as non-certified coffee. Green coffee beans are usually shipped in woven bags made from jute or hessian fibre. Jute bags are strong. Some speciality coffee suppliers use other materials inside jute bags. GrainPro and Videplast do this. These materials have advantages over traditional packaging. They preserve bean quality, prevent post-harvest loss, reduce solid waste, reduce farmer’s net carbon footprint and allow chemical-free storage. These materials are mainly used for the high-end and upper-end segments.

Other packaging options for transporting coffee include:

- Polypropylene super sacks containing 1 tonne of coffee;

- Polyethylene liners containing 21.6 tonnes;

- Vacuum-packing.

These techniques increase efficiency and maintain quality.

Figure 1: Examples of coffee packing from left to right: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: Raad, Bulk Logistic Solutions and GrainPro

Labelling for green coffee

When exporting certified coffee to Europe, your coffee needs to follow requirements for labelling, as well as extra requirements for certified coffee.

All green coffee labels on coffee exported to Europe should be written in English. It should also include the following information to make sure individual batches can be traced:

- Product name;

- International Coffee Organization (ICO) identification code;

- Country of origin;

- Grade;

- Net weight in kilograms;

- For certified coffee: name and code of the inspection body and certification number.

For certified coffee, the batch must be labelled with the name and number of the control body, and the certification number. Green coffee labels should be written in English.

You can choose to add the certification logo. This is described later on in this study.

Payment and delivery terms

You are usually paid when the buyer receives your shipment, or within 30 or 45 days. This is the same for certified and uncertified coffee.

Payment terms depend on your contract. Cash Against Documents is the most common deal when exporting coffee to Europe. You provide documents that show shipment, such as a bill of lading or invoice. You get paid in return.

It is important to look at these terms carefully. You will often be paid faster if you sell your coffee to a trading company than if you sell to a roaster directly. You can read more about this in our tips on organising your coffee exports.

Some standards also have rules for the payment of a premium.

Rainforest Alliance has payment terms for the sustainability differential (SD) and the sustainability investment (SI). These can also be a farmer premium and a group premium. These terms apply to the ‘first buyer’ of the coffee. The first buyer is the “initial certificate holder legally owning the certified product after the farm certificate holder”. In some cases, it could also be the exporter.

First buyers have to set the amount and payment terms for the SD and SI in a contract. The first buyer and the farm certificate holder have to agree on the volume, the period that the premiums apply to (e.g. which harvest), the time frame of payment, the method of payment and the currency. Payments have to be made within six months of shipment, unless local regulations state something else. See the Rainforest Alliance’s page on income and shared responsibility for more details.

Fairtrade sets out requirements for payment terms in the Fairtrade Standard for Traders. Contracts need to include information on volume, quality, price, premium amount, form of payment, terms and conditions and more. Payments need to be made quite quickly. The full requirements are described in Section 5 of the Trader Standard.

Rainforest Alliance and Fairtrade do not have payment and delivery requirements for buyers further down supply chains.

Requirements on food safety and hygiene

Exporters need to follow EU food safety laws on coffee. These rules are mainly about food safety. Traceability and hygiene are most important. You should pay particular attention to sources of contamination with pesticides, mycotoxins and mould, particularly Ochratoxin-A (OTA).

Sustainability requirements are becoming stricter

In recent years, the EU has passed new sustainability regulations. These regulations build on international soft laws. These soft laws include the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises on Responsible Business Conduct. EU regulations require coffee companies to check for human rights and environmental problems in their supply chains.

Examples of EU laws include the European Deforestation Regulation (EUDR) and the European Corporate Sustainability Due Diligence Directive (CSDDD). The European Green Deal (EGD) is the EU’s response to the global climate emergency. The EGD is a package of policies that defines Europe’s strategy to reach net-zero and become a resource-efficient economy by 2050. Besides the European Green Deal, the Forced Labour Regulation also affects coffee suppliers that export to the EU.

Tip:

- The EU regulations described in this section are constantly changing. It is important to check the current status. For example, visit the European Commission website to read more about the EUDR, the Forced Labour Regulation and the CSDDD.

The European Deforestation Regulation prohibits coffee that led to deforestation

The EU created the Regulation on Deforestation-free Products (EUDR) as part of the European Green Deal. The EUDR means companies need to show that the products they import do not come from deforested land and have not led to forest degradation. Only deforestation-free products can be put on the EU market.

In December 2024, the EU delayed the implementation of the EUDR by one year; to 30 December 2025. Micro and small enterprises have another six months. This law makes traceability and technology very important for exports to the EU market. This means the coffee industry will have to change. The EU has an information sheet that addresses frequently asked questions about this topic.

Certification can help prove your company complies with the EUDR, for example through schemes with environmental criteria that promote sustainable farming practices, like organic and Rainforest Alliance certification. However, while helpful, certification alone is not enough.

The CSDDD will increase requirements for traceability and human rights

Under the new CSDDD regulations, European companies have to improve sustainability performance throughout their supply chains. They also need to stop damaging effects on human rights and the environment. Businesses need to take the following actions:

- Integrate due diligence into their policies;

- Identify actual or potential adverse impacts;

- Prevent and mitigate potential adverse impacts;

- Establish and maintain a complaints procedure;

- Monitor the effectiveness of their due diligence policy and measures;

- Publicly communicate on due diligence.

The directive means European companies need to take responsibility for their supply chains. It forces buyers to ask for proof that you act in a socially and environmentally sustainable way.

The CSDDD is not in force yet, and there is a lot of uncertainty around it. The European Commission has suggested making the CSDDD more simple. This would make it much weaker. The directive would apply to 80% fewer companies, and it would limit legal requirements to their direct suppliers. It would also remove obligations for climate transition plans and reduce penalties. The proposal has not been accepted yet, so the final text may still change. It is unclear when the CSDDD will come into force.

The Forced Labour Regulation bans coffee produced with forced labour from the European market

The aim of the Forced Labour Regulation is to ban the production or export of any product made using forced labour.

Based on risk assessments, companies based in the EU will have to ensure that no forced labour takes place in their supply chain. In April 2024, the EU Parliament approved the legislation. Companies should be prepared to comply with the regulation’s requirements from mid-2027. Non-compliant European companies will be fined.

The full effect of the Forced Labour Regulation on exporting companies is unclear. However, it will mean that European buyers will need more information from their suppliers.

Tips:

- Make sure your traceability is as good as possible. European sustainability requirements will become stricter. You can only provide proof of your sustainable behaviour if you know where your coffee comes from. Certification could be an interesting way to do this.

- If you are unsure about any requirements, consult your buyer.

- Read more about the European Green Deal to get a better overview of the legislation.

- Read more in the CBI coffee studies tips to go green and tips to become socially responsible. Both can help you learn about what you can do to become more sustainable.

Quality requirements

Green and roasted coffee usually undergo a physical evaluation to determine their quality. Roasted coffee is also judged on several criteria, including:

- Altitude and region;

- Botanical variety;

- Processing method (washed, natural, honey, pulped);

- Bean size;

- Number of defects or imperfections;

- Bean density;

- Cup quality (flavour and aroma).

The quality assessment process is the same for all types of green beans. The exact criteria, however, differ. For example, both premium and standard coffee beans are tested for bean density (mass divided by volume). Premium coffees need to have a higher density.

Tips:

- Read our tips on complying with the EUDR in the coffee sector, or watch our webinar on the EUDR in the coffee sector. Both will give you a better understanding of how to comply with the EUDR.

- Read our tips on organising your exports and our study on buyer requirements for coffee to find out how to comply with other mandatory requirements.

- Be aware that the transition phase for the 2018/848 Organic Regulation ended on 31 December 2024. The new regulation will especially affect farmer groups. Many farmer groups will need to change their legal identity to comply with the new regulation.

- Study the EU regulation on organic production and labelling, described in EU Regulation 2018/848.

- Read our tips to go green and our tips to become socially responsible to further improve your sustainability.

What additional requirements and certifications do buyers often have?

Use of the certification logo

All certification standards have their own logo. Using the logo will help emphasise that your coffee is certified. You can only use the logo if your coffee is certified according to a standard. For most certifications, using the logo is free if your coffee is certified. Fairtrade, however, requires a fee to use the logo. It also requires written approval from Fairtrade.

Tip:

- Read the Fairtrade Mark Guidelines for all requirements on using the Fairtrade mark.

Price and premiums

Several price and premium requirements are important for coffee producers and first buyers. First buyers pay premiums to farmer groups. In some cases, exporters (the licensed company that buys the coffee from the farmer or farmer group) will be the first buyer. Minimum prices and premiums help producers meet requirements for certification.

Farmers normally get a premium for selling certified coffee. Rainforest Alliance splits the premium between a sustainability differential (SD) and a sustainability investment (SI). These are also called ‘farmer premiums’ and ‘group premiums’.

Fairtrade exporters may need to pay the Fairtrade minimum price and the Fairtrade premium. If the market price exceeds the Fairtrade minimum price, producers receive the current market price or the price negotiated upon contract signing. Check the Fairtrade website for a list of current prices and premiums. Fairtrade audit costs are different depending on the FLOCERT auditor who does the audit. You can work out the costs using the Fairtrade fee calculator.

For products that are both Fairtrade- and organic-certified, the organic differential is added to the Fairtrade minimum price. See the section on prices for exporters for a full breakdown of costs.

What are the requirements for niche markets?

Requirements for multi-certification

Some companies are multi-certified. Having one certification makes it easier to comply with other certification requirements because the requirements may overlap.

The combination of Fairtrade and organic is most common. Organic focuses on environmental sustainability, while Fairtrade focuses on social and economic sustainability. Being multi-certified provides the best market access. However, it comes with additional costs.

Requirements for niche markets

You can stand out further by becoming certified according to standards with a limited but specific demand.

Examples are:

- Demeter. Recognised for certifying biodynamic agriculture. It is a holistic approach that goes beyond standard organic farming practices. Demeter standards are a lot stricter. They focus on sustainability and the ecosystem.

- Naturland. A global certification body that covers organic and biodynamic farming. It also covers environmental protection, social responsibility and fair trade.

- Bio Suisse. It sets high standards that go beyond the Swiss government’s organic regulations. While it is a national label, its certification is sought after in international markets for its reputation.

Most private standards have additional requirements. These are in addition to EU organic legislation. You should always check the requirements the official website of the standard itself asks for.

Tips:

- Read our study on the European demand for coffee, the European market potential for certified coffee and how the EU Green Deal will impact your business for a good overview of the European coffee market.

- Visit the Access2Markets (formerly called ‘EU Trade Helpdesk’) website to learn more about legal requirements for imports into Europe.

- Visit IFOAM’s Group Certification Training Kit to learn about group certification schemes to meet EU organic label requirements for less.

- Visit the ePing website for an overview of country-specific measures that affect trade and differ from international standards.

- Learn about preferential arrangements, technical product requirements, trade procedures and documentation from the Open Trade Gate Sweden website.

- Read our study on multi-certified coffee if you are interested in adding a second label to your organic products.

- Learn from other exporters and producers in your country that have experience in exporting organic coffee to Europe.

2. Through which channels can you get certified coffee on the European market?

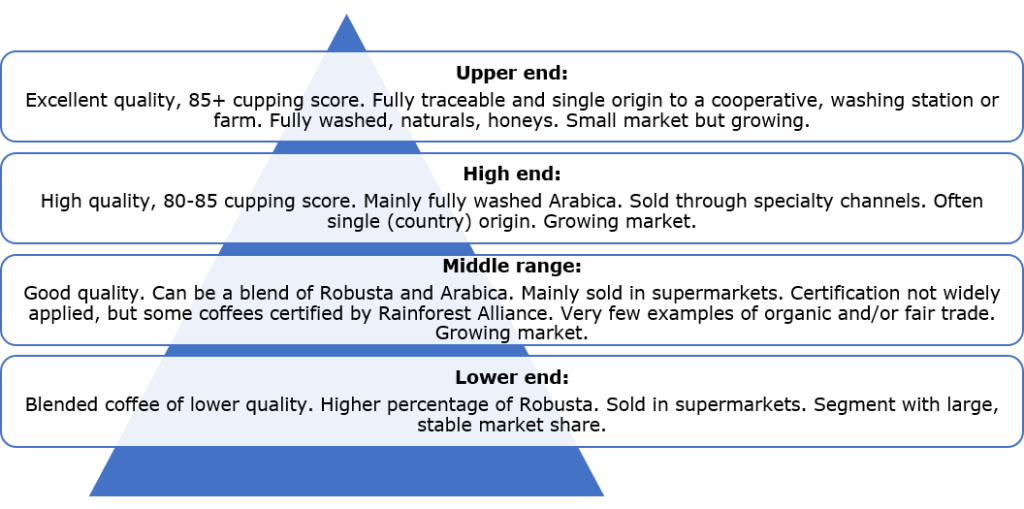

Certification is most common in the lower and middle segments of the market. 4C and Rainforest Alliance are seen most in the lower segments. Organic starts in the middle segment, but is also visible in the high and upper segments of the market. Most certified coffee enters Europe through large multinational traders, which operate warehouses in producing countries.

How is the end market segmented?

Certified coffee is sold in all market segments. It enters the European market through buyers that specialise in certified coffee and mainstream traders.

Figure 2: Coffee end market segmentation by quality

Source: Profound

Rainforest Alliance is most common in the low-end segment

Coffee sold in the low-end segment is mainly a blend of lower quality coffees. They are generally made of Robusta beans. Besides some mainstream brands, lower quality private-label products from supermarkets are also part of this segment. Most coffee pads and instant coffee are part of this segment.

Rainforest Alliance-certified coffee is often used in the lower-end segment, as are many other company standards. It is cheaper for producers to comply with Rainforest Alliance and most company standards than with Fairtrade and organic. Perla is a roaster that focuses on the low-end market. It mainly roasts for supermarkets. Some of their coffee is Rainforest Alliance-certified.

After a period of getting smaller, the lower-end market is growing again, driven by high coffee prices.

Rainforest Alliance, Fairtrade and organic are common in the middle-range segment

Mid-range coffees are commercial coffees of higher quality. This segment consists of blends that contain more Arabica than the lower-end segment. They often do not contain any Robusta.

Sustainability certifications are important in this segment. Fairtrade and organic certification are common in the mid-range segment. Rainforest Alliance certification is common. Rainforest Alliance-certified coffee in the mid-range segment usually has more Arabica beans. This mainly applies to Northern and Western European countries. Certification is still uncommon in Southern and Eastern European countries. However, there are many exceptions. Coind and Gimoka are roasters that offer Fairtrade, private-label coffee for the Italian market.

Mid-range coffee is sold to the at-home market and the out-of-home market. There are no statistics available on how these markets compare. This differs per country and certification scheme. In the Netherlands, for example, the amount of Fairtrade coffee sold to the out-of-home market is about equal to the amount sold to the at-home market.

Café Salento is an out-of-home market distributor. This Dutch company buys roasted coffee from Dutch and German roasters. All their coffee is Rainforest Alliance-, Fairtrade- and/or organic-certified. Supermarkets are the main players in the at-home market. Carrefour is a large supermarket with a high share of certified coffee in the mid-range. About 40% of Spanish coffee is certified.

The mid-range segment shows almost no movement. This is expected to stay the same in the coming years.

High- and upper-end

High-quality coffee largely consists of 100% high-quality Arabicas. They are often single origin. The upper end of this segment consists of excellent quality speciality coffees. They are mostly fully traceable, single-origin Arabica beans with a cupping score of 85 and above. The European high-end and upper-end segments are small, but growing.

Sustainability certifications are less common in the high and upper-end segments. This segment is characterised by long-term contracts between suppliers and buyers, as well as higher prices. In recent years, the high- and upper-end segments saw growth in organic-certified coffees. Fairtrade and Rainforest Alliance certification have become mainstream. However, organic certification is still considered more sustainable and healthy in the high and upper end.

Peeze is a Dutch Fairtrade-certified roaster that offers Fairtrade coffee. All their coffee has an SCA rating of 80 or higher. Based on their bean-impact line, all their coffee is Fairtrade- and organic-certified. They source their coffee from Peru. High-end and upper-end coffees are sold in specialised shops and cafés. They can also increasingly be found in supermarkets. One example is Simon Levelt coffee, which consumers can buy from the Albert Heijn supermarket. Simon Levelt roasts organic speciality coffee.

Tips:

- Look at city guides on the European Coffee Trip website to find examples of European speciality roasters and cafés. There are also several online coffee shops in Europe where you can find high- and upper-end coffees, like Roast Market and Specialty Coffee.

- Visit trade events in Europe. Certified coffees in the upper-end segment are mainly sold directly to speciality roasters. Examples of coffee festivals are those held in London, Amsterdam, Milan, Warsaw and Paris.

- There can be big differences in price premiums for certified coffee depending on the certification programme. If you decide to trade certified coffee, make a careful cost calculation first. Calculate fees, learning costs and workload. Make sure to provide the quality that buyers demand and meet their standards.

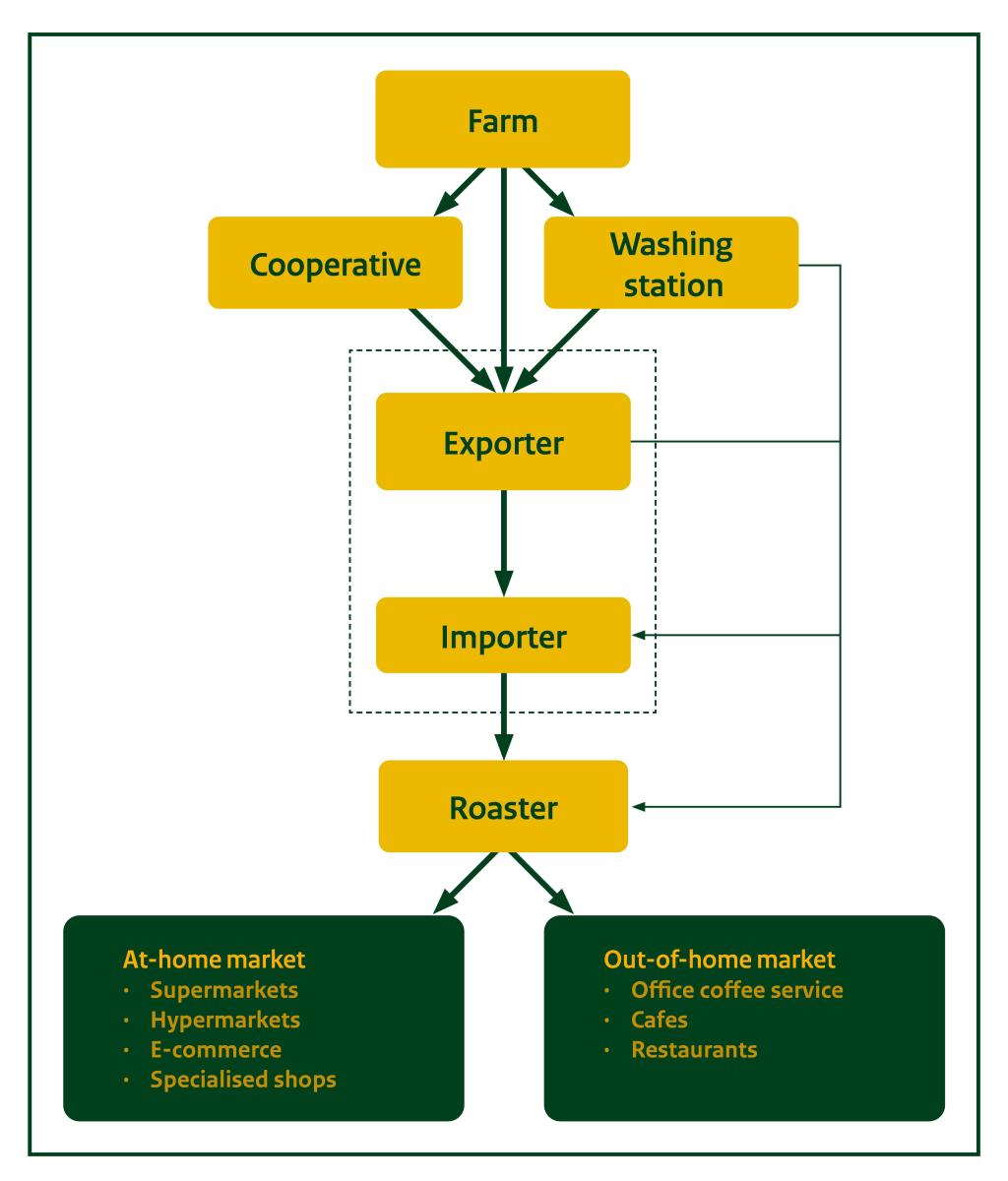

Through which channels does certified coffee end up on the end market?

The supply chain for certified coffee is made up of many actors. These actors are mentioned in Figure 3. Most coffee passes through all actors in the chain. However, other ways of entering the certified coffee market directly are appearing.

Figure 3: The supply chain for certified coffee

Source: based on Counter Culture Coffee

Importers have large roles in the supply chain

Importers are very important in the coffee market. They act as supply chain managers. They have large portfolios from a range of origins, pre-finance operations, perform quality control, manage price changes and establish contact between producers and end buyers.

In most cases, importers and exporters are the same companies. For example, Neumann Kaffee Gruppe (NKG) has a lot of warehouses in producing countries. Farmers and cooperatives can transport their coffee to a local NKG warehouse. It is then exported to NKG warehouses in Europe. As a supplier of a local warehouse, you normally do not know what the final destination is.

Some of the leading European importers are:

- Neumann Kaffee Gruppe (NKG), based in Germany;

- Louis Dreyfus Company (LDC), based in Switzerland;

- ECOM Agroindustrial (ECOM), based in Switzerland;

- ED&F Man Volcafe, based in the United Kingdom.

Many of these large importers have their own company standards. For instance, NKG has the NKG Bloom Standard and the NKG Verified Standard. NKG Bloom focuses on improving farmer livelihood. NKG Verified focuses on many different sustainability criteria.

Specialised importers can buy small- and medium-sized volumes of certified coffee. Examples include Les Cafés Dagobert, Alter Eco (France), Simon Lévelt (the Netherlands), and GEPA and Rapunzel (Germany). Pure Africa is a Dutch roaster that buys coffee directly from African farmers. The company promises to pay farmers more than the living income. Some of their coffee is also Fairtrade-certified.

For whom is this an interesting market channel?

If you do not offer much certified coffee, it is usually best to work with active traders in your country, so they can organise exports. Many traders will collect coffee. This means you do not have to arrange exports.

There are no rules about when specialised importers are better than large traders. Specialised importers have a clear focus, so only a few exporters supply according to specific criteria. If your supply fits a specialised importer’s demands, this is a good way to build long-term business relationships.

Tips:

- If you are a farmer or cooperative, make sure you know the global importers active in your region. This will give you better market access.

- Read more about the importance of different company standards in the Global Coffee Platform Sustainability Report.

Large-scale and medium-sized roasters

Most large and medium-sized roasters buy coffee from importers. However, some also purchase from exporters directly. Large roasters manage coffees with various certification standards. Roasters can work under their own brands and/or private labels. Private-label roasters may roast for mainstream clients and speciality brands.

Examples of large-scale roasters active on the European market include JDE Peet’s, Nestlé and Lavazza. Examples of medium-sized roasters sourcing organic coffee include Cafédirect and Union Hand-Roasted Coffee (United Kingdom) and Arvid Nordquist and Löfbergs (Sweden). Examples of private-label roasters include Lincoln & York (United Kingdom), Pelican Rouge Coffee Roasters (the Netherlands) and Beyers (Belgium).

For whom is this an interesting entry channel?

Supplying directly to large-scale roasters is only interesting if you can supply large volumes of consistent quality.

Supplying to medium-sized roasters that focus on speciality coffee is interesting if you have steady volumes of higher, consistent-quality coffees and are willing to engage in long-term partnerships. Many medium-sized roasters may ask for further certification.

Small roasters often focus on premium and speciality coffee

Europe is home to over 10,000 small roasters. Germany, for example, has about 2,500 roasters. Most of these are very small. Some examples are Black & Bloom, Mr. Coffee and Speicherstadt.

In Southern European countries, these small roasters usually buy low or average quality uncertified coffee, and roast for local cafes. In Northern and Western European countries, small roasters often focus on the premium and speciality segments. They often work with small and micro lots. Most of these small roasters’ coffee sources are uncertified, although organic coffee is fairly common.

Small roasters usually buy their coffee from a local trader based in Europe. Other small roasters visit producing countries themselves and have long-term relationships with producers.

For whom is this an interesting entry channel?

If you offer high-quality organic coffee, you can try to export your coffee to small roasters directly. This may lead to long-lasting business relations.

Tips:

- Contact certified coffee roasters in the high-end segment. You can find speciality coffee roasters on the European Coffee Trip and through Google.

- Emphasise your company’s story and the quality of your product.

- Visit trade fairs to meet with roasters. Examples are BIOFACH, focused on organic food, and trade fairs organised by the Specialty Coffee Association.

- Read our study on how to find buyers in the European coffee market for more tips on how to target roasters.

3. What competition do you face on the European certified coffee market?

As a certified coffee supplier, you work in a global, competitive landscape. For producers and exporters, it is important to understand the market segment you work in and the scale at which you work. By identifying these factors, you can determine which other countries you are competing with. Understanding your quality, volume and position means you can assess your competition better and create strategies to stand out in the global market. This knowledge is very important to position yourself effectively and compete successfully.

Which countries are you competing with?

The world leaders in certified coffee are Brazil and Vietnam. Both countries produce large volumes of coffee and have a good share of certified coffee production. Honduras and Peru produce much less, but a lot of their coffee is certified.

Figure 4 provides information on total certified coffee production for the eight largest certified coffee-producing countries. We only consider the largest certification schemes: Rainforest Alliance, organic, Fairtrade and 4C. Coffee categorised as ‘uncertified’ can be sustainably produced according to company standards or other standards. We did not correct for multi-certification, although it is likely that much of the coffee is multi-certified. Not all certification standards produce statistics for all countries. Only exports to the EU are used for organic.

Sources: Rainforest Alliance, FiBL, Fairtrade, 4C, USDA

Brazil is Europe’s second-largest green coffee supplier

Brazil is the world’s largest coffee producer and exporter. It produces both Arabica and Robusta. However, almost 80% of its exports are Arabica. In 2024, Brazil exported 1.27 million tonnes of green coffee to Europe.

In 2023, 29% of Brazilian production was certified, mostly Rainforest Alliance or 4C. Rainforest Alliance-certified coffee has increased a lot, from 368,000 tonnes in 2022 to 519,000 tonnes in 2023. Organic coffee production has more than doubled in recent years, from 805 tonnes in 2018 to 1,740 tonnes in 2023. Daterra is a farmers’ cooperative certified according to several standards, including Rainforest Alliance and organic. Only a small share of Brazil’s coffee is Fairtrade-certified.

The Brazil Specialty Coffee Association (BSCA) is an important seal. The association certifies the quality and sustainability of coffee. The organisation supports the Brazilian coffee sector. It aims to improve quality standards and value in the production and marketing of Brazilian coffees.

Brazil’s coffee-producing areas are quite flat. This means that more mechanical pickers are used, lowering labour costs. It has also led to lower average quality, as machines do not distinguish between ripe and unripe cherries.

Brazilian coffee farmers are relatively successful. Some factors that contribute to their success are:

- the scale of their operations;

- mechanisation;

- efficient infrastructure;

- a good climate (although climate change has drastically affected several key regions in the country).

Brazil is not a good example for many producers and exporters

Brazil is the only large coffee-producing country where the average farmer can generate a living income from coffee farming. However, it is neither possible nor a good idea for most countries to copy Brazil.

Firstly, Brazil can produce cheaply by using plucking machines. This is only possible if your country is suitable for mechanised farming. Brazil's relatively flat land and large farms are ideal for mechanised harvesting. This may be very different in your country.

Secondly, although Brazil grows a large amount of certified coffee, much of the Brazilian coffee industry is unsustainable. Pesticides are common. This leads to groundwater and ecosystem contamination, which is dangerous to humans and animals. Brazilian coffee farms mostly use the sun-grown method. This is a big problem for biodiversity. In 2018, the Global Coffee Platform (GCP) launched The Responsible Use of Agrochemicals. In 2023, 4,500 coffee farmers were trained in the responsible use of agrochemicals.

Brazil is mainly known for exporting large volumes of standard quality coffee. However, the country also has a reputation as a producer of speciality coffee.

The 2024–2025 outlook for Brazil is positive. A 5.4% production increase is expected.

Table 1: Competitive country profile of Brazil

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

Largest coffee producer and exporter in the world, meaning economies of scale.

Varied climate and geography suitable for various types of coffee.

Established infrastructure and expertise in coffee cultivation and processing.

High level of automation.

Large domestic market. | Environmental concerns related to deforestation and sustainability practices.

Climate change will impact key producing regions.

Inconsistent quality control across large production areas. | Known for its supply of coffee beans.

Often associated with volume and affordability.

Known for speciality coffees.

Positions itself as a reliable source for commodity coffee. |

Source: various

Vietnam is the world’s largest Robusta supplier

Rainforest Alliance and 4C are Vietnam’s main certification standards. Vietnamese Rainforest Alliance production increased from 209,000 tonnes in 2022 to 278,000 tonnes in 2023. TuLiem-Thang Long and Chi Lang-Dong Anh are farmer groups that produce 4C and Rainforest Alliance-certified coffee.

Organic and Fairtrade are not very common in Vietnam. Eatu Café is a coffee grower and roaster in the Dak Lak province that produces Fairtrade coffee.

The Vietnamese Ministry of Agriculture and Rural Development aims to have 35–40% of production certified by 2023.

Vietnam is the world’s second-largest coffee producer and the biggest Robusta producer. Around 90% (612,000 hectares) of Vietnam’s coffee production is used for Robusta. Vietnam focuses on creating large volumes of standard quality coffee.

Vietnam is Europe’s largest Robusta supplier. In 2024, it exported 586,000 tonnes of green coffee to Europe. At least 90% was Robusta.

Yields were lower in the 2023/2024 and 2024/2025 production seasons due to dry weather. Nonetheless, the yield for 2025 was expected to be around 1.7 million tonnes, up 9% from 2023/2024. Vietnamese production is expected to grow between 5–10% every year.

Large Vietnamese coffee exporter groups include Simexco Daklak, Intimex Group, Tin Nghia Corporation and MASCOPEX.

Vietnamese coffee production is expected to remain stable in the short term. High coffee prices encourage farmers to invest in production, which cancels out the negative impact of bad weather conditions.

Table 2: Competitive country profile of Vietnam

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

The world's largest producer of Robusta coffee.

Low labour and production costs, making it highly competitive.

Favourable climate for Robusta cultivation. | Challenges related to environmental sustainability and pesticide use.

Perception of lower quality compared to other coffee origins. | Associated with Robusta coffee and instant coffee production.

Seen as a budget-friendly source of coffee beans. |

Main source: Standard Insights

Colombia is a strong brand of high-quality coffee

Rainforest Alliance, 4C, and Fairtrade are very important in Colombia. Rainforest Alliance-certified coffee production, however, declined from 229,000 tonnes in 2022 to 167,000 tonnes in 2023. Organic production is far less important. It has been going down since 2020.

Colombia is a large producer of washed Arabica. It has a strong national coffee industry and is highly developed. The Colombian Coffee Growers Federation promotes and markets Colombian coffee. The country has a strong image and brand for high-quality coffee. Colombian coffee is known for its chocolate, nut, herb, fruit and citrus notes. Their main processing method is washed processing. The country’s most well-known coffee varieties are Typica, Bourbon, Caturra and Castillo.

Café de Colombia is a protected trademark. It is registered in eAmbrosia, the register for protected trademarks in Europe. Registration in eAmbrosia is unique among coffee-producing countries. It protects the rights of more than 550,000 small-holder families in the country.

The Colombian coffee industry is developing quickly. Coffee companies are increasing capacity and product quality. Colombian producers can follow coffee quality and tasting programmes to get certified. The Coffee Quality Institute (CQI) has a strong presence in Colombia. They provide courses in partnership with the National Institute of Professional Training, SENA. The country’s coffee is successful in competitions, like the World Barista Championships.

Table 3: Competitive country profile of Colombia

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

Very strong branding.

Strong focus on high-quality coffees.

Has many different landscapes at high altitude, leading to a great variety of high-quality coffees. | Limited economies of scale, mostly due to small farms.

Harbour is labour-intensive, leading to higher costs. | Has cultivated a very strong brand and is well-known for its high-quality coffees and unique flavours. |

Source: various

Honduras is Europe’s largest organic green coffee supplier

Rainforest Alliance is the main certification scheme in Honduras. Production of Rainforest Alliance-certified coffee remained the same in 2023, at 141,000 tonnes. Cooperativa Cafetalera Ecológica La Labor Ocotepeque Limitada (Cocafelol) is an example of a company that is Rainforest Alliance-certified. It also has Fairtrade and USDA organic certification.

Honduras was Europe’s leading organic coffee supplier in 2023 and 2021. In 2022, 2020 and 2019, Peru was larger. Both countries have similar, high organic coffee production rates. Due to changes in production, the largest producer varies. Honduras exported 44,805 tonnes of organic coffee in 2023. This has grown a lot over the past five years. The average annual growth rate is 7.2%.

Honduras has taken big steps in its coffee production, as coffee quality has gotten better in recent years. Honduras is the sixth-largest coffee producing country and a growing player in the organic market. The Honduran coffee flavour profile is rich and ranges from fruity to chocolatey.

Cooperativa Regional de Agricultores Orgánicos de la Sierra (ROAS) in Honduras is one of its largest organic coffee cooperatives. RAOS is a major exporter to Europe. It focuses on EU organic and Fairtrade certifications. The cooperative empowers women in the coffee industry. It fights gender-based legal issues in getting credit and pre-harvest loans. Their website details their values and stakeholder engagement alongside photos. Cooperativa RAOS supplies organic coffee to European buyers via partners like Café Imports Europe.

Table 4: Competitive country profile of Honduras

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

| Main producer of organic coffee. | High production volatility due to weather conditions (for example causing coffee leaf rust). | Famous for high-quality and organic coffee. |

Source: various

Tips:

- Promote your unique local varieties. European consumers like unique flavour profiles and characteristics, particularly in the speciality sector.

- Invest in your digital presence. Make sure you have an informative website that shows your journey in producing certified and traceable coffee.

- Invest in projects that you find important. These can be local, social, environmental or governance-related. This gives you an advantage and a way to connect with European customers. Kopokama Cooperative is a Rwandan company that has started many sustainability projects. You can find out more about their activities in our webinar on meeting sustainability requirements.

- Look at the United Nations’ Sustainable Development Goals to understand more about sustainability and how you can contribute. Visit the International Coffee Partners website to get ideas from how they are helping the coffee industry become more sustainable.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research