The European market potential for pigeon peas

Pigeon peas are a niche product in Europe. They are most popular among consumers from India, Africa and the Caribbean. The United Kingdom is the biggest European market for pigeon peas. This is because of its large Indian community. Growing interest in global cuisines could increase pigeon pea consumption in Europe.

Contents of this page

1. Product description: pigeon peas

Pigeon peas are a type of legume also known as 'Cajanus cajan'. Pigeon peas are very adaptable, tolerant to drought and have good nutritional value. They are an important food crop in tropical and subtropical regions. Pigeon peas are a nitrogen fixing crop and can be grown alongside other crops like maize and sorghum. This has benefits for the pigeon pea and the companion crop.

In trade, dry pigeon peas have their own Harmonised System (HS) code: HS 0713.60 Dried, shelled pigeon peas ‘Cajanus cajan’, whether or not skinned or split.

All trade data in this report concerns dry pigeon peas. There is no detailed data on frozen or preserved pigeon peas traded under HS codes 0710, 2004 or 2005.

Figure 1: Pigeon pea plant, whole seeds and split peas (Toor Dal)

Sources: Pixabay and USDA via Wikimedia Commons (retrieved 2025)

2. What makes Europe an interesting market for pigeon peas?

The European import of pigeon peas grows constantly, even when international prices are considered high. The total market size is small, but migrant consumers ensure there is always demand. The pigeon pea market is much smaller than that of other pulses, but this can change once consumers discover the versatility of pigeon peas.

Niche product with increasing value

Pigeon peas only grow in tropical and subtropical regions. This means that Europe does not have much commercial production of pigeon peas and depends completely on imports.

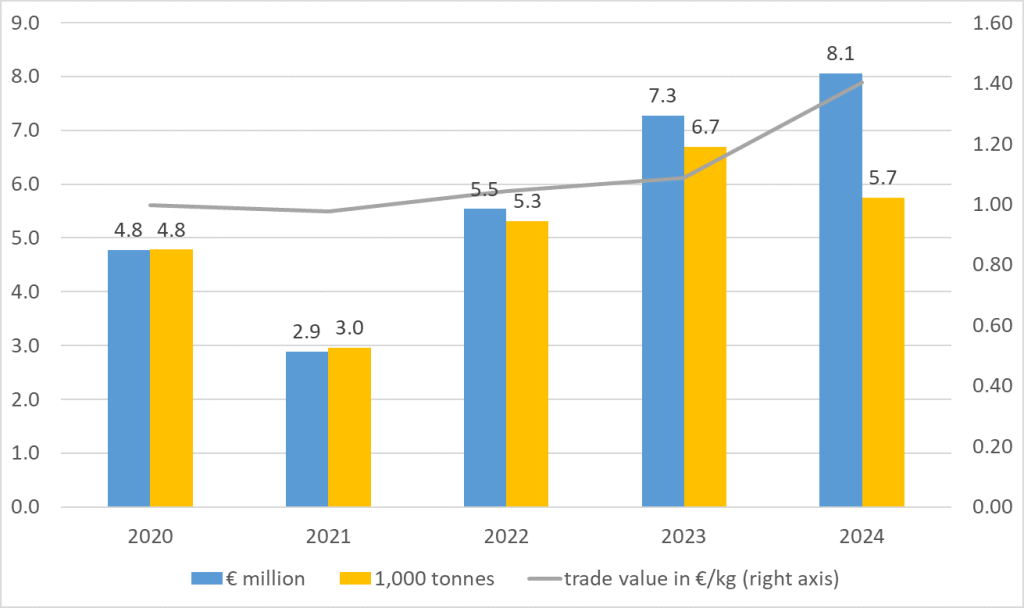

In terms of the overall pulse trade, pigeon peas are a small product. However, their import value has increased over time. Their value peaked at €8.1 million in 2024 due to high commodity prices (Figure 2). Global production reached more than 5.4 million tonnes in 2021. However, production decreased after that, making pigeon peas more expensive in 2023 and 2024.

Changes in product availability can be a challenge in the pigeon peas market. For the European market to grow, stable and affordable prices are key. Pigeon pea prices were quite high in 2024. Normal trade prices should be closer to €1.00–1.10/kg.

Figure 2: European imports of pigeon peas (including intra-European trade)

Source: ITC Trade Map (data 2025)

Tip:

- Follow global pigeon pea demand and its price indication on trade platforms such as Tridge, Global Pulse Federation and Commodity Board News. Some information is publicly available. For additional information, you will need to create a profile or subscribe.

Your main target market is the diaspora

Pigeon peas are popular in many Indian, African and Caribbean cuisines. Communities from these countries living in Europe represent a significant and growing market. Horizon Grand View Research expects that the ethnic food market will have a compound annual growth rate (CAGR) of 8.2% from 2025 to 2030. It will reach a value of over $25 billion (USD) in 2030.

India consumes more than 85% of global pigeon pea production. This is why Indian communities in Europe are your main target group. However, African and Caribbean communities are also major consumers. The cultural importance of pigeon peas ensures consistent demand in Europe.

The United Kingdom, Germany and Italy have the largest Indian communities. In the United Kingdom (UK), it is the largest ethnic minority group with a population of over 2 million. Other relevant East African and Caribbean consumer groups can be found in the UK, Germany, the Netherlands, Italy and Sweden.

The presence of large, specialised distributors and supermarkets is proof of strong demand for non-European food. Examples of distributors and supermarkets include Surya Foods (United Kingdom), Wanis International Foods (United Kingdom), Global Supermarket (Italy), Asian Food Group (the Netherlands), Amazing Oriental (the Netherlands) and Asia Market (Ireland). Most of these companies offer a combination of oriental and Caribbean food.

Tip:

- Study the offer of specialised Asian, African and Caribbean food stores to see which stores and brands sell pigeon peas.

Potential as an alternative ingredient

Pigeon peas may not be very well known in the pulse category. However, as an ingredient, they can be used like many other pulses, such as lentils, chickpeas and mung beans. These pulses can be used in a range of dishes, including soups, stews and salads.

The gap between the import volumes of pigeon peas and other pulses is very large. Between 200,000 and 300,000 tonnes of lentils and chickpeas are traded every year. Pigeon pea imports only reach around 2% of this. There is room for growth. Product promotion and competitive pricing could encourage sales to and beyond the diaspora market.

Promoting pigeon peas as an alternative ingredient will take some effort. Unlike the main imported pulses, pigeon peas are mostly produced in a traditional way by smallholder farmers. This poses challenges in efficiency and in meeting Europe’s high food standards. Crops like lentils and chickpeas are more intensively and professionally produced by larger farmers in countries like Canada, Australia and Türkiye. This makes them strong competitors.

Table 1: European import volume and calculated import value per kg in 2024

| Pulse type | Volume in tonnes | Import value/kg |

|---|---|---|

| Lentils | 282,891 | €1.14 |

| Chickpeas | 215,204 | €1.06 |

| Mung beans | 33,491 | €1.31 |

| Pigeon peas | 5,445 | €1.40 |

Sources: Eurostat and ITC Trade Map (data 2025)

Tips:

- Include pigeon peas in a more diverse range of pulses. It may be easier to enter the market with more common crops before finding a buyer for pigeon peas. You will also become more attractive as a supplier by diversifying your offer.

- Learn more about the opportunities in Europe for chickpeas, lentils, mung beans and other pulses on the CBI website.

3. Which European countries offer the most opportunities for pigeon peas?

The European market for pigeon peas is small. You will find the most potential with traditional consumers in the United Kingdom. There are similar consumer groups in other European countries. Developments in the healthy and plant-based food segments can be indicators for the potential of pigeon peas.

Source: ITC Trade Map (data July 2025)

United Kingdom: Europe’s main market for pigeon peas

The United Kingdom (UK) is Europe's biggest market for pigeon peas. This demand is the result of its large Indian community and interest in traditional foods. There are also communities from the Caribbean and East Africa.

The UK market is experiencing more demand for pigeon peas according to Future Market Insights and Virtue Market Research. Import volumes go up and down, but the average long-term growth is good. In the last five years (2020–2024), the UK imported almost 90% more than the five years before. Due to the historic relationship, India is the main supplier: 3,300 tonnes were imported from there in 2024. Mozambique and Malawi were responsible for most of the remaining 426 tonnes.

Pigeon peas are available in grocery stores and online retailers, particularly those that specialise in Indian or Caribbean ingredients. However, they are also sold in some larger supermarkets such as Waitrose and ASDA. As well as dried pigeon peas, you can find canned and frozen green pigeon peas and even ready-made meals with pigeon peas. Brands like TRS, Natco, Taj and Tropical Sun highlight their Indian and African heritage, but they also appeal to non-traditional consumers.

As a supplier, you should think about the interests of new consumers. As an example, you could pay more attention to sustainable packaging, avoiding food waste and creating social impact in origin countries. The UK-based TRS brand does this by participating in the Felix Project, which rescues and distributes surplus food from the food industry.

Figure 4: Spinach Dal with pigeon peas sold by Waitrose supermarket

Source: kiliweb via Open Food Facts (retrieved 2025)

France: Room for pigeon pea promotion

In France, pigeon peas are known as 'Pois d'Angole'. They are not widely consumed, but are popular in some Caribbean and Indian cuisines.

Pigeon peas are well known in French territories, such as Martinique, Guadeloupe and Réunion. For that reason, most pigeon peas are sold through specialised channels. They are sold by importers such as the Macéo Group and shops specialised in ethnic and exotic food, such as La Maison des Antilles, Afro Exotique and Panier Express.

The typical French consumer considers pigeon peas a niche product. According to Vitagora, pulses in general receive very little attention on supermarket shelves. However, highlighting their health benefits and environmental impact will likely increase their visibility.

Despite the common perception that pulses are challenging and time-consuming to prepare, French consumers still prefer uncooked pulses over processed, cooked varieties. This preference indicates a potential market for promoting split pigeon peas’ versatility and ease of cooking.

Interestingly, some pulses, such as lentils and chickpeas, are experiencing growth in import and production. This trend may positively influence pigeon peas, as increased awareness and acceptance of these legumes can lead to appreciation for similar products. Import volumes of pigeon peas in 2023 and 2024 were also higher than in previous years. France imports more than half of its products through Belgian and other European suppliers. Peru (168 tonnes in 2024) and India (65 tonnes) are the most stable non-European suppliers of pigeon peas to France.

France as a producer of leguminous crops

France is an important European legume producer. In 2024, it produced 848,000 tonnes of pulses. It produced 274,000 tonnes of chickpeas, lentils, and pulses other than field peas, broad and field beans, and sweet lupin, accounting for 20–25% of Europe’s total output.

Belgium: Trade hub for pulses

Belgium is a trade hub for pigeon peas. Trade statistics indicate that export and import volumes are nearly equal. This suggests that the country plays a role in global trade, but domestic consumption is limited.

Most pigeon peas imported into Belgium are re-exported to non-European countries, particularly the United States. Belgium also supplies other markets, such as Trinidad and Tobago and Cabo Verde. The origins of these imported pigeon peas are diverse. Its key suppliers include Tanzania, Ethiopia, Kenya, India and Peru.

Import volumes of pigeon peas in Belgium have varied a lot over the past five years, ranging from 351 tonnes in 2020 to 1,376 tonnes in 2024. This appears to be the result of demand.

Belgium’s market for pigeon peas includes a wide range of companies, from small enterprises like Casibeans to large corporations such as Louis Dreyfus Company (LDC). All of them import a range of pulses.

Portugal: Dependence on imports

Pulses are deeply rooted in Portuguese traditional cuisine. Legumes like beans, chickpeas, lentils and lupini beans (‘tremoços’) are used in Portuguese stews and snacks. Pigeon peas are not a significant part of the Portuguese diet. They are sometimes sold by speciality stores under the name Feijão-guandu. Nevertheless, they can replace other pulses in traditional recipes, such as in ‘Feijoada’, a Portuguese bean stew.

Even though pulses are part of food tradition in Portugal, production of pulses other than field peas, broad beans and sweet lupin is small. It declined from 8,600 tonnes to 6,800 tonnes between 2020 and 2024. According to LeguCON, a promoter of the Portuguese production of legumes, domestic production of leguminous crops only covered 16.9% of consumption in 2021.

Dependency on imported pulses increased as a result of European incentives to produce other crops such as corn, wheat and rice. At the same time, globalisation has led to a change in the Portuguese diet and consumer perceptions of legume consumption. This has not led to a significant increase in pulse imports. Portuguese pigeon pea imports are far from stable. However, they average 300 tonnes per year. Peru is the most stable source of pigeon peas, followed by Tanzania and Ethiopia. However, recent changes in EU policy could force a shift in local production and consumption. As part of the Farm to Fork Strategy, policymakers are trying to diversify protein sources and increase pulse production by 2030.

Italy: Small volumes from various countries

Pulses are part of the Mediterranean diet. They offer nutritional value and have historical significance. They are often associated with ‘cucina povera’, or peasant cuisine, and are used in dishes from different Italian regions. In these dishes, you will often find local varieties such as Borlotti beans and cannellini beans. One notable example is 'pasta e fagioli', a soup made with pasta and beans. It is popular throughout Italy.

Pigeon peas are much less well-known in Italy. They often go by the name ‘pisello d'India’, or Indian pea. They are used most in Indian cuisines. Italy has one of the largest Indian communities in Europe, after the UK and Germany. Annual import volume of pigeon peas varies between 100 and 200 tonnes, and can be sourced from various countries. Supplying countries alternate between Ethiopia, Malawi, Tanzania, Myanmar and Peru, among others.

Volumes are not likely to increase much, unless new uses are developed. The company Pedon is very innovative with pulse grains as ingredients, but pigeon peas have not received much attention so far.

Germany: Demand for plant-based food

The German market for pulses can be segmented into traditional or ethnic consumption and new consumers who want plant-based options. The market for pigeon peas is still underdeveloped, but they have the potential to fit into both segments.

Germany is the largest market for plant-based food in Europe, with sales demonstrating remarkable growth. Sales increased by 42% between 2020 and 2022, reaching €1.91 billion. The country also has the highest number of people with plant-based diets, alongside a substantial share of flexitarians. Pigeon peas have protein levels similar to lentils and chickpeas. They could become more important in the emerging market for vegan products and plant-based meat alternatives. Health benefits and taste are important features for German consumers, as is price.

Current pigeon pea sales are most likely related to the popularity of ethnic foods. While mainstream supermarkets do not carry a full range of ethnic ingredients, there are specialised Asian grocery stores where pigeon peas are sold as Toor Dal. A growing Asian community and the increasing popularity of Indian cuisine sustain a basic German demand.

International distributors play a role in marketing food brands with pigeon peas, such as Transfood, GFT Group, Asian Food Group and Heuschen & Schrouff. When exporting directly to Germany, make sure your product is within the maximum residue limits. Germany is one of the strictest countries in Europe in terms of pesticide residues. Adopting integrated pest management (IPM) or organic cultivation practices helps to reduce the risk of chemical residues.

Tips:

- Start in the United Kingdom if you plan to enter the European market for pigeon peas. Find active traders of pigeon peas via UK Trade Info by searching for commodity code 071360.

- Monitor the food trends described below before putting time and effort into targeting other European markets.

4. Which trends offer opportunities or pose threats in the European pigeon pea market?

Pigeon peas are still not common in European grocery stores. Finding the right niches can help you market pigeon peas. Professional crop and product development can make pigeon peas more attractive.

From ethnic to mainstream

The migration of non-European consumers to Europe contributes to the growth of the ethnic food market. These communities also influence general interest in global cuisines. This helps products like pigeon peas get introduced to new markets. Within the ethnic food segment, ready-to-eat meals, convenient and frozen food concepts are also becoming more popular.

The combination of convenience and traditional flavours speaks to a large target group. This trend is particularly evident in markets like the UK, Germany and France, where demand for ethnic foods is on the rise. Companies that capitalise on these trends offer a range of convenient and culturally authentic products.

Most pigeon peas are sold as dry peas. By offering easy-to-prepare pigeon peas, you may reach mainstream consumers more easily. The Peruvian company Gandules has entered this niche by offering frozen and canned green pigeon peas.

Supplier insight: Starting small can be a step into Europe’s ethnic market

“From canned pineapple to crispy potato chips, we serve it all. We began exporting to France, and as the years have passed, we've been expanding operations, shipping more items to more countries. We have sales and distribution networks in the USA, Australia, UAE, Saudi Arabia, Qatar, India, Oman, Malaysia, Singapore and Somalia, with offices, warehouses and other support. To accelerate our continuous growth, we’ve started a production plant in India.”

PRAN (Bangladesh)

“Initially, recipe mixes were only shared within the broader family but, in a very short time, they gained popularity and orders started pouring in from friends, acquaintances and general consumers. Over time, the company prospered and Mr Sultan decided to launch his very own brand: ‘Shan’. Since then, there’s been no turning back!”

Shan Foods (Pakistan)

Tips:

- Test food innovations locally before introducing them to the European market. Introducing consumer foods to Europe is complicated. You can reduce commercial risks by finding a local market for your products first.

- Use your network and people already familiar with your product to create the first opportunities in the European market. Most ethnic brands and products in Europe start out small.

Growing demand for healthy, plant-based foods

Consumers are becoming more health-conscious and looking for sustainable and nutritious alternatives to animal-based proteins. Pigeon peas are an excellent product in this regard. They are a good source of protein and fibre. This makes them a good ingredient for the growing number of people who want vegetarian or vegan food options.

As well as nutritional qualities, there are environmental benefits to plant-based proteins. They produce fewer greenhouse gas emissions and require less land compared to animal farming. This appeals to consumers who are aware of food’s environmental impact. If you want to tap into the plant-protein market, it is best to start in northwestern Europe, which has the most sales of plant-based products.

In line with the trend towards healthier and more sustainable diets, organic-certified consumption is an important niche. According to FiBL and IFOAM, the largest European markets for organic food are Germany, France, Switzerland, Italy and the UK. One company that aims to create a market for organic pigeon peas is the Indian exporter Nature Bio Foods (NBF). Their subsidiary in the Netherlands helps to serve the European market.

Tips:

- Use informative platforms like Innova Market Insights and read the CBI study Which trends offer opportunities or pose threats on the European grains, pulses and oilseeds market?. The Virtue report on pigeon pea market size (2024–2030) also offers market insights.

- Read more about the European plant-based food segment on the Good Food Institute Europe (GFI) and ProVeg International websites. ProVeg has reports on plant-based foods in different European countries.

- Use organic practices to produce residue-free pigeon peas. You should not expect a premium for organic-certified pigeon peas. Organic certification for pigeon peas is a niche within a niche. You can however use organic certification for other export crops.

Preference for local

There is a growing preference for local, protein-rich crops in Europe. Member states have developed plans to support protein-rich crops based on the new EU strategy. This will contribute to more local production and reduce reliance on imported leguminous crops, particularly for soybeans. Food companies also increasingly prefer locally sourced pulses, as these are thought to be more sustainable.

Pigeon peas cannot be grown easily in Europe, nor will they replace cheap protein sources like soybeans. The general preference for local produce also means more competition from other pulses that can be grown locally, such as chickpeas and lentils. Industry experts expect that Europe will always rely on imports. Pigeon peas will remain an interesting product for niche markets.

Crop and product development make pigeon peas more viable in Europe

Entering the European market can be difficult. Requirements for food in Europe are becoming stricter, and consumers want more and more. To make pigeon peas viable and profitable for export, you need to address sourcing and product development challenges.

Production must be safe, traceable and well-organised to meet consumer expectations. This is not always the case in the production of pigeon peas. This is because they are often part of subsistence farming systems. For pigeon peas to become viable and profitable for export, selecting the right varieties and implementing good agricultural practices are crucial. Farmers in Kenya’s Eastern Region have successfully adopted two new varieties of pigeon peas, which can serve as a model for others. Commercial crop development can help ensure the high yields and consistent supply needed to access the European market.

Introducing a relatively unknown product to European consumers is not straightforward. Food products need to be attractive in terms of taste and convenience. While traditional consumers and ethnic restaurants may have no issues with dry pulses, general consumers prefer foods that are easy and quick to prepare.

As a supplier, consider partnering with food processors or canning companies, or even developing your own processed products. This approach could help you reach new European consumers and meet their preferences more effectively. Vitagora gives several recommendations on how to make pulses more appealing to consumers, such as providing useful cooking information and integrating pulses into everyday meals.

Tip:

- It is important to make pigeon peas competitive with other legumes. Read more about buyer requirements and your competition in the study Entering the European market for pigeon peas.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research