Entering the European market for pigeon peas

Consumers of international cuisines are the main market for pigeon peas. You can reach these consumers through specialised importers and brands, and ethnic food distributors. You can find dry pigeon peas split, dried whole and preserved. Quality and food safety standards must be upheld. The countries that understand the European pigeon pea market best are India, Tanzania, Malawi and Peru.

Contents of this page

1. What requirements and certifications must pigeon peas meet to be allowed on the European market?

As with all food products that enter the European Union (EU), pigeon peas have to meet general food safety and quality requirements. You can read CBI’s summary of the requirements that suppliers of grains, pulses and oilseeds need to comply with to get their products onto the EU market.

You can use My Trade Assistant to look up information on product rules and requirements using the HS commodity code for pigeon peas (071360), the origin and the destination country.

What are mandatory requirements?

The most important aspects of exporting pigeon peas to Europe are food safety and product quality. Pigeon peas have to be safe for human consumption. Food safety and traceability should be your top priorities.

Controlling food safety in pigeon peas

Various factors, including fungi, aflatoxins, heavy metals and insects, can contaminate pigeon peas. You need to apply the principles of the Hazard Analysis Critical Control Point (HACCP) system to guarantee that your pigeon peas meet EU food safety standards. EU food safety standards also require you to ensure that your product is traceable throughout the supply chain.

There are maximum residue limits (MRLs) for pesticides, contaminants and other active substances (see Table 1). Microbiological contamination such as salmonella and E.coli must be avoided at all times. Suppliers and European importers are obligated to guarantee products are traceable and safe for consumption. To ensure this, food products are tested by accredited laboratories.

Table 1: Summary of good practices

| Practice | Example | Recommendations |

|---|---|---|

| Avoid pesticide residues | Herbicides, pesticides | Use Good Agricultural Practices (GAP) Implement integrated pest management (IPM) Use organic inputs Test your product with a recognised laboratory |

| Check heavy metals | Lead, cadmium, arsenic | Monitor soil and water quality Test your product with a recognised laboratory |

| Reduce risks of mycotoxins and bacteria | Salmonella, E.coli, aflatoxins | Use Good Agricultural Practices (GAP) Use suitable drying and storage Maintain maximum moisture of 13–14% |

| Ensure plant health and follow phytosanitary rules | Infestation of pod flies or weevils | Implement integrated pest management (IPM) Use natural fumigation (CO2, nitrogen) Use proper sorting equipment |

| Avoid physical contamination | Sand, stones, glass, metal | Use proper sorting equipment Use metal detection and infrared Take product samples and revise quality |

Source: ICI Business (2025)

Tips:

- Analyse your pigeon peas before exporting them to Europe. Make sure you meet all food safety requirements. Use a recognised laboratory (such as ISO 17025). Preferably use one that your buyer in Europe also uses.

- Keep up to date with key regulations, such as Regulation (EU) 2023/915 (July 2025) on maximum levels for certain contaminants in food, and Regulation (EU) 2019/1793 (August 2025) on the temporary increase of official controls and emergency measures. EU regulations are constantly being updated.

Good Agricultural Practices (GAP)

Good Agricultural Practices (GAP) can help you avoid potential issues. Pesticide residues are one of the most common issues in food crops in Europe. European rules for pesticide residues are strict. Before using any chemical compound, check EU regulations and follow the instructions carefully. Apply integrated pest management (IPM). It combines various pest control methods to minimise pesticide use and associated risks. Only use organic inputs for organic-certified products.

Pigeon peas can absorb heavy metals from contaminated soil. When testing your product for residues, you should test for heavy metals such as cadmium, lead and arsenic. Monitoring soil and water quality to prevent heavy metal contamination is also recommended.

Table 2: Maximum levels of heavy metal contaminants (mg/kg wet weight)

| Product | Lead | Cadmium | Inorganic tin |

|---|---|---|---|

| Cereals and pulses | 0.2 | ||

| Legume vegetables (fresh) | 0.1 | 0.02 | |

| Pulses | 0.04 | ||

| Proteins from pulses | 0.1 | ||

| Canned food (other than beverages, infant and medical food) | 200 |

Source: Commission Regulation (EU) 2023/915 (consolidated version 1-7-2025)

Tips:

- Find out the maximum residue levels (MRLs) for pesticides relevant for pigeon peas. Search for ‘peas without pods' (code number 0260040).

- Read about common problems with pigeon peas and possible solutions on PictureThis.

- Watch the informative videos on different agricultural practices for leguminous crops and pigeon peas in particular on Access Agriculture.

Drying, sorting and storage

Post-harvest practices such as drying, sorting and storage are key to maintaining a quality and safe product. Proper sorting removes most bad seeds, sand and stones.

After threshing, try to bring down the moisture level to 8–10%. Moisture levels above 14% increase the risk of spoilage, mould growth, aflatoxins and bacteria. Packaging and storage facilities must be clean and ventilated.

Tips:

- Use clean tarpaulins to dry pigeon peas. After storage, regularly check the temperature and moisture of your product.

- Read about the harvesting, drying, processing and storage of pigeon peas on Wikifarmer. You can also find information on pigeon pea insect pests and their management.

Phytosanitary certificate

Pod fly and seed-boring insects can be a serious threat. They damage the product’s appearance and make it unsuitable for sale as food. Beans with live insects are banned from being imported. Soil contamination and genetically modified (GMO) crops (often soybeans and maize) are also forbidden. As a supplier, you can reduce this risk through proper sorting and natural fumigation to eradicate insects.

Under European plant health and control rules, all plants and living parts of plants have to be accompanied by a phytosanitary certificate to enter the EU. This includes pigeon peas, according to Annex XI of Regulation (EU) 2019/2072 (consolidated version 23-7-2025). The certificate ensures that the exported beans are free from harmful pests and diseases that could pose a risk to European agriculture.

Green Deal

In 2020, the European Union implemented a set of policies and actions called the European Green Deal. The Green Deal aims to make the European economy more sustainable and climate-neutral by 2050. The action plan includes a 50% reduction in the use of pesticides and an increase in the share of organic farming land to a 25% share by 2030. This will likely decrease pesticide residue levels in the coming years.

Packaging

It is best to use 25 kg polypropylene bags to export pigeon peas to Europe. Depending on your buyer's preferences, other sizes and materials, such as multi-layered kraft paper, can also be used. There are many options for consumer products, including cans and doypacks for pre-cooked peas, and plastic or cartons for dry pigeon peas.

For the European market, packaging needs to protect the product and conform with Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food (version 27-03-2021).

Packaging must:

- Be strong, secure and appropriate for the nature of the goods;

- Be food grade and safe. For example, it needs foil linings or moisture barriers for dried pigeon peas;

- Not release harmful substances or alter the food’s taste, smell or quality;

- Have clearly visible labels that are firmly attached and cannot be easily removed.

Labelling

To export pigeon peas, you need to follow the standard rules for labelling as mentioned in CBI’s buyer requirement report on grains, pulses and oilseeds.

It is only necessary to include additional information described in Regulation (EU) No 1169/2011 on the provision of food information to consumers (consolidated version: 01/04/2025) when marketing pigeon peas to consumers.

Pre-packaged products require the following information on the label:

- Name of the food (for example: dried pigeon peas);

- List of ingredients;

- Allergen declaration;

- Net quantity;

- Country of origin;

- Best before or use by date;

- Name or address of your business;

- Batch or lot number of the produce.

Tips:

- Always discuss specific packaging requirements and preferences with your customers. Be prepared that they may have different packaging preferences. Ensure that all packaging is of good, food-grade quality.

- Read our study on buyer requirements for grains, pulses and oilseeds for more information on delivery terms, including packaging and labelling.

- Always respect regulations on food safety, labelling and phytosanitary rules. If your product does not meet the basic requirements, it can be denied entry, or you may face financial penalties or additional testing costs.

What additional requirements and certifications do buyers often have?

The most common buyer requirements are guarantees and certifications that show you meet European standards. There is no official quality standard for pigeon peas in Europe, and supply preferences may vary.

Quality grading

Pigeon peas can be graded based on variety, seed quality, colour, uniformity, purity and moisture content. Buyers may also have different preferences for the type of processing. Some need whole dried peas. Others want split, pre-cooked or frozen pigeon peas.

The required quality depends on your buyer’s specifications. Different buyers and market channels may have different preferences. Because there is no official grading standard in Europe, you can use other international standards as a guideline. The East African Standard for pigeon peas differentiates between three grades (see Table 3). Expect specifications in Europe to be some of the highest. For example, most European buyers will want a homogenous product with purity levels of 99.9% or above.

Table 3: East African grading requirements for pigeon peas, in % m/m

| Characteristics | Maximum limits (in % m/m) | ||

|---|---|---|---|

| Grade 1 | Grade 2 | Grade 3 | |

| Foreign matter | 0.5 | 1 | 2 |

| Inorganic matter | 0.1 | 0.5 | 0.7 |

| Broken/split grains | 2 | 3 | 4 |

| Pest-damaged grains | 2 | 3 | 6 |

| Rotten & diseased grains | 0.5 | 0.5 | 1 |

| Discoloured grains | 1 | 1 | 3 |

| Immature/shrivelled grains | 1 | 2 | 3 |

| Filth | 0.1 | 0.1 | 0.1 |

| Total defective grains | 3 | 5 | 8 |

| Moisture | 13 | 13 | 13 |

Source: East African Standard for pigeon peas (EAS 756:2011)

Tips:

- Check your buyer’s required purity level and other specifications. Buyers may have different preferences. Maintain strict compliance and deliver the quality agreed with your buyer. Being careless with standards will give buyers a reason to claim quality issues.

- Communicate your product specifications. See examples by Indian companies such as Premium Pulses Products and Ganesh Agro. Include a product data sheet and certificate of analysis when you offer your pigeon peas.

Certifications as a guarantee

Certifications are a good indication of your compliance with food safety requirements. They give buyers assurance. However, buyers do not rely on certifications alone. Your understanding of quality and food safety is crucial in gaining their trust. Working according to high quality standards and a HACCP-based food safety standard is just as important as the certification itself.

To get certified, it is best to implement a standard that is recognised by the Global Food Safety Initiative (GFSI). These standards are widely accepted throughout Europe. Commonly-used certifications include:

- FSSC 22000 (Food Safety System Certification);

- BRCGS (British Retail Consortium);

- IFS Food Standard (International Featured Standard).

Tip:

- Read CBI’s tips for organising your exports and CBI’s buyer requirements for grains, pulses and oilseeds. These will give you more detailed insights into the advantages of certification.

What are the requirements for niche markets?

Pigeon peas are a niche market in Europe. However, European buyers are paying more attention to sustainability and corporate social responsibility (CSR). As a processor and exporter, you ensure a sustainable supply chain alongside other actors.

Organic certification

- Organic certification can be a good way to promote a sustainable supply chain. Organic farming works in harmony with nature. It includes a set of natural practices to increase biodiversity and soil fertility, such as cover crops, crop rotation, intercropping and composting. However, organic farming is a specialisation, and European demand for organic pigeon peas is extremely low.

- To promote and market organic pigeon peas in Europe, you have to use organic production methods that comply with Regulation (EU) 2018/848 (consolidated version: 25-3-2025). You can apply for an organic certificate with an accredited certifier. Once certified, you can use the EU organic logo as shown in Figure 1. The whole supply chain must be certified, from farmer to processor and exporter.

Figure 1: The EU organic logo

Source: European Commission (2025)

Tips:

- Use organic farming to become more successful as a sustainable supplier of multiple crops – not just pigeon peas. Remember that implementing organic production and becoming certified is an investment. Invest in certification if there are European buyers interested in your products.

- Find technical guides that help you develop organic practices in the FiBL shop.

- Consult the list of approved control bodies and authorities for applying equivalent standards and control schemes in non-EU countries.

Other labels and certifications

The European market for pigeon peas is very small and specific. Buyers do not have demanding requirements in terms of additional standards. They will often require you to fill out a set of documents and declarations before doing business. Alternatively, they may ask you to comply with a specific Code of Conduct.

If pigeon peas become a more mainstream product, you should expect more demand for sustainable labels and social standards, such as Business Social Compliance Initiative (amfori BSCI), Ethical Trading Initiative (ETI), Fairtrade International and Rainforest Alliance.

Tips:

- Use the ITC Standards Map to learn about the different sustainability and social standards. See which ones are available in your country.

- Review your company’s current performance and implement the amfori BSCI Code of Conduct.

2. Through which channels can you get pigeon peas on the European market?

The main market for pigeon peas is consumers who favour international cuisines. You can reach these consumers through specialised importers, brands and distributors.

How is the end market segmented?

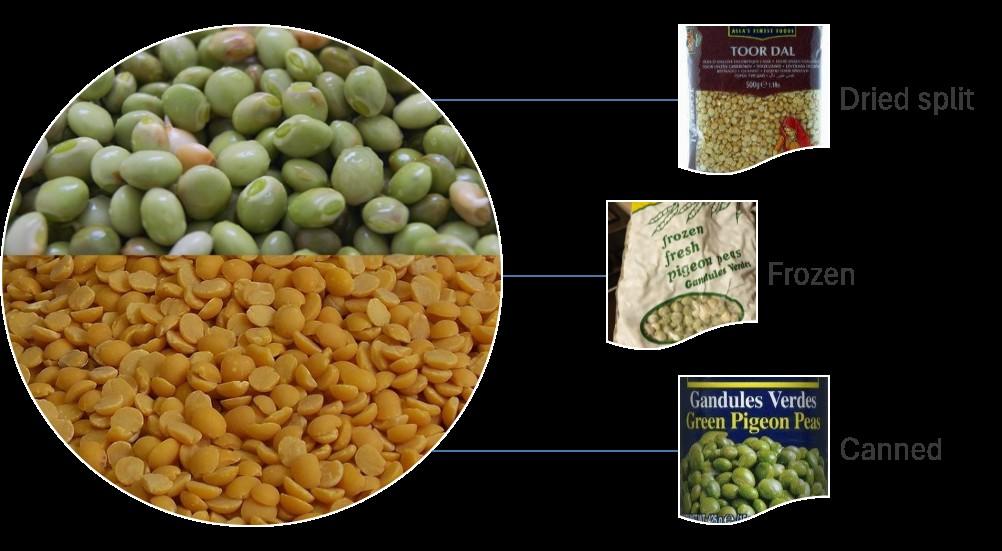

Pigeon peas are offered as dry (split) peas for making Indian Tor Dahl curry. However, you can also find brands with frozen and canned (green) peas for use in African soups and stews or Caribbean rice and bean dishes.

Consumers

Consumer groups consist of ethnic communities and consumers who like international cuisines. When marketing pigeon peas in Europe, focus on urban areas with high cultural diversity. You will most likely find large communities from India, Eastern Africa and the Caribbean.

Another potential consumer group is vegans. The average health-oriented consumer still undervalues pigeon peas. This segment could benefit from targeted information about their versatility and nutritional benefits.

Outlets

In Europe, you can find pigeon peas in independent shops, wholesalers specialised in ethnic foods and online. They are less common in mainstream grocery stores. In areas with many ethnic consumers, such as in the United Kingdom, you are more likely to find pigeon peas in supermarkets.

Since pigeon peas are common in ethnic cuisines, the food service segment is also a relevant user of pigeon peas. Wholesalers usually serve these food service clients.

Presentations

A range of exotic and ethnic food brands offer dried pigeon peas, as well as green and pre-cooked pigeon peas. Most brands offer them as dried split peas (Toor Dal). In some cases, they are sold as Gungo peas (Jamaican), Tuvar (Indian) or Gandules (Spanish). Many brands refer to pigeon peas’ heritage. It confirms the strong link with traditional consumption.

Figure 2: Market segments for pigeon peas in Europe

Source: ICI Business with images from Pixabay and Open Food Facts (kiliweb) (retrieved 2025)

Tip:

- Focus on traditional consumers and brands when marketing pigeon peas in Europe. The ethnic segment is your main market. It will likely be a principle segment in the long term.

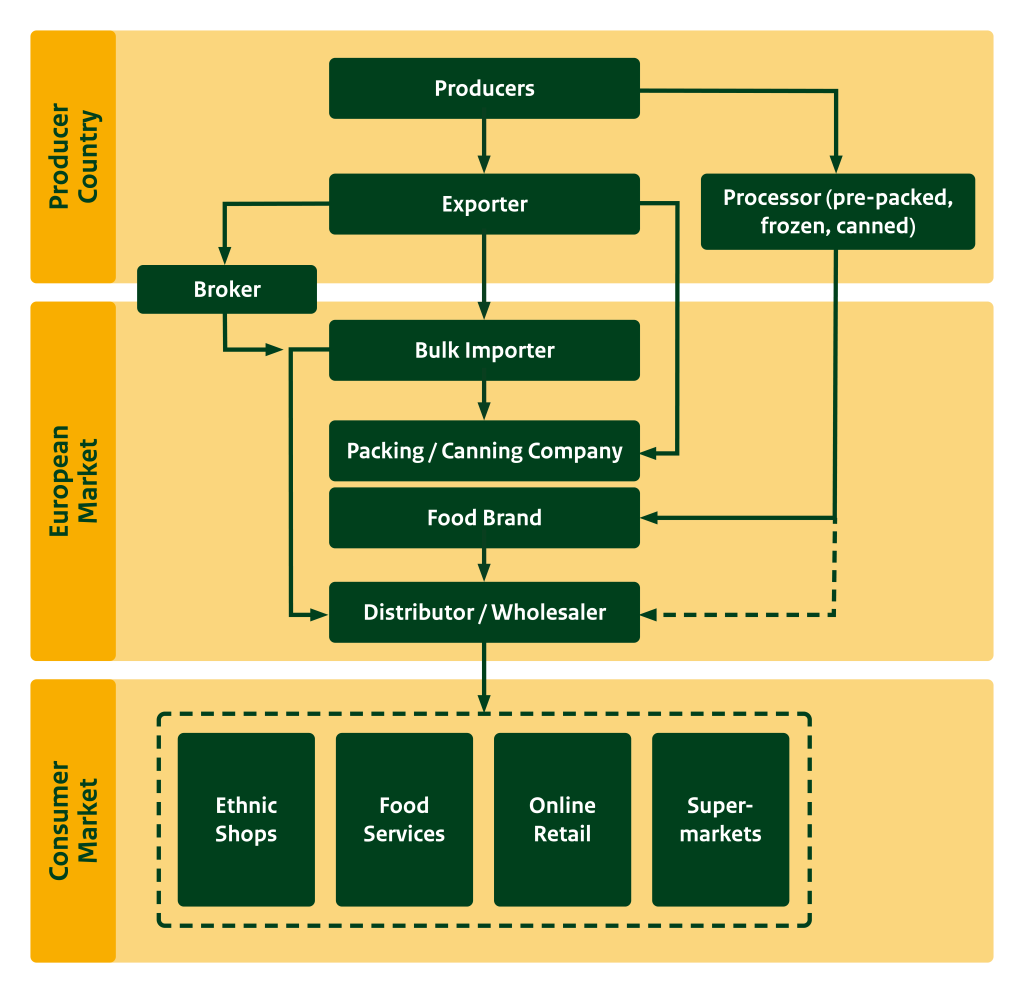

Through which channels does a product end up on the end market?

The current pigeon pea trade is mostly managed by importers and ethnic food brands. Companies specialised in ethnic food help distribute pigeon pea brands to a variety of shops and restaurants.

Figure 3: Pigeon pea supply chain

Source: ICI Business (2025)

Bulk importers and brokers

Bulk importers or traders are a common entry point for most food ingredients into Europe. They are crucial in matching supply and demand. This includes making sure that imported products meet quality and food safety criteria.

Examples of companies that import pigeon peas and other pulses in bulk are:

- Western Impex: an importer of Indian spices and food in the United Kingdom;

- AGT Foods Europe: a European importer that operates from the Netherlands;

- AGT Poortman: a British importer for mainly the UK market;

- JKT Group: a global trader with offices in India, the Netherlands, the UK and Dubai;

- Casibeans: a Belgian company specialising in the import of dry leguminous products;

- Nature Bio Foods Europe: an import company in the Netherlands with a head office in India.

Sometimes European buyers are represented by a broker, like Bean Brokers UK, Cogeser in France or Agriprime in India. Brokers are often individuals or small companies that link your product to European buyers and take a commission on sales. Their experience and network can be valuable in reaching different types of buyers, including companies that are otherwise hard to reach.

Food brands

Exotic food brands play an important role in marketing pigeon peas. Many companies have their own sourcing partners and import activities. They import bulk products and process/pack them themselves or use third-party processors and co-packers.

Natco Foods, for example, has its own processing hub in the UK. Meanwhile, Taj Foods and Gunarajan Handelsagentur import under their own brand names. Vibrant Foods sources ingredients for their brands, including TRS and East End Foods. This means you can explore different opportunities, from supplying raw materials to partnering with a brand as a contract processor or co-packer.

You may also find future opportunities in the health food segment. For example, Suma Whole Foods is a cooperative sourcing vegetarian, natural and healthy products, with a broad selection of leguminous ingredients.

The United Kingdom hosts a large number of brands that sell dried or canned pigeon peas, such as TRS, Natco Foods, East End Foods and Tropical Sun Foods. The UK-based brand Taj sells green pigeon peas. Some of these brands are available in Europe.

Brands in other European countries include:

- Orijin (France) offers whole dried pigeon peas from Peru;

- Legumor (France), a Haudecoeur brand with whole and split peas;

- Valle del Sole (Netherlands), a Unidex brand with canned and dried pigeon peas;

- Annam (Germany), a Transfood Wholesale brand that offers Indian and Sri Lankan food products;

- Goya (USA), an international brand with canned and frozen pigeon peas (gandules), mainly active in Spanish stores with Latin products.

Food distributors

Distributors can reach a wide network of independent shops and food service clients. Pandit UK, Haudecoeur (France), Transfood Grosshandel (Germany) and Unidex and NRG Imports (Netherlands) are specialised in the distribution and wholesale of ethnic and foreign brands. BanyanTree Foods (UK) caters to the high-end food service sector, including Michelin-starred restaurants.

The presence of foreign brands in the ethnic market proves there are opportunities to sell branded products. This requires partnering with local distributors and investing in a product portfolio and local marketing. This is not a realistic goal for most exporters.

Tips:

- Invest time in entering the market. Check your buyer’s potential in terms of interest, volume, level of integration and processing activities. Get to know them and their priorities. Companies that may seem to be competitors can also be clients or partners.

- Use a broker to facilitate market entry if you cannot find reliable client relations. They can help you find and connect to a suitable buyer.

What is the most interesting channel for you?

Most current pigeon pea imports go through specialised ethnic food buyers and brands. They are the most logical channel to target as a supplier. However, most food brands that import pigeon peas have well-established supply sources. It can take some time to find a steady partner.

It may be easier to connect with importers or brokers of pulses or other food ingredients. You can garner interest if you have basic quality and food safety processes in place. Remember that pigeon peas are a niche market in Europe. The number of buyers is limited. For this reason, it is best to combine your offer with other pulses.

For consumer-packed pigeon peas, you need to be able to operate at a higher level. To process pigeon peas into food for European consumers, you need to have suitable packaging and meet the highest level of food safety.

Tips:

- Meet importers and food manufacturers at large food trade fairs, such as SIAL, Anuga, Food Ingredients Europe and BIOFACH for organic food. Use their exhibitor lists or databases to search for interesting companies.

- Read our tips for finding buyers on the European grain, pulses and oilseeds market.

3. What competition do you face on the European pigeon peas market?

Pigeon peas are part of a volatile market in which India determines much of the trade dynamics. Other suppliers in Africa and Peru are also trying to gain a market share. Only small volumes reach the European market.

Which countries are you competing with?

India accounts for the largest production volume and is the main supplier to Europe. India has a big influence on the global pigeon pea market. Africa produces around 20% of total global production. In terms of exports, Peru is also a potential competitor.

Source: Faostat (July 2025)

Source: ITC Trade Map (July 2025)

India dominates trade and consumption

India is the largest supplier of pigeon peas to Europe. It has exported a large share, particularly in the last few years (2022–2024). However, domestic demand and imports are also very high. India is the largest producer and consumer of pigeon peas worldwide. In 2023, India produced 3.3 million tonnes. The country is responsible for 70–80% of global production.

Although India is the largest producer, it is also a net importer of pigeon peas. The pigeon pea trade is regulated. Due to increasing demand and declining production in India, the Indian government uses imports to address supply shortages and to stabilise domestic prices. Currently, India has extended duty-free imports of pigeon peas until March 2026. With India being the main consumer market, these decisions can have a big impact on global trade.

India only exports small volumes; 36,000 tonnes in 2024. Even with this low export volume, Indian supply is dominant in Europe. The United Kingdom (UK) is one of the main destination countries. UK brands and distributors with Indian heritage are the most common buyers.

As a competing exporter, it can be difficult to break the strong trade relationship between European and UK brands and their Indian suppliers. Instead, you could consider making India a target market.

Malawi faces opportunities and challenges

Malawi is a significant producer and exporter of pigeon peas. Much of its harvest was traditionally destined for India. Pigeon peas are among Malawi's most important export products, alongside tobacco and tea.

Pigeon peas, known locally as ‘Nandolo’, are a vital crop for smallholder farmers in Malawi. This is particularly true in the southern region, where drought is common. Official production figures state that 441,000 tonnes were produced in 2023, making Malawi Africa’s largest producer. However, these statistics may be unreliable, and exportable volumes are much lower in reality.

An extended export quota with India presented an opportunity for farmers. However, the country struggles to stay competitive. Imports from Malawi are also decreasing in Europe, where the UK is its main buyer. Despite demand from foreign markets, Malawi is not able to fully profit from its export potential. The country suffers from a highly fragmented and disorganised local market. Freight costs are high, and productivity and quality are often lower than in neighbouring countries.

To improve pigeon pea earnings in Malawi, farmers need to focus on better post-harvest handling, collective marketing and access to certified seeds. Improved national strategies and interventions from organisations such as CABI and the K-CGIAR Centre and the African Centre for Crop Improvement could make Malawi a stronger global player in the future.

Peru finds strengths in preserved peas

Pigeon peas are known in Peru as ‘Frijol de palo’ or ‘Frijol gandul’. Peru is not one of the largest producers of pigeon peas, but it still plays a role in the supply to Europe.

It produced a total of around 88,000 tonnes of pulses, including pigeon peas. Europe only imported a total value of €632,000 of dry pigeon peas. In volume, this came to roughly 340 tonnes. In reality, the import volume was much larger due to the share of frozen and canned green pigeon peas. These are not represented in the trade data for dry pigeon peas.

Peru has a favourable climate for pigeon peas and a relatively well-developed food processing industry. Companies such as Procesadora Perú target the export market with freshly frozen and canned pigeon peas. According to Agencia Agraria, 71.1% of pigeon pea exports in 2023 were preserved peas, and only 28.1% were dry pigeon peas. Considering this product diversity, the total volume of dried and preserved peas could be around 1,200 tonnes.

The main export markets for Peruvian dry pigeon peas were France, Portugal and the UK, followed by the Netherlands and Spain.

Tanzania is the world’s largest exporter

The Tanzanian government has actively supported the pigeon pea industry to boost production and exports. They have helped farmers to cultivate pigeon peas with agricultural incentives, such as subsidised fertilisers and access to credit and quality seeds. One of Tanzania’s great advantages is the Tanzania Mercantile Exchange (TMX). This is a platform where farmers, traders, exporters and other market actors can access domestic and global markets and obtain fair prices for agricultural commodities.

With a price-competitive offer, the country has become the world’s largest exporter of dry pigeon peas. In 2024, Tanzania exported a total of 341,000 tonnes. India was the main destination by far. It bought 99% of Tanzania’s pigeon peas. This shows a heavy dependence on India. In Europe, pigeon pea imports from Tanzania fluctuate. Belgium is the most stable importer of pigeon peas from Tanzania.

Tip:

- Monitor developments in the pigeon pea market to identify trade opportunities. Read news on Hectar Global Insights and Tridge. Also follow developments in India, as they influence much of the market.

Figure 6: Development of the top ten pigeon pea producer countries from 2000 to 2021

Source: Mapology @ YouTube

Which companies are you competing with?

Competitors in pigeon peas in Europe follow strict market standards. They are either well-connected with the market or add value to their product. One of the main players is Export Trading Group (ETG). It has a strong presence in Africa and an annual processing capacity of 360,000 tonnes in India.

Indian entrepreneurship

India is the dominant market for pigeon peas. Indian companies also have a strong presence in global trade. According to trade platform Volza, 165 pigeon pea suppliers were active between November 2023 and October 2024. Treta Agro was India's leading pigeon pea supplier, operating under the Just Organik brand.

Indian export companies often have a wide portfolio of products. Pisum Food Services, Yuvaraju Agro Impex and Jamal Food Exports are examples of this. Pigeon peas may only be a minor product for them. Because India itself is a major market, most companies such as Shah Nanji Nagsi Exports focus on importing pigeon peas rather than exporting them.

One particular strength of Indian entrepreneurs is their adaptability. Companies like Aryan Group, Viral Spices and Rajamudi Organics focus on meeting European requirements and presenting themselves at international trade fairs. They invest in certifications and put effort into organic production and social standards.

The main advantage for Indian pigeon pea suppliers is that they have a network of Indian communities in Europe. This helps them connect to food brands with Indian heritage.

Peruvian processing companies

In the first quarter of 2023, there were 18 Peruvian companies that exported pigeon peas. These companies included V&F, Procesadora Perú, Gandules, AC Peru, Andes Alimentos, Natural Source Peru and Andes Mills.

Peruvian exporters have found their niche in processing pigeon peas. Several of these companies use canning or freezing to preserve pigeon peas, mostly as green peas. They operate at this level to meet supply and food safety standards in the European market. For example, Procesadora Perú has certified their processing facility with BRCGS. It works with an IQF system to produce 1.2 tonnes of frozen food per hour, and it has a warehouse capacity of 160 tonnes.

Tanzanian suppliers and different quality levels

One major company that deals with dry pigeon peas is Export Trading Group (ETG). ETG is a large agricultural conglomerate based in sub-Saharan Africa. It trades commodities from 49 countries including Tanzania, Kenya, Malawi, Mozambique, Nigeria and South Africa. It also has operations in Asia, Europe, the Middle East and America.

Smaller suppliers compete in the pigeon pea market at different levels. Companies like Afrisian and Elevate Impex Limited offer pigeon peas with purity levels of 97–99%. This quality is not suitable for European buyers. They require 99.9% purity or higher, unless the buyer plans to reprocess the product after arrival. Other companies offer other qualities or gradings, such as Afrilanda and Paradise Exim.

Malawi's multi-sectoral companies

In Malawi, several companies are involved in trading pigeon peas. Not all of them have strong online profiles, so they tend to stay under the radar. Some suppliers work across different industries, including in non-related activities, such as construction works. Generally, it will be difficult for these types of businesses to make a positive impression in Europe. The Malawi Investment and Trade Centre gives an overview of export companies.

Export Trading Group (ETG) is one of the largest trading companies operating in Malawi. It covers various industries, from commodities to food ingredients, agricultural inputs, logistics and animal nutrition. Unlike the smaller businesses in Malawi, ETG has worldwide subsidiaries and is active throughout Africa. Due to its size and global presence, they can manage a multi-industry business and have no limitations in developing new markets.

Tips:

- Define your strategy and key strengths. Compare your product with those of other suppliers and look for niches where you have a competitive advantage. Once you know how to differentiate yourself from your competition, it is easier to target a specific market.

- Make sure you meet European quality standards to compete with other suppliers. If you are unable to operate on the same level, your chances of success will be very slim.

Which products are you competing with?

European consumers can easily switch between different leguminous crops. Remember that pigeon peas are some of the least common pulses. Most people purchase products they are familiar with, such as chickpeas, lentils, kidney beans and white beans. Pigeon peas need more promotion among mainstream consumers in Europe.

For more traditional consumers, pigeon peas can be a specific choice, in particular for Indian consumers. They have a specific nutty flavour. This makes them best-suited for Indian, Caribbean and African dishes. For Indian curries, lentils and chickpeas (Chana dal) are also common. If prices for pigeon peas are high, yellow peas can be a cheap replacement.

Tip:

- Diversify your product portfolio and try not to depend solely on pigeon peas. Make yourself an attractive supplier by including several other crops in your offer that fit your clients’ interests. This will make you better prepared for competing products and allow you to combine shipments with different products.

Figure 7: Examples of canned and split pulses on the UK market

Sources: kiliweb and anonymous-s7co2zv64u via Open Food Facts (retrieved 2025)

4. What are the prices of pigeon peas on the European market?

The average international trade price for pigeon peas has varied between $600 (USD) and $700 per tonne over the past decade. However, the market for pigeon peas can be very volatile.

India is the largest consumer of pigeon peas. This means it has the most influence over global prices. Between 2022 and 2024, the prices for pigeon peas were high because of a shortfall in supply, and demand in India could not be met. More recently, the Global Pulse Confederation reported a decline from $1,470 per metric tonne (CNF) from Myanmar to India in May 2024, to $725 per tonne in June 2025. This makes pigeon peas a difficult product to trade. Fluctuations result in speculation, and this can lead to poor trade behaviour.

Europe follows international prices. However, trade costs are often higher. Europe demands high purity, but it also requires multiple lab analyses. This makes the product more expensive. When exporting lower purity pigeon peas, expect to get €100–200 per tonne less for re-processing in Europe.

According to trade statistics, the calculated (CIF) import prices in 2024 were between € 1,370 per tonne for Indian pigeon peas in the UK and €2,070 per tonne for Peruvian pigeon peas in France (see Figure 8). Importers’ gross margins are somewhere between 15 and 25% to cover import costs, testing and profit margin. The canning industry is a major channel for most pulses. However, pigeon peas are usually dry-packed and sold at the retail level for €5–7 per kg.

Source: ITC Trade Map (data 2025), calculations by ICI Business

Source: calculations by ICI Business (2025)

Tips:

- Make realistic and detailed cost calculations. Quality, supply and demand determine the price of your pigeon peas. However, as a supplier, you should make your own cost calculations, and check if the trade price is realistic for your company.

- Check price updates on Pulse Pod (paid membership). Pulse Pod is a communication channel owned by the Global Pulse Confederation. It gathers valuable insights from the pulse industry.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research