Entering the Dutch market for fresh fruit and vegetables

In the Netherlands, you will find a diverse group of importers and traders with international networks. They partner with strong suppliers in countries such as Peru and South Africa. To supply Dutch buyers, you need to be well prepared in terms of requirements. Requirements are strict regarding pesticide residues, quality, supply security and sustainability.

Contents of this page

- What requirements and certifications must fresh fruit and vegetables meet to be allowed on the Dutch market?

- Through which channels can you bring fresh fruit and vegetables to the Dutch market?

- What competition do you face on the Dutch fresh fruit and vegetables market?

- What are the prices of fresh fruit and vegetables on the Dutch market?

1. What requirements and certifications must fresh fruit and vegetables meet to be allowed on the Dutch market?

The Netherlands complies with European legal standards and requirements. For a complete overview of these standards, read the CBI study on buyer requirements for fresh fruit and vegetables or consult the specific requirements for your product using Access2Market. Some standards in the Netherlands exceed European guidelines.

What are mandatory requirements?

Mandatory requirements for fresh fruit and vegetables are based on phytosanitary rules and food safety control.

Fewer pesticides than required by European legislation

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers in the Netherlands. The European Union has set a legal limit for maximum residue levels (MRLs). Regular safety inspections are carried out by the Dutch authority NVWA.

The Netherlands distributes to other European countries. The required pesticide residue levels are often lower than the legal limits, depending on the final destination and end client. Germany is one of the main export markets for Dutch traders, and one of the strictest in terms of pesticide residues.

Most Dutch supermarkets require you to comply with a residue level of just 50% of the legal limit. To supply Lidl, a discounter of German origin, residues must not exceed 33% of the legal limit. This means you must control your production process very precisely.

Tips:

- Find out the MRLs that are relevant to your product by consulting the EU MRL database. All harmonised MRLs can be found here. You can search by product or pesticide used. The database shows the list of MRLs associated with your product or pesticide;

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management;

- Read more about MRLs on the European Commission website. Check with your buyers if they have additional requirements on MRLs and pesticide use;

- Make sure that lead and cadmium contamination remain within limits, according to the EU Regulation 2023/915 on maximum levels for certain contaminants in food (consolidated version 01/01/2025).

Follow phytosanitary regulations

Protective measures against plant pests in the Netherlands are the same as those listed throughout the European Community and its member states. Rules for the trade in plants and plant products from non-EU countries require most fruit and vegetables to have a phytosanitary certificate before being brought into the European Union, guaranteeing that they are:

- Properly inspected;

- Free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- In line with EU plant health requirements, laid down in Implementing Regulation 2019/2072 (version 27/02/2025).

For some products, additional declarations may be required. For the import of pineapple, banana, coconut, durian and dates, no phytosanitary certificate is required for export to the European Union.

Inspections in the Netherlands are based on risk. Products or origins with higher risk have higher inspection rates. You may be able to reduce inspection costs by building a good track record with your buyer.

Tip:

- Make sure your plant health authority can comply with phytosanitary requirements before planning your export. Contact the National Plant Protection Organisation (NPPO) in your country and confirm they can issue a phytosanitary certificate on time.

Maintain high quality standards

The European supplementing Regulation 2023/2429 sets out detailed rules for the fruit and vegetables sector. General marketing standards appear in part A of ANNEX I (see also Table 1). Part B contains specific marketing standards for:

- Apples;

- Citrus fruit;

- Kiwifruit;

- Lettuces, curled-leaved endives and broad-leaved (Batavian) endives;

- Peaches and nectarines;

- Pears;

- Strawberries;

- Sweet peppers;

- Table grapes;

- Tomatoes;

- Bananas.

For many types of fruits and vegetables, you can also find marketing standards or guidance through:

- The Fresh Fruit and Vegetables - Standards of the United Nations Economic Commission for Europe (UNECE);

- The OECD Fruit and Vegetable Scheme of the Organisation for Economic Co-operation and Development (OECD);

- The International Food Standards in the FAO Codex Alimentarius.

The Netherlands almost exclusively requires class I fruit and vegetables as a minimum. The Quality Control Bureau (KCB) is the Dutch authority responsible for quality inspection of fruit and vegetables in international trade, and at the wholesale and producer levels. The Netherlands Consumer Authority (NVWA) is responsible for inspections at the retail level.

Table 1: General quality requirements (all classes) and permissible tolerances for fruit and vegetables

| Minimum requirements | Minimum maturity requirements | Tolerance |

|---|---|---|

Products must be:

The development and condition of the fruit or vegetable must be such that it can:

|

|

|

Source: Commission Delegated Regulation (EU) 2023/2429, supplementing Regulation (EU) No 1308/2013 regarding marketing standards for the fruit and vegetables sector

Tips:

- Discuss specific requirements with your buyer in terms of size, quality, packing, branding and other specifications. Via the Netherlands, you can reach many different markets, each with their own preferences. Make sure the product is uniform in size and quality;

- Maintain a perfect cold chain to ensure optimal freshness and taste. Explore innovative packaging, ethylene blockers and controlled atmosphere. Supply chain logistics should not affect the product or its taste in any significant way;

- Maintain strict compliance with quality requirements and deliver the quality agreed with your buyer. Being careless with product requirements or stretching minimum standards will give buyers a reason to claim on quality issues;

- Be open and transparent when resolving issues and dealing with quality claims. Remember that international traders in the Netherlands can sometimes help find an alternative market if products are not suitable for stricter clients;

- Read the CBI study on buyer requirements for fresh fruit and vegetables for additional requirements such as packaging and labelling, or our product studies for product-specific requirements.

What additional requirements and certifications do buyers often have?

As a transit country, the Netherlands has a lot of experience with standards and requirements. Dutch traders are on the front lines, and they are well aware of which standards to follow. For them, certifications that guarantee safe and sustainable fruit and vegetables are standard requirements.

Maintain good communication

In the Netherlands, you can expect companies to be very direct in their communication. Dutch traders work fast and efficiently and expect you to do the same. Business culture can be quite informal, especially in the fresh fruit and vegetables sector. However, your business partner will generally spend less time on small talk and focus on business. Punctuality and fast responses are important.

The best way to convince a Dutch client to do business with you is to have a well-organised, certified company. You should be proactive in communication. Never leave a message unanswered and communicate proactively when issues occur.

Payment and delivery terms

Preferences for payment and delivery vary among Dutch traders. Terms also depend on the type of network and end clients your buyer has. Some small traders may be more open to new suppliers and carrying more risks, while other importers may offer more secure trade through retail supply programmes.

Companies in the Netherlands always try to reduce their risk when trading. To work out terms that are beneficial to both the supplier and the buyer, you should try to develop a sustainable relationship and avoid quick opportunities.

Tips:

- See the CBI studies buyer requirements for fresh fruit and vegetables and Tips for doing business with European buyers for details on additional requirements, such as payment and delivery terms;

- Read Octagon Professionals' blog about understanding Dutch business culture and etiquette for straightforward tips on doing business in the Netherlands.

Obtain commonly used certifications

Common certifications for fresh fruit and vegetables are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are recommended most.

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GLOBALG.A.P., a social certificate such as Sedex Members Ethical Trade Audit (SMETA) has almost become a minimum requirement to have your product meet retail standards.

Retailers can also impose individual standards or requirements. For example, the leading Dutch supermarket Albert Heijn has its own protocol and minimum product requirements regarding social compliance and the environment for own-brand products. In addition to GLOBALG.A.P., they require all fruit and vegetables produced in a BSCI high-risk country to be certified with BSCI or equivalent according to social certification standards.

Standards are likely to develop further in the future. This could include reductions in air-freighted fruit and vegetables or lower residue levels.

New ambitions for crop protection

In 2024, Albert Heijn announced a new ambition regarding synthetic crop protection. From 2030, fruit and vegetable products may contain no more than three different residues of crop-protection products. Residue levels must be reduced to 25% of the legal limit. In addition, Albert Heijn is working to reduce the use of critical substances, including substances on the Toxic 12 list. Albert Heijn has informed growers about this and provides support for implementation. This ambition applies to both Dutch and international growers.

Source: Albert Heijn 2024 Sustainability Report

Tip:

- Work proactively with buyers to improve food safety, be transparent and stay updated with buyer requirements and regulations. Remember that food safety is a major issue.

Sustainability Initiative Fruit and Vegetables (SIFAV)

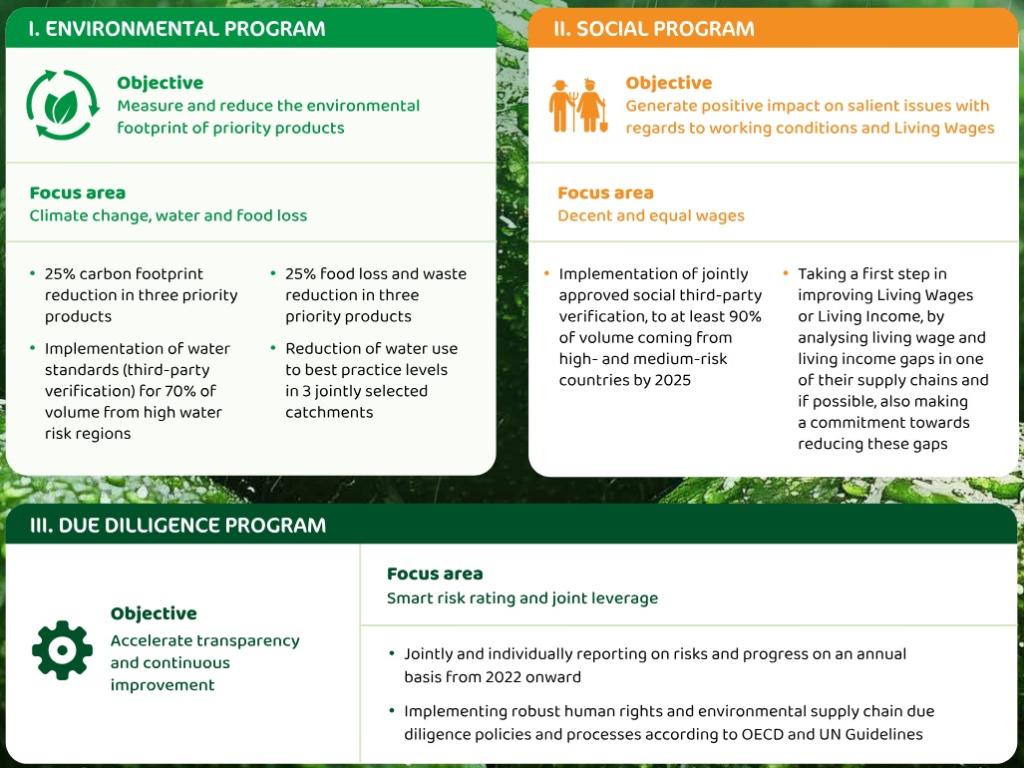

Several leading companies joined the Sustainability Initiative Fruit and Vegetables (SIFAV), a covenant that aims to create a more sustainable fresh fruit and vegetable supply chain. Members include supermarkets Albert Heijn and Jumbo, the fruit companies Greenyard Group, StaayFoodGroup, The Greenery, Nature’s Pride, Eosta, Direct Source and Roveg, and others. These companies are frontrunners in making the supply chain sustainable.

SIFAV2025 has implemented three programmes (see Figure 1). Sustainability targets include a 25% reduction in carbon footprint and food waste in priority products, implementation of water standards and taking the first steps towards improving living wages.

Figure 1: SIFAV programmes for 2025

Source: SIFAV Annual Report 2024

Tip:

- Implement at least one environmental and one social standard. See the Baskets of standards for SIFAV’s sustainability programmes.

On the way to PlanetProof

‘On the way to PlanetProof’ is a new independent quality mark for more sustainable products. It is the fastest-growing sustainability label in the Netherlands. Fresh fruit and vegetables are main focus areas.

Currently, the label is only active in Western and Southern Europe. However, it has been acknowledged by the Global Ecolabelling Network (GEN) as a reliable ecolabel. This means it can collaborate worldwide with other ecolabels to create a bigger impact.

Sustainable packaging

The European Union has decided to ban single-use plastic packaging for fruit and vegetables weighing less than 1.5 kilos by 2030. This aims to reduce plastic waste, but packaging is sometimes necessary to preserve shelf life, maintain hygiene or for practical reasons.

According to the Knowledge Institute Sustainable Packaging (KIDV), 90% of a product’s environmental impact is due to the product itself and its potential spoilage, and only 10% is due to packaging. The Fresh Produce Centre, which represents the interests of Dutch fruit and vegetable companies, is developing a list of exceptions.

As a foreign supplier, you must select packaging materials that are in line with ambitions to reduce waste. This especially applies to exporters that pre-pack fruit and vegetables, such as grapes in clamshells or freshly packed herbs. It is not possible to avoid all plastics. The trend is to look for more sustainable solutions, such as smart plastic reduction or the use of recyclable materials.

One method for measuring environmental impact

A variety of sustainability labels, initiatives and regulations throughout Europe have resulted in administrative burdens, costs and confusion. Most actors in the sector agree that environmental information should be simplified.

In response, the fresh produce sector in the Netherlands has developed a set of Product Environmental Footprint Category Rules (FreshProducePEFCR). This is a single, unified method for measuring the environmental impact of fruit and vegetables, based on existing European Commission frameworks.

The European Union will likely adopt the FreshProducePEFCR. This will reduce the need for multiple sustainability labels in the near future.

Figure 2: Explanation of the FreshProducePEFCR

Source: Fresh Produce Centre

Tips:

- Be selective in choosing packaging materials. Find the most sustainable option and only use recyclable, or preferably biodegradable, plastics. When you pack for retail clients, make sure to do so in close cooperation with your buyer;

- See the infographic on FreshProducePEFCR, which presents key areas for measuring environmental impact.

What are the requirements for niche markets?

Other requirements in the fresh produce sector include organic and other sustainable or social labels.

Use organic certification to increase product value

Organic certification can be an interesting way to set your products apart and market them at a higher value. The demand for organic fruit and vegetables is growing, although it is mainly met by European growers. Read more about organic trends in the Dutch fresh fruit and vegetable market.

In order to market organic products in the Netherlands, you must use organic production methods according to European legislation and the renewed Regulation (EU) 2018/848 (consolidated version 25-03-2025). You must apply for an organic certificate with an accredited certifier.

Organic products in the Netherlands are recognisable by the labels EU organic, EKO or Demeter for biodynamic products. Skal is the control body for organic certification in the Netherlands. The organic EKO label includes social standards on top of EU organic requirements, but it is not a common label that is demanded from foreign suppliers. Organic products that are re-exported sometimes need to comply with additional national organic standards, such as Naturland in Germany, BioSuisse in Switzerland or KRAV in Sweden.

Figure 3: The 'EU organic', 'EKO' and 'Demeter' logos all indicate an organic product in the Netherlands

Tips:

- Strive for residue-free fruit and vegetables and certify your production as organic if possible. It will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process;

- Download the List of Recognised Control Authorities and Control Bodies to see which certifiers are active in your region.

Rainforest Alliance

The adoption of the Rainforest Alliance label is increasing. Although this growth is especially notable for bananas, the label is increasingly in demand for avocados due to their potentially high environmental impact. The Rainforest Alliance focuses on transforming supply chains, promoting sustainable farming methods and improving the livelihoods of farmworkers.

Fairtrade

Fairtrade is not top of mind for Dutch importers. Most fruit and vegetable importers do not see much added value in it. This does not mean that your product should not comply with social standards. Standards such as SMETA have become a common requirement.

For some specialised companies and specific fruits, Fairtrade labels are more common. Fairtrade is a significant label for bananas and importers such as Dole, Fyffes and AgroFair. The Dutch supermarket PLUS has been committed to 100% Fairtrade bananas since 2010.

Tips:

- Implement a fairtrade scheme if you see a particular interest from your buyers or if you export bananas;

- See the CBI study on buyer requirements for fresh fruit and vegetables for a complete overview of buyer requirements and international standards.

2. Through which channels can you bring fresh fruit and vegetables to the Dutch market?

The Netherlands has a large diversity of buyers. Working with the right company can give you access to Dutch and other European markets. Supermarkets are the most dominant segment in the Dutch market.

How is the end market segmented?

Market shares of the fresh produce retail trade are not systematically recorded. Supermarkets are without doubt the dominant channel for fresh fruit and vegetables in the Netherlands. The number of specialised fruit and vegetable shops and ambulant merchants has decreased in recent years.

Table 2: Number of branches per segment

| 2020 | 2022 | 2024* | 5-year growth | |

|---|---|---|---|---|

| Wholesalers in fruit and vegetables | 1,440 | 1,630 | 1,610 | 12% |

| Supermarkets | 6,120 | 6,400 | 6,670 | 9% |

| Specialised shops in fruit and vegetables | 980 | 970 | 910 | -7% |

| Street merchants in fresh fruit and vegetables | 885 | 865 | 845 | -5% |

Source: Statistics Netherlands (CBS), *preliminary data (data retrieved July 2025)

Source: GFK/Fresh Produce Centre

Supermarkets

Fresh fruit and vegetables are the most important category for supermarkets. Their sales account for 9.5%–12% of a supermarket’s total turnover, according to experts. Supermarkets have a high market share in the retail landscape of fresh produce: almost 88%.

The fresh food department often determines a supermarket's success, which is why it is often at the entrance of a store. An attractive presentation of fresh fruit and vegetables contributes to higher sales. Competition among supermarkets is high, and as a supplier, you must deal with strict retail standards.

Dutch consumers are also very promotion-oriented. Supermarkets often try to attract consumers with discount offers. Suppliers must adjust their prices to match these promotions.

Albert Heijn is the largest supermarket chain, with a 38% market share, followed by Jumbo. Discount formulas such as Lidl and Aldi have also increased their market share over the past years. The rest of the market is covered by Superunie, which supplies a number of member supermarket formulas, such as PLUS, Dekamarkt, Dirk van den Broek, COOP and Hoogvliet. Within this group, PLUS is the largest with 8.1% market share.

Online sales by supermarkets are also developing quickly. Dutch consumers like the convenience of home shopping, which has led to the first fully online supermarket, Picnic, which offers free delivery.

Source: NielsenIQ in Distrifood (with added data for Lidl and Aldi)

Specialised shops and street markets

The number of fresh fruit shops and street merchants is declining. Independent shops face the challenge of differentiating from supermarkets, for example in assortment, quality or price. A relatively dominant customer group for this segment are pensioners and ethnic buyers.

Another type of specialisation is organic. The Netherlands has a number of organic grocery chains, including Ekoplaza, Odin and Marqt. With 85 outlets, Ekoplaza is the largest formula. Together, these chains represent approximately 23% of all organic food sales in the Netherlands. According to the Bionext trend report 2024, these specialised outlets sold €82.5 million worth of organic fresh fruit and vegetables in 2024. This is an increase of 19.6% compared to the previous year.

Food service segment

The Dutch HoReCa (hotels, restaurants and caterers) sector is a large user of fresh products. The number of restaurants increased until 2024, but rising food prices may be slowing the rate of out-of-home consumption. Still, it is an important segment for fresh products.

The gastronomic segment remains an important market for exotic and unique fruits and vegetables. Suppliers in the gastronomic segment can be wholesalers that specialise in fresh fruit and vegetables, or cash and carry, offering a complete professional assortment.

Tips:

- Maintain high standards and provide reliable volumes to make your offer suitable for the supermarket segment. If you cannot comply with supermarket standards, differentiate with a unique product to target specialised market segments;

- Read about the Dutch market potential for fresh fruit and vegetables to understand trends that drive the development of certain segments;

- Use the translation function of your web browser to read website links in this study in your own language.

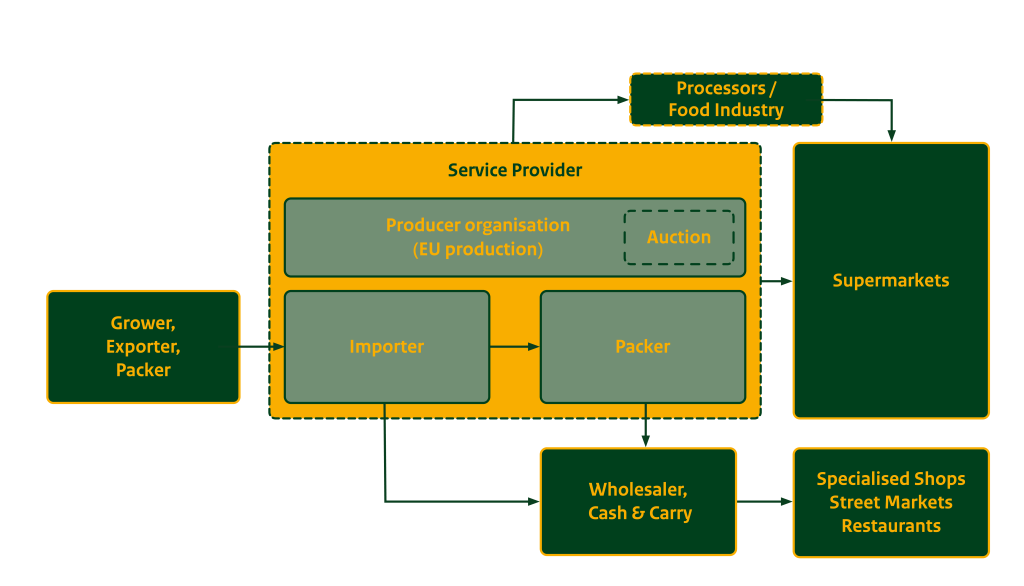

Through which channels does a product end up on the end market?

Typical channels that supply fresh fruit and vegetables on the Dutch market include grower cooperatives, international traders, service providers, wholesalers and processors such as cutters. Import, re-export, wholesale activities and added services often overlap.

Figure 6: Dutch market channels for fresh fruit and vegetables

Producer cooperatives

Producer cooperatives play an important role in the supply of fresh fruit and vegetables. These cooperatives are well organised and leave little room for foreign suppliers throughout the season. Dutch growers are capable of producing a range of fruit and vegetables, including peppers, tomatoes, eggplants, cucumbers, onions, potatoes, apples, pears, strawberries and other soft fruit. Greenhouses can extend production into colder months.

Grower cooperatives include The Greenery (Coforta), Growers United, Harvest House, OXIN Growers, ZON Fruit and Vegetables and FruitMasters. These cooperatives may be your competitors during the local season, but their commercial extensions will also purchase off-season to fulfil retailers' needs.

Importers and traders

Importers and traders in the Netherlands specialise in organising the supply chain of fresh produce, not only for the Dutch market, but also for distribution to other European countries. They manage sourcing, perform quality checks and match supply with demand. They often also work internationally.

You can find a wide range of traders and importers. The Netherlands is home to several large import companies, such as Hagé International (part of The Greenery), Bakker Barendrecht (supplier to Albert Heijn), Nature’s Pride (market leader in avocados and mangoes), Staay Food Group and Roveg.

International companies such as Greenyard and TotalProduce (now part of Dole) also have a strong presence in the Netherlands. Sub-branches include Haluco and Frankort & Koning.

Importers may have different specialisations. For example, Primeale United (formerly known as Van Oers United) is mainly focused on the import of vegetables, Olympic Fruit specialises in grapes and citrus fruit and Chiquita is a leading importer of bananas. There are also importers of exotic fruit and vegetables (such as BUD Holland), ethnic produce (such as Belimpex) and organic products (such as Eosta and OTC Organic).

Service providers

A number of fresh produce importers have expanded to become service providers to large retail chains. Several of the companies mentioned earlier, such as Bakker Barendrecht (Albert Heijn) and Nature’s Pride (Superunie), have direct relations with major supermarkets and retail purchase organisations. These companies offer (re-)packing, ripening and distribution services and become preferred suppliers to retailers.

Supermarkets usually work with supply programmes and want to buy as close to the source as possible. This gives them control and transparency in their supply chain. They usually have several fixed contracts with service suppliers, which can change per season. But they also buy additional products from other suppliers when it is convenient. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider needs.

Wholesalers

The wholesale channel in the Netherlands is characterised by spot sales and a large number of companies with different business activities.

Wholesalers are responsible for fruit and vegetables finding their way into food service, the gastronomic segment, small retailers and processors. But the wholesale channel is far from black and white. The level of integration and added services is high.

Wholesaler Van Gelder sells fresh fruit and vegetables to restaurants and cash and carry clients (Bidfood). They also manage a separate web shop for consumers. Smeding specialises in the wholesale of fruit and vegetables and works closely with cash and carry wholesaler Sligro. Kraaijeveld and De Groot International combine wholesale services with their own import channels, offering a full assortment to gastronomic wholesale clients, processing industries and retail. You can find a large concentration of traditional and smaller wholesalers at (former) wholesale markets.

Processors

Turnover in the processing segment has grown significantly in recent years. Net turnover in 2023 was €8.7 billion, almost €2 billion more than in 2022. More than half of this came from potato processing by companies such as Farm Frites. Processors that offer freshly cut vegetables and meal kits are gaining ground in response to growing demand for convenience products. Leading companies in this value chain include Vezet, Hessing, Heemskerk and Plukon Convenience.

Tip:

- Use service providers when targeting Dutch supermarkets. Their retail programmes and supply contracts may provide some stability, but remember that supermarkets maintain strict rules and do not allow you or your buyer to change supply conditions.

What is the most interesting channel for you?

Importers and traders manage the supply chain. They are your most likely channel to enter the Dutch and European markets. Which importer is most suitable for your company depends on your product, level of organisation and ambition.

As a foreign supplier, you should check how a business partner operates and on what payment terms. Importers that offer fixed prices offer more security than those with a minimum price guarantee (MPG). You could also select a partner that is good at representing your company on a commission basis.

Finding potential buyers in the Netherlands is not difficult. Most are easy to find online and are very accessible. Finding the right one can be more challenging. Many buyers have well-established relations, mostly with medium and large suppliers that are directly involved in agricultural production. Do not expect every buyer to be interested in new suppliers.

Take your time to build relationships. To supply large buyers, service suppliers and retailers, you must offer reliable quality and comply with strict requirements on certification and residue limits. For exotic and niche fruits and vegetables, you can best approach specialised importers.

The companies that are most eager to buy your product are not always the most reliable. These ‘quick traders’ may provide you with an interesting profit on the spot market, but do not always invest in a structural business relationship. This means they are less motivated to solve an issue together, making them a bigger risk for your company.

Tips:

- Familiarise yourself with Dutch buyers by visiting the most relevant trade fairs in Europe: Fruit Logistica in Berlin and Fruit Attraction in Madrid. Dutch companies are well represented there;

- Avoid doing business with partners with similar end clients. Despite the size of the Dutch fresh fruit and vegetables industry, many companies know each other and compete for the same end clients;

- Find Dutch buyers of fruit and vegetables on the Fruit Logistica exhibitor list or in the member list of the Fresh Produce Centre (not all members are published);

- Read CBI's tips for finding buyers on the European fresh fruit and vegetables market for more tips.

3. What competition do you face on the Dutch fresh fruit and vegetables market?

Competition is fierce in the Netherlands, but there are always opportunities for professional suppliers that have interesting, compliant products. To maintain a steady presence on the market, expect to work closely with importers or integrate your supply chain.

Which countries are you competing with?

Dominant suppliers to the Netherlands include Peru and South Africa, offering a wide range of fresh fruits. They are followed by Brazil (mangoes and melons), Colombia (bananas and avocados), Chile (avocados, blueberries, apples, table grapes and kiwifruit) and Costa Rica (bananas and pineapples).

Table 3: Main non-European origin countries for popular fruits with the highest Dutch import volume in 2024, in 1,000 tonnes

| Avocados | Bananas | Table grapes | Oranges | Mangoes (incl. mangosteen and guava) | Blueberries & other Vaccinium berries | |

|---|---|---|---|---|---|---|

| Total x1,000 tonnes | 388 | 1147 | 498 | 454 | 182 | 119 |

| #1 | Peru (119) | Panama (220) | South Africa (171) | South Africa (175) | Brazil (96) | Peru (53) |

| #2 | Colombia (66) | Costa Rica (224) | India (94) | Egypt (159) | Peru (32) | Chile (19) |

| #3 | Kenya (44) | Ecuador (250) | Peru (77) | Zimbabwe (13) | Ivory Coast (10) | South Africa (7) |

| #4 | South Africa (39) | Colombia (84) | Egypt (34) | Peru (8) | Dominican Republic (10) | Morocco (3) |

| #5 | Chile (28) | Dominican Republic (48) | Chile (32) | Uruguay (7) | Burkina Faso (6) | Zimbabwe (2) |

| #6 | Morocco (16) | Guatemala (45) | Namibia (22) | Morocco (5) | Senegal (3) | Serbia (2) |

Source: ITC Trade Map (July 2025)

Source: ITC Trade Map

Peru: Productive powerhouse

Peru is the leading supplier to the Netherlands, with a total value of €1.1 billion in 2024. It is the largest supplier of avocados and blueberries. Peru also has a competitive position in the Dutch and EU markets for table grapes, mangoes, (organic) bananas, sugar snaps, mandarins and asparagus.

The growth of Peruvian fresh exports has been incredible in the past decade. Major irrigation projects have been developed, for example near the villages of Majes and Olmos. These have made it possible for companies to increase production of several fruits. Strong supply from Peru regularly results in lower prices in Europe. This makes it difficult for other countries to compete in the same season.

Peru has proven its capacity to produce large volumes and good quality for the European market. Despite the distance, shipping lines manage to reach the port of Rotterdam in two or three weeks.

The main challenges in Peru include water stress and the influence of El Niño. Dutch buyers often avoid buying from dry regions if water resources are not sustainably managed. On the other hand, companies such as Agronor Perú benefit from a dry climate. They can produce organic bananas, which they sell to Agrofair in the Netherlands.

South Africa: Stable counter-seasonal supplier

Europe is an important export destination for South African fruit and vegetable exporters. South Africa's opposite production season from Europe's makes it ideal for importers to source counter-seasonal products.

Europe imported more than €3 billion of fresh fruit and vegetables from South Africa in 2024. The Netherlands accounted for 29% of that value. South Africa is the Netherlands’ main supplier of table grapes and citrus fruit. They also compete in a variety of other products, including stone fruit, sweet potatoes and mini vegetables.

Oranges are by far South Africa’s biggest citrus type, accounting for roughly 60% of citrus exports. The most-exported variety is the Valencia orange, followed by the Navel variety. For most fruits, the cultivation area has been more or less stable. There has been a gradual growth in the planted area for lemons, midseason Valencia oranges, nectarines and cherries. The area of blueberry cultivation has also increased significantly, but it was stable from 2020 to 2023.

South Africa’s success can be attributed to large, professional companies and increasing yields. South African growers have many years of experience and are at the forefront of implementing new technology. Precision farming with drones and artificial intelligence helps farmers produce more with less water and land. This advantage will secure South Africa’s position in fresh exports.

Tip:

- See Fruit South Africa's Key Fruit Statistics 2022/23 to see in which products South Africa excels.

Brazil: Third-largest supplier to the Netherlands

Brazil is one of the largest exporters of fresh fruit to the Netherlands. This mainly involves mangoes, melons, limes and table grapes.

The country’s size and climate zones are favourable for Brazilian farms. However, they do not depend as much on exports as Peru or South Africa. With well over 200 million inhabitants, Brazil has a large domestic market. Brazil is also positioning itself as a large fruit producer internationally. Over time, Brazil has managed to increase its supply to the Netherlands (and Europe), overtaking the volumes of traditionally large trade partners Chile and Costa Rica.

Brazilian companies have no problem adapting to export markets in Europe, such as the Netherlands. For example, Tommy Atkins mangoes have made way for fibreless varieties such as Palmer and Kent. New, tasty grape varieties have been introduced to address European and international preferences.

Colombia: Year-round avocado producer

Colombia has traditionally been one of the main suppliers of bananas, but it has also increased its exports of other fruits to the Netherlands.

Growing international demand for avocados has led many producers (small and large) to shift towards avocado production. Avocados have become the second-most exported fruit. With its favourable geographical location, Colombia has year-round production and relatively easy access to the European and North American markets. The main challenge is the national infrastructure for moving avocados from the field to the packing house and port. Most avocados go to Europe, with the Netherlands being the largest buyer.

Although bananas and avocados are currently the main products traded, Colombia also finds Dutch buyers for plantains, limes and exotic fruit (such as passion fruit and physalis).

Tips:

- Study supply cycles as well as seasonal competitors and check if your product could fill a supply gap. Seasonality is one of the main aspects defining competition. Dutch importers' websites are often very transparent about the origin of their product and sometimes even show calendars;

- Use the ITC Trade Map or Access2Markets' statistics function to find the main suppliers to Europe for your product.

Which companies are you competing with?

Dutch importers and retailers look for suppliers that can guarantee a reliable supply with an attractive quality-price ratio. Large companies are interested in the Netherlands due to its logistical and commercial strengths and invest in partnerships or a physical presence. As a supplier, you are in the best position to compete when you have the means to invest in quality production.

Camposol – Peru

Camposol, one of the largest producers in Peru, invested in a commercial office in the Netherlands to strengthen its presence in Europe. This makes them less dependent on traditional import channels.

For most export companies, such an investment is out of reach. It is difficult for them to compete with these integrated supply chains. On the other hand, foreign sales offices also need to ensure a year-round supply. They often start buying from other origins when the parent company is unable to supply.

As an exporter, you will see a growing number of integrated companies in the future. The best way to deal with this is to look for strong partnerships and joint ventures yourself. In the Dutch fresh produce sector, competition and partnership are closely related.

SRCC – South Africa

Size and capital are incredibly important in setting up a successful export business. Sundays River Citrus Company (SRCC) specialises in the cultivation of citrus fruit with nurseries and packing lines, and has a capacity of 9 million cartons per season. The company claims to have become the largest grower, packer and exporter of South African citrus. The integration of nurseries, production, packing and export has given it a strong position to negotiate with supermarkets in the Netherlands.

SRCC established a long-term relationship with Dutch retailer Albert Heijn. This led the Albert Heijn Foundation to invest in training facilities for farmers and employees. For Albert Heijn, SRCC can deliver large volumes with the right balance of quality and price.

Tips:

- If you have difficulty competing as a small supplier, look for partnerships in your country to increase your production and negotiation power;

- Make sure to gain access to excellent packing and logistical services. You cannot have weak links in your supply chain. Contract an experienced third party if you do not have your own facilities;

- Define your strengths and competitive advantage as a company well before entering the Dutch market. You can differentiate on different levels, for example with services, varieties, quality or distance to market, but you need to have a focus.

Which products are you competing with?

Domestic and European products may compete with imports from developing countries. There is a growing preference for more sustainable and locally produced fruit and vegetables across Europe. In the Netherlands, this will be most notable with Dutch products that are in season. Large-scale greenhouse production can extend the domestic season.

Local products that may compete with imports from developing countries include apples, pears, strawberries and other soft fruit, but most competition will come from greenhouse vegetables such as tomatoes, sweet peppers, aubergines and many others.

Competition from local products will be lowest during the Dutch winter period. This is when the consumption of imported fruit and vegetables is highest.

Tip:

- Find opportunities for products with limited production in the Netherlands or European countries. If you want to supply products that are also produced domestically, make sure you can produce outside the local season and preferably close to European markets.

4. What are the prices of fresh fruit and vegetables on the Dutch market?

Any Dutch trader will tell you that the market determines the price of the product. In the Netherlands, the price is determined not only by the Dutch market, but also by demand in other European markets.

In the case of very exotic and niche products, import is small and mostly demand-driven. For other fruit and vegetables, availability strongly influences price. The main consumed products, such as avocados, table grapes and oranges, usually have a programmed supply. This sometimes offers better price stability. When there is oversupply, large retail chains can plan additional promotions to push more products into the market.

Dutch importers generally say they work with a profit margin of at least 8% on the sales price, excluding import and handling costs. This can be higher in practice. According to retail specialists, supermarkets' gross margin on fresh fruit and vegetables is 35% on average. As an exporter, you need to be aware that there is not always a direct relationship between trade prices and consumer prices.

Dutch consumer prices for fresh fruit and vegetables have increased, especially in the past two years (2023–2024). The increase has stayed below the general rate of inflation for food prices. Compared to the European average, prices for fruit and vegetables in the Netherlands were 4.9% lower in 2024.

Prices will continue to fluctuate according to available supply. In the long term, prices will continue to rise mainly due to climate change, increasing production costs and stricter sustainability requirements from buyers.

Source: Statistics Netherlands (CBS)

Table 4: Price-level index for fruit and vegetables for a selection of European countries (EU = 100%)

| Country/region | Price-level index |

|---|---|

| Switzerland | 137.0 |

| France | 119.2 |

| Germany | 103.0 |

| Belgium | 100.1 |

| European Union (EU-27) | 100.0 |

| Spain | 95.8 |

| Netherlands | 95.1 |

| Poland | 88.7 |

Source: Eurostat

Tip:

- For accurate prices, contact your trade contacts in the Netherlands. Consumer prices can be easily found on the websites of different supermarkets, such as Albert Heijn, Jumbo, PLUS, and Ekoplaza for organic produce.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research