Entering the European market for fresh green beans

Europe is an important market for fresh green beans, offering opportunities for exporters who can meet strict standards and organise reliable supply chains. Demand is driven by both common beans, consumed widely and sold in bulk, and fine or extra fine beans, positioned as premium products in retail and food service. However, exporters face challenges such as compliance with pesticide residue limits, sustainability requirements and competition from local and regional suppliers. Success depends on quality, certification and strong partnerships with European importers and service providers.

Contents of this page

- What requirements and certifications must fresh green beans meet to be allowed on the European market?

- Through which channels can you get fresh green beans on the European market?

- What competition do you face on the European fresh green bean market?

- What are the prices of fresh green beans on the European market?

1. What requirements and certifications must fresh green beans meet to be allowed on the European market?

Fresh green beans must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant, which provides an overview of export requirements (use code 070820 for green beans).

What are mandatory requirements?

If you want to export green beans to the European Union (EU), your product must meet strict food safety and quality requirements. Think of pesticide limits, contamination control, packaging and labelling. Below you will find a summary of the main legal points to keep in mind when exporting green beans.

Control of pesticide residues

The EU has rules about how much pesticide is allowed on food. These are called maximum residue levels (MRLs) and they are set under Regulation (EC) No 396/2005. If your green beans contain more pesticide than allowed, they can be banned from entering the EU market. This is a serious issue, as green beans imported into the EU regularly fail to meet MRLs. In 2024 alone, this happened to 28 consignments from Kenya, 8 from Sri Lanka, 4 from Bangladesh, 3 from India and 1 each from Egypt, the Dominican Republic and Senegal.

Such consignments that do not comply with European food legislation are reported through the Rapid Alert System for Food and Feed (RASFF). This tool allows food-safety authorities to quickly exchange information on health risks associated with the food and to take immediate action to prevent the risk. One such example of reports of overly high levels of pesticide residues is this alert on hexaconazole in green beans from Kenya.

A high frequency of non-compliance can result in more official controls when green beans are imported. This leads to higher import costs. Regulation (EU) 2019/1793 dictates that 10% of the imported beans from Kenya need to be checked. Yardlong beans from Sri Lanka and India are under even stricter control, with a frequency of checks of 30% and 50% respectively. Yardlong beans from India must also be accompanied by an official certificate with the results of a pesticide analysis.

While buyers in most EU countries require 100% of the EU MRL threshold values, several retailers in EU member states such as the United Kingdom, Germany, the Netherlands and Austria require 50% to even 33% of the EU threshold MRLs. Coupled with these lower MRL requirements, such retailers also limit the numbers of active substances to as few as 3.

Tips:

- Check the EU Pesticide Database with the product code 0260010 (beans with pods). This helps you to see what limits apply to green beans.

- Apply Integrated Pest Management (IPM). It helps keep crops healthy with fewer pesticides by using natural solutions.

- Stay alert to changes in Regulation (EU) 2019/1793, as the European Commission reviews and updates products and frequencies twice a year.

Control of contaminants

Contaminants are unwanted substances that can get into green beans during farming, processing or packaging. The EU controls this under Commission Regulation (EU) 2023/915.

For green beans, the main concern are the heavy metals lead and cadmium, for which the maximum allowed level is 0.10 mg/kg and 0.020mg/kg (fruiting vegetables, measured in fresh weight after cleaning).

Plant health and phytosanitary regulation

Green beans must be inspected before they can be shipped to and enter the EU. This is required under Regulation (EU) 2019/2072. Your beans needs a phytosanitary certificate from the plant health authority in your country.

This certificate confirms that:

- the beans were inspected properly;

- they are free from serious plant pests; and,

- they meet the EU plant health rules.

Since the United Kingdom (UK) is no longer part of the EU, exporters must follow the cpuntry’s separate rules under the Border Target Operating Model (BTOM). Guidance for the import of plants and plant products is available on the GOV.UK website.

Typical diseases for green beans are common bacterial blight, bacterial brown spots, halo blight, rust, anthracnose and alternaria leaf spot. Pests such as aphids, trips, whiteflies and spider mites are another concern.

Tips:

- Contact your country’s National Plant Protection Organisation (NPPO) to get the certificate.

- See Annex V of Regulation (EU) 2016/2031 to view a sample certificate.

- Monitor and manage pest risks using resistant varieties, protected horticulture, drip irrigation and integrated pest management (IPM) practices.

- Conduct thorough pre-shipment inspections to minimise the risk of rejections at EU entry points.

Product quality

The minimum quality requirements are available through UNECE standard FFV-06 on the marketing and commercial quality control of beans. Green beans must be intact (with limited stalk-end damage), sound, clean, fresh in appearance and free from parchment, pests, pest damage, abnormal moisture, foreign matter and any abnormal smell or taste.

The condition of the products must be such as to enable them:

- to withstand transport and handling; and,

- to arrive in satisfactory condition at the place of destination.

Figure 1: Extra-fine beans from Kenya in a punnet, available in a Dutch online store

Source: GloballyCool, August 2025

European buyers generally require Class I green beans, which must be of good quality, typical of the variety and free from major defects. ‘Extra’ Class beans must be superior in quality, with a tolerance of 5% for Class I beans. Class I allows up to 10% Class II beans.

Table 1: Classification and specific requirements for ‘Extra’ Class and Class I

| ‘Extra’ Class | Class I |

|---|---|

Beans in this class must be:

| Beans in this class must be:

|

Source: UNECE standard FFV-06 concerning the marketing and commercial quality control of beans

Tips:

- Always meet agreed quality standards. Even small deviations can lead to buyer claims.

- Pay attention to product presentation. Well-sorted and nice packing is more attractive and likely to fetch higher prices.

- Read UNECE standard FFV-06 concerning the marketing and commercial quality control of beans and the OECD standard for beans for more details on quality standards and permitted tolerances.

Sizing, grading and uniformity

Green beans must be uniformly graded by origin, variety, quality and size. The visible part of the package contents must be representative of the entire contents. Needle beans require precise sizing into very fine, fine or medium; other beans are graded by pod width. Table 2 gives the sizes as included in the UNECE standard. European buyers use slightly different sizing classes, with extra-fine beans being 5-7 mm, fine beans 6-8mm and common beans 9-11mm.

Table 2: Provisions concerning sizing

| Classification for needle beans | Size shall not exceed |

|---|---|

| Very fine | 6 mm |

| Fine | 9 mm |

| Medium | 12 mm |

Source: UNECE standard FFV-06 concerning the marketing and commercial quality control of beans

Up to 10% may fall outside the size requirements if they fall into the next lower class.

Packaging

Green beans are highly perishable, especially fine beans, and require tailored packaging:

- Common beans are packed loose in 4-5 kg crates or boxes. Moroccan exporters of snap beans, for example, use 5 kg wooden crates with netting and separators in the middle for an attractive presentation.

- Fine beans, sold as a premium product, need very careful sorting (calixing). They come in different presentations, as both the stem (‘trimmed’ or ‘top cut’) and tail (‘tailed’) end can be removed. In the UK, for example, fine beans are often trimmed. Tailing is done mostly for aesthetic reasons or to ensure uniform cooking, and such top-and-tail cut green beans are also referred to as TT beans. They are typically packed in 2-5 kg boxes with film-covered punnets (125-250 or 500 grams) or (hot-needle) perforated polyethylene bags. Modified atmosphere packaging (MAP) offers the best protection, but has not been very successful so far due to condensation causing the fine beans to rust.

Tips:

- Always discuss the specific requirements for size and packaging with you buyer.

- Make sure your green beans are well packed and maintain a perfect cold chain to preserve quality and freshness European retailers are very much focused on product shelf life.

Handling and transport

Fine beans are picked by hand and carefully checked to make sure that they are uniform and of good quality. Harvesting usually takes place early in the morning to avoid damage from the heat. Right after picking, beans should be cooled quickly, with either water (hydrocooling) or air (forced-air cooling), to remove heat from the field and keep the beans fresh.

How beans are transported depends on the type and the country of origin. Regular green beans are often shipped by sea, road (for example, from Morocco and from Senegal) or air. Extra fine beans are usually flown in from countries like Kenya or Senegal, as they spoil quickly.

To keep green beans fresh and meet buyer expectations, it is important to use a well-organised cold chain from the moment of harvest to the time of delivery. This means that the beans should be cooled right after harvest and transported at a temperature of 5-7°C, with high humidity (90–95%). Temperatures below 4°C can cause damage to the beans, while warmer conditions can lead to faster spoilage. Careful sorting and sizing also help to improve quality. A perfect cold chain is even more critical when applying MAP.

Tips:

- Learn more about handling green beans after harvest in the produce factsheet from the Postharvest Research and Extension Center.

- Read the in-depth Review of best postharvest practices for fresh market green beans by El-Mogy, Mohamed & Kitinoja, Lisa (2019) on ResearchGate to get a better understanding of how to handle green beans for export.

- Organise your exports carefully. Read more about for example payment and delivery terms in CBI’s tips to organise your exports.

What additional requirements and certifications do buyers often have?

In addition to the legal requirements, European buyers often have other demands. These include, for example, GLOBALG.A.P. certification and compliance with social and environmental standards.

Certification

The most common certification programme for fresh produce, including green beans, is GLOBALG.A.P. Integrated Farm Assurance (IFA). This is proof to buyers that the beans are grown safely and responsibly. For packhouses, buyers may ask for the food-safety management system certification module GLOBALG.A.P. Produce Handling Assurance.

Sustainability compliance

European buyers are placing more emphasis on social and environmental responsibility. Exporters are often asked to follow a buyer’s code of conduct or to comply with recognised third-party standards. Well-known options include GLOBALG.A.P. GRASP, which checks worker welfare on farms, and Sedex/SMETA, which improves transparency and audits labour and environmental practices in supply chains. Some retailers also apply their own standards, such as Tesco Nurture.

Tips:

- Implement at least one environmental and one social standard from the Basket of Standards in the SIFAV Sustainability Initiative for Fruit and Vegetables.

- Consider sustainable packaging options for green beans, such as biodegradable plastics.

- See CBI’s buyer requirements for fresh fruit and vegetables and the tips for doing business with European buyers for more information on legal and buyer requirements.

Organic certification

Organic certification can help differentiate your beans and increase their market value, but producing and exporting fine green beans organically is challenging. Air freight is also less accepted in organic channels, due to its carbon footprint.

To sell organic produce in Europe, you must comply with Regulation (EU) 2018/848. This imposes strict residue checks, clear procedures for non-compliance and strong border and group certification controls. Exporters must be certified by an EU-approved control body listed in the Organic Farming Information System (OFIS) and demonstrate full traceability from farm to final product, often with extra audits.

Ethical certification

Smallholder production of green beans naturally draws attention to social aspects such as livelihoods and working conditions. However, consumer-facing labels like Fairtrade are still uncommon for this product, as market support for such investments is limited. Even so, some specialised European companies such as FV SeleQt in the Netherlands and Flamingo group International in the UK, do supply fair-trade certified beans to meet niche demand.

Tips:

- Strive for residue-free beans and certify your production as organic only if possible. This will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the actual list of control bodies and authorities to see active certifiers in your region.

- Explore the possibility for social actions to make your product more socially responsible. For example, think about living wage for workers, education and working conditions on the farm. Communicating these actions sometimes mean more in the market than a label.

2. Through which channels can you get fresh green beans on the European market?

The majority of green beans are sold by supermarkets, while food service is an important segment for fine beans. As a supplier you can aim for a retail supply programme or find specialised buyers who wholesale fine bean varieties.

How is the end-market segmented?

The green bean market can be segmented in different varieties, from common green beans to more exclusive and niche varieties. Each market channel has its own preferences in bean variety, quality and packing.

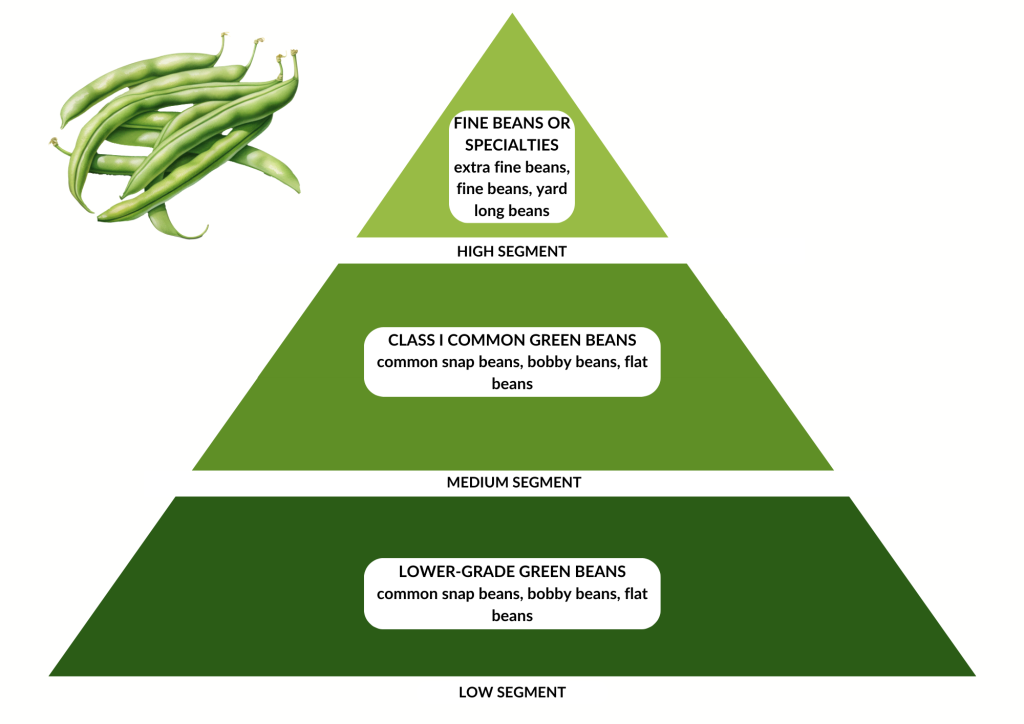

Figure 2: Market segments for green beans in Europe

Source: GloballyCool, August 2025

High segment

The high segment is made up of fine and extra-fine beans, which are always imported from outside Europe (mainly from Africa) and sold as a premium product. They are carefully sorted, often top-cut or top-and-tail cut and neatly packed (‘soldier-packed’) in small punnets or trays. Their short shelf life, delicate texture and superior taste make them popular with the food service industry and high-end supermarkets.

Niche products like yardlong beans imported from Asia also belong in this segment, catering to ethnic markets and Asian cuisine.

Average prices are considerably higher, but consumers pay for freshness, exclusivity and presentation.

Medium segment

The medium segment includes both common green beans (bobby beans and flat beans) and some speciality beans like wax beans (butter beans, or haricots beurre in French). Wax beans are especially popular in France, where retailers like Carrefour and Intermarché carry an extensive selection.

Green beans in this segment provide good quality and consistency at a fair price, with packaging and presentation that balance practicality and appeal. This segment is widely available in supermarkets, where beans are offered loose in bulk, prepacked in larger bags or as part of seasonal promotions.

Low segment

The low segment consists mainly of bulk common beans sold through street markets and lower-priced retail channels such as ethnic retail chains. Beans in this segment are typically produced locally or sourced from nearby European countries. While the quality is generally Class I, there can also be offers of lower-grade beans that do not meet the same standards. These are often sold at discounted prices on markets or supplied to the processing industry for cutting, freezing or canning. The low segment attracts the largest consumer group thanks to its affordability, but it is more vulnerable to price competition and quality fluctuations.

Tip:

- Focus on taste, quality and packaging to access more market segments.

Through which channels do fresh green beans reach the end market?

Green beans enter Europe through different trade channels. The most dependable option for exporters is to work with importers or service providers who supply directly to supermarket programmes. Importing wholesalers are also a relevant channel because they supply fine beans to the food service sector. Take into account that many specialised importing companies have integrated their business with producers.

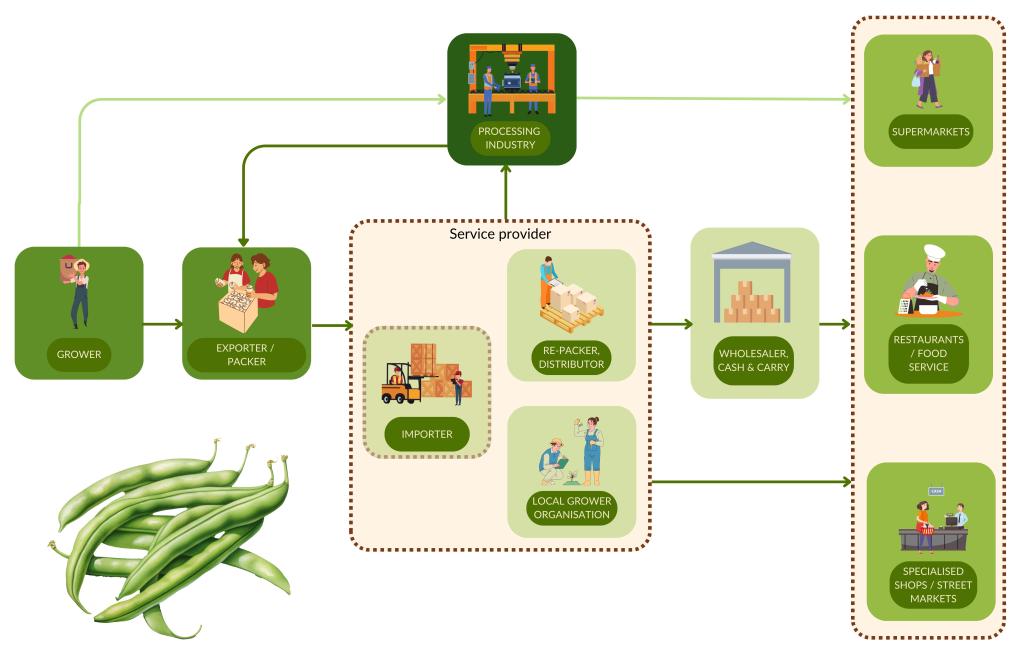

Figure 3: European market channels for green beans

Source: GloballyCool, August 2025

Importers

Importers play a central role in the European distribution of green beans. They understand the diverse requirements of end clients and can supply different channels, from wholesalers to supermarkets. Specialised importers often integrate their supply chains to ensure consistent supply and reliable product quality.

Examples of specialised importers include:

- X-Fresh (Netherlands) – Supply of haricots verts from Kenya, Ethiopia and Rwanda.

- FV SeleQt, (Netherlands, part of the Best Fresh Group)– Production in Zimbabwe, Kenya, Uganda and Guatemala; specialised in legumes, including fresh beans.

- Elbe Fruit (Germany) – Importer with a strong focus on peas, but also smaller volumes of beans.

- Jami Trading (Netherlands) – Specialised in sourcing beans from Kenya.

- Sai Trader (Switzerland) – Imports fresh vegetables, including green and yardlong beans, directly from farmers across Asia, the Middle East and Africa.

Specialised importers typically have a smaller range than the generalists, such as the exotics importer Satori (Netherlands). Working with specialists is an effective way for exporters to access the European market, especially in premium segments like fine beans, where quality, certification and year-round availability are critical.

Service providers

Successful suppliers to supermarkets act as full-service providers. They align their sourcing, packing and even branding to the needs of retailers. Supermarkets prefer to work with supply programmes and want to buy as close to the source as possible for greater control and transparency. They demand year-round volumes, reliable quality and partners who can manage the logistics for them.

Companies that succeed in this space often combine local production with multiple import sources, ensuring continuity throughout the year. For example:

- Fresh2you (Netherlands) – Own production of snap beans and fine beans in Senegal.

- Minor, Weir and Willis Ltd (MWW, United Kingdom) – Integrates local production with imports and specialises in dwarf/green beans, runner beans, broad beans and podded peas.

- Scherpenhuizen (recently took over Kamps) – Uses its cultivation base in Europe and Africa to supply beans year-round, offering bobby beans from Europe and north Africa as well as fine beans from Morocco, Senegal, Kenya and Ethiopia. With all processes in-house, Scherpenhuizen provides supermarkets with both reliability and convenience.

Processors

The processing sector is important for beans, with companies like Bonduelle, Coroos, d’Aucy, Ardo and Greenyard Frozen focusing on freezing and canning. Other players, like Plukon Food Group, focus on fresh meals. But this channel is limited for non-European exporters, as processors buy beans grown nearby to ensure freshness, reduce transport costs and avoid long supply chains.

Wholesalers

Green beans from outside Europe also reach the European market through wholesalers on the spot market. Such companies can be based in hubs from where they resell to other wholesalers (domestic or EU-based), cash-and-carry stores, market stallholders, ethnic stores, restaurants, hotels, catering companies, central kitchens, supermarkets and even schools. For example, the Marché de Rungis in Paris hosts green bean importers like AMS-Pure and exotic vegetables importers such as Moorea and Novagrim.

Rungismarket (in France), Mercabarna (Spain), Grossmarkt Hamburg (Germany), SogeMi Mercato Agroalimentare Milano (Italy) and New Spitalfields Market (UK) all are such hubs.

Tips:

- Choose the right buyer type for your business. Retailer programmes offer stability but also demand the highest levels of certification and compliance. Wholesalers may be a better fit for smaller grower groups or for the supply of exclusive varieties to gastronomy and food service.

- Explore European wholesale markets to learn what types of beans are offered, how they are presented and which buyers are active.

What is the most interesting channel for you?

Choosing the most suitable channel for your green beans depends on your profile as a supplier.

The best way to arrange a reliable supply chain is by working together in supply programmes with major service suppliers or integrate your production with European partners. This is doable if you have a large and high-quality production volume. Several of the import companies with cultivation projects in Africa manage their own production with western investment and management. These integrated supply chains can make it difficult for other producers and exporters to enter the main channels.

For exporters working with many smallholders, entering large retail chains is even more challenging. Each grower must be certified and tested, creating heavy administrative work that is often underestimated. If competing in the main supply chains is not realistic, focus instead on reliable traders and importing wholesalers. To build a sustainable business, choose buyers with steady demand and fair purchasing conditions.

Tips:

- Visit trade fairs to find buyers and to stay informed about market trends. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

- Read the CBI Tips for doing business with European buyers of fresh fruit and vegetables and learn how to select reliable business partners in Europe.

3. What competition do you face on the European fresh green bean market?

Competition in green beans comes mainly from the African continent. As well as off-season supply of regular bobby and flat beans, it satisfies year-round import demand for fine beans from integrated companies that manage to export high-quality green beans.

Which countries are you competing with?

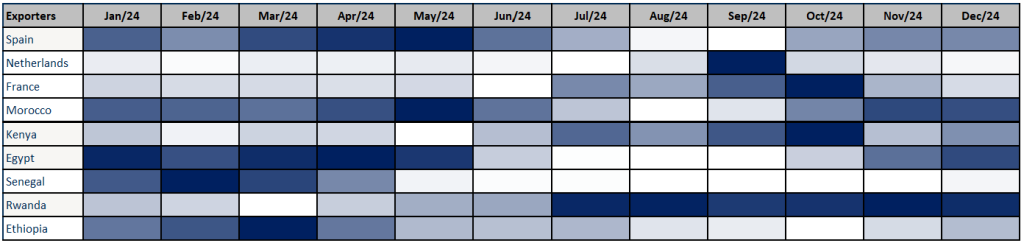

The European production season runs roughly from mid-June to mid-October (weeks 26-40). The counter-season for bobby beans and flat beans from (mainly) Northern Africa starts in October/November and lasts until June. Morocco is the largest supplier of these common beans, with its supply dominant in weeks 40-52 and weeks 18-26, while Senegal and Egypt export large volumes to Europe in weeks 1-17 and 44-22 respectively.

Figure 4: Indicative supply calendar for green beans to Europe, based on 2024 import values

Source: GloballyCool, September 2025

Fine haricots verts are generally imported all year round from Kenya, with additional supply from Senegal and Morocco. These countries have favourable climates to grow high-quality fine beans, but they sometimes also have an irregular reputation in post-harvest and handling.

Source: UN Comtrade, August 2025

*The EU, Switzerland, Norway and the United Kingdom.

Morocco dominates fresh green beans supply to Europe

Morocco is the leading supplier of green beans to the European market. Its exports stayed fairly strong overall between 2020 and 2024, despite a reduction in 2022. They reached a high point in 2021, at 154,000 tonnes, dropped slightly in 2022 and 2023 and then rose to 134,000 tonnes in 2024. With different regions and greenhouses, growers in Morocco can produce green beans all year round. However, the largest volumes of common green beans come to Europe in weeks 40-52 and 18-26.

Much of the Spanish production of green beans has moved to Morocco due to the labour costs and limitations in the production climate. Among the companies that moved production to Morocco is AgroAtlas, a major Spanish supplier of beans to European supermarkets.

Morocco mainly produces common snap beans: flat beans and bobby beans. Morocco also grows haricots verts, but this remains a smaller segment compared with the fine beans supplied by Kenya, Egypt or Rwanda. Spain is the main destination for Moroccan beans (mainly flat beans), while the Netherlands imports for re-export across Northern Europe. France imports both flat beans and finer varieties.

The main strength of Morocco is its proximity to the European market. Road transport takes two or three days up to the Perpignan wholesale market, an important hub in France for fresh produce from the south. This makes Morocco competitive in price and the ideal country to extend the European season.

Kenya remains the benchmark for fine and extra fine haricots verts

Kenyan exporters have become specialists in value-adding activities such as sorting, trimming and pre-packaging beans for air shipment to Europe. Supply comes from a mix of large commercial growers and many smallholders, with the United Kingdom as the top destination (50% share), followed by France and the Netherlands.

Kenya’s diverse climate zones and altitudes allow year-round production, although heavy rains during the rainy season can disrupt open-field crops. Challenges include inconsistent cold-chain management in value chains with many smallholders, as well as findings of excessive pesticide residues, which European buyers view critically.

Exports to Europe declined from 26,000 tonnes in 2020 to 21,000 tonnes in 2024, despite a brief rebound in 2021. Key reasons are stricter compliance demands, rising transport costs and competition. Morocco and Egypt now compete strongly on price, while Rwanda is positioning itself on quality and compliance.

Despite these pressures, Kenya is likely to remain a leading exporter thanks to low labour costs and strong expertise in fine bean cultivation and processing. Still, competitors with more stable climates may gain ground, especially as air freight faces growing environmental resistance. For the most delicate extra fine beans, however, no viable alternative transport option exists today.

Senegal: reliable quality with strong European links, but a short season

Senegal is among the main suppliers of green beans to Europe, although export volumes have fluctuated. Shipments peaked at 21,000 tonnes in 2021 and 2022, before dropping to 15,000 tonnes in 2024 – mainly due to lower exports to the Netherlands. Exports are largely driven by a handful of major producers closely tied to European companies like Scherpenhuizen (Netherlands), SCL by Barfoots (UK) and Bakker Barendrecht, which supplies Dutch retailer Albert Heijn.

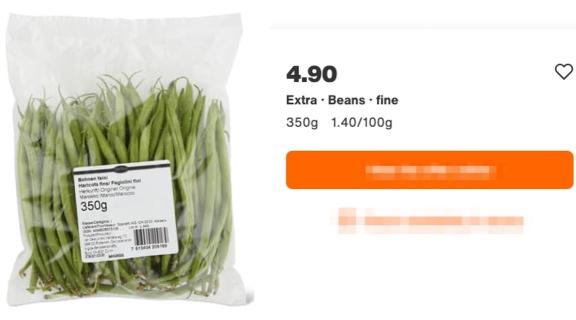

Figure 6: Fine beans from Senegal available in a Dutch mainstream supermarket

Source: GloballyCool, September 2025

The production climate is ideal for counter-seasonal bobby beans, while fine beans are also cultivated for the European market. Most beans are shipped in reefer containers, although road transport is also an option. The main destinations are the Netherlands, France and Germany, with France showing the strongest growth (CAGR 8.4%).

Senegalese beans are highly valued for their quality and consistency, largely due to the integrated supply chains of leading exporters. However, the production season is relatively short (weeks 1-17) and many growers diversify into other crops to remain profitable year-round.

Egypt: competitive on price and logistics

Egypt exports beans to Europe both by air and by sea. Growers can easily reach different European markets, such as the UK, Italy, Germany, France and the Netherlands, all of which are significant for Egyptian beans. The country is very price competitive when it comes to common snap beans, but it is less well-equipped to produce superfine or extra-fine beans.

Egypt’s exports of green beans to Europe stayed small and unpredictable between 2020 and 2024. After a brief increase in 2021 to 18,000 tonnes, exports dropped and stayed around 14,000 tonnes. This shows that while Egypt has good logistics and low costs, it still plays a smaller role in the European market, especially compared with Morocco and Kenya.

The growth in 2021 came mainly from higher demand in the UK, where Egypt – along with Morocco – partly replaced European-grown beans. Yet the decline in later years suggests that Egypt has not secured a stable position in the UK market.

Overall, Egypt offers cost advantages and good logistics, but it continues to play a secondary role in the European green bean trade compared to larger suppliers like Morocco and Kenya.

Tip:

- Check if your country has a trade agreement with the European Union or the United Kingdom. A favourable import tariff will make your product economically more attractive to buyers. The current main exporters all have favourable tariffs.

Which companies are you competing with?

In the green bean trade, you are competing with companies that have strong ties to the European market. Your main competitors are exporters from Morocco, Kenya, Senegal and Egypt. Below are brief profiles of selected companies from these countries.

Key Moroccan exporters: Nature Growers and Fructimoor

As one of the top suppliers of green beans to the European market, Morocco is home to several companies that play a key role. Nature Growers is a subsidiary of AgroAtlas and specialises in producing and exporting high-quality fresh vegetables, such as green beans, peppers and courgettes (zucchini).

Established in 2013, the company operates on about 400 hectares of land in Morocco, using both greenhouses and open fields. With certifications like GLOBALG.A.P. and BRC, Nature Growers maintains high production standards. The company mainly exports to the UK and benefits from AgroAtlas's strong logistics network.

Fructimoor is another growing Moroccan exporter, focusing on vegetables like green beans, tomatoes and peppers. The company operates mainly in the Souss region and ensures high-quality products by working closely with farms. Fructimoor manages the entire supply chain, from growing the vegetables to distributing them. As Fructimoor expands its market reach, it continues to strengthen its position in the fresh produce industry.

Vegpro Kenya Ltd

The Vegpro group has integrated the production of flowers, fresh produce and logistics. The company has its own freight forwarding business, shipping around 200 tonnes of vegetables per week.

Vegpro Kenya Ltd is specialised in cultivating and preparing vegetables such as green beans for export, in particular to the United Kingdom. It is an example of a large-scale operation with big farms and several outgrower schemes. The company focuses strongly on sustainability, using modern farming methods and strictly following strict international certification schemes like GLOBALG.A.P. and Fairtrade.

A large and integrated company has the advantage of scale, but can also invest in the post-harvest process and manage product quality.

SCL – Senegal

The Société de Cultures Légumières (SCL) started out as a test farm in 2006 by the Barfoots of Botley Ltd company. Now they supply a range of products to the United Kingdom, for example to Waitrose supermarkets. With the involvement of European produce companies, SCL has invested in growing, packing and exporting green beans and other vegetable products. They can farm on 2,000 hectares of land and produce both fine beans and bobby beans.

Green Egypt

Green Egypt is a well-known exporter, supplying over 15,000 tonnes of fresh and organic produce each year. It is valued for its high-quality products and sustainability efforts. The company serves over 21 international markets, including several European countries. With its large-scale operations, organic products and ability to manage a big supply chain (employing over 2,000 people), Green Egypt is a leading exporter in Egypt’s green bean market.

Companies that are able to organise their supply chain well, will be able to get the recognition and the interest of European buyers.

Tips:

- Define well your strengths as a company and your competitive advantage before entering the European market. This can be product related (quality, characteristics), but also in efficient logistics to Europe.

- Organise reliable and stable production of high-quality fresh beans and use this to look for long-term partnerships in Europe. Integration with a European partner is a good way to get continuity in your export.

Which products are you competing with?

A variety of products compete with fresh green beans. They can be categorised as follows:

- Seasonal competition – When green beans are in season in Europe, between July and October, imports compete directly with local European-grown beans. Especially bobby beans and flat beans, which are cheaper alternatives.

- Out-of-season competition – When green beans of the preferred type are not available or scarce, consumers often turn to frozen or preserved beans, which are widely used in ready-made meals and valued for convenience and lower price.

- Culinary competition – Fine beans, positioned as a premium culinary vegetable, compete with other exotic products like sugar snaps and mangetout (snow peas). In the food-service sector, high prices for fine beans may push chefs to substitute them with other vegetables that deliver similar taste and presentation.

- Retail competition – In supermarkets, imported fine beans are sold alongside cheaper bulk options like bobby beans or flat beans. This makes price and packaging important competitive factors.

Figure 7: Fine beans from Morocco available in a Swiss mainstream supermarket

Source: GloballyCool, September 2025

Tips:

- Compare your product with the green beans that are available in European markets. Visit wholesale markets and supermarket to see how competing fresh beans look and how they are presented. Use this to differentiate your product.

- Stay up to date with varietal development and preferences. Choose a variety that you can produce with competitive costs or one that is superior in taste and quality.

4. What are the prices of fresh green beans on the European market?

Consumer prices vary widely, as they are influenced by several factors. Import prices can be calculated based on import values and volumes. From these import prices, an estimated price breakdown can be made to show how margins are divided through the value chain.

Consumer prices

Bean type (common, fine or extra fine), origin, type of logistics and packing size have great influences on the final price for consumers. There is also a fluctuation in prices due to changing availability and quality. Prices range from as low as €5 up to €20 per kilogram.

Regular bobby and flat beans are priced between €4.5 and €7.0 per kg. Fine, air-freighted beans sell for €9-20/kg. Very fine beans attract a premium, resulting in a retail price that is a few euros more, depending on quality and packing size.

Import prices

Overall, the trend shows that the cost of imported green beans in most European countries has been rising by an average of 2-8% per year. This increase is caused by supply chain issues, the rising cost of agricultural inputs and higher labour costs.

Figure 8 shows that import prices (cost, insurance and freight, or CIF) in Europe are lowest in Spain and the Netherlands. French import prices are average, while the prices paid by importers in the UK, Germany and Switzerland are the highest. To a certain extent, this also reflects the above-average share of fine beans imported by those three countries. Fine beans require more manual labour than larger bobby beans and are often air freighted, which raises their price level.

Source: GloballyCool, August 2025

Regular beans can be imported for (CIF) prices anywhere between €1.80 and €2.40 per kilogram. Trade prices for fine and extra fine beans are higher, at between €2.40 and €3.50 per kilogram. Importers usually calculate a minimum profit margin of 8% in addition to their commercial costs, such as customs clearance and inspections.

Tips:

- Know your costs. Calculate your production and shipping costs and compare them with European import prices. If the margins do not work, improve production or post-harvest first.

- Track prices. Check FranceAgriMer (France) and Fruchtportal (Germany) for market price updates, using web-browser translation if needed.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research