The European market potential for fresh green beans

Green beans are a common vegetable in Europe, with local production in the summer. Outside that season, imported beans from outside Europe ensure a year-round supply. In addition, there is a year-round market for fine beans from more distant sources. The Netherlands and the United Kingdom remain the largest importers of these speciality beans, which typically arrive by air.

Contents of this page

1. Product description: green beans

Fresh green beans are part of the Phaseolus and Vigna genus. Most commercial green beans are the common green beans (Phaseolus vulgaris), also snap bean or string bean. These include a variety of types and names, sometimes even used interchangeably. This study has simplified the varieties as in table 1 below.

The statistics of the study are based on the Harmonised System (HS) commodity code for green beans: 070820 "beans (vigna spp., phaseolus spp.), shelled or unshelled, fresh or chilled".

Fava beans and edamame beans (immature soybeans) are also sold in Europe, with or without pods. But they are not part of this study because they do not belong to the Phaseolus or Vigna bean family. For peas such as sugar snaps and snow peas, see CBI’s study on exporting fresh peas to Europe.

Table 1: Bean varieties, types and names

| Bobby beans | Sometimes referred to as French bean, common green bean, haricots verts, snap bean or string bean. Bobby beans are 9-11 millimetres in diameter, typically from a species such as ‘Nerina’, ‘Bronco’ or ‘Paulista’. They are produced mostly in large plantations, as they are less labour intensive than the extra fine beans. |

|---|---|

| Fine/extra fine beans | Fine beans (6-8mm) and extra fine beans (5-7mm) tend to be smaller, more tender and quicker to cook. These fine beans are also called haricots verts, filet beans or needle beans. They require more manual labour and so do better in smallholder farms, although most smallholders do not consider extra fine beans a viable crop because of the low yield per hectare. Examples of varieties that are grown for fine stringless ‘needle’ beans are ‘Samantha’, ‘Teresa’ and ‘Amy’. Varieties such as ‘Julia’ and ‘Sagana’ are very fine varieties. |

Flat beans | Flat beans can be of the common bean variety (Phaseolus vulgaris). They are also commercialised as helda beans, romano beans, stringless beans or Italian green beans. |

| Runner beans | Runner beans are similar to common flat beans. They are sold under similar names. Runner beans have rough wide and flat pods, but they belong to the Phaseolus coccineus variety. They are a productive variety and therefore cheaper than common green beans. |

| Yardlong beans | Yardlong beans, also known as asparagus beans, snake beans or long-podded cowpea, are a subspecies of the cowpea bean (Vigna unguiculata subsp. sesquipedalis). It has long pods measuring 35-75 centimetres. In Europe, yardlong beans are considered an exotic bean. |

Wax beans | Wax beans are yellow beans, also known as butter beans (haricots beurre in French). |

Purple string beans | Beans can come in different colours. Besides yellow wax beans, there are also purple string beans, a variety of the common green bean. |

Figure 1: Different coloured beans

Source: Pixabay

2. What makes Europe an interesting market for fresh green beans?

Europe relies on imports to ensure a consistent year-round supply of green beans, as domestic production can only meet demand between July and September.

Year-round demand requires imports

Common green beans are consumed throughout the year in Europe. Most European production happens during the summer months, while most green beans from outside Europe are imported between October and June to cover the off season. This dependence on suppliers from outside Europe makes it an attractive market for exporters from developing countries. Figure 2 shows that Europe imports green beans almost exclusively from developing countries.

Source: UN Comtrade, August 2025

*Developing countries defined according to the OECD-DAC list of ODA recipients. 'Rest of the world' refers to all other countries.

In 2024, Europe imported 190,000 tonnes from developing countries. That was almost equal to intra-European trade, at 205,000 tonnes. Both categories have seen a modest decline of 2.8% over the past 5 years.

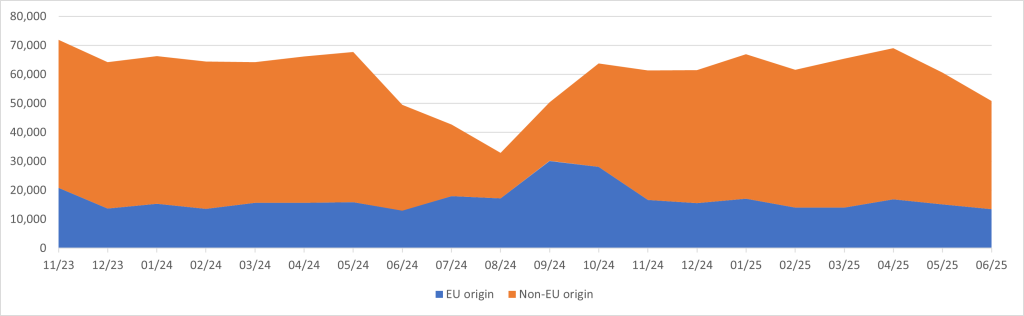

Special varieties such as fine, extra-fine and yardlong beans are not usually grown in Europe. These are imported throughout the year, with the market often peaking during the Christmas season when premium products are in high demand. Figure 3 shows the supply of green beans to Europe through the year, clearly revealing the peak in European supplies in September-October and the lower volume from developing countries in June-September (weeks 26-40). Imports in those months are confined mainly to the ongoing supply of fine and extra-fine beans.

Figure 3: European imports of green beans by main origins per month, November 2023-June 2025 (in thousand €)

Source: GloballyCool, based on Trademap statistics, September 2025

Tips:

- Stay informed about the latest updates in the European green beans market through news items on Freshplaza, Eurofruit, Fruitrop and FreshFruitPortal.

- Balance efficiency and quality: price matters for common beans, while air-freighted fine beans need to be top quality.

3. Which European countries offer the most opportunities for fresh green beans?

Between 2020 and 2024, Spain remained Europe’s top market for green beans from developing countries. It was followed by the Netherlands, France and the United Kingdom. Their import volumes stayed mostly stable or showed slight declines, as revealed by figure 4 and further explained below.

By contrast, Germany stood out as the only major market showing growth. Meanwhile, Switzerland remained a small but stable destination, with little change in import volumes over the years.

Source: UN Comtrade, August 2025

Spain: Europe’s largest market is shaped by Morocco’s dominance

In 2020-2024, Spain remained the largest destination for green bean imports from developing countries in Europe, although overall volumes fell by 3.0% on average (CAGR) per year. Locally, the green bean is called judía verde. Imports first grew to reach an all-time record in 2021 at 85,000 tonnes, but then dropped to 65,000 and 62,000 tonnes in 2022 and 2023 respectively. Imports partly recovered in 2024, to reach 69,000 tonnes.

The total share of green beans imported from developing countries dropped to below 60%, as Spain imports large volumes from France. Almost all imported product is conventional, as imports of organic beans have remained small, with volumes of 15-26 tonnes per year since 2022.

Morocco dominates the Spanish market, with 60-80,000 tonnes of green beans supplied to Spain each year. Morocco’s success comes from its geographic closeness, cost advantages and ability to complement Spanish production during seasonal shortages. This close trading relationship has also led to strategic integration. Spanish companies like Agroatlas have established farms in Morocco, managing over 700 hectares in the Agadir region. These farms focus on bobby beans and flat beans for European retail.

While the Spain-Morocco dynamic is strong, import data shows signs of market maturity. High import volumes, combined with limited growth in recent years, indicate that Spain may already have approached its peak potential as a destination for green beans.

Outlook

Spain’s population is now 48.6 million and is set to grow slowly, by about 0.1% per year. This indicates a relatively stable domestic demand outlook. Spain’s inflation rate is forecast to be around 3.3% in 2025, falling to about 1.6% in 2026. This expected declining growth in consumer prices should ease pressure on household budgets and support a small growth in green bean consumption and imports (1-3% per year).

The Netherlands: trade hub for mainstream and organic beans

The Netherlands is Europe’s second-largest importer of green beans, although total import volumes fell from 64,000 to 54,000 tonnes between 2020 and 2024. Imports from developing countries formed the majority of the supply, at 70% in 2024, after peaking at 78% in 2022. This highlights the Netherlands’ continued reliance on suppliers from developing countries to meet market demand.

Morocco remains the main supplier, showing small growth (+1.5% CAGR). Spain grew by 2.7%, while Senegal declined sharply in 2023 but regained growth in 2024. Kenya and Egypt have lost significant ground, with Kenya down 18% per year due to serious quality problems. Overall, sourcing is consolidating around Morocco and Spain, with inconsistent supply from Africa. Rwanda stands out with a huge increase, however, from almost nothing to 170 tonnes in 2024. Rwanda has gained a good reputation as a high-quality supplier of fine beans.

The Netherlands plays an important role as a European re-export hub for green beans (sperziebonen in Dutch). Dutch traders handle large volumes and channel them to destinations such as Germany, Belgium, France and Italy. In 2023, the Netherlands shipped a record volume of around 10,000 tonnes of green beans to Germany alone, more than double the volume recorded in 2022. This underlines the country’s strategic role in supplying the rest of Europe.

For exporters from developing countries, the Netherlands offers valuable opportunities. Working with Dutch importers provides access not only to the Dutch market but also to wider European distribution, making the country a key gateway to markets such as France and Germany. Competition, however, is fierce. The two large integrated players Scherpenhuizen and Fresh2You dominate by managing the entire chain from production to packing and distribution, keeping costs low and ensuring efficiency. Fresh2You, for example, combines own production in the Netherlands, Morocco and Senegal with occasional imports from Spain and Egypt.

Figure 5: Green beans from ‘Carlo’, the brand of one of the Dutch integrated vegetable companies

Source: GloballyCool, August 2025

Organic green beans hub

The Netherlands is the main entry point for organic green beans in Europe. Most come from Morocco by road, with a high of 451 tonnes in 2023, but falling to 273 tonnes in 2024. Imports from Egypt also grew until 2022 (238 tonnes), but then dropped to 80 tonnes in 2024. Senegal has supplied smaller but steady amounts by road (76-102 tonnes) since 2021. Ethiopia and Kenya send only very small volumes, by air.

Figure 6 shows that the Netherlands imports almost all the organic green beans entering the EU. Spain imports very little, with volumes of 15-26 tonnes per year since 2022. Note that details on organic imports by the United Kingdom, Switzerland and Norway are not available.

Source: GloballyCool, August 2025

Outlook

GDP (gross domestic product) in the Netherlands is forecast to grow 1.3% in 2025 and 1.2% in 2026 (spring 2025 forecast). If import demand rises roughly 1.5 times faster than GDP, import volumes of green beans should go up by about 2% per year.

France: Europe’s largest producer with an appetite for fine beans from developing countries

After France’s import peak of green beans in 2021, at 54,000 tonnes, imports dropped every year to reach 42,000 tonnes in 2024. Despite this decrease, the market remains highly dependent on developing countries, which supplied 35,000 tonnes in 2024, equal to a record 84% of total imports. Imports play a modest role when compared to the large production in France (more than 430,000 tonnes in 2023), but are complementary due to the French production window and the additional need for fine beans.

Among suppliers from developing countries, Morocco leads. It accounts for around 54% of France’s total imports. Kenya holds second position, with approximately 15% and 6,100 tonnes, as the country remains the benchmark for fine and extra fine haricots verts for which France is a large market. Senegal ranks third with 8.8% (3,700 tonnes). Egypt and Rwanda also play a smaller but steady role, with import shares of 4.1% and 1.1% (1,700 and 500 tonnes) respectively. In particular, supplies from Egypt (+16% per year), Senegal (+8.4%) and Rwanda (+8.8%) experienced strong growth.

Priméale is a key domestic player in the French green beans market. The company offers a wide range of fresh vegetables, including haricots verts, and supplies both retail and food service channels across France. Its strong local presence, combined with experience in sourcing and distributing high-quality beans, makes Priméale a major competitor for imported beans, particularly in the fine and extra fine segments.

Organic market opportunities

France has firmly established itself as a leading player in organic agriculture across Europe. As of 2024, around 10% of France’s agricultural land was under organic cultivation, equal to over 2.7 million hectares. Organic farming now includes nearly 15% of all French farms. The country is a leading organic market by sales in Europe, ranking second only to Germany. Most of these organic beans, however, are locally produced. France does not import organic beans itself, but probably does import some from the Netherlands.

Figure 7: Organic green beans in an organic webshop in France

Source: GloballyCool, August 2025

Outlook

The EU expects French GDP to grow 0.6% in 2025 and 1.3% in 2026. This will support a slight growth in imports of about 1% in 2025 and 2% in 2026.

United Kingdom: import challenges and upcoming opportunities

The United Kingdom (UK) has seen a decline in green bean imports in recent years. Volumes dropped from 43,000 tonnes in 2020 to just under 27,000 in 2024. This reduction is linked to weaker consumer demand due to inflation, combined with Brexit-related trade barriers. They introduced extra costs and stricter import procedures for fresh produce.

Despite this overall decline, the UK continues to rely strongly on suppliers from developing countries, at more than 25,000 tonnes in 2024. Kenya remains the largest source, supplying almost 11,000 tonnes in 2024, although its volumes dropped from more than 13,000 tonnes annually until 2022 to below 11,000 tonnes in 2023 and 2024.

Egypt has strengthened its position, growing steadily at an annual rate of 11% and reaching 6,100 tonnes in 2024. Morocco saw a significant drop, with exports falling from nearly 8,000 tonnes in 2020 to just over 4,000 tonnes in 2024. Supplies from Senegal fluctuated, showing a peak in 2022 before falling back to 1,000 tonnes and ending with a small overall decline. One noteworthy development is Rwanda’s growth, with exports increasing more than fivefold during this period, to 1,000 tonnes in 2024.

These changes show that while the UK market is challenging, opportunities remain for exporters. For established suppliers like Kenya, maintaining market share will depend on stronger differentiation through quality, certification and reliability. Egypt’s consistent growth shows that competitive pricing and efficient logistics can secure a place in the market, even as overall demand slows. Meanwhile, Rwanda’s growth reveals opportunities for smaller suppliers of high-quality fine beans looking to gain market share.

Outlook

The Office for Budget Responsibility sees the UK’s real GDP growth reaching 1.0% in 2025 and 1.9% in 2026 (spring 2025 forecast). Import volumes grow 1.2-1.5 times faster than GDP, which means that imports will likely grow by roughly 2.0-2.5% in 2025-2026.

Germany: stable imports with changing supplier dynamics

The German market remained largely stable, with green beans (or grüne Bohnen) imports declining moderately from 25,000 tonnes in 2020 to 24,000 tonnes in 2024. Within this overall stability, however, the supplier landscape has changed. Developing countries have gained significant share, reaching a record 57% of total imports in 2024. Imports from developing countries have recovered strongly since 2022, reaching more than 13,000 tonnes in 2024.

Morocco is the most dynamic supplier, more than doubling its shipments to Germany from 3,700 tonnes in 2020 to nearly 9,000 in 2024. Senegal also recorded steady growth, at an average 7.7% per year. By contrast, Egypt’s exports declined from 3,900 to 2,100 tonnes over the same period. The same went for Kenya, declining from 1,300 to 400 tonnes.

Germany’s consumer preferences shape opportunities for exporters. According to the 2024 Nutrition Report, 91% of Germans consider healthy eating important and 71% eat fruit and vegetables daily. This supports strong potential for vegetables, including green beans.

At the same time, sustainability is a key factor. The German Packaging Act (VerpackG) sets strict rules called Extended Producer Responsibility (EPR). All companies, including exporters from outside Europe, must register their packaging in the LUCID system, take part in recycling schemes and make sure that any packaging for consumers follows the rules when sold in Germany. This impacts exporters of beans packed for consumers.

German buyers for the mainstream food retail segment are highly attentive to food safety and extremely strict on residue limits, which are sometimes stricter than the general EU maximum levels. For suppliers able to adapt to this, Germany represents a promising opportunity in Europe’s green bean trade.

Outlook

German GDP is expected to remain stable in 2025 and to rise 1.1% in 2026. Green bean imports tend to grow slightly faster than GDP, and so are forecast to go up marginally in 2025 and by 1.0-1.5% in 2026.

Switzerland: a stable but concentrated niche market

Switzerland is a small but steady market for green bean exporters from developing countries. Import volumes from these countries are around 3,000 tonnes and have increased only slightly in recent years, at a compound annual rate of 0.5%.

Due to a drop in total imports, suppliers from developing countries have strengthened their role substantially. By 2024, they provided about 84% of Switzerland’s total green bean imports, up from between 73 and 79% in previous years. This shows that green beans from developing regions are very important in fulfilling Swiss market needs. Almost 75% (2,900 tonnes) come from Morocco, and smaller volumes from Kenya, Senegal and Thailand (180 tonnes, 150 tonnes and 50 tonnes respectively).

Organic market

Switzerland’s organic market has been experiencing remarkable growth. According to FiBL data, Switzerland has one of the highest organic food consumption rates per capita in the world. The country’s organic market has reached around CHF 4 billion (approximately €4.3 billion), with fruit and vegetables making up a large share. Swiss consumers are willing to pay more for organic and sustainably produced products, making certified green beans an attractive option for buyers and retailers.

Figure 8: Yardlong beans

Source: Pixabay

Outlook

Swiss GDP is projected to grow by about 1.3% in 2025 and 1.2% in 2026. If import demand for green beans grows roughly 1.5 times faster than GDP, then Switzerland’s import volumes of fresh green beans could rise by about 1.9% per year in 2025–2026.

Tips:

- Participate in the Fruit Logistica trade fair in Berlin to gather more knowledge on different markets and find potential buyers. There will be many companies present – see the exhibitor list.

- Go to the website of the Fresh Produce Centre to find Dutch importers and service providers that can be helpful when exploring the Dutch market.

- Read what makes Germany an interesting market for fresh fruit and vegetables on the CBI market intelligence platform.

- Visit the Fruit Attraction trade fair in Madrid to connect with Spanish fresh produce companies. You will also find companies from other European countries.

4. Which trends offer opportunities or pose threats in the European fresh green bean market?

Fine green beans are a luxury that do well in Europe’s culinary experience. Consumers are also used to always having fresh beans available, all year round. For green beans to maintain positive growth, it is crucial to make sure the supply is reliable and sustainable. Sustainability is a key issue for green beans from developing countries.

Sustainable transformations in the fresh green bean market

European retailers and consumers now expect suppliers to use environmentally friendly farming methods, to limit pesticide use and to follow responsible production practices. Exporters who focus on sustainability position themselves as reliable and premium partners for European buyers. Showing a low carbon footprint and responsible farming methods can also help suppliers to access higher-value markets.

Climate change is affecting green bean production in Europe, too. In southern regions, droughts and heatwaves are making local harvests less reliable. Exporters from countries with stable climates can use this to their advantage by presenting themselves as dependable year-round suppliers. Investing in water-saving systems, climate-resilient crops or controlled farming environments helps to ensure a steady supply and demonstrates sustainability, two qualities that European buyers value highly.

Sustainable practices are also becoming important in logistics and distribution. Using low-carbon transport, renewable energy in packing facilities and efficient cold storage can reduce environmental impact. Exporters who adopt sustainability at every stage will not only meet European standards but also gain a competitive edge in a market where environmental responsibility strongly influences purchasing decisions.

Meeting Europe’s green packaging demands

Across Europe, traditional plastic packaging is being phased out due to new rules and stricter regulations, such as bans on single-use produce wrapping. As a result, companies are moving towards biodegradable, compostable and reusable alternatives. Another development, condensed atmosphere (CA) packaging, has not been successful so far. CA packaging causes condensation and rust, and so importers have decided to switch instead to the best option currently available – hot needle packaging (‘perforated bags’).

New solutions, such as compostable films or plant-based wraps, are becoming popular replacements for plastic. These innovations also support the EU’s Circular Economy Action Plan and Packaging Waste Directive Exporters complying with these regulations meet the rising expectations of both consumers and retailers, too. Choosing packaging that balances environmental responsibility with effective product protection helps suppliers to build a strong reputation and to gain or remain competitive in the European market.

For green beans, using eco-friendly packaging may offer advantages in terms of shelf life. At the same time, it reduces the beans’ environmental footprint by replacing traditional plastics. Sustainable packaging also improves brand image, as more retailers and consumers relate biodegradable or minimalist designs with quality and care for the planet.

Convenience is driving growth

Convenience is a major trend in the European fresh produce market. Consumers are looking for products that are not only fresh, but also quick and easy to prepare. Pre-washed, trimmed and ready-to-cook formats, such as finely trimmed French beans and small ready-to-cook bundles, are becoming more popular. These products meet the demand for healthy, time-saving meal solutions and create opportunities for exporters to stand out in the market.

Several exporters from developing countries are already responding to this trend by investing in convenience-focused formats. For example, a number of Kenyan companies have specialised in sorting, cutting and packing fine beans. One of these is AAA Growers, a leading exporter that has its own processing facilities and connections to the European retail. Nicely sorted and packed fine beans offer the best chance of a high return.

For green bean exporters, adopting similar approaches can be an effective strategy. Offering products that are washed, trimmed and packaged for easy use can transform a basic commodity into a ready-to-cook or ready-to-eat solution.

Figure 9: Ready-to-use green beans in a Dutch supermarket

Source: GloballyCool, August 2025

Shift in consumer preferences toward local and seasonal

European consumers are increasingly embracing the ‘buy local, eat seasonal’ trend, creating challenges for exporters of green beans. Campaigns like the EUFIC interactive seasonality map encourage shoppers to choose produce grown in their own region during peak harvest periods. This preference is driven by the benefits of reduced food miles, lower greenhouse gas emissions and fresher produce. Locally sourced green beans are promoted as fresher and more sustainable, which strongly appeals to environmentally conscious buyers in many European markets.

Supermarkets now actively promote seasonal produce with ‘in-season’ or ‘local’ labels to attract shoppers. Through shelf tags and marketing campaigns, they highlight authenticity and sustainability, making domestic beans the preferred option during Europe’s peak growing months. Supported by EU agricultural policies, growers in France, Spain and Italy can supply large volumes during the summer.

The challenge is not just about sales volume, it is also about perception. Under pressure to meet sustainability commitments and cut carbon emissions, many food retailers and service companies prefer to showcase local produce, even if costs are higher. An article from Food Business Review Europe highlights that using locally sourced ingredients enhances brand image and appeals to conscious consumers.

For exporters, standing out is crucial. Adding value through organic certification, premium varieties or sustainable and convenience-focused packaging can help differentiate your products.

Tips:

- Use refrigerated transport from the field to the pack house and from the pack house to the (air)port. This will maintain the fresh quality and preserve the shelf life of your product.

- Look for specialised importers when selling a niche product or exotic bean variety. Specialised companies usually provide better access to ethnic and exotic markets.

- Discuss with your clients how to reduce the use of plastic. European companies often have ideas or know good examples of sustainable packaging in their market. Either way, you will also give a positive signal that you are concerned about the sustainability of your product.

- Read more about Which trends offer opportunities on the European fresh fruit and vegetable market on the CBI market intelligence platform.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research