Entering the European market for Robusta coffee

Europe has strict rules for imports of Robusta coffee, but they are the same as those for Arabica coffee. There are some country-specific requirements, but most legislation comes from the European Union. They are largely the same for all member states. Most Robusta goes into lower-quality blends. Large companies export the most. However, small exporters that offer high-quality Robustas are getting more opportunities. Vietnam, Brazil, Indonesia and Uganda are the main countries that produce Robusta. They are very different in terms of strengths, weaknesses and reputations.

Contents of this page

1. What requirements and certifications must Robusta coffee meet to be allowed on the European market?

The European Union (EU) is a single market. The EU makes a lot of rules for coffee imports. These rules apply to all member states. For exporters, EU legislation usually matters more than country-specific legislation.

Some country-specific legislation may affect you indirectly. For example, in Italy, government organisations may ask for extra information, such as proof of sustainability in the procurement process. As a supplier, you may have to provide information about the sustainability of your business policies and practices. Your buyer may use this to win contracts.

Some European countries are not part of the EU, like Switzerland and the UK. EU regulations do not apply to these countries. However, most have requirements that are very similar to the EU. There are no specific requirements for Robusta. The requirements that apply to Arabica apply to Robusta too.

We focus on requirements for exporting Robusta coffee to the EU. The requirements can be split into:

- Mandatory requirements (e.g. food safety and hygiene);

- Additional company requirements;

- Niche market requirements (e.g. specific labelling).

These are described below. Most requirements are the same for all European markets. For more details, read our report on requirements for the European coffee market.

Tips:

- Find information about country-specific regulations in our studies on interesting export markets. For Robusta, the main export markets are Germany, Italy and Spain.

Most mandatory requirements come from the EU

Most mandatory requirements are legal requirements that come from the EU. They include food safety, labelling, payment, sustainability and quality requirements.

Requirements on food safety and hygiene

Exporters have to follow EU food safety laws that apply to coffee. These rules mainly deal with food safety. Traceability and hygiene are the top priorities. Particular attention should be given to specific sources of contamination with pesticides and mycotoxins/mould, particularly Ochratoxin-A (OTA).

Tips:

- Visit the EU Pesticides Database for an overview of each pesticide’s maximum residue levels (MRLs). You can search for ‘coffee’ or the active ingredient of your pesticide. This will show the MRLs of the active ingredients accepted in the EU.

- Always check with your buyers if they have stricter limits on pesticides.

Labelling requirements

Labels on green coffee exported to Europe should be in English, and have the following information to ensure individual batches can be traced:

- Product name;

- International Coffee Organization (ICO) identification code;

- Country of origin;

- Grade;

- Net weight in kilograms;

- For certified coffee: name and code of the inspection body and certification number.

Figure 1: Example of green coffee labelling

Source: Escoffee

Payment and delivery terms

You are usually paid when the buyer receives your coffee, or within 30 or 45 days. This depends on your contract. Cash Against Documents is the most common payment method when exporting coffee to Europe. You need to provide documents that prove shipment, such as a bill of lading or invoice, and get paid in return.

It is important to look at these terms carefully. You will usually be paid sooner if you sell your coffee to a trading company rather than selling to a coffee roaster directly.

Packaging requirements

Green coffee beans are usually shipped in bags made of jute or hessian fibre. Jute bags are strong. Some speciality coffee suppliers use other materials inside jute bags. GrainPro and Videplast do this. These materials are better than traditional packaging. They preserve bean quality, prevent post-harvest loss, reduce solid waste, reduce farmers' net carbon footprint and allow chemical-free storage. These materials are mainly used for the high-end and upper-end segments.

Other packaging options for transporting coffee include:

- Polypropylene super sacks that contain 1 tonne of coffee;

- Polyethylene liners that contain 21.6 tonnes;

- Vacuum-packing.

These techniques increase efficiency and maintain quality.

Figure 2: Examples of coffee packing from left to right: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: Raad, Bulk Logistic Solutions and GrainPro

Tips:

- Read the CBI study on buyer requirements for coffee in Europe for all the requirements.

- Check EUR-Lex for more information on limits for different contaminants. For information on preventing and reducing Ochratoxin-A contamination, read Codex Alimentarius CXC 69-2009. Use the search tool to find the codes that contain information on Ochratoxin-A and choose your language.

- For information on the safe storage and transport of coffee, visit the website of the Transport Information Service.

- Learn more about delivery and payment terms for your green coffee exports by reading our study on organising coffee exports to Europe.

Sustainability requirements are becoming stricter

In recent years, the EU has passed new sustainability regulations. These regulations build on international soft laws. These soft laws include the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises on Responsible Business Conduct. EU regulations require coffee companies to check for human rights and environmental problems in their supply chains.

Examples of EU laws include the European Deforestation Regulation (EUDR) and the European Corporate Sustainability Due Diligence Directive (CSDDD). The European Green Deal (EGD) is the EU’s response to the global climate emergency. The EGD is a package of policies that defines Europe’s strategy to reach net-zero and become a resource-efficient economy by 2050. Besides the European Green Deal, the Forced Labour Regulation also affects coffee suppliers that export to the EU.

Tip:

- The regulations described here are constantly changing. It is important to check their current status. For example, visit the European Commission website to read more about the EUDR, the Forced Labour Regulation and the CSDDD.

The European Deforestation Regulation prohibits coffee that led to deforestation

The EU created the Regulation on Deforestation-free Products (EUDR) as part of the European Green Deal. The EUDR means companies need to show that the products they import do not come from deforested land and have not led to forest degradation. Only deforestation-free products can enter the EU market.

In December 2024, the European Union delayed the date of implementing the law by a year, to 30 December 2025. Micro and small enterprises have six more months. The law makes traceability and technology very important for exports to the EU market. This will mean things need to change in the coffee industry. The EU has published a sheet that answers common questions about this topic.

Certification can help prove your company complies with the EUDR, for example through schemes with environmental criteria that promote sustainable farming practices, like organic and Rainforest Alliance certification. However, while helpful, certification alone is not enough.

The CSDDD will increase requirements for traceability and human rights

Under the new CSDDD regulations, European corporations have to improve their sustainability performance throughout their supply chains. They also need to stop damaging effects on human rights and the environment. Businesses need to take the following actions:

- Integrate due diligence into their policies;

- Identify actual or potential adverse impacts;

- Prevent and mitigate potential adverse impacts;

- Establish and maintain a complaints procedure;

- Monitor the effectiveness of their due diligence policy and measures;

- Publicly communicate on due diligence.

The directive means European companies need to be responsible for all of their supply chains. It forces buyers to ask for proof that you act in a socially and environmentally sustainable way.

The CSDDD is not in force yet, and there is a lot of uncertainty around it. The European Commission has suggested making the CSDDD more simple. This would make it much weaker. The directive would apply to 80% fewer companies, and it would limit legal responsibility to their direct suppliers. It would also remove obligations for climate transition plans and reduce penalties. The proposal has not been accepted yet, so the final text may still change. It is unclear when the CSDDD will come into force.

The Forced Labour Regulation bans coffee produced with forced labour from the European market

The aim of the Forced Labour Regulation is to ban the production or export of any product made using forced labour.

Based on risk assessments, companies based in the EU will have to ensure that no forced labour happens in their supply chain. In April 2024, the EU Parliament approved the legislation. Companies should be prepared to comply with the regulation’s requirements from mid-2027. Non-compliant European companies will be fined.

The full effect of the Forced Labour Regulation on exporting companies is unclear. However, it will mean that European buyers will need more information from their suppliers.

Tips:

- Make sure your traceability is as good as possible. European sustainability requirements will become stricter. You can only provide proof of your sustainable behaviour if you know where your coffee comes from. Certification could be an interesting way to do this.

- If you are unsure about any requirements, consult your buyer.

- Read more about the European Green Deal to get a better overview of the legislation.

- Read our tips to go green and tips to become socially responsible. Both can help you learn about what you can do to become more sustainable.

Quality requirements

Green and roasted coffee usually undergo a physical evaluation to determine their quality. Roasted coffee is also judged on several criteria, including the following:

- Altitude and region;

- Botanical variety;

- Processing method (washed, natural, honey, pulped);

- Bean size;

- Number of defects or imperfections;

- Bean density;

- Cup quality (flavour and aroma).

The quality assessment process is the same for all types of green beans. The exact criteria, however, differ. For example, both premium and standard coffee beans are tested for bean density (mass divided by volume). Premium coffees need to have a higher density.

Tips:

- Know the coffee you sell. Understand where it is grown, the processing, the quality and the grading, as well as the flavour. This can help you sell your coffee for more, based on its quality profile and market demand.

- Learn about green coffee grading. The Specialty Coffee Association is a key source. You can also read about other ways to assess coffee quality.

- Inform yourself on artificial intelligence (AI) solutions to improve the process of coffee grading. These are promising to enhance the efficiency of the grading process. Programmes already available in the market include Demetria, Csmart, Agrivero, ProfilePrint and Avercasso. You can read more about this on the Digital Coffee Future website.

Food safety requirements

Buyers will usually ask for a phytosanitary certificate. This certificate is awarded by your country’s plant protection authorities. Phytosanitary certificates guarantee that coffee:

- is properly inspected;

- is free from pests;

- meets all plant health requirements.

What additional requirements and certifications do buyers often have?

Some buyers may ask for extra food safety requirements for processing, or additional quality standards.

Additional food safety requirements

Some buyers may ask for extra safety guarantees from you. In terms of production and handling processes, you should think of:

- Good Agricultural Practices (GLOBAL G.A.P.): This is the main standard. It is a voluntary standard for certifying agricultural production processes that provide safe and traceable products. Certification organisations, such as Rainforest Alliance, often incorporate GAP in their standards.

- Quality Management System (QMS): This system is based on Hazard Analysis and Critical Control Points (HACCP). It is increasingly required by buyers as a minimum standard for green coffee production, storage and handling. Regular checking of residue levels in your coffee could be part of this. Pay extra attention to Ochratoxin-A (OTA), polyaromatic hydrocarbons (PAHs) and glyphosate contamination.

What are the requirements for niche markets?

Exporting organic coffee, Fine Robusta and roasted coffee means additional requirements. Most Robusta is exported through international trading houses, which arrange exports and imports.

Requirements for organic coffee

Exporting organic Robusta to the EU comes with extra requirements. To market your coffee as organic in the European market, it has to comply with EU regulations on organic production and labelling. Regulation (EC) 2018/848 covers organic production and labelling rules. Regulation (EC) 1235/2008 covers imports of organic products from outside the EU.

Organic coffee is checked at the EU border. To import organic coffee to the EU, every delivery needs to include an electronic certificate of inspection (e-COI). This certificate should be set up in the Trade Control and Expert System (TRACES). It must be signed by a control authority in your country before export.

Buyers of organic Robusta will usually also need a glyphosate test. Glyphosate is a herbicide used to kill weeds. It is not allowed in organic production. The test ensures that no glyphosate is used.

Tips:

- Learn more about exporting certified coffee by reading our studies on organic coffee, certified coffee and multi-certified coffee.

- Find importers that specialise in organic products on the organic-bio website.

- Use this cost calculator to work out the cost for your organisation to become Fairtrade-certified. Also ask for quotes from different certifiers before deciding which one you want to work with. Ask for timelines and how many days would be charged. Always talk about certification with your buyers before making any decisions.

- Try to combine audits if you have more than one certification to save time and money. You can also explore the possibilities for group certification with other local producers and exporters.

Requirements for Fine Robusta

Fine Robusta is very high-quality Robusta. Some also call it ‘speciality Robusta’. Fine Robusta has its own standards. These are different from Arabica speciality coffee standards. The Coffee Quality Institute (CQI) launched its Fine Robusta Standards and Protocols in 2019. Fine Robusta may need to undergo a CQI grading process.

Fine Robusta is graded according to its cupping profile. If you sell Fine Robusta, tell your buyers about this score. Adding this information to the documentation of the coffee you export can add value. It is very important to be aware of the quality of your coffees. You can do this through local cupping experts, or you can train to become a Robusta Q grader yourself.

Transparency is also very important. Many buyers are interested in stories about the product’s origin. Think of details about the coffee farms and growers, how and where it is grown, and details about processing facilities. This means you should know all about your coffee. You need to know every detail, from soil management to the final cup score, from plant variety to processing methods, and from farmers to trade.

Buyers often visit farms in direct trade to assess your coffee first-hand and build long-term partnerships. You must be willing to answer all their questions honestly.

Requirements for roasted coffee

Sensory assessment: coffee cupping

Coffee is tested and scored using a method called ‘cupping’. Buyers use different protocols and standards to do a sensory assessment (taste and judge coffee). However, the CQI has standard protocols and best practices for cupping coffee. Quality attributes include flavour, fragrance/aroma, aftertaste, acidity, body, uniformity, balance, cleanliness, sweetness and off-notes.

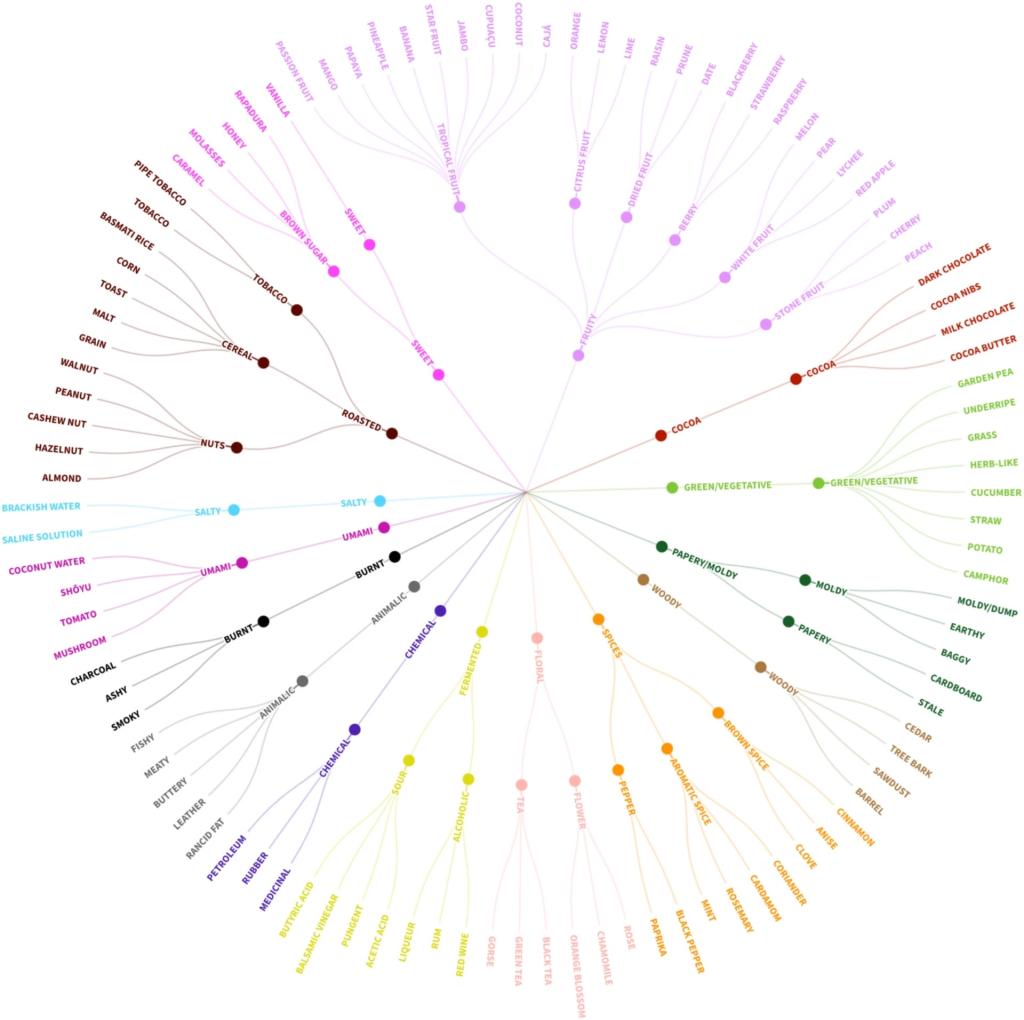

The Robusta flavour wheel is a tool developed to evaluate and standardise the aroma and flavour profile of Robusta coffee. It organises 103 aroma and flavour descriptors into a three-tiered wheel.

Figure 3: The Robusta Flavour Wheel

Source: Carvalho et al.

Hygiene requirements for roasting

Food imported into the EU is subject to official food checks. Inspectors can check products at the border or after it enters the EU. These checks make sure that products meet legal safety requirements. All coffee roasters in the EU must use a process based on Hazard Analysis and Critical Control Points (HACCP) principles. A HACCP plan is very important part for companies that want to be successful in the European market. The HACCP principles for roasted coffee focus on keeping coffee safe and of good quality. Steps include checking for issues like contamination and ensuring that coffee meets safety standards. Monitoring and keeping records are also important to ensure coffee remains safe for consumption.

Trade tariffs

If you export roasted coffee to the EU, the standard import duty is 7.5%. The duty for decaffeinated roasted coffee is 9%. These rates can change depending on trade deals between the EU and your country. Note that the importer is responsible for paying the trade tariff, not the exporter.

Tips:

- Check if any roasted coffee trade duties apply to your country on the Access2Markets website.

- Read our study on exporting roasted coffee to Europe to learn more about this market.

2. Through which channels can you get Robusta coffee on the European market?

Robusta is mainly used in the lower segment. Fine Robusta is becoming more popular, but it still makes up a very small part of the market. Options for direct trade are very limited in the Robusta value chain. However, there are some options in the high and upper end market. Online marketplaces may help you reach more buyers.

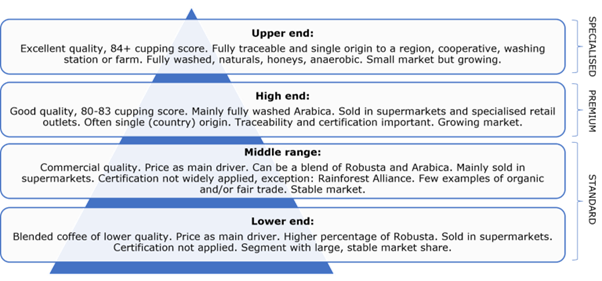

How is the end market segmented?

The coffee end market can be split into four segments: the lower end, middle range, high-end and upper-end.

Figure 4: Coffee end market segmentation by quality

Source: Profound

Low-end segment

This is the largest market segment for Robusta. Robusta is the main coffee used in lower-quality blended coffee. It is commonly sold in supermarkets. Its low cost and high caffeine content make bulk commercial blends and instant coffee attractive. Instant coffee is very important in coffee consumption, especially in Eastern Europe.

The lower-end market segment has been shrinking for years. However, it is currently growing again due to high global green coffee prices.

Some important traders in this segment are Neumann Kaffee Gruppe (Germany), Sucafina (Switzerland) and Olam. Be aware that most traders in this segment are also active in other segments. This is especially true of large trading houses.

Important roasters in this segment include JDE Peet’s (Douwe Egberts blends use Robusta), Lavazza (offers lower-price blends like Lavazza Crema e Gusto), Tchibo (Germany) and private-label supermarket brands, such as Lidl and ALDI.

Middle-range segment

The middle-range market is a large segment. It represents a large share of the EU’s coffee consumption. The middle-range segment was growing, but high prices have put pressure on this segment.

For Robusta, this segment is much less important than the lower segment. Many Robustas in this segment are certified in Northern and Western European countries. They may have a Rainforest Alliance, Fairtrade or organic label.

Huge companies dominate the middle-range segment, like the lower segment. Most players active in the lower segment are also active in the middle-range segment. ECOM (Switzerland), Volcafe (Swiss-based) and Neumann Kaffee Gruppe (Germany) are examples of traders in this segment.

Roasters very active in this segment are:

- Lavazza, based in Italy, with several mid-range blends;

- Segafredo Zanetti, based in Italy, the world’s largest espresso roaster;

- Tchibo, based in Germany.

High-end and upper-end segment

The high-end and upper-end market segments are growing in Europe. This is driven by consumer preference for higher quality and speciality coffee. This is particularly clear in Northern and Western Europe, where consumer awareness of coffee quality and traceability is rising.

Robusta is still rare in the high-end and upper-end segment. However, Fine Robusta is marketed as a unique or premium alternative to Arabica. Speciality-grade Robusta (with an SCA cupping score of 80–85) represents a niche but growing part of the market. The Coffee Quality Institute has had a database with Robustas rated since July 2024.

Some roasters use it for boutique blends and single-origin coffee offerings. It is also used by roasters that experiment with innovative espressos, cold brews and darker roast profiles. Traders include Sucafina (Switzerland), Falcon Coffees (United Kingdom), The Coffee Quest (the Netherlands) and Mare Terra Coffee (Spain).

Well-known roasters are:

- Black Sheep Coffee: based in the United Kingdom, known for its Fine Robustas;

- Coffee Collective: based in the United Kingdom, offers several Fine Robustas.

Tips:

- Be aware of the coffee quality you sell. Higher quality means higher prices. Very high-quality beans, if processed well, can also offer opportunities for direct trade.

- Visit the Specialty Coffee Association (SCA) and the Coffee Quality Institute websites. You can learn more about the high-end coffee segment, Fine Robusta quality criteria, market trends and main players.

- Explore ways to improve the quality of the coffee you produce. Certification, good agricultural practices and post-harvest processing can improve the quality of your product and raise its market value.

Through what channels does Robusta coffee end up on the end market?

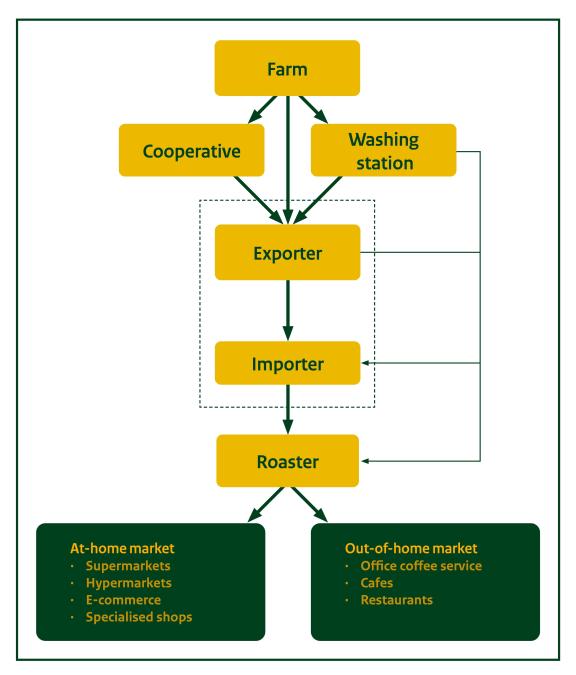

Robusta usually follows the same channels as Arabica coffee. However, direct trade is less common. Figure 5 lists actors in the Robusta supply chain. Most coffee goes through all the actors in the chain.

Figure 5: The Robusta coffee supply chain

Source: based on Counter Culture Coffee

The Robusta coffee market chain is made up of several actors. Each plays an important role in the production, distribution and consumption of Robusta coffee.

Exporters are key actors

Exporters are the first key actors in the Robusta coffee supply chain. They source raw Robusta beans directly from coffee producers in major producing countries like Vietnam, Brazil and Uganda. Then, they supply these beans to international importers or roasters.

Roles of exporters:

- Purchase Robusta beans from coffee farmers, cooperatives or washing stations;

- Ensure quality control: sort, grade and process beans to meet export standards;

- Manage logistics and shipping to deliver green coffee beans to importers or buyers abroad.

In the coffee supply chain, exporters and importers are usually the same companies. Large companies that are both exporters and importers include ECOM (Switzerland), Volcafe (Swiss-based) and Neumann Kaffee Gruppe (Germany). These companies usually have a lot of warehouses in coffee-growing areas. This makes it easy for farmers, cooperatives or washing stations to sell their coffee. Some companies are only based in producing countries and sell their coffee to European importers. One example is Dakman Coffee from Vietnam. Kaweri Coffee Plantation is a Ugandan Robusta farm that focuses on exports to Europe.

Are exporters the most interesting channel for you?

If you are a farmer, washing station or cooperative with small volumes of average-quality Robusta coffee, it is important to work with several exporters. Directly exporting to Europe is expensive and difficult without experience. If your coffee is high quality, you can use exporters. You can also try to export directly to Europe. Selling straight to European buyers might raise your profit margins by cutting out a middle actor. However, it also means more work, higher risk and investment in export know-how.

Importers are mostly the same companies as exporters

Importers are the link between exporters and roasters. They purchase Robusta coffee in bulk and sell it to other European traders or roasters.

Roles of importers:

- Source coffee from exporters;

- Handle supply chain logistics (e.g. customs, storage and quality control);

- Supply green coffee beans to roasters;

- Sometimes repackage or blend smaller lots for resale.

There are also independent Robusta importers. Examples are:

- DRWakefield (United Kingdom);

- This Side Up (the Netherlands);

- Belco (France).

If you are an exporter of green Robusta, it is very important to connect with different importers. This gives you more choice and may help you get better deals.

Exporters may skip importers and sell directly to roasters. This can be beneficial. However, it also comes with a lot of extra costs and requires a lot of knowledge. Selling to roasters directly usually only works in the high-end segment, where roasters value direct relationships and storytelling.

Roasters in espresso-based countries need Robusta coffee

Roasters purchase green Robusta coffee beans from importers or traders and process them into roasted coffee products. They play a very important role in working out the flavour profile and branding of Robusta coffees.

Roles of roasters:

- Roast, blend, and package coffee for retail and commercial sales;

- Supply B2B customers such as cafés, restaurants, and hotels;

- Sell directly to consumers through retail stores, including supermarkets, online channels, or specialised outlets.

Large-scale commercial roasters represent most Robusta processing volume, supplying supermarket chains and cafés. Large roasters that operate under their own brands include Lavazza, Kimbo, JDE Peet’s, Illycaffè and Hausbrandt. A lot of Robusta is also roasted by private-label roasters, such as Coind, Gruppo Gimoka and Daroma.

The coffee market is slowly changing

The European coffee market is slowly changing. Some farmers and cooperatives have direct relations with roasters. This gives roasters more control and transparency. In some cases, roasters also take steps to shorten the supply chain. Illy Caffè, for instance, is one of Italy’s best-known coffee companies. It works with farmers directly. Most of its coffee, however, still comes from large trading companies.

Online marketplaces are helping to make this change and promote direct trade. Marketplaces are platforms that connect actors, mainly connecting farmers to roasters. Using marketplaces allows farmers, cooperatives and washing stations to cut out parts of the chain. This may help you to increase your profits and tell the story of your coffee. Marketplaces include:

Tips:

- Talk to different buyers to find the best deal, but you should also work on long-term relationships. Having a good relationship with a buyer is a great asset.

- Build your brand by telling a story using photos, videos and clear messaging. Share this on your website and social media to attract European customers. Highlight the farmers, location, vision and methods behind your coffee. Also share your core values. Some consumers that buy Fine Robusta coffee will want to know where their coffee comes from and how it is made. It helps them feel more connected to the product.

3. What competition do you face on the European coffee market?

As a coffee supplier, you work in a global and highly competitive market. For producers and exporters, it is important to understand your market segment and production scale. By knowing what these are, you can work out which other countries you are competing with.

If you understand the quality, quantity and position of your coffee, you can better assess your competition and create strategies to stand out in the global market. This is very important for effectively positioning yourself and competing successfully.

Which countries are you competing with?

The world’s four largest Robusta producers are Vietnam, Brazil, Indonesia and Uganda. They also export the most Robusta to Europe. Vietnam, Indonesia and Uganda mainly focus on Robusta. Brazil, however, produces 69% Arabica and 31% Robusta. Still, its Robusta exports are larger than Indonesia’s. So, Brazil is an important competitor.

Vietnam is the world’s largest Robusta supplier

Vietnam is the world’s second-largest coffee producer and the biggest Robusta producer. Around 90% (612,000 hectares) of Vietnam’s coffee-producing land is used for Robusta. Vietnam’s coffee production focuses on creating large volumes of standard-quality coffee. Vietnam is Europe’s largest Robusta supplier. In 2024, it exported 586,000 tonnes of green coffee to Europe. 90% or more was Robusta.

Yields were lower in the 2023/2024 and 2024/2025 production seasons due to dry weather. Nonetheless, the 2025 yield is expected to be around 1.7 million tonnes. This is up 9% from 2023/2024. Vietnamese production is expected to grow 5–10% yearly.

Large Vietnamese coffee exporter groups include Simexco Daklak, Intimex Group, Tin Nghia Corporation and MASCOPEX.

Vietnamese coffee production is expected to remain stable in the short term. High coffee prices encourage farmers to invest in production. This helps offset the negative effects of bad weather conditions.

Table 1: Competitive country profile of Vietnam

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Brazil is the largest green coffee supplier

Brazil is the world’s largest coffee producer and exporter. It produces both Arabica (around 70%) and Robusta (around 30%). However, almost 80% of its exports are Arabica. In 2024, Brazil exported 1.27 million tonnes of green coffee to Europe. Around 20% (250,000 tonnes) of this was Robusta. In Brazil, Robusta is called ‘Conilon’.

In 2023/2024, bad weather hurt Brazil’s Robusta production. For 2024/2025, a 1.4% increase in Robusta production is expected. Exports to Europe are expected to increase for 2025. There are indications that European importers want to bring imports forward before the EUDR regulation comes into force.

Brazil’s coffee-producing areas are relatively flat. This allows for mechanical harvesting. The use of mechanical pickers has reduced labour costs in Brazil’s coffee production. Because mechanical harvesting cannot tell ripe cherries from unripe ones, it often results in lower quality.

Economically, Brazilian coffee farmers are quite successful. Factors that contribute to their success are:

- Large-scale operations;

- Mechanised harvesting;

- Efficient infrastructure;

- Government and private sector support;

- Generally favourable climate (although some regions are struggling with climate change).

Brazil is the only large producing country where the average farmer can make a living income from coffee farming.

Brazil is known for exporting large volumes of standard quality. However, the country also has a strong reputation as a producer of speciality coffees. The sector receives a lot of support through the Brazil Specialty Coffee Association. The association aims to improve quality standards and value in the production and marketing of Brazilian coffees.

The 2024/2025 outlook for Brazilian Robusta is positive. While Arabica production will go down, Robusta production is expected to increase by 15% in 2025/2026 due to favourable weather conditions.

Table 2: Competitive country profile of Brazil

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Indonesia is the world’s second-largest Robusta exporter

In 2024, Indonesia exported 49,000 tonnes of green coffee to Europe. This is about a third less than in 2023. This drop came from bad weather conditions in the 2023/2024 season. Around 85% of Indonesian coffee exports to Europe are Robusta.

Robusta production went down by 9% to 516,000 tonnes in the 2024/25 season. This was because of lasting weather problems from 2023/24. Crops largely failed to recover in the lowlands of Southern Sumatera. However, Robusta production increased in highland areas.

Rising Robusta bean prices have led to an increase in coffee berry theft in the Southern Sumatera region. In response, farmers have heightened security by organising patrol groups. Local authorities have introduced a coffee land registration programme to trace traded beans.

Domestic consumption is growing quickly. Indonesia exports around 46% of its green coffee production. About 20% of Indonesia’s coffee exports are certified or verified as sustainably produced. Indonesia has some of the largest organic coffee production areas worldwide. It had around 60,000 hectares in 2018.

Indonesian Robusta coffee is rich in varieties. Some famous varieties include:

- Lampung Robusta: Known for its chocolate, brown sugar, woody, sweet and earthy flavours;

- Temanggung Robusta: Characterised by an earthy, caramel flavour profile;

- Jampit Robusta: Offers a sweet, caramelised sugar aroma and a full, heavy body with dark chocolate notes;

- Kintamani Robusta: Tastes chocolatey, nutty and fruity, with a hint of lemon.

Indonesia has very low average coffee production per hectare. This is mainly because its system is made up of many smallholder farmers that have limited access to resources and support.

Table 3: Competitive country profile of Indonesia

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

| Rich in varieties and flavours. |

Uganda: coffee has strong potential

Uganda is known for its Robusta coffee. It used to account for 80% of the country’s coffee output. For 2024/25, Robusta production was forecast to reach 354,000 tonnes. This is slightly more than the 352,000 tonnes in 2023/2024.

Robusta coffee thrives in lowland areas of Central, Eastern and Western Uganda. The maturation of high-yielding seedlings, timely rains and support from the Uganda Coffee Development Authority (UCDA) all help production. Interventions include high-quality cultivars, inputs and training on better management practices.

In terms of trade, most of Uganda’s coffee exports are Robusta. Robusta exports were expected to reach 395,000 tonnes in 2024/25, thanks to good prices and production increases. In 2024, Uganda exported 195,000 tonnes to Europe.

Smallholder farmers mainly grow coffee in Uganda. They can be supported by NUCAFE, the national umbrella coffee farmers’ organisation. NUCAFE represents more than 213 farmer cooperatives and associations. Around 80% of total Ugandan production is Robusta. Uganda has some of the largest organic coffee production areas in the world. This amounted to 66,000 hectares in 2018.

The Uganda Coffee Development Authority (UCDA) helps to promote and guide the development of the Ugandan coffee industry. It does so through quality assurance, research and improved marketing techniques. UCDA works towards achieving the Presidential Directive of exporting 20 million 60 kg bags of coffee by 2030. UCDA has also encouraged the production and marketing of high-quality Arabica coffees. Private companies have also invested in Uganda. They focus on sustainable production approaches.

Uganda is the only African country where green coffee is available throughout the year. This gives the country a big advantage. However, changes in weather patterns due to climate change are increasing supply chain difficulties. Production in 2024/2025 was expected to remain the same as in 2023/2024.

Ugandan exporters include ACPCU and Great Lakes Coffee. Uganda Ankole Coffee Producers Cooperative Union is a Ugandan company that exports coffee to Europe. It exports its organic Robusta via DRWakefield.

Table 4: Competitive country profile of Uganda

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them.

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, varieties, qualities, post-harvesting techniques and certification. You can also share the history of your organisation, your coffee-growing farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and at trade fairs. Quality competitions also offer good opportunities to share your story, such as the auctions organised by the Cup of Excellence.

- Are you interested in exporting high-quality coffee? Learn more about grading protocols and best practices on the website of the Specialty Coffee Association (SCA). You can also consider getting a Q Robusta Grader certificate to cup and score your coffee through smell and taste according to international standards.

- Work with other coffee producers and exporters in your region if your company size or product volume is too small. As a group, you can promote good-quality coffee from your region and be more attractive and competitive.

- Develop long-term partnerships with your buyers. This includes complying with their requirements and keeping promises. Read our tips on doing business with European coffee buyers for more information.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research