Entering the Dutch coffee market

The Netherlands is home to medium-sized market and has a decent share of premium and certified coffee. Most coffee requirements come from European Union legislation, although the Netherlands also has its own legislation regarding due diligence. The main suppliers to the Dutch market are Brazil, Vietnam and Colombia.

Contents of this page

1. What requirements and certifications must coffee meet to be allowed the Dutch market?

You can only export coffee to the Netherlands if you follow strict European Union requirements. Buyer requirements can be categorised into three groups:

- Mandatory requirements: legal and non-legal requirements you need to meet to enter the market;

- Additional requirements and certifications: you need to comply with these to be competitive in the market;

- Niche requirements: apply to specific niche markets.

The main points for these requirements are given below. If it is relevant, we specify it for the Dutch market.

What are mandatory requirements?

Legal requirements

You must follow the European Union legal requirements applicable to coffee. These rules focus on food safety, with traceability and hygiene as the top priorities. Special attention should be given to specific sources of contamination, namely:

- Pesticides — consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide;

- Mycotoxins/mould, particularly Ochratoxin-A (OTA);

- Salmonella (although coffee is considered low-risk).

Sustainability requirements become stricter

The main sustainability requirements derive from the European Green Deal (EGD). The EGD is the European Union’s (EU) response to the global climate emergency. The EGD is a package of policies that sets out Europe’s strategy to reach net zero emissions and become a resource-efficient economy by 2050. These policies include the EU Deforestation Regulation (EUDR) and the European Corporate Sustainability Due Diligence Directive (CSDDD). Another key rule is the Forced Labour Regulation. It applies to all businesses, including coffee suppliers that export to the EU.

European Deforestation Regulation bans coffee linked to deforestation

Under the EUDR, importers must prove their coffee does not come from recently deforested land. In November 2025, the EU decided to postpone the regulation a second time, to 30 December 2026. Micro and small enterprises have six more months. This law makes traceability and technology crucial for exports to the EU market. This has implications for the coffee-producing industry. The EU has provided an information sheet that addresses frequently asked questions about this topic.

Dutch companies will need more information to proof due diligence in the future

The CSDDD regulations requires European corporations to improve sustainability throughout their global supply chains. Its final form and implementation are still uncertain. The European Commission proposes simplifying the CSDDD, which would make it much weaker. The directive would apply to 80% fewer companies. It would also limit the obligations only to their direct suppliers. Furthermore, it removes obligations for climate transition plans and reduces the penalties. The proposal has not been accepted yet, so the final text can still change. It is yet unclear if and when the CSDDD will come into force.

Forced Labour Regulation bans coffee produced with forced labour from the European market

The Forced Labour Regulation bans the production or export of any product made using forced labour. Using risk assessments, companies based in the EU have to make sure that no there is no forced labour within their supply chains. In April 2024, the EU Parliament gave its final approval on the legislation. Companies should be prepared to comply with the Regulation’s requirements by mid-2027. Non-compliant European companies will be fined. You can read more about this regulation on the RVO website.

The full effect of the Forced Labour Regulation on exporting companies is still unclear, although European buyers will inevitably require more information from their suppliers.

Tips:

- Increase your traceability. European sustainability requirements will become stricter. You can only prove your sustainable behaviour if you know where your coffee comes from. Certification could be an interesting way to do this depending on market interest.

- Consult your buyer if you are unsure about any requirements.

- Read more about the European Green Deal for a better overview of the legislation.

- Learn what you can do to become more sustainable in the CBI’s tips to go green and tips to become socially responsible.

- Read more about national due diligence legislation across European countries.

Payment and delivery terms

Payment is generally required when the coffee is accepted, or within 30 or 45 days. This depends on the terms in your contract. Cash Against Documents is the most common deal when exporting coffee to Europe. You provide documents proving shipment, such as a bill of lading or an invoice, and get paid in return. This ensures you are paid for your goods.

It is important to examine these terms carefully. Generally, you will be paid sooner if you sell your coffee to a trading company than if you sell it to a roaster directly. You can read more about this in our tips on organising your coffee exports.

Quality requirements

Green coffee is graded and classified before export. There is no universal grading and classification system for coffee. The Specialty Coffee Association’s standards for green coffee grading are often used as a point of reference. However, most producing countries have and use their own grading systems.

According to the International Trade Centre (ITC), grading is usually based on the following criteria:

- Altitude and region;

- Botanical variety;

- Preparation — wet processed (washed), dry processed (natural), semi-washed (wet-hulled), pulped natural or honey processed;

- Bean size or screen size, sometimes also bean shape and colour. Note: screen size is important to ensure that coffee batches are uniform in size. This allows for uniform roasting which improves the quality of the final product);

- Number of defects or imperfections;

- Roast appearance and cup quality in relation to flavour, characteristics and cleanliness;

- Bean density.

Specialty coffee is graded according to the Coffee Value Assessment (CVA). The CVA replaced the SCA cupping score in 2025. Although no longer favoured by the SCA, the cupping score is still widely used in the industry. Although not mandatory, adding CVA results to the documentation of the coffee you are exporting might add value. It is very important to be aware of the quality of your coffees. This can be done either through local cupping experts or by becoming a cupping expert yourself.

Note that there is no exact definition of specialty coffee within the coffee industry. The SCA considers specialty coffee as a coffee or coffee experience recognised for its distinctive attributes. This gives it a a higher value on the market.

Labelling requirements

Labels of green coffee exported to the Netherlands should be written in English. They should also include the following information to ensure traceability of individual batches:

- Product name;

- International Coffee Organisation (ICO) identification code;

- Country of origin;

- Grade;

- Net weight in kilograms;

- For certified coffee: name and code of the inspection body and certification number.

Figure 1: Examples of green coffee labelling

Source: commodity.com

Packaging requirements

Green coffee beans are traditionally shipped in woven bags made from jute or hessian natural fibre. Jute bags are strong and robust. Other materials, such as Grainpro or other innovative material like Videplast liners, are often used to pack specialty coffees inside jute bags.

Most green coffee beans of standard quality imported into the Netherlands are packed in container-sized bulk flexi-bags that hold roughly 20 tonnes of green coffee beans each. The rest of the green coffee is transported in traditional 60 or 70 kg jute sacks, held in containers of 17 or 19 tonnes, respectively.

Other packaging used in transporting coffee includes polypropylene super sacks for 1 tonne of coffee, polyethylene liners for 21.6 tonnes and vacuum-packed coffee. These techniques provide two advantages in the coffee trade, namely increasing efficiency and maintaining or preserving quality.

Figure 2: Examples of coffee packing: jute bag, container-sized flexi bag, GrainPro and Videplast liner

Sources: RAAD, Bulk Logistic Solutions and GrainPro

Tips:

- For the full buyer requirements, read the CBI study on buyer requirements for coffee in Europe. You can also consult the specific requirements for coffee on the European Commission website of Access2Markets.

- Check EUR-Lex for more information on limits for different contaminants. For specific information on the prevention and reduction of Ochratoxin A contamination, refer to the Codex Alimentarius CXC 69-2009.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Read more about quality requirements for coffee on the website of the Coffee Quality Institute.

What additional requirements and certifications do buyers often have?

Additional food safety requirements

Expect buyers in the Netherlands to ask you for extra food safety guarantees. For production and handling processes, you should focus on:

- Implementing Good Agricultural Practices (GAP). The main standard for GAP is GLOBALG.A.P. It is a voluntary standard for certification of agricultural production processes that ensures safe and traceable products. Certification organisations, such as Rainforest Alliance, have integrated GAP into their standards. In the Netherlands, the Nederlandse Voedsel en Waren Autoriteit (NVWA) maintains an overview of national food safety.

- Implementing a Quality Management System (QMS). A system based on Hazard Analysis and Critical Control Points (HACCP) is a minimum standard for green coffee production, storage and handling. Regularly checking residue levels in your coffee is a standard part of this system. Pay particular attention to Ochratoxin-A (OTA), polyaromatic hydrocarbons (PAHs) and glyphosate contamination.

You should keep in mind that your Dutch importer might re-export large quantities of green coffee to other destinations in Europe. Buyers in those countries may push their specific requirements down the supply chain. These might increase the need for you to adopt other specific certifications or standards. It will depend on the final market and market channel used.

Additional sustainability requirements

Corporate responsibility and sustainability are very important in the European coffee sector. In the Netherlands, coffee companies highlight farmer relations, transparency in their operations. They also show their social and environmental impact at origin. Examples of these company policies or codes of conduct are those of Pelican Rouge Coffee Roasters, UCC Coffee Benelux and JDE Peet’s.

As an exporter, adopting codes of conduct or sustainability policies on your environmental and social impact may give you a competitive advantage. Buyers will likely require compliance with their code of conduct, and/or complete supplier questionnaires on your production practices.

Certification standards are very often part of the sustainability strategy of traders, coffee roasters and retailers. As such, a standard like Rainforest Alliance has become increasingly important in the mainstream coffee market. About 65 coffee supply chain actors operating in the Netherlands are Rainforest Alliance certified. These include traders, like Greencof and Trabocca, and roasters, such as Neuteboom Coffeeroasters and UCC Coffee Benelux.

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Find out which standards or certifications are preferred by potential buyers in your target segment. Buyers may have preferences for a certain food safety management system or sustainability label. This depends on their end clients and/or distribution channels.

- See our study on certified coffee for more information about the demand on the European market, trends and specific trade channels.

- Improve your sustainability practices with our tips to go green and our tips to become socially responsible.

What are the requirements for niche markets?

Organic

Exporting organic coffee comes with extra requirements. To market your coffee as organic in the European market, it needs to comply with the European Union’s regulations for organic production and labelling. Regulation (EC) 2018/848 sets out the rules on organic production and labelling.

Organic coffee is checked at the EU border. To import organic coffee to the European Union, the shipment needs to include an electronic certificate of inspection (e-COI). The certificate should be set up in the Trade Control and Expert System (TRACES). It must be signed by a control authority in your country before the shipment leaves the country.

Dutch organic roasters use the EU organic label when packaging. They can also choose to add the EKO label or the Demeter label. Both labels come with additional requirements and external audits.

Figure 3: The Dutch EKO label

Source: Voedingscentrum

Fair trade

Before you can market your coffee as fair trade, an accredited certifier must audit your farms and processing facilities. In the Dutch market, the main standard is Fairtrade, audited by FLOCERT. Alternatives include Fair for Life (by IMO/Ecocert) and Fair Choice (by Control Union). These are less well known in the Dutch market but may come with the advantage of lower entry costs.

Always check demand and interest for a specific certification with your (potential) buyer. Also check whether premiums apply in the case of Fair Choice and Fair for Life.

Direct trade

The high-end specialty coffee segment is characterised by direct trade relations. There is also high transparency and traceability from producer to consumer. Besides high quality, these buyers are interested in your stories about the origin of your coffee. This implies that you should know the specifics of your coffee and be ready to share details. Other than that, direct trade may result in more frequent coffee farm visits and product checks by your buyers. It can also give the opportunity to build long-term business relations.

Tips:

- Learn more about organic farming and European organic guidelines on the European Commission website and the Organic Export Info website.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- Find importers that specialise in organic products on the website Organic-bio.

- Visit trade fairs for organic products, like Biofach in Germany. Check out their website for a list of exhibitors, seminars and other events at this trade fair. Here you will also find booths of the organic certification bodies.

- If you produce coffee according to a fair trade scheme, find a specialised Dutch buyer that is familiar with sustainable or fair trade products, for instance via the FLOCERT customer database.

- Try to combine audits in case you have more than one certification, to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

- Use this cost calculator to estimate what costs will be involved for your organisation to get Fairtrade-certified.

2. Through which channels can you get coffee onto the Dutch market?

The Dutch end market for coffee can be segmented by quality and by type of consumption: in-home and out-of-home consumption. The high-end segment represents a growing niche market in both the in-home and out-of-home segments. Consumers increasingly demand specialty coffees. Suppliers in producing countries mainly enter the Dutch market through importers or medium-sized and large roasters.

How is the end-market segmented?

The Dutch end market for coffee can be segmented by quality, as shown in the figure below:

Figure 4: Coffee end market segmentation by quality

Source: ProFound

In the Netherlands, supermarkets are the main sales channel for coffee. In 2024, 72% of coffee consumers in the Netherlands bought at least some of their coffee in service supermarkets. Supermarkets have a wide variety of coffee products, ranging from low-end to high-end products. The largest supermarkets in the Netherlands are:

- Albert Heijn. 37% market share in 2024. Parent: Ahold Delhaize, Netherlands/Belgium

- Jumbo. 20.3% market share in 2024. Owned by Van Eerd Group, Netherlands

- Plus. 8.1% market share in 2024. Part of Sperwer Group, Netherlands

- Lidl. Market share unknown. Part of Schwarz Group, Germany

- Aldi. Market share unknown. Part of Aldi Nord, Germany

Low end

Coffees in the low-end segment are mainstream, lower-quality and mainly blended coffees. These blends are characterised by high shares of Robusta beans. Besides some mainstream brands, lower-quality private label products from supermarkets also belong to the low-end segment. Most coffee pads and instant coffee also belong to this low-end segment. Coffees in the low end of the market are mainly sold in supermarkets and through service channels, such as offices and universities.

Table 1: Product and price examples in the low-end segment (based on Albert Heijn’s retail prices in 2025)

| Product | Retail price (€/kg) | |

|---|---|---|

| Perla Aroma, private label (Whole beans, Rainforest Alliance certified, 500 gram package) |

| 16.98 |

| Douwe Egberts Aroma Rood (Ground coffee, 500 gram package) |

| 17.98 |

Mid range

Mid-range coffees are commercial coffees with a good and consistent quality profile, such as quality espresso. This segment typically consists of blends with a higher proportion of Arabica compared to the low-end segment. The mid-range segment represents a stable coffee market, where sustainability certifications are important.

Mid-range coffees are often sold in supermarkets and by the food service industry. Premium private label ranges of retailers usually belong to the mid-range segment.

Table 2: Examples of mid-range products and prices (based on Albert Heijn’s retail prices in 2025)

| Product | Retail price (€/kg) | |

|---|---|---|

| Lavazza Espresso Barista Perfetto (Whole bean, 100% Arabica, 500 gram package) |

| 31.58 |

| Fairtrade Original Single origin Colombia (Whole bean, 100% Arabica, Fairtrade & organic certified, 500 gram package) |

| 26.58 |

High and upper ends

High-quality coffee mainly consists of washed Arabicas. These coffees are often single origin and coffees with a special story. The upper end of this segment consists of specialty coffees of excellent quality. Some are from micro or nano lots that go through processing methods such as naturals and honeys. These are mainly fully traceable and single-origin Arabica beans. The high and upper-end segments are small but growing markets.

Sustainability certifications are less common in this segment. This is because sustainability practices are often seen as widespread among buyers. Long-term contracts between suppliers and buyers, as well as higher prices, characterise the high and upper-end segment.

Coffees from this segment are mainly sold directly by specialty roasters, in shops, online, as well as at coffee events. Many supermarkets now stock a small offer of specialty coffees in their assortment. For instance, at the shelves of supermarket Albert Heijn you can find a range of organic specialty coffees from roaster Simon Lévelt. The organic supermarket Ekoplaza also offers specialty coffees of Simon Lévelt, as well as coffees from Dutch specialty roaster Bocca.

An example of a coffee event in the Netherlands is the Amsterdam Coffee Festival. An example of a specialised Dutch coffee web shop where you can find high and upper-end coffees is Dutch Coffee Dealer.

Table 3: Examples of coffees in the upper-end market segments (based on Kolibri Coffee Roasters prices in 2025)

| Product | Retail price (€/kg) | |

|---|---|---|

Thikagiki Varieties: SL-28, SL-34, Ruiru 11, Batian Process: Washed Producer: Thikagiki Farmers’ Cooperative |

| 61.00 |

Razz Punch Variety: Bourbon, Papayo Process: Washed, lactic acid process Producer: La Reserva |

| 88.00 |

Mariano Variety: Yellow bourbon Process: Honey Producer: Fazenda Mariano |

| 43.60 |

Segmentation by type of consumption

Besides market segmentation by quality, the Dutch coffee market can also be segmented into in-home and out-of-home consumption:

- In-home consumption: About 75% of coffee consumption in the Netherlands takes place at home. Supermarkets are the main sales channels. Home consumption is becoming increasingly diverse because of different qualities, and the growing popularity of coffee beans and ready-to-drink products. The growing demand for beans and capsules has led to a slight decrease in the use of ground coffee, coffee pads and instant coffee.

- Out-of-home consumption: About 25% of coffee is consumed out-of-home.

Tips:

- Refer to our study on trends in the coffee market to learn more about developments within different market segments.

- Check the website of the Specialty Coffee Association (SCA) to learn more about the high-end coffee segment, market trends and main players.

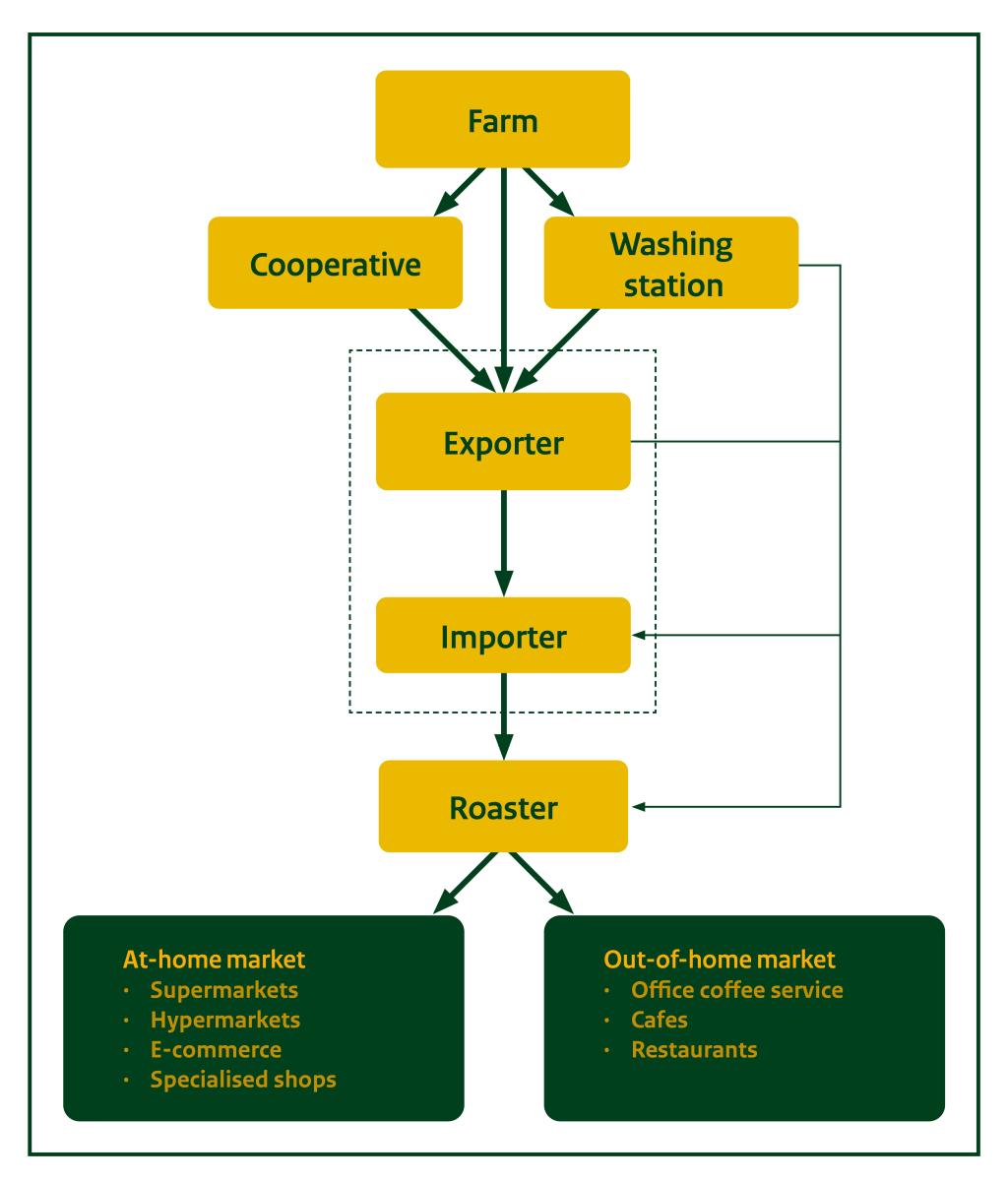

Through which channels does coffee end up on the end-market?

As an exporter, you can use different channels to enter the Dutch market. Your route to the market will vary depending on the quality of your coffee and your supply capacity. The figure below shows the most important market entry channels for your green coffee beans in the Netherlands.

Figure 5: The Dutch coffee supply chain

Source: Counter Culture Coffee

Importers

Importers play an important role in the coffee market, functioning as supply chain managers. They maintain wide portfolios from various origins, pre-finance operations, perform quality control, manage price fluctuations and establish contact between producers and roasters. In most cases, importers have long-standing relationships with their suppliers and customers. Importers usually either sell the green beans to roasting companies in the Netherlands or re-export them to other European buyers.

Large-scale importers usually have minimum volume requirements starting at around 10 containers. These cover a wide range of qualities, varieties and certifications. They also provide strong support for logistics, marketing and financial operations. Examples of medium- and large-scale importers in the Netherlands include: J&B Commodity Trading, S&D Sucden, Greencof and Bijdendijk. These supply coffee to large roasters and mainstream retailers in Europe.

Specialised importers handle small and mid-sized volumes of high-quality and single origin coffees, from microlots to full container loads (FCL). Examples of specialised importers in the Netherlands are: Daarnhouwer & Co, Trabocca, This Side up and The Coffee Quest. Coffees from these importers end up partly in mainstream retail, organic retail and specialty shops.

For whom is this an interesting entry channel?

The best entry channel for you depends on the quality of your coffee and the volume you can supply. If you are an exporter of green coffee beans and can only offer small volumes, entering the Dutch market through large importing companies in your country is often the best option. These companies arrange purchases through local agents or representative offices in producing countries. Contacting these agents or representatives can be a good starting point for small-scale exporters.

Specialised traders can be interesting if you export high-quality coffee. Keep in mind that many specialised importers prefer to work directly with producers or cooperatives. Many importers still work with the cupping scores, in which case a score of 80+ is considered specialty coffee.

Large roasters

Most large roasters buy their own coffee beans through an importer. But they might also source from exporters at origin. Roasters usually perform analysis and cup testing to check the evenness of the roast. They also look for any defects that can occur in post-harvest processes, such as fermentation, drying and storage. Large roasters usually blend different qualities of green coffees to help quality stay consistent. The final product is distributed to retailers and the food service industry.

Roasters can operate under their own brands and/or private label. Examples of large roasters in the Netherlands include: JDE Peet’s, Maas, Selecta, Ahold Delhaize Coffee Company and UCC Coffee Benelux. An example of a medium-sized to large private label coffee roaster in the Netherlands is Pelican Rouge Coffee Roasters. Private label roasters, such as Ahold Delhaize Coffee Company, may roast for mainstream clients as well as for specialty brands.

For whom is this an interesting entry channel?

Supplying directly to large-scale roasters is only interesting if you can supply large volumes of consistent quality. Discuss minimum quality and other requirements, such as certification, with your potential buyer.

Medium-sized and small roasters

There is a growing number of small roasters importing green coffee directly from origin, but most buy their coffee via importers. This is because not all small roasters can take on the additional responsibilities necessary to import directly from source. Importers help roasters with financial services, quality control and logistics. Nevertheless, small roasters often maintain a direct connection with their producers.

Small roasters are often specialised in single origins and the finest specialty coffees. Examples of small roasters in the Netherlands include: Boot Coffee, White Label Coffee, Back to Black, Bosbrand and Brandzaak. Refer to this website to find a long list of smaller Dutch coffee roasters.

Examples of medium-sized coffee roasters importing directly from origin are Mocca d’Or, Simon Lévelt and Peeze. Examples of medium-sized roasters engaged in private label are Neuteboom, Private Label Coffee and Beans Coffee Roasters.

For whom is this an interesting entry channel?

Supplying to small roasters is interesting for producers and exporters that have high-quality coffees. It is important to be able to guarantee traceability. You should be willing to engage in long-term partnerships. Say, for example, you have very high-quality coffees and are currently working through an importer. Then it would be interesting to explore direct trade possibilities to see whether you could connect directly with roasters. This requires you to have the financial means and technical know-how to organise export activities.

Supplying to medium-sized roasters may also be an interesting alternative if you have a consistent and reliable quality and volume. Most medium-sized roasters will also require one or more certifications for sustainable production. Be aware that many smaller roasters may not be importers, but that it is nevertheless important to interest them in your coffee. A logistic partner (importer) can then be found to ship your coffee to destination.

Online marketplaces facilitate trade

Online marketplaces are platforms that connect actors in the chain. They mainly connect farmers to roasters directly. Using marketplaces allows farmers or cooperatives to cut out parts of the chain. This may allow you to get better prices for your products. Only a very small amount of coffee reaches Dutch roasters through a marketplace. Some of these marketplaces are:

Beyco is a Dutch company you can use to target the Dutch market. You can also use Raw Material and Algrano as they work globally. For example, Raw Material is a British company, but the Dutch roaster Wakuli sources through this platform.

For whom is this an interesting entry channel?

Using marketplaces is very interesting for companies interested in shortening the supply chain. Marketplaces make trading much easier. However, you need to bear in mind that you still need a lot of expertise on how to organise your exports. This means arranging the right paperwork, stocking in a warehouse, performing quality control, setting up shipping, organising insurance and much more.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certifications. For more tips on finding the right buyer for you, see our study on finding buyers in Europe.

- Attend trade fairs and other events to meet potential Dutch buyers. Interesting events include SCA’s World of Coffee (every year in a different European city), Biofach (organic, Germany) and the Amsterdam Coffee Festival. Attending such physical or virtual events can provide you with additional insight into the preferences of Dutch buyers and/or consumers.

- Check out the list of importers and roasters on the website of the Dutch Coffee and Tea Association. It will help you find potential partners and learn more about the Dutch market.

- Invest in long-term relationships. It is important to establish strategic and sustainable relationships with them. This will help you manage market risks, improve the quality of your product and reach a fair quality-price balance.

- See our study on buyer requirements for coffee to learn which European market standards and requirements you need to comply with when supplying to Europe.

- See our study on how to do business with European buyers for more information about complying with buyer requirements. It offers information on how to send samples and how to draw up contracts.

3. What competition do you face on the Dutch coffee market?

As a coffee supplier, you operate in a global and competitive landscape. For producers and exporters, it is important to understand the market segment you operate in and the scale at which you work. By identifying these factors, you will be able to find out which countries you are competing with. Understanding the quality level, volume and position of your products allows you to better assess your competition and develop strategies to stand out in the global market.

Which countries are you competing with?

Competition on the Dutch coffee market is fierce. Based on Eurostat data, 77% of all green coffee is imported from producing countries directly. Belgium accounts for 7.7% of Dutch green coffee imports. Germany is responsible for 7.6%. These countries are not considered in this section.

In this section, we focus on the six largest producing countries that export to the Dutch market. These are:

- Brazil (32.8%)

- Vietnam (20.6%)

- Colombia (5.2%)

- Honduras (3.8%)

- Kenya (3.7%)

- Peru (3.4%)

Note that although a lot of coffee imported into the Netherlands comes from Kenya, much of it is likely produced in Uganda. Read our section on Kenya’s coffee market for more information.

Brazil: the world’s largest coffee producer

Brazil is the world’s largest coffee producer, with production volumes expected at 3.9 million tonnes in 2025/2026. Brazil produces both Arabica (75%) and Robusta (25%), but about 80% of exports are Arabica. In 2024, the Netherlands imported about 73,000 tonnes of green coffee from Brazil. This is 33% of total Dutch imports. Between 2020 and 2024, imports from Brazil grew by an average of 26% yearly.

Brazil’s main coffee-producing areas are accessible with mechanical picker machines. The use of mechanical pickers has reduced labour costs. It has also led to lower average quality, because machines do not distinguish between ripe and unripe cherries.

Brazil mainly produces natural and pulped natural coffees. Low-grade Brazilian Arabica is mostly used in blends.

Brazilian coffee farmers are relatively successful thanks to:

- Large-scale production;

- Government support systems;

- Mechanised cherry picking;

- Efficient infrastructure;

- Favourable climate (although climate change has significantly affected several key regions).

Brazil is the only large producing country, where the average farmer can generate a living income from coffee farming.

The country is mainly known for exporting large volumes of standard quality. But it also has a strong reputation as a producer of specialty coffees. This is in part thanks to the Brazil Specialty Coffee Association. This association aims to elevate the quality standards and enhance value in the production and marketing of Brazilian coffees. Examples of successful exporters of specialty coffees in Brazil are Burgeon and Bourbon Specialty Coffees. Large Brazilian exporter Costa Café has also started exporting specialty coffees besides its regular mainstream coffee exports.

The 2024/2025 outlook for Brazil is positive. A 5.4% increase in production is expected.

Table 4: Brazil’s competition profile

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Vietnam: the world’s largest Robusta supplier

Vietnam is the world’s second largest coffee producer. Approximately 96% of its production is Robusta. The Netherlands imported about 46,000 tonnes directly from Vietnam in 2024. Between 2020 and 2024, Vietnamese exports to the Netherlands increased at a yearly rate of 48.3%.

Large Vietnamese coffee exporter groups include Simexco Daklak, Intimex Group, Tin Nghia Corporation and Mascopex.

The Vietnamese coffee production is expected to remain stable in the short term. High coffee prices encourage farmers to invest in production. This cancels out the negative effects of bad weather conditions.

Climate change poses a serious threat to the Vietnamese coffee sector. So the country is working hard to achieve greater coffee sustainability. Private and public actors in Vietnam focus more and more on making coffee production a sustainable practice and source of income for smallholder farmers. They work together with many international actors, such as Bioversity and CIAT and IDH

Table 5: Vietnam’s competitive profile

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Source: Standard Insights

Colombia: the largest supplier of washed Arabicas

Colombia is the world’s third-largest coffee producer. The Netherlands imported 11,600 tonnes of green coffee directly from Colombia in 2024. Between 2020 and 2024, Dutch imports from Colombia increased at an average yearly rate of 16.5%.

Colombia is the world’s largest producer of washed Arabica. It has a strong coffee industry and is very technologically developed. The country has an established image and brand for high-quality coffees. Colombian coffee is known for its chocolate, nut, herb, fruit and citrus notes. Its main processing technique is washed processing. The country’s most well-known coffee varieties are Typica, Bourbon, Caturra and Castillo.

The Colombian Coffee Growers Federation strategically promotes and markets Colombian coffee. Café de Colombia is a protected trademark. It is registered in eAmbrosia. This is the register for protected trademarks in Europe. Registration in eAmbrosia is unique among coffee-producing countries. It protects the rights of more than 550,000 small-holder families in the country.

The Colombian coffee industry is developing quickly. Coffee companies are increasingly involved in capacity building and product quality. Colombian producers can follow coffee quality and tasting programmes to get certified. The Coffee Quality Institute (CQI) has a strong presence in Colombia. It provides courses in partnership with the National Institute of Professional Training SENA. The country’s coffee has ongoing success in competitions, such as the World Barista Championships.

Examples of successful Colombian cooperatives or private organisations exporting coffee to the international market include Red Ecolsierra and La Maseta.

Table 6: Colombia’s competitive profile

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Honduras is a main supplier of organic coffee

In 2024, the Netherlands imported 8,500 tonnes from Honduras. Between 2020 and 2024, green coffee imports from Honduras registered a 22.5% yearly increase. In 2024, the imports dropped from 9.4 to 8.5 thousand tonnes. Leaf rust and domestic labour shortage led to a 24% coffee production reduction in 2023/2024.

The Honduran Coffee Institute IHCAFE has been promoting the production of value-added coffees. It did so either through certification or by actively improving quality. The country has grouped coffee production and quality specifications into six regions with different microclimates and soil composition.

Honduras has a growing reputation as a high-quality coffee supplier. A relatively large share of Honduras's coffee is organic. According to FiBL & IFOAM The World of organic Agriculture 2022, about 24,000 hectares were dedicated to organic coffee farming in Honduras. This is approximately 5.7% of the total planted coffee area in the country.

Certified coffee production in Honduras has grown, from 42% in 2018/2019, to 58% in 2022/2023. This includes Fairtrade, Rainforest Alliance, 4C, and organic certification.

Examples of successful exporters in Honduras are Cafico (organic coffee) and Aruco (specialty coffee).

Table 7: Competitive country profile of Honduras

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

| High volatility due to bad weather conditions, such as leaf rust. |

|

Source: Standard Insights

Kenya’s coffee market is highly regulated

In 2025, Kenya exported 8,100 tonnes of green coffee to the Netherlands. Between 2020 and 2024, Kenyan exports to the Netherlands increased by an average of 104% yearly.

Kenya’s grading system makes it easy to source high-quality coffee. Kenya’s coffee industry is organised around coffee auctions hosted by the Nairobi Coffee Exchange (NCE). It is a government-owned, not-for-profit organisation. At the auctions, lots with higher quality coffee are sold for higher prices. This system benefits international market prices for Kenyan coffee but limits the opportunity for Kenyan producers to trade with international actors directly. Kenya’s Coffee Producers Association (KCPA) represents almost 350,000 coffee producing households to empower them to address issues related to production, processing and marketing.

Kenya’s coffee is rated high for vibrant and crisp citrus, pepper and blackberry flavours. The washed processing technique is the most common processing method in Kenya. Othaya Coffee is a Kenyan coffee producer with Fairtrade certification. Othaya Coffee gives a sustainable income to around 1,100 small-scale farmers.

Uganda’s coffee producers often use Kenya to get their green coffee to Europe. Uganda is forecasted to produce 413,000 tonnes of green coffee in the 2025/2026 season. Most of their coffee is Robusta. As Uganda is landlocked, it often uses the Kenyan port of Mombasa to export its coffee.

Table 8: Kenya’s competitive profile

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Peru: a top position in sustainable coffee production

In 2024, the Netherlands imported 7,600 tonnes of green coffee from Peru. Between 2020 and 2024, Dutch imports grew at an average yearly growth rate of 42%.

According to UNDP, coffee is one of Peru’s main agricultural products. It accounts for around 25% of agricultural income. Up to 40% of farmland is destined for coffee production. In the highlands, this figure rises to 70%. Peruvian exporters are especially important in the specialty market. Peru is the global leader in specialty coffee production. One Peruvian specialty exporter is RainForest Trading.

Next to specialty coffee, Peru also is a major supplier of organic coffee. It is the second largest organic coffee exporting country. It has 90,000 hectares of land dedicated to growing organic coffee.

The flavour profile of Peruvian coffees is usually nutty, chocolaty and mildly citrusy. The country’s varieties include Catimor, Pache, Bourbon, Typica and a small amount of Pacamara. The main processing method is wet processing.

Peruvian coffee is known for its consistent quality and sustainable production. It is one of the leading countries that trades Fairtrade certified coffee. 75% of the coffee industry is owned by smallholders. Peru introduced a national coffee brand, Cafés del Peru, to the international market in 2018.

Table 9: Peru competitive profile

| Strengths | Weaknesses | Image on the coffee market |

|---|---|---|

|

|

|

Tips:

- Identify your potential competitors and learn from them. Look at their marketing strategies, the product characteristics they highlight and their value addition approaches. Successful companies that already export to the European market, from which you can learn, include. Look at Indian Organic Farmers Producer Company (India), ACPU (Uganda), O’Coffee (Brazil), Bourbon Specialty Coffees (Brazil) and La Meseta (Colombia). Another interesting exporting company to learn from is Caravela Coffee. This company has a wide portfolio of specialty coffees from Latin America. It facilitates contact between roasters and producers, and has set up representative offices in destination markets.

- Identify and promote your unique selling points. Give detailed information about your coffee-growing region or origin, the varieties, qualities, post-harvesting techniques and certification of the coffee you offer. You can also tell the history of your organisation, your coffee growing farm and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and trade fairs. Quality competitions also provide good opportunities to share your story. For instance, refer to the auctions organised by the Cup of Excellence.

- Are you interested in exporting high-quality coffee? Learn more about cupping scores on the website of the Specialty Coffee Association (SCA).

- Work with other coffee producers and exporters in your region if your company size or product volumes are too small. As a group, you can promote good-quality coffee from your region and be more attractive and more competitive on the European market.

- Develop long-term partnerships with your buyers. This implies always complying with their requirements and keeping your promises. This will give you a competitive advantage, more knowledge and stability on the Dutch market. See our tips on doing business with European coffee buyers for more information.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research