The Dutch market potential for coffee

The Netherlands is home to a medium-sized coffee market and plays an important role in the European coffee trade. It is an important trade hub and home to a large roasting industry. Dutch consumers value quality and sustainability. But increased prices means consumers look for cheaper alternatives.

Contents of this page

1. Country description: The Netherlands

The Netherlands has a population of nearly 18 million. The capital is Amsterdam. Rotterdam, The Hague, and Utrecht are also major cities. It borders Germany to the east and Belgium to the south, with the North Sea to the west and north. The Netherlands is an import transport and trade hub in the European market.

The Dutch economy is strong and diverse, with trade and shipping at its core. Rotterdam is home to one of the world’s largest ports. Services account for 77% of the Dutch economy.

Coffee has a long history in the Netherlands. In the 17th century, Dutch traders were some of the first to import coffee beans into Europe. They played a significant role in spreading coffee plants around the world. Today, coffee is deeply embedded in Dutch daily life and consumed at home, in cafes and at work.

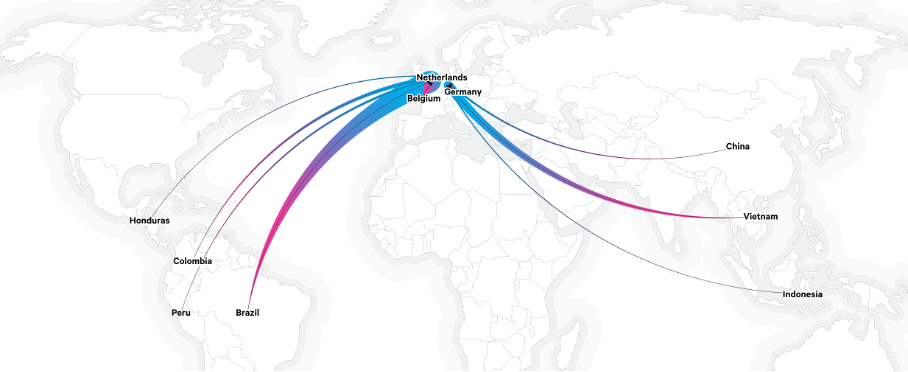

Figure 1: Main trade flows of green coffee into the Netherlands

Source: Resoucetrade.earth

2. What makes the Netherlands an interesting market for coffee?

The Netherlands is an important trade hub. It re-exports many different products, including significant amounts of coffee. The Netherlands is also one of Europe's leading roasted coffee exporters and has quite a large roasting industry.

Source: Eurostat, 2025

Imports grew by an average of 3.6% every year between 2015 and 2024. Exports were steady between 2015 and 2021 but have grown since. Re-exports rose by an average of 56.3% every year from 2021 to 2024.

The Netherlands is a large coffee importer in Europe

The Netherlands is the sixth largest importer of green coffee in Europe, up from seventh in 2020. In 2024, green coffee imports reached 222,400 tonnes. Of this, 77% came directly from producing countries. In 2020, this direct share was only 30%, with most coffee arriving from Belgium. By 2024, this share had dropped to 19%. The Netherlands has taken over some of Belgium’s role as a coffee trade hub.

Several coffee-trading companies are active in the Dutch market. These include S&D Sucden, Louis Dreyfuss Company (LDC) and the Dutch Bijdendijk. Dutch specialty coffee importers include Simon Levelt, Trabocca, This Side Up and The Coffee Quest. The Port of Rotterdam is the main entry point for green coffee into the Netherlands.

The Netherlands plays an important role in coffee re-exports in Europe

The Netherlands is an important European trade hub. It re-exports many different products, including a great amount of coffee. In 2024, the Netherlands was the third largest re-exporter of green coffee beans in Europe, with re-exports of 90,000 tonnes. However, this is a much lower volume than the two largest re-exporters. Belgium re-exported about 185,000 tonnes. Germany even re-exported 321,000 tonnes in 2024, if we include green coffee decaffeinated in Germany. In 2024, about two-thirds of the Dutch re-exports went to Germany (59,000 tonnes).

The Netherlands holds a key position in global roasted coffee exports

The Netherlands is one of the largest exporters of roasted coffee in the world. In 2024, the Netherlands exported 96,000 tonnes of roasted coffee. This makes it the fourth largest exporter. Only Italy, Germany and Switzerland export larger volumes of roasted coffee. Roasted coffee exports from the Netherlands have shown a slight decrease since 2020. In this year, exports reached 99,000 tonnes.

Examples of large and medium-sized coffee roasters on the Dutch market are Ahold Delhaize Coffee Company, JDE Peet’s (taken over by Keurig Dr Pepper in August 2025),Peeze, Pelican Rouge Coffee Roasters and UCC. Examples of small roasters focused on specialty coffees include Boot Coffee, Espresso Fabriek, Beans Coffee and Back to Black.

The Netherlands offer a strong consumer market for quality coffee

The value of the Dutch coffee market is about €1.2 billion. Coffee is consumed by 83% of the population, with the average drinker consuming 3.6 cups per day. When buying coffee, consumers consider price (61%), taste (58%) and special offers (52%) to be most important. Coffee quality (44%) and brand (41%) are also significant. Men place more weight on quality, while women respond more to special offers.

Few consumers consider origin (10%) or sustainability (10%) when purchasing coffee. When considering sustainability, responsible production (65%) is most important, followed by a certification seal (58%). Other factors include origin (45%), recyclable packaging (39%), less waste (39%) and farmer income (38%).

Tips:

- Use the translation function in your browser to make the studies available in your language.

- Access EU Access2Markets to analyse European and Dutch trade dynamics yourself and to build your export strategy. By selecting the Netherlands as your reporting country, you will be able to follow various developments. These include trade flows with established suppliers, the emergence of new suppliers and changing patterns in direct and indirect imports.

- See our study of trade statistics for coffee for more detailed information on the European green coffee bean trade.

- Explore the website of the Dutch Coffee and Tea Association for more information about the coffee industry in the Netherlands. Look at their member list to find an overview of local coffee traders and roasters.

3. Which coffees offer the most opportunities on the Dutch market?

Dutch consumers value quality and sustainability. As a result, certified coffee products have a strong presence in the market. Major certifications include Rainforest Alliance, Fairtrade and Organic. Many products carry more than one certification.

Rainforest Alliance imports have shown a major decline

Demand for Rainforest Alliance-certified coffee increased in 2024. Globally, Rainforest Alliance-certified imports increased from 864,000 tonnes in 2023, to 1,050,000 tonnes in 2024. European demand climbed from 615,000 tonnes to 751,000 tonnes between 2023 and 2024.

The Netherlands was a major importer in 2022, responsible for almost 15% of all European Rainforest Alliance certified coffee imports. Since 2022, Rainforest Alliance imports have dropped from 144,000 tonnes to 60,000 tonnes in 2024. This is a 58% decline in just two years. The main reason for this is that JDE Peet’s reduced its sourcing of Rainforest Alliance certified coffee. JDE Peet’s is the largest roaster in the Netherlands. The company shifted to Enveritas certified coffee. Although the outlook for the long-term is uncertain, it is unlikely that import levels will recover to 2022 levels.

Pelican Rouge is a Dutch roaster that only roasts certified coffee. A large share of their coffee is Rainforest Alliance certified.

Fairtrade has Dutch roots

Fairtrade started in 1988 in the Netherlands under the name Max Havelaar. The name comes from a character in a famous Dutch 19th century novel that criticised Dutch colonialism. Max Havelaar sought for fairer distribution of profits. In 2021, the organisation officially changed its name to Fairtrade Nederland.

Fairtrade green coffee sales amounted 5,664 tonnes in 2024, up 4% from 2023. This is equal to about 5% of the Dutch market. The share of Fairtrade certified coffee has remained stable for many years.

Sucafina is a global coffee trader based in the Netherlands. The company sources coffee certified according to different certification programs, including Fairtrade.

Organic imports declined in 2024

Organic import levels were stable between 2020 and 2023. There were slight fluctuations between 131,000 tonnes and 136,000 tonnes. In 2024, however, imports dropped by 12.8% to 116,000 tonnes. There are many reasons for this decline. One of them is lower global availability. Because prices for non-organic coffee increased in 2024, a lot of non-organic coffee was sold as regular coffee. It is likely that organic imports will recover in the coming years.

In the Netherlands, organic imports dropped from 3,445 tonnes to 2,569 between 2022 and 2023. Simon Lévelt is an all-organic Dutch specialty coffee roaster. Its coffee is available in specialised shops and supermarkets.

Fairtrade-Organic is the main type of multi certification

There are no available statistics for multi-certified coffee or the Dutch market. Perla is a brand available in the Dutch supermarket chain Albert Heijn. All Perla coffee is Rainforest Alliance certified, and some is also Organic certified. Perla is roasted by the Ahold Delhaize Coffee Company.

Company standards gain importance

Many major coffee companies have developed their own sustainability programmes, known as company standards. These company standards aim to establish a baseline for sustainable production practices. However, they are usually less demanding than independent third-party programmes like RA or Fairtrade. Many company standards are recognised by the Global Coffee Platform according to its equivalence mechanism.

There are no figures on how many Dutch coffee imports comply with company-specific sustainability standards. However, globally, these company standards are rising. In 2020, according to the Global Coffee Platform, 4.4% of all coffee sales complied with a company standard. By 2023, this share had grown to 21%.

The share that complies with a company standard differs per company. The standards that are important also differ per producing country. In Brazil, Enveritas certifies coffee for JDE Peet’s, the largest coffee roaster in the Netherlands.

Tips:

- Find potential organic business partners in the Netherlands by checking this list of Dutch organic coffee importers. For Rainforest Alliance, check the Dutch Rainforest Alliance-certified coffee brands.

- Promote the sustainable and ethical aspects of your production processes. Support these claims with certification. Read our study on doing business with European coffee buyers for more tips on marketing and promoting your coffee.

- Before committing to a certification programme, make sure to check market demand and whether it is cost-beneficial for your product. Always do this with your potential buyers.

- Find out which certification standards and company standards are important in your country. The Global Coffee Platform’s sustainability report is a good starting point. Alternatively, you can consult the websites of the different standard bodies and their certifications programmes.

- Read our studies on certified coffee, multi-certified coffee, organic coffee and relevant social certifications to identify more opportunities in these markets.

The Netherlands has a vibrant specialty coffee market

The Netherlands has a large and growing specialty coffee culture (see the section on trends). Dutch demand for specialty coffee is huge. The Netherlands has a large consumer base for specialty coffee. However, the Netherlands is also an important specialty coffee exporter. Some relatively large international specialty coffee roasters are based in the Netherlands. Examples include Friedhats, Manhattan, Dak Coffee roasters, Koffiestation, Wakuli, Black and Bloom, and 30ML. All these companies roast and serve their own specialty coffees.

Dutch companies active in the specialty segment sometimes source their coffee from producers directly. For example, the Dutch Koffiestation sources some of its coffee directly from Bette Buna in Ethiopia. This shows the importance of coffee origins and social impact. It makes storytelling more important in the coffee trade. One example of a coffee exporter with compelling storytelling is the Brazilian Fazendas Dutra Organic Specialty Coffee.

Almost all specialty coffee is Arabica coffee. However, Robustas are growing in significance in the Dutch specialty coffee market. Robustas may be an interesting alternative. Roasters sometimes use ‘clean Robustas’ (Robustas with a natural taste) in specialty coffee blends to reduce the price. The Coffee Quest is a Dutch trader that sources fine Robustas.

Tips:

- If you offer rare coffees, reach out to Dutch specialty coffee traders or specialty coffee roasters that value innovation. Dutch specialty coffee lovers are eager to try new flavours.

- Invest in cupping facilities: a lab and skilled Q-graders. Understanding the quality and value of your own product will help you talk the buyers’ language and negotiate better prices.

4. Which trends offer opportunities or pose threats in the Dutch coffee market?

Per capita coffee consumption in the Netherlands is among the highest in the world. The coffee market shows rising demand for high-quality and sustainably produced coffees. At the same time, Dutch consumers care more in where, how and by whom their coffee is grown. This makes it more and more important for coffee exporters to tell the story behind their product and production processes.

Premiumisation drives growth on the Dutch consumer market

The Dutch consumer market is growing more in value than in volume. The Netherlands is a wealthy country, and the market is saturated. The consumption per capita is slowly decreasing. Today, 83% of the Dutch population drinks coffee. The average consumption is 3.6 cups per day. In 2018, it was 4.1 cups per day. This decline is mainly due to health concerns. These have been at play since 2005.

Growth comes from higher-priced products. The Netherlands ranks second in the EU in terms of coffee spending per capita. In 2023, the Dutch spent €84.40 on average per year on coffee, only behind Luxembourg. More consumers purchase speciality coffee, which they mostly consume out-of-home. At home, more consumers use an espresso machine; the consumption of coffee pads is reducing.

The ready-to-drink (RTD) market is also growing. RTD coffees are often expensive. These drinks often contain many other ingredients besides coffee, such as milk and sugar. Many of these drinks are iced coffees. Since 2022, the proportion of milk-based iced-coffee drinkers has increased from 10% to 14%. RTD coffees also tap into other trends, such as using plant-based milk alternatives and adding protein to products. This creates opportunities for suppliers of lower-quality coffee. As coffee is only one of many ingredients in RTDs, the quality of the coffee is less important.

Most companies that tap into the trend of premiumisation export high-quality coffee. Bette Buna is an Ethiopian specialty coffee farm that sells directly to European roasters. One of their clients is the Dutch Coffee Station.

Increasing prices and the Dutch coffee market

A global shortage of coffee has raised prices. The Asian consumer market is growing. At the same time, bad weather conditions, partly caused by climate change, have reduced harvests. Because of this, global coffee market prices have risen sharply after years of low prices. Higher prices have affected the Dutch coffee consumption market.

In 2025, Dutch supermarkets disagreed with Douwe Egberts increasing its prices by 15–20%. Large supermarkets chains like Albert Heijn, Jumbo, Plus and Picnic challenged the countries’ largest coffee roaster JDE Peet’s to explain its price increase demand. Albert Heijn and Jumbo stopped selling JDE Peet’s products for a while because they could not agree on a price. Eventually, the supermarkets agreed to pay more, and JDE Peet’s coffee brands returned to the shelves. This episode exposed coffee’s fragile economics. Meanwhile, JDE Peet’s reported a 50% increase in profits in 2024, largely due to higher prices.

Coffee exporters can benefit from improved price levels, although green coffee prices are still only a small part of what the consumers pay. Only 20% of consumer prices stay in the exporting country. The extent to which farmers and exporters benefit from increased prices depends on the country and the regulations surrounding Farm Gate Prices. Farmers in Guatemala, Honduras and El Salvador have profited from much higher prices. In Ethiopia, Farm Gate Prices declined due to a combination of currency devaluation and inflation. In all producing countries, rising fertiliser costs, labour shortages and climate change expenses have started to eat into profits.

Brokers and commodity traders who buy and sell coffee futures profit from price swings. When prices rise, they sell stored coffee at a premium. But when prices dip, they buy cheap. This speculation makes prices more unstable, which makes it harder for farmers to plan.

To profit from higher prices, it is important to remain flexible. This requires access to funding or high liquidity to sell at the right moment. It also requires market access, ideally to importers directly, to reduce the length of the value chain. Sorgeba Union is a group of Ethiopian producers that offers its coffee directly to importers through the online marketplace Beyco.

Some specialty coffee importers, like This Side Up, avoid market speculation and price swings by using long-term contracts. They work with farmers directly and agree on stable prices for several years. This gives farmers more security and helps them plan ahead. By building trust and keeping relationships open and transparent, both sides benefit. Farmers can invest in better coffee and care for their land, knowing they will get a fair price. This approach supports sustainability in coffee trade and helps create more stable and fair supply chains.

Tips:

- Explore direct trade models. These can help more revenue reach producers. But keep in mind that direct trade can be complex, costly and logistically challenging. Read our study on Entering the Dutch coffee market for more information on direct trade.

- See our study on trends on the European coffee market to learn more about current trends on the European market.

- See the national chapter of the Netherlands of the Specialty Coffee Association (SCA) for more information about the Dutch specialty coffee market.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI

Please review our market information disclaimer.

Search

Enter search terms to find market research