Entering the European market for organic cocoa

Organic cocoa must meet the EU regulation for organic to be sold on the European market. Non-EU countries like the United Kingdom and Switzerland have an equivalency agreement. This means that extra certifications are not needed for these countries, although many Swiss companies will also demand Bio Suisse certification. Most organic cocoa is imported through specialised importers. The main exporters are the Dominican Republic, Sierra Leone, the Democratic Republic of Congo, Peru and Uganda.

Contents of this page

1. What requirements and certifications must organic cocoa meet to be allowed on the European market?

You can only export organic cocoa to Europe if you comply with strict European Union (EU) requirements. Most of the requirements that are relevant for organic cocoa also apply to all cocoa exported to Europe. If you want more information about sector-level trends, read the CBI study What requirements must cocoa meet to be allowed on the European market. This section will only explain the requirements that are specific to organic cocoa.

What are the mandatory requirements?

Organic certification is not a legal requirement for cocoa. But to sell organic cocoa on the European market, it must comply with European organic legislation. This includes regulations for production, processing and trade. You can find the rules for organic production and labelling for countries in the EU in Regulation (EC) 2018/848. The regulation was updated in 2022.

The new regulation has several changes. For example, production rules are now easier to understand and the control system has been strengthened. Producers in third countries must now also comply with the same rules as those producing within the EU. The changes all happened 1 January 2025.

Figure 1: The EU organic logo

Source: European Commission

Obtain EU organic certification with a recognised authority

From January 1, 2025, it is mandatory to have audits against the new EU organic regulation. Companies have had 3 years (since 2022) to change to the new certificate. Old certificates are valid until 15 October 2025 during the derogation period. After 15 October 2025, only suppliers that are certified in compliance with Regulation 2018/848 can keep delivering organic products to the EU.

From 1 January 2025, only officially recognised control authorities and control bodies can give out organic certificates in countries outside the EU. Check this list to make sure that you are always working with an approved certifier. Approved companies will get a certificate to show that their products meet organic standards. All companies are checked at least once a year.

The local competent or control authorities check all organic products imported into the EU. Getting in touch with the right authority is the responsibility of the importer. There is a list of approved authorities for each country on the EU Agriculture and Rural Development website.

Also, all organic products imported into the EU must have the correct electronic certificate of inspection (e-COI). The e-COI must be given to the authorities before a shipment leaves. The importer is responsible for requesting the e-COI through TRACES. As an exporter, you must communicate with your buyer about the e-COI before the cocoa is shipped.

Importers need to have a strong Internal Control System (ICS) in place. An ICS is a framework that helps to make sure that products meet organic standards. As part of the ICS, the group will do internal inspections on its members. This means that certifiers mainly need to check that the ICS works well and only need to do random checks on individual members. A strong system helps give the importer feel more confident that the certification is in order. Fairtrade or Rainforest Alliance certification can help build your ICS.

Read the CBI Entering the European market for organic cocoa if you want more information about the impact of the new regulation.

Learn more about the organic requirements for European countries outside the EU

If you want to export to European countries outside the EU, check the required legislations for that country. The EU and Switzerland have signed an agreement on trade in agricultural products. EU organic and Swiss organic are seen as equivalent. You do not need extra certification if the cocoa is already EU organic certified. Cocoa can also be imported as organic in Switzerland if it complies with the requirements in Swiss Organic Law.

Bio Suisse is a privately owned organic standard in Switzerland. You do not need to have Bio Suisse certification for selling organic products on the Swiss market. But it is very popular in Switzerland. Most organic buyers in Switzerland will want to see a Bio Suisse certification. Some companies and retailers have even based their own organic standards on this program. This means that for exporters that want to enter the Swiss market, Bio Suisse certification could offer a lot of added value.

Bio Suisse is seen as an excellent certification program with extra criteria compared to EU organic. This could mean that it takes more effort to become certified. On the other hand, Bio Suisse cocoa could also have the benefit of higher premiums.

The EU and United Kingdom (UK) also have an equivalence agreement in place. Cocoa that is EU organic certified can be imported as organic in the UK under the Organic Products Regulations. The UK and EU reconfirmed the equivalency in 2023.

Learn more about other programs

USDA Organic allows a farm or processing facility to sell their products as organic in the United States of America (USA). USDA Organic is recognised as equivalent by the EU. This means that EU Organic cocoa can be imported by the EU and re-exported to the USA as organic cocoa.

There are a few extra requirements if the organic cocoa is re-exported to the USA. But these are the responsibility of the European exporter. As an exporter from a producing country to the EU, you do not need to do anything extra. A 2025 court ruling in Germany could have an impact on equivalence in the future.

Some European countries also have their own voluntary organic standards and labels. Examples are Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark).

There are private organic standards that go further than the EU standard. Examples are Naturland (Germany), KRAV (Sweden), Soil Association (United Kingdom), Demeter (several countries) and Regenerative Organic Certification (several countries, focused on regenerative agriculture). Most private standards have stricter rules than those in the EU organic legislation.

Ensure compliance with other EU regulations

Importers in the EU will also demand cocoa that is compliant with the EU Regulation on Deforestation-free Products (EUDR). All cocoa products that you export to the EU will need to comply with this regulation by 30 December 2025. Micro and small enterprises (MSEs) will have an extra six months to comply. Read the CBI study Tips to become EUDR-compliant in cocoa if you want more information.

It can be simpler for organic supply chains to become EUDR compliant. Firstly, organic supply chains are already more familiar with being open about where their products come from and origin information. Secondly, the products can already be traced back to make sure that organic cocoa is not mixed with non-organic cocoa.

A more difficult part of compliance is the requirement for geolocations (polygons or GPS points). This is difficult because most small cocoa farmers are not as digitally advanced. Exporters and importers can help create the geolocations for EUDR compliance. For example, Tradin Organic has the target to create geolocations and set up a deforestation prevention system for all cocoa origins by 2025.

More laws and regulations will be put in place in the coming years. These include the Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD).

The CSDDD requires companies to identify and deal with their adverse human rights and environmental impacts. It will apply to large EU companies with more than 1,000 employees and more than EUR 450 million turnover worldwide. Non–EU companies with more than EUR 450 million turnover in the EU are also part of this. Companies will need to start complying by 2027.

The CSRD requires companies to report on social and environmental risks and on the impact of their activities on people and the environment. As an exporter, you need to comply if you have a net turnover of over EUR 150 million in the EU and have at least one subsidiary or branch in the EU. You may also get information requests from your buyers. The CSRD will start to apply to reports published in 2025.

Labelling

The EU has a logo for organic products. This makes it easier for consumers to recognise organic products and helps to market them across the entire EU. When you export cocoa as organic, you must label the batch with the name and number of the organic control body and the certification number. The labels should be written in English. Using the EU organic logo is mandatory for pre-packaged foods (such as couverture).

For an organic claim, a chocolate product needs to have at least 95% organic ingredients (article 30 of regulation 2018/848). If a chocolate company wants to sell their chocolate products as organic, then (most of) the other ingredients also need to be organic. This includes sugar, milk and other ingredients.

Tips:

- Be aware that the transition phase for the Organic Regulation ended on 31 December 2024. The new regulation will have an especially big effect on farmer groups. Make sure that your audit against the new regulation is planned as soon as possible. Old certifications are no longer valid after 15 October 2025. Auditors will be very busy in the months before this deadline, so book your audits early. Always check the requirements asked for by the official website of the standard, so that you are up to date with the latest regulation.

- Only use a control body that is recognised by the EU for organic certification. Check the EU list of recognised control bodies and control authorities. If you have any questions about getting your COI and what this means for your exports, it is best to contact your control body. Your potential client may also have information that can help you.

- Inform yourself about the costs involved with certification. Direct costs include expenses that are necessary to comply with the organic standard, and the audit costs. If you are new to organic certification, ask for price quotations from different certifying bodies in your region and negotiate with them to get the best price.

- The IFOAM website is a useful source for information about organics. You can learn more about organic farming and organic guidelines on the European Union website and the Organic Export Info website. Check the International Trade Centre’s Standards Map for a full overview of certification schemes.

- Read the guidance from IFOAM if you want more information about setting up your ICS. A strong ICS will help you get through audits and gives your buyers trust and confidence that you can deliver the organic cocoa. Naturland also has a handbook on setting up an ICS.

What additional requirements and certifications do buyers often have?

It can also be helpful to be certified against other programs to create more opportunities to sell your cocoa. Selling as a multi-certified company can also mean higher premiums (cocoa can be sold for multiple premiums).

Consider certification against social certification

The most requested combination is Fairtrade certification with EU Organic certification. This combination deals with both the social and environmental side of sustainability. About 50% to 60% of Fairtrade cocoa is also organic certified. The combination has added value for buyers on the European market.

For exporters and producers, it could be interesting to become certified against both organic and Fairtrade programmes. This could open up new markets. Make sure that you also check with your current buyers if they are interested before you invest in multi-certification.

The combination with Rainforest Alliance is less common. In 2021, only 7% of Rainforest Alliance cocoa was also organic certified. The share was also 7% for UTZ-certified cocoa. More recent data is not available. The added value of Rainforest Alliance and organic certification comes from being able to sell the cocoa to different channels with different demands.

Fair For Life is a program that is popular in combination with Bio Suisse in Switzerland. The Swiss Bio-Foundation set up Fair for Life in 2006 and it is now managed by Ecocert. The standard has social and environmental requirements for all companies in the supply chain. Organic certification is not required for Fair for Life certification, but it is encouraged.

Read the CBI study on Exporting certified cocoa to Europe if you want more information about the benefits of multi-certification.

Price and premiums

For Fairtrade organic certified cocoa, an Organic Differential of EUR 300 per tonne is added to the Minimum Fairtrade Price. For all other organic cocoa, price differentials or premiums are common but are not mandatory. Read the section on the price for organic cocoa if you want more information.

Tips:

- Try to combine audits if you have more than one certification. This could save time and money. You could also look into the possibilities for group certification with other producers and exporters in your region.

- If you are a Latin-American producer that is also Fairtrade certified, connect with CLAC, the Latin-American and Caribbean Network of Fair Trade Small Producers and Workers. CLAC offers services to almost 1,000 Fairtrade certified organisations. Their workshops, training and meetings are a great place for networking.

What are the requirements for niche markets?

Bean to bar chocolate is a niche segment that could require organic certification. Many bean to bar products are also organic certified. This adds value for consumers and helps tell the sustainability story of the brand.

However, the costs and investments for organic certification are not always worth it. In some cases, it is too expensive or difficult for a small-scale producer or brand to organise. Some importers even prefer chocolate without organic certification, because it makes it easier to import. If they import organic certified chocolate, then their facilities also need to be organic certified, which increases the costs and complexity.

Tips:

- Read our tips to go green and our tips on how to become more socially responsible for other ways to make your products more sustainable.

- Read the CBI study Exporting bean to bar chocolate for more information about these products.

2. Through which channels can you get organic cocoa on the European market?

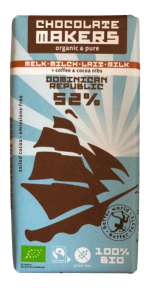

Most organic cocoa is imported by European importers that specialise in organic. A smaller volume of organic cocoa is also imported by multinational conventional traders, mid-sized and small traders. Final products are usually sold in large supermarkets or smaller markets with a focus on organic. However, exporters do not sell directly to retailers. The most interesting approach for exporters is to build a strong, long-term relationship with specialised organic importers.

How is the end-market segmented?

Organic cocoa and cocoa products are used mainly for chocolate. Other large product groups are confectionery, drinks and food products. The pharmaceutical industry uses a very small share of cocoa supply. This study will focus on chocolate, because this is the most important product group.

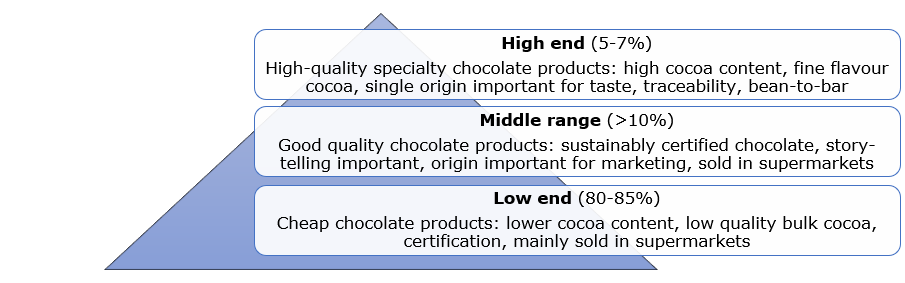

The chocolate industry can be divided up by quality. Organic cocoa is used in both the mainstream and the specialty cocoa market. It is more common in the high-end segment.

Figure 2: Segmentation of the chocolate market based on quality

Source: ProFound – Advisers In Development

Low-end segment

Chocolate in the low-end segment is cheaper and usually has a lower cocoa content. The cocoa is used for multinational brands and lower-quality private label products from supermarkets. Organic certification is rare.

However, there are some exceptions. For example, German supermarkets Aldi (GUT BIO), REWE (Bio) and Netto Marken (BioBio), Belgian supermarket Colruyt (BON BIO) and Swiss supermarkets Coop (Naturaplan) and MIGROS (Frey Bio) sell organic private-label chocolate. More examples are shown in the table below.

Table 1: Examples of private-label organic chocolate sold at supermarkets in the Netherlands

| Product | Retail price | Retail price per kg | Packaging |

|---|---|---|---|

| Lidl organic pure chocolate 100 grams | 1.99 euros | 19.90 euros |

|

| Albert Heijn organic pure chocolate 100 grams | 2.29 euros | 22.90 euros |

|

Source: Albert Heijn 2025 and Lidl 2025

Figure 3: Private label brand BioBio (top-left corner) sold at Netto in Germany at the same price point as other chocolate products

Source: Long Run Sustainability

Mid-range segment

The mid-range segment includes chocolate products of good quality. Products are often certified Rainforest Alliance or Fairtrade, but organic certification is not common. Mid-range products are also mainly sold in supermarkets, usually in the high-quality category.

Table 2: Examples of mid-range segment chocolate products sold at Albert Heijn (Dutch retailer) in 2024

| Product | Retail price | Retail price per kg | Packaging |

|---|---|---|---|

| Alter Eco Pure organic chocolate | 3.99 euros | 33.90 euros |

|

| iChoc Super nut organic milk chocolate | 2.89 euros | 28.90 euros |

|

Source: Albert Heijn 2025

High-end segment

Smaller, more specialised chocolate makers produce high-end chocolate products. They mainly use fine-flavour or specialty cocoa. These products often have a high cocoa content. They are usually made with organic cocoa.

Examples of small bean to bar brands are Blanxart (Spain), Domori (Italy), mi joya (Belgium), and Fjåk Chocolate (Norway), Paccari (Ecuador, sold in Europe), Marou Chocolate (Vietnam, sold in Europe), Chocolatemakers and Original Beans (the Netherlands), Zotter (Austria), Friis-Holm (Denmark) and Meybol Cacao (Germany). Read the CBI study on Exporting specialty cocoa to Europe to find more examples.

Table 3: Examples of high-end segment organic chocolate products sold at Ekoplaza (Dutch retailer) in 2024

| Product | Retail price | Retail price per kg | Packaging |

|---|---|---|---|

| Chocolate Makers Pure 80 grams | 3.99 euros | 49.88 euros |

|

| Happy Chocolate Pure 85 grams | 3.99 euros | 46.94 euros |

|

| Lovechock Pure 70 grams | 5.69 euros | 81.29 euros |

|

Source: Ekoplaza 2025

Tips:

- Exporters usually do not export to a specific market segment. Most organic cocoa exporters have little or no influence on where the cocoa ends up. The producer is only linked to a brand when they are specifically marketed on the final product, which is rare. The next section on channels is more relevant for exporters.

- Read the CBI study 9 tips for finding buyers on the European cocoa market if you want more background information about how the cocoa market is segmented.

Through which channels does organic cocoa end up on the end-market?

Almost all organic cocoa enters the European market through a specialised organic importer. These importers resell the organic cocoa, as beans or as processed cocoa (paste, butter, powder and couverture). The importer often does not know where the cocoa ends up on the market. They sell to a buyer who then processes the cocoa further. For exporters, this also means that usually, you will not know where the organic cocoa ends up (with which brand or company, or even in which country).

Other channels are multinational traders, mid-sized importers and small importers. Craft or bean to bar buyers usually buy through an intermediary, so they are not a common import channel.

Most organic chocolate is sold in supermarkets and hypermarkets. The organic cocoa for private-label products in large supermarkets can also enter Europe through larger traders. This is because private label manufacturers often already have relationships with these suppliers for their bulk cocoa. Organic cocoa for smaller ecological supermarkets usually enters the European market through specialised traders.

Figure 4: Importers of organic cocoa on the European market

Source: Author

Specialised organic cocoa importers

The most common channel for organic cocoa is through specialised organic cocoa importers. These are large importers that import most or all their cocoa as organic. Their corporate identity is centred around organic food ingredients. There are not many specialised cocoa importers and processors. This is because it is difficult and expensive to process organic cocoa, and because they need the storage space to store the cocoa.

The three largest European organic cocoa importers are Tradin Organic, PRONATEC and ICAM. Together, they make up around 80% to 90% of all organic cocoa imports into Europe.

Tradin Organic is based in the Netherlands and has personnel based around the world, including an office in Sierra Leone. Tradin Organic sources organic cocoa from different countries. Their processing facility at Crown of Holland was opened in 2013, with a capacity of 9,000 tonnes. They are responsible for most of the organic cocoa imported from Sierra Leone. Tradin sourced 20,000 tonnes of organic cocoa in 2022.

PRONATEC is an importer and processor based in Switzerland. They have organic cocoa mass, butter, powder and nibs at their own production facility since 2022. Their focus is more on Latin-American cocoa. On the other hand, Tradin Organic focuses on Africa. They have a subsidiary in the Dominican Republic (YACAO) and partnerships in Madagascar, Paraguay and several other countries. Almost their entire cocoa volume is organic, except for when cocoa gets downgraded, which does not happen often. PRONATEC has a capacity of up to 15,000 tonnes of cocoa per year.

ICAM is an Italian company focusing on organic cocoa. They own a collection and processing centre in Uganda as part of their development work there. They also have projects in the Dominican Republic and Peru. In 2023, 68% of the 26,068 tonnes of cocoa purchased was certified Rainforest Alliance, Fairtrade or Organic. ICAM says they are the world’s leading producer of organic chocolate. They processed 27,000 tonnes of cocoa in 2023 and sourced 80% organic products.

Some specialised companies that process organic cocoa will only buy organic cocoa (and no regular cocoa). If a company only processes organic, it makes it easier for them to process the cocoa. This is because the machines do not need to be cleaned between batches. But because of the high costs, not many companies are able to specialise, so options for processing of organic cocoa are limited.

Organic cocoa importers with processing facilities will sometimes process organic cocoa for other companies. They will do this if they have enough capacity to process extra cocoa. That way, the other company does not have to make sure that the cocoa is not mixed in their own facilities during processing. An example is Tradin Organic, which has a processing facility in the Netherlands.

Organic importers buy for specific clients and speculatively. For some imports, they already have a buyer ready to buy it. For other imports, they will store the cocoa because they expect that demand will go up.

Multinational traders and processors

A small amount of organic cocoa is imported to the European market through multinational traders and processors. They usually source their cocoa directly from producing countries and have their own operations there. These companies will only buy a very small part of their cocoa beans as organic cocoa. They do not say what the organic share is, but for many this might only be around 1-2% of total imports.

The largest companies are Barry Callebaut, Ofi and Cargill. Together, these three companies made up more than half of global cocoa sales in 2021. But their organic cocoa volumes are only a very small part of their overall cocoa volume. Other large importers are Cemoi, Ecom, Sucden and Touton. In 2023, Cémoi imported organic cocoa from Ecuador, Peru, the Dominican Republic and São Tomé and Príncipe.

Mid-sized traders

There are also mid-sized traders that source part of their volume as organic. But their volumes are usually only a small part of their total buys. They are not focused on organic cocoa. Examples are Minka SCS, Walter Matter and Cocoasource (Switzerland) and Natra (Spain). Cocoasource imported 437 tonnes as organic in 2023, which was around 1% of their total volume.

Small specialty traders

Small specialty traders also import organic cocoa into Europe. These typically only import no more than a few hundred tonnes of organic cocoa per year. These importers can buy part or all of their cocoa as organic. However, because of their small volumes, they are less important to exporters than the specialised organic importers. Examples of smaller specialty trading companies are Silva (Belgium), Uncommon Cacao (United States, with storage facilities in the Netherlands), Naturkost Übelhör and Bohnkaf-Kolonial (Germany) and Le Cercle du Cacao (Belgium).

Tips:

- Before becoming certified organic, check with your potential buyers if they want to buy organic cocoa. Decide if certification would give you a competitive advantage over other suppliers to the European market. Make sure that certification makes sense financially and that it helps you build long-term relationships with buyers.

- You can find importers from specific European markets that specialise in organic products on the website of Organic-bio. You can also check which potential European buyers have EU organic certification on the Organic Operator Certificates list. Search for cocoa and the list will show all companies with an approved certificate for cocoa.

- Watch the CBI webinar Opportunities and requirements for exporting organic cocoa to the European market.

What is the most interesting channel for you?

The most interesting channel is specialised organic cocoa importers. This is how most organic cocoa beans come into Europe.

Exporting to specialised organic cocoa importers has several advantages. They are experienced in organic cocoa imports, so they are a great source of information and support. Some importers can even help producers and exporters to prepare for organic certification. They are connected to a large network of organic buyers in Europe and have storage facilities for organic cocoa. This makes it easier for them to buy extra volumes as organic.

A possible disadvantage is that being tied to one importer could limit the options of selling to other importers. If you are contractually linked with one buyer, it can be more difficult to sell to others. If you have an attractive contract, this should not be a problem. It is important to make sure that the contract is beneficial for both parties.

For producers and exporters, it is important to be an attractive partner for these importers. There are several ways to make your product more attractive.

One way is to make sure that there is a strong Internal Control System (ICS) in place. A buyer can help, but it is the responsibility of the farmer group to train and prepare the farmers.

Knowing where the cocoa comes from is also very important to importers. This is called traceability. Exporters need to show that they have their traceability under control. If there is any cross-contamination, the first thing a buyer wants to see is traceability, to rule out risks in the future.

Volume and scale are also important. A cooperative must be able to always offer a large enough volume to be an attractive supplier. Volumes become interesting to importers at a minimum of 200-300 tonnes per year.

A strong relationship is the basis for all this. Specialised importers prefer to work with the same supplier for many years. Companies like PRONATEC have worked with some suppliers for longer than a decade. Importers will also look for organisations with a strong structure and good communication.

Tips:

- Personal connections are important for developing new relationships and supply chains. Build a relationship with the specialised organic cocoa importers based in Europe. This is the main way to access the European market for organic cocoa. Direct relationships with chocolate brands and private label producers are rare.

- Long-term relationships are very important in the organic cocoa sector. When there is a long-term relationship, it is more interesting for the buyer to help develop the farmer groups.

- Exporters and importers can also pre-finance organic production. It is important to have very clear contractual agreements in place when this is done.

- Read the CBI studies about Building your business, which includes studies on finding buyers, doing business and organising export.

3. What competition do you face on the European organic cocoa market?

The largest exporters of organic cocoa to the EU are the Dominican Republic, Sierra Leone, the Democratic Republic of Congo (DRC), Peru and Uganda. They all have a strong link with different European countries. Part of the organic cocoa is exported by local exporters, while international traders are also sourcing directly through subsidiaries.

Which countries and companies are you competing with?

The total area cultivated as organic cocoa worldwide was 509,000 hectares in 2023. Africa had the largest area with 62%, followed by Latin America (37%), Asia (1%) and Oceania (less than 1%). The countries with the largest organic cocoa area were Sierra Leonne with 165,000 hectares, followed by the Dominican Republic with 114,000, the DRC with 84,000, Peru with 42,000 and Ghana with 23,000.

The largest exporters of organic cocoa to the EU in 2023 were the Dominican Republic (17,000 tonnes), Sierra Leone (12,000 tonnes), the DRC (8,000 tonnes), Peru (7,000 tonnes) and Uganda (5,000 tonnes). These five countries together made up 86% of total organic imports into the EU. They are not large cocoa producers, but are very focused on organic production.

The Dominican Republic exports more organic cocoa than Sierra Leone, even though it has a smaller organic cocoa area. This can partly be explained by lower yields in Sierra Leone compared to the Dominican Republic. It can also be due to mixing or downgrading of organic cocoa in Sierra Leone.

Total organic exports were less than 100,000 tonnes in 2023. This is low compared to the total farmed area. There are three reasons for the low volumes exported per hectare. First, countries like the DRC and Sierra Leone have a low density of cocoa trees per hectare and low yields. These farms do not produce a lot of cocoa. Second, some organic cocoa is downgraded to conventional when contamination is found. Third, not all organic cocoa is sold as organic because of a lack of demand. With the high cocoa prices, some organic cocoa is now also sold as conventional because what sets it apart becomes less interesting compared to the high overall price.

Very little organic cocoa is imported from Ghana and Côte d’Ivoire, the world’s largest cocoa producers. There is some organic cocoa available, but a lot of it is sold as conventional cocoa. There are several reasons for this, including mandatory fumigation for exports, regulation of the cocoa sector and a lack of organic approved exporters. Organic cocoa export from these countries is not expected to grow much in the coming years.

Source: TRACES 2025

Some origin countries have a stronger connection with specific consumer countries. For example, the Netherlands is the main importer of organic cocoa from Sierra Leone (led by Tradin Organic). Belgium is the largest importer from the DRC and the Dominican Republic (led by PRONATEC), and Italy is the main importer from Uganda (led by ICAM). These connections are important for exporters to keep in mind. It could be easier to export to specific countries when there are already export supply chains in place.

Source: TRACES 2025

The Dominican Republic is the main exporter of organic cocoa to Europe

The Dominican Republic plays an important role in the production and exports of certified cocoa. There has been a lot of investment in organic cocoa production. 51% of their cocoa supply was organic in 2021, which was the second-most in the world after Tanzania. The Dominican Republic had the third-largest area of organic cocoa production in the world after Sierra Leone. Peru and was the largest exporter of organic cocoa to the EU in 2023.

There has been a strong shift from North American exports to European exports. In 2002, 74% of their cocoa was exported to North America, and only 24% to Europe. In 2020, this has shifted to only 29% to North America and 55% to Europe. The main ports are in Belgium, the Netherlands, Germany and Italy. Belgium is the most important port, with more than half of all imports.

Organic cocoa production in the Dominican Republic will probably stay stable. Much of the land available is already farmed for cocoa and other products. There is not much room for growth. However, the global cocoa shortage has set the country up as an important player for organic and premium cocoa.

Conacado is an example of an exporter in the Dominican Republic. They offer a large list of certifications, including Rainforest Alliance, Fairtrade, Organic (USDA and EU), Fair for Life, Bio Suisse and others. They can also process cocoa, with a capacity of 26,000 tonnes per year. Conacado has partnered with Valrhona on a project to map farm plots.

Table 4: Competitive country profile of the Dominican Republic

| Strengths | Weaknesses |

|---|---|

|

|

Source: Gaia cacao and others

Sierra Leone exports mostly to the Netherlands

Sierra Leone is the second-largest exporter to the EU. Exports have decreased in the last two years, but overall exports increased by an average of 1% per year between 2019 and 2023. Organic cocoa production and exports will probably go up over the coming years. 60% of the cocoa produced in Sierra Leone is organic. Almost all (97%) EU import from Sierra Leone was imported by the Netherlands.

Pesticides in Sierra Leone are not as easily available as in Latin America. This means that a lot of cocoa is “organic by default”, because pesticides are simply never used. This makes it easier to expand organic production in Sierra Leone. The levels of cadmium in the ground in Sierra Leone are also low compared to some Latin-American countries. This makes the cocoa more attractive to some buyers in countries where consumers are worried about cadmium levels in their food.

An example of an exporter is Tradin Organic, which has a large office in Sierra Leone. Tradin Organic has played a big role in the rise of Sierra Leone as an organic origin. Tradin Organic is responsible for a large share of these imports. The company has also invested in organic production in Sierra Leone for many years. Supported by a grant of 1.85 million euros from the EU, Tradin Organic and ECOTOP want to convert 1,100 hectares into dynamic agroforestry systems by 2027.

Table 5: Competitive country profile of Sierra Leone

| Strengths | Weaknesses |

|---|---|

|

|

Sources: Techagro, Worldbank, Cocoaradar and IDH

Democratic Republic of Congo exports are expected to rise

The DRC is the third-largest exporter of organic cocoa to the EU. In 2023, they exported 8,000 tonnes to the EU. Exports have been quite steady, with an average of 8,500 between 2019 and 2023. However, organic cocoa production and exports will probably rise over the coming years.

A lot of cocoa from the DRC is also “organic by default”. This makes it relatively easy to produce organic cocoa. However, a lot of work needs to be done to make the farms more productive and to prepare them for certification.

Deforestation risk is high in the Congo Basin, which spans Cameroon, Gabon and the DRC. The country lost about 8.5% of its total forest area between 1990 and 2020. Deforestation is driven by industrial agriculture, small-scale farming, and expanding cities. Cocoa production is linked to seven times more deforestation than other livelihoods. When exporting from the DRC, it is important to make sure that the cocoa does not cause deforestation. This will also be important to comply with the new EUDR regulation.

The main importer from the DRC is Belgium, with 60% of all EU imports. Examples of brands that use organic cocoa from the DRC are Chocolatemakers (based in the Netherlands) and Virunga Origins (Belgium, produced in DRC).

Table 6: Competitive country profile of the DRC

| Strengths | Weaknesses |

|---|---|

|

|

Source: various

An example of an organic cocoa exporter in DRC is Esco Kivu. They promote sustainable cocoa production and improve farmer livelihoods with training programs, support for cooperatives, projects and other support measures. Many of these initiatives and their impact are described on their website. Apart from to Europe and the US, they also hold stocks of organic cocoa in Europe. The Dutch brand Chocolate Makers uses cocoa from their cooperative.

Figure 7: Organic cocoa at Esco Kivu in the Democratic Republic of Congo

Source: Esco Kivu

Peru

Since 2019, organic cocoa farming has grown a lot in Peru. Some reports say that Peru is now the second-largest organic cocoa producer in the world. This growth has led to a risk of deforestation.

Peru is the fourth-largest exporter of organic cocoa to the EU, with 7,000 tonnes in 2023. Most of this cocoa is imported by the Netherlands (41%) and Italy (32%). Organic exports to the EU have gone down by an average of 12% per year between 2019 and 2023.

Peru has problems with pesticide use. There is contamination from non-organic cocoa farms and other crops like bananas. The local government encourages and stimulates the use of pesticides.

An example of an organic producer and exporter is ACOPAGRO. The cooperative was founded in 1997 to improve the quality of the cocoa and give the farmers technical assistance. They partnered with PRONATEC. They are now one of the biggest organic cocoa cooperatives in Peru.

Table 7: Competitive country profile of Peru

| Strengths | Weaknesses |

|---|---|

|

|

Source: CGIAR and others

Uganda

Development of the organic sector in Uganda had some ups and downs, with a peak in 2007/08. This number then went down steadily while the area and the number of producers grew slowly. Exports of organic products started with pineapples and sweet bananas, and soon after included cocoa and many other products.

Uganda is the fifth-largest exporter of organic cocoa to the EU, with 5,000 tonnes in 2023. Most of this cocoa is imported by Italy (49%) and Belgium (27%). Organic exports to the EU are growing. They have increased by an average of 11% per year between 2019 and 2023.

Although production potential is limited to the central and western regions (including the Semuliki Forest), there is a lot of potential for scaling production. Vanilla is often grown together with coffee or cocoa.

An example of a cooperative in Uganda is Bundibugyo. They work with the local government, partners such as Progreso Foundation, and are supported by the Rabobank Foundation. They do not export cocoa themselves but sell to exporters. There is a list of their buyers on their website (5 buyers in 2025). Of these buyers, 2 are local and 3 are international. African Trade Winds is a Cocoasource (Switzerland) subsidiary, Ainea & Sons is a local exporter, Bundicao is owned by Minca SCS (Switzerland), Esco Kivu is a local exporter also working in DRC, and Ofi (global) has an office in Uganda.

Table 8: Competitive country profile of Uganda

| Strengths | Weaknesses |

|---|---|

|

|

Sources: GIZ and others

Madagascar

Madagascar is a small cocoa origin. The country only exported 5,000 tonnes of beans to the EU in 2023. However, a fairly large share of exports was organic, at around 27% (1,300 tonnes). Exports are growing, with a 24% annual average rise between 2019 and 2023. A large share of these exports could also be fine-flavour cocoa. ICCO says that 100% of cocoa exports from Madagascar can be classified as fine flavour cocoa.

The most important destination is the Netherlands at 53% of imports, followed by Belgium (23%) and France (12%). Walter Matter is an important buyer of Madagascar cocoa, buying around 30% of their production.

There are several chocolate companies active in Madagascar. These include Chocolat Madagascar by Chocolat Robert, Beyond Good, MIA and Menakao. An example of an exporter is Golden Atlas. They ship by sea from Antsiranana/Diego through two shipping line companies: CMA-CGM and MSC.

Table 9: Competitive country profile of Madagascar

| Strengths | Weaknesses |

|---|---|

|

|

Source: Silva Cacao and others

Tips:

- Learn about organisations and initiatives that offer technical support to help you with organic certification. Start your search with the organic movement in your own country and ask if it has its own support programmes or knows about existing initiatives. Check the database of IFOAM Organics affiliates for organic organisations in your country.

- For more detailed information about important exporters and EU importers of organic cocoa, take a look at the 2018-2023 database published by TRACES. The TRACES website will publish data about the year 2024 in 2025.

4. What are the prices of organic cocoa on the European market?

Organic cocoa gets a higher price on the international market. At the same time, input costs can be lower, since expensive fertilisers and other substances are not needed. If done right, organic cocoa relies on internal inputs rather than external inputs. This means that a higher price with lower inputs should lead to a higher income for farmers. Organic cocoa production is also better for the health of the farmer (with less exposure to harmful substances) and the environment. This also has a financial benefit for the farmers and for the planet.

Organic cocoa production also has specific expenses that contribute to the (higher) market price of organic cocoa. Costs are made to comply with the requirements and get through the audits. Premiums and price differentials are paid to the farmers and farmer groups. Exporters also make costs to comply with the requirements and to ship organic cocoa. Many of these costs are passed on along the supply chain.

Producers that can offer consistent volumes of quality organic cocoa have a better position in the value chain than producers of regular cocoa. Demand for organic cocoa is higher than supply, which helps the negotiation position of the producers. Organic cocoa also usually demands a higher premium than regular cocoa. These and other factors give producers quite a strong negotiation position.

This study only focuses on the prices that are specific to organic cocoa. For more information about the breakdown of prices in cocoa see the CBI study Entering the European market for certified cocoa.

Price differentials

You usually need to pay a higher price for organic cocoa. This price differential rewards the producer or exporter for their efforts to make sure that the cocoa is organic. The differentials are not published, because they depend on negotiations and specific supply chains. Some examples have been published:

- The 2021 Global Cocoa Market Study estimates the organic premium at 300 USD per tonne.

- A 2021 study found that the organic premium paid to producers in the Dominican Republic ranged from 70 USD to 105 USD per tonne.

- A 2024 BASIC study reports that the common differential for organic is 200 to 300 euros per tonne. The range for organic cocoa is 180 to 280 euros, and for Fairtrade organic the range is 270 to 300 euros per tonne. Differentials are becoming much less of a motivation when the FOB (Freight On Board) prices are higher than 6,000 USD per tonne. With these prices, the differentials fall below 5% of the FOB price.

- Fairafric reports paying a 600 USD premium per tonne.

- For Fairtrade organic certified cocoa, an Organic Differential of 300 euros per tonne is added to the Minimum Fairtrade Price.

Certification costs

There are no standardised certification costs. The costs are different for each group, country and certification body used. They can vary according to the size of the group (number of members) and depend on which auditors are available in the country of origin.

BASIC reports the costs per member around 200 euros per year for 2023. This would equal around 100 euros per tonne of organic cocoa in 2023. Most of these costs are for internal management costs. They project the costs to increase by 15 to 100 euros per tonne in 2025. This means a likely increase of 20-30% in certification costs.

The new EU requirements are not expected to lead to higher costs according to BASIC. Operators in the EU did not make higher costs because of the changes. If there were higher costs, they were mainly because the COI was not correct or the shipment was delayed.

Tips:

- There are several websites that publish the price of cocoa. The futures price can be found on the ICE website and the ICCO website.

- Changes in Fairtrade prices and premiums are published on the Cocoa Fairtrade Minimum Price Differential page.

Long Run Sustainability carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research