The European market potential for bean to bar chocolate

Demand for bean to bar chocolate is increasing. Consumers are demanding healthier and more responsible products more often. However, the total export volume of bean to bar chocolate are still extremely small. The main markets for bean to bar are Germany, the United Kingdom (UK) and France.

Contents of this page

1. Product description: bean to bar chocolate

Bean to bar chocolate is chocolate that is made by one company, starting from the raw cocoa beans and ending with the finished chocolate products. The producer or manufacturer controls the entire process from bean to chocolate. Products are usually made with high-quality cocoa. Usually, there is an ethical or sustainability story behind the product as well.

There is no universally agreed definition of bean to bar chocolate. The terms can be used for different business models. However, bean to bar is mostly used by small companies with a direct connection to the cocoa farmers. The final product is usually of a high standard.

Most bean to bar chocolate is produced in small batches. Usually, each step of the process is done manually. This gives chocolate makers more control over the process and brings out the best of the beans.

A sub-category of bean to bar is tree to bar. With tree to bar chocolate, the chocolate producer also owns the farms where the cocoa is produced.

Bean to bar chocolate produced in origin countries

Bean to bar chocolate can be produced in cocoa-producing countries and in consuming countries. In both cases, the company receives the beans and creates the final product. Bean to bar products produced in origin countries can be sold in the origin country or exported to other consuming countries. For example, Brazil has a large domestic bean to bar market but does not export a lot of chocolate.

European imports of bean to bar chocolate are very small. Experts estimate the craft bean to bar market at 0.2% of the global cocoa market. Only a small portion of bean to bar chocolate is produced in origin countries. That is why the scope of this study is probably less than 0.01% of the global cocoa market. Based on global production of 5 million tonnes, this would mean around 500 tonnes of cocoa.

The European bean to bar market is very competitive, and quality is the most important characteristic of the chocolate. Very few bean to bar chocolate producers can successfully export to Europe. Read the trends section for more information about this.

This study will cover tree to bar and bean to bar chocolate products that are exported from producing countries to Europe. Bean to bar producers in Europe or other non-producing countries (such as the United States) are not included.

Chocolate is traded under the HS code 1806 Chocolate and other food preparations containing cocoa.

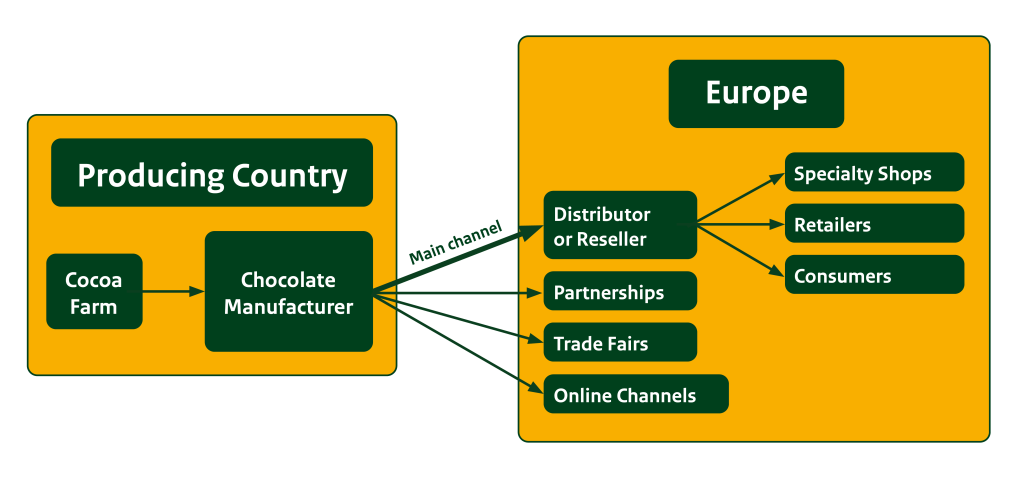

Figure 1: The scope of this study: bean to bar and tree to bar chocolate exported from producing countries

Source: Long Run Sustainability

2. What makes Europe an interesting market for bean to bar chocolate?

Demand for craft chocolate is increasing. Overall demand is small, but the market is expected to grow. European bean to bar production is becoming more common. It is difficult for exporters to enter the market. However, bean to bar chocolate produced in origin countries has a unique story that European manufacturers cannot offer.

Chocolate imports in Europe are very small but increasing

Europe mostly imports cocoa as beans or products (paste, butter, powder). Chocolate imports are small, with 54,000 tonnes of chocolate imported from producing countries in 2023. However, most of this volume came from Côte d’Ivoire (90%) and Malaysia (2%). These countries are large cocoa processors but they are not known as exporters of bean to bar chocolate. Most or all of their volume is exported as bulk chocolate. Only 4,666 tonnes were imported from other producing countries in 2023.

Only a small part of this volume is bean to bar chocolate. These products come from many different countries, including Brazil, the Dominican Republic, Ecuador, Madagascar, Peru, the Philippines, Uganda, Vietnam and several other countries. HS code 1806 does not make a difference between craft/bean to bar and conventional chocolate. Because of this, it is difficult to know how much is bean to bar. If the cocoa content is 30%, and one-third of chocolate import is bean to bar chocolate, then the total bean to bar exports to Europe would only contain around 500 tonnes of cocoa beans.

European chocolate imports from producing countries increased by an average of 23% per year from 2019 to 2023 (excluding Côte d’Ivoire and Malaysia, which mainly export bulk chocolate). Colombia, Peru, Mexico, Brazil, Vietnam and Thailand were the largest exporters over this period. Export increased for all countries except Vietnam during this time. While total exports are still very small, the volumes are increasing. This could provide an opportunity for bean to bar chocolate exporters.

Source: Eurostat and Trademap 2025

The countries with the highest per-capita chocolate consumption are in Europe

Europe is an attractive market for chocolate. The world’s average chocolate consumption is around 0.9 kg per capita per year. Many European countries consume much more than that. In 2023, people in Switzerland consumed the most chocolate per capita at 10.9 kg. They were followed by Estonia (9.0 kg), Germany (8.9 kg), Finland (8.6 kg) and Lithuania (6.9 kg). This makes Europe an attractive market for bean to bar chocolate export, compared to other regions in the world.

However, Europe also has a high concentration of chocolate companies. It is difficult to enter the market, especially as a small craft chocolate producer.

Europe has the world’s largest bean to bar market

European demand for specialty or premium chocolate products is growing. The market is expected to grow by 8.7% per year between 2025 and 2030. Demand for high-quality bean to bar chocolate products is expected to keep increasing as well.

The craft chocolate market is benefiting from this strong demand. Over the past 20 years, the craft chocolate industry has grown around twice as much as the commodity cocoa market. Europe is home to 49% of all craft chocolate companies. This is the largest share in the world, followed by the United States of America (33%), Canada (3%) and Australia (2%). The large number of craft companies in Europe shows that there is a lot of demand for craft chocolate in Europe.

There is a lot of competition in the premium and craft chocolate segment. Bean to bar exporters compete directly with European bean to bar producers. They find it hard to get access to the crowded European market. However, there is room for growth in bean to bar high-end retail and boutique gifting markets. This could still offer opportunities for bean to bar exporters.

Tips:

- The European market for bean to bar chocolate is very small and dominated by local bean to bar producers. Exporters can focus on what makes their chocolate special to stand out in the market. Bean to bar exporters are unique because they create more value in the producing country, since the entire chocolate product is produced there.

- Read more about premium and specialty cocoa in the CBI study The European market potential for speciality cocoa.

3. Which European countries offer the most opportunities for bean to bar chocolate?

There are many bean to bar chocolate producers in Europe. The European countries with the most bean to bar chocolate makers are France, Italy, Germany, Austria, the UK and Switzerland. These countries are attractive markets for bean to bar producers. However, this also means that exporters of bean to bar products will have to deal with more competition on these markets.

Source: Journal of Agriculture and Food Research 2021

The top European importers of chocolate from producing countries were the UK, Belgium, Germany and the Netherlands in 2023. Together, this made up 88% of total European chocolate imports. This does not include Côte d’Ivoire and Malaysia, they are excluded because they export (mostly) bulk non-craft chocolate.

Source: Eurostat and Trademap 2025

This study will look more closely at three large chocolate importers (the UK, Germany and the Netherlands) and three countries with strong domestic bean to bar industries (France, Italy and Switzerland).

France has a history of craft chocolate makers

France has a history and a strong presence of craft chocolate makers. The French chocolate sector has nearly a hundred SMEs and around 400 artisan chocolatiers and confectioners. Many of these have joined the Confederation of Chocolate and Confectioners of France, which is a professional organisation of artisan chocolatiers.

France also has a strong French bean to bar association. The association brings together chocolate makers, experts and ambassadors in the bean to bar industry. Members make commitments to quality in production, ethical and environmentally responsible sourcing, cocoa varieties used, and to the sharing of resources. Their members are listed on their website.

France has many famous local chocolatiers. One example is Chocolaterie A. Morin, an artisanal chocolate factory founded in 1958. They have relationships with farmers and receive the beans in France, where they produce bean to bar chocolate and other chocolate products. Chocolat Bonnat is another French chocolatier that specialises in single-origin chocolates. They are known for their bean to bar approach and direct trade. Chocolaterie Robert works with Chocolat Madagascar. Other examples of specialised chocolate makers include Michel Cluizel, Grain de Sail and Le Cacaotier.

Imports of chocolate from producing countries are very low. More than 99% of chocolate imports from producing countries came from Côte d’Ivoire, which is not a bean to bar chocolate exporter. Around 100 tonnes per year came from other producing countries, mostly Ecuador (28 tonnes in 2023), Costa Rica (20 tonnes), Brazil (17 tonnes), Madagascar (14 tonnes) and Peru (9 tonnes).

The popularity of craft chocolate makes France an interesting market for bean to bar exporters. However, there is a high concentration of local craft chocolate makers in France. This could make it difficult for bean to bar exporters to compete on the French market.

Italy’s craft market is growing

Italy has a long history of producing quality chocolate. Several large Italian companies have made chocolate from cocoa beans for the large-scale commercial retail market for many years. However, craft chocolate has only recently started to grow. Most small chocolate makers that use specialty cocoa were only started around 2018-2019.

In 2024, this growth led to the launch of the Italian bean to bar chocolate association. The 15 founding members are part of 10 companies. They decided to start relatively small to launch the association, but they expect to grow further. One of their goals is to increase the consumption of bean to bar chocolate at the national level.

One example is Domori, a manufacturer that uses only specialty cocoa. They own plantations in Latin America. Another example is Karuna Chocolate. They source beans from all over the world for their bean to bar products.

Italy does not import much chocolate from producing countries. From 2019 to 2023, Italy imported an average of 62 tonnes of chocolate per year from producing countries. Most of this came from Nigeria (25 tonnes in 2023), Peru (22 tonnes), India (9 tonnes) and Ecuador (6 tonnes). A big part of this volume is probably bulk rather than bean to bar chocolate.

The growing craft market could make it interesting for bean to bar exporters to find access to the Italian market. The bean to bar association is also open to members outside Italy.

Germany has fewer local bean to bar makers

Germany is Europe’s third-largest importer of chocolate from producing countries (excluding Côte d’Ivoire and Malaysia) with 694 tonnes in 2023. Most of this came from Colombia (279 tonnes), Ghana (181 tonnes), Thailand (146 tonnes), Mexico (36 tonnes) and India (20 tonnes). Most chocolate imports from Ghana are probably bulk, non-craft chocolate.

Germany has a market that is enthusiastic for craft chocolate. Demand is strong and growing. Germany also hosts Eurobean, which is a bean to bar chocolate festival.

However, Germany does not have as many craft chocolate makers as France or the UK. One reason is that it is difficult to be officially recognised as a certified professional in Germany. This is much more difficult than in some other European countries where official recognition is not necessary. This difficulty means that fewer craft companies are able to set up in Germany.

Germany does not have a bean to bar or craft chocolate association. Chocolate is represented by the Association of the German Confectionery Industry (BDSI). The German Cocoa Trade Association represents the interests of the German cocoa trade industry. However, the focus is on bulk, commercial-grade cocoa and not on specialty cocoa for the craft market.

One example of a professional craft chocolate maker is Georgia Ramon. They build long-term relationships with small cocoa farmers by working with bean traders. Meybol Cacao is a tree to bar brand from Hamburg. They work together with farmers in Peru. Another example is Fairafric.

Chocolats de Luxe is an example of a German distributor. They resell bean to bar chocolate from around the world. Products can be shipped worldwide.

There are small organic retail chains that sell bean to bar products, working with wholesale companies. A very small share of these products is imported from producing countries.

Germany could be an interesting market for exporters of bean to bar chocolate. There is a lot of demand for craft chocolate but there are not that many local craft chocolate producers.

The United Kingdom is the largest importer of chocolate in Europe

The UK is Europe’s largest importer of chocolate from producing countries (excluding Côte d’Ivoire and Malaysia) with 1,837 tonnes in 2023. Most of this came from Peru (900 tonnes), Colombia (669 tonnes), India (78 tonnes), Vietnam (47 tonnes) and Brazil (32 tonnes). Only a small part of these chocolate imports is bean to bar chocolate.

The main way for bean to bar chocolate to enter the UK is through Cocoa Runners. Through the Cocoa Runners Club, tastings and events, they let people experience everything that craft chocolate has to offer. Since starting in 2013, they have sampled over 10,000 bars made by artisan chocolate makers who use beans that are produced by specialty growers.

There are also UK-based bean to bar brands. One example is Pump Street Chocolate. They buy from 9 different origins. Another example is Chocolate Tree, a Scottish bean to bar producer that buys from farmers in Central and South America. The traders they work with are listed on their website. Other examples are Willie’s Cacao, Firetree Chocolate and Bullion Chocolate Makers. These examples could give bean to bar makers in origin countries some ideas of what the UK market looks for in bean to bar chocolate.

If exporters want to enter the UK market, the main way is to build a relationship with Cocoa Runners. They are the most important bean to bar importer in the UK.

Swiss demand is expected to grow

Switzerland is not a large market when you look at the population. However, the Swiss eat a lot of chocolate. Switzerland is an attractive market for bean to bar chocolate because the people there like high quality. Consumers there have a lot of buying power within Europe because of the strong value of their currency and high income. The Swiss market is expected to grow strongly in the coming years.

Criollo Quetzal is a Swiss bean to bar reseller that only sells chocolate made in producing countries. They have products from over 30 different countries in Central and South America, the Caribbean, Africa and Asia Pacific. Their mission is to offer these chocolate makers access to the Swiss and European markets.

An example of a Swiss bean to bar producer is Choba Choba. They are owned by a farmer cooperative in Peru. The cocoa is shipped to Switzerland where the chocolate is made. The Swiss office sells the Choba Choba chocolate through their partner shops.

Swiss imports of chocolate from producing countries are very low. From 2019 to 2023, Switzerland imported an average of 40 tonnes of chocolate per year from producing countries. Most of this came from Mexico (29 tonnes in 2023), Thailand (9 tonnes), Vietnam (8 tonnes), Colombia (5 tonnes) and Brazil (3 tonnes). Because the total volume is only 40 tonnes, a reasonable share of this volume may be bean to bar chocolate.

The Netherlands is a global hub for cocoa and chocolate

The Netherlands is Europe’s largest importer of cocoa beans, paste, butter and powder. Amsterdam is the world’s largest cocoa port. However, most of the cocoa that comes into the Netherlands is shipped onwards in Europe, either with or without further processing.

The country also plays a role in the import and redistribution of bean to bar and craft chocolate. The Netherlands is Europe’s fourth-largest importer of chocolate from producing countries (excluding Côte d’Ivoire and Malaysia) with 634 tonnes in 2023. Most of this came from Peru (81 tonnes), Colombia (73 tonnes), India (27 tonnes), Nigeria (14 tonnes) and the Philippines (12 tonnes). A big part of this volume is probably bulk rather than bean to bar chocolate.

There are several companies active in the import and distribution of bean to bar chocolate. One example is Clearchox. Their website is available in Dutch, English, German and French, and they re-export to several countries around Europe. They work closely together with some of the brands that they sell. Other examples are The High Five Company, De Chocolademeisjes and Craft Chocolate Store (de Chocoladeverkopers).

There are also several bean to bar producers in the Netherlands. One example is Chocolatemakers. They ship beans from several origins and produce the chocolate in Amsterdam. They have a strong focus on sustainability and carbon footprint. Some of their beans are shipped by sailboat, and part of their redistribution to Germany is done by bicycle.

Original Beans is a Dutch chocolate maker with a strong focus on sustainability and conservation. They buy directly from cocoa farmers in various countries. Other examples are Mesjokke, Krak chocolate and Heinde & Verre.

Some premium shops sell imported bean to bar chocolate. One example is Simon Lévelt, where they sell Pure Chocolate and other brands. They buy their products from European distributors and sell bean to bar chocolate from producing countries, including from Jamaica.

Tips:

- Make sure that the quality is good enough for the European market. Distributors will only import products that meet the high European standards. Check the Cocoa Runners blog for more information about quality, tasting and flavour. Try to buy some products to get a better idea of the quality they are looking for.

- Get in touch with importers and distributors if you have a high-quality bean to bar product. Check their online store to see which bars have been sold to get an idea of the quality that is needed. See for example the stores of Cocoa Runners, Criollo Quetzal and Clearchox.

- Go to trade events. Examples are Chocoa (the Netherlands), Salon du chocolat (France), Schoggi Festival (Switzerland) and EuroBean Chocolate Festival (Germany).

- Take a look at the bean to bar producers in other European countries as well. Examples are Zotter (Austria), Friis-Holm (Denmark), Mi Joya and Millésime (Belgium), Fjåk Chocolate (Norway) and Blanxard (Spain). Blanxard is a well-known brand in Spain and is available in some supermarkets next to big global brands. Check this list for more examples of bean to bar makers in Europe.

- For more information about these European markets, read our studies on exporting cocoa to the Netherlands, Germany, the UK, France, Switzerland and Italy.

4. Which trends offer opportunities or pose threats in the European bean to bar chocolate market?

Consumers want products that are ethical and responsibly bought. The craft or bean to bar chocolate industry is in a good position to benefit from this trend. There is a lot of competition on the European market, so bean to bar exporters should focus on what makes them unique. Rising prices could make export more difficult as well, but this could also bring some benefits to bean to bar makers.

Figure 5: Cocoa beans

Source: Etty Fidele on Unsplash

Attention on sustainability issues keeps increasing

Consumer demand for more sustainable products keeps increasing. Consumers in Europe are increasingly aware of sustainability. More than 80% of consumers are willing to pay extra for a more sustainable product. Some research has shown that consumers are willing to pay almost 10% more.

European consumers are more aware that what they choose to buy is important. They feel like they can make an impact with the choices that they make, buying one product instead of another product. If prices are similar, consumers are more willing to buy products that they believe are more responsible or ethical. Bean to bar chocolate is often marketed as more ethically responsible or more sustainable. The rising demand could therefore be an interesting opportunity for exporters of bean to bar chocolate.

The craft or bean to bar chocolate industry is in a good position to benefit from this trend. Bean to bar products are known for being more ethical and more environmentally conscious. This industry often also pays farmers higher prices above farmgate price. At the same time, big chocolate companies have a reputation for being less sustainable and less ethical. This gives bean to bar chocolate an advantage over standard chocolate.

Certification can also help companies benefit from this trend. For example, demand for Rainforest Alliance and Fairtrade certified cocoa is expected to keep going up in the coming years. The State of Sustainability Initiative expects demand for Voluntary Sustainability Standards to keep growing. However, this growth is uncertain and depends on many factors.

Bean to bar exporters can benefit from this trend. Quality and ethical sourcing are seen as the two most important factors when buying beans. Because consumers want higher-quality and more ethical products, the bean to bar market is in a good position.

An example of a cocoa supplier that has done well out of this trend is Kuapa Kokoo, a large farmer’s union in Ghana. They have strong marketing on sustainability and certification. Kuapa Kokoo is certified by the Rainforest Alliance and Fairtrade. You can read about their work on the Fairtrade website. They sell to many of the world’s largest companies. The cooperative also owns a share of Divine Chocolate, a company that sells chocolate products made from their cocoa beans.

Health-conscious consumers are driving growth

Consumers are becoming more health conscious. High-quality chocolate products are being sold more often for their health benefits. There is a growing interest in healthy living in Europe. A study from 2023 found that 60% of European consumers are now more focused on healthier food and drink consumption.

This health trend has grown since the COVID-19 crisis which led to an increasing demand for organics. It made consumers more aware of food quality and health. Consumers believe organic foods are healthier and safer than conventional products. Most bean to bar chocolate is also organic, so bean to bar producers can also take advantage of this trend.

This trend is strongest among adults aged 18 to 34 years. This group is putting sustainability and ethics first in their purchases more than other age groups do.

The growing health awareness in Europe also comes with several challenges. For example, it has raised concerns about sugar intake. Younger Europeans are more aware of the health risks. The high levels of sugar in many chocolate products could mean that fewer people buy them. A benefit of bean to bar chocolate is that it is often made with a high cocoa content (and therefore less sugar). This makes it a healthier choice than high-sugar chocolate products.

Price increases are both a threat and an opportunity

The price of cocoa has gone up dramatically since 2023. The price reached record levels in January 2025 and has stayed high since then. One reason for the price increase is that global production has gone down, especially in West Africa. Less cocoa is now available on the global market, which makes the remaining cocoa more attractive and more expensive. For more information about the price of cocoa, see the CBI study What is the demand for cocoa on the European market.

As a result, cocoa companies are buying any cocoa they can. They are buying outside their traditional supply chain more often.

This has affected bean to bar chocolate producers. They have traditionally paid premium prices for cocoa, which has helped them secure supply and create long-lasting relationships. But since farmers can get extremely high prices for their cocoa on the market, some are now also selling to other (more mainstream) buyers. This can make it more difficult for bean to bar buyers to get the beans they need.

It can be helpful to work with distributors that focus on high-quality craft chocolate. These are less likely to stop buying from suppliers when the prices go up. They know the reality of the price and the farmers better than distributors that do not specialise.

Higher prices can also be an opportunity. The price of chocolate in Europe has gone up a lot. However, the price of cheaper chocolate has gone up more than the price of premium chocolate. This is because premium chocolate already used expensive beans. As a result, the difference between standard chocolate and premium chocolate has become smaller. This could lead to more consumers buying premium products like bean to bar chocolate.

There is a lot of competition on the European market

It is very difficult for bean to bar chocolate exporters to enter the European market. There is already a lot of competition on the market. The number of bean to bar makers in Europe is increasing as well. In 2020, the Fine Cacao and Chocolate Institute estimated that Europe had over 90 high-quality chocolate makers and manufacturers.

European bean to bar makers have several advantages compared to those in producing countries. For example, it is cheaper and easier to ship beans compared to chocolate. European companies also know the domestic markets better than chocolate makers outside Europe and have better local connections. Factories and machines are often more advanced and high-tech in Europe. This helps to create high-quality chocolate. Storage and shipping are also easier because temperatures in Europe are cooler than in cocoa-growing countries.

Bean to bar products produced in origin countries must meet the standards of European products. In many cases the quality is not at the level that is needed. This makes it impossible for a lot of bean to bar producers to enter the European market. They must first of all convince the importer or distributor that the quality is good enough to sell the product on the market.

However, bean to bar makers in producing countries also have advantages. They offer a unique product, and most of the value added goes directly to the producing country. They understand the origin and the farmers much better than European chocolate makers. If the quality is high enough, this unique story can help sell the products on the European market.

Tips:

- Take advantage of these trends by highlighting the important parts of your chocolate. Focus on health, sustainability and quality. Communicate on your website, through social media, and on your packaging.

- Make sure that the quality of your chocolate is high enough. Check the information provided by UK distributor Cocoa Runners for more information about taste and flavour.

- Long-term relationships with farmers can help you get the supply you need. If you have always paid farmers good prices for their cocoa and have long-term agreements in place, they are more likely to sell to you when they can get higher prices elsewhere.

Long Run Sustainability carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research