Entering the European market for bean to bar chocolate

Although demand for bean to bar chocolate is growing, total volumes will stay small. Bean to bar chocolate is estimated at about 0.2% of the global cocoa market. Most of this volume is made in Europe. Only a small part of this is imported from producing countries. The most important thing is quality, and certification is not always needed. Partnerships with European companies can help you get into the European market. The main exporting countries are Ecuador, Peru and Madagascar.

Contents of this page

- What requirements and certifications must bean to bar chocolate meet to be allowed on the European market?

- Through which channels can you get bean to bar chocolate on the European market?

- What competition do you face on the European bean to bar chocolate market?

- What are the prices of bean to bar chocolate on the European market?

1. What requirements and certifications must bean to bar chocolate meet to be allowed on the European market?

You can only export cocoa to Europe if you comply with strict European Union (EU) requirements. You can find a complete overview of these standards in the CBI study on Buyer requirements for cocoa. This study only talks about the specific requirements for exporting bean to bar chocolate.

What are mandatory requirements?

There are no special rules that apply specifically to the export of bean to bar chocolate. Bean to bar chocolate is part of the category chocolate, and the requirements for chocolate apply. Read the CBI study on Buyer requirements for cocoa for the applicable requirements or Exporting chocolate to Europe for more details about exporting chocolate.

Exported bean to bar chocolate may also need to comply with new EU regulations. This depends on many factors, including their size and where exporters are in the supply chain. Your buyers may also need specific information from you so they can apply the rules. Important regulations include the EU Regulation on Deforestation-free Products (EUDR), the Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD).

What additional requirements and certifications do buyers often have?

European buyers may have many other requirements or expectations. They may want certification against a Voluntary Sustainability Scheme (VSS) like Fairtrade or organic. Buyers can also have expectations about the quality of the chocolate and the packaging design. When buyers import bean to bar chocolate, they also want to be sure it was made in a sustainable way, for example.

Voluntary certifications

Certifications can make your bean to bar chocolate more attractive on the European market. However, they are not always needed.

Fairtrade certification is helpful but not always needed for bean to bar chocolate. The products are seen in the market as going further than what Fairtrade offers. For high-end premium products, Fairtrade certification can even make the brand less attractive. Having a Fairtrade label on pack could reduce the value of the products. Fairtrade certification can also be very expensive for bean to bar producers. The costs of setting up and maintaining a certification often are not worth the benefits of certification.

This is also the case for organic certification. Most bean to bar chocolate products are made with organic cocoa but some are not certified organic. The costs and investments for organic certification are not always worth it. It can be too expensive or difficult for a small-scale producer or brand to organise and implement. Organic certification can also make it more difficult to import the chocolate. This makes organic certification undesirable in some cases.

Some importers even prefer chocolate without organic certification, because it makes it easier to import. If they import organic certified chocolate, then their facilities also need to be organic certified. This makes importing the chocolate more expensive and complicated.

Rainforest Alliance is more commonly used for bulk and mid-range products. It is not often used with bean to bar chocolate.

Shipping and storage

Bean to bar exporters have specific requirements and needs that cocoa bean exporters do not have. These include shipping and storage requirements.

The supply chain for bean to bar is different from the supply chain for cocoa beans or derivatives (paste, butter, powder). Shipping requirements are also different because products are usually shipped in small batches. This is because they are also produced in small batches. Often there is not enough chocolate available to combine it into large batches.

The products are usually imported to Europe by airplane. The batches are often not large enough to be shipped by container. This increases the CO2 emissions of the chocolate product, and this needs to be included in any carbon claims that the product makes.

If shipping can be combined with other products, then it could be possible to ship per container. This reduces the carbon footprint of the chocolate product and the transportation costs a lot.

Exporters can arrange the shipping themselves, but it is easier if the importer does this. European distributors can help with the logistics. The flight routes can make it harder or easier to import the chocolate. For example, if a flight from Latin America has a stopover in the United States of America (USA), it can make import more difficult. Sometime there are more controls on the product in the USA.

Storage can be more expensive because products need to be stored in refrigerated spaces with air-conditioning. Chocolate needs to be stored in a cool place.

Price and premiums

Craft chocolate is usually made with high-quality cocoa that is sold at a higher price. The high price of cocoa makes the chocolate product more expensive. There are no fixed prices or premiums for craft chocolate. You can read the section on the prices of bean to bar chocolate for more information.

Transport costs have an impact on the final price. A lot of bean to bar chocolate is transported by airplane. Longer and more expensive flights make the product more expensive. For example, import from Uganda is usually cheaper than import from the Philippines.

What are the requirements for niche markets?

There are many ways in which you can strengthen your brand. Most bean to bar brands have a story to tell. This story usually involves sustainability and how it helps farmers and the environment. Consumers need to be able to trust this story. You can also make your brand more attractive to consumers by showing that it is made in origin. There are different ways to make your brand stronger in Europe.

Tree to bar

Some chocolate brands market themselves as tree to bar. There is no agreed definition of tree to bar, but this usually means that the chocolate manufacturer also owns the cocoa plantation. An example is Soklet in India. Their plantations are in the Anamalai’s foothills of India. They say they make tree to bar chocolate and talk about their plantations in their marketing and on their website.

Direct trade

Another way to make your brand stand out is to promote it as direct trade. There is no official definition for direct trade. In most cases, it is used to show that there is a direct link between the cocoa producers and the chocolate producers without any intermediary.

Some brands have created their own program or label to show that they do direct trade. Some also label their products as “made in origin” or by saying in which country it is made, for example “made in Ecuador”. However, these are not official requirements. They are labels or claims that the brand has created themselves. Claims are not audited by third parties.

Local ingredients

Some brands make themselves stand out by adding local ingredients to the chocolate. These ingredients are specific to the country and make the brand unique on the European market. They also make the connection with the producing country stronger.

An example is Theo and Philo from the Philippines. Their storytelling focuses on how they include local ingredients. They have many chocolate products mixed with different local ingredients, for example with calamansi (a local citrus hybrid), labuyo chili (a chili pepper from the Philippines) and pili nuts (native to the Philippines).

Competitions

It can be helpful to take part in competitions. If you win an award, more people will see your chocolate and it can make your chocolate more popular. Cacao of Excellence organises chocolate competitions. The winners are promoted on their website. Bean to bar companies also promote the awards that they have won. One example is Chocolat Madagascar, which has a page on their website that talks about to the awards that they have won.

Corporate certifications

There are ways for companies to show that they are doing the right thing and that they are responsible for their actions and open about what they do. One way to do this is to become B Corp Certified. This is not common in bean to bar chocolate, but it can help build trust in your brand. Examples are the Colombian chocolate company Luker Chocolate and the Ugandan company Latitude Chocolate.

Transparency

Importers or distributors will often want to check that you are telling the truth. They need to be able to trust that the claims are correct and accurate.

Opening the farms and factory to the public is one way to make things more transparent. One example is Krakakoa Chocolate on Bali, Indonesia. They have a flagship store that people can visit. You can also visit their chocolate factory. Latitude Craft Chocolate in Uganda can also arrange for people to visit the chocolate factory and cocoa farms.

Packaging design

Bean to bar chocolate packaging often has an attractive design. They are bright, colourful and creative. There are no requirements or certification for creative design, but it is necessary to stand out in the European market. Companies use the packaging design to make themselves stand out in the market and tell their unique story.

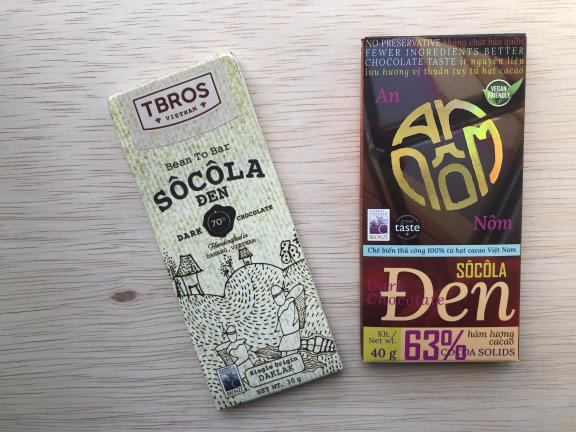

Table 1: Examples of bean to bar chocolate packaging designs

| Product |

|

|

|

|

|

|---|---|---|---|---|---|

| Name | Disidente | Pure | TBROS | Valura Chocolate | Chocolate Makers |

| Type | Bean to bar made in origin | Bean to bar made in origin | Bean to bar made in origin | Bean to bar direct trade | Bean to bar direct trade |

| Bean origin | Colombia | Jamaica | Vietnam | Uganda | Democratic Republic of Congo |

Manufacturing | Colombia | Jamaica | Vietnam | New Zealand | The Netherlands |

Credit: Disidente, Pure, Socola Den, Valura Chocolate and Chocolate Makers. All photos by Long Run Sustainability

Tips:

- Check with your buyers if they need Fairtrade, organic or any other certification. Decide how difficult or costly it would be to become certified organic or Fairtrade. The costs might not be worth it.

- Make sure that the chocolate complies with the European Union’s Regulation on Deforestation-free Products (EUDR). This regulation says that from 30 December 2025, all products need to be legal and free from deforestation. Read the CBI study Tips on how to become EUDR-compliant in cocoa for more details about the regulation.

- If you want more information about organic cocoa, you can read the CBI study Exporting organic cocoa to Europe.

2. Through which channels can you get bean to bar chocolate on the European market?

Bean to bar chocolate from cocoa-producing countries usually reaches consumers through specialty stores, distributors and online shops. These involve different people or companies and processes.

How is the end-market segmented?

Bean to bar is a niche product. You cannot in many places in Europe. The main place where consumers buy bean to bar products from origin is online and in specialty shops. You can also buy it through local distributors or at events.

Premium stores

Some premium stores or specialty shops in Europe sell bean to bar chocolate products from origin. This includes organic supermarkets, delicatessen shops, concept stores, giftshops and museums shops. These stores will buy their products from distributors. You can find more information about distributors in the next section.

Quality is usually an important selling point for these stores. They are usually smaller stores that need smaller volumes, which is what bean to bar makers can offer.

Retailers

Some retailers (supermarkets) will also sell bean to bar chocolate. However, they often need larger volumes than bean to bar exporters can supply. Bean to bar chocolate is usually not available in the amounts that larger retailers would need. This means that they usually work together with bean to bar producers in their own country. One example is the Spanish brand Blanxard, which you can buy in local supermarkets.

Online shops that sell craft chocolate

There are several online shops in Europe that sell bean to bar chocolate products directly to consumers. Consumers can often become members and receive products regularly, for example every month. They can also place individual orders.

Distributors that sell directly to consumers

There are also platforms that set up a direct relationship between consumers and producers. An example is Crowd Farming. Farmers can apply and become part of the network. Crowd farming sells the Filipino brand Auro Chocolate.

Tip:

- Read the CBI study 9 tips for finding buyers on the European cocoa market for more background information about how the cocoa market is divided up.

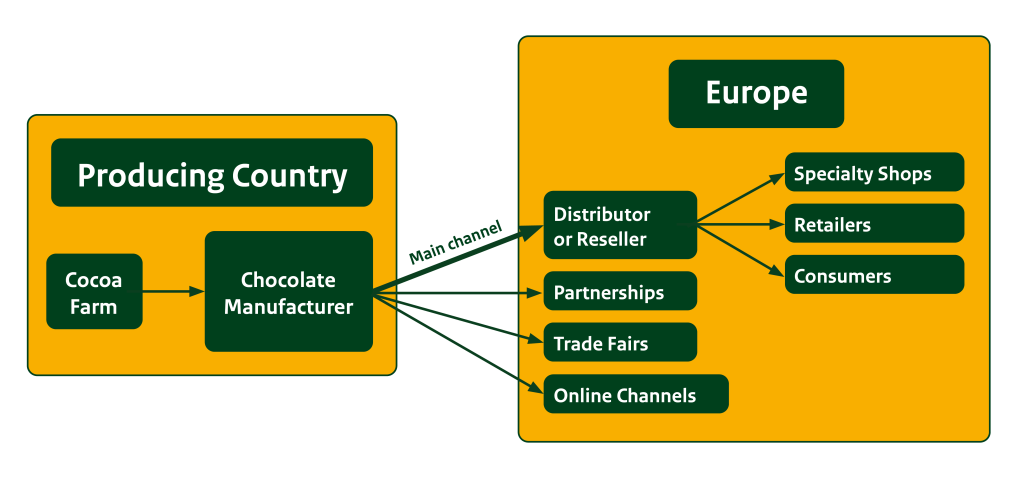

Through which channels does bean to bar chocolate end up on the end-market?

You need a European importer to get bean to bar chocolate onto the European market. Most bean to bar makers produce small volumes and cannot meet the demand that retailers have (for frequency and volumes). There are different types of channels that can help you import on the European market. The main channel is through European distributors and resellers.

Figure 1: The main channels for bean to bar chocolate

Source: Author

Distributors and resellers

The main way for bean to bar chocolate exporters to enter the European market is through distributors and resellers. They buy bean to bar chocolate from companies all over the world. They then sell these directly to consumers online or to retail stores.

These distributors know a lot about the local market and have a large retail network. Often, they will have long-term relationships with the brands that they buy. Some also offer services to bean to bar chocolate exporters. This includes logistical support in shipping, storage, translations of packaging text, marketing and after-sales customer support. It can also include support in setting up the business in origin.

There are several European chocolate distributors that specialise in bean to bar and craft chocolate. Examples are Cocoa Runners in the United Kingdom, ClearChox and The High Five Company in the Netherlands, Club del Chocolate in Spain and Criollo Quetzal in Switzerland. Read the CBI study The European market potential for bean to bar chocolate for more details about distributors in specific countries.

Partnerships

It can be helpful for a bean to bar producer in origin to develop a partnership with a company in Europe. The partner company can help with the import and marketing activities in Europe. They have a better idea of the demand, which helps to plan the supply. They also offer help with local distribution and customer support and can give guidance on quality requirements.

These can be integrated companies owned by the farmers. An example is Choba Choba, a Swiss chocolate brand owned by a farmer cooperative in the Peruvian Amazon (Cooperativa Agraria Cacaotera Choba Choba). The cocoa is shipped to Switzerland, where the chocolate is made.

Partnerships can also be between bean to bar exporters and importers. For example, MIA is a bean to bar brand that produces the final product in the country of origin (Madagascar and Ghana). The products are then shipped to Europe, where they are sold at stores throughout Europe. They have an office in the UK.

There are also partnerships of companies that focus on different products. An example is Krakakoa Chocolate, an Indonesian bean to bar manufacturer. They have a partnership with Slow Forest Coffee, a Danish coffee company. The partnership works because the organisations share values and a commitment to the environment. Coffee and chocolate are products that go well together. The merger helps Krakakoa to grow across Asia and Europe. It also makes it easier for Krakakoa to organise the logistic side of exports.

Another example of a unique partnership is the partnership between the Dutch Chocolatemakers and a local cocoa farming community in Peru. With help from external financing, Chocolatemakers has helped the NorAndino cooperative build a chocolate factory. They can now process their cocoa harvest in their own factory. At the moment, they are making cocoa mass. They have plans to start making couverture in the future. This helps create value in origin and makes it easier for the local community to sell their cocoa.

There are also chocolate companies in origin that are buying or investing in European companies. One example is Luker Chocolate, which bought a majority stake in the Slovakian Lyra Group in 2022. This made their product range bigger and helped to streamline their European logistics.

Trade fairs

Visiting a trade fair can be very useful for bean to bar chocolate makers from producing countries. It gives you a chance to learn what consumers and buyers expect when it comes to quality, packaging, and sustainability. It lets you see what competitors are doing, and understand how others tell their brand story. Trade fairs also give you direct access to potential buyers, distributors, and people you can work together with. These events give insight into trends in consumer markets, so that chocolate makers adapt their products.

Examples are:

- Salon du Chocolat in France. Here you can meet important players in the chocolate and cocoa industry. The festival offers performances, demos, competitions and a trade fair for professionals (the B2B village).

- Chocoa in the Netherlands. Here, you can promote your products and meet other chocolate makers. Chocoa is part of the Amsterdam Cocoa Week, which includes a conference, a fair, workshops, and many other activities.

- EuroBean Chocolate Festival in Germany. Here you can meet bean to bar chocolate makers. The focus is on direct trade, fair prices, long-term partnerships and being open.

- Schoggifestival in Switzerland, organised by Good Chocolate Hub. It includes a chocolate market, panels, workshops, tastings, children’s program, lectures, readings, guests, film screenings, food and drinks, and more.

- Events organised by distributors. For example, Cocoa Runners organises in-person tastings and events.

These fairs are a great opportunity to meet importers, distributors, investors and other potential business partners. They are also a way to meet consumers and sell chocolate products directly to them.

Online channels

Bean to bar exporters can also sell directly to consumers through their own webshops. Examples are Kakaw (Sweden), Club del Chocolate (Spain), Schokov Shop (Austria), Cocoa Runners (United Kingdom), Feine Schokolade (Germany), CriolloQuetzal and Chocolats du Monde (Switzerland) and Clear Chox (the Netherlands). However, this is not common and it is only a small share of total sales.

Tips:

- Make sure that you have a product that is attractive to European importers. The quality of the product is most important. Importers also look at the sustainability story and price. Importers will often want to check the story and ask for evidence, so make sure that you can prove the impact. Other factors are the level of professionalism, packaging design and certifications.

- Check the website of Cocoa Runners to learn more about what they find important in a brand. Their chocolate needs to be produced by an established bean to bar maker. They also require full traceability back to the bean and details about the processing.

What is the most interesting channel for you?

The most interesting channel is distributors. This is the main way for bean to bar chocolate to reach the European market.

An example of a bean to bar brand that successfully works with distributors in several European countries is Auro Chocolate from the Philippines. They export cocoa beans and bean to bar chocolate products to France, Spain, Belgium, Italy, the Netherlands and several other countries. See their website and sustainability report for an example of how a bean to bar manufacturer can show the great sustainability work that they do.

Auro Chocolate visits Europe every year to visit fairs and meet their clients in person. Meetings are usually set up through their local distributor. The meetings help their distributors and clients communicate about their brand. They also promote awards that they have won at shows and fairs. The visits also help Auro explain to the farmers where their cocoa ends up. They often take pictures of the final products to show farmers. This helps them appreciate the cocoa that they produce.

Tips:

- Importers and distributors can also help you get access to specific European markets. In addition to importing bean to bar products, they often also support the brands that they buy from.

- Get in touch with European distributors and web shops that sell bean to bar chocolate to consumers.

- Learn more about cocoa quality. One example is the cocoa programmes of the Chocolate Institute, which include a cocoa grading course and training on growing specialty cocoa.

- Read the CBI studies Tips to find buyers and Tips to do business to learn more about how to do business in Europe.

3. What competition do you face on the European bean to bar chocolate market?

Bean to bar products can come from any producing country where a company manages to build a relationship with a European distributor. There are good examples of companies in Ecuador, Peru, Brazil, Madagascar and many other countries.

Which countries and companies are you competing with?

Bean to bar chocolate is made with cocoa that is unique and of high quality. The cocoa can come from any origin country that produces high-quality cocoa. Although most commodity cocoa comes from central and west Africa, only 4% of craft chocolate bars have West African Origins. Bean to bar chocolate is more often made with cocoa from Latin America.

Europe does not import a lot of chocolate from producing countries. Only 4,666 tonnes were imported from producing countries in 2023 (excluding Côte d’Ivoire and Malaysia, which are large cocoa processors and not known as exporters of bean to bar chocolate). Colombia (1,278 tonnes), Peru (1,027 tonnes), Mexico (830 tonnes), Brazil (323 tonnes) and Vietnam (294 tonnes) were the largest exporting countries in 2023. Export went up for all countries except Vietnam during this time.

Source: Eurostat and Trademap 2025

Only a small part of this volume is bean to bar chocolate. HS code 1806 does not make a difference between craft/bean to bar and conventional chocolate. So, it is difficult to estimate how much is bean to bar.

Another way to look at competition is to see which origins are used for bean to bar chocolate production around the world. The most common origins for the beans used in bean to bar chocolate are Ecuador, Venezuela, Peru, Dominican Republic and Madagascar. These countries all produce high-quality beans that are exported to bean to bar makers. However, the bean to bar chocolate is usually made in Europe (49%) or North America (33%), not in the country of origin.

Source: Journal of Agriculture and Food Research 2021

Not all countries are able to export bean to bar chocolate products. To do this, you need a local company to successfully create a high-quality chocolate product and find a market in Europe. There are not many brands in the world that can export bean to bar chocolate to Europe. There are good examples of companies in Ecuador, Peru and Madagascar. You can see some examples in the table below.

Table 2: Examples of bean to bar chocolate brands that have successfully exported to Europe

| Country of origin | Brand |

|---|---|

| Brazil | |

| Colombia | Cacao Disidente |

| Costa Rica | Nahua Chocolate |

| Dominican Republic | |

| Ecuador | |

| Indonesia | |

| Jamaica | |

| Madagascar | |

| Mexico | |

| Nicaragua | Momotombo |

| Peru | |

| Philippines | Auro Chocolate |

| Thailand | |

| Uganda | Lattitude Chocolate |

| Venezuela | Franceschi Chocolate |

| Vietnam |

Source: Cocoarunners and CriolloQuetzal 2025

This study will take a closer look at Ecuador, Peru, Madagascar and Brazil. Brands from these countries have been some of the most successful brands at exporting bean to bar chocolate to Europe. These origins are also all in the top 7 origins for beans used in European bean to bar brands.

Figure 4: Bean to bar chocolate from Vietnam

Source: TBROS and An Nom. Photo by Long Run Sustainability

Ecuador is a key exporter of bean to bar chocolate

Ecuador produces a lot of cocoa. In 2023, they were the third-largest cocoa-producing country in the world. The country is expected to overtake Ghana as the world’s second largest cocoa producer in the coming years. Europe is an important market for Ecuador. They were responsible for 6% of all cocoa bean exports to Europe in 2023.

Ecuador does not export a lot of chocolate. They only exported 100 tonnes to Europe in 2023. On average, they exported 100 tonnes during the 4 years before that as well. However, a large part of this could be craft or bean to bar chocolate.

Ecuador is one of the main origins used in bean to bar chocolate. They have a reputation for high-quality cocoa. Premium cocoa includes cocoa with a superior quality and value. Premium cocoa is often sold at higher prices, above bulk market prices. The cocoa has specific qualities, such as being free from defects, high quality and flavour profiles, a unique origin, or sustainability-related qualities.

An example of a bean to bar chocolate exporter from Ecuador is AWKI Chocolate, which works with chocolate farmers and produces in Ecuador. As part of their mission, AWKI wants to empower female growers and vulnerable people by fighting gender inequality, gender violence, and providing new jobs. For other exporters, it could be interesting to learn from their journey, which is described on their website. The company was launched in 2018 and has seen growth and challenges along the way. They grew to 3 international clients in 2022 and attended the Salon du Chocolat in Paris.

Other examples include Kuná Chocolate, which is closely tied to a cooperative that was founded by indigenous Kichwa peoples that harvest high-quality cocoa from the Amazonian jungle. Ecuatoriana de Chocolates produces chocolate locally with cocoa from associations of small cocoa producers in different parts of the country. Paccari is a bean to bar company that works with over 4,000 organic farming families. Their brand has a strong presence in the UK, and they have a website specifically for the UK market. Conexion is a company that exports bean to bar chocolate and locally made couverture that is then processed in other countries.

Peru is involved in many bean to bar products

Peru is one of the smaller bean exporters to Europe. In 2023 they exported 27,000 tonnes of beans to Europe. This is 1% of European imports from producing countries. However, in 2023 Peru became one of the largest producing country exporters of chocolate to Europe. From 2022 to 2023, export to Europe went up by 914 tonnes to a total of 1,027 tonnes of chocolate. This was mostly because they exported 866 tonnes more to the UK.

While Peru is an important origin for chocolate, not many producers export bean to bar chocolate. A lot of chocolate is exported as couverture or ingredients. This is not seen as bean to bar chocolate export.

Many bean to bar products are made with Peruvian beans, but are not made in Peru. An example is Choba Choba, a Swiss chocolate brand owned by a farmer cooperative in the Peruvian Amazon. They do not export chocolate but only the beans for further processing in Switzerland. They are welknown in Switzerland and are members of the Swiss Initiative on Sustainable Cocoa (SWISSCO).

There are some bean to bar producers from Peru. One example is Cacaosuyo. They collaborate closely with small farmers and make sure all their chocolate can be traced from start to finish. They also want to improve the quality of life for cocoa farmers by actively involving them in the value chain. The chocolate has won awards at the International Chocolate Awards for 10 years in a row. See their website for an example of how these awards can be presented.

Another example is Meybol cacao, which works closely with farmers in Peru, ships the beans to Europe, and produces the chocolate in Germany.

Madagascar has a relatively large bean to bar sector

Madagascar is a small cocoa-producing country. Europe only imported 6,000 tonnes of cocoa beans from Madagascar in 2023. This was only 0.3% of Europe’s total bean imports.

However, they are a relatively important country in the organic cocoa and craft chocolate sector. 1,300 tonnes of beans were exported to Europe as organic in 2023. This was 22% of Madagascar’s bean exports.

Madagascar does not export a lot of chocolate to Europe. The country only exported 41 tonnes in 2023, mostly to the UK and France. Annual exports were around 50 tonnes from 2019 to 2023. However, a relatively large share of this chocolate is exported as bean to bar or craft chocolate.

There are several bean to bar companies based in Madagascar. One company is Chocolat Madagascar by Chocolat Robert. The cocoa is produced in the Sambirano valley in Northwest Madagascar. Farmers are paid high prices, which depend on the quality of beans. The cocoa is transported to be crafted into chocolate at the Chocolaterie Robert factory in Madagascar.

Beyond Good is another chocolate company based in Madagascar. They work with 91 farmers, and all farm locations can be clearly seen on an interactive map. Beyond Good is seen as a company with very high standards. In 2025, they got the highest overall score on the Chocolate Scorecard. They are opening a second factory in Uganda.

MIA also produces chocolate locally using Madagascar cocoa beans. They work with local farmers and support local ecosystems by planting trees in a national forest and get local communities involved to protect the forests.

Menakao is a chocolate factory based in Madagascar. They work with 5 plantations to make sure the quality is always high. They also make sure they know where each batch of cocoa comes from.

Brazil has a strong local bean to bar market

Europe does not import a lot of cocoa from Brazil. In 2023, only 252 tonnes of beans were imported from Brazil, placing them 31st overall. However, Brazil is one of the larger origins of chocolate among producing countries. Total European imports were 323 tonnes in 2023. Imports have gone down by an average of 23% per year from 2019 to 2023. The Netherlands imports most of the chocolate from Brazil.

Brazil has a very active local bean to bar chocolate industry. They even have a bean to bar association. The bean to bar products vary in quality. Some brands have successfully exported to Europe, but many brands do not yet have the quality that is required for export. If the quality and production methods improve, then Brazil has potential for more export to Europe.

One example of a chocolatier that has successfully exported to Europe is Luisa Abram. It is a family-owned bean to bar chocolate company and is named after one of its owners. The company gets their cocoa from small farmers and wildly grown cocoa trees in the Amazon Rainforest. The cocoa is transported to São Paulo. This is where the chocolate is made. Luisa Abram has been exporting to Europe since 2015 and has won many awards.

Other examples of bean to bar chocolates that are available in Europe are Baianí Chocolates, Luzz Cacao and Mestiçço.

Tips:

- Look at the bean to bar producers in other producing countries as well. Examples are Marou Chocolate (Vietnam), Grenada Chocolate Company (Caribbean), Latitude Chocolates (Uganda), Fairafric (Ghana), Soklet (India), Krakaroa and Jungle Gold (Indonesia), Definite Chocolate and Milz Chocolat (Dominican Republic) and Auro Chocolate (the Philippines).

- You can read the CBI study The market potential of bean to bar chocolate in Europe for more examples of bean to bar chocolate brands in important European countries.

4. What are the prices of bean to bar chocolate on the European market?

Bean to bar chocolate is more expensive than traditional chocolate on the European market. The beans are often sold for a higher price, and costs are higher throughout the value chain. This section will show a few specific examples of bean to bar value chains for which publicly reported data is available. You can read the CBI study What is the demand for cocoa on the European market for more information about the price breakdown of cocoa and margins along the value chain.

Cocoa Runners reports that craft chocolate has always paid much more to farmers. They get 7,000 USD to 15,000 USD per tonne. This is much more than the commodity prices of 2,000-2,500 USD per tonne (before the price increase in 2024-2025). Craft cocoa prices have also been rising by 50-150%.

Some bean to bar chocolate makers openly report on the price they pay to farmers. This shows the distribution of value along the supply chain. One example is Auro Chocolate, a Filippino bean to bar brand that reports these details in their sourcing report. They say they pay 10% to 45% above the standard price.

Table 3: Value along the supply chain for Auro chocolate

| Category | Value per tonne of cocoa |

|---|---|

| Price paid for cocoa by Auro | USD 2,661 |

| Farmer’s income for wet beans | USD 750 |

| Farmer’s income for dried fermented beans | USD 3,130 |

| Farmer’s income for organic wet beans | USD 1,090 |

| Percentage paid above farmgate price | 10% to 45% higher |

Source: Auro sourcing report 2022-2023

Auro also reports the breakdown in value along the supply chain. 44% of the price is farmer’s income. This is significantly higher than the 7% to 11% farmer share for conventional chocolate products.

Table 4: Breakdown of the expenses along the supply chain for Auro in 2022-2023

| Type | Share in % |

|---|---|

| Farmer’s income | 44% |

| Additional premium | 2% |

| Post-harvest process | 6% |

| Domestic storage and logistics | 10% |

| Chocolate production | 37% |

| Other costs | 1% |

| Total | 100% |

Source: Auro sourcing report 2022-2023

Another example is Choba Choba, a Peruvian/Swiss chocolate brand. Choba Choba paid USD 5,222 per tonne in 2023, which was more than 100% above the market price.

Tips:

- Price is not the most important factor in bean to bar chocolate, unless the price is much higher than the competition. Quality will always be the most important factor. However, price is important. The higher price also lets bean to bar companies pay farmers more and communicate about this to consumers.

- Take a look at the price breakdown of bean to bar brands that report on these. Also check the websites of resellers and specialty stores to find out more about the retail price of these products. This can give you a better idea of how you compare to other brands.

- There are several websites that publish the price of cocoa. The futures price can be found on the ICE website and the ICCO website. Changes in Fairtrade prices and premiums are published on the Cocoa Fairtrade Minimum Price Differential page.

Long Run Sustainability carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research