The European market potential for MICE tourism

MICE tourism includes travel to meetings (M), incentives (I), conferences (C), and exhibitions (E), of which the conference market is the most lucrative. The United Kingdom and Germany are the biggest European markets. However, the approach to this market is fundamentally different from that of leisure tourism. As a business you can play a role in the facilitation of the event itself, or participate in the leisure programme before, during and/or after the event. This leisure part provides interesting opportunities, because more and more delegates want to extend their visit to the destination. To raise interest, you need to offer products and services that are sustainable.

Contents of this page

1. Product description

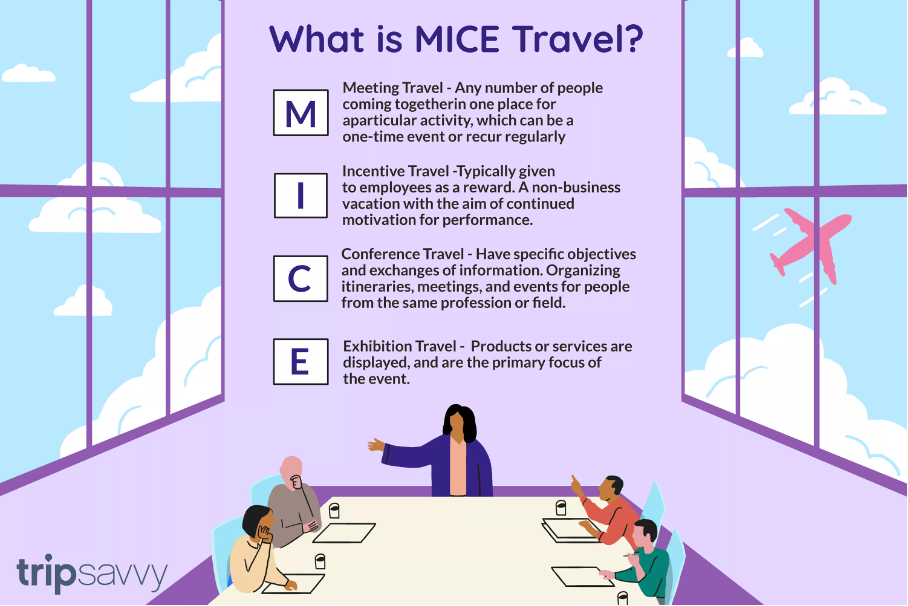

MICE tourism refers to business travel for the purposes of Meetings, Incentives, Conferences and Exhibitions. These are organised to achieve a wide range of business, academic, professional or cultural objectives. The acronym of MICE clearly identifies the components of the market, such as displayed in Figure 1.

Figure 1: Components of MICE tourism

Source: www.tripsavvy.com

MICE tourism is a niche within business tourism. However, the word business needs to be interpreted in a broad sense. It also includes public bodies, semi-public bodies such as non-governmental organisations, associations, universities, and any other kind of organisation.

MICE tourism is a type of tourism where large groups of people come together in a particular place and for a particular reason, such as a mutual interest. Therefore, it can also be considered a specific kind of group tourism. When meetings involve a large group of people, they are normally held at convention centres.

Over the past few years, the term MICE has become less popular. Increasingly, it is referred to as the meetings industry or the events industry.

As a business you could assist in facilitating MICE events. This means that you could contribute by providing all kinds of creative services, such as directional signages, banners, show displays, kiosks/exhibit space, event photography, event marketing, sponsorship management, AV/technical production, group air fulfilment, on-site event logistics & staffing, supplier management, virtual meetings, and risk management services.

Tip:

- Contribute to an event by offering a leisure programme before, during and after the formal event. Make sure that attendees of MICE events at your destination do not only fly to your country for a three-day conference, but try to make an effort to extend their trip and try to create cross-overs with other niche-markets in tourism such as cultural tourism, adventure tourism, nature tourism, or wellness tourism. As the preparation and planning of a MICE events takes a long time, even several years, you need to have a pro-active attitude and realise that you need to invest time years before you may reap the fruits of your efforts.

2. What makes Europe an interesting market for MICE tourism?

The MICE market is the highest revenue contributor to the tourism industry. Globally its value accounted for $805 billion in 2017, $916 billion in 2019 and it is projected to reach $1,439 billion in 2025 and $1,780 billion in 2030. So the global market shows a continuous growth – with a dip in 2020 due to the COVID-19 pandemic.

There is a number of factors that drive the growth of MICE tourism. Some of these factors are listed in Table 1.

Table 1: Factors that drive and impede the growth of MICE tourism

| Demand factors | Supply and facilitation factors |

Growth of the corporate sector Growth in Foreign Direct Investment (FDI) activities Proliferation of Small and Medium Scale Enterprises Growth of international business travel Growth of global tourism Growth in the frequency of MICE events such as meeting activities around the globe | Growth of activities by the MICE industry (both companies and individuals) Increasing investments in the development of infrastructure and technological advancements Increase in internet penetration Growing adoption of smart devices Digitalisation of travel payments |

All MICE niches are on the rise and (before the outbreak of the COVID-19 pandemic) it was expected that this growth would continue in the future. Yet, globally, the Meetings niche is the biggest of the four. In 2017 it accounted for $505.8 billion of the revenues.

The European MICE market is the biggest in the world

Europe dominates the global MICE market with a market share of 50%, and it is expected that Europe will keep this position until 2030. Also, in terms of the number of international association conference participants, Europe is the largest market in the world. In 2000, 6% of all outbound trips from Europe were related to MICE. Of the outbound MICE trips 48% was within the niche of Conference/congress/seminar, 42% was related to Exhibitions/trade fairs and 10% to Incentives (unfortunately figures about Meetings were not registered).

The European MICE market is not only attractive because it is big and growing. It is important to note that MICE tourism has a positive impact on the growth of businesses, cities, and destinations as it is an influential and significant economic factor, because:

- Business travellers spend more than leisure travellers in a short period of time (but they are more demanding as well!).

- MICE events serve as networking opportunities for all businesses involved, and so they have a positive effect on many other industries and in particular on the local tourism industry.

- Professional contact and sharing of knowledge give a boost to creativity and innovation.

- MICE events can give a boost to the local job market.

- Attendees of MICE events may extend their stay to enjoy their leisure time at the destination, while they may also decide to return later with their partner, family or friends for a holiday.

- Because MICE tourism is not bound to the regular tourism seasons in Europe, MICE events are particularly welcome in the low tourism season.

- MICE tourism may enhance the reputation of a destination.

So the European MICE market is a very lucrative and profitable kind of tourism which offers great opportunities for any destination.

Conferences are the jewel in the crown of MICE to focus on, because they are the most lucrative. Conferences of international associations, such as the ones for architects or cardiologists, are a good example. They may attract up to 30,000 attendees. If you are located in a country that is already popular for leisure tourism and has an attractive climate, that is an advantage. It is likely that the key infrastructure of airline connections, airports, and hotels is already in place. They make your destination attractive for incentive travel. Tanzania is a good example of such an incentive destination.

As the MICE sector is increasingly looking for unique and memorable experiences, new MICE destinations are emerging, and they may become more important than before. Countries in Latin America, Africa and Asia are looking increasingly at incoming MICE tourism. A country such as Egypt has been building their infrastructure and sees a growth of MICE tourism. Be aware that the way your country has dealt with the COVID-19 pandemic will be a factor in the decision-making process of the organisers of MICE events. This is a disadvantage for emerging destinations.

For destinations to open their doors to MICE, a convention bureau needs to be established. This is an essential step to marketing and branding the destination which is different from the marketing for leisure and holidays. In fact, a convention bureau is a Destination Management Organisation (DMO), but different to tourism DMOs. The size of a convention bureau is not necessarily large. It could consist of one person. They are usually staffed by local people. The skills of the men and women working there determine how successful they can be.

The convention bureau in Kenya that is currently being established is a good example. It puts the country on the map as a MICE destination. Namibia, Rwanda and Ethiopia have recently come into the market with brand new convention bureaus. The main focus of these convention bureaus is conferences (of international associations) and incentives.

Important considerations for the planners and the attendees in the MICE market are location, quality, experiential value, and sustainability. These are important conditions that you need to have in place in your destination in order to be attractive to the European MICE market. Regarding the location, it is mainly accessibility, security and sufficient capacity that matter.

Quality refers to facilities such as customer service, safety/security and reliable transport, clean and comfortable accommodation, good catering, and conference rooms with excellent technical infrastructure. Experiential value refers to a location that offers a unique and memorable experience at a reasonable price, for example by means of an exciting leisure programme before and/or after the formal part of the programme.

Tips:

- Ensure that you focus on quality, experiential value and sustainability.

- Attend classes at the MICE Academy in Africa, if you can, to learn about the MICE industry and to establish the necessary skills, or by attending one or more events by ICCA (International Congress and Convention Association) from which you learn pretty quickly. It is good to know that the MICE industry is quite a cooperative and collaborative industry, in which contacts are easily established.

- Keep informed about how to respond to COVID-19 and on how to manage the effects of COVID-19.

3. Which European countries offer most opportunities for MICE tourism?

The share of European countries is quite stable. The United Kingdom and Germany have been the biggest source markets for MICE and business travels in Europe for years. The list is led by the UK market with 4.5 million outgoing MICE trips a year, directly followed by the German market with 3.3 million MICE trips. These two leaders are followed by France with 1.6 million MICE trips. Switzerland (a non-EU country), Spain and Italy rank lower with a similar share of respectively 1.1 million, 1.1 million and 1.0 million outbound MICE trips.

Note: the data for Spain are from 2000, the other data from 2012.

United Kingdom

The United Kingdom is the most important country of origin for outbound MICE tourism. In 2012 the country counted 4.5 million outbound MICE trips. Although the data of how these trips were distributed across the MICE niches are 10 years old, it is likely that the majority of outbound MICE trips are for meetings and incentives, as the number of MICE trips to conferences and exhibitions is relatively small.

The United Kingdom market looks promising for small and medium-sized enterprises (SMEs) in the field of leisure, as 29% of business travellers that were interviewed during the corona pandemic would like to extend their stay to enjoy leisure time at the destination in the future.

Table 2: Some MICE statistics of the United Kingdom

| Outbound travel expenditures on business and professional travel in billions of euros (2019) | No data available |

| Outbound MICE trips (2012) | 4.5 million |

| Share of outbound MICE trips of all outbound trips | 2% |

| Share of outbound MICE trips of all outbound business trips (2000) | 9% |

| Number of outbound I-trips (incentives) (2000) | No data available |

| Number of outbound C-trips (conference, congress or seminar) (2000) | 0.4 million |

| Number of outbound E-trips (exhibitions or trade fairs) (2000) | 0.4 million |

| Share of travellers who want to take the opportunity to extend business trips so they can have leisure time at the destination (2021) | 29% |

Germany

The German outbound MICE market is the second largest, with 3.3 million trips in 2012. In Germany outbound MICE trips constitute over a third of all outbound business trips (35%). Although the data in the table are incomplete, it is likely that the biggest contributors to the outbound MICE trips are meetings and conferences.

Companies, mainly in finance, insurance, pharma and automotive, have a large share in the outbound MICE market and spend high budgets on events and incentives. These industries predominantly organise kick-off events, conferences and meetings. In 2018 intercontinental events had a share of 20.8%, a growth of 4.6% in 10 years. Only 15% of the travellers that were interviewed during the COVID-19 pandemic say they would like to extend their business trip at the destination for leisure purposes.

Table 3: Some MICE statistics of Germany

| Outbound travel expenditures on business and professional travel in billions of euros (2019) | €26.0 billion |

| Outbound MICE trips (2012) | 3.3 million |

| Share of outbound MICE trips of all outbound trips | 3% |

| Share of outbound MICE trips of all outbound business trips (2000) | 35% |

| Number of outbound I-trips (incentives) (2000) | 0.4 million |

| Number of outbound C-trips (conference, congress or seminar) (2000) | 1.7 million |

| Number of outbound E-trips (exhibitions or trade fairs) (2000) | No data available |

| Share of travellers who want to take the opportunity to extend business trips so they can have leisure time at the destination | 15% |

France

France is the third-largest MICE market in Europe, concerning outbound travel, but the size is much smaller (1.6 million outbound trips) than the United Kingdom (4.5 million) and Germany (3.3 million). The French MICE market takes a large share of outbound business travel (40%). Although the data for France are incomplete, it is likely to assume that trips to Exhibitions and Conferences make up the biggest share, whereas the contribution by trips to Meetings and Incentives is quite small. One in five travellers that were interviewed during the COVID-19 pandemic say they would like to extend their business trip with some leisure time.

Table 4: Some MICE statistics of France

| Outbound travel expenditures on business and professional travel in billions of euros (2019) | €9.8 billion |

| Outbound MICE trips (2012) | 1.6 million |

| Share of outbound MICE trips of all outbound trips | 7% |

| Share of outbound MICE trips of all outbound business trips (2000) | 40% |

| Number of outbound I-trips (incentives) (2000) | No data available |

| Number of outbound C-trips (conference, congress or seminar) (2000) | 0.7 million |

| Number of outbound E-trips (exhibitions or trade fairs) (2000) | 1.0 million |

| Share of travellers who want to take the opportunity to extend business trips so they can have leisure time at the destination | 19% |

Spain

The market size of outbound MICE tourism in Spain counted 1.1 million trips in 2000. Compared to the other countries in the top five, MICE tourism has a very big share in business tourism at large: 74%. The data for Spain are incomplete, yet the table shows that it is likely that outbound Conference and Exhibition trips make up a similar share of about half a million. For leisure businesses Spain looks like a promising market, as one third of the business travellers would like to extend their business trips with leisure activities.

Table 5: Some MICE statistics of Spain

| Outbound travel expenditures on business and professional travel in billions of euros (2019) | €4.5 billion |

| Outbound MICE trips (2000) | 1.1 million |

| Share of outbound MICE trips of all outbound trips | 12% |

| Share of outbound MICE trips of all outbound business trips (2000) | 74% |

| Number of outbound I-trips (incentives) (2000) | 0.1 million |

| Number of outbound C-trips (conference, congress or seminar) (2000) | No data available |

| Number of outbound E-trips (exhibitions or trade fairs) (2000) | 0.6 million |

| Share of travellers who want to take the opportunity to extend business trips so they can have leisure time at the destination | 33% |

Italy

Italy is ranked last in the top five of European countries in terms of the size of the outbound MICE market. Its market size is nearly as large as in Spain. Similar to Germany, the outbound MICE market makes up a share of one third of the outbound business market (34%). Incentive trips and Conference trips each constitute about one third of the market. The remainder is composed of outbound trips to Meetings and Exhibitions, although data are not available. Just like in Spain, Italian business travellers are likely to extend their future trip with leisure activities (39%), which makes it an interesting market for businesses.

Table 6: Some MICE statistics of Italy

| Outbound travel expenditures on business and professional travel in billions of euros (2019) | €3.6 billion |

| Outbound MICE trips (2012) | 1.0 million |

| Share of outbound MICE trips of all outbound trips | 6% |

| Share of outbound MICE trips of all outbound business trips (2000) | 34% |

| Number of outbound I-trips (incentives) (2000) | 0.3 million |

| Number of outbound C-trips (conference, congress or seminar) (2000) | 0.4 million |

| Number of outbound E-trips (exhibitions or trade fairs) (2000) | No data available |

| Share of travellers who want to take the opportunity to extend business trips so they can have leisure time at the destination | 36% |

Tip:

- Target associations with membership across Europe (and beyond) to attract MICE events from the European market, instead of targeting specific countries. The challenge is to enter the bidding system and to win the event, which takes place a number of years in advance and for which a lot of paperwork needs to be completed. It is a competitive tendering system usually led by the convention bureau. The ICCA website provides good reports about strategies for bidding. Rwanda can act as a best practice, as they have a very efficient convention bureau.

4. Which trends offer opportunities on the European market for MICE tourism?

There are two main trends on the MICE market that stand out: digital transformation/hybrid events and sustainable travel. These trends offer opportunities for innovative concepts.

Digital transformation and hybrid events

The COVID-19 pandemic has caused a major disruption to MICE tourism. Although a structural change of the MICE industry had already started before because of the use of social media, meeting apps and the shift towards virtual and augmented reality elements, the pandemic has boosted the digital transformation.

Many events hosted in 2020 and 2021 have been offered as hybrid events, and it is anticipated that hybrid events will be here to stay, and that its share will grow. Companies, associations and potential participants have become more cautious about travelling internationally, and because many people have lost income, they may have become more hesitant before paying a lot of money on attending an event physically, while they can also attend online by means of applications such as Zoom or Teams. It is likely that at hybrid events the share of live will gradually increase at the cost of the share of virtual over the years. The face-to-face part may become the new luxury.

This transformation to hybrid events is a big challenge for the entire MICE industry, for the associations as well as for the destinations, venues, convention centres, hotels, and so on. Therefore, it is anticipated that the change is going to shake up the MICE industry a lot. All parties need to at least have basic plans to adapt to this trend and run hybrid events. Many providers of conference and congress venues are already responding to the changes in demand and have been investing in technology for hybrid or digital formats.

The rise of hybrid events does also have advantages, such as:

- Companies in the UK who started to experiment with virtual events have caused an increase in business of MICE agencies.

- Compared to traditional on-site events, hybrid events are virtually expanded in space and not subject to one specific location. So, they will be open to larger communities.

- In normal times the very big conferences could only be hosted by a limited number of cities, because they have the appropriate venue and hotels. If the events become hybrid, and physical attendance gets smaller, the events are open to many more destinations. So new destinations are able to bid for such events for the first time.

Sustainable travel

The increased public awareness of the environment in Europe also affects MICE tourism. In fact, sustainability is now one of the main criteria for companies to choose the right venue. For example, two-thirds of buyers and sellers in the MICE market are incorporating Corporate Sustainable Responsibility into their incentive programmes. MICE destinations should try to find a fair balance between the economic benefits of the event and the negative social and environmental consequences of the travel and tourism associated with it.

It is especially attendees from generation Y and generation Z who are aware of and concerned about sustainability. For 65% of Generation Y employees, dedication of their employer to sustainability is key for their loyalty to the company. The behaviour of these generations is increasingly influenced by ethics, moral values, concerns about the environment, animal welfare, production and labour practices, and desires to positively impact communities and people.

These travellers demand availability and affordability of ‘green’, ‘eco’, ‘climate neutral’ and organic services and products. Many do not only want to reduce their holiday footprint, or visit a destination, but also to enrich it (‘do-good, feel-good’ holidays, ecological tours).

Sustainability has become a trend in tourism and its importance will evolve further in the future, boosted by the international United Nations Sustainable Development Goals and the political agenda of national governments in the EU. With the growing importance of Gen Y and Gen Z for the tourism market, the demand for more sustainable tourism experiences will expand, so the pressure for businesses to act will increase.

Sustainability criteria may play an important role in the bidding process, so convention bureaus and their associated providers at the destinations need to take aspects of sustainability in service, product, accommodation and other areas into account. Having a strategy for sustainability can convey credibility and trustworthiness.

For you as a business, sustainability provides opportunities to tap into the MICE market by creating the link between the formal MICE event and the local community, its nature and its culture by offering sustainable products and services, excursions, tours, etc. It also offers the opportunity to involve the local community in these offerings and to provide unique and memorable experiences.

Euromonitor published a ranking of countries around the world based on sustainability of tourism. You can check this list to see how sustainable your country is compared to others. The report also lists the major permanent changes in consumer behaviour per world region. The report can help your business to become more sustainable and purpose-driven.

Tips:

- Visit the Global Sustainable Tourism Council website, which provides guidelines on how to develop a sustainable business.

- Keep in mind that customers are reluctant to pay a premium for more environmentally sustainable products or services. You can also try to make your business or product offer greener and get certified.

- Collaborate with other stakeholders at the destination, such as local residents and businesses, also from other sectors. This could be local guides or experts, providers of local food and of local accommodation, local farms or factories, and more (look at the website of Tourism for SDGS for an example in East Africa).

This study was carried out on behalf of CBI by Molgo and ETFI.

Please review our market information disclaimer.

Search

Enter search terms to find market research