The European market potential for food tourism

Food trails, festivals, local food markets and artisan producers are some of the most popular tourism experiences in the sector today. Food tourism is a key driver of growth. Europe is a major market, and interest in food tourism was set to increase in 2025, particularly for British and Dutch nationals. Sustainable and responsible practices are key to providing authentic food tourism products. Healthy eating, vegetarianism, veganism and flexitarianism are also becoming more popular across the world today.

Contents of this page

1. Product description: food tourism

Food tourism is travelling to experience a region’s food and beverages. It can also be called culinary or gastronomy tourism. The World Food Travel Association (WFTA) defines it as ‘travelling for a taste of place to get a sense of place’.

Food has become one of the key drivers of tourism. Everyone eats and drinks. Travellers pay more attention to local cuisines when they travel and increasingly choose destinations based on the traditional cuisine there.

Figure 1: What is food tourism?

Source: World Food Travel Association, 2024

Food tourism involves a wide network of businesses. This means there are many opportunities for food tourism product providers, depending on the sector they work in. The businesses include:

- Food and beverage providers – These are the core businesses where food tourists directly engage with local food and drink. Examples include restaurants, cafés, street food stalls, food trucks, wineries, breweries, distilleries, bakeries, delicatessens and traditional food markets. This group supplies food tourism businesses.

- Food experience providers – These businesses often provide hands-on food experiences. For instance, cookery class providers, food tours and tastings, wine and beer tours and tastings, foraging (e.g. for truffles or mushrooms) and farm visits. Agritourism is also part of this category.

- Travel and hospitality businesses – These businesses can provide access to food tourism experiences. They include hotels and resorts that might offer cookery classes or partner with local chefs; food-focused accommodation providers like farm stays or vineyard hotels; and tour operators that specialise in food tourism.

- Food product and retail businesses – These are the businesses involved in food production and/or distribution, such as speciality food shops that sell spices, chocolate and gourmet foods; local producers such as cheese makers, beekeepers and coffee farms; farmers’ cooperatives; and food festivals. This group may conduct food tourism and provide services to food tourism businesses, like factory tours.

- Marketing and support services – These businesses include DMOs (destination marketing organisations) that promote and/or sell food experiences in regions or cities; influencers and content creators who drive demand for food experiences; and online platforms, including OTAs (online travel agents) such as Viator, GetYourGuide and local guides, and review sites like Tripadvisor and Google.

Try to identify as many food tourism businesses in your destination as you can and learn from them.

Figure 2: Businesses involved in food tourism

Source: Acorn Tourism Consulting, 2025

Understand the benefits of food tourism

Food tourism helps local people and communities, destinations and visitors. Food can bring people together, possibly more than anything else. Food experiences attract new customers and returning visitors keen to discover a different aspect of food culture in a destination they return to. To that end, food tourism helps preserve local culinary heritage and traditions. Food tourism can take place all year round, so there are no seasonality issues.

Food tourism, whether rural or urban, brings in money and boosts local economies. It needs local people to be involved, so it supports skill development and creates jobs. Meaningful cross-cultural exchange is one of the key parts of sustainable and authentic experiences, and food tourism helps local communities be proud of what they have.

Figure 3: The benefits of food tourism

Expert insight

Erik Wolf, Executive Director, World Food Travel Association

Culinary tourism explores a destination through its food and drink products, traditions and experiences. It is no longer a niche market, but a powerful and growing sector. It reflects a deeper interest in culture, identity and sustainability. At its core, culinary tourism is about showcasing a place’s unique culinary culture and heritage.

Every visitor eats and drinks, making food and drink the most universal part of the travel experience. Unlike shopping, sports or museum visits, meals are unavoidable, so destinations have a natural platform to tell their stories. But today’s food-loving travellers do not just look for a list of restaurants. They want meaningful, authentic and memorable experiences, to taste local specialities, visit producers, learn traditional recipes and connect with the people behind the food.

This is a valuable opportunity, especially for rural areas, small towns and emerging destinations. With thoughtful development, local tourism offices and businesses can turn everyday culinary traditions into visitor experiences. These can attract tourists, generate small producers’ income and give residents a sense of pride. When done well, culinary tourism strengthens cultural identity, supports local economies and creates ambassadors who carry the story of a place far beyond its borders.

By investing in their food culture, destinations can build resilience and become more visible in a competitive global tourism landscape, all while preserving and celebrating what makes their communities special.

Examples of food tourism experiences

Food experiences are very popular among travellers. Table 1 shows the most common food tourism experiences on the market.

Table 1: Food tourism experiences and market examples

| Food experience type | Description |

|---|---|

Food festivals

| Food festivals are widespread and provide opportunities for local food producers and businesses to show their food to local people and tourists. There are many internationally famous festivals, such as Oktoberfest in Munich, Germany, the world’s largest beer festival, and Pizzafest in Naples, Italy.

There are also many local food festivals. These include the Chocolate Festival of Belize in Punta Gorda, the Ubud Food Festival in Bali, Indonesia, and the African Food and Drinks Festival in Abuja and Lagos, Nigeria.

Food festivals are often part of cultural trips abroad. This trip to India includes several food festivals. |

Food trails

| Food trails are a good way for producers to branch out and show off their specialities. The Coffee Culture Trail in Colombia visits several coffee farms to learn about coffee cultivation and processing. Participants can enjoy tastings too. The African Foodtrail offers a range of trails, including the Mombasa Street Food Tour. Local operator Saigon Street Eats in Vietnam offers a range of food trails, including the Pho Trail, where participants enjoy one of the country’s traditional dishes.

|

Food museums

| Food museums are a great way for visitors to learn about a country’s cuisine. Examples include the Wonderfood Museum in Penang, Malaysia, the Museo del Café in São Paulo, Brazil, the Tequila and Mezcal Museum in Mexico City and the National Food Museum in Johannesburg, South Africa. |

Food and wine tastings

| Food and wine tastings are common food tourism experiences, and there are many different types. Examples include:

Multi-day food-based holidays are also common in Europe. Operators include Intrepid, Secret Food Tours and Gourmet on Tour. |

Cookery classes

| Cookery classes to learn how to make traditional dishes of a destination are popular as one-off experiences or as part of a wider group tour. Examples include learning to cook a Colombian meal in Pereira with a professional chef and a family, a market visit and cookery class in Hoi An, Vietnam, and a cookery lesson in Marrakech, Morocco.

|

Wine trails

| Many developing countries have top-class wineries, including Chile, South Africa, Argentina and Lebanon. Wine trails are often combined with food and activities like cycling. Examples of wine trail packages on the market include a horseback wine tour and country grill in Chile, a trail to experience the best of the Bekaa Valley’s wine heritage in Lebanon and tracing the roots of winemaking in Mendoza in Argentina.

Wine holidays are also common in Europe. They are offered by a range of specialist and general tour operators, including Cellar Tours, Good Wine Tours and Wine Paths. |

Vegan tourism

| Vegan tourism involves travel experiences in keeping with the vegan principle of using no animal products. It extends beyond food to include animal-friendly activities and ethical shopping. Vegan food tours are especially popular in destinations where vegan food is more common, like India, which has a deep-rooted vegan culture, and Thailand, where Buddhist dishes are vegan.

Good examples of tours include this vegan cookery class and market tour in Colombo.

Multi-day vegan tours are also available. Vegan Travel offers a 13-day Thailand Vegan Adventure. |

Producer visits

| Visiting farmers and artisan producers is common and is often considered part of agritourism. For instance, Sahakari Spice Farm in Goa, India, offers tours and food made from produce grown on the farm. |

Local farmers’ markets

| Visits to local farmers’ markets are often part of wider food experiences, such as cookery classes or cookery experiences with local families. Visiting a market before preparing a meal offers great authenticity and connection with the family and place. |

Source: Acorn Tourism Consulting, 2025

End-market segmentation and consumer behaviour

The market for food tourists is large and varied. People have very different travel motivations, tastes and behaviours in terms of food tourism. The following segments give an outline of the different food tourists on the market today. Remember that food tourists may fall into more than one segment at any one time.

Table 2: Characteristics of food tourists by segment, motivation and behaviour

| Food tourist segment | Travel motivation and behaviour | Characteristics |

|---|---|---|

Authentic experience seeker | This group likes local, traditional and culturally immersive food experiences. They like to visit local markets, take part in food tours and cookery classes and eat at locally/family-run restaurants. | The largest group: accounts for 30–35% of food tourists. Broadly distributed across all age groups, but with a larger cohort in the Gen Y and Gen Z (aged 30–45 and 13–29 respectively in 2025) consumer groups.

How to reach them:

Emphasise heritage and culture, use storytelling and ‘eat like a local’ messaging. |

| Social media foodie | This group looks for experiences that are ‘Instagrammable’ and that they can share, as well as trendy food experiences. They look for visually appealing food and seek out popular cafés, food trucks and pop-up eateries. | A large group: 20–25% of food tourists, typically Gen Y and Gen Z.

How to reach them:

Focus on the visual aspects of your offer. Using relevant influencers can help reach them. |

| Budget gourmet | Budget gourmets love great food at affordable prices. They eat at hidden gems, food stalls and use food apps for recommendations. | Account for 15–20% of the market, dominated by young people travelling on a budget, including students, backpackers and other budget-conscious tourists.

How to reach them:

Showcase affordable ‘must-try’ dishes and offer street food guides and value-for-money food experiences. |

| Wellness-focused food traveller | This group likes to combine health, sustainability and food. They look for places that offer organic, vegan, farm-to-table and eco-conscious dining options. | A small, niche group growing in line with sustainability and wellness trends. Accounts for 10–15% of food tourists. They are health-conscious people, often women, aged between 25 and 50.

How to reach them:

Promote clean and healthy eating, sustainability and wellness-related food experiences. |

| Culinary connoisseur | They look for gourmet, high-end and unique culinary experiences. They will often plan trips around fine-dining restaurants, including those with Michelin stars and chef-led experiences. | They are a small but high-spending market. They account for between 8% and 12% of food tourists. They are typically well-educated professionals with a mid to high income level, aged 35–60.

How to reach them:

Highlight exclusivity, chef credentials and luxury culinary packages. |

| Event-driven traveller | This group travels to attend food festivals and other events where food is a key offering. | A smaller group driven by seasonal events, 5–10% of food tourists. The market includes food bloggers and influencers, couples and other food enthusiasts.

How to reach them:

Highlight signature events, local traditions and festival atmosphere. |

| Family foodie | Travelling families, often with younger children, look for food experiences that the whole family can enjoy, like child-friendly restaurants, food festivals and interactive experiences. | An important group for destinations attracting families (5–8% of food tourists), but less important than other groups. They include families with children and multigenerational families.

How to reach them:

Promote family-friendly venues, interactive activities like cookery classes and inclusive menus. |

Source: Acorn Tourism Consulting, UN Tourism, World Food Travel Association, 2025

Accessible tourism on the European market

Accessible tourism is the ongoing effort to make sure all people, regardless of physical limitations, disabilities or age, can access tourist destinations, products and services. It involves publicly and privately owned tourist locations. The improvements benefit people with permanent physical disabilities, as well as parents with small children, elderly travellers, people with temporary injuries and their travel companions. Tourists with disabilities may travel individually, in groups, with their family or with carers.

Accessibility and food tourism

To be an accessible business in the food tourism market, you should focus on physical, sensory and dietary factors to support your guests. You should be clear on your website and in marketing materials about what can be provided; for example, if your site is ‘wheelchair accessible’ or ‘unsuitable for people with visual impairments’.

- If you plan to provide services for wheelchair users, make sure that the routes you take are suitable over flat terrain or ramps are available. If there are lifts, make sure that they can fit a wheelchair and have space for another person.

- If you offer walking tours, clearly state who they are suitable for and whether long distances are involved. People with disabilities need full information so that they can make their own decisions.

- Choose partners (restaurants, producers, museums) that offer accessibility as a norm.

- Provide interpretation (menus, information cards, leaflets, etc.) suitable for people with hearing or visual issues.

- Work with your partners to be transparent about food and ingredients so that people with allergies feel safe.

Tip:

- Read the CBI studies 'The European market potential for accessible tourism' and 'Entering the European market for accessible tourism products' for practical and useful advice to make your tours accessible.

2. What makes Europe an interesting market for food tourism?

Europe is the largest outbound source market for international arrivals in the world. Food is a major reason for travel. This makes it an interesting market for food tourism. The WFTA (World Food Travel Association) says that Europeans spend a high proportion of their budgets on food and drink, around 25%. This rises to 35% in more expensive destinations, and in less expensive destinations it accounts for around 15% of the overall budget.

Food tourism is valuable. It had a global value of around $13.8 billion (USD) in 2024. This is expected to rise to $84 billion by 2034, growing at a compound annual growth rate (CAGR) of 19.9%. Europe has the largest market share, 35%, valued at $4.6 billion in 2024 and expected to be worth $28.5 billion by 2034. That is a CAGR of 20.1% over the next ten years.

Source: Precedence Research, 2025

Vegetarians, vegans and flexitarians are a growing target market. Europeans are increasingly rethinking eating meat for health, environmental and animal welfare reasons. In Europe, vegetarianism and veganism are on the rise, and there has been a notable shift towards flexitarian diets. These diets mean consumers choose to eat less meat but do not give it up altogether.

In 2023, around 4% of Europeans identified as vegetarians, with higher numbers in Germany and the UK. More Europeans said they had flexitarian diets (42% in Germany, 39% in the UK).

Figure 5: Ways of eating in Europe

Source: Glanbia Nutritionals, Healthy Snacking U&A Study, 2022

Food tourism appeals to all European source markets. Tasting traditional dishes helps visitors learn about communities’ heritage and lifestyles. Local food experiences, such as sharing meals with local families and taking part in cookery classes, provide opportunities for meaningful interactions, deeper connections and a better understanding of host communities.

Tips:

- Think about including a vegetarian or vegan tour alongside your regular food tours. You will be able to expand your market this way.

- Read the study 'Entering the European market for food tourism products' to understand the requirements for providing food tourism products. You need to be aware of the high expectations that Europeans have of food tourism experiences.

3. Which European countries offer the most opportunities for food tourism?

The European countries that offer the most opportunities for food tourism in developing destinations are the largest outbound markets: Germany, the UK, France, Italy, the Netherlands and Spain.

Europeans consider a destination’s food an important reason for travel. This means that there are good opportunities for food tourism. CBI conducted research in 2025 among the key source markets: France, Germany, Italy, Netherlands, Spain and the UK. More than one-quarter of respondents said that food and drink activities were a key reason to travel in 2024 (27%). All source markets except Germany said that interest in food and drink activities while on holiday was set to increase in 2025.

Source: Acorn Tourism Consulting/CBI, 2025

Germany

Germany has the largest outbound travel market in Europe: 86.6 million Germans travelled overseas in 2022. Overseas trips are still on the rise. In 2024, 56.4 million Germans went on 68.3 million holiday trips of at least 5 days. Destinations abroad accounted for 52 million of these trips. This represents an increase in both travellers (4.1%) and the number of trips they make (5.9%).

Popular developing destinations for German outbound tourists include Türkiye, Egypt and Mexico, which attract the most people. Germans also like to visit countries with historical ties to their country, such as Namibia, where German is still spoken. In 2025, CBI research found that Germans are planning fewer trips to Türkiye and more trips to South and Southeast Asia.

Almost 1 in 3 said that food and drink activities were important when travelling in 2024 (29%), although this was set to decline to 17.9% in 2025. Despite this, with so many outbound travellers, these activities still attract a large market of travellers.

Around 10% of Germans say that they are vegetarian and 2–3% are vegan. These are among the highest figures in Europe. And 30–40% of the population say that they are flexitarian. This means they are mainly vegetarian but sometimes eat meat. Germans aged 18–35 are more likely to have plant-based diets. These groups will likely research destinations that offer plant-based food options and value sustainable and ethical dining experiences.

Germans are very interested in travelling sustainably. 49.7% said they would consume locally-sourced produce. Good food and drink options were important for 27.7% when planning trips.

There is a large tour operator market in Germany. Operators that specialise in food tourism are limited, but most adventure tour operators offer food experiences, such as Gebeco and Studiosus Reisen. Rotel Tours is an interesting overland adventure operator. It travels using custom-built vehicles known as ‘rolling hotels’ across Africa, Asia and Latin America. Food experiences are built into its itineraries.

United Kingdom (UK)

The UK is the second-largest source market of outbound tourists from Europe. UK residents went on 86.2 million visits abroad in 2023. This represents a growth of 21.4%. However, this figure is lower than 2019 (93.1 million). Top destinations for UK outbound travellers include Türkiye, India and Morocco. For 2025, trips to South and Central America were set to rise.

Food and drink are the most popular activities for outbound tourists from the UK. In 2024, 34.4% stated that food and drink were key activities on trips abroad. For 2025 trips, this is set to rise by 9.3% to 43.7%. When planning trips, 38.4% of British travellers consider food and drink options important.

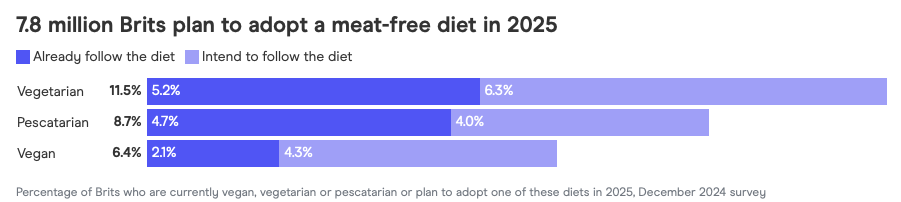

The UK has a lot of non-meat eaters compared to other source markets. Around 12% of the UK population do not eat meat. This is set to increase to 26.6% in 2025. About 5.2% of the UK population say they are vegetarian, and 2% are vegan. However, these numbers were set to rise in 2025 to around 11.5% vegetarians and 6.4% vegans.

Figure 7: UK population adopting a meat-free diet in 2025

Source: Finder, 2025

Like in Germany, the younger generations (Gen Z and Gen Y, aged 13–45 across both generations, as of 2025) eat the least meat.

British travellers generally like to be sustainable when travelling, with 46.4% stating that they consume locally-sourced products.

As travel for food experiences is popular among UK nationals, several specialist tour operators cater for foodies and ‘wine buffs’ (also known as oenophiles). These include Gourmet on Tour, Grape Escapes and Wine Paths. However, tour operators that offer themed or special interest holidays that have food and drink as a category are most common. These include Expressions Holidays, Inspiring Travel and Macs Adventure. Intrepid Travel is a global tour operator known for its wide range of food-inspired short trips and holidays.

France

France is the third-largest outbound market in Europe. French travellers made 54.87 million outbound trips in 2023. This market is expected to grow in the coming years. It had a value of around $72.9 billion (USD) in 2025. It is expected to rise to $124 billion by 2035. This represents a CAGR of 5.4%.

Like Germans, French tourists prefer overseas destinations to domestic travel (75% vs. 25%), although European destinations like Spain and Italy are most popular. Morocco is the most popular country among developing destinations, followed by Türkiye and Tunisia. CBI research showed that interest in travelling to South and Southeast Asia was set to increase in 2025.

Interest in food and drink is also growing. In 2024, 1 in 5 (20.2%) stated that food and drink were a key activity when travelling overseas. In 2025, this is set to rise by 5.9% to more than a quarter of respondents (26.1%). When planning a trip, good food and drink options were the most important factor for almost one in five travellers (19.2%).

Around 5.2% of the population identify as vegetarians and 1.1% as vegans. However, interest in flexitarianism is growing. In 2022, 34% of French consumers identified as such. This shows a trend towards reduced meat consumption.

In terms of sustainability, more than half (57.8%) of French travellers like to consume locally-sourced produce when they travel.

The French tour operator market is large and complex. Food and wine are important sub-segments for many tour operators, and there are many specialist tour operators. Let’s Eat the World offers culinary tours and cookery workshops in Europe and South America, specifically Peru and Colombia. Adventure tour operators like Terre Voyages have gastronomy as a theme in their itineraries.

Italy

Around 31 million Italians took overnight outbound tourism trips in 2023. This is a 24.1% increase from the previous year. Italians are spending more while abroad, an increase of 11.8% per trip. Asia is popular, especially Japan. More Italians plan to travel to Africa in 2025. Other popular food destinations include Vietnam, Morocco and India.

In 2024, food and drink activities were important to almost 1 in 5 Italians (18.8%) on trips abroad. However, for trips overseas in 2025, interest in food and drink was set to increase to almost one-third (29%), a 10.2% increase.

Around 9.5% of Italians identify as vegetarian or vegan. Since 2014, the number of vegans has increased fourfold, reflecting a growing trend towards plant-based diets. Italians like good food and drink options when planning trips overseas (33.7%). Italian travellers are also at the top of the market in terms of sustainability in food choices, with almost two-thirds stating that they like to eat and drink locally-sourced produce when travelling (60.3%).

The Italian travel trade is split into many segments, with more than 12,000 tourism companies on the market. Food and drink holidays are usually offered as part of itineraries. WeRoad is a new tour operator (2017) that creates group adventures focusing on immersive cultural experiences and activities like exploring local food and engaging with local communities.

The Netherlands

Dutch people are very adventurous, and travel is important to them. Around 85% of the population travel for personal reasons. In 2022, they took 23.1 million overnight outbound trips. Türkiye, Egypt and Morocco are the main developing destinations. Interest in Mexico has also grown recently. South and Southeast Asia are key travel destinations. Interest in Africa is expected to increase in 2025.

Food and drink activities are most important to the Dutch of all the source markets: 2 out of 5 state that they were the main activity. Food and drink activities are the top choice for Dutch travellers this year, and having good food and drink options is important to them in the planning stages (44.5%).

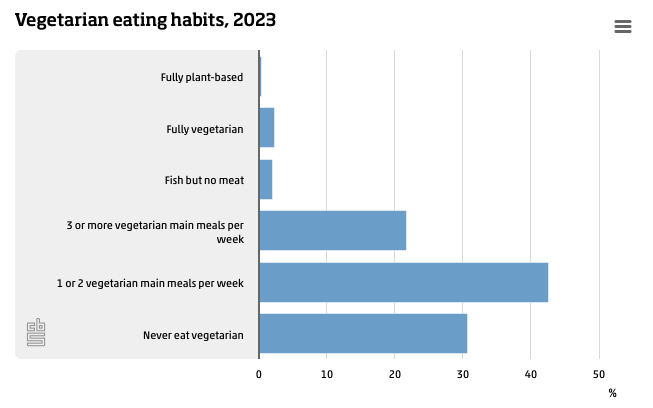

There has been a large shift towards plant-based diets. Although there are relatively few vegetarians and vegans in the Netherlands (3% and 0.6% respectively), over one-third of the population say they are flexitarian (35%) and 25% of main meals consumed are reported to be vegetarian. These figures reach 60% for Amsterdam residents, who consider themselves vegetarian, vegan or flexitarian.

Figure 8: Vegetarian eating habits in the Netherlands

Source: Statistics Netherlands, 2024

The Netherlands is one of the most sustainably minded European source markets. 37% of Dutch travellers state that they like to consume locally-sourced produce when on overseas trips.

As Dutch nationals are adventurous, many tour operators cater to this market. Food and drink experiences are often part of their trips. Sawadee Reizen offers tours all over the world. Better Places offers culinary experiences. Withlocals is a well-known Dutch OTA (online tour operator) that connects travellers with local hosts around the world.

Spain

Spanish nationals took around 19.3 million international overnight trips in 2023, an increase of 19.6% compared to 2022. Morocco, Mexico and Türkiye were the top destinations for Spanish travellers travelling outside Europe. However, they also like to travel to Spanish-speaking countries like Colombia, Costa Rica and Chile.

Compared with the other source markets, food and drink activities were less important in 2024 (16.8%). In 2025, interest in food and drink activities while travelling abroad was set to increase to 28.4%, an 11.6% increase. When planning trips, 22.5% of Spanish travellers consider good food and drink options important.

Vegetarians and vegans account for 4% and 0.8% of the population, respectively. 7% of the population states they are flexitarian. More than half (58.7%) like to consume locally-sourced produce when they travel.

Examples of tour operators that offer food and drink holidays include Paladar y Tomar, which travels to Morocco. Cultural and adventure tour operators, such as Catai Tours, usually have food and drink as part of their trips.

Tip:

- Find out more about source markets to determine those most suitable for your business. The CBI study 'What is the demand for outbound tourism on the European market?' will help you do this.

4. Which trends offer opportunities or pose threats in the European food tourism market?

The food tourism sector is expected to grow. It is driven by demand for authentic experiences and the desire to connect with local people and places. Social media is key for promoting food tourism activities and attracting the Gen Z and Gen Y markets. As more Europeans eat more healthily and the trend towards vegetarianism, veganism and flexitarianism grows, there are more opportunities for local food tourism operators.

Sustainable and responsible practices are key to providing authentic food tourism products

Most people want to make sustainable travel choices. Booking.com’s 2025 Sustainable Travel report found that 93% of global travellers felt this way, and 84% think that sustainable travel is important and are committed to eco-friendly practices. Reducing food waste is a key part of sustainable food tourism. Ideas to help providers meet this requirement include providing smaller portions, using locally sourced ingredients and giving away excess food to local communities or organisations. Using more eco-friendly packaging and less plastic also helps.

The desire to help local communities has also grown over the years. 73% of travellers aim to spend their money this way. Many food tourism experiences directly support local communities. 77% of global travellers want authentic and immersive tourism experiences, as well as common food experiences. There are great opportunities for food tourism providers to offer sustainability throughout their tours, and the market is very open to these types of trips.

The Folk Tales is a small local tour operator based in Delhi. Its USP (unique selling point) is sustainable tours. It has a smaller offer, so that it can focus on doing what it does well. Itineraries include a food tour in Jaipur and an Old Delhi walking tour that includes food tasting. The operator describes all its sustainability policies and actions on its website. It is good practice to tell your guests exactly what you do to be a sustainable tour operator.

Tips:

- Make sure that your food tourism tour is sustainable. Think of ways to improve. For instance, pick your suppliers carefully. Make sure that they use locally sourced produce and minimise food waste. The more sustainable your tours are, the more attractive they will be to your guests, who like to feel that they are making a difference.

- State all your sustainable practices to attract European markets.

Social media and influencers are driving growth in food tourism

Food tourism growth is driven by social media, especially Instagram, TikTok and YouTube, and many food and travel influencers. Food and drink posts, reels, stories and blogs are common across multiple platforms. When they are combined with travel, it is easy to see why. Images and videos of delicious-looking food and people enjoying food and travelling to new places attract large audiences who want to try the dishes and visit the places where they can enjoy them.

Social media platforms are especially popular among younger generations. Gen Z (aged 13–29) and Gen Y (aged 30–44) are known for their love of experiences over things. Street food, local markets and food festivals are high on their list of things to do when they travel. Food trails and festivals are particularly attractive activities for this group, and they are in high demand. They help promote lesser-known destinations by posting content and reviews, which is great news for places off the beaten track.

Destinations use social media and influencers to promote their cuisine and attract visitors. Many travel influencers promote cuisine associated with destinations, such as Tokyo for sushi and wagyu beef, Naples for pizza and India for street food.

Tips:

- Work on your social media accounts and website to attract the Gen Z and Gen Y markets. If you want to attract this market, make sure that the content you post is relevant and inspirational. Use the CBI study 'How to be a successful tourism company online' to help you.

- Think about working with a food influencer to build awareness and trust in your product. You do not have to use an expensive influencer. A local influencer can be very effective for the local market. The CBI study 'How to work with influencers' can help.

Healthy eating creates opportunities for food tourism providers

Healthy eating is a growing global trend. There are many reasons for this. The pandemic, for example, pushed this development as more people felt that they needed to control their health. People are also more aware of environmental factors around food production, and animal welfare has also played a part in encouraging vegetarianism, veganism and flexitarianism.

We have seen how these movements are more popular among European consumers. Veganuary – eating a vegan diet in January – has been practised worldwide over the past ten years and it appears to be more popular every year.

Influencers support the market through blogs and websites, like Veggie Wayfarer, the Nomadic Vegan and My Vegan Travels.

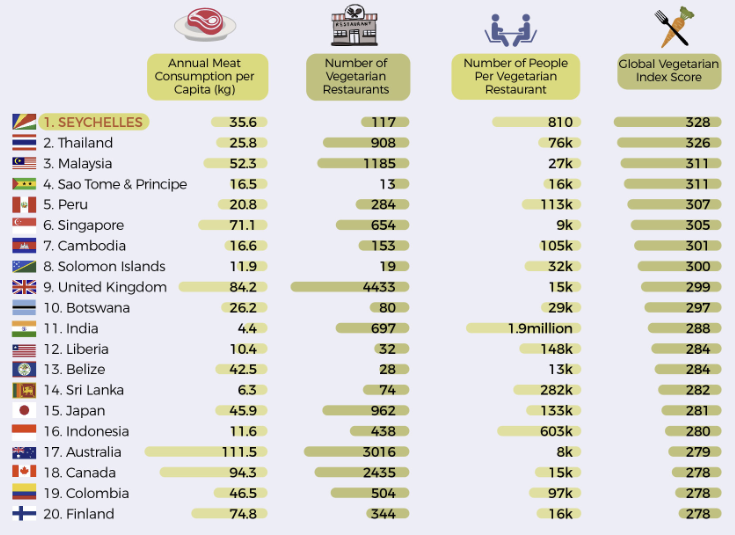

This trend creates many opportunities for developing countries. The table below shows the top vegetarian countries in the world. However, there are many more countries where food tourism fits well to showcase healthy, local vegetarian cuisines. Exquisito Peru offers a range of food tours, including a vegan food tour in one of the world’s top food cities, Lima.

Figure 9: Top 20 vegetarian-friendly countries

Source: Oliver’s Travels, 2024

Tips:

- Use tempting images of healthy food like vegetables and fruit to attract the market, and fully describe what you offer. Only promote your food tourism product as ‘healthy eating’ if it really is healthy. You will hurt your reputation if you make misleading claims.

- Be clear about your product in your marketing. Do not confuse vegetarian with vegan cuisine. Vegetarians do not eat meat, while vegans do not eat any produce from animals at all (e.g. dairy, eggs and honey). It is important that you understand this distinction. Read the study 'Entering the European market for food tourism' to learn more about what this market demands.

Disclaimer: The statistics quoted throughout this study are drawn from various sources. Due to differences in data collection and presentation methods, figures may not always be directly comparable.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research