The European market potential for turmeric for food additives

The European market for natural food colours, including turmeric, is shaped by innovation, a shift towards plant-based products, evolving regulations and demand for ethical sourcing. Consumers seek cleaner, more sustainable diets. This makes the food industry demand natural ingredients that combine strong colour performance with health benefits and sustainability. Brands also face pressure to demonstrate traceability and ethical impact. Turmeric suppliers who meet these expectations have a good chance to succeed in Europe’s evolving food market.

Contents of this page

1. Product description: turmeric

Curcuma longa (turmeric) is a herbaceous perennial plant native to southeast Asia. It belongs to the ginger family (Zingiberaceae). The rhizome (underground stem) of turmeric has been used as a medicine and a spice for thousands of years. Turmeric has evolved from a traditional cooking spice to become a valuable natural food additive. This development is driven by growing consumer awareness of synthetic food dyes and increasing demand for transparency in food ingredients.

Figure 1: Turmeric plant

Source: Self Sufficient Me, 2025

Chemically, turmeric contains about 50-60% curcumin. That gives it a range of colours, varying from yellow to a deep orange. Turmeric contains about 5% volatile oil, resin and yellow colouring substances known as curcuminoids. They are responsible for its yellow colour and many of its benefits as a food, such as its antioxidant effects.

Most Curcuma longa is produced in the following countries:

- Major producers – India, China, Myanmar, Indonesia, Bangladesh and Vietnam;

- Emerging producers – Thailand, Peru, Madagascar, Costa Rica, Nicaragua, Pakistan, Nigeria, Ethiopia and Fiji.

India dominates global production. It grows 80% of the world’s turmeric. States like Andhra Pradesh, Tamil Nadu, Karnataka, Odisha and West Bengal are major cultivation centres. The diversity of the soils and climate in India contributes towards the unique flavour profiles of different turmeric varieties.

Each variety of turmeric is distinctive in terms of its curcumin content, colour intensity and flavour profile. This makes them suitable for different applications in the food industry. The variety chosen by a buyer depends on its intended end use, and also market requirements.

Table 1: Turmeric variety classifications

Classification | Variety type | Key characteristics | Primary uses |

|---|---|---|---|

| By curcumin content | High-curcumin varieties | 6-8% curcumin content, deep orange colour | Premium pricing, extract production |

| Standard varieties | 2-4% curcumin content, bright yellow colour | Most commercially traded, general food use | |

| Speciality varieties | Up to 8.7% curcumin content | Exceptional quality for extract production | |

| By physical characteristics | Finger turmeric | Long, slender rhizomes | Higher curcumin content |

| Bulb turmeric | Rounded main rhizomes | Powder production | |

| Fresh turmeric | Harvested young | Immediate processing or fresh market sales | |

| By processing suitability | Oleoresin-grade | Balanced curcumin and volatile oil content | Oleoresin extraction |

| Extract-grade | High-curcumin varieties | Standardised extracts | |

| Powder-grade | Good colour retention and grinding properties | Ground turmeric production |

Source: ProFound, 2025

Turmeric as a food additive

As well as its traditional use as a spice, turmeric is being used more and more as a natural food additive. This change creates great new opportunities for suppliers to the European food industry. Food manufacturers seek to replace synthetic colourants with natural alternatives. Turmeric’s dual functionality as both a colourant and flavouring agent makes it particularly valuable for this. There are stricter rules for artificial colourants and consumers demand natural products. This makes turmeric an essential ingredient across multiple food categories.

Turmeric is being used in in food processing in two main ways:

- Food colourants (curcumin extracts) – Curcumin is a pure, flavourless colourant. It is extracted from turmeric oleoresin by crystallisation and has a purity level of about 95% (under EU rules, this must not be less than 90%).

- Turmeric oleoresins – In processed foods, turmeric is used mainly in the form of an oleoresin. That has a similar flavour and colour profile to the ground spice, but has a number of advantages as a food ingredient. It contains approximately 37–55% curcumin.

Turmeric has various specific uses as an additive in food and beverage products.

It provides natural yellow colouring for cheese (particularly processed varieties), butter and margarine, yoghurt and dairy desserts and plant-based milk alternatives. In dairy products, turmeric offers a clean-label alternative to synthetic yellow colourants that keeps the appearance consumers expect. The growing plant-based dairy market particularly values turmeric for its ability to recreate the rich colour of traditional dairy products without requiring artificial additives.

In curry powder, spice blends, mustard, processed meats, soups, broths, sauces and condiments, turmeric acts as both a colourant and a flavouring agent. In these products, its natural origin lines up with with consumer preferences for recognisable ingredients. Its inherent antimicrobial properties can also help preserve products.

In cakes and pastries, cookies, biscuits and confectionery products like cereals, turmeric provides a natural yellow colour that appeals to health-conscious consumers. And it offers a clean-label solution that meets growing demand for natural ingredients in sweets and treats.

Functional drinks, wellness shots, golden milk, turmeric lattes, soft drinks and probiotics requiring natural yellow colouring are all fast-growing product categories. Beverage manufacturers value turmeric for its dual use as both a colourant and a functional ingredient. This allows them to market products containing turmeric as offering health benefits beyond basic nutrition. The rising popularity of convenience and wellness beverages has made turmeric an essential ingredient for brands targeting busy, health-conscious consumers.

Seasoned snacks and crackers, ready-to-eat meals, flavoured convenience foods and nutrition bars use turmeric to create appealing golden colours, while also meeting clean-label requirements. In snack applications, turmeric’s natural antioxidant properties can help product stability and making it last longer. The convenience-food sector values turmeric’s ability to provide both visual appeal and potential health benefits. This helps support marketing claims about natural ingredients.

Figure 2: Typical products coloured with turmeric

Source: Oterra, 2025

Trade data

When exporting turmeric products to Europe, you need to know their correct trade classification (HS code). For this study, we have analysed three HS codes that cover the different forms in which turmeric enters the European market as a food additive and a colourant.

Table 2. HS code classification for turmeric food applications

| HS code | Product classification | Description | Relevance to turmeric |

|---|---|---|---|

| 091030 | Turmeric (Curcuma longa) | This code covers whole, ground and powdered turmeric in its traditional spice form. While not exclusively for food additive applications, this classification helps us to understand overall European demand for turmeric. | Overall market demand indicator |

| 32030010 | Dyes of vegetable origin, including dye extracts | This code covers turmeric when used specifically as a natural food colourant or dye extract, whether chemically defined or not. | Direct application for turmeric colourants |

| 330190 | Extracted oleoresins and concentrates | This classification includes turmeric oleoresins and concentrated extracts used in food applications. These products represent the more processed forms of turmeric which offer standardised colour strength and enhanced functionality for food manufacturers. | Premium processed products |

Source: ProFound, 2025

Tip:

- When exporting turmeric products, make sure that you understand which HS code applies to your specific product. Curcumin extracts for food colouring may fall under a different classification than oleoresins or whole turmeric, which can affect import duties and regulatory requirements.

2. What makes Europe an interesting market for turmeric for food additives?

Europe is a large market with health-conscious consumers, supportive regulation and cutting-edge innovation. All of these factors support the use of turmeric as a food additive. There is growing demand in Europe for clean-label products. Turmeric has a dual role as a colourant and a functional botanical. This makes it one of the most promising natural ingredients for exporters who want to target the European market.

A large health-driven market for natural ingredients

Europe is the world’s largest and most innovative food and drink market, with a total annual turnover of €1.2 trillion. The region’s size, combined with rising health consciousness, makes it an attractive destination for natural, functional ingredients like turmeric. Exporters of turmeric from developing countries benefit from a market that is not only large, but also increasingly focused on health, transparency and sustainability.

Figure 3 shows European imports of turmeric and ginger, two key spices within this category, in recent years. Imports of turmeric grew by 40.8% between 2017 and 2024, from €59.9 million to €84.4 million. And ginger imports rose by 49.3%, from €35.2 million to €52.6 million, over the same period. Despite a dip in 2022, both spices have maintained strong long-term growth. And they reached their highest levels so far in 2024.

Source: ITC Trade Map, 2025

This rising demand is closely linked to consumer health trends. According to a 2025 BCG report, health has overtaken price and taste as the number-one driver of food and beverage purchases in Europe. Historically, food businesses preferred synthetic dyes because they were cheaper and often provided better taste profiles in processed foods. Now, however, growing consumer awareness about product ingredients has shifted their preference toward natural alternatives. Although turmeric may be more expensive and sometimes less neutral in flavour than synthetic alternatives, consumers now favour natural products. This means that they increasingly prefer natural turmeric, despite the trade-offs.

Increasing demand for clean-label, functional and premium products

As clean-label expectations become mainstream, European consumers are driving demand for more natural, recognisable ingredients. Turmeric’s simplicity, appearing on labels as ‘curcumin (E100)’ or ‘turmeric extract’, meets this need for transparent, plant-based ingredients. The clean-label ingredients market is expected to grow significantly in the coming years, reaching €180 billion globally by 2035. And Europe will maintain its position as a front-runner in this trend.

European consumers are also pushing back against ultra-processed foods. They want shorter ingredient lists and natural alternatives. Replacing synthetic yellow dyes like tartrazine (E102) with turmeric allows manufacturers to simplify labels and to avoid the mandatory warnings required for artificial colours. In the UK, this movement has gained more followers through Dr Chris van Tulleken’s bestselling book, 'Ultra-Processed People'. This has influenced both consumer awareness and government policy.

The trend towards more premium products is also reshaping European demand for turmeric. Consumers increasingly prefer ready-to-use wellness products – such as functional beverages, immune-boosting shots and golden milk lattes – over traditional home preparation. This change is creating opportunities for turmeric oleoresins and extracts that combine health benefits with modern convenience. This is especially the case in the quickly growing functional beverage sector.

Favourable regulation and innovation are driving demand

EU regulations favour natural food colourants over synthetic alternatives, and that is creating good opportunities for turmeric suppliers. Under Regulation (EU) 1333/2008, curcumin (E100) is approved as a food additive. On the other hand, synthetic colourants like tartrazine (E102) face more and more restrictions. Any product containing one of the ‘Southampton Six’ synthetic colours must show on the label that the additive "may have an adverse effect on activity and attention in children". Turmeric-based colourants face no such restrictions, and so allow brands to create bright yellow and orange products without triggering consumer alarm.

This regulatory advantage is a key selling point for turmeric exporters. It allows manufacturers to create clean-label products that meet both legal requirements and consumers’ desire for natural ingredients.

Regulation is also having an effect on how new products are made. More and more established food businesses and start-ups are now active in the area where health, wellness and food overlap. The EU is investing €500 million in new projects that will advance the EU Green Deal objectives for sustainable transformation of the EU economy. As part of this initiative, 91 new projects are being funded by the EU to deliver innovative research and solutions in the field of sustainable food, agriculture and the environment. This strategy is having a positive impact on innovation in the food-tech sector: an increasing number of start-ups are working on sustainable food systems, healthy diets and a healthy planet.

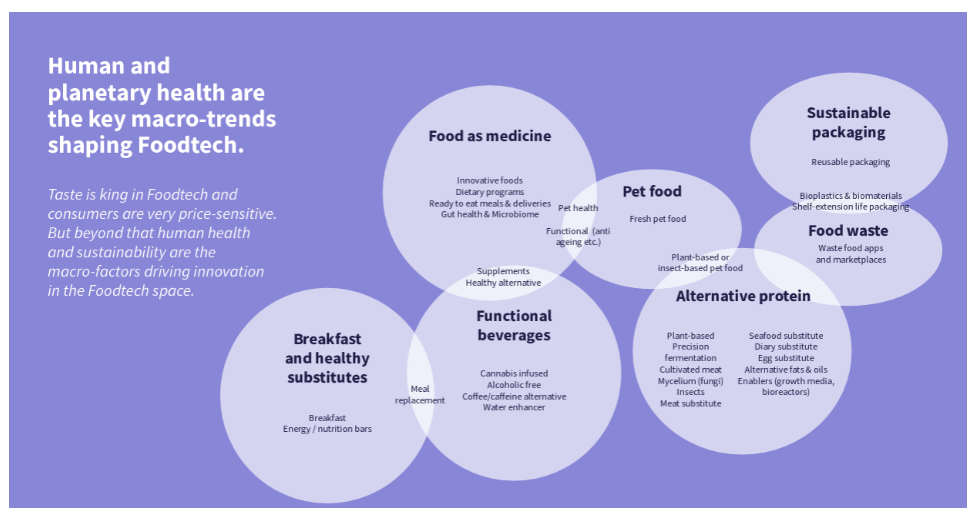

According to DFIN, Europe’s food-tech sector is being influenced by two general trends:

- Human health;

- Planetary health.

Figure 4: Human and planetary health as key drivers of innovation

Source: Dealroom, 2025

These trends influence not only what consumers eat, but also how products are developed, packaged and marketed. Categories like functional beverages, gut health and food as medicine are expanding fast.

Turmeric fits into this picture very well because of its natural anti-inflammatory and antioxidant properties. This makes it an important ingredient in products targeting gut health, immune support and inflammation reduction. These are key concerns for consumers seeking everyday wellness through natural foods, especially because Europe has an ageing population.

Legacy brands reformulate to meet demand for natural, functional and recognisable ingredients. Turmeric stands out as a single ingredient that ticks all the right boxes: clean label, colour, flavour, function and traceability.

Tips:

- Keep track of regulatory changes by using resources like KPMG’s European Regulatory Radar. Focus in particular on the regulations targeting ultra-processed foods, because turmeric can act as a natural alternative.

- Align your turmeric offering with health-driven trends in Europe. For example, by highlighting its anti-inflammatory and antioxidant properties.

- Stay informed about product development and innovation in the EU food and beverage industry by reading newsletters like Food Ingredients Europe and Food Navigator.

Growing European demand for vegetable-based food colours

Europe’s vegetable-based food colour market is experiencing strong growth. This makes it an attractive destination for suppliers of turmeric. The specific trade data for turmeric tracks the spice in all its forms. Keeping an eye on imports of vegetable-origin colourings gives you a better understanding of demand for turmeric as a natural food additive.

Between 2017 and 2024, European imports of vegetable-origin colouring matter grew a lot in both value and volume. In fact, several major markets showed double-digit percentage increases. This growth shows the broader move away from synthetic dyes, as well as increasing consumer demand for natural, plant-based alternatives.

Germany leads the European market for vegetable-based dyes. Imports there reached €114.3 million in 2024 – a 45% increase since 2017. France follows as the second-largest importer, at €81.3 million (+35%). The Netherlands, Italy, Spain and the UK each imported €62-71 million worth of vegetable dyes.

Table 3: European import values and volumes of vegetable-origin colouring matter, 2020-2024

| European market | Value in € millions | % value change (2017–2024) | Volume in metric tonnes | % volume change (2017–2024) |

|---|---|---|---|---|

| Germany | 114.3 | 45.16 | 5,523 | 13.43 |

| France | 81.3 | 34.74 | 5,813 | 31.19 |

| Netherlands | 70.6 | 71.86 | 3,100 | -41.19 |

| Italy | 68.1 | 46.64 | 10,186 | 42.9 |

| Spain | 65.4 | -14.84 | 4,114 | -6.84 |

| UK | 62.8 | 21.83 | 3,672 | -45.78 |

Source: ITC Trade Map, 2025

To help you better understand the trends in this market, figure 5 shows the proportion of vegetable-based versus animal-based dye imports in these focus countries from 2017 to 2024.

Most European markets show a clear move towards vegetable-based alternatives. The UK recorded the strongest movement in this direction, at 10.6%. It was followed by Germany (6%), France (4%) and Italy (2%). Spain moved slightly in the opposite direction, with a 2.9% shift in favour of animal-based dyes. The Netherlands stands out as an exception, with a 37% shift toward animal-based dyes during this period. Despite this outlier, the overall European trend confirms that companies across the region increasingly favour vegetable-based dyes like turmeric. This change is driven by clean-label demands and by regulatory pressure to move away from synthetic and animal-origin colourants.

Source: ITC Trade Map, 2025

Tips:

- Target Germany, France and the UK to sell vegetable-based dyes such as turmeric, because these markets show both high import values and positive shifts toward plant-based alternatives.

- Keep an eye on upcoming markets like Poland and Belgium, which also showed strong growth rates and may offer less competition than established markets.

3. Which European countries offer the best opportunities for turmeric for food additives?

Germany, the Netherlands, France, the UK and Spain offer the best opportunities for turmeric exporters. Each of these markets has its own distinct characteristics in terms of volume, value and product preferences. Growth across them is also uneven. Some, like France, are growing steadily. Others, like the UK, have seen imports decline in volume but rise in value. That shows a move towards premium concentrated extracts.

Source: ITC Trade Map, 2025

In terms of volume, the UK recorded the largest decline in imports of turmeric between 2020 and 2024: from 10,408 tonnes to 4,060 tonnes. The Netherlands and Germany maintained high volumes, although both saw some changes over those years. Germany ended 2024 at 5,569 tonnes and the Netherlands at 5,373 tonnes. France showed gradual growth, rising from 2,208 tonnes to 2,643 tonnes. Spain and Italy remained smaller but stable markets.

The table below shows the changes in imports of oleoresins between 2020 and 2024. It includes their value and volume in 2024, as well as the percentage change in both over that period.

Table 4: Import volumes and values of oleoresins in selected European countries, 2020-2024

| European markets | Value in € millions | % value change (2020–2024) | Volume in tonnes | % volume change (2020–2024) |

|---|---|---|---|---|

| Spain | 30.9 | 127.1 | 1,504 | 177.33 |

| Germany | 17.9 | -11.64 | 934 | 27.53 |

| France | 14.3 | 2.81 | 673 | 67.11 |

| UK | 13.5 | -45.54 | 674 | -38.44 |

| Netherlands | 9.6 | 20.64 | 392 | 27.23 |

| Italy | 3.2 | 32.51 | 98 | -78.1 |

Source: ITC Trade Map, 2025

Germany

Germany has 85 million residents and over 186,000 food and beverage enterprises. It is the largest consumer market in Europe and a key driver of food innovation. In 2024, Germany passed the Netherlands to become the leading European importer of turmeric. Imports of vegetable-based dyes reached €114.4 million – a 45.16% increase in value since 2020. Volumes also grew, to 5,523 tonnes (+13.43%). This reflects sustained demand across the food and beverage industry. Germany’s imports of oleoresins increased by 27.53% to reach 934 tonnes in 2024, even though total import value declined by 11.64% to €18 million. This suggests either falling prices or a move towards lower-cost suppliers.

According to Business.gov.uk, Germany is Europe’s largest food producer. Its food and drinks industry is country’s fourth-largest industrial sector. Turmeric is increasingly being used for its anti-inflammatory and antioxidant properties. REWE, one of Germany’s largest retailers, refers to turmeric as "the golden spice for health" and uses it in teas, functional beverages, organic products and other categories.

In Germany, sustainability and transparency are very important. This shows growing concerns about food safety, as well as pressure to adopt clean labels. They are creating an innovative environment for product development. German consumers pay close attention to sourcing claims. It pushes brands to have a preference for traceable and certified turmeric extracts. This trend has prompted innovations like REWE Group’s QR-code-enabled transparency tools for organic meat and milk, as well as a rise in own-label food lines using natural ingredients.

One leading player in natural colours is Symrise, which has a 70-year tradition in the industry with its SymColor® range. Another is Doehler, which sources ingredients worldwide in a vertically integrated manner. Other interesting companies include Silesia Aroma, Henry Lamotte Oils and Rüther Gewürze.

Natural colours like turmeric in food and beverages requires innovative technologies and expertise. Firms like TER Ingredients and BIOSS offer a full service covering product and colour development.

Roeper and All Organic Treasures (specialising in organic ingredients) are interesting German-based trading companies active in natural colours like turmeric.

The Netherlands

In the Netherlands, the main industries that use food colours are cheese making and beverages. In addition, the country is a key trade and innovation hub in Europe. It combines good logistics and infrastructure with a dynamic food-technology sector. And it is a key re-exporter of natural food ingredients, including turmeric, to the rest of Europe and the UK.

In 2024, the Netherlands was the second-largest European importer of turmeric. It was previously the largest, but has now been overtaken by Germany. In the same year, its imports of vegetable-based dyes increased to €70 million, up 72% in value from 2020. And the volume of its oleoresin imports rose to 392 tonnes (+27.24%). Despite this growth, there could be a change in European distribution patterns, with turmeric skipping Dutch traders and going directly to processing countries.

The Netherlands remains a front-runner in plant-based innovation and food tech. Accelerators like Start Life are backing next-generation food-ingredient start-ups. Retailers such as Jumbo are price-matching plant-based meats to make them more accessible. This creates good opportunities for turmeric-based dyes and oleoresins. This is especially true for those with traceability, organic labels and functional health benefits.

Ingredient formulator DSM (now part of the Firmenich group) and the trading firms Holland Ingredients and Caldic are examples of Dutch companies working with natural food colours. Other interesting players include Will & Co and De Lange. More information can be obtained from the NEA, the Dutch Association of Flavours and Fragrances.

United Kingdom (UK)

The UK is the biggest consumer of ultra-processed foods in Europe. It is also home to one of the fastest-growing movements wanting cleaner functional ingredients. Public pressure, government policies like the sugar tax and the rise of health-first retailers such as WellEasy are moving food manufacturing priorities towards natural ingredients.

Turmeric imports spiked to 11,000 tonnes in 2020, most likely driven by pandemic-era health awareness. In 2024 their volume stabilised at about 4,500 tonnes. The fall may be due to post-Brexit disruptions, rising costs or declining novelty. Imports of natural dyes reached €62.8 million by value in 2024, a 21.83% increase since 2020, even though their volume dropped by 45.78%. This suggests a shift towards more concentrated or premium extracts, and towards plant-based products. Turmeric oleoresin imports fell 38.44% by volume, but their value remained relatively high at €13.5 million. That indicates targeted usage in high-end wellness products.

Turmeric’s functional and natural colour properties are increasingly valued in the Uk in sectors like health drinks, clean-label snacks and wellness-focused ready meals. This is despite the decline in bulk volumes.

The country’s main importers are Dura Color, Plant-Ex and ScotBio. Other interesting players include British Pepper and Spices, Lionel Kitchen, Treatt, House of Flavours and Phoenix Products. The UK has a Food Additives & Ingredients Association (FAIA), which can be a good starting point to search for potential buyers.

France

France is one of the leading European importers of ingredients for the food and beverage industry. Functional foods continue to shape consumer preferences there. The demand for organic products has been increasing, and in 2022 France ranked as the leading organic market in Europe, with a €12.1 billion retail valuation. Turmeric stands to benefit from the demand for functional, clean-label, organic products.

Turmeric imports have increased steadily since 2020, stabilising at just over 2,500 tonnes in 2024. France is Europe’s second-largest importer of vegetable-based dyes. Their value in 2024 was €81.3 million in 2024, up 34.74% from 2020. France also ranks as the third-largest importer of oleoresins, with a 67.11% increase in volume from 2020 to 2024 and a total value of €14.3 million.

French consumers focus on details. Especially in the premium and bio-food sectors, where ingredient transparency, sourcing story and nutritional value strongly influence purchasing decisions.

France is home to Naturex (part of the Swiss-based multinational Givaudan), one of the main natural extract companies worldwide, It sources and sells natural ingredients for the food, health and beauty sectors. Other French importers of oleoresins and dyes include Robertet, Nactis, Metarom and Anec France.

Spain

Spain stands out as one of Europe’s most active hubs for food colourant and oleoresin formulation. This position is based on a well-established network of domestic companies with a strong reliance on global sourcing.

Spain imported €65 million worth of vegetable dyes in 2024 – a 14.84% decrease in value and a 6.84% decline in volume compared with 2020. Importantly, though, Spain is also Europe’s leading importer of oleoresins. Their imports were worth €30 million in 2024, with volume up 177% from 2020. This increase indicates rising demand for concentrated natural flavour and colour solutions.

Spanish food companies frequently import colourants and oleoresins from outside Europe, particularly from China and the United States. This underlines Spain’s role as both a formulator and redistributor. Within Spain, the sector is supported by leading players like Sancan. It is known for solutions across the animal-based and plant-based segments. Another leading firm is Coralim, which provides adjusted natural colours and antioxidants.

Others include PROCONA (part of the SEIMEX Group), Secna, Sancolor, Colorante Campanar, Flavorix Aromáticos and Bidah Chaumel, a prominent trader of food ingredients. These companies position Spain as a key gateway for innovative and scalable natural colouring systems within the EU.

Italy

Italy has a smaller market for natural food colours like turmeric. However, data shows that it is a country where value often outweighs volume. That reflects a market preference for high-quality, multifunctional ingredients for use in premium health foods and supplements.

Turmeric imports in Italy stood at around 2,300 tonnes in 2024. That was lower than in Poland, although those imports have been increasing steadily in value since 2020. Italy’s dye imports reached €68 million by value in 2024, and in volume terms were the highest of any European country – more than 10,186 tonnes, a 42.9% increase since 2020. This reflects strong demand for premium, high-purity extracts, often destined for natural food colouring, functional products and high-end cosmetics. There was also a modest shift toward vegetable-based dyes, most likely influenced by plant-based innovation and consumer awareness. Imports of oleoresins were worth €3.2 million, but fell sharply in volume (-78%). That suggests either supplier consolidation or a move towards more concentrated, value-added forms of the product.

Consumers in Italy are more likely to recognise and accept natural colours derived from locally familiar plants like beetroot, paprika and tomato. The country’s organic product market is one of the largest in Europe and continues to grow steadily. This makes the appeal of clean-label, plant-based ingredients stronger. Turmeric with an origin story, organic certification and functional health claims is fits well with these evolving consumer preferences.

Italy is not typically a direct importer of natural food colours from developing countries. Instead, it tends to source them from other EU countries, like Spain, France and Germany. The key local importers and formulators in Italy include Aromata Group and D-Ingredients. They operate alongside international players with a strong local presence, such as Brenntag and Sensient.

Tips:

- Check the list of members of the Natural Food Colours Association to identify the main European and international companies active in this sector.

- Conduct further market research to better understand the differences between the countries listed above. Use free statistical databases such as ITC Trade Map or Access2Markets.

- Be sure to read the CBI module on finding buyers for food additives to identify potential commercial partners in different European countries.

4. What trends offer opportunities or pose threats in the European turmeric for food additives market?

Europe’s turmeric market is being shaped by four powerful trends: the plant-based boom, tighter purity rules, rising demand for ethical sourcing and the emergence of biotech colourings. Each presents both opportunities and risks for exporters. Suppliers who understand these movements and can meet new expectations are most likely to get high-value buyers.

Shift to plant-based diets and colours

Plant-based diets are no longer a niche trend in Europe; they are quickly becoming mainstream. 51% of European meat-eaters have reduced their annual meat intake, with Germany, France and Italy leading the way. Of those who are cutting down on meat, 47% say that this is mainly for health reasons, 29% because of animal welfare and 26% due to environmental concerns. This reflects a broader trend, not only towards sustainability but also towards personal well-being and dietary balance. In countries like the UK, Germany and the Netherlands, where ultra-processed food consumption remains highest, this is especially the case.

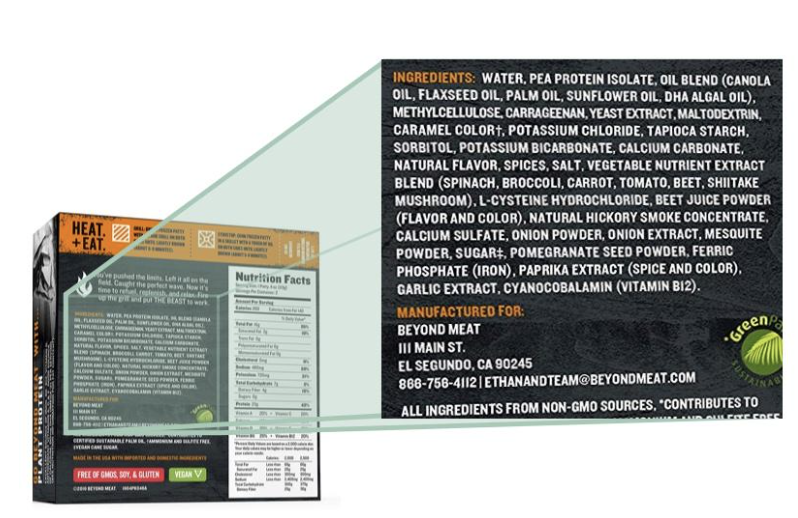

There is more to this shift than simply avoiding meat, however. Consumers are not just scanning for animal-free logos. They are also scrutinising ingredient lists, looking for simple, recognisable items that they can pronounce. Even plant-based burgers – many of which contain turmeric colouring – face pushback if they contain too many additives or ‘chemical-sounding’ ingredients.

Figure 7. List of ingredients from Beyond Burger, a popular meat-free option

Source: Clean Food Facts, 2025

As a natural, plant-based colourant and flavouring, turmeric helps manufacturers to clean up their labels but still offer vibrant colours. And it allows them to tell a functional health story (anti-inflammatory, antioxidant, digestive health).

Importantly, plant-based products often require complex solutions to make items like meat substitutes more visually appealing. For example, Naturex has launched a product line called VegebriteTM Veggie Reds. Intended to achieve an authentic meat-like colour in meat substitutes, this is made from beetroot and other natural extracts. Turmeric is particularly well-suited for plant-based meat alternatives. Here it can be used to colour patties, nuggets, sauces or curries in place of synthetic dyes.

Tip:

- To discover new opportunities and applications for turmeric, monitor specialist trade events focusing on the vegan and flexitarian markets. Key events include the Free From Functional Food Expo in Amsterdam and Veggie World in Hamburg, where you can connect with buyers looking for plant-based solutions.

Stricter purity criteria for food additives

One of the biggest obstacles when exporting turmeric extracts to Europe is purity. The EU’s regulation for food additives, including natural colourings like turmeric, has clear purity criteria. These are legally defined rules that describe how clean, safe and consistent a food colouring must be.

That means clear limits on:

- Contaminants like heavy metals or pesticide residue;

- Microbial growth, such as mould or bacteria;

- Solvent residues (especially for turmeric oleoresins);

- The percentage of the active component, like curcumin in turmeric.

These criteria are written into EFSA’s official food additive regulations and are checked by importers. If your turmeric fails to meet these standards, or you cannot prove that it does, buyers will not take the risk. European buyers want turmeric that is traceable, tested and properly documented. Suppliers who can consistently meet EU purity criteria will stand out, especially in the crowded and competitive plant-based ingredients market.

What you now need, at the very minimum:

- A certificate of analysis (CoA);

- A technical data sheet (TDS);

- Detailed specifications for curcumin content;

- Lab test results for contaminants;

- Proof of good manufacturing practices (GMP) and food-grade processing methods.

Suppliers who can provide these documents will be far more attractive to companies making natural, clean-label foods. For example, Supracorps from Peru provides basic product information on its website. That includes curcumin content ranges, moisture levels and organic certification status. Although not a comprehensive technical data sheet, this baseline information helps potential buyers to understand product specifications and it signals professionalism. And that is better than providing no documentation at all.

The focus on purity has also encouraged more sustainability certification within the natural food ingredients industry. Companies like GNT offer organic-certified options for ingredients such as safflower, turmeric and paprika. And the NATCOL Code of Conduct lays down clear standards for the classification, sourcing, manufacture, quality and safety of natural food colours.

This shift stems from food safety concerns, mainly about pesticide residues and cross-contamination throughout ingredient supply chains. Extraction processes can concentrate impurities found in botanical raw materials. That makes source quality another important factor. For consumers, organic certification means healthier and safer ingredients.

Producers who meet strict standards for both colouring performance and food safety are more likely to export their turmeric colourings and oleoresins to the European market.

Tip:

- Be prepared to provide documentation to support any statements you make. Consumers in Europe are increasingly interested in the social aspect of your product and your company. Be ready to prove your policies on corporate social responsibility (CSR).

Demand for evidence of ethical sourcing and sustainability

European consumers are demanding more transparency than ever. 63% say they want to see improved visibility in product certification and sourcing. Part of this trend relates to ingredients like turmeric and other food colourants: consumers want ingredients to be instantly recognisable and understandable, and to know exactly where they come from. This has a direct impact on importers, who prefer to partner with suppliers able to prove their sustainability efforts and ethical sourcing practices.

Establishing traceability systems can be challenging, but it presents a clear opportunity for turmeric suppliers in developing countries. Go beyond a certification logo and actively share your story. This includes how you grow your crop, who you work with and how you support local communities.

Suppliers who practise ‘building in public’ by documenting their progress, highlighting their farmers and being honest about challenges are seen as trustworthy and stand out. They make it easier for European buyers to communicate sustainability to their own customers.

One example of a company doing this well is Doselva, which is helping farmers in Nicaragua to grow high-value spices like turmeric through regenerative practices. Jefferson Shriver, its founder, regularly shares transparent updates on the firm’s impact and farmer relationships via LinkedIn. Its website also shows how it works with farmers. The Doselva Insumos programme, for instance, provides seed and input financing to any farmer who wants to grow sustainable turmeric.

Video 1: Storytelling by organic ginger and turmeric supplier Doselva

Source: Jefferson Shriver YouTube Channel, 2025

Overall, the more you show, the more you stand out. Another interesting example comes from DACE (Vietnam), which openly displays its harvest calendar on its website. This informs buyers about exactly when products are available and how the firm plans its growing seasons. It also highlights all its certifications – BioSuisse, Naturland, GLOBALG.A.P., Organic and Fair for Life – to make it easy for buyers to verify its ethical and sustainability credentials. This level of transparency about both farming practices and certification status builds immediate trust with European buyers, who need to demonstrate responsible sourcing to their own customers.

In this social context, Fairtrade certification is currently less relevant for natural food colours. But it can still be used to support an ethical claim.

Tips:

- To earn buyer trust, tell your story and document your farming practices. Show your farmers and explain your extraction process.

- Read the CBI report on tighter EU due diligence rules and what exporters of natural ingredients need to know. That also tells you more about how Doselva communicates its sustainability efforts.

- Be open to visits by buyers to your facility. If you are transparent and create a trustworthy partnership, importers will be more open to buying added-value natural colourant directly from your country rather than just the raw material.

The rise of biotechnology in food colouring

Biotechnology uses tiny living organisms, such as yeast, bacteria or algae, to make ingredients. This is beginning to change how natural food colours are made. The process is still in its early stages. But it is seen as a long-term solution to problems like limited supply, high cost and colour stability.

Companies like Ginkgo Bioworks and Conagen are at the forefront of this technological revolution. They use fermentation (similar to the way beer or yoghurt is made) to grow colour compounds in a lab. These can then be used as natural alternatives to synthetic dyes, or even to create new colours that are not easily found in nature.

For example, spirulina (a natural blue-green algae) has become a popular natural colouring. But it has one big weakness: it breaks down with heat. Through biotechnology, companies are now creating more heat-stable versions of spirulina-based colours. This makes them viable for more foods, like baked goods, or for candies.

Biotech-made colours may offer cheaper and more consistent options than turmeric. That, after all, is grown in fields, depends on the weather and fluctuates in price and supply. Colours made through fermentation can be scaled quickly, stored easily and are highly concentrated.

But despite this, many European businesses still prefer to import natural food colourings. They have a number of reasons:

- Turmeric is more than a colour, it is also a flavour and a health ingredient linked to anti-inflammatory and antioxidant benefits;

- It is a familiar and trusted plant in Europe, especially in the clean-label, organic and plant-based markets;

- Consumers increasingly care about natural origin, farming stories and ethical sourcing. Lab-grown colours cannot compete with a strong, authentic origin story.

Biotech is a promising trend that may reshape the natural colouring market in the long run. For now, however, turmeric still has a significant role to play. Especially if suppliers focus on quality, storytelling and the broader value turmeric has to offer, beyond just its colour.

Tips:

- In your marketing, talk about turmeric’s health benefits, cultural heritage and farming impact. These authentic qualities differentiate your product from synthetic and lab-grown alternatives.

- Use storytelling and transparency to show how turmeric supports local farmers and sustainability goals. Again, this is something that biotechnology cannot do.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research