The European market potential for strawberries

The European strawberry market is a high-value market with consumers who expect quality and freshness. Despite the dominance of local growers, demand allows for additional imports. The United Kingdom (UK), Spain, France and Germany import the most strawberries from developing countries, but there is also a small window to supply Poland and a niche market in the Netherlands.

Contents of this page

1. Product description: strawberries

The common strawberry is known as the garden strawberry. This is a hybrid species of the genus Fragaria (scientific name Fragaria × ananassa). The northern hemisphere also has a wild variety that grows naturally, known as the wild or woodland strawberry (Fragaria vesca).

Table 1: Product code and examples of varieties

| Harmonised System (HS) code | 081010 Fresh strawberries |

|---|---|

| Commercial cultivars (examples) | June-bearing varieties:

Everbearing/day-neutral varieties:

|

Most varieties in Northern Europe are short-day plants or June bearers that hibernate in winter, such as Elsanta, Sonata, Clery and Malling Centenary. The everbearing and day-neutral varieties are more common in Southern Europe. Spain is the largest producer and exporter of strawberries in Europe. Popular Spanish varieties include Camarosa, Fortuna, Sabrina and Candonga. The strawberry sector is moving toward everbearing varieties.

Table 2: Popular strawberry varieties for domestic production

| Region | Popular varieties for cultivation |

|---|---|

| Netherlands | Sonata, Lambada |

| UK | Malling Centenary |

| Central Europe | Alba, Asia, Brilla, Joly, Romina, Sibililla (early and mid-season production) |

| Germany, (Poland) | Cristina, Letitia (late season), Malwina (very late season) |

| Central Europe & Germany | Clery (patented by Consorzio Italiano Vivaisti-CIV) |

| Northern & central Europe | Sonata, Elsanta (old cultivar, no patent, gradually being replaced by various new cultivars) |

| Scandinavian countries | Korona |

| France | Gariguette (old cultivar), Darselect |

| Southern Europe (central areas of Italy, Spain, Greece) | Clery, Joly, Alba, Asia, Garda, Eva, Romina, Sibilla, Cristina, Darselect |

| Southern Europe (Southern Italy, Spain, Greece) | Florida-Fortuna, Camarosa, Monterey, Portola (USA cultivars), Sabrosa-Candonga, Sabrina, Rociera, Melissa (Spanish cultivars), Calinda, Victory, Primavera (new cultivars) |

| Huelva (Spain) | Florida-Fortuna, Primoris, Rociera and Rabida (Fresas Nuevos Materiales-FNM) |

Source: Status of strawberry breeding programs and cultivation systems in Europe and the rest of the world, Journal of Berry Research, vol. 8, no. 3, pp. 205-221, 2018, complemented with additional sources

Tip:

- For a more complete overview of strawberry varieties, see Frutas-hortalizas.com, strawberryplants.org and the list of strawberry cultivars on Wikipedia. You can also find commercial varieties through breeding companies, nurseries and breeding initiatives, like Flevo Berry, BerryLAB, Fresas Nuevos Materiales, Hansabred and Driscoll’s.

2. What makes Europe an interesting market for strawberries?

Strawberries are a popular and high-value summer fruit. Despite most strawberries being grown locally, there is always a period of low availability when strawberries are imported. The need for strawberry imports may increase due to declining European production.

Strawberries are a high-value and popular summer fruit

Strawberries are the most popular fruit in Europe. The market is mature, with large volumes and relatively stable demand. European cultivation provides a year-round fresh supply, as the European Union (EU) accounts for 11% of global strawberry production. Around 60% of the EU’s strawberries, about 1.2 million tonnes, are consumed within the country of production.

However, Europe’s off-season production cannot meet demand. As a result, there is a need to add to the local harvest in the winter and early in the season. European strawberry production has also fallen by 13% over the past decade. This could mean opportunities for exporters from developing countries. Although imports from non-European suppliers only make up a small part of Europe’s total consumption, volumes are still interesting.

Source: UN Comtrade (August 2025)

*Developing countries are defined as the OECD-DAC list of ODA recipients. ‘Rest of the world’ refers to all other countries.

Europe’s total annual strawberry imports generally stays around 500 million tonnes. They declined slightly from 507,000 tonnes in 2020 to 491,000 tonnes in 2024, after peaking at 516,000 tonnes in 2022. This was mainly due to declining trade within Europe. This translates to a compound annual growth rate (CAGR) of -0.8%.

At the same time, strawberry imports from developing countries grew from 38,000 tonnes to 44,000 tonnes, with a CAGR of 3.5%. As a result, their import market share grew from 7.6% to 9%. This shows Europe can be an interesting market for non-EU exporters.

Supply window opportunities for developing countries

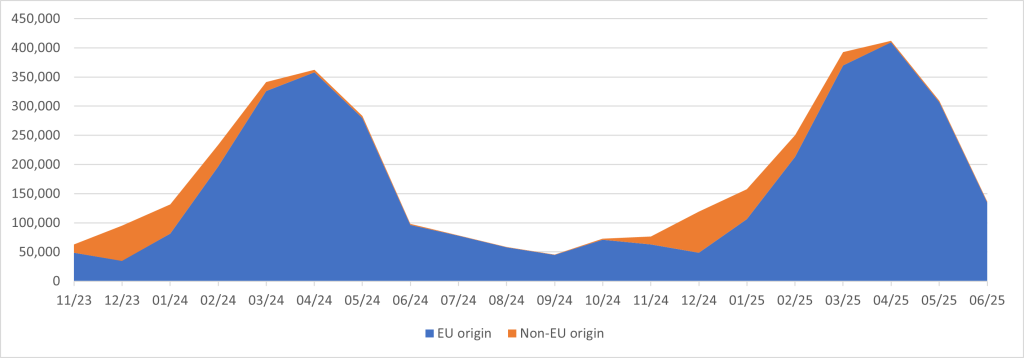

Figure 2: European imports of strawberries by main origins per month, in thousand tonnes

Source: Globally Cool, based on UNComtrade statistics (August 2025)

Europe mainly imports strawberries between November and March, with a peak in December for the Christmas holidays. This window should be the main focus for most non-European suppliers. If European production continues to decrease, the demand for imported strawberries may grow. But at the same time everbearing varieties that extend the season are growing more popular.

To supply your strawberries to Europe, they need to be of premium quality and grown sustainably. This helps them compete with European greenhouse production.

Tips:

- Stay up-to-date with the latest in the European strawberry market. For example, subscribe to newsletters and platforms like Freshplaza, with its regular overview of the global strawberry market, Eurofruit and FreshFruitPortal.

Learn more about the developments on the European market and meet other strawberry companies at international events. Examples are the Fruitnet Berry Congress and Fruit Logistica, the largest trade fair for fresh produce in Europe.Read the CBI’s tips for finding buyers and doing business with European buyers of fresh fruit and vegetables.

3. Which European countries offer the most opportunities for strawberries?

Strawberries are consumed all over Europe. The UK is the main importer of strawberries from developing countries by far. Spain, France and Germany follow. Poland and the Netherlands may also offer opportunities.

Source: UN Comtrade (August 2025)

On average, Europeans consume 1–6 kg of strawberries per person per year.

Source: GloballyCool, (August 2025)

The UK: Leading importer from developing countries since Brexit

British people consume 2.3 kg of strawberries per year (2023). This is just under the European average of 2.6 kg per capita. In the summer of 2025, strawberries were the most popular fruit, liked by 89% and known by 100% of British adults. The UK has plans to produce more strawberries nationally, but still depends on imported strawberries to meet demand. Local British production declined from 130,000 tonnes in 2020 to 106,000 tonnes in 2023.

A lot of strawberries in the UK are produced through protected cultivation, mainly using polytunnels. Investments have been made in strawberry varieties such as the Malling Centenary, a strong plant that provides quality fruit. New technologies could also boost strawberry yields, like Dyson's Hybrid Vertical Growing System. However, British berry growers are struggling with the continued increase in operating and labour costs. They also face challenges with seasonal labour, as workers can only get a six-month visa for a picking season of up to nine months.

Since the UK left the EU (Brexit), the country has become Europe’s leading importer of strawberries from developing countries. The increased paperwork delays EU imports. As a result, the difference between requirements for strawberries from the EU and more distant supplying countries in North Africa and the Middle East have become smaller.

However, in January 2025, strawberries were moved from the medium-risk to the low-risk category for imports from the EU. This means they are now 'deregulated' and do not require phytosanitary certificates or physical import checks. As a result, strawberry imports from the EU have become more competitive again.

Between 2020 and 2024, British imports of strawberries from developing countries performed well. They grew from 3,400 tonnes to 20,000 tonnes at an impressive CAGR of 56%. With that, their direct import market share grew from 5.7% to 31%.

Spain was the UK’s main strawberry supplier in 2024, providing about half of all imports. Egypt and Morocco were next, each accounting for around 15%. The British government has trade agreements with these countries, which may help them export more strawberries. However, Egypt faces an important limitation: the UK’s 6,000 tonne tariff-free quota for Egyptian strawberries. This quota is used up earlier every year, with the 10% duty on out-of-quota volumes starting as early as 10 January (2025). Efforts from the Egyptian side to increase the quota have been unsuccessful thus far.

The UK also bought smaller volumes from less common suppliers, such as Jordan. However, the new rules that make it easier to import strawberries from the EU may reduce opportunities for developing countries in the coming years.

Tips:

- To explore which varieties are common in the UK, see the assortment of local supermarkets like Tesco and Waitrose.

- Read more about the characteristics of the British market in the CBI study on exporting fresh fruit and vegetables to the United Kingdom.

Spain: Major producer that mainly imports from Morocco

Spain is the largest producer and supplier of strawberries in Europe. High investments in cultivation combined with the current risks have offset some of the Spanish strawberry farmers. Other farmers are investing in early varieties so they can enter the market earlier in the season.

Despite local production, there are still specific windows when foreign farmers (mainly from Morocco) can supply Spain with strawberries. The country exports strawberries throughout the year, but its main season runs from February to May. Opportunities are particularly good in the off-season.

Spain generally produces between 320,000 and 400,000 tonnes of strawberries. In 2020, the harvest was much lower than normal, at 273,000 tonnes, due to adverse weather conditions. As a result, the country’s imports of strawberries from developing countries were relatively high that year: 15,000 tonnes. Since then, they have declined considerably, reaching 6,700 tonnes in 2024.

Most of these imports come from Spain’s leading supplier, Morocco. Production costs are lower and the season is slightly different in Morocco. This allows the country to supply Spain mainly between November and March. However, Morocco’s share in annual Spanish imports has declined from about 80% to about 50%. The UK has become Morocco’s leading strawberry export destination instead. A small volume of 100 to 500 tonnes is flown between October and December every year from Peru, which shares a language.

Tips:

- See the assortment of local retailers like Mercadona and Eroski to explore which varieties are common in Spain.

- Find potential production and trade partners in Spain at Fruit Attraction.

- For more information, see the CBI study on exporting fresh fruit and vegetables to Spain.

France: High standard in sensory quality

France is a large import market for strawberries. However, its consumers are more particular than those in other European countries. Strawberries are the most popular fruit among the French, with 30% considering them their favourite. Every year, the average French person consumes 1.9 kilogram of strawberries, much lower than the European average (2.6 kilogram). French consumers have high standards for the taste of strawberries. Varieties such as Darselect and the older Gariguette do well in France because of their unique flavour. It is difficult to introduce new cultivars if their fruits do not reach the same sensory quality.

The French preference for local fruit has not proven favourable for imports. In November 2024, retail organisation Mousquetaires Group announced that Intermarché and Netto would promote seasonal French fruit throughout the year and stop supplying their shops with strawberries for the holiday season. Nevertheless, 2024 was a good year for strawberry imports from developing countries. Imports generally fluctuate around 3,000 tonnes but they grew to 5,700 tonnes in 2024. This translated to a relatively strong direct import market share of 10%.

Spain is France’s leading strawberry supplier by far, with an overall share of around 70%. Suppliers from developing countries like Morocco and Egypt also perform well, especially in 2024, when their direct import market shares reached 7% and 2.6%, respectively.

When doing business in the French market, you must focus on strawberries with superior flavour. Exporting from a country that maintains good trade relations with France, such as Morocco, is an advantage.

Tips:

- Look at the offer of supermarkets like Carrefour to explore which varieties are common in France. Discuss which varieties have potential with potential buyers. Share samples if your variety is unknown.

- Check out the market prices (in French) on the Market News Network of France Agrimer. Search for ‘fraise’ (strawberry).

Germany: Leading consumption market

Germany is the largest market for strawberries in Europe. Fresh strawberries are very popular in spring and summer. Strawberries the most popular fruit in Germany, alongside apples and bananas. 77% eat them at least occasionally. The average German person consumes 2.7 kilograms of strawberries per year, just above the European average.

Love fruits

Strawberries are widely recognised as one of the world’s ‘love fruits’, symbolising romance, indulgence and affection. Their bright red colour, heart-like shape and sweet flavour make them especially popular around Valentine’s Day. Across Europe, retailers and suppliers increasingly capitalise on this association by offering special Valentine’s promotions, often featuring premium-quality strawberries presented in heart-shaped boxes or luxury packaging. These products are marketed as romantic gifts or components of dessert assortments, often paired with chocolate or champagne. As a result, the weeks leading up to Valentine’s Day typically see a sharp increase in strawberry demand and prices. Suppliers from countries such as Egypt and Morocco time their shipments to meet this seasonal sales peak.

Figure 5: Strawberries in a Valentine package in a German retail outlet, early February 2025

Source: GloballyCool, February 2025

Germany is the third-largest producer of strawberries in Europe, after Spain and Poland. In 2023, the country produced 131,000 tonnes. A gradual shift from open field to protected cultivation will secure the local supply in the future and extend the local season. Breeding programmes by Flevo Berry and Hansabred, among others, make the sector stronger with varieties that fit future cultivation systems. This way, German farmers continue to fulfil the growing demand for (local) strawberries. Local is considered more sustainable, as is organic cultivation.

The technical development of the German open-field strawberry production will take time. A great part of the consumption will depend on imported strawberries for many years to come. As a result, Germany is also Europe’s largest overall strawberry importer. These strawberries mainly come from European suppliers. 60–70% of imports come from Spain. Greece and the Netherlands follow, supplying 18% and 10% in 2024, respectively.

With Germany’s large domestic production and preference for local and regional strawberries, the market share for imports from developing countries is relatively small at about 3%.They differ according to the availability of local and regional supply, from about 2,000 to 5,000 tonnes. These imports mainly come from Egypt and Morocco, with a direct import market share of 1–2% each.

For non-European suppliers, it is important to be relatively close to the German market and to be able to supply during the European winter period. German retailers are some of the strictest in terms of requirements, including permitted pesticide residues. At the same time, they expect reliable, economic offerings. This means you may be able to sell large volumes to German retailers if your product meets all the requirements.

Tips:

- Look at the offer of supermarkets like REWE, Edeka, Aldi and Lidl to explore which varieties are commonly grown and sold in Germany.

- Try to get a supply contract with a supermarket or discounter so you have a reliable supply and a stable price. However, you should be prepared for extensive paperwork, such as reporting on your actions on food safety and sustainability. You also may have to submit your pesticide spraying registers.

- Adopt different quality and sustainability standards to enter the German market. Read more about these standards in the CBI’s studies on buyer requirements for fresh fruit and vegetables and exporting fresh fruit and vegetables to Germany.

Poland: Opportunities for Eastern European suppliers

Poland is the second largest producer of strawberries in Europe after Spain. Per year, the average Polish person consumes 5.9 kg of strawberries. This is the highest consumption rate in Europe.

Local production grew from 158,000 tonnes in 2020 to 195,000 tonnes in 2023. Polish strawberry growers are increasingly implementing modern agricultural technologies like polytunnels, allowing them to extend their season. Poland’s Kashubian strawberry also has European Protected Geographical Indication (PGI) certification. This guarantees that each batch meets strict quality standards.

This emerging Eastern European market is also amongst the largest importers of strawberries from developing countries. Imports generally fluctuate from between 1,000 and 2,000 tonnes, representing a relatively strong direct import market share of about 20–40%. They mainly come from Eastern European countries, like Serbia (770 tonnes in 2024), Albania (284 tonnes) and Ukraine (110 tonnes). Egypt, Türkiye and Morocco also supply strawberries to Poland. Poland’s main suppliers are Greece and Spain.

Netherlands: Technical cultivator with small opportunity for premium trade

Strawberries are Dutch consumers’ favourite summer fruit, enjoyed by more than 90%. The average Dutch person consumes 3.5 kg of strawberries per year, which makes the country fourth largest consumer in Europe, behind Poland, Greece and Austria. The Netherlands has year-round demand for strawberries, and large production and net export value. The country relies less on imports from outside Europe. It does manage some minor long-distance imports for the premium trade, but it does not serve the same trade hub function for strawberries as it does for many other fruits.

Figure 6: Dutch strawberries in a street market, early November 2025

Source: GloballyCool, November 2025

The Netherlands is a leading country in strawberry breeding, production and trade. Dutch strawberry production has doubled in 15 years, despite a more than 15% decrease in cultivated area. More than 86 million kg of strawberries were harvested in 2024. Three-quarters of these were grown in greenhouses and polytunnels, compared to ‘just’ half of the total harvest in 2010. Cultivation under glass and tunnels allows production to continue in smaller volumes outside the main season, with artificial lighting. As such, there is less need for imports from Northern Africa.

The Netherlands is Europe’s fourth largest strawberry importer after Germany, the UK and France. Like in Germany, the market share for imports from developing countries is relatively small. Most imports come from Belgium and Spain. Dutch strawberry imports from developing countries generally fluctuate around 1,000 tonnes. Egypt and Morocco were the largest suppliers of these countries. Respectively, they exported 676 tonnes and 261 tonnes of strawberries to the Netherlands in 2024.

Tips:

- See the assortment of supermarkets like Albert Heijn and Jumbo to explore which varieties are common in the Netherlands.

- See our study on exporting fresh fruit and vegetables to the Netherlands for more information on the Dutch market.

4. Which trends offer opportunities or pose threats in the European strawberry market?

European consumers’ increasing focus on leading healthier yet busy lifestyles stimulates their interest in strawberries. Freshness and taste are crucial, and they often prefer local over imported strawberries. There is growing interest in sustainability, but environmentally conscious consumers may be less likely to buy off-season imported strawberries. Technical improvements further extend the local seasons. As a result, you will have to strive for perfect quality and timing with attractive varieties to remain interesting for European buyers.

Healthy lifestyles stimulate interest in strawberries

European consumers are very health conscious. They increasingly focus on leading healthier lifestyles, which means improving their eating habits. According to Statista, about 60% of EU consumers actively try to eat healthily. They seek to reduce their consumption of processed foods and artificial additives and preservatives.

This can boost the interest in strawberries, which are a healthy snacking alternative. With about 3 calories, 0.5 g of sugar and 5 mg of vitamin C per strawberry, they are naturally sweet yet light. In a study of Italian consumers, health benefits were considered strawberries’ second-most important attribute after their appearance.

This could offer opportunities. In a 2024 survey of five European countries, 81% of Europeans said they would like to consume more fruit and vegetables – specifically 88% of Italians, 84% of French and Spanish people, 76% of Germans and 72% of Dutch people. Price is the main obstacle, as 43% of Europeans have reduced their consumption of fruit and vegetables due to inflation. Other barriers include a lack of practicality and insufficient quality.

Tip:

- Do not make health claims that have not been confirmed. Study the EU legislation on nutrition and health claims for more information.

Convenience is key

European consumers increasingly prefer convenience. Strawberries fit well into this trend, because they are easy to eat and ideal as a fresh, healthy snack. European supermarket chains have innovated extensively in convenience food, offering ready-to-eat fruit in portion-sized packaging for busy lifestyles. These items often have higher margins, meaning retailers and processors develop more lines that meet consumer demand.

Strawberries for the convenience market come in small, snackable punnets of 125–300 g, like Marks & Spencer’s strawberry fruit pots. For additional convenience, Jumbo offers hulled strawberries in a sealed cup. Strawberries are also used in ready-to-eat fruit salad cups, like Tesco’s melon, kiwi and strawberry mix, and Albert Heijn’s apple, strawberry and blueberry mix.

Tips:

- Ask your buyer for their specific requirements for packaging type and size.

- Keep your strawberries at the right temperature and under the right conditions to ensure optimal freshness and taste. For more information, see the CBI’s study on market entry for strawberries.

- See the CBI’s study on the requirements for fresh fruit and vegetables for information about labelling your consumer products.

Focus on sustainability and local freshness

Sustainability has become mainstream in the fruit and vegetable sector. European buyers are increasingly interested in sustainable produce, and they want transparent supply chains. Sustainability covers both social and environmental aspects. Sustainable sourcing is an important trend in large importing countries like Germany, the Netherlands and the UK. As such, you will increasingly have to deal with sustainability requirements from European buyers.

Local production

Freshness, price and appearance are important factors for European consumers when they buy strawberries. But in reality, taste and seasonality are the main reasons for purchasing them. For this reason, locally grown strawberries are becoming more important for consumers.

Many European consumers only buy strawberries when these are harvested in their own country. These strawberries offer the best guarantee for freshness, but they also have the best reputation in their own market. Taste and sweetness are a common argument for buying local strawberries. For professional buyers, sustainability also plays a role as local, seasonal strawberries do not involve long-haul shipping. However most European retail buyers have realised that the very early European greenhouse strawberries can be less sustainable than strawberries imported from Egypt and Morocco. This has made them push less for earlier and earlier European greenhouse strawberries.

Especially French and Italian consumers value local strawberries because of their flavour. In 2024, French retail organisation Mousquetaires Group announced eight commitments to increase consumer demand and encourage the preference for French produce. In Germany, local supply is also gaining importance because it is considered to be more sustainable and safer. In the UK and the Netherlands, consumers are the least worried about whether strawberries come from domestic cultivation. However, even in these locations, national strawberries are clearly marked on the package.

Strawberries are heavily promoted during the local season, but some consumers are prepared to pay a premium for high-quality, tasty strawberries during the off-season. At the same time, sustainability-conscious consumers exhibit sustainable behaviours, are more concerned about climate change, and are less likely to buy non-seasonal strawberries. When exporting strawberries to Europe, you must pay attention to quality and taste and understand how consumers experience your product. By supplying superior-tasting strawberries, you motivate consumers to continue purchasing your product.

Organic strawberries

Increased interest in sustainability and healthy lifestyles also boosts demand for organic produce. Organic retail sales value in the EU more than quadrupled between 2004 and 2022, with particularly strong growth from about 2014 to 2020. It peaked at €4.6 billion in 2021, before dropping by 3.4% in 2022. This likely reflects a decline in consumer demand due to the cost-of-living crisis and rising food prices.

Similarly, EU imports of organic fruits dropped by 16.6% in 2022, from 143,000 tonnes to 119,000 tonnes. However, after two years of decline caused by the sharp increases in food prices, demand rebounded in 2024 when EU imports of organic fruit, vegetables and olive oil increased by 6.4%.

The Netherlands is the EU’s largest importer of organic agri-food products, with close to 1 million tonnes. Germany and Belgium follow. These countries’ imports increased in 2024: 17% for the Netherlands, 2% for Germany and 13% for Belgium. As key trade hubs, they re-export many of their imports to other EU countries.

Supermarkets in the top EU importing countries sell fresh organic strawberries, but mainly when they are in season. Organic strawberries are often seasonal European produce, especially because this is considered more sustainable. Nevertheless, there are opportunities in the market. In 2020 and 2021 some small volumes of organic strawberries were imported from Morocco to Spain (close to 180 tonnes) and the Netherlands (20 tonnes) and from Turkey to Germany (20 tonnes). Egypt’s family-owned organic farm Fruitibelle and the Dutch trading organisation Tradin Organic are examples of companies that export and import organic strawberries to Europe.

Plastic-free packaging

With the increased interest in sustainability comes a need to make packaging more sustainable and reduce plastic use. This was already an issue for many retailers and conscious consumers, but now EU restrictions on single-use plastics force companies to take action.

Packaging made from cardboard or moulded paperboard pulp is sustainable, especially suitable for organic strawberries. For example, Belgian retailer Delhaize now sells its strawberries in cardboard boxes. These boxes are fully recyclable at end-of-life. On-pack QR codes provide consumers with information about the origins of the strawberries, the local grower and cultivation method, and recipes.

Mainstream retailers in Northwest Europe are increasingly using refrigerated display units with doors to store and present fragile fruits such as berries. These enclosed cooling systems help maintain a consistent low temperature and humidity. This is essential for preserving the delicate texture, flavour, and visual appeal of strawberries, raspberries, and blueberries.

Closed-door refrigerated display cabinets

By preventing exposure to warm air and reducing dehydration, the displays significantly extend shelf life and minimise waste. Closed-door refrigeration also aligns with retailers’ sustainability goals, as it reduces energy consumption compared to open-air coolers. The clear glass doors still allow for attractive product presentation and make sure that berries remain fresh and inviting for longer. This helps both product quality and environmental efficiency.

Figure 7: Strawberries in a closed-door refrigerated display cabinet, Dutch mainstream retail outlet, August 2025

Source: GloballyCool, August 2025

Tips:

- Reduce your use of pesticides through natural or integrated pest management (IPM). Read more about IPM at the Food and Agriculture Organization (FAO) and check for guidelines in your country.

- Ask your buyers about potentially supplying organic strawberries. Buyers in this market often specialise in organic produce and follow strict guidelines. Read more about the principles of organic agriculture at IFOAM Organics International.

- See the CBI’s studies on market entry for strawberries and buyer requirements for fresh fruit and vegetables for more information about sustainability standards and organic certification.

- Offer different packaging options and anticipate developments in sustainable packaging and convenience products. Using attractive packaging will also you to stand out.

Smaller supply window due to technological improvements

Growers in Europe are adopting more and more technology in the cultivation of strawberries. Many already work with a form of protected horticulture, using substrates, plastic tunnels, glass greenhouses and artificial lighting. This technological improvement is accompanied by developments in improving strawberry cultivars, such as early-growing or late-season varieties.

As a result, strawberry farms in Europe not only gain more control and efficiency in production, but they also extend production seasons. Consumer demand is encouraged by an almost year-round supply of quality strawberries. As such, while consumption is increasing, the window of opportunity for external suppliers is becoming narrower.

Breeding quality strawberries

European breeding programmes have become very common. Since the mid-90’s the Community Plant Variety Office (CPVO) has protected almost 550 new strawberry cultivars for use in the EU.

The main focus points of breeding are:

- Extending seasons;

- Ease of picking;

- Taste;

- Yields;

- Shelf-life;

- Adjustment to climate or production method.

As a foreign producer, you must keep up with the developments in the strawberry industry. Besides excellent cultivation techniques, it is crucial to have access to superior cultivars. Ther Strawberry Jordan Nursery provides these through a license agreement with Eurosemillas, reproducing Californian strawberry varieties such as the Camarosa, Ventana and Albion.

Using digitalisation to maintain efficiency

The Belgian company Octinion introduced the first commercial strawberry picking robot at Fruit Logistica in February 2019. The University of Essex has been working with jam makers Wilkin & Sons to trial a low-cost strawberry-picking robot to speed up harvest and tackle the labour crisis. These robots can harvest, weigh and package strawberries very fast.

Video 1: Low-cost strawberry-picking robots

Source: University of Essex at Youtube

These types of digitalisations will help European farmers to remain efficient and competitive in the future. It will keep strawberry prices affordable and avoid the switch to low-cost production countries.

Tips:

- Explore different strawberry varieties with breeding and licensing companies. Having a superior strawberry cultivar is a very good way to stand out.

- See what kind of digital technologies you can implement to make your business more efficient and competitive the CBI’s tips to go digital in the fresh fruit and vegetable sector.

- Read more in the CBI study onwhich trends offer opportunities in the European fresh fruit and vegetable market.

GloballyCool and ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research