Entering the European market for raspberries and blackberries

Exporters need to meet strict legal and quality requirements to enter the European market for raspberries and blackberries. Certifications also help. Berries that meet the requirements reach consumers through different routes. This can be through vertically integrated companies, specialised importers or wholesalers. Your main competitors are producers from Europe and Morocco. Prices vary across seasons, origins and destination markets. Understanding these dynamics is key to succeeding in this competitive but promising market.

Contents of this page

- What requirements and certifications must raspberries and blackberries meet to be allowed on the European market?

- Through which channels can you get raspberries and blackberries on the European market?

- What competition do you face on the European raspberries and blackberries market?

- What are the prices of raspberries and blackberries on the European market?

1. What requirements and certifications must raspberries and blackberries meet to be allowed on the European market?

Fresh raspberries and blackberries need to meet the EU’s general requirements for fresh fruit and vegetables. These are detailed in our buyer requirements study for fresh fruit and vegetables. Requirements may change, so it is important to regularly check new developments.

Visit My Trade Assistant on Access2Markets to explore specific export conditions for raspberries, blackberries, mulberries and loganberries to the European Union (EU). Enter the Harmonised System (HS) code for these berries (081020), your country and the destination country in the EU.

The ITC Market Access Map also provides insights into customs tariffs, tariff rate quotas, trade remedies, regulatory requirements and preferential regimes for your product in various target markets, including the United Kingdom (UK) and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland).

What are mandatory requirements?

There are different marketing standards and requirements for different berries. However, all berries have to be clean and ready for direct consumption (safety), and their quality must be preserved through effective transport protocols and post-harvest processes.

Use of pesticides and contaminants

Pesticide residues are very important for fresh produce suppliers. Strawberries have been the focus of recent studies by the European Food Safety Authority (EFSA) on pesticide residues. However, this topic is relevant to all berries, including raspberries and blackberries.

The EU sets maximum residue levels (MRLs) for pesticides and other contaminants in food products. Items that go over these limits are taken off the market. This means a reclamation from your buyer. Currently, the maximum level of lead for raspberries and blackberries is 0.1 mg/kg. For cadmium, this is 0.03 mg/kg for blackberries and 0.04 mg/kg for raspberries. Non-compliance with these limits and the General EU Food Law is reported through the Rapid Alert System for Food and Feed (RASFF).

Sweden and Belgium recently reported exceeding levels of pesticides. They found excessive methamidophos content (0.44 mg/kg found, vs. 0.01 mg/kg allowed) in blackberries from Mexico. Sweden and Belgium took several measures, including a product recall from consumers, withdrawal from the market, destruction of produce and a sales ban. There have been other notifications about exceeding contaminants like lead. Recent notifications from non-EU countries only involved frozen raspberries.

Tips:

- Search for the applicable MRLs of pesticides under the food products section of the EU pesticides database. Type the product name in the search bar and click on the product to display the results.

- Check the maximum levels of contaminants in Regulation (EU) 2023/915, and monitor changes.

- Keep detailed records of the plant protection products (PPPs) used. Record all spraying activities too. The initial importer may be held legally responsible if MRLs are exceeded. This is why many buyers ask for this information.

- Visit the RASFF Window and enter ‘raspberries’ or ‘blackberries’ in the subject field to check recent notifications.

- Ask your buyers about their specific MRL requirements. Several European supermarkets have stricter requirements than those stated by law.

Microbiological criteria

EFSA’s last major assessment on microbiological criteria for berries (2014) focused on salmonella and norovirus risks in fresh and frozen berries. It did not find enough evidence to set specific criteria. However, it recommended agricultural, hygiene and manufacturing practices to reduce contamination.

If imported berries are found to contain pathogens, food safety authorities may stop their entry into the EU or take them off the market in accordance with Regulation No 2073/2005. EFSA states that rainfall, the use of contaminated water and unclean equipment may cause contamination. Recent RASFF alerts reported norovirus in blackberries from Serbia and in frozen berries.

Tips:

- Use clean water and clean equipment during the cultivation and packaging stages. Follow strict hygiene protocols if berries are hand-picked.

- Read the European Union’s guidance document for information about managing microbiological risks in fresh fruit and vegetables. This promotes good hygiene practices at the primary production level.

Quality requirements

The revised UNECE Standard FFV-57 (2023) sets quality rules for fresh berries, including raspberries and blackberries. It defines three classes (Extra, I, and II). It also covers size, tolerances, presentation and labelling. European buyers typically require at least Class I, but Class II may be accepted for organic produce.

Figure 1: Class I raspberries from Morocco at the ICA Maxi supermarket in Sweden

Source: ICI Business

Packaging and labelling

You need to comply with general European labelling and packaging regulations. You can read more about these in our buyer requirements study for fresh fruit and vegetables.

European supermarkets demand sustainable berry packaging. Dutch importer Berries Pride introduced a cardboard tray with a topseal film. It contains 30% recycled plastic, cutting plastic use by 94% compared to their previous trays.

To offer sustainable packaging cost-effectively, growers and exporters have to be prepared to handle it at the source. This may require adapting or investing in specific machinery. This can be costly and complex. Some do this by renting equipment or partnering with buyers who commit to purchase volumes. If sending in bulk or repacking in destination markets is an option, it is expensive and not sustainable in the long term. Consumers will not pay much more for eco-friendly packaging. This means efficiency at the origin is essential.

Beyond sustainability, packaging has to protect berries from mould and dehydration. Innovations like Hazel Technologies’ solution help extend shelf life and keep up quality during storage and transit.

Packaging sizes for consumers vary widely. They range from 125 g clamshells to 425 g packages. However, due to the short shelf life, it is more common to find smaller packages of 125–150 g. There is no standard size for raspberries and blackberries. However, industry experts report that good raspberries should have an average weight of at least 4 g.

Tip:

- Discuss labelling and packaging requirements with your buyer. Their requirements will depend on the end market, your client’s profile and repackaging capabilities.

Payment and delivery terms

Payment terms for raspberries and blackberries are not very different from those of other products in the fresh produce sector. Agreements range from fixed prices and minimum guaranteed prices (MGPs) to open accounts. Fixed-price contracts and advance payments offer the most security. However, only a few buyers are willing to start under these terms. Most buyers pay some (30–50%) against documents, and the balance 30–50 days after arrival. New and small suppliers may need to be flexible to attract buyers.

Regarding delivery terms, the most common incoterms in the fresh produce sector are FOB (Free on Board – seller delivers to the port, buyer takes it from there), CIF (Cost, Insurance and Freight – seller pays for transport and insurance to the destination port, only used for sea/inland waterway) and CIP (Cost and Insurance Paid – equivalent to CIF when using air freight). The delivery term used will depend on your buyer’s needs. It is important to discuss this in advance.

Tips:

- Read CBI’s tips for doing business with European buyers of fresh fruit and vegetables. It provides an overview of the different payment terms in the fresh produce sector.

- If you decide to work under open account or consignment, do thorough due diligence and ask for references from other suppliers.

What additional requirements and certifications do buyers often have?

Beyond standard certifications, buyers of raspberries and blackberries also value special varieties, professionalism and a good understanding of specific market needs.

Certifications

Many retailers and key players in the berry industry, such as BerryWorld and Berries Pride, are members of the Sustainability Initiative Fruit and Vegetables (SIFAV). SIFAV members work together to drive sustainability in fresh fruit and vegetable supply chains. Their social and environmental standards set a benchmark for the industry.

As well as the usual requirement of GLOBALG.A.P, berry buyers often need their suppliers to be certified under a water standard. Most buyers require the GLOBALG.A.P SPRING add-on. This is even more important if your berries come from a high-risk area in terms of water scarcity. Other standards that are part of the SIFAV Basket of Water Standards are accepted too, such as the Alliance for Water Stewardship. Suppliers are often asked for social standards like GRASP. UK buyers often require SMETA before doing business.

Tip:

- Check SIFAV’s list of high water risk regions. If your country and region are listed here, you should consider getting certified under one of the standards included in the Basket of Water Standards.

Varieties

There have been big advancements in raspberry and blackberry varieties, particularly in improving flavour. In the past, many berries were too sour. This discouraged repeat purchases. Today, sweeter and more aromatic varieties have boosted consumer acceptance and demand. However, more advancements are expected. New varieties are still being introduced to the market.

Most consumers still do not recognise specific variety names. However, they consistently return to berries that meet their expectations in terms of taste, aroma, size, colour and firmness. Meeting these preferences will build consumer loyalty and strengthen your relationship with your buyers.

Tip:

- Read the trends section of the market potential study for raspberries and blackberries for more information about breeding programmes, varieties and consumer preferences.

Understanding your buyers’ needs and being trustworthy

Retailers are the main sales channel for berries. Their top priority is ensuring a consistent, year-round supply. Supply shortages mean high prices for consumers. Everyone wants to avoid this. To manage this, buyers and sourcing managers work to diversify their sourcing strategies. They aim to balance local and international suppliers, standard and premium quality, small and large growers, and practical and sustainable packaging options.

As a supplier, you need to understand where your product fits in this sourcing matrix. Trends like local produce and sustainable packaging affect demand. However, the broader reality is that berries are increasingly expected to be available year-round, like bananas, apples and grapes.

This shift places a premium on long-term supply stability and reliability. Professionalism and consistency are key to gaining and maintaining buyer trust. This trust is essential to develop a growing category like berries in a way that benefits everyone.

Tip:

- Reply to emails quickly and communicate well with your buyers, even during challenging times.

What are the requirements for niche markets?

The organic market offers opportunities for developing countries that are close to Europe. Being nearby gives them an edge. Air freighted organic products face challenges due to consumer concerns about the environment.

To market your fruit as organic in the EU, you need to comply with Regulation (EU) 2018/848. It sets the rules for organic production and labelling. The updated organic regulation came into effect in 2023. The transition period ended in January 2025. It has a big effect on smallholder groups, who now need to operate independently.

Tips:

- Evaluate whether organic production is viable for your business. Certification is expensive, and most of the supply is European.

- Review the new organic regulations, especially if you are a cooperative or an exporter that supports group certification. Read these articles by Helvetas and Fairtrade for guidance.

2. Through which channels can you get raspberries and blackberries on the European market?

Supermarkets are the main sales channel for berries in the European market. It is important to understand how the market is divided, the routes you can take to reach these different parts, and other sales points to successfully enter the European market.

How is the end-market segmented?

The European berry market is becoming increasingly segmented by quality and premium positioning. In supermarkets (the main sales channel for berries), you can typically identify three key segments: good value for money, premium and organic. These segments can also be found in other points of sale, such as street markets and specialised shops.

Figure 2: Market segments for raspberries and blackberries in Europe

Source: Dana Chahin

There is no exact public data on the size and growth of each segment. However, industry experts and trend reports always highlight that the premium segment is growing the fastest. Consumers show strong willingness to pay more for high-quality and premium berries. However, the value for money segment is thought to be the largest in Europe.

Retailers often adjust their offering to one or more of these segments. For instance, European discounters like Lidl and ALDI mainly focus on the value for money category. Organic-focused retailers, like Alnatura in Germany and Naturalia in France, cater entirely or mainly to the organic segment. Many other supermarkets have a mixed strategy. They offer products that cover two or all three segments.

A clear example of this segmentation is the British retailer Waitrose. Its brands are divided into distinct categories, reflecting different quality and pricing levels.

Table 1: Waitrose brands per segment

| Segment | Waitrose’s own brand | Price per kilo (raspberries) | Price per kilo (blackberries) |

|---|---|---|---|

| Good value for money | The Essential Waitrose (Everyday value) | £15 | £17.34 |

| Premium | The Waitrose Own Label No.1 Waitrose | Between £16.67 and £17.34 £20 | £20 |

| Organic | The Duchy Organic | £23.20 | No offer when consulted |

Source: Prices and information retrieved from the Waitrose website in May 2025

Tip:

- Visit the websites of supermarkets across Europe to view different segments. Freshplaza offers a list of worldwide retailers you can use to get started.

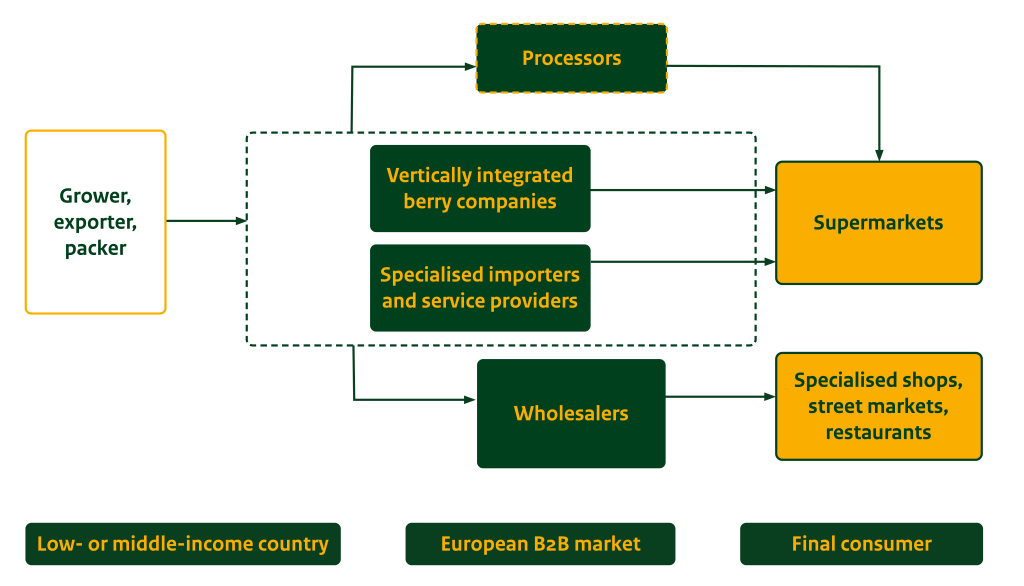

Through which channels do raspberries and blackberries end up on the end-market?

Raspberries and blackberries reach the European market through several key channels. These include vertically integrated berry companies, specialised importers and service providers, and wholesalers. Each of these plays a distinct role in connecting producers and exporters with consumers. The most relevant channels in Figure 3 for developing country suppliers are described below.

Figure 3: Distribution channels for raspberries and blackberries in the European market

Source: Dana Chahin

Vertically integrated berry companies

Vertically integrated berry companies play a key role in the supply chain. They manage everything from production and sourcing to marketing and retail supply. These companies range from global giants like Driscoll’s, BerryWorld, and Hortifrut, to smaller but highly specialised players. Companies like Growers Packers, ABB Growers, Berryway and Angus Soft Fruits are examples of producers that also handle sourcing, packing and direct retail supply.

Whether large or small, these companies provide access to stable retail channels, technical support and efficient logistics. This makes them good partners for growers that want to scale their operations and make them more professional. Vertical integration is an ongoing trend in the berry sector. There is more concentration in the number of players, and more companies are adopting this model. As a result, this channel is expected to capture a larger share of the market in the coming years.

Specialised importers and service providers

Specialised berry importers and service providers play an important role in the berry supply chain. They understand the end clients’ requirements and are large enough to serve multiple markets. They ensure a consistent, year-round supply of berries by sourcing from around the world.

These players are key in between points between growers and retailers. Some of them supply supermarkets. Others provide access to wholesale, food service and processing markets (directly or indirectly). Examples of these players include Primafruit and DPS Ltd in the UK. These are dedicated suppliers to supermarkets. Dole is an importer of berries that serves different markets across Europe.

Wholesalers

Wholesalers serve secondary channels like fruit shops, vendors and food service. Most do not import directly. Instead, they rely on local or specialised suppliers. They operate without fixed contracts and trade on the spot market, facing greater price volatility.

There are some exceptions. For example, Smith and Son Ltd (UK) is a wholesaler at the Western International Market. It has direct import operations and a global grower network for a wide range of products.

Tip:

- Ask potential buyers about their clients and requirements to see if they fit your target market, and to understand their role in the berry value chain.

What is the most interesting channel for you?

Vertically integrated companies and specialised importers are the most strategic and relevant channels for raspberry and blackberry exporters from developing countries. Both models coexist, but vertical integration is becoming increasingly common. Many major players combine their own production with sourcing from abroad to ensure year-round supply. Traditional traders and importers are evolving by investing directly in production and forming partnerships at the origins.

Fruit Logistica (Berlin) and Fruit Attraction (Madrid) are Europe’s main trade events for fresh produce. They are ideal places to meet vertically integrated companies and specialised importers. Company websites and industry platforms like Freshplaza and Eurofruit also offer useful insights into their sourcing models.

In addition to large trade fairs, consider attending events that focus exclusively on berries. The Fruitnet Berry Congress, the Berry Area at Macfrut (Italy),and the International Blueberry Organisation (IBO) summit attract decision-makers from berry production, marketing and retail. These events offer a more targeted setting for networking and understanding the latest market trends. This makes them ideal for exporters that want long-term partnerships.

Tips:

- If you attend events or trade fairs, prepare by researching exhibitors and scheduling meetings with companies that match your supply capabilities in advance.

- When reaching out to buyers, highlight your ability to meet berry-specific standards (MRLs, shelf life, cold chain, varieties). Emphasise your harvest calendar and volumes, especially if you can fill seasonal gaps in their supply.

- Try to find a berry specialist partner that understands the complexities of the category, including quality control, fruit management, packaging and strict retail requirements.

3. What competition do you face on the European raspberries and blackberries market?

The European market for raspberries and blackberries is very competitive. There are strong suppliers from Morocco and leading European producers. Substitute products, like other berries and processed alternatives, also play a big role in the market.

Which countries are you competing with?

A few suppliers dominate the European raspberry and blackberry market. Most of these are from nearby regions. Morocco leads in import value, followed by Spain and Portugal. Mexico and Guatemala follow in terms of import value, after several European countries. However, their values are very small compared to Morocco and Europe, and the trade is concentrated in blackberries.

Source: Trade Map, May 2025

In terms of volume, Serbia exports more than Mexico, and Moldova exports more than Guatemala. However, Serbia’s low unit prices indicate lower-grade berries. They are likely meant for processing. Their limited export destinations (Austria for Serbia and France for Moldova) make Guatemala and Mexico more important competitors in this category.

South Africa and Kenya are becoming more important. The UK is their main destination. Countries like Ukraine, Türkiye and Greece are not very important for now. However, they are increasingly attractive to European buyers due to their proximity.

Europe: a strong producer, preferred when in season

In 2024, European imports from other European countries reached 144,477 tonnes, worth €1,131.7 million. 35.3% of the European volume came from Spain (50,936 tonnes), 31.3% from Portugal (45,236 tonnes), 11.5% from the Netherlands (16,619 tonnes), 7.4% from Germany (10,693 tonnes) and 5.8% from Poland (8,396 tonnes). These five countries represented 90% of the total volume imported by Europe from European countries. They are also among the top ten European producers of berries (Figure 5).

Note: ‘Other berries’ includes blackberries, currants and other berries as grouped by Eurostat.

Source: Eurostat, May 2025

Spain was the second-most important origin of European imports of raspberries and blackberries after Morocco. The country is an important producer. However, as a European hub, it also re-exports from other countries. Portugal is a leading producer in Europe. Most of its production goes to the export market. Poland is a special case. It is investing in increasing production and in growing the local consumption market. This means there are opportunities for Polish growers and suppliers from abroad.

European countries are important competitors to developing countries in supplying raspberries and blackberries. This is primarily due to their proximity, infrastructure and consumer preferences. When available, European production is generally preferred to ensure shorter supply chains and minimise the need for air freight.

However, Europe faces challenges, raising concerns about the sustainability of local production. These challenges include climate change, labour shortages and rising production costs. Seasonal gaps still require imports. Demand for year-round, sustainable sourcing is growing. This creates space for developing countries that can offer high-quality produce with reliable logistics.

Tip:

- Follow developments of berry growers’ associations in key European producing and exporting countries. Italian Berry is a leading information platform for the European berry sector, focusing on Italy. It offers a directory of growers’ associations and information about producers across Europe.

Morocco: Europe’s leading non-European supplier

Although European countries supply the most raspberries and blackberries to Europe combined, Morocco is the top individual country supplier. It is a strong competitor to other countries. However, as the market evolves, buyers may diversify sources to manage risk. Morocco’s strong foundation makes it a big player among developing country exporters.

In 2024, European countries imported a total of 91,345 tonnes of produce from Morocco, reaching an import value of €714.2 million. Spain was the largest importer. It accounted for 43.2% of the total volume (39,504 tonnes), followed by the UK with 22.7% (20,726 tonnes), Germany with 21.6% (19,738 tonnes), and France with 9.5% (8,661 tonnes). Together, these four countries made up 97% of all reported imports from Morocco. The remaining volume was distributed among smaller importers, such as Poland, Switzerland and Norway.

One of Morocco’s key strengths is its geographic proximity to Europe. This allows for shorter transit times and truck transport. Investments in modern cultivation techniques, greenhouse production and varietal innovation have also boosted both yield and quality. Morocco has a positive reputation among European buyers. It positions itself as a reliable off-season supplier that can ensure consistent volumes. It is mainly active from October to June for raspberries and January/February to September/November for blackberries.

However, Morocco’s dependence on water resources, labour challenges and limited land availability are concerns. They may affect long-term sustainability. The pressure for year-round supply with higher quality and sustainability standards will shape its future competitiveness. Morocco is well-positioned to take advantage of premium and seasonal windows. However, other countries could gain ground by investing in innovation, improving supply chain transparency or targeting niche segments, such as organic or fair trade.

Tip:

- Consider attending the Morocco Berry Conference in Agadir. The event has become a key platform for local producers and to explore industry trends. It attracts a varied audience, including importers, breeders and technology providers.

Mexico: a strong producer with a limited presence in Europe

Mexico produces a range of berries. It is an important competitor for blackberries in Europe and a major global producer. It contributed 21.8% to total global production in 2023. However, its presence in the European market is limited and concentrated in a few countries. In 2024, Europe imported 2,233 tonnes from Mexico, equivalent to €27.2 million. 42.9% of this was imported by Germany, followed by the UK (27.9%), Luxembourg (10.4%) and the Netherlands (6.4%).

Although efforts have been made to diversify export destinations, approximately 95% of Mexican berry exports went to the United States and Canada by the end of 2024. Only about 5% reached Europe and Asia. The focus on North American markets is largely due to geographical proximity and established trade relationships.

Because of these factors, its expansion into the European market faces significant hurdles. Logistical challenges, market preferences and internal industry issues (rising production costs, labour shortages and climate-related issues) suggest that Mexican blackberry exports to Europe are unlikely to increase in the near future.

Tip:

- Check for a Mexican presence at leading European trade fairs, such as Fruit Logistica and Fruit Attraction. Aneberries (the Mexican berry organisation) and other leading berry suppliers participated in the 2025 edition of Fruit Logistica. They had a stand as part of their strategy to enter the European market.

Guatemala: small but reliable blackberry exporter to Europe

Guatemala is a relatively small but consistent supplier of blackberries to Europe, particularly to the UK. In 2024, Europe imported 1,078 tonnes from Guatemala, worth €10.4 million. The UK imported 940 tonnes (87.2%), followed by Spain (11.7%) with 126 tonnes. Other European destinations were almost negligible. Guatemala has a more balanced global distribution strategy than Mexico. In 2024, Europe accounted for 44% of raspberry and blackberry exports. The USA had a share of 54%.

Guatemala offers high-quality blackberries, but lacks visibility in Europe compared to other key exporter countries. Its limited marketing and narrow berry contribute to this. Still, the UK market is promising for Guatemala due to its openness to diverse origins and premium air freight fruit. This article highlights the Guatemalan company Kultiva Organics and its European activity under the Agrocumbre brand.

Guatemala’s future competitiveness will depend on its ability to maintain high standards, manage logistics efficiently and differentiate itself through certifications and niche positioning, such as fair trade. However, rising transport costs and increasing European demand for shorter supply chains could be challenging for Guatemalan exporters. Despite these issues, the country's foothold in the UK suggests a small but stable position in the European blackberry trade.

Which companies are you competing with?

You will mainly be competing with big players and integrated companies. The companies described below will give you an idea of your competition.

Surberry SL: Year-round berries from Spain, Morocco and Portugal

Surberry SL is headquartered in Huelva, Andalusia, Spain. It is a prominent player in the European berry market. It specialises in the production and export of premium berries, including raspberries and blackberries. Established in 2014, the company produces and operates across Spain, Portugal and Morocco. It uses these countries’ diverse climates to ensure year-round availability of high-quality berries. Surberry’s commitment to quality is reflected in its international certifications, such as GLOBALG.A.P., IFS, BRC and Integrated Production.

Surberry emphasises sustainable practices to reduce water usage and improve crop health, including its hydroponic systems. This aligns with growing consumer demand for environmentally responsible agriculture. Surberry’s export capabilities are helped by its focus on varietal selection. This ensures that its berries meet European consumers’ taste, firmness and shelf-life expectations. The company's dedication to innovation and quality means it is a major competitor for other developing country suppliers that want to enter or expand into Europe.

iBerry: Fast-growing exporter with raspberries in its assortment

iBerry Morocco is a rapidly growing exporter and competitor in the European berry market. Its production areas are in the south (Agadir) and north (Larache and Kenitra) of Morocco. iBerry focuses on supplying high-quality soft fruits to Europe, particularly to large retail chains. Their main crop is blueberries. However, the company also grows raspberries. It can supply 1,500 tonnes during its production period. Its product range includes frozen berries.

iBerry has a sales team in the UK and offices in Europe as part of its commercial strategy. Its distribution partners are in key markets, including the Netherlands, Germany, Belgium and Switzerland. Its partnerships serve to sell and form alliances in varietal development and with other growers in Europe. For example, iBerry Morocco and Berry Point Poland showcased themselves as vertically integrated growers of high-quality berries under their Berry Stars brand at Fruit Attraction 2024.

iBerry’s marketing strategy includes a LinkedIn page with 4,000 followers. They highlight their modern production sites and sustainable practices, and emphasise quality and traceability. By aligning with European expectations on certifications and logistics and by offering year-round availability through controlled cultivation, iBerry has positioned itself as a reliable, forward-looking supplier in an increasingly competitive market.

Berries Paradise: Mexican producer focusing on the United States, but with a strong position in Europe

Berries Paradise is a leading Mexican producer and berry exporter that stands out as a significant competitor in the premium blackberry segment. Most of their exports are directed to the United States and Canada (about 80%). However, they also serve other countries in Europe, Asia and South America. Their European destinations include France, Belgium, Germany, Italy and the Netherlands. Berries Paradise supplies the market with an equal combination of its own production and alliances with other local producers.

Its strategy involves developing a global presence and expanding into the European market. As part of this, they participate in trade fairs like Fruit Logistica. However, it is important to note that despite these efforts, Europe is still a secondary market compared to North America. Their exports face challenges like air freight capacity constraints, especially during peak seasons, when other products like avocados compete for space.

While Berries Paradise wants to grow its market share in Europe, it currently represents a smaller portion of its overall exports. However, do not overlook it as a supplier, especially if you want to compete in the air freighted blackberry segment.

Tips:

- Consider strategic partnerships to sell more. You can learn from examples like iBerry’s Berry Stars initiative and the mixed structure of Berries Paradise’s ownership and partner-based production.

- Maintain a strong presence on LinkedIn, the leading professional social network. It is increasingly used for positioning and to connect with potential buyers.

Which products are you competing with?

Raspberries and blackberries have unique characteristics and nutritional profiles. This means they cannot be completely substituted. However, other berry types and value-added products, like frozen berries, are important competitors.

Other fresh berries

Other fresh berries (particularly blueberries and strawberries) offer both opportunities and challenges. Blueberries stand out because of their longer shelf life and year-round availability. This is driven by their diversified sourcing and stable pricing. These berries have better consumer awareness and appeal to multiple demographics. However, their milder flavour and lower perceived exclusivity make them less interesting for consumers who want a gourmet experience.

The rising popularity of blueberries, combined with innovations like snack-friendly packaging, positions them well in the convenience-driven market. However, the threat of oversupply could intensify price competition and affect profitability in the sector. Although strawberries and blueberries are strong competitors, raspberries and blackberries can also benefit from their popularity. Mixed-berry boxes are becoming more common in supermarkets. Berry boxes can help introduce consumers to a wider variety of berries (see Figure 6).

Figure 6: Mixed-berry packaging at a supermarket in the Netherlands

Source: Dana Chahin

Frozen berries

Frozen berries are a good substitute for fresh raspberries and blackberries, especially where price, shelf life and convenience matter. They provide year-round availability, lower costs (particularly off-season) and easy logistics. This makes them ideal for smoothies, baking and food service. Their ability to reduce food waste and use surplus or ‘ugly’ fruit also appeals to retailers and environmentally conscious consumers.

Frozen berries lack the texture and premium appeal of fresh ones. However, there is growing interest in healthy snacking and meal prepping. This increases their market share. For fresh berry growers, this presents an opportunity. By investing in freezing equipment and choosing varieties that suit the frozen industry, they can diversify their sales channels and reduce waste from unsold or overripe fruit. iBerry from Morocco is an example of a company active in both the fresh and frozen berry market segments.

Tips:

- Check specialised importers’ mixed-berry ranges, such as Special Fruit (Belgium).

- Read the CBI study Exporting frozen berries to Europe to better understand the European market for frozen berries.

4. What are the prices of raspberries and blackberries on the European market?

Prices for raspberries and blackberries vary widely across European countries (Figure 7). They are influenced by factors like origin, availability of local supply and market dynamics. The highest average import unit prices are in Switzerland, the UK and Germany. The lowest are in Spain. There are peaks outside the local season, and higher prices when produce is imported from other countries or non-European sources.

These seasonal swings have been consistent over the past five years. However, average European import unit prices have steadily increased: from €6.3/kg in 2020 to €7.8/kg in 2024. This trend is not limited to raspberries and blackberries. Rising costs and high retail premiums have affected fresh produce categories.

Roamler studied retail prices in France, Germany and Poland between January 2023 and March 2024. France consistently recorded the highest average retail prices of these three countries. These were €21.24/kg for raspberries and €25.70/kg for blackberries, compared to €19.70 and €22.40 in Germany, and notably lower prices in Poland at €14.20 and €16.30. The study shows that retail prices go down during each country’s domestic season and rise when imports increase. This shows a pattern similar to import unit prices.

Be aware that retail prices are not always related to trade prices. When availability is very high, supermarkets might introduce additional promotions to help sell extra volumes. This pushes retail prices down.

Source: Trade Map, May 2025

Figure 8 shows the average retail price composition of an ex-packhouse product brought in bulk from an exporter, reaching a supermarket in Europe via a supermarket:

- 35% of the final price is the markup applied by the retailer. This covers costs such as supermarket stores, distribution, depots, quality and technical checks, product losses, marketing and customer promotions, and employment costs;

- 20% is applied by the importer. Importers normally apply a 30% margin to the cost price (the price at which they bought the produce from the exporter). Importer costs include container and pallet handling at the port, transport to warehouses and distribution, re-packaging or re-palletising, quality checks (pesticide MRLs), marketing contributions to supermarkets and staff expenses;

- 46% is the exporter ex-packhouse price. This is the price at which the exporter sold the product to the importer. This price includes a markup applied by the exporter to cover production costs, raw materials, transport costs, and so on.

Source: Industry sources

Importer and supermarket margins seem high (30% and 35%, respectively). However, the approximate importer net operating margin is about 2%, or 1–4% for supermarkets. This is because of the range of costs specified above.

Tips:

- Talk to your buyers to understand current price levels in their markets. Buyers are often willing to share insights on pricing trends and can help you identify the best time to position your produce.

- Regularly check the websites of European supermarkets to follow retail prices. Italian Berry offers historical, current and other data on retail prices in Italy.

Dana Chahin carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research