Entering the European market for tomato purée and paste

New tomato purée and paste exporters wishing to enter the European market need to verify their products via regular laboratory tests. You may have a competitive advantage if you offer high flavour and elevated Brix products and if you have proof of sustainable production (such as a social audit report or an organic certification). The strongest competitors for suppliers of tomato purée and paste come from inside Europe (Italy, Spain and Portugal), as well as from external price-competitive origins (like China and Türkiye).

Contents of this page

- What requirements and certifications must tomato purée and paste meet to be allowed on the European market?

- Through which channels can you get tomato purée and paste on the European market?

- What competition do you face on the European tomato purée and paste market?

- What are the prices of tomato purée and paste on the European market?

1. What requirements and certifications must tomato purée and paste meet to be allowed on the European market?

All food products sold in the European Union (EU), including tomato purée and paste, must be tested for safety. Along with providing proof of compliance with European food safety regulations, there is an increasing demand for sustainably processed tomato products. This study underlines the most important tomato purée and paste market requirements, but for a general overview, read the CBI study on buyer requirements for processed fruit and vegetables.

What are the mandatory requirements?

Complying with the established maximum levels for harmful contaminants is obligatory in order to export to Europe. In the case of tomato purée and paste, some of the most frequent reasons for market withdrawals are impurity, unauthorised additives and pesticide residues. The most important developments are the European Directives on Due Diligence and Corporate Sustainability Reporting. These directives specify that all players in the supply chain must comply with certain social and environmental requirements.

Make your own checklist to assess contamination risks in the supply chain

You should regularly check the European Commission Regulation, which is frequently updated, to see the maximum levels for specific contaminants.

Contaminants to check for are:

- Pesticide residues: The EU regularly publishes a list of approved pesticides that are authorised for use and which sets maximum residue levels (MRL);

- Microbiological contaminants: The European regulation on microbiological criteria for foodstuff sets the limits for pathogenic micro-organisms, their toxins and metabolites;

- Alternaria toxins: The European Commission is recommending that Alternaria toxins be monitored in processed tomato products. Over the last few years, tomato purée and paste of different origins were removed from the EU market due to high levels of alternariol. To prevent this type of contamination, it is important to check the quality of fresh tomatoes before processing with manual and machine sorting and floating tanks;

- Tin: The limit is set for 200 mg/kg for canned products and 50 mg/kg for infant food;

- Process contaminants: If heating of tomato paste is not monitored well, there is a possibility of furan and acrylamide formation;

- Packaging contaminants: Plastic materials must be in line with the European Regulation on Plastic Food Contact Materials – materials and articles intended to come into contact with food. Attention should be given to the levels of bisphenol A and phthalates.

Always declare your tomato purée and paste properly

Selling fake or falsely declared food in Europe is considered a crime. Authenticity tests on tomato purée and paste are carried out to prevent fraud. A common fraud or mistake is using unauthorised additives. Since 2023, there were 10 cases of market withdrawals of tomato purée and paste imported from Egypt and Syria due to the presence of sorbic acid and benzoic acid. Those substances can be used as preservatives in certain foods, but are not allowed in tomato purée and paste.

It is important to keep up to date with industry standards in your local market, and not only when exporting to Europe. Two recently published research articles exposed unauthorised additives, erythrosine and starch, in tomato paste sold on the Lebanese and Ghanaian markets. Another type of adulteration is related to declaring Italian origin. In August 2025, the BBC World Service investigated 64 samples of processed tomato products and found Chinese paste declared as Italian by several European brands.

Check levels of mineral oil hydrocarbons

Mineral oil saturated hydrocarbons (MOSH) and mineral oil aromatic hydrocarbons (MOAH) are contaminants that can harm human health. Although official limits have not been set yet, they are expected soon. The proposed maximum MOAH level for food with a fat content below 4% (including tomato purée and paste) is 0.5 mg/kg. Levels of MOSH and MOAH have already been checked by many European buyers. In May 2025, a Dutch company found MOAH levels that were too high (1.7 mg/kg) in tomato purée originating from Spain, and stopped distributing the product.

Follow labelling rules

The bulk label should use coding for each lot. Labelling should indicate the product name, country of origin, style, lot code, net weight and shelf life. Also, allergen warnings need to be visible on bulk packaging. More details can be provided in the accompanying bulk packaging documents.

For retail packaging, product labelling must comply with the European Union Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information. Retail packaging must be labelled in a language that is easily understood by consumers in the European target country. In Italy, there is a 2-year mandatory trial to clearly label the country of tomato cultivation and the country of tomato processing.

Tip:

- Read more about transport and storage conditions for canned goods on the Cargo Handbook website.

Comply with legislative requirements on sustainability

Some of the most relevant European laws related to environmental and social sustainability are incorporated into the European Green Deal (EGD). The EGD includes legislative changes, with a timetable outlining when they will come into force. The most important specific legislations for tomato purée and paste are:

- Organic food regulation (all organic operators must implement changes before October 2025);

- Sustainability labelling of food products (under discussion);

- Corporate Sustainability Due Diligence Directive (in force);

- Packaging and packaging waste (from January 2030);

- Corporate sustainability reporting (from 2027 for the fiscal year 2026 for listed SMEs, and voluntary for non-listed SMEs);

- The EU Forced Labour Regulation (in force from December 2024);

- Empowering consumers for the green transition (in force, but applies from September 2026).

What additional requirements and certifications do buyers often have?

In addition to the mandatory requirements, food safety, quality and sustainability standards have become equally important.

Meet specific quality characteristics

There is no official European standard for tomato purée and paste. In most cases, buyer quality requirements will be in line with international standards, such as the Codex Alimentarius Standard for Processed Tomato Concentrates (PDF) or the US Code for Tomato Concentrates. Still, many quality parameters are measured in line with the old EU regulation for minimum quality requirements for products processed from tomatoes, which is no longer in force. Some of the major quality indicators are:

- Processing method – commonly described either as ‘cold break’ or ‘hot break’. In cold break processing, temperatures of 60-70°C are used for partial enzymatic de-activation, resulting in low-viscosity (more liquid) products. In hot break processing, higher temperatures of up to 100°C are used for total enzymatic deactivation, resulting in high-viscosity (thicker) products;

- Percentage of soluble solids (or Brix level);

- Consistency and viscosity – describes the thickness of the paste. This is commonly measured with a Bostwick consistometer;

- Chemical characteristics – the most important are total acidity and pH value (must be below 4.6);

- Microbiological parameters – aside from official EU microbiological limits, it is common to provide proof of absence of Altenaria toxins. This is commonly performed with a standardised microscopic technique called the Howard mould count; this count should be well below 40%, although many traders tolerate products with up to 60%;

- Composition – the tomato-processing industry prefers only clean tomato purée and paste, with no additives. Addition of salt, sugar, water, spices or acidity regulators is possible for tomato-based sauces or ketchup, but not for purée and paste;

- Defects – good-quality purée and paste should contain no impurities, such as peels, seeds or foreign bodies. The appearance of a light brown colour on the surface should be minimal;

- Organoleptic characteristics – flavour, taste, texture, colour. Colour is also described with the Hunter Lab scale.

Offer safe and aseptic packaging

The largest quantities of tomato purée and paste in Europe are imported and traded in bulk. Packaging is part of the processing line, where purée and paste are sterilised and, immediately after sterilisation, packed into aseptic bags. Packaging can be in different sizes, but the most common method is aseptically filled foil bags of 240 kg which are placed into steel drums. Import of retail-packed purée and paste is not common for the leading retail chains, but is seen in some ethnic shops. Those options include cartons, tubes, cans and even glass containers.

Bulk packaging is commonly labelled with data, such as product name, producer details, country of origin, net and gross weight, manufacturing date, shelf life (commonly 2 years from the manufacturing date), batch code, storage and handling instructions, and often the drum number.

Get food safety-certified

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will refuse to work with you unless some type of food safety certification is provided. In addition to certification, serious buyers will usually visit or audit your production facilities before buying.

Most European buyers will ask for a Global Food Safety Initiative (GFSI)-recognised certification. For tomato purée and paste, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000).

Invest in sustainability

Demand for sustainably sourced food is growing in Europe. To help consumers make more ecological choices, development of labelling systems such as Eco-Score, Eco Impact, Planet-score and Enviroscore is expanding. Along with requirements related to environmental impact, demand for a more transparent and fair supply chain is also growing.

One way to show that you take care of farmers and workers is to become certified with standards such as Fairtrade, Fair for Life or Rainforest Alliance. Before investing in those certification schemes, it is strongly recommended to check potential prices with European buyers, as currently there are no Fairtrade-certified tomato purées or pastes on the European market. Instead, it is much more common for buyers to request social audits like SMETA (by Sedex) or BSCI (by amfori).

Tips:

- Follow steps in the grading manual for tomato sauce to ensure that your tomato purée and paste are of good quality.

- Read CBI’s tips to go green and tips to become a socially responsible supplier to learn more about growing market requests regarding sustainability.

- Read the CBI study on trends in the European processed fruit and vegetables market for an overview of developments regarding sustainability initiatives in the European market.

- Subcontract annual production with farmers in a fair and transparent way to align with international prices.

What are the requirements for niche markets?

Consider organic certification

To market tomato purée and paste as organic in Europe, tomatoes used in processing must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can place the European Union’s organic logo on the packaging, as well as the logo of the standard holder, for example Soil Association in the UK or Naturland in Germany.

If you want to produce and export tomato purée and paste to Europe, be aware of important new rules that may impact your business. The new EU Organic Regulation will come into force from October 2025. This regulation is accompanied by more than 20 secondary acts that regulate the production, control and trade of organic products in more detail. Some of the important aspects to be aware of are detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Consider ethnic certification

Islamic (halal) and Jewish (kosher) dietary laws impose specific dietary restrictions. If you want to focus on Jewish or Islamic ethnic niche markets, you should consider implementing halal or kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation (by the Alliance for Product Quality in Africa project) to better follow new rules.

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through which channels can you get tomato purée and paste on the European market?

If you want to offer bulk tomato purée and paste, good entry points are European tomato processors. However, independent traders specialised in the supply of organic food or ethnic markets can provide opportunities for certified or retail-packed products.

How is the end market segmented?

Tomato purée and paste are almost equally used as a retail product or as an ingredient in the food industry and food service segments. Within the retail segment, tomato purée is sold in significantly larger volumes compared to tomato paste, because it is a common ingredient (passata) for home cooking in pasta, pizza and other dishes.

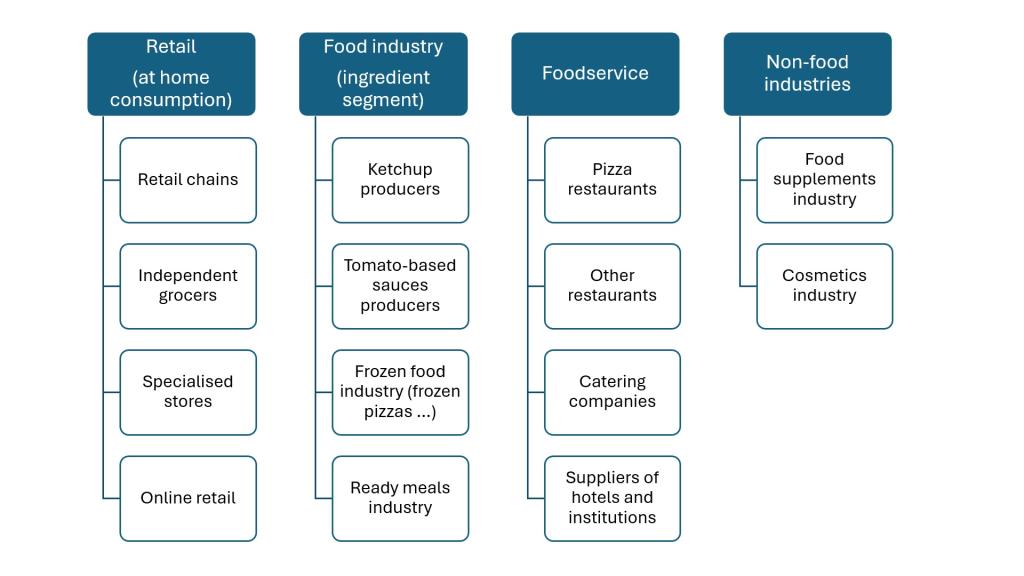

Figure 1: End-market segments for tomato purée and paste in Europe

Source: Autentika Global

Retail

Leading European retailers very rarely buy retail-packed tomato purée and paste directly from non-European origins. In most cases, they are supplied through specialised distributors. In the case of ethnic shops (such as Turkish or Asian stores), the import of retail-packed processed tomato products is more common.

Types of sub-segments (points of sale) of the tomato purée and paste retail segment in Europe include:

- Retail chains – European retail chains are roughly divided into discounters (like Lidl, ALDI, Penny) and supermarkets/hypermarkets (like Carrefour, Tesco, EDEKA, REWE, Delhaize, Albert Heijn). The main retail chain trend is an increasing share of private labels (own retail brands). The leading independent brands in Europe are Mutti and Cirio, though there is also an increasing number of organic brands (private labels and independent ones like Bioitalia or Alnatura);

- Fine foods and delicatessen shops – Many shops in these categories sell Italian products like olive oil, dried pasta and tomato sauces. Instead of products that can be found in most supermarkets, they tend to sell ‘homelike’ products (like Passata Rustica) or regional products (Delizie di Calabria, Fiammante);

- Specialised organic and health food shops – Many organic shops are a part of specialised organic food retail chains. Some European shops that sell organic tomato purée and paste are also drugstores (dm, Rossmann) or food supplement stores (like Holland & Barrett);

- Specialised ethnic supermarkets – These shops provide specific opportunities for entering the market without competing with leading retail brands. The most relevant types of ethnic supermarkets for tomato purée and paste sales are Turkish, North African and Asian;

- Online retailers – Online trade is often part of the business model of regular supermarket chains. Specialised online retailers include companies like Ocado (UK) and KoRo (Germany).

Food industry

The food industry in Europe is a major user of tomato purée and paste, which account for approximately one-third of all ingredients for final product formulations. The main users in this sub-segment are:

- Ketchup producers – The European ketchup industry commonly uses tomato paste as the main ingredient, diluted with additions of other ingredients like salt, sugar, vinegar and seasonings. Some of the best-known ketchup brands in Europe are Heinz, Thommy (owned by Nestlé) and Hellmann’s (owned by Unilever). Ketchup retail sales in Europe are estimated to be nearly €2.5 million for 2024;

- Sauce producers – Tomato paste is one of the major ingredients for the production of a wide range of sauces in Europe. The best-known types include pasta sauces (like Barilla, Buitoni), pizza sauces (with tomato purée and added ingredients), Indian curry sauces (Tikka Masala, Rogan Josh), Mexican sauces (salsa roja, enchilada sauce) and North African/Middle Eastern/Mediterranean sauces (shakshuka, harissa). Retail sales of pasta sauces in Europe are the largest in the world (€3.5 million in 2024);

- Frozen food industry – The leading user of tomato purée and paste is the frozen pizza industry, with many producers like Dr. Oetker, Gustavo Gusto and Roncadin. Other important users are the producers of frozen ready-made meals;

- Ready-made meals industry – This is a fast-developing industry in Europe. In volume terms, the largest quantities are used by producers of ready-made tomato-based soups. The retail value of soup sales in Europe is estimated to be more than €5 million, according to the Euromonitor report commissioned by Tomato News.

Figure 2: Example of pasta sauce (private label by Lidl)

Source: Autentika Global

Food service

The European food service segment (hotels, restaurants, catering) accounts for one-third of total sales of tomato purée and paste. In volume terms, the leading consumers are fast food restaurants (especially pizzerias). This market segment rarely imports tomato purée and paste directly, but rather via specialised distributors. The segment uses specific packaging, such as 3 kg cans.

Non-food industries

Non-food industries are not the focus of this study, but it is worth mentioning that concentrated tomato powder (usually produced by spray-drying tomato paste) is an ingredient for food supplements and the cosmetics industry. The main product in this category is lycopene, produced through solvent extraction from tomato paste powder. Other products include tomato extracts and tomato seed oil from tomato seeds separated during processing.

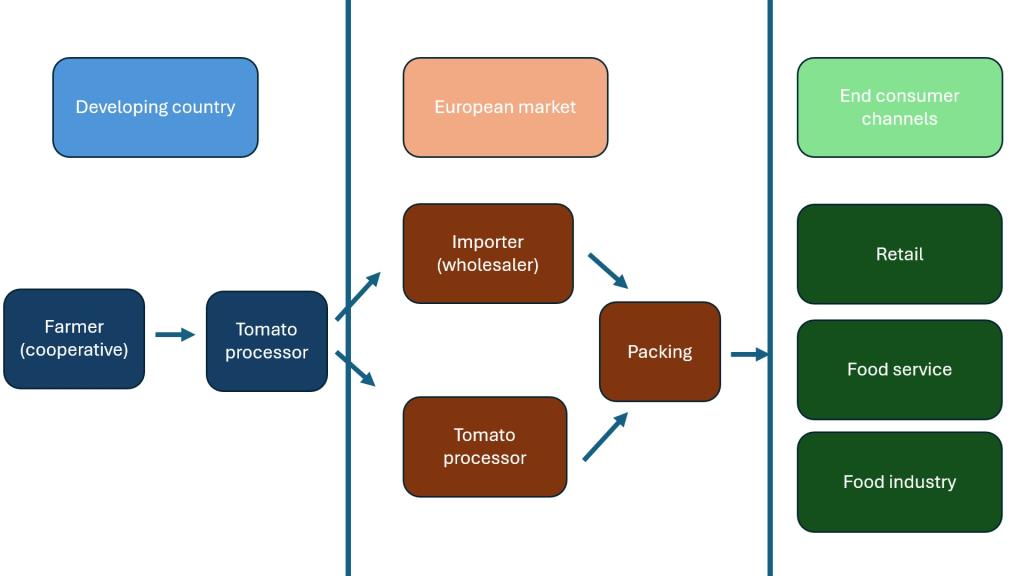

Through which channels does a product land on the end market?

In terms of volume, the most important channel for tomato purée and paste are the leading European tomato-processing companies. They import large quantities of highly concentrated paste, which are either repacked and sold on the European market, or used as an ingredient for other products. Retail-packed products are difficult to export to Europe, with the exception of some ethnic supermarkets. As Europe is the largest producer of tomato purée and paste, price competitiveness is the major success factor in the market.

Figure 3: European market channels for tomato purée and paste

Source: Autentika Global

European tomato processors

Most tomato paste is imported by European tomato processors as highly concentrated (usually over 34 Brix). After import, a large share of imported tomato concentrate is simply repacked and re-exported, or mixed with locally produced concentrate. A smaller share is processed further into consumer products. Tomato purée is imported in much smaller quantities than tomato paste, as European processors focus on added-value products such as passata, convenient packaging, and tomato-based sauces with ingredients for pasta and pizza.

To supply tomato processors, it is very important to benchmark with China, as low prices are the main driver of the increased import of tomato concentrate.

Importers (wholesalers)

Importers can be specialised with processing equipment, such as mixing lines (forto sauces) and packaging lines (to supply the retail and food service segments). Some importers are general processed fruit and vegetable traders, while a smaller number is specialised. They can be classified into several broad categories:

- Specialised processed fruit and vegetables traders – importers who supply different market segments. They may resell products unchanged or repack into formats for different market segments (for example into cans for the retail segment or bag-in-box for the food service segment). Henry Lamotte Food, I.Schroeder and Kiril Mischeff are among them;

- Catering suppliers – importers that supply hotels, restaurants and establishments, like Holland Bazaar and Caterers Choice;

- Juice ingredient suppliers – including large processors (Agrana, Döhler) and specialised traders (like Global Food Suppliers). However, they trade smaller volumes compared to processed vegetable traders;

- Spices and condiments traders, like Verstegen, use imported products for sauce formulations;

- Organic and natural food ingredient traders include specialised organic wholesalers like KoRo Drogerie, and baby food traders like Baby Alp;

- Ethnic food importers – suppliers of ethnic shops (Mayyas, Nergiz Großmarkt).

Tip:

- Study the exhibitor lists of large trade fairs, like Anuga, SIAL or Food Ingredients Europe, to find potential buyers for your tomato purée and paste.

What is the most interesting channel for you?

European tomato processors are the best channel if you are able to offer tomato paste produce of standardised quality in high volumes and at competitive prices. Specialised traders can be the choice for smaller exporters. There is a higher chance of selling tomato purée and paste through this channel if you can offer organic certification. Suppliers of ethnic supermarkets can be a choice if you wish to supply ethnic restaurants related to the origin of tomato products.

Tip:

- Understand a retailer’s demand for sustainable products and make yourself more competitive by investing in various audit schemes, such as those involving corporate social responsibility (CSR) practices.

3. What competition do you face on the European tomato purée and paste market?

As most tomatoes in the world are processed in Europe, especially in Italy, Spain and Portugal, you can expect fierce competition, especially from large processors that own international retail brands. On the other hand, as the cost of production in Europe is much higher than in China and other large producing countries, some European processors may be willing to import some quantities from other origins. At the product level, except for fresh tomatoes, there is no similar substitute to tomato purée and paste in home cooking.

Which countries are you competing with?

The leading competitors are European processors. On average, Europe is the leading global tomato processor, with approximately 11 million tonnes of processed tomatoes per year, slightly ahead of the USA (with 10.5 million tonnes) and China (8 million tonnes with very high fluctuations). Within Europe, the leading processor is Italy, with 5.5 million tonnes of processed tomatoes on average per year, followed by Spain (2.8 million tonnes) and Portugal (1.5 million tonnes).

Source: Autentika Global, Eurostat and ITC Trade Map

As production is becoming expensive, European processors are focusing on added-value products (passata and canned tomatoes). The major competitor, specifically for tomato paste of high Brix, is China. Other competition from non-EU countries comes from the USA, Türkiye, Egypt, Ukraine, Chile, Iran and Israel. While European and US processors carefully plan and contract crops to be processed, the Chinese output is quite unpredictable and has high fluctuations; this strongly influences global market prices.

Source: Autentika Global, Eurostat and ITC Trade Map

The European tomato-processing countries, internationally established brands

The leading tomato processors in Europe are Italy, Spain and Portugal, together accounting for over 85% of total European production. All 3 leading processing countries are investing a lot of energy to carefully plan and subcontract tomato production and keep prices stable. However, this is not easy, as they are facing problems such as a shortage of skilled labour, climate change, price pressure (especially from China and the USA), and sustainability demands. The main characteristics of leading processing countries are described below.

The Italian tomato-processing industry is one of the most advanced in the world, with state-of-the-art processing technology. The industry is also increasingly adopting sustainable practices and precision agriculture. Most tomato purée and paste is produced in Northern Italy (especially in the Parma region), while Southern Italy focuses more on canned tomatoes. Key players include companies like Mutti, Conserve Italia (Cirio brand) and La Doria.

In Northern Italy, the cultivated area is above 64 thousand ha on average, with an average yield of 70 t/ha. This is smaller compared to the area and yield in Southern Italy due to different cultivars and microclimatic conditions. In volume terms, Italy exports less tomato paste than China, but does so at a much higher value, as it focuses on added-value products. In 2024, Italy exported 860 tonnes of added-value products, though more than half was for passata (less than 12% Brix). The leading target markets are Germany, Austria, France and the UK.

The Spanish tomato-processing industry is focused on the production of tomato paste and tomato powder. Extremadura is a major processing region, with a high concentration of processing plants. Among the industry leaders are Conesa, Tomates del Guadiana, Transa and Pronat. In 2024, Spain exported 267 tonnes of tomato purée and paste. The main export products were double-concentrated paste (a 40% share) and triple-concentrated paste (30%). The leading markets are Germany, the Netherlands, France and the UK.

Portuguese tomato processors source 1.5 million tonnes of tomatoes each year, grown on around 17 thousand ha. The leading processor is Sugal Group, with the capacity to process even more tomatoes than are grown in Portugal thanks to facilities in Portugal, Spain and Chile. In 2024, Portugal exported 236 thousand tonnes of tomato purée and paste. The main exported product is double-concentrated paste, with an almost 70% share, followed by triple-concentrated paste (13%). The main export markets are the UK, Germany, Spain and Japan.

China, global leader in triple-concentrated tomato paste

Though it is among the top tomato-processing countries, the Chinese tomato-processing industry is showing unpredictable fluctuations, which strongly influences global prices. In Europe, the US and South America, processors plan carefully contracted areas to keep stable prices. China often overproduces, which makes prices collapse globally. These cycles of overproduction seem to repeat themselves every 4-5 years.

Northern Xinjiang is the leading production region in China. It accounts for approximately 60% of the total output, followed by Southern Xinjiang (20%), Inner Mongolia and Gansu. The regions of Northern and Southern Xinjiang have an arid climate and abundant sunlight, and are suitable for large-scale mechanised farming. Despite good climate conditions for tomato growing, the Xinjiang regions were reported on several times concerning potential human rights violations – see the BBC Eye Investigation report or the UN Human Rights assessment report.

China is the leading global exporter of tomato paste. In 2024, it exported nearly 1.2 million tonnes of tomato purée and paste at a value of €1.1 million. By comparison, Italy exported about 800 thousand tonnes, but reached a higher export value, which indicates Chinese price competitiveness. The main Chinese export product is triple-concentrated paste. The leading markets for bulk paste are Italy with a 13% share, followed by the Russian Federation and Saudi Arabia. The leading markets for retail or food service-packed paste are Iraq, Ghana and Nigeria.

Türkiye, strong export orientation

Türkiye’s tomato processing industry is modern and export-oriented, with strengths in paste production and increasing diversification. The country serves as a regional hub between Europe, the Middle East and Africa. The weakness of the industry is the difference between tomato growing and processing: the leading processors are equipped with modern facilities, yet still depend to a certain extent on small-scale farmers. To avoid this dependence (as is the case in Balıkesir), most tomatoes are sourced from Bursa and Izmir.

In 2024, Turkish exports of tomato purée and paste reached 177 thousand tonnes. The main export destination was Iraq with a 34% export share, followed by Italy (14%), Germany (8%), Japan (5%) and Saudi Arabia (4%). Over 40% of exports is purée, the remaining 60% is paste. The main target market for bulk purée is Iraq, while the main market for retail-packed purée is Italy. The main markets for paste are Italy and Germany.

Tip:

- Read Tomato News to learn more about expected crops and industry developments in the leading tomato processing countries.

Which companies are you competing with?

In the bulk trade of tomato paste, the leading competitors are Chinese companies. In the subsegment of low-Brix or retail-packed products, the main competitors are from Italy. Turkish companies, equipped with canning and retail packaging facilities, are also increasingly exporting purée to Europe.

Casalasco Group

Casalasco Group is Italy’s largest industrial tomato processor. The company manages an integrated ‘seed-to-shelf’ supply chain that includes around 800 farms, 5 factories and over 70 packaging lines. Casalasco’s annual processing volume is around 800 thousand tonnes of fresh tomatoes. Although more famous locally than internationally because of its retail brands, it is one of the best companies to benchmark due to its integrated supply chain based on cooperation with farmers.

Casalasco is expanding internationally through strategic acquisitions (Unilever’s German sauces; Italian preserve brands) and robust investment. In late 2024, Casalasco began building Italy’s first agrivoltaic park on 2 ha near its Fontanellato plant. This aims to generate ~1,600 MWh/year (covering 90% of the plant’s energy needs), reduce CO2 by 680 tonnes annually, and support their on-site Innovation Centre.

Other leading European competitors are Sugal Group (Portuguese, with facilities in Chile and Spain), Conesa Group (with multiple plants across Spain, Portugal and the UK), Mutti (a leading retail brand with an innovative machine working directly in the field) and Conserve Italia (with the Cirio brand).

Xinjiang Chalkis

Xinjiang Chalkis is one of the world’s top tomato paste producers, owning around 23 processing plants across Xinjiang, Gansu, Inner Mongolia and Tianjin. The company is also present in France, with the acquisition of Le Cabanon. Annual production capacity exceeds 360,000 tonnes of tomato paste. A recent focus on early-, mid- and late-maturing tomato cultivars has enabled them to extend the processing window from 45 to 60 days annually. Despite its international presence, the company is criticised for labour conditions in the Xinjiang supply chain.

Morning Star

Morning Star is the largest single tomato processor in the world. Its facilities can handle over 3,000 tonnes/hour and collectively process around 40% of total US production. The company is vertically integrated from seeds to final products. It uses modern and innovative technologies such as satellite-monitored irrigation, automated mechanical weeding and gravity-fed unloading cooling ponds. Other notable US processors are J.G. Boswell, Los Gatos, Stanislaus and Campbell’s.

Tukas

Tukas is the leading Turkish tomato processor, also processing a wide range of vegetables. The existing plants (in Torbalı, Manyas and Akhisar) have a total annual production capacity of around 100 thousand tonnes. In 2025, Tukas partnered with the Italian equipment producer CFT Group to install two new tomato-processing lines at the new Niğde/Nidge facility. These lines will include a hot-break line (1,000 t/h) for high-viscosity paste and a cold-break line (1,300 t/h) for less processed paste packaged in cans or 200 kg aseptic barrels.

These companies are only a few illustrations of industry leaders: the list is not exhaustive and includes hundreds of tomato processors worldwide.

Tips:

- Participate in the Tomato News conference to meet some of the leading tomato processors worldwide.

- Regularly visit European trade fairs like Anuga, SIAL and BIOFACH (organic) to meet your competitors and potential clients.

Which products are you competing with?

Tomato purée and paste have distinct taste characteristics and culinary applications, so it is almost impossible to find a substitute. There is no other type of liquid vegetable product that can be used to substitute tomato purée and paste. The only relevant substitute is fresh tomatoes, used in home cooking to produce tomato purée, especially in Italian dishes or stews. Freshly produced tomato purée is sometimes favoured by celebrity chefs, especially in Italian cuisine and cooking shows.

Still, fresh tomato is a weak substitute for ready-to-use tomato purée and paste, because of the following:

- Leading brands produce tomato purée and paste with tomatoes as the only ingredient;

- Leading processors produce tomato purée shortly after harvest, preserving many nutrients;

- Industrial tomato cultivars have a rich flavour and good texture, and cannot be substituted with fresh tomato cultivars available in European supermarkets;

- Modern technology enables more flavour and richer colour compared to homemade tomato purée;

- It is more convenient and time-efficient to choose ready-to-use tomato purée and paste compared to fresh tomatoes.

Tip:

- Read the CBI study on fresh tomatoes for information about European fresh tomato production, and compare it with industrial tomato production.

4. What are the prices of tomato purée and paste on the European market?

Prices of tomato purée and paste vary from season to season and depend on many factors, such as origin, cultivar, Brix level and quality. Logically, prices increase with concentration, meaning that tomato purée has the lowest price per kg, while triple-concentrated paste (36-38 Brix) has the highest price. There is no exact rule, but usually the highest prices are for tomato purée and paste of European origin, with Italy being the most expensive, followed by Spain and Portugal. The most expensive non-European origin is generally Chile, and the cheapest is China.

The price breakdown below is a very rough indication, considering that many different factors affect production costs, such as season, quality, origin, packaging and certification. The example below is based on the calculation for retail-packed, triple-concentrated paste. This is an example only, as most triple-concentrated paste products are not sold as retail products but are used as ingredients in other products.

Table 1: Triple-concentrated tomato paste retail price breakdown

| Export process steps | Type of price | Price breakdown | Tomato price per kg (example) |

|---|---|---|---|

| Fresh tomatoes | Raw material price | 5.8% | €0.7/7 kg (based on the assumption that 7 kg of industrial tomatoes is needed for 1 kg of 36-38 Brix tomato paste) |

| Processing costs (washing, crushing, evaporation, packaging, labour) | Production costs | 11.7% | €1.4/kg (based on the assumption that processing costs are €0.4/kg) |

| Export price | FOB price | 12.5% | €1.5/kg |

| Import, shipping, handling and storing | CIF price | 13.3% | €1.6/kg |

| Packing into retail containers | Packaging costs | 25% | €3 |

| Wholesale price | Wholesale price (value-added tax included) | 66.7% | €8/kg |

| Retail sales of the final packed product | Retail price | 100% | €12/kg (for a 200g tube of triple-concentrated paste) |

Source: Autentika Global, based on industry sources

Tip:

- Monitor processed tomato price updates from the Tomato News website.

This study was carried out by Autentika Global on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research