The European market potential for tomato purée and paste

Europe is a leading global importer of tomato purée and paste. The European tomato purée and paste market is expected to grow 4%-5% annually in the long term. A positive consumption forecast is related to the increased consumption of ready-made meals and price inflation, keeping in mind that those products are common bulk commodities. The leading importers of tomato concentrate are Italian and Spanish tomato processors. For developing-country suppliers, other promising markets are Germany, the United Kingdom, Poland and Romania.

Contents of this page

1. Product description: tomato purée and paste

Tomato purée and paste are thick liquids made by concentrating the juice and pulp of fresh tomatoes after removing the skins, seeds, and coarse fibre.

In this study, the words ‘tomato purée and paste’ will be used for products with different levels of dry matter. This is because EU legislation has no official standard for different grades of tomato purée. However, industry players differentiate between several types of these products. You can read more about this in the market entry study for tomato purée and paste.

A widely accepted description defines tomato purée (also called passata or tomato sauce) as a low-Brix product (generally between 8-12). Tomato paste (or tomato concentrate) is often defined as a single concentrate with Brix 12-20, double concentrate with Brix 20-34 and triple concentrate with Brix over 34.

Different product categories will be analysed in more detail, bearing in mind that several industry standards use specific product names related to the percentage of soluble solids.

The equipment used for large-scale tomato processing is different from the equipment used for small-scale processing. Generally, the major processing steps are:

- Harvesting, cleaning and sorting – to select and prepare the tomatoes for processing. Most tomatoes produced for industrial processing are produced in open fields. This is different from tomatoes sold in supermarkets in Europe, which are mostly produced in greenhouses;

- Crushing and enzyme inactivation – to stop the degradation of pectin leading to a watery texture;

- Pulping and refining – to remove skins and seeds;

- Concentration – to reach the desired Brix level;

- Sterilisation and aseptic filling – to prepare the product for storage and transport. For bulk export, usually bag-in-drums packaging is used.

The leading product in bulk trade is tomato paste with a higher Brix level (usually over 34). Concentrated tomato pastes are used as a raw material to produce different types of tomato-based sauces and ketchup. These products are often traded by countries that lack a first-stage tomato processing activity, like the Netherlands, Germany and Belgium.

This study covers general information regarding the tomato purée and paste market in Europe that is of interest to producers in developing countries. When the study refers to ‘Europe’, it includes the 27 member states of the European Union plus the United Kingdom, Switzerland, Norway, Iceland and Liechtenstein. Developing countries are defined as the countries that are listed as official development assistance recipients.

The following Combined Nomenclature codes are used for statistical analysis.

Table 1: Products in the ‘tomato purée and paste’ product group

| Combined Nomenclature number | Product |

|---|---|

| 20029011 | Tomato purée and paste with a dry matter content <12% in an immediate packing with net content >1 kg. |

| 20029019 | Tomato purée and paste with a dry matter content <2% in an immediate packing with net content ≤1 kg. |

| 20029020 | Tomato purée and paste with a dry matter content 12%–20% by weight. |

| 20029041 | Tomato purée and paste with a dry matter content 20%–34% by weight in an immediate packing with net content >1 kg. |

| 20029049 | Tomato purée and paste with a dry matter content 20%–34% by weight in an immediate packing with net content ≤1 kg. |

| 20029080 | Tomato purée and paste with a dry matter content >34% by weight. |

Source: EU Regulation 2024/2522

2. What makes Europe an interesting market for tomato purée and paste?

Europe is the largest importer of tomato purée and paste in the world, accounting for over 45% of global imports. Among the top 10 global importers of tomato purée and paste, 6 countries are from Europe. Europe is also the leading processor of tomatoes, though competitive prices from other origins provide opportunities for non-European suppliers. Exporters of tomato purée and paste can find opportunities in different market segments, such as:

- Large industrial suppliers (which often substitute some of the volumes from imports);

- Food-processing companies (with products such as ready-made meals or tomato sauces);

- Traders (imported and re-exported bulk products).

The demand for different types of tomato purée and paste in Europe is driven by rising consumer interest in convenience as well as new tastes. Due to busy lifestyles, the consumption of ready-made meals is increasing. Many types of easy-to-prepare meals and soups contain significant amounts of tomato purée and paste. Also, producers of tomato-based sauces are constantly launching new products adapted to different international cuisines.

Source: Autentika Global and ITC Trade Map, 2025

Over the last 5 years, the European market for tomato purée has grown at an average annual rate of 3%, reaching 1.5 million tonnes in 2024 with a value of €2.29 billion. Approximately 75% of this quantity is traded within Europe, while the remaining 25% is imported from non-European countries. The leading European suppliers are Italy and Spain, with China as the main non-European supplier.

Low-Brix tomato purée and paste (with dry matter content <12%) is the major type of processed tomato product traded between European countries. This type of purée (often called passata) is mostly used by European consumers for home cooking (Figure 2). However, this product is rarely imported from non-European countries, as value addition (retail packing and dilution) is done after imports of bulk products. In 2024, EU countries imported around 358 thousand tonnes of retail-packed passata, but only 2% was imported from outside Europe.

Figure 2: Tomato passata by the Italian brand Mutti

Source: kiliweb via Open Food Facts, under the Creative Commons Attribution-ShareAlike 3.0 Unported license

Most of the tomato purée and paste imported from non-European countries consists of concentrated products in bulk packaging. Over 95% of imports to Europe from developing countries is bulk-packed, while less than 5% is retail-packed. In 2024, the most-imported product from non-EU countries was tomato concentrate, with over 34% dry matter. This accounted for almost half of total imports (Figure 3).

Source: Autentika Global and Eurostat, 2025

Consumption characteristics

In 2022 and 2023, the consumption of canned tomato products strongly rose during the COVID-19 pandemic due to stockpiling of canned products. In 2024, consumption stabilised again. According to Tomato News, there is an increasing demand for tomato purée and paste and other processed tomato products. To meet this demand, European tomato processors also import some processed tomato products if the price is competitive.

This situation provides opportunities for developing-country exporters, because European domestic tomato farming and processing is shrinking. Faced with climate change, environmental and social pressure, as well as price inflation and diminishing numbers of tomato farmers, European processors are increasingly importing tomato purée and paste, sauces and ketchup. In addition to higher imports, processors and packers are also increasingly importing added-value products. Imports of ketchup and tomato sauces to Europe have grown by 40 thousand tonnes since 2020.

The apparent consumption (production + imports – exports) sharply rose from 1.98 thousand tonnes in 2020 to 2.2 thousand tonnes in 2022, then dropped to 2.07 thousand tonnes in 2023. Western European countries consume more processed tomatoes (15 kg/person/year) compared to Eastern European countries (12 kg/person/year). This per capita consumption between Western and Eastern Europe is expected to become evenly balanced in the coming 10 years, because of the expected higher consumption in Eastern Europe (almost 5% per year).

According to a Euromonitor report published by Tomato News, most tomato purée and paste in Europe is used as an ingredient in ready-made meals and for home cooking. Other strong consumers are pizza restaurants and frozen pizza producers, as well as producers of sauces, ready-to-use pasta sauces and ketchup. Within these categories, the strongest surge in consumption (1.8% annual rate) is expected in pasta sauces.

Tip:

- Read the Tomato News Yearbook to learn more about developments in the processed tomato market.

3. Which European countries offer the most opportunities for tomato purée and paste?

Exporters of tomato purée and paste from developing countries may find opportunities in different European market segments. The biggest opportunities, especially for tomato concentrate, can be found in leading processing countries like Italy and Spain. These countries are primary processors of tomatoes, but also import some quantities to meet European demand. Opportunities can be also found in markets that are trade hubs or have second-stage processing industries, like Germany and the United Kingdom.

Source: Autentika Global and ITC Trade Map, 2025

The leading European importer of tomato purée and paste in 2024 was Germany, with an 18% European import share, followed by the UK (14%), Italy (14%), the Netherlands (8%), France (8%) and Poland (6%). Since 2020, the largest surge in imports was seen in Italy (11% annual growth rate), Austria (26%) and Spain (11%).

Source: Autentika Global and ITC Trade Map, 2025

Some of the leading importers are not the most attractive markets for developing-country suppliers because they source most of their tomato purée and paste from European tomato-processing countries. Figure 5 shows the European markets that are most attractive for developing-country suppliers. Among them, Italy, Poland and Spain import tomato paste (mostly highly concentrated) to boost their own output, while Germany and the UK are large consumers.

Although not ranked among the top 6 importers from developing countries, France, Portugal and the Netherlands are very attractive markets due to the strong growth of imports from developing countries.

Italy: largest European tomato processor

Italy is the world’s third-largest tomato producer, representing 11.6% of world production and 47.7% of European production, and is the leading European processor and exporter of tomato-based products. In 2024, 5.3 million tonnes of tomatoes were processed in Italy. The average Italian production of tomato pureé is over 1.2 million tonnes, with approximately 80% accounting for low-Brix products and 20% for tomato concentrates. Faced with a production decrease due to high raw material prices, Italy is also increasingly importing tomato purée and paste.

Italian tomato purée and paste imports have been growing at an annual rate of 11%, reaching 216 thousand tonnes and valued at €275 million in 2024. Being the leading producer and recognised internationally by several brands, the Italian import of retail tomato products is insignificant. Italy focuses on bulk import of concentrated tomato purée and pastes to supplement the local industry. In 2024, of the total imported quantities, 61% accounted for tomato concentrates with over 34% dry matter and 31% for products with 20%–34% dry matter.

The leading supplier to Italy is China, with a 46% import share in 2024, followed by the USA (13%), Türkiye (11%), Portugal (9%) and Spain (8%). Türkiye and Iran are gaining the most market share even though their supply was insignificant before 2012. Italy’s imports of Chinese tomato paste consist mainly of paste that is repacked for re-export.

The range of importers in Italy is broad and includes bulk processors, retail packers, traders and brokers. After imports, tomato concentrate is further processed into passata and other sauces or used as an ingredient in Italian cuisine. Some Italian processed tomato brands are known worldwide (like Mutti and Cirio by Conserve Italia), while some are more present on the Italian market (Santa Rosa, Pomi, Petti, Masseria Raciti). Along with the established brands, each Italian retail chain has their own private label for a range of processed tomato products.

Italian tomato processors are not price-competitive, they invest more in low-Brix products, which have higher costs. An important retail trend is to emphasise the Italian origin with labels (such as 100% Italian) or to mention the production area (Tuscany, Sicily, etc.). Another trend is to promote a specific single tomato variety or cultivar with a specific flavour, colour or texture (Datterini, Siccagno, Giallo, etc.). Also, to attract consumers, Italian processors are innovating with products that have a thicker and coarser structure and which are similar to homemade purées.

Figure 6: Typical Italian supermarket shelf with processed tomato products

Source: Autentika Global

Tip:

- Find Italian processors and traders on the Tomato News Directory.

Poland: processor, importer and exporter

Poland has been increasing its processing of tomatoes, reaching over 200 thousand tonnes in 2024. Polish companies produce retail-packed tomato purée and pastes for the local market but also export these products as private labels for some German retail chains. However, local production is insufficient to satisfy local and German retail demand, and Poland imports significant quantities of tomato concentrates from producing countries.

The import of processed tomatoes to Poland is relatively stable, reaching 95 thousand tonnes in 2024. Tomato purée and pastes account for over 70% of imports. China was the leading supplier, with a 20% share, followed by Italy (16%), Ukraine (16%), Germany (13%), Spain (12%) and Egypt (7%). Among all suppliers, Egypt is gaining market share at the fastest rate. Import from Egypt has increased almost sixfold, from 1.2 thousand tonnes in 2020 to 6.5 thousand tonnes in 2024.

Poland provides opportunities in different market segments, including large processors like Agros Nova (part of the Maspex Group) and Döhler, and producers of sauces (like Dawtona, Fanex and Pudliszki), ketchup (like Kotlin, part of Nestlé) and ready-made meals. The Polish food industry is growing at a fast rate and supplies some of the leading European discounters, like Lidl.

Figure 7: Tomato purée and paste (passata rustica) by Polish processor Dawtona

Source: arc2 via Open Food Facts, under the Creative Commons Attribution-ShareAlike 3.0 Unported license

Tip:

- Contact the Polish Association of Fruit and Vegetables Processors for more information on the tomato-processing industry in Poland.

Germany: leading European importer of tomato purée and paste

Since 2020, imports of tomato purée and paste to Germany have dropped at an annual rate of 2%, but the import from developing countries has grown. This provides opportunities for new suppliers. In 2024 imports reached 275 thousand tonnes, at a value of €456 million. As Germany is not a significant tomato processor, most import consists of retail-packed products (70%). Highly concentrated purée and paste (with >34% dry matter) make up only 9% of total imports.

The leading supplier in 2024 was Italy, with a 45% import share, followed by Spain (13%), Austria (11%), Portugal (9%) and Türkiye (5%). Retail-packed and branded tomato purée and paste is imported mostly from Italy and to a certain extent from Austria. Other countries mostly supply bulk products. Import from Türkiye increased almost twofold, from 7.5 thousand tonnes in 2020 to 14.7 in 2024. Due to a significant presence of Turkish supermarkets, restaurants and traders, Germany is the leading destination market for Turkish tomato purée and paste.

Germany provides opportunities for suppliers of organic tomato purée and paste. Still, developing countries do not benefit yet from this opportunity as most imported organic tomato purée and paste originates from Italy. This means that there are market opportunities for developing-country suppliers. Aside from Italy, in 2024 Germany imported only 325 tonnes of organic tomato purée and paste. Organic products are sometimes sold under original Italian brand names, as well as under private labels of specialised organic retailers like BioMarkt, Alnatura, tegut…, ebl-Naturkost, dm and SuperBioMarkt.

The main importers of tomato purée and paste are producers and packers of sauces and ketchup. These include suppliers of international brands (Divella, Mutti, Cirio, de Cecco, etc.) and local producers (like Hengstenberg with their own Oro brand). A niche opportunity exists in the German ketchup industry for a specific seasoned product called curry ketchup, with Hela being the leading producer. Opportunities can also be found among private-label suppliers (like Jütro, part of I.Schroeder) and wholesalers (like Henry Lamotte).

Figure 8: Tomato passata, the Oro brand in Germany

Source: twoflower via Open Food Facts, under the Creative Commons Attribution-ShareAlike 3.0 Unported license

Tips:

- Contact the German Association of Vegetable Processors (BOGK) for more information about the German vegetable-processing industry.

- Find traders of processed tomato products through the German Trade Association, Food Federation of Germany or the B2B online company portal WLW.

Spain: processor with increasing import needs

Spain is the second-largest tomato processor in Europe, after Italy. Each year it processes over 2 million tonnes of tomatoes. In 2024, Spain exported 267 thousand tonnes, but due to unstable harvests and rising labour costs, production became very expensive. To lower costs, processors have boosted their imports of processed tomato products. Unlike Italy, which is focused on exporting retail products, bulk tomato concentrate makes up the main share of Spanish exports.

Most Spanish imports (over 90%) are bulk products for use in the Spanish tomato-processing industry. Spain imports tomato purée and paste from many origins, providing opportunities for emerging developing-country suppliers. Since 2020, Spanish imports have grown at an annual rate of 11%, reaching 69 thousand tonnes in 2025 with a value of €84 million.

In 2024, Spain imported most of its tomato purée and paste from Portugal (43%), followed by China (33%), Italy (16%) and India (3%). The fastest-growing supplier is China (mostly bulk tomato concentrate), rising significantly from only 1.9 thousand tonnes in 2020 to 23 thousand tonnes in 2024. Other suppliers, though with a significantly smaller share, are India, Israel, Egypt, Morocco and Ukraine.

Imported tomato purée and paste in Spain are mostly used by tomato processors and packers to supplement local production. The leading processor is Conesa Group, with an annual processing capacity of 1.4 million tonnes and 10 production facilities (in Spain, the USA, China and Portugal). Other prominent processors are Transa, Sugal Group and Pronat.

After the initial stage, tomato concentrate undergoes further processing and packing. The larger share is then packed as private labels for Spanish retailers like Mercadona (Hacendado label), Carrefour (Classic and Bio labels), Eroski (Eroski basic), Lidl (Freshona label) and DIA. Some independent tomato purée and paste brands in Spain are Helios, Pedro Luis, Cidacos, Orlando (owned by H.J. Heinz Foods Spain) and Hida.

Tip:

- Find Spanish tomato processors and traders in the Tomato News Directory. Under country, select ‘Spain’, and under sector, select either ‘Tomato Processor’ or ‘Trader or Broker’.

The United Kingdom: versatile market and ketchup lovers

The tomato purée and paste market in the UK is characterised by a diverse assortment of products, private labels and independent brands. Although the Italian origin is often highlighted on the retail packaging, only 16% of tomato purée and paste is imported already packed, while over 50% of tomato purée and paste is imported in bulk. Over 33% of imports consist of high-Brix tomato concentrate that is further reprocessed after import.

Since 2020, UK imports of tomato purée and paste have grown at an average annual rate of 3%, reaching 208 thousand tonnes in 2024 and worth €366 million. The leading supplier in 2024 was Italy with a 38% share, followed by Portugal (21%), Spain (16%), Greece (7%), China (7%) and Chile (2%). The countries gaining market share at the fastest rate over the last 5 years are Greece, China, Chile, Türkiye and Egypt.

Chile showed especially high growth. UK imports from Chile rose from only 170 tonnes in 2020 to over 6 thousand tonnes in 2023. This growth is due to increased export by the Sugal Group, headquartered in Spain but with a processing facility in Chile. Imports from Italy, the leading supplier, are characterised by retail-packed Italian brands (like Mutti and Ciria) and many Italian speciality brands imported by companies like Annessa Imports, Bonta Italia and Carnevale.

After import, tomato concentrates are processed into various sauces by companies like Silbury (tomato purée and paste, pasta and pizza sauces), Premier Foods (cooking sauces), Princes Group (canned food) and Heinz UK (ketchup, passata, etc). In the retail segment, most tomato sauces are sold as private labels of leading chains like Tesco, ASDA, Sainsbury’s, Morrison, Waitrose, ALDI, Lidl and M&S. Some independent UK-based brands are Napolina, Cook Italia (by LaDoria) and Biona (organic).

Ketchup producers are large users of imported tomato purée and paste. The UK also imports already-prepared ketchup. The UK is the largest import market globally for ketchup, with an import of over 180 tonnes, mostly from European countries.

The UK market is a highly diversified market with several categories of traders. These include distributors of international brands (like Ab World Foods), ingredient suppliers (Brusco, Kiril Mischeff), Italian food distributors, freshly prepared food producers (Bakkavor, Oscar Mayer), catering companies (BB Catering Supplies, Caterers Choice), wholesalers (like Costco) and organic and sustainability-focused suppliers (like Essential).

Tip:

- Contact the Food and Drink Federation to find out more about UK tomato processors, packers and traders.

Romania: diversified market

Over the past 5 years, Romanian imports of tomato purée and paste have shown a stable growth rate of 2%. In 2024, imports reached 33 thousand tonnes, at a value of €42.3 million. Nearly half of imports are retail-packed products (mostly from Italy), while the remainder is imported as a bulk ingredient for Romanian tomato sauce and ketchup processors. Over 35% of imports are high-Brix tomato concentrate.

Romania imports most tomato purée and paste from Italy (24%), followed by China (17%), Germany (17%), Iran (14%), Hungary (8%) and Poland (7%). Türkiye has a small market share (3%) but has shown strong growth. Imports from Türkiye (mostly a high-Brix tomato concentrate) rose from 187 tonnes in 2020 to almost 900 tonnes in 2024. Other suppliers that are increasing their market share are Italy, Iran and Hungary.

A large portion of imported tomato concentrates is used by Romanian processors and sauce producers. One of the leading companies in this sector is Orkla Foods Romania, part of the Norwegian Orkla Group. The Romanian retail market is characterised by large private-label volume sales by discount supermarkets like Lidl and Kaufland. These companies are sometimes supplied by their centralised procurement location in Germany, though some Romanian tomato processors, like Defne Selos and Contec, also supply them.

Along with private labels, some prominent Romanian brands that are also exported to other European countries include Olympia (processed tomato brand by Contec Foods) and Sultan.

Tip:

- Contact the Romanian Chamber of Commerce for information about Romanian tomato processors and traders.

4. Which trends offer opportunities or pose threats in the European tomato purée and paste market?

The European tomato purée and paste market is impacted by several factors. The most important are sustainability challenges, including climate change, increasing production costs, and EU sustainability and social legislative requirements. This has led to increased imports of tomato purée and paste and other tomato products of non-European origins.

Sustainability and environmental responsibility are shaping the European processed tomato sector

Faced with climate change, the energy crisis, high-energy inputs and European legislation related to tomato production, processing tomatoes in a sustainable way is becoming extremely important. On the production side, leading tomato-processing countries are investing in cultivars that are pest-resistant and require less irrigation. According to the EU Farm to Fork Strategy, by 2030, the use of chemicals should drop by 50% and the production of organic tomatoes should increase.

Currently, European producers of tomatoes for processing are not very eager to reduce the use of chemicals or switch to organic production. Unlike in the fresh tomato segment (in greenhouses), the reduction of chemicals used in open field tomato production could shrink the yield by up to 26%. This would raise production costs for European farmers. The import of organic tomato processed products is therefore expected to increase.

At present, European imports of organic tomato purée and paste from developing countries are insignificant, and make up only 1% of total imports. In 2024, organic imports were 4.3 thousand tonnes, with 72% imported by Italy, 21% by the Netherlands and 7% by Germany. The USA supplied 95% of the 4.3 thousand tonnes, and Türkiye supplied the remaining 5%. Tunisia supplied an insignificant 200 kg.

Source: EU, 2025

Developing-country suppliers should explore more opportunities for exporting tomato products to Europe. A notable example of sustainable tomato production and processing is the Egyptian Sekem Group. They are a prominent player in Egypt’s tomato production sector, known for its sustainable farming practices and organic and high-quality products. In 2019, Sekem launched the ‘Greening the Desert’ project with the goal of regenerating 50,000 hectares of desert land through regenerative practices such as organic and biodynamic farming.

In addition to agricultural sustainability initiatives, the EU is also asking food processing companies to reduce carbon emissions and recycle water. Within tomato-processing factories, the amount of wastewater must be controlled in the range of 8–10 m3 per tonne of product. To save water, new technologies such as Ohmic heating and heat pumps are likely to start playing a more important role, as they make it possible to save water and energy during processing.

On the consumer side, a major trend is the shift towards recyclable and biodegradable packaging (cartons, lightweight cans, compostable films, etc.). In the bulk trade, the Aseptic Bag Manufacturers Association is promoting flexible aseptic pouches as a solution to preserve the freshness of tomato purée and paste and to reduce carbon emissions, which is significantly lower compared to canned products. Another significant consumer trend is the increased demand for organic products.

Rising labour costs in Europe are influencing the entire supply chain

Ongoing price inflation – which has also led to higher labour costs – is influencing European tomato processors and the purchasing habits of European consumers. Price inflation first started during the COVID-19 pandemic and continued after the war in Ukraine started, which raised energy prices. Higher labour costs are increasing the cost of the final products. According to Euromonitor research, consumers are switching from organic to conventional options due to climbing organic food prices, and budget-friendly private-label products are boosting their market share. This can provide opportunities for developing-country suppliers, as some private-label products can be packed outside Europe.

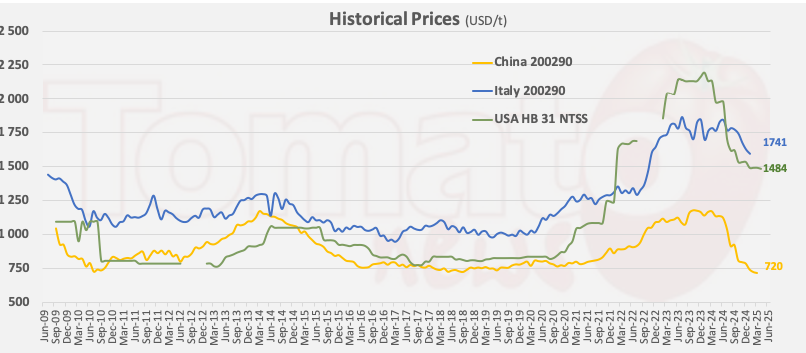

Due to rising labour costs, imports of tomato purée and paste from cost-competitive origins are growing, with China benefitting the most from this trend. For many developing-country suppliers, it is difficult to compete with Chinese prices, though new suppliers can be competitive through value addition. For example, offering organic tomato purée and paste can boost competitiveness on the European market.

Figure 10: Historical prices of tomato paste, USD/t

Source: Tomato News

Being price-competitive in the European processed tomato market is not enough. There is mounting pressure by European industry bodies to ensure that imported processed tomato products are environmentally and socially sustainable. For example, at the Tomato World event in 2024, Oi Pomodoro, the tomato-processing organisation of Northern Italy, asked EU authorities to apply the same social and environmental standards to non-European suppliers.

According to a press release from Oi Pomodoro, many products from China, Iran, Türkiye and Egypt offer low-cost products but fail to meet social, environmental and food safety requirements. These sub-standard products are freely sold on the European market, but internal EU rules forbid European producers from producing and selling these same sub-standard products. This creates an inconsistency that negatively impacts European producers.

Healthier eating habits and a clean label trend are influencing tomato product innovations

Plant-based diets and vegan trends support the consumption of processed tomato products. To further support consumption, processors are underlining the specific benefits of tomato purée and paste with innovative product launches. One example is the promotion of the lycopene content in tomato paste. Lycopene is a carotenoid known for its antioxidant properties. Some clinical research indicates that tomatoes and lycopene may protect against cancer incidence and mortality.

Some tomato paste producers emphasise the higher concentration of lycopene in processed tomato products compared to fresh tomatoes. Lycopene content in fresh tomatoes can range from 1–8 mg per 100 g, while tomato paste can contain 10–14 mg lycopene per 100 g. One brand that emphasises a high-content lycopene product as well as an organic product is Bio Orto. They state that their organic passata has one of the highest levels of lycopene detected in products of the same type, reaching as much as 243 mg/kg. Another brand is Agraz Tomato Paste High Lycopene.

Figure 11: High-lycopene tomato pulp

Source: kiliweb via Open Food Facts, under the Creative Commons Attribution-ShareAlike 3.0 Unported license

Tomato pulp is also used for the extraction of other carotenoids. For example, Lycored, the global leader in natural carotenoids for food, developed a supplement extracted from the pulp of the yellow tomato. This product, named Lumenato, does not contain lycopene but is a blend of phytoene and phytofluene.

Along with promoting the health benefits of lycopene in tomato purée and paste, other health trends are the advent of tomato products that contain 100% tomato with no added ingredients (such as sugar, salt or additives). New product launches include ‘no sugar added’ ketchup like Real Good, ‘no added sugar’ ketchup with recyclable packaging, Heinz Tomato Ketchup No Added Sugar & Salt, and ‘no added sugar’ Biona organic ketchup. While most brands use sweeteners instead of sugar, Biona ketchup is free of both.

Many aspects of convenience

Producers of tomato purée- and paste-based products are trying to serve end consumers in different ways. The most common aspects of convenience are:

- Online sales – After the outbreak of the COVID-19 pandemic, many producers of essential products increased their online sales. Almost every European retail chain now offers online sales. Other retail chains operate exclusively online, such as UK-based Ocado. Heinz, the leading producer of ketchup and tomato sauces, has launched a direct-to-consumer sales channel, Heinz to Home, taking advantage of the surge in e-commerce.

- Smaller consumer packaging – Until recently, tomato purée and paste were mostly packed in 400-500 g packaging. However, due to a short shelf life after opening and to prevent food waste, producers are shrinking packaging size. The common packaging sizes are now 200 g and smaller, down to 70 g. One example of a range of convenient packaging is Cirio by Conserve Italia. Another trend is packaging concentrated types of purée and paste in tubes with an extended shelf life.

- Variety of ready-sauces – To help consumers prepare quick meals at home, tomato processors in Europe are offering a wide range of pasta sauces, pizza sauces and toppings, and chilli sauces. Instead of preparing pasta sauces, consumers can now buy pre-mixed sauces such as Marinara, Bolognese, Amatriciana, Arrabbiata and Puttanesca. Common ingredients are chili, garlic, basil, olives and cheese.

- Ready-to-eat meals – Producers of chilled and frozen foods are big users of tomato purée and paste. Ready-made meals (chilled or frozen) show an annual growth of 1.2% in Western Europe, and 0.8% in Eastern Europe. The pizza industry has an annual growth of 1.3% in Western Europe and 3.3% in Eastern Europe. The ready-to-eat soup industry shows an annual growth of 0.2% in Western Europe, and 1.5% in Eastern Europe. Tomato purée and paste suppliers should target those market segments.

Figure 12: Cirio tomato purée and paste packed in 3x 200 g

Source: smoothie-app via Open Food Facts, under the Creative Commons Attribution-ShareAlike 3.0 Unported license

Tips:

- Read Tomato News articles to be better informed about tomato-processing trends shaping the European and global markets.

- Make a realistic business plan with the aim to pay at least a living wage, not only to your employees (including seasonal workers) but also to tomato farmers. Participating in social audits like SMETA or BSCI is the recommended first step in this process.

- Read more about sustainable tomato processing in Europe on the EU-funded Tomato Sauce Project website.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research