Entering the European market for dried figs

European buyers need safe, traceable dried figs that meet strict requirements. Successful suppliers use HACCP systems and hold GFSI-recognised certificates. Specialised importers and packers are still the best entry route into retail and industry. Competition is intense. Türkiye is the largest exporter, while European origins and new suppliers are becoming more popular. Prices depend on Türkiye’s harvest size and quality, so good management of risk and contracts is very important.

Contents of this page

1. What requirements and certifications must dried figs comply with to be allowed on the European market?

General requirements that apply can be found in our study about buyer requirements on the European processed fruit and vegetable market. The document below mainly applies to dried fig imports.

In this study, the term ‘Europe’ refers to the 27 European Union (EU) states, the United Kingdom (UK) and the European Free Trade Association (EFTA) countries. ‘Developing countries’ refers to nations on the OECD-DAC 2025 list of aid recipients.

What are mandatory requirements?

All dried figs sold in Europe need to be safe. They have to follow the law and regulations.

Import tariffs and customs

The EU’s usual external import tariff for dried figs (HS 0804.20.90) is 8%. However, some developing countries benefit from lower rates under trade schemes. Türkiye, Afghanistan, Morocco and Albania benefit from a 0% import duty. Iranian exporters have to pay the 8% import duty. The current tariff levels on dried figs can be found on the European Commission’s Access2Markets website.

Switzerland (part of EFTA) and the UK apply their own import duties. They sometimes offer better rates to certain developing countries.

Phytosanitary certificate and plant health

Dried figs are a plant product. This means that European plant health law applies. The EU requires a phytosanitary certificate for most fruit that comes into the EU. This document is given out by the plant health authority in the exporting country. It shows that dried fig shipments are inspected and free from harmful pests and diseases.

The certificate is not a free pass for goods to enter Europe. Inspectors will verify the certificate at the European border. They sometimes inspect shipments for any insects or signs of plant disease. The shipment can be quarantined or rejected if live pests are found.

Food safety and contaminants

European food safety legislation is strict. All dried fig products need to be safe for consumption. The EU’s General Food Law (Regulation EC 178/2002) requires food products to be fully traceable. This means you need to keep records of where your figs come from and who you sell them to.

Dried fig exporters also need to implement a food safety management system based on Hazard Analysis and Critical Control Points (HACCP) principles in their processing plants. This is part of the EU food hygiene regulation (EC) No 852/2004.

Contaminant limits must be respected. Mycotoxins are a large problem in dried figs. Mycotoxins are toxins that come from moulds. The EU sets maximum allowed levels for aflatoxins in food. For dried figs, the limit for aflatoxin B1 is 6 µg/kg. The sum of all aflatoxins (B1 + B2 + G1 + G2) is 10 µg/kg. Another mycotoxin, ochratoxin A (OTA), is also monitored. A limit of 8 µg/kg OTA has applied to dried figs since January 2023.

Dried fig exporters must also respect limits on heavy metals, like lead. Dried fruits have a lead limit of 0.1 mg/kg under EU rules. Separately, Regulation (EC) No 1333/2008 sets limits on sulphites (E220-228) if they are used as preservatives. The permitted maximum level in dried figs is 2,000 mg/kg.

Pesticide residues need to be below the European Maximum Residue Levels (MRLs). The MRLs are set by Regulation (EC) No 396/2005. Many fig producers use minimal pesticides. However, if you have to use them, combine them with Integrated Pest Management techniques.

More than 400 dried fig notifications were reported to the European Rapid Alert System for Food and Feed (RASFF) between 2020 and 2024. Almost all notifications were related to mycotoxins.

Border controls and import checks

Dried figs go through a European border control post on arrival. Officials carry out document and identity checks at these posts. Sometimes they also perform physical checks. This includes sampling for laboratory testing. Dried figs from certain countries need to go through increased controls due to problems in the past.

Commission Implementing Regulation (EU) 2023/174, from 2023, increased the frequency of identity and physical checks to be performed on dried fig imports from Türkiye from 20% to 30%. In June 2024, Commission Implementing Regulation (EU) 2024/1662 lowered the frequency of checks on dried figs from Türkiye back to 20%.

Product quality standards

European countries do not impose a specific size grading or a quality classification for dried figs. However, dried fig buyers expect industry standards. International norms can help you. The United Nations Economic Commission for Europe (UNECE) standard for dried figs is widely used as a reference point.

The standard sets out basic quality requirements for dried figs, such as limiting the moisture content to 26% for untreated dried figs. High moisture figs can have a moisture content above 26% and up to 40%. Figs are harvested at very high moisture levels, around 79.5 g/100 g. This leads to quality loss and makes the final product spoilable.

The UNECE standard also seperates dried figs into classes: Extra Class, Class I and Class II. Each have criteria for their appearance, size and defects. Extra Class figs need to be uniform in size and colour and mostly free from defects. There are usually about 65 fruits per kg. Class I allows small defects and up to 120 figs per kg. Class II can have more defects and are smaller. See Table 1 for more details.

Table 1: Quality tolerances for dried figs (expressed as % of defective produce, by number or weight)

| Extra | Class I | Class II | |

|---|---|---|---|

| a. Defects allowed | 10 | 15 | 30 |

| of which no more than | |||

| Damaged by pests | 9 | 12 | 15 |

| Seriously damaged by sunscald, split or torn, excessively dried | 8 | 10 | 20 |

| Mouldy and fermented | 3 | 4 | 5 |

| Living pests | 0 | 0 | 0 |

| b. Size tolerances | |||

| For produce not conforming to the size indicated in total | 20 | 20 | 20 |

| c. Tolerances for other defects | |||

| Foreign matter, loose stems, eye (ostiolum) and dust (by weight) | 0.5 | 0.5 | 0.5 |

Source: Autentika Global, UNECE, 2025

Labelling

Proper labelling is necessary. For retail-packaged dried figs, you need to follow the EU Food Information to Consumers Regulation (EU) No. 1169/2011. This means the package label needs to display at least:

- Product name (‘Dried Figs’);

- Net weight (in metric units, like 500 g);

- Lot number or traceability code;

- Best before date;

- Name and address of the European importer or packer;

- Country of origin of the figs.

European Regulation (EU) 2023/2429 requires you to show the origin for dried fruits, nuts, dried figs and dried grapes. This applies to packaged products and products sold loose. Products also need to show the country of origin on their labels. This regulation came into effect on 1 January 2025.

You should also list any ingredients or additives. Pure dried figs normally have no extra ingredients. If you use coating (for example, rice flour to prevent sticking) or preservatives, these need to be in the ingredients list. Allergens need to be highlighted.

Some traditional fig products have protected names. Examples include ‘Kimi fig’ from Evia (Greece), which has a Protected Designation of Origin (PDO), and ‘Royal Markopoulo figs’, which are a Protected Geographical Indication (PGI) in the EU. You cannot label your figs with names like these unless they come from those regions and are certified under that scheme.

Packaging and handling

There are no product-specific packaging laws for dried figs apart from general food packaging rules. Following food contact regulations is mandatory. The EU’s Framework Regulation (EC) 1935/2004 on food contact materials states that packaging materials cannot transfer harmful substances to the food they contain.

Dried figs for export are usually bulk packed in corrugated cardboard cartons lined with polyethylene inner bags. The inner liner should be made of food-grade plastic. Cartons are used for better protection. Make sure the packaging is sturdy enough for long transit and changes in humidity.

What additional requirements and certifications do buyers often have?

Besides legal requirements, many European buyers and retailers have their own rules and preferences.

Food safety certification (private schemes)

European buyers often impose their own quality and safety standards. In practice, this means they ask for third-party certification for your operations. The main certification standards in the European dried figs market are the ones recognised by the Global Food Safety Initiative (GFSI). The Brand Reputation Compliance Global Standard for Food Safety (BRCGS) and the International Featured Standard (IFS) are both common.

UK retailers usually require BRCGS certification, as it was developed in Britain. German and French retailers may prefer IFS certification. Both BRCGS and IFS address similar aspects (for example, factory conditions, HACCP and traceability). In practice, some buyers require a specific scheme. It is wise to obtain the one your target market expects. FSSC 22000 is also a GFSI approved certification. You should also be ready for unannounced audits or inspections by buyers or third parties.

Quality management and traceability

Buyers may look at your overall quality management. Being ISO 9001 certified can help, although it is less important than food safety certifications. Showing that you have strong internal quality control processes can help you get bigger contracts.

Be prepared for buyers to ask to test your traceability procedures. They may ask you to simulate a recall and show that you can trace all dry figs from a given lot back to the farmers. Make sure you can do this quickly. EU law requires trace-back and trace-forward (to buyers) results within 24 hours.

Social and ethical standards

More and more European buyers want to see proof that their dried fig suppliers respect social compliance standards. This is still not mandatory for importing dried figs. However, buyers may still ask your company to undergo an ethical audit like Sedex Members Ethical Trade Audit (SMETA) or Business Social Compliance Initiative (BSCI). These audits check working conditions, wages, health and safety and environmental aspects in your operation.

European importers provide checklists of issues they want checked. Or, they might not want an audit but ask if you are Sedex registered instead. Sedex is an online platform where you can share your audit reports with customers.

What are the requirements for niche markets?

Selling to niche markets often means following extra rules like organic production or religion-based food rules.

Organic niche

Organic dried figs can fetch a higher price. They can also be offered in specialty organic shops and health food segments. To sell dried figs as organic in the EU, you need to fully comply with the EU Organic Regulation. Figs need to be grown without synthetic pesticides or fertilisers. You also need to make sure that every step (growing, drying, processing) is certified by an accredited organic certifier.

Figure 1: Organic dried figs sold by Germany’s dm-drogerie markt

Source: Autentika Global

If you work with many small farmers, there is a provision for group certification for smallholders under the new organic regulation. Make sure the EU approves your chosen organic certifier for your country. An electronic Certificate of Inspection (COI) needs to be issued through the EU’s TRACES system by your certifier.

UK importers may ask for a GB Organic Certificate issued by a UK-accredited body like Soil Association or OF&G. In Switzerland, organic products need to meet the Bio Suisse standard if they want to use the Bio Suisse label. Bio Suisse requirements are stricter than EU organic rules in some respects.

Fair trade and ethical niches

Europe has consumers and firms that care about Fairtrade principles. If your fig supply involves small farmers or a cooperative, think about whether Fairtrade International certification could add value. Fairtrade certification means fig farmers receive a minimum price and a premium for community projects.

In Switzerland, you can sell Fairtrade organic figs through Claro or Gebana. Some fig producers may look at Fair for Life or other similar fair trade schemes that are more flexible or have different requirements.

In addition to formal certifications, European buyers may be interested in your Corporate Social Responsibility (CSR) initiatives. If your company supports fig farmers with interest-free loans or if you employ local women and provide childcare, mention these in your marketing.

Niche cultural and dietary markets

Europe has high Muslim populations in France, Germany and the UK. Dried figs are often naturally halal, but you may need a halal certificate from an accredited Islamic centre to meet buyer requirements.

Europe also has Jewish populations, especially in France, the UK and Belgium. Getting kosher certification from a rabbinical authority can help you sell to kosher stores. Figs, like many dried fruits, can attract insects, which is an issue in kosher law as bugs are not kosher.

Figure 2: Vegan and organic ‘bliss balls’ made with dried figs and nuts

Source: Autentika Global

Gluten-free food and veganism are also important trends. Dried figs fit into these trends.

Tips:

- Use the My Trade Assistant module on the Access2Markets website to check the level of import duties on products you want to export to the EU. For exports to the UK, use the UK government’s Integrated Online Tariff tool.

- Test your product extensively through a certified lab before exporting. Use proper sorting, cleaning and storage to remove any contaminated figs.

- Follow advice in the Codex Alimentarius code of practice for the prevention and reduction of aflatoxin contamination in dried figs. You should also consult the code of hygienic practice for dried fruits.

- Follow the buyer’s packing instructions carefully. Goods are usually palletised on EUR pallets (120x80 cm) unless the buyer asks otherwise.

- Be ready to share documentation: certificates, audit reports, lab test results and even references from other buyers.

2. Through which channels can you get dried figs onto the European market?

European buyers of dried figs can be split into two main groups based on end use: the food industry and direct consumer markets. Most dried fig exports to Europe are in bulk packaging, typically 10–12.5 kg cartons. Industry sources estimate that around 80–85% of the trade volume is bulk. The remaining 15-20% of volume exported to Europe is packed in consumer-ready formats. These formats include trays, pouches and flow packs.

How is the end-market segmented?

In Europe, dried figs are used as snacks and ingredients in the food processing industry. Approximately 60% of total dried fig imports are re-packed and sold as snacks through the retail channel. The remaining 40% are used as industrial ingredients, according to industry sources. The food service market is small.

The retail consumer segment looks for attractive appearance and taste. Figs need to be properly graded by size and colour. Fruit skins need to be intact and have minimal defects.

The industry segment also uses lower grades (including broken or small figs) for paste and dicing. Appearance is less important in this case, but food safety and consistent sugar and moisture levels are essential.

Figure 3: End-market segments for dried figs in Europe

Source: Autentika Global

Direct consumption (snack segment)

Dried fig consumption rises during the Christmas season. Sales include retail products like snack packs of whole dried figs, mixed dried fruit packs and figs for baking. Consumer interest in healthy, natural snacks boosts sales in this segment.

Retail includes the mainstream and premium sub-segments. Mainstream dried figs are standard-grade products sold at affordable prices in supermarkets. These are often sold under private labels.

Premium dried figs are intended for a higher-end market. These figs are larger and visually attractive, often the Lerida-style layered figs or extra-grade fruits. They can include organic and specialty varieties. They are often sold by gourmet and organic retailers at higher prices. Brands like Rapunzel in Germany and Crazy Jack in the UK specialise in organic dried fruit. Dried figs in novel presentations are popular around Christmas. They are sometimes hand-wrapped or included in special seasonal snack boxes.

Ingredient segment (food processing segment)

The food processing industry uses Europe’s dried fig imports in products like baked goods, bars, confections and dairy. Food manufacturers value dried figs for their natural sweetness and texture.

Figure 4: Breakfast muesli with dried figs

Source: Autentika Global

Buyers in this segment demand consistent quality, large volumes, year-round deliveries and strict compliance with food safety.

Tips:

- Build relationships with ingredient importers that supply bakers and cereal makers. They often look for suppliers that will be reliable in the long term.

- Invest in product presentation and organic certification to get into higher-end markets.

- Search the specialised trade fair Fi Europe exhibitor list to find potential buyers in the food ingredient segment.

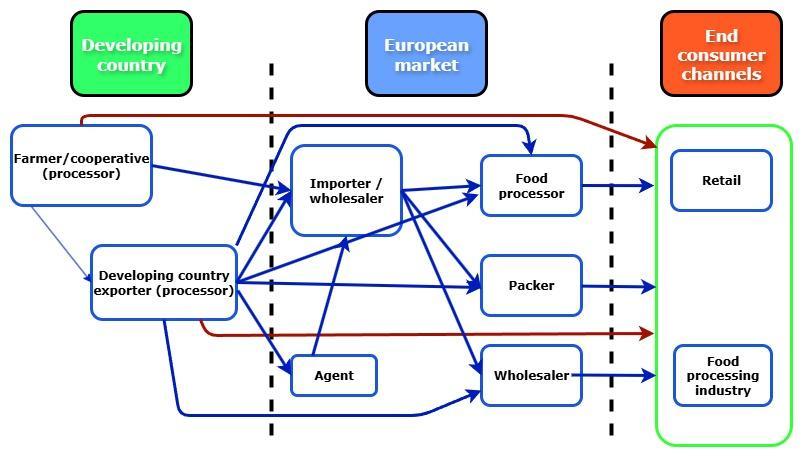

Through which channels does a product end up on the end-market?

Most developing-country exporters ship their dried figs to specialised importers or wholesalers. These companies supply the different end-use channels.

Figure 5: European market channels for dried figs

Source: Autentika Global

Importer/wholesaler

Specialised importers can help you deal with customs clearance and quality controls. They also often act as intermediaries that break bulk shipments into forms needed by different buyers. Some are active as packers and processors, helping to sort and repack dried figs. They can also help process them into diced figs and paste for industry. Importers are usually experts in EU regulations and market preferences.

Dried fig importers include Germany’s Horst Walberg Trockenfrucht Import (HOWA), Zieler & Co., Heinrich Brüning and Herbert Kluth. Dried fig importers based in other countries include UK-based J.O. Sims and Voicevale, Denmark’s Berrifine, France’s Brousse Vergez and the Dutch Tovano.

Packer

More dried fruit is repacked for retail in Europe than the industry uses directly. Packers are companies that take bulk dried figs and pack them into consumer-ready packaging, with weights from 200 g to 1 kg. They then distribute the packed products. Many importers have developed their in-house packing capabilities. In practice, this means that they become importer-packers. So, there is overlap between these two roles.

Whitworths in the UK imports dried figs, but it also packs them under its own brand and for retailers. Germany’s Seeberger imports and sells premium packed nuts and fruit. Italy’s Noberasco handles the import, processing and branding of dried figs. Packers add value by sorting the figs based on their quality.

Agent/broker

Some importers act as agents or brokers. This means that they connect foreign suppliers with big European clients and charge commission. Examples of dried fig agents in European markets include Kenkko (the UK), Specialty Brokers (Germany), Cardassilaris Family (Greece) and Connect (Italy).

Food processors

Another major channel is direct supplies to Europe’s food manufacturers. Large European food companies that use dried figs need reliable bulk suppliers. Big manufacturers sometimes engage in direct import if they need large volumes or specific varieties. One example is France-based Andros that makes fig jam or the UK’s confectionary industry giant, McVitie’s, which makes fig rolls.

Retail

Large retail groups sometimes go around importers for certain products. This happens more often if they have internal importing units or are part of a sourcing partnership.

E-commerce is an up and coming direct channel. Some exporters look into selling through Amazon or online specialty retailers in Europe. European online shops like KoRo (Germany) and Farmy (Switzerland) offer imported dried fruits. They sometimes source directly from producers.

Tips:

- Search the members list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM) to find buyers from different channels and segments.

- Monitor developments in the snack market by visiting the European Snack Association’s news section.

- Use agents or brokers wisely. In some cases, hiring a European sales agent can help you find buyers in different channels

What is the most interesting channel for you?

Specialised importers for dried fruits or dried fruits and nuts are the best channel into the European market. These specialised importers are often also packers for certain European markets. They are often involved in trading and have detailed knowledge about market supply and demand. Sometimes they already have contracts with buyers.

Importers usually attract supply from many growers and exporters. This means that even small producers can reach large European buyers. You do not have to aim for a big supermarket like Carrefour or Tesco directly. Instead, you can supply an importer like Germany’s Scheuer Import. These importers often supply many different retailers.

3. What competition do you face on the European dried figs market?

European buyers import tens of thousands of tonnes of dried figs every year. As an exporter, you need to understand how your direct competitors work.

Which countries are you competing with?

Most figs come from a few key origins. Türkiye dominates supply, followed by far smaller volumes from within Europe itself, Iran and Albania. In 2023, the EU bought about 35,900 tonnes of Turkish figs. This is around 95% of all its fig imports that year.

The growth rates in the graph below are shown as the compound annual growth rate (CAGR).

Source: Autentika Global, ITC, 2025

Türkiye: Europe’s leading supplier

Türkiye is the world’s largest dried fig supplier. Turkish dried figs are the industry standard in Europe. The country produces over 60% of the global dried fig supply, including the famous Sarılop (Calimyrna/Smyrna) variety grown in the Aydın region of western Türkiye.

Turkish exporters offer large and consistent volumes and a range of grades. The industry is well organised, with established exporters and quality control schemes. Türkiye’s Ministry of Agriculture enforces a strict food codex for figs. Contaminated figs are removed from the market. Over 1,500 tonnes of aflatoxin-affected figs have been destroyed and used for energy in recent years.

Aydın accounts for about 80% of Türkiye’s fig production. This makes supply vulnerable to weather and climate issues. In mid-2025, for example, Aydın experienced a heatwave of 42–44°C after a period of drought. This raised concerns about stress on fig trees. Climate extremes, as well as occasional frosts, have led to smaller harvests.

Figure 7: Turkish premium dried figs

Source: Autentika Global

Turkish dried fig output fell to about 60,000 tonnes in 2024/2025, the lowest level in many years. Lower harvests have pushed export prices up sharply. European importers faced record prices in 2024. Turkish figs reached around €10 per kilo, much higher than the €3–4 per kg of a few years ago.

The share of Türkiye’s dried fig exports going to Europe has dropped from about 52% to 39% over the past decade. Some Turkish exporters have stopped exporting to Europe to avoid costly rejections at the border and product recalls. Some other markets are less demanding about aflatoxin testing and less thorough with rejections at the border.

European import statistics show that Türkiye’s share of Europe’s dried fig imports fell in volume from about 72% in 2020 to 64% in 2024. European importers bought only 26,000 tonnes from Türkiye in 2024. This was down from almost 34,500 tonnes in 2021.

Türkiye’s exports to Europe fell by 4.4% per year between 2020 and 2024. The immediate causes were the smaller harvest and quality rejections. Another factor is Türkiye’s strategy to develop other markets. Turkish suppliers have aggressively expanded into North America, the Middle East and East Asia. This change in strategy has opened a window for competitors to supply more to Europe.

The Aegean Exporters Association forecasts a 17% increase in 2025/2026 production, depending on good weather conditions during fruit development. This was reported in the July 2025 issue of NutFruit, published by the International Nut & Dried Fruit Council (INC).

Europe: a significant producer and competitor

Large volumes of dried figs are also produced and re-exported within Europe. Several Mediterranean countries grow dried figs, especially Spain, Greece and Italy. Their combined supply has become much more important. In 2024, around one third (34.4%) of the dried figs available in Europe came from European countries. This is up from about one quarter (26.6%) in 2020.

European importers bought 14,135 tonnes of dried figs from European suppliers in 2024. The annual growth rate between 2020 and 2024 was 5.1%.

Spain is the largest European dried figs producer. It harvested around 12,000 tonnes in 2024/2025, according to the July 2025 issue of NutFruit. Greek dried fig production in the same season amounted to 2,600 tonnes, while Italian production was 2,500 tonnes. Spanish production will probably rise to 13,200 tonnes in 2025/2026, while Greece is expected to produce 5,800 tonnes. Italy is expected to produce 5,000 tonnes in the new season, if the weather is favourable.

Spanish fig production is concentrated in Extremadura. One famous fig variety is the Calabacita/Pajarero fig. It is dried for both domestic use and export. One of Greece’s most famous varieties is Kalamata figs. These are often flattened and dried in rings. Italy has a smaller but growing output, thanks to new fig orchards in Calabria and Puglia. These countries have a long tradition of fig cultivation.

European origin also means easier compliance with EU food standards and no import tariffs or customs hurdles in the single market. European packers sometimes highlight that their figs are grown and processed according to EU regulations.

One of the biggest weaknesses of European suppliers is the limited volume that they can provide. European producers cannot compete with Türkiye in terms of quantity. European figs are usually more expensive, too.

Iran: a major global supplier with a small role in Europe

Iran is the world’s second largest producer of dried figs. It produced 35,000 tonnes in 2024/25. Iran’s production is expected to fall to 32,500 tonnes in 2025/2026, according to the July 2025 issue of NutFruit.

Iran’s role in Europe’s dried fig market is limited. Western companies and countries often do not want to work with Iran because of on and off economic sanctions against the country. Iran is an important player in the global dried figs market, but it is mostly active as a supplier for China, Arab countries and Russia.

Most Iranian figs are grown in the south of the country, especially in Estahban in the Fars Province. Iranian dried figs are naturally sun-dried on the tree. The Estahban Rainfed Fig Orchards Heritage System has been recognised as a Globally Important Agricultural Heritage System (GIAHS) by the Food and Agriculture Organization of the United Nations (FAO).

Iranian officials have said that many new fig orchards have been planted in the last few years. This could double Iran’s fig output within the next decade.

Iranian dried figs are generally cheaper than Turkish figs. Recent price comparisons show Iranian Grade AAA figs trade at around $5.1 (USD) per kg FOB and lower grades under $5. Turkish figs were around $8–9 per kg FOB. The highest grade (AAA or 101 grade in Iran) consists of very light-coloured, sweet, large figs.

This lower price is a combination of several factors. These include Iran’s currency depreciation, lower production costs and because Iranian figs cannot get the same price premium as Turkish figs. Iranian figs are mostly smaller than Turkish Lerida types. These smaller figs may be more suitable for fig paste production.

Europe’s direct imports from Iran increased in 2024. Europe only imported about 66 tonnes from Iran in 2023, but this went up to roughly 247 tonnes in 2024. This suggests some European traders have started testing Iranian figs as a supplement.

Albania: an emerging supplier

Albania is a small but growing supplier of dried figs to Europe. The average growth rate of exports to Europe amounted to 21.3% between 2020 and 2024. However, this is calculated from a low base of 98 tonnes in 2020. Albania is now close to overtaking Iran as a dried fig supplier to Europe.

Albania has several advantages, such as being a candidate country for EU membership. The country is also located very close to the EU market. It shares the Adriatic coast with Greece and is located close to Italy. This means Albanian exporters can ship figs to Western Europe overland in a matter of days. So, freight costs are lower and transit times are shorter than those of more distant suppliers.

Albanian figs are mostly produced in the southern coastal areas of the country, where the climate is Mediterranean. Albania’s fig production methods are often traditional and almost organic. Many fig trees in Albania are not heavily treated with chemicals. Some figs are even harvested wild from untended trees in rural areas.

Tips:

- Focus on quality, volumes and compliance if you want to compete with Turkish suppliers. They have economies of scale and strong relationships with buyers in Europe. It is hard to beat Türkiye on volume or price, but you may be able to compete in niche segments.

- Check the import tariffs for your product using the My Trade Assistant for goods tool on the Access2Markets website.

- Check if your country is on the EU’s GSP list. The GSP helps developing countries by reducing or removing tariffs on their exports to the EU.

Which companies are you competing with?

Turkish and European dried fig suppliers are important in the European market. They often set standards and prices.

Turkish companies

TARİŞ is the common name for four cooperative unions, which started operating in the 1910s. They were first created for fig and raisin products. Tariş Fig Union works with thousands of growers. It runs the world’s largest fig processing facility in Aydın, which is 60,000 m² and can process 15,000 tonnes per year.

Kırlıoğlu Figs is an important family-owned firm in Aydın. It grew from farming its own orchards to operating a 51,000 m² modern factory. The company meets European standards with certified hygienic processing. BATA Food (Bardakçı Tarım) is a Turkish dried fig exporter that is known for quality management and logistics. It operates a BRC-certified fig factory in Izmir and keeps stock in Rotterdam, so it can serve European clients quickly.

Çevik Gıda is a family-run fig specialist from Aydın with three generations of expertise. Its strength is product innovation. In addition to traditional dried figs, Çevik produces fig seed oil, fig delights and chocolate-coated figs.

KFC Gida offers a wide range of dried fig products, including organic, Lerida and Garland dried figs, diced figs, fig paste and pulled figs. The company publishes its sustainability reports and offers organic, quality and other certified figs.

Gülmaş Food is a Turkish dried fruit wholesaler that has over 70 years of experience. The company offers Lerida, Protoben, Pulled, Garland, Bağlama, Makaroni and Layer dried fig products. Other companies include Alimpex, Nurer Incir, Donger Gida, Torosular, Güven Ticaret and Gabay Fig.

European companies

Higos El Pajarero is a Spanish family company dedicated to high-quality dried fig production. It has been active for almost 50 years. It started out quite small (20 tonnes/year) but has now grown to 1,600 tonnes thanks to its quality. Pajarero controls much of its supply chain. It has its own fig orchards in Extremadura and is partnered with local farmers.

Sykiki is a Greek agricultural cooperative that specialises in dried figs and fig paste. The business was founded in 1953 in Kalamata. The cooperative runs a modern packing facility. It produces the renowned Tsapela Kalamata string figs. Agapiou Figs on Evia island produces Taxiarchis dried figs and other value-added products, including Sykomaida fig paste and stuffed figs.

Rango is an Italian dried fig producer from Calabria. It targets the premium dried fig market. The company’s image is artisanal and authentic. It presents its figs as a gourmet, all-natural product.

Iranian companies

Kourosh is part of one of Iran’s largest food industry groups. It is one of the largest exporters of Iranian dried figs. Kourosh benefits from economies of scale in terms of sourcing and distribution. Its strength lies in strong logistics and wide network.

Armani Food says it is Iran’s largest dried fruit exporter. The company is a large exporter of dried figs. It offers dried figs in many grades and forms. It also offers oven-dried fruit in whole, sliced, granulated and powdered forms. The company says it directs 10% of its profits to orphans.

Datik Holding is another large exporter of premium Iranian figs, dates and nuts. It has over 30 years of experience. It focuses on organic production and high quality. Nutex is based in Iran’s Fars province and is a major producer and exporter of dried figs. Other exporters and suppliers include Chamak Group and Pariz Nuts.

Albanian companies

Rinaldi LTD is an exporter of fresh and dried fruits, including dried figs. The company offers a wide range of fruits grown by Albanian farmers. Roland 2012 is another major fresh and dried fruit exporter. It also supplies dried figs (fiq të thatë).

A&V Sakaj is a smaller dried fig exporter that focuses on fruits from traditional organic farms in Albania. Based in Fier, a region known for dried figs, it promotes natural farming methods and traceability. Denis Manko is an Albanian fresh and dried fruit supplier that offers dried figs.

Tip:

- Diversification can be an advantage. If you export dried figs, consider offering complementary products.

Which products are you competing with?

In Europe, dried figs directly compete with fresh figs. Dates compete with figs as snacks and in their use as a natural binder in bars and baking. Prunes can also replace figs for health-led snacking and functional bakery. Dried fruits and raisins are also competitors.

Tip:

- Highlight the unique benefits and origin story of premium dried figs. For inspiration and ideas, look at the website of Italy’s Santomiele. It is a century old family company. It offers a range of premium dried fig products based on the prized ‘Dottato’ cultivar. Read more about Santomiele's story in this report.

4. What are the prices of dried figs on the European market?

European dried fig prices very much depend on supplier prices in Türkiye. Poor harvests in Türkiye have significant effects on European prices.

Table 2 below shows a rough indication of margins in the value chain. Keep in mind that different origins have different duties and shipping costs.

Table 2: Sample structure of the retail price of dried figs (250 g branded pouch of dried figs)

| Components | Description | Dried figs in 250g pouch | |

|---|---|---|---|

| % of shelf price | € per pouch | ||

| Farmer/raw figs | Fig fruit | 20% | €0.50 |

| Processor/exporter | Processing, packing and exporter margin | 20% | €0.50 |

| Transport and import costs | Freight, insurance, import duty | 11% | €0.275 |

| Importer/distributor | Importer’s margin and handling | 11% | €0.275 |

| Retailer | Retail margin and overhead | 31.5% | €0.78 |

| VAT (7% on food) | Value added tax | 6.5% | € 0.16 |

| TOTAL | 100% | € 2.50 | |

Source: Autentika Global, 2025

Tips:

- Consult prices on the Aydin commodity exchange. It provides weekly, monthly and annual prices for dried figs. Search for ‘Kuri Incir’ in Turkish.

- Follow average monthly wholesale prices of dried figs in France through the agriculture ministry’s RNM network.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research