Entering the European market for almonds

To sell almonds in Europe, you must prove food safety, quality and sustainability. Test every lot for aflatoxins, pesticides and microbes. You must also label allergens clearly and follow European Union (EU) packaging, traceability and sustainability requests. Buyers expect GFSI food safety certificates and quality that is in line with international standards. Pasteurisation is raising production costs. The main competitors are California (USA), Spain and Australia.

Contents of this page

1. Which requirements and certifications must almonds meet to be allowed on the European market?

All food products sold in Europe, including almonds, must be tested for safety. Along with providing proof of compliance with European food safety regulations, there is an increasing demand for sustainably processed almonds. This chapter underlines the most important almond market requirements, but for a general overview, read the CBI study on buyer requirements for processed fruit and vegetables.

What are the mandatory requirements?

To export almonds to Europe, obey strict limits on pathogens, pesticides, mycotoxins and other contaminants. Aflatoxins cause the most border rejections. Make sure to monitor and lab test every lot before export. Your label must clearly warn that almonds can trigger allergies. Buyers also demand proven quality, recognised food safety certificates and evidence of sustainable farming. New EU Due Diligence and Corporate sustainability reporting directives hold every supplier accountable for social-environmental standards.

Make your own checklist to assess contamination risks along the supply chain

You should regularly check the European Commission Regulation, which is frequently updated, to see the maximum levels for specific contaminants.

These are the most important contaminants to check for:

- Aflatoxin levels: The main reason for EU border rejections. Legal limits are 8 µg/kg for aflatoxin B1 and 10 µg/kg for total aflatoxins. The Rapid Alert System for Food and Feed informed about 17 cases of high aflatoxins in 2024. The root causes are sometimes kernels damaged by insects where mould develops, though much more often the cause is stockpiling almonds with high moisture for too long.

- Microbiological contaminants: The European regulation on microbiological criteria for foodstuffs sets the limits for pathogenic micro-organisms, their toxins and metabolites. To prevent contamination, pasteurisation of almonds is frequently done and is even obligatory in the USA.

- Process contaminants: If almonds are roasted, it is important to control temperature and use food-grade oils to avoid contamination with acrylamide, polycyclic aromatic hydrocarbons, 3-MCPD and glycidyl esters. Ethylene oxide as a fumigant is banned in the EU.

- Hydrocyanic acid: The maximum allowed limit is 35 mg/kg. The maximum level does not apply to bitter almonds sold in small quantities where the warning ‘Only to be used for cooking and baking. Do not consume raw!’ is clearly visible.

- Pesticide residues: The EU regularly publishes a list of approved pesticides that are authorised for use, and sets the maximum residue levels (MRLs). Since almond kernels are doubly protected by hull and shell, pesticides are usually not a reason for concern. Some buyers may request MRL test results.

- Packaging contaminants: Plastic materials must be in line with the European Regulation on Plastic Food Contact Materials. Special attention should be paid to the levels of bisphenol A and phthalates.

Check the levels of mineral oil hydrocarbons

Mineral oil saturated hydrocarbons (MOSH) and mineral oil aromatic hydrocarbons (MOAH) are contaminants that can harm human health. Although official limits have not yet been set, they are expected soon. The proposed maximum MOAH level for almonds is 2 mg/kg. Germany has already set a benchmark level of 4 mg/kg, which is regularly checked.

Follow labelling rules

The bulk label should use coding for each lot. Labelling should indicate the product name, country of origin, style, lot code, net weight and shelf life. Allergen warnings need to be visible on bulk packaging. More details can be provided in the accompanying bulk packaging documents.

For retail packaging, product labelling must comply with the European Union Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and the minimum font size for mandatory information. Retail packaging must be labelled in a language easily understood by consumers in the European target country.

Tips:

- Focus on insect control, fast drying below 6%, cool storage and lot-by-lot aflatoxin testing. Prevention in the orchard is cheaper than trying to ‘clean’ aflatoxin after harvest.

- Use aflatoxin rapid test kits to quickly inspect almonds on a daily basis (e.g. Romer Labs, R-Biopharm, Neogen, Vicam, Charm Sciences).

- Read more about the transport and storage conditions for almonds on the websites of the Transport Information Service and Cargo Handbook.

Comply with the legislative requirements on sustainability

Some of the most relevant European laws and legislation related to environmental and social sustainability are incorporated in the European Green Deal (EGD). These are the most relevant specific legislations for almonds:

- Organic food regulation (all organic operators must implement changes before October 2025);

- Sustainability labelling of food products (under discussion);

- Corporate Sustainability Due Diligence Directive (in force);

- Packaging and packaging waste (from January 2030);

- Corporate sustainability reporting (from 2027 for the fiscal year 2026 for listed SMEs, and voluntary for non-listed SMEs);

- The EU Forced Labour Regulation (in force from December 2024);

- Empowering consumers for the green transition directive (in force, but to be applied from September 2026).

What additional requirements and certifications do buyers often have?

In addition to the mandatory requirements, food safety, quality and sustainability standards have become equally important.

Meet specific quality characteristics

Since January 2025, the EU started to officially implement the marketing standards regulation for dried fruit and nuts. The label must state the single country of origin. This was an important update compared to previous legislation versions where it was sufficient to write ‘EU’ or ‘Non-EU’ as the origin.

The basic standard for almonds are the United Nations Economic Commission for Europe (UNECE) standards (for kernels, blanched kernels and in-shell almonds). In addition to UNECE standards, traders in Europe accept the United States’ Standard for Grades of Shelled Almonds, although Europeans often use different grading parameters.

Some of the major quality indicators are:

- Defect tolerances – Limits for quality defects include foreign matter and shell fragments; other cultivars; rancid and damaged kernels; chipped, bitter or undersized kernels. Some quality defects differ per cultivar and cannot be unified. These include percentage of doubles (two kernels developing in one shell), split, broken and in pieces.

- Class – Based on defect tolerance, almonds can be classified into 3 classes as ‘Extra’, ‘Class 1’ or ‘Class 2’. Another widely accepted method is the US classification system of 7 classes (‘Fancy’, ‘Extra No 1’, ‘Extra No 1 Supreme’, ‘Select Sheller Run’, ‘Standard Sheller Run’, ‘Whole and Broken’ and ‘Pieces’).

- Size – European almond packers prefer to use the system that expresses a maximum diameter of the equatorial section of the almond kernel in mm (like 17-18 mm for the largest size). Those size numbers can be expressed differently in Italy or France, where numbers show the length of kernel (for example, 38-40 corresponds with 17-18 mm). The US system uses the number of kernels within 1 ounce (28.35g).

- Moisture – Should be ≤6%, but some European buyers may request ≤5%.

- Chemical parameters – The most important are free fatty acid (measures hydrolysis) and the peroxide value (measures oxidation). Together, these two parameters show proof of ‘freshness’ and the absence of rancidity.

- Organoleptic characteristics – Colour, taste, aroma and texture, which can vary by cultivar.

- Pasteurisation status – Pasteurisation efficiency is expressed as ‘log reduction’. For example, a 4-log Salmonella reduction means a 4 zero (10000) reduction. In practice, this means that if 10000 colony-forming units (CFU) were present in 1g of almonds before treatment, no more than 1 CFU may remain afterwards.

Offer safe and aseptic packaging

The largest quantities of almonds in Europe are imported and traded in bulk packaging. Import of retail-packed almonds is not common. Common packaging includes low-density polyethylene liners that are placed in cardboard boxes. The preferred size in Europe is 25 kg, but 50 lb (22.68 kg) is still accepted, due to the packaging equipment used in California. Typically, 60–64 cartons are placed on 1 Euro-pallet.

Get food safety certified

Most established European importers will refuse to work with you unless some type of food safety certification is provided. In addition to certification, serious buyers will usually visit or audit your production facilities before buying.

Most European buyers will ask for a Global Food Safety Initiative (GFSI)-recognised certification. For almonds, the most popular certification programmes recognised by GFSI are the following:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000).

Invest in sustainability

There is an increasing demand for sustainably-sourced food in Europe. To help consumers make more ecological choices, labelling systems are being introduced, such as Eco-Score, Eco Impact, Planet-score and enviroscore. Along with the requirements related to environmental impact, there is increasing demand for a more transparent and fair supply chain.

One way to show that you take care of farmers and workers is to become certified with standards such as Fairtrade, Fair for Life or Rainforest Alliance. Most European buyers will appreciate proof of social audit, such as SMETA (by Sedex) or BSCI (by amfori).

Tips:

- List the laboratory test method for each quality parameter of your almond specification. For example, if you claim that moisture is maximum 5%, either explain which type of moisture analyser you use or which laboratory method (such as ISO 665/hot-air oven). That gives your buyer the possibility to re-check with the same method, which will speed up claims resolution.

- Read CBI’s tips to go green and tips to become a socially responsible supplier to become familiar with growing market requests on sustainability.

- Read the CBI study on trends in the European processed fruit and vegetables market for an overview of developments regarding sustainability initiatives in the European market.

What are the requirements for niche markets?

Consider organic certification

To market almond kernels as organic in Europe, almond trees must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can place the European Union’s organic logo on the packaging, as well as the logo of the standard holder, for example L’agriculture biologique (AB) in France, Bio Suisse in Switzerland or Naturland in Germany.

If you want to produce and export organic almonds to Europe, be aware of important new rules that may impact your business. The new EU organic regulation comes into force in October 2025. This regulation will be accompanied by over 20 secondary acts that regulate in more detail the production, control and trade of organic products. Some of the important acts to be aware of are detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Consider ethnic certification

Islamic (halal) and Jewish dietary laws (kosher) impose specific food restrictions. If you want to focus on Jewish or Islamic ethnic niche markets, consider implementing halal or kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation (by the Alliance for Product Quality in Africa project) to better follow the new rules;

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through which channels can you get almonds on the European market?

Good entry points for almond kernels are specialised importers and wholesale traders. To avoid competition with industry giants from California, Spain and Australia, good channels are specialised niche traders focused on sustainability and organic almonds, or industry users searching for specific cultivars and sensory characteristics.

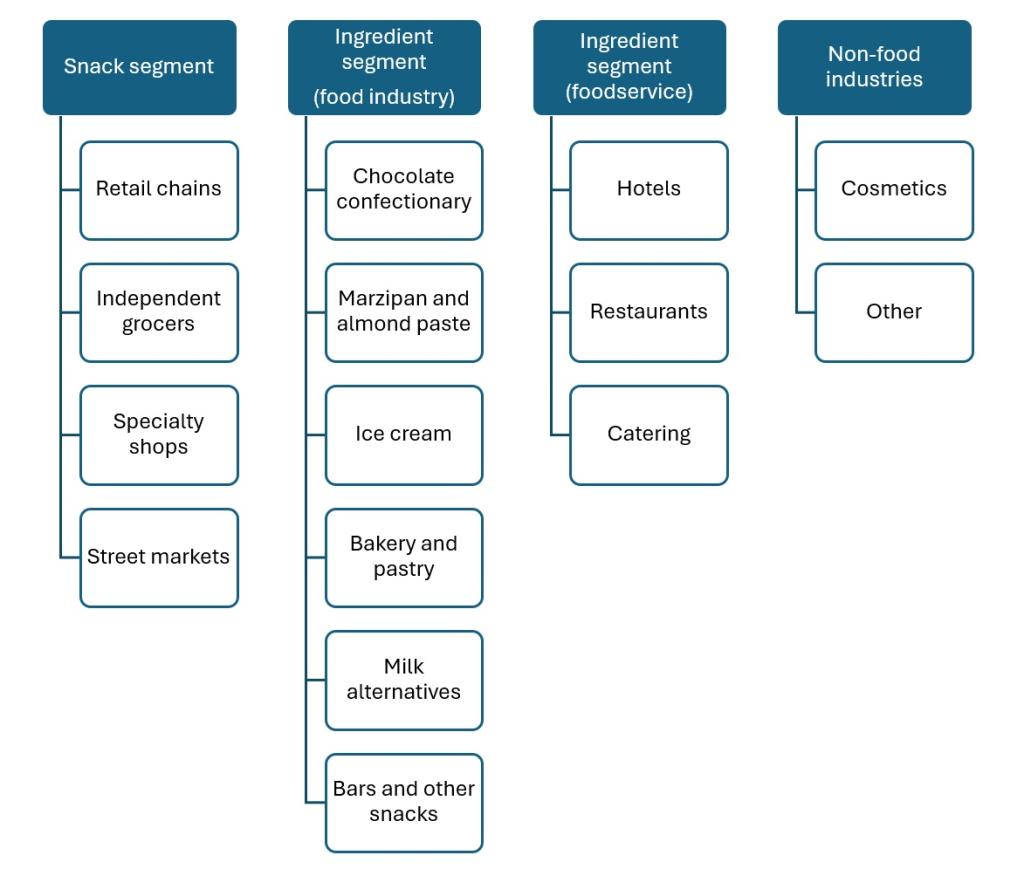

How is the end market segmented?

European almond segments fall broadly into two main categories: almonds sold as snack products (retail) and almonds used as ingredients in food manufacturing and food service. Estimates suggest that the snack/retail segment is slightly larger and accounts for approximately 60% of the market, while the ingredients segment accounts for the remaining 40%.

Figure 1: End-market segments for almonds in Europe

Source: Autentika Global

Retail

Leading European retailers very rarely buy retail-packed almonds directly from non-European origins. There are several main sub-segments (points of sale):

Retail chains – European retail chains are roughly divided into discounters (like Lidl, ALDI, Penny) and supermarkets/hypermarkets (Carrefour, Tesco, EDEKA, REWE, Delhaize, Albert Heijn). Almonds are marketed under retailer brands (private labels) or by specialised snack companies. In 2024, private labels accounted for roughly 40–48% of fast-moving consumer goods sales in countries like Spain, Germany and the Netherlands.

Alongside these, there are established national brands like Seeberger and Farmer’s Snack in Germany, Duyvis (PepsiCo brand) in the Netherlands, Noberasco and Madi Ventura in Italy, and Forest Feast and Whitworths in the United Kingdom. Spain is characterised by a number of different packers, including Importaco, Borges and Frumesa.

The most common are roasted and salted almonds, often sold in pouch packs of 100–200 g. There is also a growing range of flavoured almonds (smoke-seasoned, chili-spiced, wasabi-coated) and candied or chocolate-covered almonds for indulgent snacking. Almonds are frequently included in mixed-nut assortments and trail mixes. Promotional labels often highlight that almonds are high in protein, vitamins and unsaturated fats.

Snack almonds must meet high product standards beyond the basic European food safety rules. Buyers in this segment demand premium appearance and taste, as the nuts are eaten straight from the pack. Roasted almonds need to be crunchy, which means controlling moisture. European roasters typically ensure that almond moisture stays below ~5% to maintain crispiness.

Other retail formats – Independent grocers and fine foods and delicatessen shops are supplied through specialised distributors. There is a special category of organic and health food shops. Leading organic food retail chains include BioMarkt and Alnatura in Germany, Veritas in Spain, Naturasi in Italy and Ekoplaza in the Netherlands. Some European shops sell organic almonds in drugstore chains (for example dm and Rossmann) or in food supplement and variety shops (like Holland & Barrett).

Online retailers – Online trade is often part of the business of regular supermarket chains. Specialised online retailers include Ocado (UK) and KoRo (Germany).

Food industry

The food industry in Europe is a major user of almonds. Food manufacturers use almonds in many forms: whole kernels, diced or sliced pieces, almond flour/meal, paste or butter, and even almond oil.

Chocolate and confectionery manufacturers – Many classic chocolate bars contain whole or chopped almonds. European giants like Lindt (for example Lindt Classic Almond bar), Ferrero (for example Rafaello), Mondelez and Nestlé all use almonds in some products. In the praline and candy sector, chocolate-coated almonds are a common luxury snack.

Bakery, pastry and marzipan – Ground almonds and almond paste form the base of marzipan. In Germany, marzipan production accounts for about 15–16% of almond usage. Major marzipan producers (Niederegger in Germany, Odense in Denmark) favour high-quality almonds for their recipes, such as the Valencia varieties from Spain. However, due to price inflation they often blend California almonds (generally milder and cheaper) with Spanish almonds (stronger flavour).

Almonds are also key in biscuits and pastries. Well-known almond-based products in the European bakery industry include Italian amaretti cookies, French galette des rois (almond frangipane tart), Scandinavian almond tarts and macarons. Large industrial bakeries and ingredient suppliers buy almonds blanched, in slivered or flaked form for decorating baked goods, or as a fine flour for mixing into doughs and fillings.

Ice cream – The ice cream industry uses almond pieces as toppings that are often coated with different sweet syrups before being used on ice cream. To supply this segment, offering pasteurised almonds is extremely important due to the high sensitivity of milk products to pathogen contamination.

Dairy alternatives and plant-based foods – In the past decade, almonds have found a booming new end use as a base for plant-based dairy alternatives. Almond milk was one of the pioneering nut milks and remains among the top dairy alternative drinks. Brands like Alpro (Danone), Provamel, Califia Farms and many supermarket brands produce almond milk in Europe. The trend towards plant-based eating has kept almond demand high, though competition from oats, soy and other bases is increasing.

Protein snacks and energy bars – Almonds are frequently used in energy and cereal bars, often combined with fruits. This is a fast-growing category driven by the demand for healthy, high-protein snacks. Sometimes almond paste is used in this product formulation, especially in high-fat/low-carb products that are suitable for keto diets.

Food service

The food service segment includes all the almonds used by restaurants, hotels, bakery shops and caterers in their daily operations. Chefs use almonds in both savoury and sweet dishes. Finely sliced almonds may garnish salads or curries, almond flour might coat a piece of fish (as in the classic French truite aux amandes), and crushed almonds can top desserts. In bakeries and cafés, almonds go into croissants (especially popular in France), cakes (almond sponge cakes, frangipane fillings) and decorations (toasted flakes on pastries).

Non-food industries

Non-food industries are not the focus of this study, but it is worth mentioning that almond oil is an important ingredient in the cosmetics industry.

Tip:

- Choose your segment and partner strategically. For many SME exporters, the snack segment in Europe is attractive because it is slightly larger and growing, but it is also extremely competitive and dominated by the Californian offer. On the other hand, the ingredient segment offers opportunities for good, flavoured almonds.

Through which channels does a product land on the end market?

Each year, Europe imports roughly 250–300 thousand tonnes of almonds from non-European countries. Europe’s own almond production is limited (under 10% of global output), so import supply chains play a crucial role. The largest volumes of almonds reach Europe through importers that can distribute them further, but sometimes they are imported directly by the final users (packers, roasters, processors) before reaching the end market.

Figure 2: European market channels for almonds

Source: Autentika Global

European importers/wholesalers

The largest volumes of almonds reach the European market through specialised importers that usually trade a wide range of dried fruit and nuts. They play a key role in distributing almonds, importing bulk almonds and supplying food manufacturers and packers. Importers typically operate warehouses for storage and may do basic processing (sorting, pasteurising).

Importers from the leading importing countries include Calconut (Spain), Rhumveld Winter & Konijn (the Netherlands), Bösch Boden Spies (Germany), Besana (Italy), Freeworld Trading (United Kingdom) and Agro Sourcing (France).

Brokers/agents

The traditional role of agents was to match exporters with European buyers for a commission. A broker (like Secoex in Spain or Connect in Italy) helps an SME exporter find customers without taking ownership of the product. However, this role of agents is changing. Now agents also participate in procurements by leading retail chains. They can subcontract services, such as packaging and roasting, and supply end users more directly.

Roasters and packers

Roasters and packers are direct suppliers to supermarkets, usually winning contracts with supermarkets through a competitive procurement process. They usually roast and salt almonds for snacks, but to extend the offer, also invest in other processing equipment, such as for blanching, slicing and grinding. Many packers have packaging equipment of different formats, which enables them to pack almonds of different sizes and materials.

For example, Importaco (Spain) roasts and packs large quantities for Mercadona (the leading retailer) while Seeberger (Germany) packs their own brand of nuts, dried fruit and mixes for many supermarkets. Their role adds value by making almonds ready for final use (improving taste, texture and safety). In addition to retail chains, some European packers and distributors specialise in supplying nuts to smaller retailers or food service clients, like METRO Cash & Carry.

Food industry users

Food manufacturers (chocolate, bakery, cereal and dairy-alternative companies) use almonds as ingredients. They often secure their supply via contracts and demand strict quality and safety certification. For instance, Ferrero (Italy) needs almonds for confections and Danone (through its Alpro brand in Belgium) purchases almonds for almond milk. This ingredient segment accounts for roughly 40% of almond use in Europe, mainly in confectionery and baking.

Still, only very large companies import directly, while the majority of industry users are supplied through importers and specialised wholesalers. Industry users can have a special quality request, such as buying blanched almonds, which are often processed in Europe instead of in the country of origin. The ice cream industry usually requests pasteurised almond pieces.

What is the most interesting channel for you?

For almond exporters from developing countries, these 3 channels are the most attractive for market entry:

- Specialised importers & packers – This is the primary route. Importers and packers are relatively easy to approach and they consolidate demand from many end users. They handle import logistics and already have distribution networks.

- Food industry (ingredient buyers) – This channel can provide potentially better prices by cutting out middlemen. However, these buyers demand lower volumes compared to wholesalers, strict quality, consistent supply capacity, and certifications. Becoming an approved supplier can require significant investment and time.

- Brokers and agents – Using a broker can be a quick way for an SME to find buyers in Europe without extensive market knowledge. The disadvantage is often a lack of commitment, as brokers mostly offer spot deals rather than stable contracts.

Tips:

- Ensure quality and compliance to meet basic buyer requirements. Invest in proper sorting, grading and lab testing (especially for aflatoxins), and obtain relevant certifications.

- To build trust, be dependable and responsive: start with a modest trial order and deliver it as promised. Communicate proactively and adapt to feedback.

3. What competition do you face on the European almond market?

The United States dominates European supply, supported by Blue Diamond and heavy promotion, but faces water use concerns and possible tariffs. Spain, the EU’s top grower, sells flavour-rich ‘Mediterranean’ kernels but has variable yields. Australia ships fresh off-season nuts, while Morocco serves organic niches. Leading firms are Blue Diamond, Dcoop, Select Harvests and Itto Group. Cashews compete in salted snacks, while hazelnuts rival almonds in chocolate products.

Which countries are you competing with?

Around 30% of almonds consumed in Europe is sourced from European producers, and the remaining 70% is imported. The USA is the strongest competitor in the almond supply, with around 50% of all almond exports to Europe. To maintain their leading position, Californian exporters invest a significant amount of money in promotional campaigns in Europe. The main internal European competitor is Spain, which is recognised for its sustainably grown and high-quality almonds.

Source: Autentika Global, Eurostat and ITC Trade Map

A significant share of the almond supply to Europe goes through transit countries like Spain, the Netherlands and Germany. The second-largest external supplier is Australia, followed by Vietnam, Morocco, Chile, Afghanistan and Türkiye. Since Vietnam is not an almond-producing country but a processor, the main external competitors come from the USA, Australia, Morocco and Chile.

Source: Autentika Global, Eurostat and ITC Trade Map, 2025

The United States, leading global almond producer and exporter

The USA dominates global almond production, consistently producing over 70% of the world’s supply. On average, it produces 1.2 million tonnes of almond kernels. Although almonds are also consumed locally, the industry is strongly export-oriented. To support US export marketing activities, the leading almond export cooperative (Blue Diamond Growers) and the Almond Board of California receive $3-5 million in funding each year.

Nearly all US almonds come from California’s Central Valley, where a Mediterranean type of climate and intensive agricultural farming enable huge yields. Currently, Californian farmers grow almonds on more than 560 thousand ha. Nonpareil is the dominant cultivar, followed by Monterey, Independence and others. To maintain high quality in export, pasteurisation is obligatory in the US. Almonds destined for export to Europe are tested for aflatoxins through the Pre-Export certification programme.

After 2 years of slight decline, US exports sharply rose to 716 thousand tonnes in 2024. Spain is the leading target market with a 12% export share, followed by the United Arab Emirates (10%), the Netherlands (8%), Türkiye (8%) and Germany (6%). The European market is traditionally the most important market for Californian exporters, accounting for over 40% of total exports. The fastest export growth is seen in the United Arab Emirates, Türkiye and Morocco. The promotion of almonds to India is also very strong.

American almonds are often seen as the standard for price and availability across snack, baking and confectionery uses. However, this dominance has its drawbacks. California faces water scarcity and stricter sustainability demands. Droughts and high water usage have raised concerns among eco-conscious buyers. Heavy reliance on bee pollination also causes environmental pressure, as bee hives are transported from colder areas to warm California in mid-February.

Tasty Mediterranean almonds, dominated by Spanish supply

Spain is Europe’s largest almond producer, with almonds grown on more than 750 thousand ha and with production fluctuating around 100 thousand tonnes per year. Most almonds are grown across Andalusia, followed by Castilla-La Mancha, Aragón, Valencia and Murcia. Although Spain grows almonds on a larger surface than California, the yield is significantly smaller because many Spanish farms are traditional and rain-fed. 80% of almonds in Spain is grown without irrigation, 15% is irrigated but with deficit irrigation, and only 5% is fully irrigated.

Spanish almonds are flavour-rich and commonly get better prices than Californian almonds. Traditional Guara-type cultivars are the dominant production, but many other cultivars are present, such as Lauranne/Avijor (French-Spanish crosses) or the famous Valencia types. Famous cultivars are Marcona and Largueta, as they are traditionally used in Spanish nougats (turrón) and coating. However, they are grown on relatively small areas compared to other cultivars.

Spanish exports fluctuate, but also show an increasing trend. Exports reached 120 thousand tonnes in 2024. Most almond kernels were exported to Germany with a 22% share, followed by France (21%), Italy (20%), the Netherlands (5%) and Portugal (4%). Impressive growth is seen in Türkiye and Egypt. Since 2020, export has increased sixfold to Türkiye (to 4.2 thousand tonnes) and sevenfold to Egypt (to 2.3 thousand tonnes).

European buyers often perceive Spanish almonds as ‘Mediterranean’ and authentic. In recent years, Spanish growers have planted new high-yield orchards (many with drip irrigation) to increase supply. They are also adopting organic methods more widely and promoting sustainability and European origin. On the weak side, Spanish production is fluctuating more. Also, prices for locally grown almonds are often higher, so mainstream industry buyers may still choose cheaper imports.

Figure 5: Some of the leading almond cultivars in Spain and Portugal

Source: Autentika Global

Italy is Europe’s second-largest almond producer with a production of around 20 thousand tonnes per year. Production is mainly in Sicily and Puglia. Italian varieties (such as Avola from Sicily) are prized for their aroma and are used in confectionery and amaretti cookies.

Portugal is a smaller but fast-growing almond supplier with cultivars similar to Spain’s. New almond orchards are being planted around the Alqueva irrigation project and, due to irrigation, Portugal’s production is set to rise sharply. Spain and Portugal are running the EU almond promotion project (Figure 6).

Figure 6: Sustainable almond project information

Source: Autentika Global

Australia, off-season supplier

Australia has become the second-largest almond exporter globally, with a production of over 100 thousand tonnes. More than half of production is exported. Almond orchards in Australia are concentrated along the Murray River in Victoria, New South Wales and South Australia. Major Australian varieties (Nonpareil, Carmel and Price) are like California’s, and the quality is high.

Australian farmers harvest almonds around February-March, which allows them to ship fresh new-season almonds to Europe when Northern Hemisphere crops are out of season. The country’s almonds are often used when European manufacturers need a supply in late spring and summer. Overall, Europe views Australia as a reliable alternate source, especially valued for off-season supply and high standards.

Australian almond exports have been continuously growing and reached 94 thousand tonnes in 2024. The main market for Australian almonds is China, with a 40% share, followed by Türkiye (12%), Vietnam (10%) and India (6%). From an almost non-existing export, Australia managed to export 5.7 thousand tonnes of almonds to India in 2024. Export marketing activities are supported by the Almond Board of Australia.

Morocco, small but growing

Morocco is a modest but growing almond country of origin in the European market. The major production regions are around Meknès, Fès and Marrakesh. Most Moroccan almonds are grown in rain-fed orchards on hillsides. Yields are lower than in irrigated farms, but some growers are improving their production practices and planting new orchards. Moroccan almonds tend to be sweet and are used in local pastries (like almond paste for sweets).

Morocco’s strength as an exporter is its geographic proximity to Europe. Transit times are short and there are favourable trade ties. Some Moroccan producers target niche markets by highlighting their almonds as naturally grown or even organic (though not all are certified). Export volumes are still very small, fluctuating between 200 and 400 tonnes. In fact, Morocco imports a huge amount of California almonds to satisfy its own demand.

To compete, Morocco is focusing on improving quality and sustainable practices. This could open doors to Europe’s speciality segment. For example, artisan chocolatiers or organic traders might try Moroccan almonds for a point of difference.

Tip:

- Highlight your unique strengths to avoid price competition with global giants. Stress what makes your almonds special – an organic certification, a distinctive local variety, a fair-trade story. Use your origin to your advantage (such as ‘High-altitude almonds with unique flavour’ or ‘Naturally sun-grown with no irrigation’). This helps differentiate your product in a crowded market.

Which companies are you competing with?

In the bulk trade of almond kernels, the principal competitors are Californian companies, the leading among them being the Blue Diamond Growers cooperative. Although they are not the only one in California, their production practices, innovation and investment in export marketing campaigns can be used as good-practice examples for many emerging suppliers.

Blue Diamond Growers

Blue Diamond is the world’s largest almond-processing and marketing company. It is a cooperative owned by thousands of almond growers. Blue Diamond’s strengths lie in its scale and innovation. It has built consumer brands (like Blue Diamond Almond snacks and Almond Breeze milk) while also supplying bulk ingredients. The company is known for its consistent quality. It sets strict grading standards and invests in research for new products and better farming.

Other leading American competitors are Summit Almonds, Harris Family Enterprises and Campos Brothers Farms.

Dcoop – Frutos Secos

Dcoop – Frutos Secos is the nut division of Dcoop, Spain’s biggest agrifood cooperative. It brings together 24 first-tier cooperatives and over 365 almond-growing families, who farm about 10 thousand (mainly irrigated) orchards across Andalusia, Castilla-La Mancha and Murcia. The crop is hulled, shelled and packed in modern plants, like the Villarrubia plant in Córdoba, before being sold to food manufacturers and traders. In the 2023-2024 season, the group marketed about 8 thousand tonnes of almond kernels.

To speed up growth, Dcoop has a strategic alliance with Importaco. This alliance aims to increase joint sales of ‘Mediterranean almonds’ to 12 thousand tonnes per year and raise Dcoop’s production to 20 thousand tonnes by 2027. They are planting high-density orchards and drought-tolerant varieties to reach this target. The cooperative presents itself to buyers as a scalable, fully-traceable alternative to US origins, with strong sustainability credentials and farmer ownership at its core.

Other important competitors from Spain are Unio Nuts, Crisolar and Borges Agricultural & Industrial Nuts.

Select Harvests

Select Harvests is Australia’s leading almond company, managing orchards and a modern processing plant in Victoria. It is a grower-processor that controls the product from farm to export, ensuring traceability. Select Harvests’ strengths are efficiency and diverse offerings. Its facility can sort, blanch, roast and pack almonds to different client requests.

Itto Group

Itto Group (Ain Taoujdate, in the Fès-Meknès region) is generally regarded as Morocco’s biggest integrated almond processor. It runs two modern conditioning/packing stations that handle the crop from its own 3 orchards and from selected partner farms. The ‘Itto Almonds’ business unit handles 2 thousand tonnes of kernels per year, equivalent to about 10% of Morocco’s total almond kernel supply.

Morocco’s almond industry is still modest, compared with Spain or California. For now, the Itto Group provides a genuinely industrial-scale option, while growing companies such as Purnat and others cover the medium and artisan segments. Morocco is expected to boost its supply when new irrigated orchards planted under the Generation Green plan reach full bearing around 2030.

Tip:

- Learn from the leaders, but find your own edge. As a smaller exporter, you can provide personalised service, custom products or niche varieties that set you apart in a positive way.

Which products are you competing with?

European buyers and consumers have many alternatives to almonds. Depending on the end use – snacking, confectionery, bakery, or plant-based beverages – almonds face competition from other nuts, seeds, and even grain products. There are 2 major competing products:

- Cashew nuts – the major competitor to almonds in the salted and roasted market segment. It has a similar price, good taste and a range of applications.

- Hazelnuts – the traditional nut used in chocolate bars.

Tip:

- Target the right segments. Understand where almonds are irreplaceable or very strong, and focus on those markets. By playing to almonds' strengths in each segment, you reduce direct competition with substitutes.

4. What are the prices of almonds on the European market?

The prices of almonds vary from season to season and depend on many factors, such as origin, cultivar and product type (size and style). There is no exact rule, but usually the highest prices are for Spanish almonds. Standard prices to compare are Californian, which influence global price trends depending on Californian harvests.

The price breakdown below is a very rough indication. Many different factors affect production costs, such as season, quality, cultivar, certification and margins. The example is based on the calculation for the supply chain from Californian farmers to the final product sold by European retailers. The example shows prices, but not investment costs and profits – for example, pasteurisation lines for high-volume processing are very expensive.

Table 1: Salted and roasted almond price breakdown

| Export process steps | Type of price | Price breakdown | Almond price per kg (example) |

|---|---|---|---|

| Farm gate price | Raw material price | 28.58% | €4/kg (based on the assumption that kernel equivalent price to farmers in 2024 was $1.6–2.0/lb) |

| Processing costs (washing, crushing, evaporation, packaging, labour) | Production costs | 30% | €4.2 (based on the assumption that processing costs are €0.2/kg) |

| Export price | FOB price (including handling and margin) | 32.14% | €4.5/kg |

| Import, shipping, handling and storing | CIF price (freight, insurance and handling at European ports) | 33.57% | €4.7/kg |

| Importer wholesale price | Wholesale price | 35.71% | €5/kg |

| Secondary processing | Roasting, salting and retail packing | 46.43% | €6.5/kg |

| Wholesale to retailers | Including VAT | 60.71% | €8.5/kg |

| Retail sales | Final retail shelf price | 100% | €14/kg (average price for private-label 100–150 g packaging) |

Tip:

- Monitor almond prices from industry intelligence sources such as Mintec and Stratamarkets.

This study was carried out by Autentika Global on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research