The European market potential for natural ingredients for women’s health

Europe is a large market for natural ingredients in women’s health products, driven by a strong consumer preference for natural products. European countries are among the leading importers of medicinal and aromatic plants, botanical extracts and saps. Germany, France, Italy, Spain, the UK and the Netherlands combine high import volumes with strong supplement industries and the presence of industry players. Opportunities for natural ingredient exporters come from increased research investment, the rise of niche women’s health brands and the popularity of functional herbal infusions.

Contents of this page

- Product description: natural ingredients for women’s health products

- What makes Europe an interesting market for natural ingredients for women’s health?

- Which European countries offer the best opportunities for women’s health ingredients?

- Which trends offer opportunities or pose threats in the European natural ingredients market for women’s health?

1. Product description: natural ingredients for women’s health products

In Europe, a wide range of botanicals are used to support women’s health. Some of the most commonly used botanicals include:

- Black cohosh (Actaea racemosa);

- Chaste tree or monk’s pepper (Vitex agnus-castus);

- Maca (Lepidium meyenii);

- Fenugreek (Trigonella foenum-graecum);

- Red clover (Trifolium pratense);

- Raspberry leaf (Rubus idaeus);

- Dong quai (Angelica sinensis);

- Ginseng (Panax ginseng);

- Shatavari (Asparagus racemosus);

- Evening primrose oil (Oenothera biennis);

- Wild yam (Dioscorea villosa);

- Ashwagandha (Withania somnifera);

- Fennel (Foeniculum vulgare);

- Sage (Salvia officinalis);

- Ginger (Zingiber officinale);

- Nettle leaf (Urtica dioica).

Some of these botanicals have an EU herbal monograph and can sometimes be used in herbal medicinal products, but most can only be used as food supplements.

Women’s health and natural health products

Women’s health usually includes both female-specific conditions and general health issues that may affect women differently or more frequently than men. Examples of these health issues are areas like bone health, digestive health, skin and hair health, stress and anxiety relief, and weight management. In this study, women’s health means a range of health concerns that are specific to the female reproductive system and hormonal life stages. Some examples are menstruation, pregnancy, perimenopause and menopause.

Treatments for female-specific conditions vary depending on their main cause and severity. Some health issues are temporary and happen during specific phases, such as menstrual cramps, premenstrual syndrome (PMS), or discomfort during perimenopause and menopause. Other health issues are chronic and require long-term management, such as endometriosis, infertility or polycystic ovary syndrome.

Treatment depends on the type and severity of the health issue. Some conditions are managed with conventional medicine in consultation with a doctor. But women often turn to natural health solutions for mild problems and to help with discomfort during natural life phases.

In line with changing lifestyles, many consumers choose over-the-counter (OTC) medicines and food supplements. Food supplements are especially popular because they are seen as safer and healthier than synthetic products. Many supplements contain a blend of botanicals, minerals and vitamins. Supplement formats vary from capsules and powders to gummies. For mild discomfort, female consumers often use herbal infusions to relieve symptoms and give them a feeling of well-being.

There are also herbal medicinal products for female-related health issues. But these are less commonly used, and fewer are available to consumers in most European countries. Innovation and product development are also much more limited compared to food supplements because of the extensive regulatory processes in this segment.

Figure 1: Women’s health product examples – food supplements

Source: Holland & Barrett, 2025

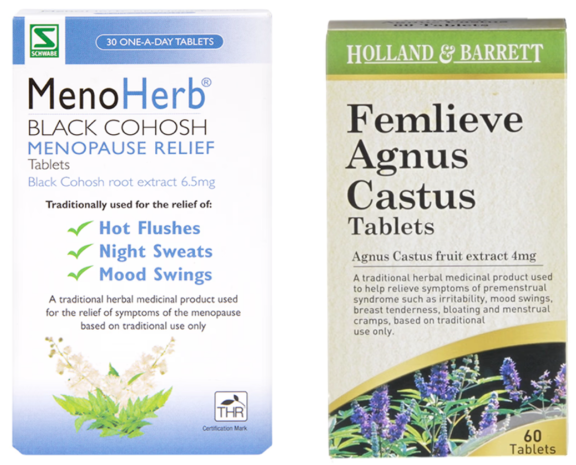

Figure 2: Women’s health product examples – herbal medicine

Source: Holland & Barrett, 2025

Tips:

- Check lists of botanicals that are allowed to be used in food supplements, like the BELFRIT list. This is important because not all botanicals are allowed in food supplements in Europe. You can also check with health authorities and experts to learn what is permitted under EU regulations.

- Check the list of EU monographs to find out whether the plant species you export can be used in medicinal products in the EU. You can also find out what specific therapeutic areas it can be used in. Search the database by using the plant’s botanical name.

- Be careful when making health claims about your products, because these are regulated in the EU. Check the EU Food and Feed Information Portal Database to find out what kind of health claims are allowed for food supplements.

- For more information on research into the health benefits of your specific ingredient and to access scientific resources, visit Examine.

- Read CBI’s factsheets on digestive health, stress and anxiety and immune support to find out more about these specific health areas.

2. What makes Europe an interesting market for natural ingredients for women’s health?

Europe offers a large and growing market for natural ingredients used in women’s health products. Demand is driven by rising awareness of women’s health needs, a strong interest in natural food supplements, and a steady stream of new product launches. Europe is also a leading importer of medicinal and aromatic plants (MAPs) and botanical saps and extracts.

Women’s health products find an important market in Europe

Europe is a growing market for women’s health products. In 2024, it was estimated to be worth US$13.4 billion (€11.5 billion). Supplements are a very large and growing segment in the women’s health market. Their popularity is supported by factors such as convenience and ease of use.

Between 2025 and 2030, the European women’s health market is expected to grow at an average annual rate of 5.1%. Germany, France, Italy and the UK are the leading markets for women’s health products in Europe, and are expected to see continued growth.

Key drivers are rising awareness of women’s health and the lifting of social taboos around topics such as menstruation and menopause. Around the world, 52% of women report being concerned about health issues. Many women are looking for solutions to manage symptoms and support health throughout different life stages. Around 40% of women get medical advice to treat conditions such as PMS and menopause symptoms. Around one-third of these women choose natural remedies.

Women’s health is an innovative market with many new product launches. Western Europe accounts for one-third of new product development in women’s health supplements, followed by North America with 32%. Condition-specific supplements, such as those for menopause, are still the primary focus for innovation. The number of women’s health supplement launches in Europe grew by 19% annually between 2019 and 2023. Sexual health supplements showed the fastest growth, going up by 81%. New product launches targeting menopause relief grew by 21%.

An example of a recently launched innovative botanical ingredient in the European market is Lifenol™, developed by Givaudan. This patented hops extract (Humulus lupulus L.) won the Vitafoods Europe Innovation Award in 2025. Its benefits are supported by gold-standard clinical trials, showing effectiveness in relieving menopausal symptoms such as hot flushes and in supporting bone mineral density.

Europe is a large importer of medicinal and aromatic plants (MAPs)

According to ITC Trade Map data, Europe imported a total of 230,000 tonnes of MAPs in 2024, to a value of €1.5 billion. European import volumes went up by 1.7% on average per year between 2020 and 2024. During the same period, import value increased at an average year-to-year rate of 8.9%.

In 2024, 48% of the value of total European imports came from developing countries, up from 44% in 2020. India, Egypt, China, Morocco and Kenya are some of the largest non-European suppliers of MAPs to Europe.

Europe’s largest importer of MAPs is Germany, which imported nearly 30% of all European MAPs in 2024. After Germany, the largest importers in terms of volume were Spain (11% of the European total), France (9.9%), Italy (7.5%), the UK (7.3%) and Poland (7.3%).

MAPs are used by Europe’s manufacturing industry, which is home to some of the most prominent product and ingredient manufacturers in the global nutraceutical industry. This means that innovation and the development of new botanical-based products are continually advancing.

Source: ITC Trade Map, 2025

Europe is also a major importer of botanical saps and extracts

In 2024, Europe imported a total of 82,000 tonnes of vegetable saps and extracts, according to ITC Trade Map data. European import value reached €1.2 billion, around 35% of global vegetable saps and extracts imports. Between 2020 and 2024, both import value and volume increased by 3.1% per year on average.

The share of imports coming from developing countries has gone up from 34% in 2020 to 44% in 2024. China, India, Vietnam, Madagascar, Mexico and Kenya are some of the largest developing countries supplying saps and extracts to Europe. Suppliers from these countries and other economies outside of Europe compete with a competitive extraction industry in Europe.

When it comes to volume, Europe’s largest importer of saps and extracts is the Netherlands, with around 37% of European imports in 2024. Other large European importers of saps and extracts in 2024 were Germany (11%), Spain (10%), Italy (7.5%), France (6.3%) and Belgium (5.5%).

Source: ITC Trade Map, 2025

Tips:

- Read the CBI study on the demand for natural ingredients for health products on the European market for more trade data on herbal medicinal products and food supplements.

- Visit online sources such as the ITC Trade Map and the EU’s Access2Markets website for more trade statistics on botanicals.

- Check the latest market trends and developments in online magazines such as Nutra Ingredients: Women’s Health, Nutraceuticals World and Vitafoods Insights.

3. Which European countries offer the best opportunities for women’s health ingredients?

Germany, France, Italy, Spain, the UK and the Netherlands are the main European markets for natural ingredient exporters targeting women’s health. These countries are the top importers of MAPs and botanical saps and extracts in the region. Their strong food supplement markets and the presence of industry players also offer interesting opportunities for exporters of natural ingredients used in women’s health products.

Germany

In 2023, over 35 million adult women lived in Germany, including an estimated 9 million experiencing menopause. This means there is a large consumer base for women’s health products. In 2024, 57% of German women reported that they had used food supplements in the past year, compared to 45% of men. The market is responding to this trend by offering a broader range of women’s health products tailored to different life stages, from menstruation to menopause.

Germany has one of Europe’s largest food supplement markets. According to market research by Mintel, the German food supplement market reached an estimated value of €1.8 billion in 2023, following a 4.8% increase compared to 2022. By 2028, the market is expected to reach a value of €2.1 billion, a sales growth of 15%. In 2023, 65% of Germans reported using dietary supplements, a 5% increase compared to 2021. About a third of Germans regularly consume food supplements as part of their daily routine.

Natural and organic health supplements in Germany are more often seen as safer and higher-quality options. According to a survey conducted for Food Supplements Europe, nearly 60% of respondents in Germany thought organic, natural or GMO-free labelling were important when choosing food supplements.

Examples of German brands active in the women’s health supplements segment are nu3 and Nature Love.

Germany is also an important market for herbal medicine. This is offered by pharmacies located in care institutions, such as community health service centres and outpatient clinics. In total, 829 market-authorised or registered herbal medicinal products are available. Germany is home to traditional herbal medicine companies of all sizes, such as Schwabe, Pascoe and Schaper & Brümmer.

Germany is also an important trade partner. It imported nearly 68,000 tonnes of MAPs in 2024, with a value of €448 million. Between 2020 and 2024, import volume went down by 1.3% on average per year, while import value increased by 8.4% over the same period. In volume, the main non-European supplying countries to Germany were India (16%), Egypt (11%), the US (4.5%), Nigeria (3.7%) and Türkiye (2.8%). Examples of large MAPs importers in Germany are Martin Bauer, Kräuter Mix and Galke.

Germany is also a major importer of botanical saps and extracts in Europe. It imported 8,700 tonnes in 2024, with a value of €280 million. Between 2020 and 2024, German imports went up by 4.2% per year in volume and 1.4% in value. Germany imported its largest share of botanical saps and extracts from China, which was 18% of total German imports in 2024. Other large suppliers were the Netherlands (12%), Mexico (10%), France (9.6%) and Spain (9.5%). Besides China, important developing countries included India (6.7%), South Africa (3.2%) and Kenya (2.7%). Examples of German players in the botanical saps and extracts market are AromaPlant, MöllerPharma and Flavex Naturextrakte.

France

In 2025, France’s 21 million women aged 15-64 are an important target group for the European women’s health products market. Women are the most important consumers of food supplements in France: about 57% of users. Women’s health products accounted for an estimated 3.5% of the total market turnover in 2024.

France is home to the third-largest European market for food supplements. In 2024, the French food supplements market was worth €2.9 billion, up 5.7% compared to the year before. The supplements market in France is expected to grow at an average annual rate of 8.1% from 2025 to 2030. The main sales channel for supplements in France is pharmacies, where sales grew by over 8% between 2023 and 2024. Sales of women’s health products in pharmacies reached a value of almost €56 million in 2024, up 9.2% compared to the previous year.

When deciding what to buy, 68% of French consumers look for food supplements labelled as organic, natural or non-GMO. On the French market, 75% of food supplements include at least one plant, and 25% are organic. Overall, the main active ingredients in food supplements are plants (35% of the market), followed by vitamins and minerals (30%).

An example of a French brand that focuses exclusively on women’s health products is MiYé. One of its products, MY Women’s Balance Essentials, contains adaptogenic plants designed to help women manage hormonal variations due to premenstrual syndrome and perimenopause. The formulation includes ashwagandha, rosemary, lemon balm, and vitamins B9, B12 and D.

Apart from food supplements, France is, along with Germany, a leading market for herbal medicine in Europe. A French company offering both supplements and herbal medicine is Arkopharma. In its products targeting women’s health, it uses ingredients such as red clover, sage, evening eye oil and black cohosh.

In terms of trade, France is the third-largest European importer of MAPs as well as saps and extracts. French imports of MAPs reached a value of €131 million in 2024 (23,000 tonnes), up from €97 million in 2020. By volume, the main suppliers in 2024 were Morocco (13%), India (11%), Italy (9.3%), Germany (8.4%) and China (7.1%). Other emerging market suppliers in the top 10 were Egypt (4.0%) and Tunisia (3.0%).

French imports of botanical saps and extracts reached a value of €133 million in 2024 (5,200 tonnes), down from €145 million in 2020. In volume, its main suppliers were neighbouring countries Italy (35% of total French imports) and Spain (11%), followed by Mexico (10%) and China (8.3%). France has a number of companies involved in the processing and trade of MAPs, as well as saps and extracts, such as Nexira and Nateva.

Italy

Italy is home to the largest food supplement market in Europe, worth €4.5 billion in 2023. About 73% of Italians used supplements at least once in 2023. That same year, the population of women aged 18-64 in Italy reached nearly 18 million, making it an interesting consumer base for women’s health products. About 61% of supplement consumers in 2019 were women (no newer data available).

Italy’s women’s health and beauty supplements segment was valued at around US$1.4 billion (€1.2 billion) in 2024. Between 2025 and 2030, the segment is expected to grow by 4.6% per year on average, to a value of US$1.8 billion (€1.5 billion) by 2030. Vitamins are the most popular category, and botanicals are expected to record the fastest growth rate over the forecast period.

An example of a natural supplement brand targeting women’s health in the Italian market is Salugea. Its menopause relief product contains a blend of botanical extracts, including red clover, kudzu, wild yam, dong quai and verbena.

Consumer interest in natural products is high in Italy: 73% of surveyed Italians indicated that organic, natural or GMO-free labelling was important to them when choosing food supplements. This is much higher than the European average of 56%. One of the main trends in the Italian supplement sector is women’s health, especially products supporting gastrointestinal health.

Getting market authorisation for food supplements is much simpler and less expensive than for herbal medicines. This is why most medicinal plants in Italy are marketed as botanical food supplements. But the country is still home to important herbal medicine companies offering women’s health products. For example, Prodeco Pharma created its Donna W brand, a product line specifically developed for women, especially those going through menopause.

Italy has a strong consumer market and is one of the leading importers of MAPs in Europe. In 2024, it imported 17,000 tonnes valued at €104 million, up from 13,000 tonnes worth €78 million in 2020. India was Italy’s largest MAP supplier in 2024, responsible for 15% of total imports, followed by Poland (14%), France (12%), Austria (6.9%) and Germany (5.0%). Besides India, the only two other emerging market economies in the top 10 were Morocco (3.8%) and Türkiye (3.3%).

Italian imports of saps and extracts came to 6,200 tonnes in 2023, worth €140 million. Between 2020 and 2024, Italy’s imports grew at an average annual rate of 7.5% in volume and 10% in value. The country’s main suppliers in 2024 were China (24%), followed by France (14%), India (13%) and Vietnam (8.7%).

Examples of Italian companies trading in MAPs and saps and extracts are A. Minardi & Figli and Carlo Sessa.

United Kingdom (UK)

In 2025, the UK was home to over 22 million women aged 15-64. This made it one of the largest consumer bases for women’s health products in Europe. Women in the UK use more food supplements than men, especially those aimed at supporting skin, hair, hormonal balance, prenatal health and immunity. They also show a stronger preference for preventive wellness routines.

The UK women’s health market was worth an estimated US$2.1 billion (€1.8 billion) in 2024, and is expected to reach a value of US$3.1 billion (€2.6 billion) by 2030. Menopause relief is the fastest-growing segment in the women’s health market over the forecast period. The growing focus on health and rising availability of supplements have driven growing demand. In 2024, the entire supplement market was valued at US$3.1 billion (€2.7 billion). Between 2025 and 2034, the market is expected to grow by 10% per year on average, to a value of US$8.2 billion (€7.0 billion) by 2034. An example of a company in this market is Vitabiotics, which offers a wide range of multivitamins and supplements specifically for women. They use ingredients like fenugreek, ginkgo and ginseng.

Private labels also play an important role in the UK supplement market. For example, wellness retailer Holland & Barrett has successfully developed its own brands, offering a broad range of women’s health products. An example is their Evening Primrose Oil supplement enriched with vitamin B6 and vitamin E, which contribute to the regulation of hormonal activity.

In addition to food supplements, herbal medicine has also found an important market in the UK. Natures Aid’s PremEeze is an example of a traditional herbal medicine made in the UK. It contains chaste tree (Vitex agnus-castus L.) and is used to help relieve premenstrual symptoms such as irritability, mood swings, breast tenderness, bloating and menstrual cramps.

By volume, the UK is the fifth-largest importer of MAPs in Europe. In 2024, imports were nearly 17,000 tonnes, worth €114 million. Between 2020 and 2024, import volume went up by 7.3% per year on average, and the value increased by 14%. The top 3 suppliers by volume in 2024 were India (14%), Spain (12%) and Kenya (11%). Other large suppliers from emerging economies in the top 10 were Egypt (7.7%), Nigeria (5.9%), Türkiye (4.9%) and Morocco (4.6%).

Imports of saps and extracts by the UK amounted to 2,700 tonnes in 2024, worth €66 million. The import value was stable between 2020 and 2024, and import volume went down by 11% per year on average. The UK’s main suppliers in 2024 were China (24%), India (16%), Italy (12%) and the US (8.7%).

An example of a UK trading company using MAPs and extracts is Organic Herb Trading.

Spain

In 2024, over 16 million women aged 15-64 lived in Spain. These women have a wide range of health needs across different life stages, from reproductive health to menopause support. In Spain, women show a stronger preference for supplements than men. Spain’s women’s health and beauty supplements market generated US$806 million in turnover in 2024. Between 2025 and 2030, this segment of the market is expected to grow by 5.6% per year on average, to US$1.1 billion by 2030.

The overall Spanish food supplement market is the fifth-largest in Europe, with a turnover of more than €2 billion in 2024. Between 2023 and 2024, the market grew by 8.6% in value and by 3.1% in volume. Between 2019 and 2024, the average annual growth rate was 6.3%. Pharmacies are the leading sales channel, with 8.6% sales growth between 2023 and 2024.

Vitamins and mineral supplements are the most important category in the supplements market, but supplements with plant extracts are also very popular. Around 59% of respondents in Spain said that organic, natural or GMO-free labelling was important to them when choosing food supplements. This is a little higher than the European average of 56%. An example of a natural supplement brand in the women’s health segment is Woments, whose Menobalance product for menopause support contains ashwagandha and saffron.

Spain is also an important importer of MAPs. In 2024, Spain was Europe’s second-largest importer of MAPs by volume. Total imports were 25,000 tonnes, valued at €100 million. Between 2020 and 2024, import volume showed a slight year-to-year decline of 0.4%, and import value had a growth rate of 3.8%. The main supplying countries to Spain were Morocco (25% of total imports), Egypt (9.4%) and the US (6.3%). Other important emerging market economies were Peru (4.6%) and India (4.1%). Nutris is an example of a company using botanical ingredients. It specialises in nutraceutical ingredients to formulate food supplements as well as sports, infant and medical nutrition.

When it comes to imports of botanical extracts and saps, Spain came third in terms of volume in 2024. It imported a total of 8,600 tonnes, worth €120 million. Between 2020 and 2024, import value grew by 7.7% per year on average, and import volume grew 7.5% per year. Select Botanical is an example of a Spanish importer and manufacturer of botanical extracts.

The Netherlands

With 5.7 million women aged 15-65 in 2024, the Netherlands has a relatively small consumer base compared to other European countries. But supplements are very popular: about 72% of people in the Netherlands over the age of 17 use food supplements to support their health. Women use supplements more often than men (69% vs 44%).

The Dutch food supplement market was valued at €860 million in 2024, up from €775 million in 2023. Consumers spent an average of €80 on supplements. Nearly 2,600 supplements are registered in the Dutch Dietary Supplement Database, with vitamins representing the most popular category.

An example of a brand in the Netherlands exclusively targeting women’s health is Viv Support. Its (Pre) Menopause Support product contains chaste berry, black cohosh, red clover and velvet bean (Mucuna pruriens), and its Pre Menstrual Support supplement combines rose root (Rhodiola rosea), chaste tree and Griffonia simplicifolia.

Herbal medicine consumption is also common in the Netherlands. In 2023, nearly one-third of Dutch consumers used herbal remedies, often alongside conventional medication. A well-known herbal medicine brand in the country is A.Vogel, which cultivates around 70% of its own raw materials and sources the rest from global suppliers. The company offers several products for women’s health, including tablets to relieve menstrual discomfort formulated with yarrow (Achillea millefolium) and raspberry (Rubus idaeus).

The Netherlands is also a European trade centre for natural ingredients. It is home to several companies specialised in importing and distributing health and food ingredients. In 2024, the Netherlands was the largest European importer of saps and extracts by volume, with imports reaching 31,000 tonnes worth €114 million. Between 2020 and 2024, import value grew by 11%. Vietnam was the leading supplier, accounting for 48% of total imports, followed by the Dominican Republic (24%) and Italy (16%).

For MAPs, the Netherlands ranked eighth in Europe in 2024, importing 9,600 tonnes worth €60 million. Kenya was the top supplier (35% of total imports), followed by India (10%) and Germany (10%). Other emerging economy suppliers in the top 10 included Vietnam (2.7%), Egypt (2.6%) and Thailand (2.3%).

Examples of Dutch companies active in the import of MAPs, as well as saps and extracts for the health market, include Health Ingredients Trading and VNK Herbs.

Tips:

- Find out which market offers the best opportunities for your company. You can get market information from sector associations, which you can find on the website of the European Federation of Associations of Health Product Manufacturers, and in the online product portfolios of brands, distributors and retailers.

- Read the members pages of sector associations to find lists of companies involved in the supplement and herbal medicine sector in specific countries. See, for example, the members page of the Spanish Association of Food Supplements or the members list of the British Herbal Medicine Association.

- Read our tips for finding buyers on the European natural ingredients for health products market for information on how to approach European buyers successfully.

4. Which trends offer opportunities or pose threats in the European natural ingredients market for women’s health?

Rising investment in research and innovation is driving the development of products and ingredients in the women’s health segment. Niche brands that focus fully on women’s health are emerging alongside long-standing companies expanding their portfolios. Functional herbal infusions tailored to women’s needs are also becoming more popular, leading to consumers becoming more familiar with certain botanicals. At the same time, the regulatory environment in Europe is becoming stricter. This limits supply and product development opportunities.

Growing research and innovation in women’s health products

Women’s health is a top trend in the European health market. Historically underserved, this segment is now receiving more attention from the industry and researchers. The EU is committed to advancing women’s health through research and innovation. It has invested over €2 billion in more than 1,000 projects focused on women’s health. This has driven progress in medical research, disease prevention and gender-sensitive healthcare solutions. It has also created new opportunities for innovative, evidence-based products and ingredients. One example is Libifem, Gencor’s branded, standardised fenugreek extract. It is clinically proven to support sexual health and relieve menopausal symptoms. An example of a developing country exporter of fenugreek is Herbs Oasis from Egypt.

These developments have also created a better environment for the niche positioning of brands and companies founded with a single focus on women’s health. Examples of these brands in the European market are Health and Her (UK), OVA (UK), Jolly Mama (France) and MiYé (France).

Innovation is also going further than specific reproductive and hormonal health concerns to deal with broader aspects of well-being. Stress management, energy, sleep quality, digestive health and immune support are becoming more integrated into women’s health formulations. For example, MyOva’s Balance supplements include ashwagandha (Withania somnifera) to boost energy and improve mood, and are suitable for women with polycystic ovary syndrome. MiYé’s Serenity Essentials product fights physical and mental fatigue and mood swings, and contains the adaptogenic plants saffron (Crocus sativus), Griffonia simplicifolia and rhodiola (Rhodiola rosea).

New product development is becoming more focused on well-known, multifunctional botanicals like curcumin, turmeric, ginseng, fennel and evening primrose oil. Innovation with new botanicals is limited. In 2025, the Court of Justice of the EU ruled that companies selling supplements containing botanicals cannot make health claims about their products. One exception is if those claims have been approved by the European Commission, based on evaluations by the European Food Safety Authority (EFSA). But a large number of botanicals have been awaiting final evaluation by EFSA for over a decade. Before the court ruling, manufacturers were still allowed to use those ‘on-hold claims’. Because manufacturers cannot use these health claims anymore, they cannot talk about the potential benefits on their labels.

Safety concerns drive scrutiny of botanicals, also for those used in women’s health

Botanical ingredients are constantly under scrutiny by European authorities because of their potential risk to consumers. This limits supply and product development opportunities. Sometimes, this results in the prohibition of certain ingredients in specific markets. For example, Denmark banned the use of ashwagandha (Withania somnifera) in 2023, and food supplements containing Garcinia camboja were banned in France in 2025.

Food products sold on the European market are constantly checked for safety. In 2024, a working group of 26 national food safety agencies across the EU identified 117 botanicals that should not be used or used to a limited extent in food supplements. Of these botanicals, 13 substances were prioritised for possible prohibition or restriction in the future, according to Article 8 procedures under Regulation No. 1925/2006. Among these 13 substances are botanicals commonly used in women’s health products like black cohosh (Actaea racemosa), maca (Lepidium meyenii) and ashwagandha (Withania somnifera).

Amid these developments, the industry is currently awaiting regulatory clarity. Associations like the European Federation of Health Product Manufacturers (EHPM) are urging the EU to strike a balance between precaution and consumer access to botanical products.

Because of these developments, exporters need to be informed about European regulations. They also emphasise the importance of having a complete technical file on your product. The technical file gives detailed information about your ingredient, which will help regulators evaluate its safety and suitability for use in food supplements. It will also show buyers that your product complies with EU requirements, and that it is safe for consumption and of consistent and high quality.

In this context, you need to know that EU legislation is also putting more pressure on European buyers to make sure their supply chains are sustainable. This is why buyers often look for transparent supply chains when selecting product suppliers. For exporters, this means that it is important to have information on production and labour practices and environmental issues. Sustainable certification is a niche segment in the health industry.

The growing niche segment of women’s health botanicals in herbal infusions

Europe is home to a large and growing functional herbal infusion market. This growth is driven by rising health consciousness among consumers. Women are an important target group, because many seek healthy, low-calorie, low-caffeine drinks with potential wellness benefits. Herbal tea consumption is more popular among women than men, with 35% of women consuming it compared to 25% of men.

A growing niche in the functional herbal infusion market is women’s health teas. More and more brands in Europe are offering herbal infusions tailored to women’s health, addressing needs during menstruation, pregnancy, breastfeeding and menopause. Many botanicals are used in these products, and popular ingredients include raspberry leaf, red clover, ginger and turmeric.

The growing availability of herbal infusions that boost women’s health helps to make women more familiar with natural ingredients and their associated health benefits. This boosts demand for these botanicals within the industry. At the same time, it also raises consumer awareness, reduces risk perceptions, and improves the credibility of natural ingredients in the wider health product market.

Examples of women’s health products launched by well-known companies include:

- Pukka’s Womankind blend, which combines chamomile (Matricaria chamomilla), shatavari (Asparagus racemosus), liquorice (Glycyrrhiza glabra), hibiscus (Hibiscus rosa-sinensis) and marigold (Tagetes), among other ingredients;

- Yogi Tea’s Women’s Balance, with raspberry leaves (Rubus idaeus), liquorice, lemon verbena (Aloysia citrodora) and ginger (Zingiber officinale), among other ingredients;

- Twinings’ Menopause Cool Moments, made with lemon balm (Melissa officinalis), sage (Salvia officinalis) and dandelion (Taraxacum officinale), among other ingredients.

Alongside these well-known players, a growing number of companies have built their identity entirely around supporting women’s health through tea or related products. An example is UK-based HotTea Mama, an award-winning tea brand specialising in blends for periods, pregnancy, motherhood and menopause. Its Milk’s Up breastfeeding support tea includes a blend of fennel seeds (Foeniculum vulgare), fenugreek seeds (Trigonella foenum-graecum), aniseed (Pimpinella anisum), lemon verbena and rosemary (Salvia rosmarinus).

Important European markets for herbal teas that combine herbs, flowers and fruits include Germany, Poland, the UK and France. Despite the growing popularity of herbal teas and their role in making ingredients related to women’s health more popular, it is important to know that the claims for botanical ingredients used in herbal teas have not yet been evaluated by the EFSA.

Figure 5: Examples of herbal infusions targeting women’s health

Source: company websites, 2025

Tips:

- Stay informed on regulatory changes in the EU. For example, by following the food supplements page of the EFSA and that of the European Commission.

- Identify and analyse common issues affecting the entry of your ingredients into the European market. Search the EU’s Rapid Alert System for Food and Feed (RASFF) database for examples of withdrawals from the market and the reasons for these withdrawals.

- Find out about local practices in your country around botanicals supporting women’s health. Traditional uses can be a good starting point. For new ingredients, check if there is a history of medicinal use going back at least 30 years (and at least 15 in the EU).

- Do not make medicinal claims about your ingredient in your product documentation or marketing materials if you are targeting the food supplements market. Claims in food supplements can relate only to function (“helps reduce tiredness during menstruation”) and risk reduction. You should also make sure you have the research to prove your claims.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research