The European market potential for frankincense

Europe is a growing market for frankincense, especially as a natural ingredient in health products that target inflammation, joint support and immune function. An ageing population is driving demand, and so is an increased focus on preventive health and a shift towards traceable botanical ingredients. Germany and France are important markets that offer the best opportunities for frankincense exporters. Exporters of frankincense who invest in sustainability and storytelling are in a good position to access this market.

Contents of this page

1. Product description: frankincense

Frankincense is an aromatic resin obtained from the bark of Boswellia trees, which grow in dry, mountainous regions across Africa, the Middle East and India. The resin is released from the bark when it is intentionally tapped and hardens into small globules known as ‘tears’. Frankincense has been used for over 5,000 years in religious rituals, perfumery and traditional medicine, and it still plays a big role in the health and wellness industries today.

Figure 1: Frankincense in resin and oil format

Source: iStock, 2025

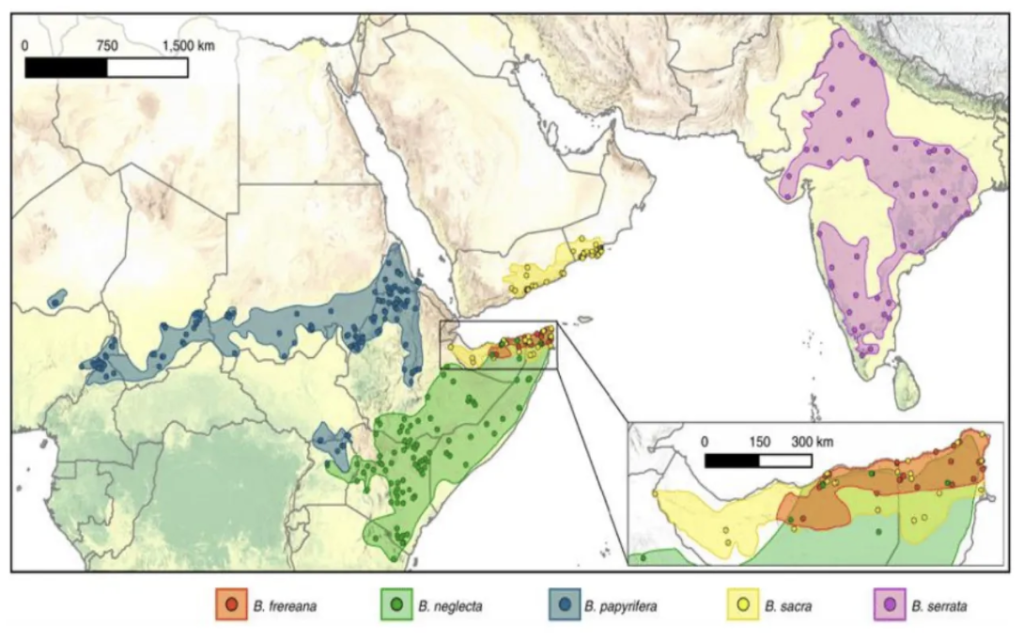

There are several commercially significant Boswellia species. These species are geographically distinct and yield different types of resin, each with its own unique composition, properties and applications. Boswellia serrata is the most valuable for health products in the European market.

Different species of frankincense are primarily sourced from the following regions:

- Boswellia sacra: grows in Oman and Yemen, where it produces high-quality resin traditionally used in spiritual and respiratory applications.

- Boswellia serrata: native to India, and the most widely used species in health supplements because of its high boswellic acid content and extensive use in ayurvedic medicine.

- Boswellia carterii: found in Somalia and East Africa, and a key source of essential oil used in aromatherapy.

- Boswellia frereana: native to Somalia, used more for perfumery and skincare, but contains little to no boswellic acids and is not used in food supplements.

Figure 2: Geographical distribution of various Boswellia trees around the world

Source: Frankincense: Art and Science of Resin, 2025

Each of these species yields resin with varying chemical compositions, aromatic profiles and health applications.

Table 1: Comparison table of the 4 main types of Boswellia

| Characteristic | Boswellia sacra | Boswellia serrata | Boswellia carterii | Boswellia frereana |

|---|---|---|---|---|

| Aroma | Sweet, light, almost floral | Spicy, complex, herbal | Bold, deep, slightly citrusy | Bright, clean, not fruity |

| Main chemical components | High α-pinene (up to 80%) | High α-thujene | α-pinene (30-60%) | Variable α-pinene and α-thujene |

| Oil yield | 9-10% | ~10% | 5-6% | ~2% |

| Main uses | Skincare, respiratory, spiritual | Anti-inflammatory medicine | Aromatherapy, skincare | Perfumery, skincare |

| Unique properties | Considered ‘sacred’ grade | Contains boswellic acids | Softer, more balanced aroma | Lacks boswellic acids |

| Therapeutic benefits | Analgesic, immune support | Joint health, anti-asthmatic | Antimicrobial, expectorant | Calming, skin rejuvenation |

Source: eOil.co.za, 2025

Frankincense contains a complex mix of boswellic acids, monoterpenes, sesquiterpenes and diterpenes, which contribute to its therapeutic effects. The most studied active compounds are acetyl-keto-boswellic acid (AKBA), a natural compound derived from the gum resin of Boswellia serrata trees, and beta-boswellic acid. Both of these compounds have been shown to inhibit inflammatory enzymes and cytokines.

Importantly, frankincense is processed into either an extract (for supplements) or an essential oil (for aromatherapy and cosmetics). These two forms differ in terms of composition, usage and regulation.

Table 2: Frankincense extract versus oil breakdown

| Aspect | Frankincense extract | Frankincense oil |

|---|---|---|

| Extraction method | Solvent (ethanol/CO₂) or water | Steam or hydro-distillation |

| Main active components | Boswellic acids (for example, AKBA, KBA) | Terpenes (for example, α-pinene, limonene) |

| Form | Powder or paste | Volatile liquid oil |

| Used in | Capsules, tablets, functional food | Aromatherapy, skincare, perfumes |

| Stability | Stable in oral use | Sensitive to heat and oxidation |

| EU regulatory path | Food supplement | Cosmetic/aromatherapy (not typically ingestible) |

Source: ProFound, 2025

Applications of frankincense in health products

The best opportunities for frankincense in Europe are in food supplements and herbal health products. These are products intended for internal use, often in the form of:

- Capsules or tablets (standardised to boswellic acid content);

- Joint and mobility support formulas;

- Gut health and inflammation-support supplements.

Scientific research confirms the role of boswellic acids in reducing inflammation by inhibiting inflammatory enzymes (for example, COX-2). These effects make Boswellia a natural alternative to non-steroidal anti-inflammatory drugs (NSAIDs) for arthritis, inflammatory bowel disease (IBD) and other chronic inflammatory conditions.

Meanwhile, frankincense essential oil, primarily from Boswellia carterii, is used topically in combination with other essential oils, or via inhalation. Its benefits include:

- Anti-ageing effects in skincare;

- Antimicrobial protection for wounds and blemishes;

- Stress relief, immune support, and respiratory easing when used in aromatherapy.

Given the scope of this study, we will focus on frankincense as a natural ingredient for health products, specifically in the form of standardised Boswellia extracts used in food supplements.

Figure 3: Examples of Boswellia products on the EU market

Source: ProFound, 2025

Boswellia extracts are featured more and more often in targeted food supplements formulated to address inflammation-related conditions, such as joint pain, menstrual cramps and gut discomfort.

- In France, CycloSoft combines frankincense with magnesium and vitamin B6 to support menstrual comfort and reduce abdominal cramps.

- In Germany, Boscari Weihrauch is marketed as a natural anti-inflammatory for long-term joint, gut and immune system support.

- In the Netherlands and other European markets, products like Swanson’s Boswellia serrata capsules are positioned for joint health and mobility, often highlighting a high boswellic acid content.

These examples reflect Boswellia’s broad consumer appeal. Standardised extracts for oral supplements are still the most relevant and regulated application within the European health products market.

Trade data and product classification

There is no single HS code for frankincense and its derivatives, so trade flows are approximated using 3 related categories that capture its main commercial forms.

Table 3: HS codes used to approximate frankincense trade volumes

| HS code | Description | Product forms covered |

|---|---|---|

| 130190 | Other natural gums, resins, gum-resins and oleoresins | Raw frankincense resin (tears, chunks), unprocessed form |

| 330130 | Resinoids | Distilled, concentrated or solvent-extracted frankincense |

| 121190 | Plants and parts for perfumery, pharmacy or insecticidal use | Frankincense, dried, powdered or in its botanical raw form |

Source: ProFound, 2025

- HS 130190 is the main code for frankincense resin, but also covers similar resins such as myrrh, copal and benzoin. To refine the analysis, this study focuses on exports from key producing countries, such as Somalia, Ethiopia, Sudan, Eritrea, India and Kenya. For these countries, most trade under this code will probably represent frankincense or myrrh.

- HS 330130 captures processed frankincense (for example, resinoids, extracts), helping to track value-added formats and buyer preferences.

- HS 121190 includes medicinal and aromatic plants (MAPs) and serves as a proxy for dried or powdered frankincense traded in health and herbal remedy markets.

2. What makes Europe an interesting market for frankincense?

Europe is an attractive market for frankincense extracts. Reasons include rising import values and volumes for medicinal and aromatic plants, strong and growing consumer interest in natural health remedies, and growing demand for multifunctional supplements.

Rising value of EU imports of medicinal and aromatic plants

MAPs are gaining momentum in Europe as consumers increasingly embrace natural wellness lifestyles. The growing interest in natural wellness remedies creates a supportive market environment for all botanical ingredients. For this reason, processed MAPs are finding a place in functional foods, supplements, cosmetics, aromatherapy and modern pharmaceuticals. The broadening application of MAPs is driving new demand across multiple industries. Higher consumer acceptance also means the market is more open to botanicals in different forms, from whole plants to processed extracts being used for health purposes.

European consumers who embrace herbal wellness are also more likely to trust a botanical extract like frankincense for health applications because of its long-established use in religion. Consumer familiarity creates market opportunities for all levels of botanical processing and product forms. The shift in consumer demand for MAPs is reflected in trade data.

Source: ITC Trade Map, 2025

Between 2020 and 2024, the total value of MAP imports into the EU grew by 43%, from €972 million to nearly €1.39 billion. In contrast, total import volumes stayed largely stable, which signals a clear market shift towards higher-value plant materials. These are plant materials that are better processed, standardised, traceable and often backed by clinical evidence or traditional use recognition. These qualities are especially relevant to ingredients like frankincense, which must be sourced from outside Europe but align well with current consumer values.

Germany and France are the most significant EU importers of MAPs, both in quantity and value. The data below shows rising demand for high-quality botanical extracts in key European markets.

Table 4: Leading MAP importers in the EU and their 2024 import performance

| Country | 2024 import volume (metric tonnes) | % change in volume (2020-2024) | 2024 import value (€) | % change in value (2020-2024) | 2024 % from developing countries |

|---|---|---|---|---|---|

| Germany | 67,854 | -5.1 | 448.4 | 38.2 | 50.3 |

| France | 22,836 | 16.2 | 131.2 | 34.8 | 58.9 |

| Italy | 17,312 | 35.7 | 103.7 | 32.6 | 47.0 |

| Poland | 16,779 | 44.6 | 84.5 | 112.2 | 34.7 |

Source: ITC Trade Map, 2025

At the same time, developing countries supplied nearly 48% of the EU’s total MAP import value in 2024, up from 45% in 2020, and surpassing 52% at one point in 2022. The stabilisation of MAP volumes does not mean there has been a drop in demand for non-European, high-value botanicals. Instead, it shows the evolution of a more sophisticated and value-oriented import market that cares about traceability and sustainability.

Europe leads global demand for herbal and alternative health products

Europe is at the forefront of the global shift towards holistic and preventive healthcare. This trend is reflected in the size of Europe’s complementary and alternative medicine (CAM) market, which was valued at approximately €48.7 billion in 2024. It is also projected to grow at a rapid compound annual growth rate (CAGR) of 23.7%, reaching a value of nearly €409.7 billion by 2034. Europe accounted for over 32% of the global CAM market in 2024. This made it the largest and most dynamic region for plant-based and traditional health solutions.

Several factors are driving this expansion:

- The increasing prevalence of chronic diseases and an ageing population who are looking for non-invasive and long-term solutions.

- A growing focus on stress reduction, immune support and inflammation management, often through self-care routines and supplements.

- The integration of CAM therapies into conventional healthcare systems in countries such as Germany, Austria, France and the Netherlands.

Self-care is another major driver, and consumers more and more often prefer to take control of their health. Statistics support this, as the market for self-care medicine is expected to be worth €69 billion by 2029. Convenience, easy access and cost savings are pushing Europeans towards self-care supplements and herbal remedies. This is especially relevant for frankincense extracts, because they are often used in joint and mobility support supplements. They also have anti-inflammatory effects that are backed by research. This positions them as a natural fit for self-managed wellness among Europe’s ageing population.

Approximately 1.2 billion minor ailments are self-managed across Europe every year. This highlights both the scale of the opportunity and the need for trusted, safe and effective ingredients. The Nordic region and countries like Germany and Poland lead in self-care practices. Cost comparisons show that supplements and natural remedies are not only more affordable but also preferred by health-conscious consumers.

Source: AESGP, Self-Care in Europe Report, 2025

This growth is also visible in national health budgets. In 2022, European countries spent €90.4 billion on preventive healthcare. Germany alone spent €38.4 billion, followed by France (€12.7 billion) and Italy (€10.6 billion). This growing investment in prevention is in line with the growing demand for natural ingredients with functional health benefits.

Table 5: Current spending on preventive healthcare relative to GDP, 2022

| Rank | Country | Spending on preventive healthcare (% of GDP) |

|---|---|---|

| 1 | Germany | 1.0% |

| 2 | Austria | 0.83% |

| 3 | Netherlands | 0.62% |

| 4 | Finland | 0.58% |

| 5 | Italy | 0.53% |

| 6 | France | 0.48% |

| 7 | Czechia | 0.46% |

| 8 | Croatia | 0.45% |

Source: Eurostat, 2025

Ingredients like curcumin (from turmeric) have gained wide popularity in Europe for their anti-inflammatory properties and integration into joint health and digestive supplements. But Boswellia serrata offers similar, and in some cases complementary, benefits. Its active compounds (boswellic acids) have been shown to inhibit inflammatory pathways. That is why they offer relief from arthritis, gut inflammation and even respiratory symptoms.

As more consumers seek effective alternatives to NSAIDs and synthetic anti-inflammatories, Boswellia is in a good position to follow the path of curcumin as a mainstream botanical active in the European supplement market.

The EU offers strong demand for convenient health formats

One of the defining features of the European market for natural health products is the demand for convenient, easy-to-use delivery formats. European consumers lead busy lives and are looking for supplements that fit into their daily routines. This has made products like capsules and soft gels some of the most popular formats for botanical supplements. After all, they offer precise dosing, are easy to carry and require no preparation time.

This convenience trend is very relevant for frankincense, since capsules remain one of the most preferred ingestion methods. They offer consistent dosing, long shelf life, and easy integration into morning or evening routines.

The broader convenience trend goes further than supplements in all food categories. Innova’s consumer trend research indicates that 3 in 5 consumers globally are using convenience foods once a week or more, with 1 in 5 using them more than once a day. A 3% increase in convenience food usage has been observed worldwide. The growth in convenience foods is mainly driven by younger demographics and higher-income groups, reflecting the premium that busy European consumers place on time-saving solutions.

doTERRA’s frankincense capsules show how convenience messaging resonates with busy consumers. The company positions its product as an “all-in-one, easy-to-swallow dose for seamless integration into any wellness routine”. It emphasises that “this wellbeing essential fits effortlessly into your day”.

doTERRA’s communication strategy focuses on 3 key convenience benefits:

- The innovative liquid-based format requires no preparation time;

- The standardised 60% AKBA concentration eliminates guesswork;

- The capsule format allows for portable daily supplementation.

By describing frankincense as deliverable “in the most convenient, powerful way imaginable”, doTERRA addresses time-pressed consumers who want traditional botanical benefits without the hassle of measuring powders.

The messaging highlights traditional ingredients and modern convenience. It talks about frankincense’s centuries-old heritage but also positions capsule formats as the perfect solution for busy consumers. This approach is popular with shoppers who like traditional ingredients and how they can be used in their daily lives.

Tips:

- Focus your marketing efforts on Germany, France, Italy and Poland. These are top MAP importers showing strong value growth, and willingness to pay higher prices for quality botanicals.

- Use frankincense’s familiarity advantage in your marketing materials to create trust with buyers who value ingredients with traditional uses over synthetic alternatives. Unlike newer botanical ingredients, frankincense has a centuries-long history of documented use in European religious and cultural contexts.

- Market your frankincense extract as a complementary or alternative anti-inflammatory ingredient with similar applications. Highlight the clinical evidence for boswellic acids in dealing with arthritis, gut inflammation and respiratory symptoms. This will help buyers identify clear positioning opportunities in existing supplement categories.

3. Which European countries offer the best opportunities for frankincense?

Germany, France and Spain offer the strongest market potential for frankincense extracts and processed formats. Portugal is the largest importer of raw resins. The Netherlands and Poland are fast-growing markets, driven by rising demand for supplements and growing manufacturing industries. Portugal is unusual because it imports gum karaya.

Source: ITC Trade Map, 2025

The table below shows that import volumes and values of HS code 130190, including but not limited to raw frankincense resin (tears and chunks), have grown in volume and value over the last 5 years.

Table 6: Key trade data for natural gums and resins (HS 130190) to selected European countries, 2020-2024

| Country | 2024 import value (€) | % change in value (2022-2024) | 2024 import volume (metric tonnes) | % change in volume (2020-2024) | % value from developing markets |

|---|---|---|---|---|---|

| Portugal | 30,961 | 70.4 | 29,661 | 19.1 | 95.4 |

| Spain | 12,902 | -3.2 | 2,976 | 46.5 | 40.2 |

| Netherlands | 8,566 | 10.8 | 2,574 | -22.2 | 7.4 |

| Germany | 20,919 | 17.2 | 1,862 | -17.8 | 89.4 |

| Poland | 2,556 | 114.4 | 1,059 | 295.1 | 34.5 |

| France | 15,831 | -1.2 | 909 | -56.8 | 62.9 |

Source: ITC Trade Map, 2025

The table below shows that import volumes and values of HS code 330130, including but not limited to distilled, concentrated and solvent-extracted frankincense, have grown in value and volume over the last 5 years. Portugal is not mentioned in Table 7 because of its negligible trade activity.

Table 7: EU imports of resinoids (HS 330130) in 2024 and growth since 2020

| Country | 2024 import volume (metric tonnes) | % change in volume (2020-2024) | 2024 import value (million €) | % change in value (2020-2024) |

|---|---|---|---|---|

| France | 205 | +51.9% | 3,510 | +203.6% |

| Spain | 204 | +580.0% | 0.245 | +63.3% |

| Netherlands | 136 | +123.0% | 0.818 | +39.6% |

| Germany | 39 | +129.4% | 0.544 | +87.6% |

| Poland | 16 | –15.8% | 0.069 | +27.8% |

Source: ITC Trade Map, 2025

Portugal is unusual: it is a high-volume importer of gum karaya from Brazil

Portugal is the largest European importer of natural gums and resins by volume. They imported 29,661 tonnes in 2024, over ten times more than Germany. Between 2020 and 2024, import volumes went up by 19%, while values rose by 71% to €30.9 million. But this trend is an outlier and probably does not reflect the frankincense trade. Over 95% of imports under HS 130190 came from Brazil, a major exporter of gum karaya (from Sterculia urens), which is used as a food additive (E416). A key EU distributor is Willy Benecke GmbH (Germany).

Unlike Germany, France and Spain, Portugal imported virtually no resinoids (HS 330130) in 2024. This suggests a market focused on bulk raw materials, light processing or re-export rather than on formulation of finished products. That is why its high resin intake reflects gum karaya’s food and industrial uses, and not a significant role for frankincense in the Portuguese market.

Spain is a rapidly growing market with rising interest in natural extracts

Spain offers a fast-growing opportunity for exporters of frankincense and related botanical ingredients. The Spanish market has traditionally been less driven by over-the-counter herbal products compared to Northern Europe. But the consumption of food supplements has already reached a sales level of €2 billion, and is expected to grow at an annual rate of 5% over the next 5 years. When asked about choosing food supplements, 59% of Spanish respondents said that organic and natural labelling was important to them. This is higher than the European average of 56%.

This trend is reflected in Spain’s recent trade performance. Imports of natural gums and resins reached 2,976 metric tonnes in 2024, a 46% increase from 2020. Developing countries made up 40% of the total value. The growth in resinoid imports has been especially strong. In 2024, 204 metric tonnes were imported. This was a 580% increase in volume and a 63% rise in value (€245,000) compared to 2020. These shifts suggest a rising demand for processed, concentrated or standardised botanical inputs, including frankincense extracts.

Spain’s growing role as a regional consumer, processor and food-tech hub makes it attractive for exporters that can offer consistent quality, technical data and certification. Although volumes are smaller than in Germany or France, the growth trajectory is strong, especially for processed formats.

Notable market players include:

- Soria Natural: a national leader in plant-based health solutions, including Boswellia capsules.

- IVB Wellness Lab: focuses on joint health formulas combining Boswellia with complementary ingredients.

- FutuNatura: an online retailer offering Boswellia extracts across southern Europe.

- Bidah Chaumel: one of Spain’s most active wholesalers of natural oils, extracts and essences for the food and cosmetics industry.

The Netherlands is a value-added gateway for traceable and processed frankincense ingredients

The Dutch market is smaller in terms of population. But it has a highly engaged supplement consumer base, strong online retail channels, and an established role as a logistics and repackaging hub within the European botanical supply chain. Although raw resin imports fell by 22% in volume between 2020 and 2024, to 2,574 metric tonnes, the trend for processed ingredients tells a different story. Imports of resinoids went up again strongly after a dip in 2022, to 136 metric tonnes in 2024, more than double the 2020 figure. Import values rose by 40%, totalling €818,000, with the majority sourced from developing countries. This pattern reinforces the Netherlands’ role in handling, standardising and re-exporting high-value inputs across Europe.

The Dutch organic market reflects interest in traceable and certified inputs. Dutch organic retail sales grew by 9.6% in 2024, reaching a value of €1.77 billion. The strongest gains were made in speciality organic and health store channels. Nearly 96% of Dutch consumers buy organic occasionally, and in the first half of 2025 organic food sales reached 3.5% of total supermarket food spending, up from 3.2% a year earlier. This upward trend signals growing consumer willingness to pay for verified sustainable products. This is a good sign for certified organic and FairWild frankincense entering both the health and aromatherapy markets.

The Netherlands’ consumer supplement market shows a similar trend. Around 60% of Dutch adults use supplements regularly, and the vitamins and minerals segment alone is expected to reach €195 million in 2025. Although the Netherlands does not have a deep herbal-medicinal tradition like Germany and France, its consumer retail and e-commerce sectors are highly active, dominated by chains such as Kruidvat, Etos and Holland & Barrett.

Notable Dutch players include:

- Dutch Essentials: a manufacturer offering Boswellia capsules for joint health, appealing to natural remedy seekers.

- MyCell® Vitamins: a direct B2C product that offers highly efficient absorption of vitamins and supplements with patented technology.

- De Hekserij: offers a frankincense essential oil made using steam distillation. Although the resin is sourced from Somalia, the oil is processed in France.

- Olie Meesters: Organic essential oil with vegan, organic and GMO-free certification.

Germany is a mature and structured market for traceable botanical ingredients

Germany is one of the most mature and structured markets in Europe for MAPs and botanical ingredients. The country has a strong tradition in phytotherapy, herbal medicine and plant-based functional products. This tradition is supported by a highly regulated natural health sector and a large base of botanical importers, processors and manufacturers.

Importantly, Germany ranks as the second-largest destination for organic imports in the EU. Total organic import volumes increased by 2% in recent years. Data confirms that Germany is still one of Europe’s largest organic markets. It has an estimated value of around €16-17 billion and a rapidly growing supplement sector. German buyers are becoming more focused on wild plants and ethical supply chains. This means that certified wild botanicals, such as frankincense, are especially interesting.

Germany is still a key entry point for exporters of frankincense, especially those offering traceable and value-added products. In 2024, the country imported 67,854 metric tonnes of MAPs, the highest volume in the EU, and spent €448.4 million, up 38% from 2020.

Resin imports were 1,862 metric tonnes in 2024. Although this was a slight decline (-18%) from 2020, 90% of the import value came from developing countries. This highlights Germany’s sourcing ties with traditional producer nations. For processed materials, Germany imported 39 metric tonnes of resinoids in 2024, up 129% in volume and 88% in value (€544,000) compared to 2020. This shows a shift towards higher-quality, standardised extracts. This is a good development for exporters of Boswellia extracts who can offer sound documentation and demonstrate sustainable harvesting practices.

Key German importers include:

- Roeper: offers frankincense in powdered formats sourced from Somalia, Sudan, Ethiopia and India.

- Willy Benecke GmbH: supplies various Boswellia species for pharmaceutical, perfumery and ayurvedic uses.

- Martin Bauer Group: a leading European supplier of plant-based ingredients with a strong footprint in herbal formulations.

Poland is emerging as a hub for natural ingredients and local processing in Eastern Europe

Poland is quickly becoming a hub for natural health ingredients. This is because of its growing consumer market but also as a relocation base for processing and manufacturing. Its cost-effective infrastructure, skilled workforce and EU membership have made it a popular destination for companies shifting production from Western Europe. This is helped by rising consumer interest in plant-based and traditional remedies, often influenced by German herbal practices and monographs.

Poland’s trade data also shows this shift. Between 2020 and 2024, imports of resins grew by 294% in volume (from 268 to 1,059 metric tonnes) and 114% in value (to €2.6 million). At the same time, just 34% of the import value came from developing countries, even though this share has grown in recent years. Resinoid imports remain low (16 metric tonnes in 2024), but sourcing from developing markets more than doubled in value compared to 2020. This suggests early-stage but growing demand for processed and concentrated botanical ingredients.

Overall, openness about regulations in Poland is high, and frankincense faces no special barriers. The market is generally open to new natural ingredients, especially those with a proven track record in Western Europe.

Notable players include:

- Herbapol Kraków: a herbal brand offering Boswellia-based supplements with pharmacy distribution.

- Hepatica: local nutraceutical producer offering Boswellia serrata capsules.

- Swanson: a US brand with broad retail reach in Polish pharmacy chains like DOZ.

- Natural Poland: a major importer and distributor of Boswellia serrata extract, offering standardised powder formats for supplements and pharmaceutical processors.

France is a high-value market for frankincense extracts and botanical innovations

France is a strategically important market for natural health ingredients. It is characterised by strong consumer awareness and a well-regulated system that supports both food supplements and herbal medicinal products. The French food supplements market reached a value of €2.7 billion in 2023, with 78% of consumers making purchasing decisions driven by the concept of naturalness. Consumers are highly engaged in wellness, with 72% believing that food supplements are effective. Top concerns include fatigue (52%), stress (46%) and poor sleep (46%).

France remains a stable and high-value importer of frankincense. In 2024, the country imported €15.8 million worth of resins, with 63% of volume (909 tonnes) coming directly from source countries. Although volume dropped by 57% compared to 2020, the smaller decline in value suggests a shift towards processed forms. France is also the largest European importer of resinoids, with 205 tonnes imported in 2024 (+52% since 2020). These imports were worth over €3.5 million, more than three times the total value of 2020. Much of this growth came from developing countries.

France’s organic market was valued at around €12.2 billion in 2024. Although the amount of land used for organic farming has been reduced somewhat, consumer demand for authentic wild-sourced ingredients remains strong. The country has a deep heritage in aromatherapy, nutricosmetics and phytotherapy. Wild-collected botanicals such as frankincense are highly valued for their purity and natural origin.

FairWild and ethical sourcing trends further reinforce this opportunity. France is home to visible FairWild licensee brands such as Ecoidées and Laboratoires Expanscience, which are already integrating certified wild-sourced botanicals into their product lines. For these buyers, FairWild certification is a storytelling tool and a way to show compliance with EU due diligence and biodiversity frameworks.

Notable companies already working with frankincense include:

- Laboratoire Lescuyer: markets Harpago-Boswellia, combining Boswellia with devil’s claw for joint mobility.

- Arkopharma: offers Arkocaps® Boswellia and various Boswellia-enriched joint complexes, widely distributed through pharmacies.

- Nutrixeal: includes Boswellia in CycloSoft®, a supplement targeting menstrual discomfort through anti-inflammatory activity.

- Vitall+: produces standardised Boswellia capsules, widely available through French online pharmacies like City Pharma.

- HELPAC: offers a certified organic Boswellia serrata essential oil distilled in France, positioned for use in aromatherapy, massage blends and wellness applications.

- Biolandes: supplies an Olibanum (Boswellia carterii) resinoid extract, designed for perfumery and skincare formulations, known for its warm, balsamic fragrance profile.

4. Which trends offer opportunities or pose threats in the European frankincense market?

The future of frankincense in Europe is being shaped by 4 major trends:

- the growing demand for natural joint health solutions among ageing populations;

- increased pressure to ensure traceable and sustainable sourcing;

- potential trade restrictions due to CITES listing;

- innovation in absorption and delivery formats.

Exporters who adapt to these trends by offering traceable and value-added ingredients will be in a better position to access high-value buyers and long-term partnerships.

Europe’s ageing population drives interest in preventive joint health solutions

In January 2023, the EU’s old age dependency ratio – the number of people aged 65+ per 100 working-age adults – reached 33.4%, up from 27.7% in 2013. According to projections, the dependency ratio will continue to rise in the coming decades. Many regions will exceed 60-70% by 2100. Europe’s demographic transformation is leading to increased pressure on healthcare systems, social services and pension schemes.

Governments and consumers alike are turning to preventive approaches that delay chronic conditions and preserve independence. Especially in areas such as mobility, inflammation, joint pain and immune support. This means that there is growing demand for natural ingredients with anti-inflammatory and functional properties.

This is where frankincense plays an increasingly important role. Many products now have Boswellia as a core ingredient in multi-functional formulas targeting mobility and ageing-related discomfort.

- California Gold CurcuminUP: combines frankincense extract with turmeric, ginger and black cumin seed oil to target inflammation, supporting joints and overall vitality.

- Youtheory Joint Collagen + Boswellia: a supplement explicitly positioned to “fight the effects of ageing”, combining collagen with Boswellia to support long-term joint health.

- Thorne Joint Support Nutrients: offers a high-quality formulation that provides relief from “soreness and stiffness”.

Figure 7: Examples of products containing Boswellia for joint strengthening

Source: ProFound, 2025

Since the COVID-19 pandemic, European consumers have become more proactive in managing their own health. In the UK, 70% of consumers reported spending more on preventive medicine in 2024 than they did in 2023. This highlights a shift towards preventive health, to maintain quality of life in old age.

For frankincense exporters, this trend reinforces the value of offering clinically supported, standardised Boswellia extracts in formats that are suitable for older adults, such as soft gels, tablets and easy-to-absorb powders.

Sustainable sourcing, traceability and storytelling

Across Europe, both consumers and importers are demanding greater transparency and sustainability in the sourcing of botanical ingredients such as frankincense. A recent study found that 63% of European consumers want improved visibility in product certification and origin. This puts pressure on brands and, in turn, their suppliers to prove ethical sourcing and environmental responsibility.

Example: Neal's Yard Remedies

One company leading by example is Neal’s Yard Remedies (UK). Through its ‘Project Frankincense’, the company works directly with harvesting communities in Oman to promote non-destructive tapping, protect desert ecosystems and strengthen local livelihoods. While its products are in the cosmetics and aromatherapy sector, the underlying principles of traceability, transparency and sustainability also apply to frankincense used in health products and supplements.

Source: Neal's Yard Remedies

This type of ‘source-to-shelf traceability’ is increasingly expected by European importers, because it helps them align with consumer values, meet regulatory requirements and build stronger brand stories.

Other examples of suppliers tapping into sustainability and traceability trends are:

- Arbor Oils of Africa: a Kenyan essential oil distillery that sources wild frankincense and myrrh resins, and has pioneered non-destructive harvesting techniques. Instead of repeated tapping, collectors gather resin that naturally comes out when long-horn beetle larvae bore under the bark. This minimises stress on Boswellia trees and supports regeneration. Arbor Oils first achieved FairWild certification in 2014-2015, which it renewed in 2022. It now works with around 1,700 wild collectors managing over 60,000 hectares of Boswellia stands under certified sustainable practices. The resin is Organic- and FairWild-certified, giving access to high-value European markets where traceability and verified ethical sourcing are key entry conditions.

- Derman Oil: combines FairWild and EU Organic certifications with a strong ‘tree-to-bottle’ traceability system. Each harvest area is GPS-mapped, collectors are formally registered and trained every year, and every resin batch is assigned a unique lot number for authentication. This ensures purity, traceability and compliance with strict buyer specifications from the start of the supply chain.

- Kobac General Trading: FairWild- and Halal-certified, operates an exclusive collector-contract model that prioritises ecological regeneration cycles and social accountability. By maintaining close relationships with its harvesters, the company can document the provenance of each lot. In this way, they can ensure compliance with FairWild and Organic control systems while supporting stable incomes in rural areas.

Tips:

- Obtain Organic or FairWild certification if you can, or at a minimum, share evidence of sustainable sourcing. Before investing money in getting a new certification, always check demand with potential buyers and consider the certification costs.

- Show your harvesters, landscapes and processes through storytelling and visuals.

- Give importers clear documentation of your social and environmental practices.

Potential CITES listing could disrupt frankincense trade

The Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) is an international agreement between 184 parties. It is aimed at protecting species from overexploitation due to trade. Species listed under CITES are divided into 3 appendices:

Table 8: Overview of CITES appendices

| CITES appendix | Scope |

|---|---|

| Appendix I | No trade allowed except in exceptional circumstances for endangered species |

| Appendix II | Trade allowed with permit (legal acquisition + non-detriment findings) |

| Appendix III | Voluntary listing by individual countries to regulate trade with their help |

Source: ProFound, 2025

A growing policy-level worry for frankincense exporters is the possible inclusion of Boswellia species under CITES Appendix II, which would mean stricter controls on international trade.

At the 2019 CITES COP18 summit, countries agreed to begin compiling data on Boswellia trade and evaluate if one or more species meet the criteria for listing. Most experts think that inclusion in Appendix II will be the most likely outcome. Although a listing may help prevent ecological loss, a study titled Good intentions meet complex realities from Wageningen University highlights that listing all 24 species in one go (each with different ecological and trade contexts) could be too broad of a move, and harmful to sustainable exporters.

Countries like Somalia, Ethiopia and Sudan – where infrastructure and monitoring systems are limited – could find it difficult to comply with CITES permit requirements. This risks trade delays, supply disruptions and livelihood loss for rural resin-harvesting communities.

The Wageningen researchers highlight import-country solutions as more effective and flexible alternatives to a formal listing. These could include measures such as buyer-driven sustainability standards, traceability protocols and voluntary certifications.

Tip:

- For exporters, proactive engagement in traceability, sustainable harvest documentation and partnerships is a key strategy to stay resilient when regulatory changes may happen.

Innovation is driving new uses and applications for frankincense

European health companies are more often focused on ingredient innovation, especially in terms of bioavailability and absorption. Just like turmeric has transformed from raw powder to advanced curcumin extracts and water-soluble formats, frankincense could follow the same path.

A leading example is the Dutch company MyCell® Vitamins, which has developed a liquid frankincense extract using patented MyCell Enhanced® technology. This innovation can increase the bioavailability of Boswellia extract to 99%, compared to the 7-8% typically found in conventional supplements. The result is a product that is up to 20 times more absorbable and works faster and more effectively than standard capsules or tablets.

The frankincense extract can easily be added to a glass of water or juice, offering an easy format for older adults who are sceptical about supplements or consumers who prefer liquid dosing. The product targets inflammation, joint health and immune support, and its delivery system earned the company the CPhi Pharmacy Award in Madrid, a top honour in pharmaceutical innovation.

Tips:

- Highlight your ability to supply premium-grade resins or resinoids with lab testing, consistent quality and standardised boswellic acid content.

- Approach innovative brands and formulators that are looking for traceable raw materials to use in advanced delivery formats.

- Emphasise sustainability, transparency and origin storytelling, which are very attractive to companies marketing premium functional health products in Europe.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research