Entering the European market for frankincense

To enter the European frankincense market, you must comply with strict food safety regulations, provide complete documentation and show sustainable sourcing practices. Success depends on your ability to comply with EU legal requirements. You will need to offer traceable, certified products that match buyer expectations around quality and transparency. Key competitors include India, Ethiopia, Kenya and Oman. Prices for frankincense on the European market vary depending on the product’s origin, certifications and format.

Contents of this page

1. What certification and other requirements must frankincense meet to be allowed on the European market?

Requirements for frankincense depend on what it will be used for. When frankincense is exported as an extract for food supplements, it falls under the scope of European food law. This includes strict regulations on food safety, contaminants and labelling. When sold as an essential oil for aromatherapy use, it is regulated under cosmetics and complementary medicine frameworks rather than food law. Requirements focus on the safe handling of volatile oils, and classification and labelling under the Classification, Labelling and Packaging (CLP) Regulation.

What are the mandatory requirements?

To enter the European market, you must comply with food safety laws. This includes laws related to contaminants and maximum residue limits. Traceability is becoming a prerequisite to trade. If you export essential oils for aromatherapy use, you must ensure proper classification, labelling and packaging. You also need to comply with the Convention on Biological Diversity and the Nagoya Protocol requirements.

Food safety

If you are supplying frankincense for use in food supplements, you must comply with applicable EU food laws and safety regulations. Below is a list of key legal obligations that suppliers of frankincense extracts must comply with:

- EU food supplement legislation, which makes rules for product composition and labelling.

- The European General Food Law (Regulation (EC) 178/2002), which makes sure that all food products placed on the EU market are safe.

- Hazard Analysis and Critical Control Points (HACCP), which sets hygiene rules for processing and handling.

- Regulation (EC) No 1881/2006, which sets maximum levels for contaminants in foodstuffs. Examples are heavy metals such as lead, cadmium and mercury, as well as mycotoxins, nitrates and other environmental contaminants. Products that go over these limits may be rejected at the EU border by customs or food safety authorities and listed in the Rapid Alert System for Food and Feed (RASFF).

- Regulation (EC) No 396/2005, which sets rules for maximum residue levels (MRLs) for pesticides in food. These limits apply both to raw frankincense resin and to final extracts, which may be more concentrated.

- Good Agricultural and Collection Practices (GACP), which are required for the collection of Boswellia resin.

- Good Manufacturing Practices (GMP), which are required for extracts or oleoresins used in finished supplements.

- EU rules on traceability throughout the value chain, under the ‘one step back, one step forward’ principle.

The use of Boswellia serrata oleoresin and Boswellia sacra bark in food supplements is permitted under the BELFRIT list (Belgium, France, Italy). This list is an important reference for botanicals across the EU. But the BELFRIT list does not set maximum levels for boswellic acids. This means that each EU member state can apply its own rules. In practice, this creates some variations.

Frankincense has been studied for its anti-inflammatory impacts. But claims about its therapeutic effects are still classified as ‘pending’ by the European Food Safety Authority (EFSA). To stay compliant, companies often use authorised vitamin and mineral claims in formulations instead of making direct medicinal claims about frankincense.

Tip:

- Check the CBI study on buyer requirements for more information on mandatory and additional requirements for this sector.

Extraction methods for frankincense essential oil

Frankincense essential oil can be obtained from the resin of Boswellia trees using two main methods:

- Steam distillation: the most common method, widely used for commercial production and recognised as the industry standard.

- Hydrodistillation: used when the resin is first ground into powder. Powdered resin can clump together when exposed to heat and steam, blocking the distillation process. To avoid this, the powder is suspended in water and distilled with it. This allows the steam to circulate more effectively, to improve oil recovery.

Both methods are accepted in the European market, but steam distillation is preferred for larger volumes. Hydrodistillation is used where powdered resin is processed.

Classification, labelling and packaging (CLP) requirements for essential oils

The EU CLP Regulation sets rules for the labelling of hazardous chemicals and mixtures. Its relevance is limited to the handling of raw materials in manufacturing. For example, in situations where frankincense oil or resin is supplied in bulk and classified as hazardous. In such cases, CLP labels are required on supply containers in the production chain, but not on finished product packaging for direct-to-consumer (D2C) food supplements.

Although frankincense essential oil is not usually classified as corrosive, its exact CLP classification depends on the oil’s chemical composition, which varies by Boswellia species. Exporters must review the composition of their oils against the European Chemicals Agency (ECHA) database to decide on their hazard status. If a constituent is classified as corrosive or flammable, the relevant pictograms are used. You can check Stoffenmanager’s website for an explanation of each GHS hazard pictogram.

Figure 1: Hazard symbols for frankincense essential oil

Source: ECHA Chem, 2025

When it comes to packaging, industry practices differ depending on the size of the order. For bulk shipments, industry practice when exporting frankincense essential oil is to use stainless steel containers. These containers have a chemically resistant high-density polyethene liner to avoid degradation. For medium volumes of less than 30 kg, aluminium bottles are often used. For smaller retail units, amber glass bottles with PTFE-lined caps are recommended.

Figure 2: Example of containers with HDPE liner and aluminium bottles

Source: EFPackaging, 2025

Figure 3: Example of a smaller container with a PTFE-lined cap for smaller quantities

Source: ProFound, 2025

Cleanliness is also critical, and all packaging must be sterilised or food-safe to avoid contamination. For labelling, all containers, from small bottles to bulk drums, must have a physical label derived directly from the Safety Data Sheet (SDS).

Labels should include:

- Product identification: INCI name, botanical name, CAS/EINECS number;

- Hazard information: classification, pictograms and precautionary statements;

- Physical/chemical data: net weight in metric units, shelf life and flash point if applicable;

- Handling and storage instructions: for example, “store below 25°C, protected from light”;

- Supplier details and batch number: for traceability and compliance.

For flammable oils, the flash point must be explicitly stated. Shelf life and storage instructions are also required to make sure buyers handle the product safely.

Packaging requirements for frankincense resin

If you are exporting frankincense resin to Europe for aromatherapy or processing, you need to be aware that frankincense is highly sensitive to moisture and contamination. Its volatile oils must be preserved to retain aroma and functionality.

Low-density polyethene (LDPE) bags are the most common packaging format for frankincense resin. LDPE is moisture-resistant, and it protects resin from dampness that could degrade its quality. It provides a barrier against dust and contaminants, and an airtight seal helps preserve the volatile oils that define frankincense’s aroma. The bags’ semi-flexibility also allows them to adapt to different resin shapes, preventing leakage.

Figure 4: Example of LDPE packaging for frankincense resin

Source: Nippon Kodo Wholesale, 2025

For bulk shipments, exporters often use multi-layer paper bags lined with polyethene. This packaging combines paper strength with moisture protection, making it suitable for 25-50 kg shipments. The Sudanese supplier Abnaa Sayed Elobied, for example, exports Boswellia papyrifera resin in 25 kg and 50 kg polypropylene/paper bags lined with polyethene.

Documentation

European buyers require their suppliers to provide detailed information about the products they sell and the companies behind them. Some of the most important documents related to frankincense are:

- Safety Data Sheet (SDS): describes frankincense’s physical, health and environmental hazards, along with handling, storage and transport precautions.

- Technical Data Sheet (TDS): a summary of the product’s specifications and key technical properties, such as appearance, processing method and shelf life.

- Certificate of Analysis (CoA): provides lab test results for a batch, confirming quality parameters.

Tip:

- Check the documentation practices of suppliers such as O&3 (UK), who provide a full set of documents, including allergen declarations, INCI details, manufacturing flow charts, IFRA statements and product marketing sheets for their Boswellia carterii essential oil.

CITES and access and benefit-sharing

The Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) is an international agreement between 184 parties. It is designed to protect species from overexploitation. The Species+ database and CITES authorities can be used to determine the status of frankincense species in international trade.

Currently, Boswellia subspecies are listed in Annex D of the EU Wildlife Trade Regulations, meaning trade is monitored but not yet strictly controlled. This lets the EU gather data on volumes and origins, with the option of stricter measures if conservation risks are identified. But a 2022 CITES publication on Boswellia led to an agreement to monitor frankincense trade. A future listing in CITES Appendix II remains possible, which would require export permits and sustainability assessments.

Exporters must also comply with the Nagoya Protocol on Access and Benefit-Sharing (ABS) under the Convention on Biological Diversity (CBD). This requires fair and equitable sharing of benefits with communities when genetic resources or traditional knowledge are used.

Figure 5: Nagoya Protocol and ABS explained simply

Source: Naturvårdsverket, 2018

What additional certification and other requirements do buyers often have?

Apart from legal requirements, more and more European buyers expect frankincense suppliers to demonstrate sustainability, provide transparent documentation, and meet delivery and payment terms.

Sustainability

European buyers of frankincense extracts and essential oils are under more pressure to meet strict sustainability and transparency requirements. This is driven by growing consumer demand for ethically sourced natural ingredients, and by new EU policies such as the European Green Deal and the Corporate Sustainability Due Diligence Directive (CSDDD). Although these regulations do not apply directly to exporters outside the EU, they do have a significant indirect effect.

For frankincense, European buyers prioritise:

- Responsible harvesting, making sure trees are not overexploited and natural regeneration is respected;

- Fair labour conditions for harvesting communities involved in resin collection and initial processing;

- Reduced environmental impact through efficient processing, packaging and transport.

Many European buyers prefer suppliers that have a Corporate Social Responsibility (CSR) policy or similar framework in place. Tools such as the Supplier Ethical Data Exchange (Sedex) can help exporters to demonstrate ethical practices and improve visibility to responsible European buyers.

Large retailers are highlighting responsible sourcing in their product information more often. For example, Tesco markets a frankincense essential oil (Boswellia carterii) sourced from Somalia via a Sedex-registered supplier, underlining sustainable and ethical practices.

Tip:

- Read Neal's Yard Remedies’ article on how it sources organic frankincense via FairWild-certified value chains.

Payment terms

As a frankincense exporter, you need to strike a balance between protecting your business and offering terms that meet buyer expectations. Before agreeing to trade terms, check the reliability of your buyer, the size of the order, your cash flow needs and overall trade risks. The safest option for new relationships is a Letter of Credit (LC), where a bank guarantees payment once the agreed-upon shipping terms are met. Different types of LCs exist, such as irrevocable (most secure), revolving (for repeated orders) and red/green clause (with advance payments). Your bank can advise you on which type suits your needs.

Tip:

- See the CBI study on organising your export of natural ingredients for health products to Europe for more information about the available payment terms in the sector.

Delivery terms

Meeting delivery expectations is very important when doing business with European buyers. Failure to meet agreed terms (whether for timing, volume or cost) can quickly damage or even end a trading relationship. This is why exporters of frankincense must carefully plan logistics and align with buyer priorities.

Table 1: Key factors influencing the choice of freight, and tips for exporters

| Factor | Air freight | Sea freight |

|---|---|---|

| Delivery time | Fastest option, reliable for urgent orders | Slower, often several weeks, depending on the destination |

| Delivery volume | Suitable for small shipments; cost per kg is higher | More economical for large shipments |

| Cost of shipping | Higher overall, especially for bulk goods | 4-6 times cheaper for large volumes |

| Best use case | Small, high-value, urgent shipments | Bulk resin or extract shipments |

Source: ProFound, 2025

Tips:

- Use the Freightos freight calculator to get instant price information for international shipping by sea and air. This will let you make a more informed decision before agreeing on delivery terms with buyers.

- See the CBI study on organising your export of natural ingredients for health products to Europe. This explains the available payment terms used by this sector.

What are the requirements for niche markets?

Niche markets for frankincense are primarily driven by sustainability and ethical sourcing certifications. FairWild is the most prominent standard, and Kosher certification serves a smaller but valuable market segment targeting Jewish communities.

FairWild

FairWild-certified frankincense primarily serves a premium niche market focused on ethical sourcing, sustainability and quality. Buyers in this segment include high-end brands in aromatherapy and perfumery that focus on traceability and environmental responsibility.

The FairWild Standard is built on 3 themes: ecological, socio-cultural and business responsibility, and promises that wild-harvested resources are managed sustainably and fairly throughout the value chain.

FairWild’s 7 principles are especially important for frankincense, because Boswellia trees face overharvesting and community exploitation in parts of the Horn of Africa:

- Conservation of collected species – harvesting rates ensure Boswellia populations remain viable.

- Positive impact on habitats and landscapes – collection avoids damage to fragile dryland ecosystems.

- Respect for human rights – harvesters, often from vulnerable groups, are treated fairly.

- Fair arrangements – collectors are paid fairly and work in safe conditions.

- Recognition of customary rights – local communities keep access and receive benefits.

- Legal compliance – harvest and trade respect national and international law.

- Responsible business practices – exporters maintain traceability, transparency and ethical marketing.

Figure 6: FairWild certification logo

Source: FairWild, 2025

Tips:

- Check the FairWild Standard (v3.0) for requirements and indicators that apply to frankincense exporters.

- Explore the list of FairWild-certified participants, which includes both producers and processors, to understand current market players and identify potential partners or competitors.

Kosher

Kosher certification is required for processed frankincense products (such as essential oils, incense and extracts) that contain additives or are produced in facilities handling non-kosher ingredients. This means this certification offers valuable market access to Jewish communities in Europe and North America.

Tips:

- Look at brands that offer Kosher-certified frankincense or essential oils, like Young Living and Pure Mountain Botanicals, to see how they position themselves in the market. This can help you decide on pricing strategies, target consumer groups, and communication styles relevant to niche Jewish and health-conscious buyers.

- Consider certification through bodies such as EarthKosher, which specialises in natural and organic products and is widely recognised by European and North American buyers.

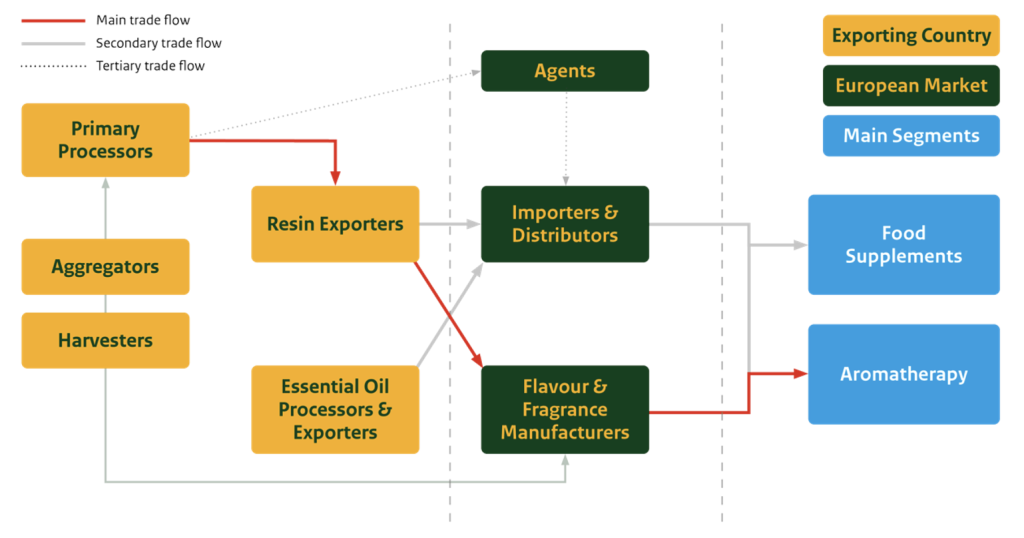

2. Through which channels can frankincense enter the European market?

Frankincense, as a natural ingredient for health products, enters the European market through two main channels: food supplements and aromatherapy. Importers and distributors are still the most strategic entry points, because they connect exporters with well-known networks and support compliance with EU regulations.

How is the end market segmented?

The European market for frankincense resin and extracts can be divided into two main industries.

- Food supplements: frankincense (Boswellia serrata extracts) is widely used in capsules, tablets, powders and gummies. It is valued for its anti-inflammatory properties and potential in managing arthritis, inflammatory bowel disease, asthma and oral health. It may even be useful in anticancer applications. Products in this segment are regulated as dietary supplements, requiring compliance with Good Manufacturing Practices (GMP), accurate labelling and disclosure of active ingredients.

- Aromatherapy: frankincense essential oil is used for inhalation or topical application (in diluted form). It is marketed for relaxation, stress and anxiety relief, respiratory support, immune support and pain relief. In Europe, aromatherapy products are often positioned within complementary and alternative medicine, and they must comply with relevant safety, efficacy and labelling standards.

Figure 7: Main applications for frankincense in food and health products

Source: ProFound, 2025

Table 2: Examples of products used in supplements (food) and aromatherapy (health)

| Food supplements | Aromatherapy |

|---|---|

| This segment includes Boswellia extracts in capsules, tablets, powders and gummies for oral consumption. | This segment includes Boswellia essential oils for inhalation or diluted topical application. |

| Example: Swanson Boswellia serrata extract for joint health and mobility (UK) | Example: Neal’s Yard organic frankincense (Boswellia sacra) essential oil |

Source: ProFound, 2025

Among the different Boswellia species, Boswellia serrata (Indian origin) is the most widely studied for its anti-inflammatory properties. Clinical trials and reviews have focused mostly on Boswellia serrata resin extracts and their boswellic acid content, particularly AKBA, in relation to conditions such as osteoarthritis, asthma and inflammatory bowel disease. This means that Boswellia serrata has become the dominant species used in European food supplements. Other species like Boswellia carterii and Boswellia sacra remain more common in aromatherapy and perfumery applications.

Tip:

- Position Boswellia serrata extracts for the supplements sector, where scientific evidence and market demand are strongest. Target Boswellia carterii or Boswellia sacra oils to aromatherapy buyers.

Through which channels does frankincense end up on the end-market?

Frankincense is most often exported in resin format, because many producing countries do not have the right infrastructure to process frankincense resin into standardised extracts. But European buyers are more often setting up direct partnerships with producers and communities to ensure quality, traceability and authentic storytelling.

In the food supplements sector, the supply chain is more industrialised. Boswellia serrata extracts are usually processed by specialised manufacturers in India before they reach European nutraceutical companies. Supplement brands rarely partner directly with origin-country producers. Instead, they source standardised extracts through importers who guarantee quality, regulatory compliance and certification.

Figure 8: Typical value chain for frankincense resin and essential oil from production to market

Source: ProFound, 2025

Importers and distributors

In all segments, specialist European importers and distributors play a central role. They buy frankincense in resin or oil form, handle compliance with EU regulations, and resell to supplement manufacturers or aromatherapy brands. Distributors usually require full documentation, including technical data sheets, certificates of analysis and traceability records.

Examples of importers and distributors dealing directly with frankincense on the European market include Roeper (Germany). They offer frankincense in 4 formats and grades, all packed in 50 kg bags. Willy Benecke GmbH (Germany) supplies Boswellia species for the pharmaceutical, perfumery and ayurvedic industries. Frankincense Myrrh Trade (Italy) offers Omani-sourced frankincense products like resin, essential oil and body soap.

Flavour and fragrance manufacturers

This channel is highly consolidated and dominated by large multinationals such as Givaudan, Robertet and MANE. They usually maintain long-standing sourcing partnerships with suppliers in origin countries. These companies are taking steps to demonstrate sustainability in their sourcing of frankincense. For example, Givaudan (Switzerland) launched its House of Naturals division in 2024. It focuses on developing exclusive natural ingredients with a focus on quality and sustainable processes.

Agents

Agents act as intermediaries between exporters in producing countries and buyers in Europe. They provide market knowledge, introduce exporters to relevant partners, and sometimes also negotiate on behalf of importers or manufacturers. Agents can work independently or under contract with larger companies. They are useful for new entrants, but they usually charge a 3-10% commission, which reduces supplier margins.

Tip:

- Use platforms such as Internationally United Commercial Agents and Brokers (IUCAB). They can support you in identifying credible agents across European countries.

What is the most interesting channel for you?

For suppliers of frankincense, importers and distributors are the most promising entry points into the European market. These companies act as the link between exporters and a wide network of buyers in sectors such as nutraceuticals and aromatherapy. Importers and distributors have set up relationships with European brands and manufacturers. This gives them a broad customer base that is difficult for exporters to reach directly. When suppliers provide high-quality resin, backed by clear specifications and robust traceability, importers are more willing to collaborate closely, invest in long-term partnerships and actively market the product to their networks.

Tips:

- Visit trade fairs like Food Ingredients Europe and BioFach to identify and meet potential buyers.

- Take a look at the International Federation of Essential Oils and Aroma Trades (IFEAT) directory to see the European companies involved in the production, processing, trading and manufacturing of essential oils.

3. What competition do you face on the European frankincense market?

India dominates the European frankincense trade in volume and value, particularly for essential oils and extracts. Somalia, Ethiopia and Kenya supply smaller volumes but they focus on certifications and traceability more often.

Which countries are you competing with?

Source: Access2Markets, 2025

European imports of natural gums and resins from key producer countries reached a value of €17.0 million in 2024. India dominated, while Somalia and Ethiopia recorded big drops. Kenya had the largest value increase, although both its volumes and values remain low.

Table 3: Overview of volumes and values of HS code 130190 exports to Europe from selected countries

| Country | Value 2024 (million €) | % change in value 2020-2024 | Export quantity 2024 (tonnes) | % change in export quantity 2020-2024 | Main export destination countries |

|---|---|---|---|---|---|

| India | 12.2 | 17.4 | 1,191 | -7.3% | Germany (73%), Spain (8%), Italy (8%), France (4%) |

| Somalia | 2.69 | -83.5 | 274 | -77.4% | France (49%), Germany (32%), Spain (14%) |

| Ethiopia | 0.77 | -15.2 | 124 | -26.5 | Greece (89%), Germany (10%) |

| Kenya | 0.16 | 157.9 | 25 | -16.3 | Germany (99%) |

Source: Access2Markets, 2025

Under HS code 33012949 (non-terpenated essential oils, including frankincense), import volumes from these countries were 487 tonnes in total in 2024. Although this HS code includes a range of oils, most of the recorded trade is related to frankincense, with India providing nearly all the supply. India dominated trade, and Kenya and Somalia supplied only small volumes. Export volumes and values from Ethiopia have been left out because of a lack of data.

Table 4: Overview of volumes and values of HS code 33012949 exports to Europe from selected countries

| Country | Value 2024 (million €) | % change in value 2020-2024 | Export quantity 2024 (tonnes) | % change in export quantity 2020-2024 |

|---|---|---|---|---|

| India | 40.8 | -2.4 | 471 | -10.3 |

| Kenya | 0.77 | -8.0 | 15 | 15.0 |

| Somalia | 0.07 | -76.3 | 0.6 | -71.8 |

Source: Access2Markets, 2025

India

India is the leading supplier of frankincense to Europe, mainly in the form of Boswellia serrata resin, extract and essential oil. Imports of natural gums and resins from India were valued at €12.2 million in 2024, up 17% compared to 2020. But volumes dropped from 1,285 tonnes in 2020 to 1,191 tonnes in 2024, suggesting higher average prices and stronger value addition. India dominates the trade in essential oils. After no reported trade until 2022, European imports reached €40.9 million and 471 tonnes in 2024. This can be attributed to the fast expansion of India’s frankincense oil industry. This is helped by significant processing capacity, technical expertise and established supply chains for herbal extracts. The data highlights India’s shift from exporting bulk resin to supplying higher-value oil. This makes it the leading non-producer country in the European frankincense oil market.

Recent developments in India strengthen its position as a leading supplier of Boswellia serrata:

- In 2024, a clinical study showed that a standardised extract (Boswellin® Super) delivered rapid symptom relief in patients with knee osteoarthritis. This supports the use of Indian frankincense extracts in nutraceuticals, helping exporters respond to European buyers who want evidence-based products.

- Government support has also grown. In 2023, India’s National Medicinal Plants Board revised its main support scheme to fund cultivation, set up quality repositories and improve supply-chain traceability.

- At the production level, companies are working with forest departments to promote sustainable harvesting. One partnership planted around 12,000 Boswellia serrata saplings over 25 hectares in Madhya Pradesh between 2020 and 2023. They combined this with training for harvesters in sustainable tapping practices.

India also benefits from strong national standards. Its pharmacopoeia bodies maintain monographs and quality references for Boswellia serrata. Exporters can use these as benchmarks when preparing technical documentation for European buyers.

Somalia

Somalia is a traditional supplier of frankincense to Europe, primarily in the form of Boswellia carterii and Boswellia frereana resins. Imports of natural gums and resins from Somalia were valued at €2.7 million in 2024, down by 84% compared to 2020. Volumes dropped from 1,212 tonnes in 2020 to just 274 tonnes in 2024, because of supply challenges and market instability. European imports of essential oils from Somalia are limited. After a modest trade of €300,000 and 2 tonnes in 2022, volumes fell further to less than 1 tonne valued at €73,000 in 2024. This illustrates Somalia’s weak position in processing and reliance on raw resin exports. Overall, the data underline a declining role for Somalia in the European frankincense trade. This is because of volatility in production and limited value addition capacity.

Although frankincense remains critical to Somalia’s economy, the sector faces serious challenges. Harvesting is mostly unregulated, and overharvesting is common. Trees are tapped too frequently and intensively. This leads to degradation and ageing trees that are dying faster than they can regenerate. Exploitation by middlemen and foreign buyers has also been an issue, with much of the profit not going to local communities who collect the resin.

However, recent developments show a push for more equitable and sustainable practices:

- In 2023, a group of 280 Somali women formed the Beeyo Maal cooperative to process and market frankincense independently. They created new opportunities in what used to be a male-dominated sector.

- In 2024, the HALO Trust launched a Frankincense Revival initiative in Somaliland, in partnership with the Royal Botanic Garden Edinburgh. The idea was to safeguard woodlands and set up licensed cooperatives with Fair Trade and FairWild certification.

- In 2025, a UK-funded project via the Darwin Initiative and FairWild Foundation also began to map supply chains and introduce sustainability standards.

Ethiopia

Ethiopia is a traditional producer of Boswellia papyrifera frankincense resin. Imports of natural gums and resins from Ethiopia were valued at €800,000 in 2024, slightly below the 2020 level (-15%). Export volumes dropped from 170 tonnes in 2020 to 125 tonnes in 2024, because of a reduction in availability from Ethiopia’s northern production areas. European imports of essential oils from Ethiopia are very small, with no reported trade in 2023 and only €45 in 2024. This highlights Ethiopia’s reliance on raw resin exports and its limited development of oil-processing capacity. Overall, Ethiopia maintains a modest but steady presence in the European resin market, although volumes are limited.

Boswellia papyrifera trees in northern Ethiopia (Tigray, Amhara and Oromia) make up about 90% of the country’s gum and resin exports. Like other countries in the Horn of Africa, over-tapping and poor regeneration threaten these woodlands. During the 2020–2022 civil war, resin collection intensified as communities were looking income, putting more pressure on the resource. A 2023 study by the Journal of Forest Business Research concluded that the sector is “not sustainable”. Ethiopia exports over 11.8 times more ecological value than it receives in payment, showing inequities in the frankincense trade.

However, some interventions have begun to restore equitable and sustainable trade:

- In 2024, a partnership between the Czech Republic and UNDP launched a project in Tigray to train harvesters, set up nurseries and rebuild market links.

- Nationally, Ethiopia is also discussing CITES protection for Boswellia species, although experts warn that heavy restrictions could harm rural livelihoods. Instead, researchers focus on targeted support, cooperatives and incentives for conservation to balance trade with sustainability.

Kenya

Kenya is an emerging supplier of frankincense, primarily harvesting Boswellia neglecta (often called ‘Kenyan black frankincense’) in arid northern counties such as Marsabit, Samburu and Turkana. Imports of natural gums and resins from Kenya were valued at €200,000 in 2024, a sharp rise from €63,000 in 2020. Volumes also rose modestly, from 30 tonnes in 2020 to 25 tonnes in 2024, showing growth in value despite small absolute quantities. In essential oils, European imports from Kenya were up and down, peaking at €2.9 million and 37 tonnes in 2023 before falling to €800,000 and 15 tonnes in 2024.

Example: Arbor Oils of Africa

A central player is Arbor Oils of Africa, a Kenyan essential oil distillery sourcing wild frankincense and myrrh resins. The company has pioneered non-destructive harvesting techniques. Rather than making repeated tapping cuts, collectors harvest resin that comes out naturally when long-horn beetle larvae bore under the bark. This method reduces tree stress and helps conserve Boswellia populations.

Arbor Oils of Africa first achieved FairWild certification in 2014-2015 and renewed it in 2022. Today, around 1,700 wild collectors, mostly from Samburu communities, manage approximately 60,550 hectares of Boswellia stands using certified sustainable practices. The resin collected is both Organic- and FairWild-certified. This makes it possible to access high-value European niche markets that require traceability and proof of ethical sourcing.

Kenya is also part of the 2025 FairWild Certifying Sustainable Frankincense project, funded by the UK Darwin Initiative. This programme includes Somalia and Kenya, and wants to map informal resin trade networks and bring more harvesters into compliance with sustainability standards.

Tip:

- Take a look at the various companies participating in the FairWild standard for frankincense. Study their websites closely to see how they communicate about their certification and market their frankincense.

Which companies are you competing with?

Competing companies range from large-scale processors with extensive certification to smaller exporters focusing on the FairWild Standard. They all showcase traceability, sustainable harvesting and community development efforts.

India

Kush Aromatics Exports offers frankincense in different formats, including essential oil, therapeutic-grade oil and CO₂-extracted oil. The essential oil is the most expensive one. Each product is supported by a detailed technical analysis of its chemical composition, including levels of α-Pinene, α-Phellandrene and Linalool. The company highlights the benefits of CO₂ extraction, noting its short processing time, high yield and low energy use, and the purity of the extracts produced.

MANE Kancor Ingredients operates as part of the French MANE Group, following MANE’s acquisition of a majority stake in Kancor in 2014. The company makes good use of its strong international backing and holds many certifications. These include FSSC 22000, ISO 9001, ISO 14001, ISO 45001, ISO 50001, HACCP and GMP, as well as Halal and Kosher. MANE Kancor specialises in boswellic acid extracts, with titration levels of 50-90% and AKBA (acetyl-11-keto-β-boswellic acid) concentrations of 10-30%. Its product portfolio is tailored to nutraceutical applications, with established use in capsules, soft gels, tablets, gummies and functional foods.

Somalia

Derman Oil holds USDA Organic, FairWild and EU Organic certifications and is recognised for pioneering ‘tree-to-bottle’ traceability. Its system includes GPS-mapped harvest zones, registered and annually trained collectors, and batch authentication through unique lot numbers. This ensures that only resin that meets strict purity standards moves on to the next stage of processing and trading.

IHSAN Resins Society Limited supplies Grade 1 and 2 Boswellia carterii, with traceability back to sourcing regions. They also invests in community development, especially involving young women.

Kobac General Trading, which is FairWild- and Halal-certified, works only with contracted collectors, focusing on harvesting practices that respect Boswellia regeneration cycles. Neo Botanika partners with French flavour house Synamore, and has been supplying FairWild-certified frankincense for over 30 years.

Figure 10: How frankincense producers communicate traceability and transparency

Source: Younis Aroma, 2025

Ethiopia

Ekalinna supplies steam-distilled frankincense essential oil, marketed in smaller B2C formats and tailored to perfumery. Its oils are notable for their high octyl acetate content (67%), making them very suitable for fragrance applications.

Floracopeia offers a wide range of frankincense types, including occulta (Somaliland), papyrifera (Ethiopia), rivae (Ethiopia), sacra (Oman) and serrata (India). Much of its sourcing centres on Ethiopia, with innovative products such as frankincense-nilotica shea butter blends and frankincense-myrrh co-distillations. Although many of its products target the US market, certifications such as USDA Organic add credibility.

Gargore Trading Company Group exports aromatic resins and essential oils, with applications in cosmetics, flavour and fragrance, incense, aromatherapy, supplements and oral health. Its frankincense resins are packaged in 25, 50 and 100 kg bags, targeting larger wholesale buyers.

Kenya

Besides Arbor Oils of Africa, another key Kenyan supplier is Nagaad Resins and Gums Company Limited. This company processes and packages a wide range of frankincense products, including carterii, frereana, rivae, sacra and neglecta. Its organic Boswellia carterii frankincense is graded into 3 categories depending on block or tear size. The company holds multiple certifications, including ECOCERT Organic, USDA NOP, Organic Consumers Alliance of Kenya and Halal.

Tip:

- Take a look at the websites of companies that have achieved FairWild certification, such as Amouage.

Which products are you competing with?

In the health supplements area, frankincense competes with a wide range of established anti-inflammatory ingredients. Turmeric/curcumin dominates this area, supported by extensive clinical research, strong consumer recognition, and widespread use in both mainstream and natural health products. Fish oil and omega-3 supplements are also big competitors, positioned as trusted anti-inflammatories with proven cardiovascular and joint health benefits. Other plant-based ingredients, such as ginger and green tea extract, are growing in demand, especially from consumers seeking natural and clean-label solutions.

But frankincense is still turning out to be a niche competitor. Its active compounds, boswellic acids, are believed to reduce inflammation in people suffering from arthritis, inflammatory bowel disease and asthma. This aligns frankincense with consumer needs in the same categories dominated by turmeric, omega-3s and ginger. But frankincense still does not have enough clinical evidence and consumer awareness enjoyed by other mainstream products.

Its competitive advantage lies in differentiation, because it offers a long history of traditional use, growing scientific validation and compatibility with premium supplement formats such as capsules, soft gels and gummies.

4. What are the prices of frankincense in the European market?

The price of frankincense resin and essential oil varies widely, depending on the product form, species and quality parameters, such as grading and value-added certifications.

Several factors influence price levels and buyer expectations:

- Geopolitical instability in production countries: Somalia, Sudan and Ethiopia are among the main suppliers of frankincense resin. They all face challenges related to conflict, weak governance or export restrictions.

- Traceability and sustainability concerns: overharvesting and poor management of Boswellia trees create supply risks. Buyers demand traceability systems and sustainable harvesting assurances more often. If these are lacking, prices are often lower.

- Certification premiums: resin and oils with FairWild certification can get higher prices in EU markets. Certified products are especially sought in the EU food supplements and aromatherapy markets, where buyers are willing to pay more for sustainability and safety assurances.

- Risk of CITES listing: discussions about including Boswellia species under CITES Appendix II have raised concerns. Even though Boswellia is not yet listed, the perceived risk contributes to cautious buying and speculative pricing.

- Species and origin premiums: Boswellia sacra (Oman, Yemen) and Boswellia frereana (Somalia) often command higher prices than Boswellia serrata (India). This is because of their aroma profiles and traditional use in perfumery and rituals.

- Format (resin versus essential oils): Resin is generally cheaper per kilogram but sold in larger quantities, while essential oils can get much higher per-litre prices because of processing costs, yield variability and the technical expertise required in distillation.

Table 5: Typical prices for frankincense resin on the European market

| Company | Product and origin | Volume | Price (€) | Notes |

|---|---|---|---|---|

| Buxtrade GmbH (Germany) | Boswellia subspecies (Ethiopia) | 1 kg | €24.90 | Resin ranging from 2 mm to 15 mm (the same that is used in its supplements); wholesale price. |

| Norfolk Essential Oils (UK) | Boswellia carterii (Somalia) | 1 kg | €29 | Resin used for in-house distillation; imported fresh from Somalia; wholesale price. |

| LiveMoor (UK) | Boswellia carterii resin (origin not mentioned) | 1 kg | €33.40 | Light yellow pea-sized tears, premium grade A resin; wholesale price. |

| Aromandise via Youdoit (France) | Boswellia carterii (Somalia) | 1 kg | €44.90 | Frankincense in bulk. Intended for incense burning (sacred resin) and pea-sized 21x30 mm; wholesale price. |

| Stübener Kräutergarten (Austria) | Boswellia sacra (Yemen) | 1 kg | €76.90 | Organic-certified business, positioned high-grade resin for incense and aromatherapy use; wholesale price. |

| Herboristerie Desmecht (Belgium) | Boswellia sacra (origin not mentioned) | 1 kg | €112 | Mentions “organic” quality but no certification to prove this. Volume discounts: -20% versus 100 g unit price. Packaged in bulk in paper sacks. |

Source: ProFound, 2025

Tip:

- Exporters who can combine competitive bulk pricing and clear documentation (SDS, TDS, CoA) are in the best position to appeal to both price-sensitive and quality-focused buyers.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research