The European market potential for shea butter

The European cosmetics market is large and continues to grow, especially in the natural and organic segment. Nilotica shea butter fits this trend as it is natural, soft and easily absorbed by the skin. While still new in Europe, there is interest from brands looking for safe, ethical and unique ingredients. Its creamy texture and high oleic acid content make it suitable for premium skincare and baby care. Countries like France, Germany, the Netherlands and Italy offer the best opportunities for exporters that can share a good product story, show clear benefits and meet quality standards.

Contents of this page

- Product description: shea butter

- What makes Europe an interesting market for nilotica shea butter?

- Which European countries offer the best opportunities for nilotica shea butter for cosmetics?

- Which trends offer opportunities or pose threats in the European nilotica shea butter market for cosmetics?

1. Product description: shea butter

Shea butter, also known as karité butter, is a vegetable fat obtained from shea nuts. When shea butter is used as an ingredient in cosmetic products, it is listed as Butyrospermum parkii butter. This follows the CoSing database of registered names for cosmetic ingredients (also known as INCI names).

Fat is obtained from the fruit of the shea tree, a member of the Sapotaceae family famous for its soaping properties. The shea tree used to also be known as Butyrospermum parkii and belonged to the genus Butyrospermum, which means ‘butter seed’. However, this botanical name was replaced. The shea tree is now known as Vitellaria paradoxa, and has two seperate subspecies: paradoxa for West African trees and nilotica for East African trees.

Differences between paradoxa shea butter and nilotica shea butter

West African shea butter, from the Vitellaria paradoxa, and East and Central African shea butter, from the Vitellaria nilotica, share the same INCI name today. The International Cosmetic Ingredient Nomenclature Committee works hard to make sure that names stay the same with as few changes over time as possible. This is because any change to an INCI name requires companies to print new ingredient labels for all products with that ingredient. However, there is a procedure for updating INCI names. In the future, the new botanical name for shea butter may be adopted as the INCI name, which means that each subspecies would have its own name.

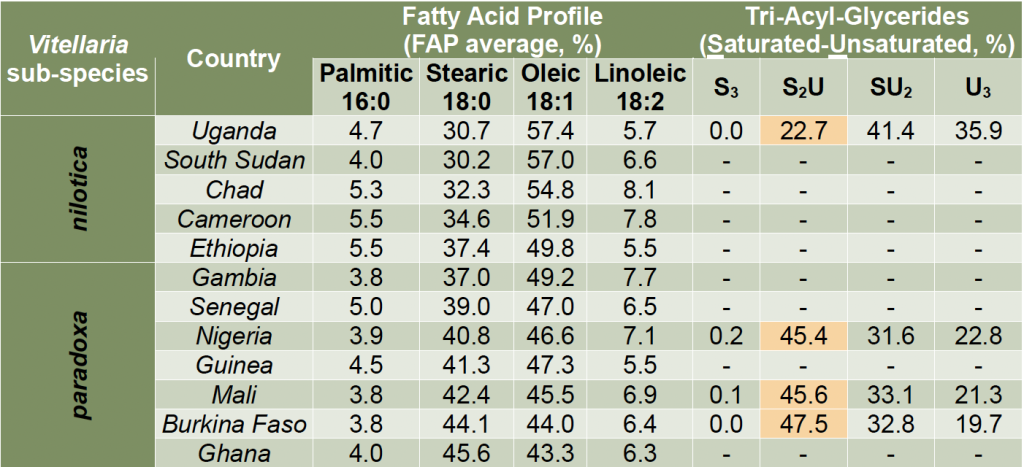

Nilotica shea butter is a soft, creamy vegetable fat derived from the nuts of the Vitellaria nilotica, a subspecies of the Vitellaria paradoxa native to East and Central Africa, notably Uganda, South Sudan and parts of Ethiopia, Chad and Cameroon. Compared to West African shea butter, nilotica has a smoother balm-to-oil texture and melts at lower temperatures (25-30°C). This is due to its higher oleic acid content (57-65%) and lower stearic acid levels (30-32%). These characteristics make it particularly attractive for skincare, body care and pharmaceutical products.

Table 1: Fatty acid composition of shea butter

| Component | West African shea ssp. Paradoxa | East African shea ssp. Nilotica |

| Oleic acid (omega-9) | 40-50% | 47-67% |

| Stearic acid | 36-50% | 21-38% |

| Linoleic acid | 4-8% | 4-9% |

| Palmitic acid | 2-8% | 2-8% |

Source: DLG Naturals TDS, The Soap Kitchen COA and PRAAN Naturals, 2023

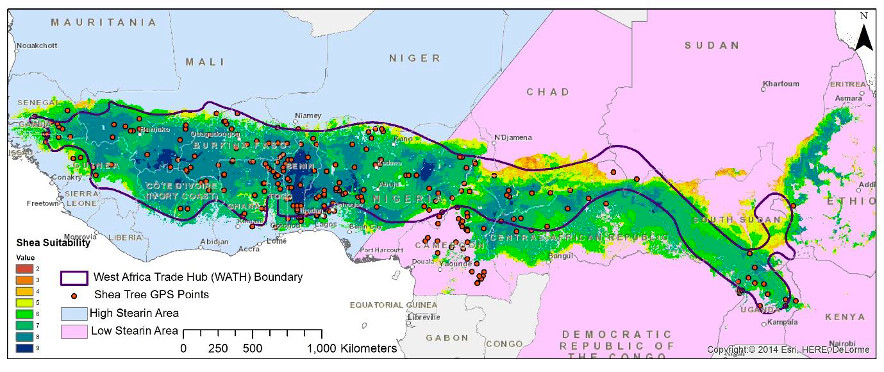

Shea trees are native to sub-Saharan Africa in a region known as the shea belt. This region extends from Senegal in West Africa to Kenya in East Africa. The shea belt is known for its daytime temperatures ranging from 24˚C to 38˚C and a mean annual rainfall of between 500 and 1,400 mm. Most commercial harvesting takes place in Ghana and Burkina Faso, and most exports go through the port of Tema in Ghana.

Figure 1: Shea belt region (distribution of shea trees in Africa)

Source: ProFound, 2025

Figure 2: Detailed map of the shea belt

Source: Uganda Shea Market Study, August 2024

A key difference in processing lies in the method of fractionation. Traditional acetone-based solvent fractionation, which is commonly used to separate the hard stearin and soft olein parts, does not meet organic certification criteria because it uses a chemical solvent.

Nilotica shea butter can be separated using dry fractionation techniques, which rely only on temperature and mechanical processes. This method keeps the product as it is and allows processors to meet EU organic certification standards.

Figure 3: Characteristics of Vitellaria paradoxa versus Vitellaria nilotica

Source: Uganda Shea Market Study, August 2024

Based on its functional and sensorial characteristics, nilotica shea butter is starting to be used across different cosmetic product segments, including:

- Skincare: lotions, creams, moisturisers, baby oils and sun care;

- Haircare: shampoos and conditioners;

- Decorative cosmetics: lip balms and lipsticks.

Figure 4: Examples of products containing nilotica shea butter in the European cosmetics market

Source: Onatera and Aroma-Zone, 2025

Table 2 lists the classification names and codes for shea butter. These codes and ingredient names are used as product identifiers in documentation (as listed in CoSing and with Chemical Abstracts Service (CAS) number) and in trade (Harmonised System codes). The HS code classification is used for all exports, not just cosmetics.

Table 2: Classification of shea butter, including nilotica

| Source | Classification |

|---|---|

| International Nomenclature Cosmetic Ingredient (INCI) names, according to CoSing (European Commission database with information on cosmetic ingredients) | CoSing lists 29 ingredients known as or derived from shea butter, including: Butyrospermum parkii butter Shea butter glycerides Hydrogenated shea butter |

| Chemical Abstract Service (CAS) numbers | 194043-92-0 (Butyrospermum parkii butter/shea butter glycerides) 91080-23-8 (Butyrospermum parkii butter extract) 225234-14-0 (Butyrospermum parkii butter unsaponifiables) 226993-83-5 (PEG-60 and PEG-75 shea butter glycerides) |

| Harmonised System (HS) codes | 1515.90 (other fixed vegetable fats and oils and their fractions, refined or not, not chemically modified) 1207.92 (‘shea nuts’/‘karité nuts’, broken or not); however, no trade is recorded under this code 1207.99100 (oilseeds and oleaginous fruits, broken or not); several African countries record trade of shea nuts under this code |

Source: ProFound, 2023

Trade data

There is currently no specific Harmonised System (HS) code to distinguish nilotica shea butter from other types of shea butter or vegetable oils. This means that international trade data does not show the difference between Vitellaria paradoxa (mainly from West Africa) and Vitellaria nilotica (from East Africa), or between shea butter used for food and cosmetics. Nilotica is grouped under broad HS codes such as 120799 (other oilseeds and oleaginous fruits) and 151590 (other fixed vegetable fats and oils). According to the CSJ Report for Uganda (2024), nilotica shea butter makes up only about 1% of total global shea butter exports, mainly because it is still new in international markets and processed in smaller numbers.

Even though nilotica’s export share is still small, there are signs of growing interest. European buyers are looking for new, natural and ethical ingredients. Nilotica’s soft texture and high oleic acid content make it attractive for cosmetics. This report uses both trade data and expert insights to explain the market situation. While exact data on nilotica is limited, more companies are exploring East African sourcing. This shows that demand is increasing.

In the case of nilotica shea butter, the main producing countries are Uganda and South Sudan. As both are landlocked, exports from Uganda are typically done through ports in neighbouring countries, usually via Mombasa in Kenya.

2. What makes Europe an interesting market for nilotica shea butter?

Europe is one of the most dynamic and strategic markets for natural cosmetic ingredients globally. As both a major consumer and exporter of beauty and personal care products, the region leads global preferences for innovation, sustainability and ingredient transparency. Natural and ethically sourced ingredients, such as nilotica shea butter, are becoming more important to manufacturers and final consumers. This shows a growing want for clean-label and plant-based cosmetic solutions.

Growing European imports of vegetable oils and oilseeds

European imports of natural vegetable oils continue to increase, driven by the cosmetics industry’s demand for high-quality, sustainable ingredients. In 2024, imports of products under HS code 151590 (including shea butter, moringa, marula and argan oils) reached €1.39 billion and 511,000 tonnes, up from €1.29 billion and 463,000 tonnes in 2023. This steady growth reflects the rising interest in plant-based oils for skincare, haircare and other personal care applications.

A country analysis for the top European importers of HS 151590 (vegetable fats and oils) showed a situation in which nilotica could be in demand based on growing need for vegetable oils and fats.

- Germany: In 2023, Germany imported 75,059 tonnes of vegetable fats and oils under HS 151590, valued at €217 million, representing about 22% of Europe’s total volume in this category. Germany also imported 342 tonnes from Ghana and 0.435 tonnes from Burkina Faso. This shows an interest in African sourcing;

- France: France is a major importer of vegetable fats and oils in Europe. In 2023, it imported 25,504 tonnes under HS 151590, worth €73 million and accounting for about 7% of European imports by volume.

In the same year, France imported 5,383 tonnes from Burkina Faso (worth about €9.8 million) under broader vegetable oils trade; - UK: Imported 20,300 tonnes of vegetable oils in 2023, valued at over €59 million. Around 17,200 tonnes came from EU partners, but 410 tonnes were sourced directly from Africa. Among African suppliers, Ghana led with 172 tonnes; and,

- Spain & Italy: In 2023, Spain imported over 33,000 tonnes of vegetable fats and oils, while Italy’s imports reached 29,600 tonnes. Imports from Africa also rose: Italy imported 3,510 tonnes from African sources, compared to 2,890 tonnes imported by Spain. Much of this likely included shea butter from Ghana and Burkina Faso.

Although trade data does not separate paradoxa and nilotica shea butter or food and cosmetic use, nilotica benefits from these broader trends. Exporters in Uganda, Kenya, Ghana and Côte d’Ivoire are already offering this soft, olein-rich butter to Europe through regional consolidation hubs. Its unique technical qualities, organic certification potential and ethical sourcing model makes nilotica shea interesting for European brands seeking to innovate with natural, high-performing raw materials.

Europe’s position in the cosmetics industry

Europe remains a key hub for the production, consumption and export of cosmetic products, making it a vital destination for suppliers of natural ingredients, such as shea butter.

Cosmetics market size and global position

In 2024, the European cosmetics market reached a value of approximately €104 billion. This confirms Europe’s position as the third-largest cosmetics market in the world, after North America and North Asia. Europe accounts for approximately 24% of the global beauty and personal care market, which was valued at €540 billion worldwide in 2024.

European consumers and brands increasingly align with trends favouring natural, organic and ethically sourced ingredients. The European market for natural and organic personal care products is projected to grow at an annual rate of 6.4% until 2035. This strong growth reflects the continued preference of European consumers for clean beauty, plant-based formulations and products free from synthetic chemicals.

Europe’s cosmetics industry remains a global leader not only in consumption but also in production and exports:

- In 2024, the manufacturing output of cosmetics in Europe was valued at approximately €11 billion; in addition, a further €18 billion was contributed indirectly by the supply chain (packaging, retail, research and development).

- Exports of European cosmetic products to non-European countries reached €29.4 billion, highlighting Europe’s strong position in high-value, specialised cosmetic formulations.

Although cosmetics currently are responsible for for most nilotica exports, the butter can also be used by the food industry, especially in chocolate and spreads. Nilotica has lower stearic acid levels and melts faster than West African shea butter. This makes it suitable for some food products. For example, shea stearin is used as a cocoa butter equivalent in chocolate, and shea olein can be added to plant-based spreads.

However, the current price of nilotica shea butter, which is higher than that of West African shea butter, can make it difficult to compete in the food ingredient industry, which is mainly focused on high volumes and lower prices.

Import of natural cosmetic ingredients

Europe is also the largest global importer of natural cosmetic ingredients, including vegetable oils, essential oils, botanical extracts and plant butters. In 2023:

- Europe accounted for 48% of global import volume and 42% of global import value for vegetable oils and essential oils used in cosmetics.

- Over 33% of the value of these imports originated from developing countries, including key suppliers such as Mexico, Peru, Kenya, Ghana and Burkina Faso.

The skincare segment drives the European cosmetics market

The skincare segment is the largest segment of the global cosmetics market, accounting for 39% of total cosmetics sales in 2024, followed by haircare at 21%. In Europe, the skincare segment has the highest market value of the cosmetics industry, reaching 27.7 billion euros in 2023. Skincare products can use the highest percentages of shea butter, particularly nilotica shea butter, compared to other categories. For example, the French brand Cosmesana promotes its nilotica shea butter cream by highlighting that it is softer and creamier than classic shea butter thanks to its high olein content. This protects, soothes and regenerates all skin types.

The European skincare segment grew by 10% between 2022 and 2023. This segment is predicted to continue growing, driven by increased usage of cleansers, moisturisers and exfoliators. There are opportunities for nilotica shea butter, as paradoxa shea butter is already used in a wide range of creams, lotions and butters due to its soothing properties.

Tips:

- See our study on the demand for natural cosmetic ingredients in Europe to find more information on relevant markets, sales, imports and potential products in the natural cosmetics segment.

- Have a look at our tips for doing business with European buyers of natural cosmetic ingredients to learn more about specific features of European buyers and businesses that may help you increase your chances of exporting.

- Stay informed about the latest developments in the skincare segment through industry media, such as Cosmetics Design Europe, to identify new opportunities for your nilotica shea butter.

3. Which European countries offer the best opportunities for nilotica shea butter for cosmetics?

In 2024, Europe accounted for about a quarter of the global cosmetics market and around 38% of the global natural/organic cosmetics market. Within Europe, Germany and France are the largest markets for cosmetics, with the highest numbers of natural product launches and a strong focus on innovation. Italy and Spain, together with the Netherlands, are also important markets for both conventional and natural cosmetics, with increasing African imports of vegetable oils and butters such as shea butter.

Germany: the biggest European market for cosmetics and personal care

In 2024, Germany was the biggest European market for cosmetics and personal care products. Valued at €16.9 billion, it is projected to grow at an annual rate of 4-5% through 2030.

The German natural cosmetics sector now includes over 50% of the country’s consumers, which means that demand for eco-friendly, premium cosmetics is strong. Moreover, consumers typically continue to purchase natural cosmetics once they have started doing so, even when facing financial challenges.

According to ITC TradeMap, Germany imported 1,792 tonnes of vegetable oils and fats under HS code 151590 (which includes shea butter and related oils) in 2024, worth a total of €101 million. These imports accounted for 8% of total European imports and 4.1% of total volume.

One of the leading cosmetics manufacturers in the German market is Dr. Hauschka. This skincare company produces natural products with ingredients sourced from fair trade and sustainable suppliers. Dr. Hauschka sources organic, fair trade shea butter from southwestern Burkina Faso. Since the company already uses shea butter in its formulations, nilotica shea butter could offer an opportunity to develop new products or update existing ones.

In Germany, demand for eco-friendly and natural cosmetics continues to grow, especially through niche channels like Reformhaus, organic shops and wellness retailers. Consumers want transparency, ethical sourcing and high product quality, all of which matches with nilotica shea butter’s profile.

Tip:

- To connect with German buyers, consider exhibiting at BioFach, Europe’s largest fair for organic and natural products. This event brings together importers, brands and retailers looking for certified, sustainable ingredients, and offers a strong platform for building direct partnerships.

France: the leading European importer of vegetable oils for cosmetic use

France is the second-largest cosmetics market in Europe, with a total value of €14.2 billion in 2024. It is the top exporter of cosmetic products in Europe, representing 18.6% of global cosmetics exports.

In 2024, France and Italy were Europe’s leading cosmetics exporters, accounting for over 50% of total global exports from Europe, representing a value of €14.9 billion. These figures highlight France’s leadership not only as a manufacturer but also as an entry point for international trade in premium cosmetics.

France is the leading European importer of vegetable oils for cosmetic use. In 2023, it accounted for 17.6% of total EU imports by volume and 18.2% by value, with around 75,000 tonnes valued at €248 million according to ITC TradeMap. Between 2018 and 2023, volumes rose by 1.7% annually, while values increased by 10.6%, reflecting strong demand for natural and organic oils, including shea butter.

While most of France’s shea butter imports arrive via other EU countries, Burkina Faso remains the country’s main non-EU supplier. In 2023, France imported 7,410 tonnes of vegetable oils worth €9.8 million from Burkina Faso, mostly assumed to be shea butter. Total imports from Africa reached 9,823 tonnes, including 8,700 tonnes from the shea belt region. These figures, combined with France’s leadership in natural and luxury cosmetics, make it a key market for certified, ethical ingredients like nilotica shea butter.

In France, there are a number of manufacturers of natural cosmetics that offer beauty and personal care products made from shea butter and other derivatives. Some of the most important manufacturers are L’Occitane en Provence, Typology, Caudalie, French Girl Organics, Nuxe, SO’BiO étic, Mademoiselle Bio and Lady Green Paris.

France is a global hub for cosmetic innovation and re-export, with strong demand for natural, effective and ethically sourced ingredients. The 'clean beauty' trend continues to influence product development, with brands looking for plant-based ingredients like nilotica shea butter that offer both performance and traceability.

Tip:

- Explore opportunities at Natexpo, France’s leading trade fair for natural and organic products. This event connects suppliers of ethically sourced ingredients with formulation laboratories, contract manufacturers and cosmetic brands.

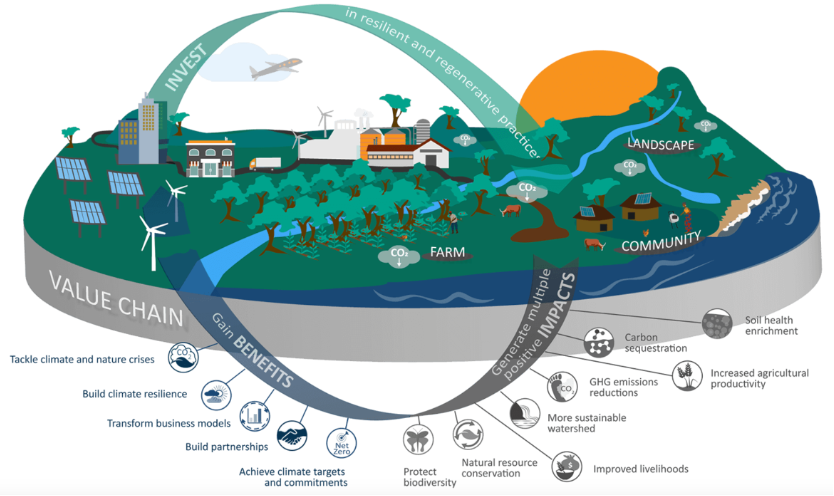

Insetting programme case study: Burkina Faso Solidarity-Sourced Shea Butter

L’Oréal’s shea butter project in Burkina Faso is a good example of how companies can help people and protect the environment at the same time. Through its Solidarity Sourcing and Carbon Balanced programmes, L’Oréal works with Olvea and the local social business Nafa Naana to support around 22,000 women who collect shea nuts.

Since 2016, the project has provided over 5,000 improved cooking stoves that use less firewood. This helps reduce deforestation and carbon emissions; over 10,500 tonnes of CO₂ were saved in 2019. The new stoves also save women time and money. They spend less time collecting firewood and more time on other activities, and their families spend less money on energy. The project also created 31 local jobs for the people who build the stoves.

This successful experience in West Africa could be expanded to East Africa, especially to support nilotica shea butter production in countries like Uganda and South Sudan. By working with partners such as Olvea East Africa, similar programmes could help local communities, protect the environment and support women’s incomes in the nilotica shea sector.

Figure 5: What is an insetting programme?

Source: International Platform for Insetting (IPI), 2025

The UK is one of Europe’s largest markets for cosmetics and personal care products

The UK remains one of Europe’s largest markets for cosmetics and personal care products. In 2023, the UK cosmetics market was valued at approximately €11.1 billion. The UK organic beauty and well-being market also continued to grow steadily, reaching €183 million in retail sales.

Since Brexit, the UK has operated under its own cosmetics regulation, which remains closely aligned with the EU framework. Regulatory divergence has been minimal, and there has been no significant negative impact on the cosmetics industry in terms of trade, sales or consumer demand.

According to ITC TradeMap, the UK imported 20,300 tonnes of vegetable oils in 2023, valued at over €59 million. Most of these imports – around 17,200 tonnes – came from EU countries, while 410 tonnes were imported directly from Africa. Ghana remained the leading African supplier, with 172 tonnes exported to the UK.

Several UK-based cosmetics companies use ethically sourced shea butter. The Body Shop, for instance, has partnered for over 25 years with women-led shea cooperatives in Ghana, offering fair prices and investing in social impact initiatives. Other examples include Shea Revere and Akoma, both of which specialise in natural nilotica shea-based skincare. Akoma uses Fairtrade-certified shea butter sourced from cooperatives in northern Ghana, ensuring transparency and fair income for producers.

Italy and Spain: two of the most dynamic cosmetics markets in Europe

Italy and Spain continue to be two of the most dynamic cosmetics markets in Europe. In 2023, Italy maintained its position as the third-largest cosmetics market in the region with a value of €11.9 billion, while Spain remained fifth with €9.7 billion. Both countries demonstrated strong market performance, with Italy’s cosmetics market growing by 4.1% and Spain achieving 6.2% growth in 2023.

These countries are also among the top 5 European importers of vegetable oils for cosmetic use. According to ITC TradeMap, in 2023 Italy accounted for 8.4% of total EU vegetable oil imports by value, compared to 8.1% for Spain. In terms of volume, Spain imported over 33,000 tonnes in 2023, while Italy reached 29,600 tonnes, continuing positive trends in demand for natural oils.

The increase in imports from Africa has been notable. Italian imports of vegetable oils from Africa have been rising at an average annual rate of 132%, reaching 3,510 tonnes in 2023. Spain recorded similar momentum, importing 2,890 tonnes in 2023 and growing at an average annual rate of 106% between 2018 and 2023.

In Spain, the company Maison Karité has emerged as a champion of ethical and sustainable sourcing. The brand offers a line of vegan, biodegradable and certified organic cosmetics, including pure, handmade shea butter sourced from women’s cooperatives in Ghana. Maison Karité supports 72 women producers by providing equipment and facility improvements to help modernise their shea operations and improve production capacity.

Similar partnerships could be developed in Uganda and South Sudan to support nilotica shea butter cooperatives, promoting sustainable sourcing, fair trade practices and investment in local processing infrastructure.

The Netherlands: a major European import hub for vegetable oils from non-European countries

The Netherlands is the second-largest importer of vegetable oils in Europe, both in value and volume. It is also among the top 5 importers in the world. The Netherlands holds an 11% share of the total value of European imports and a 13% share in terms of volume. In 2022, Dutch imports of vegetable oils reached a volume of 57,000 tonnes (€141 million), representing an average annual growth of 3.0% in volume and 8.5% in value since 2018.

The Netherlands is a major European import hub for vegetable oils from non-European countries. More than 50% of the Netherlands' vegetable oil imports come from countries outside Europe.

The port of Rotterdam is one of the largest and most efficient shipping hubs in Europe. Many bulk shipments arrive in Rotterdam and are then distributed to other EU countries, including Germany, France, Belgium and Scandinavian markets.

Tips:

- As nilotica shea butter has a different chemical profile compared to West African shea butter (paradoxa), it is important to send samples to R&D teams for testing and formulation. Create demand by highlighting nilotica’s sensorial properties and positioning it as a premium alternative in skincare formulations.

- Consider supplying organic shea butter when targeting markets like Germany, Italy, the UK and France.

- As buyers in the Netherlands, the UK and Germany re-export to other EU countries, look into certifications such as EU Organic, COSMOS or Fair for Life to strengthen your position in the market.

- Have a look at our CBI study What requirements must natural ingredients for cosmetics comply with to be allowed on the European market?

4. Which trends offer opportunities or pose threats in the European nilotica shea butter market for cosmetics?

Demand is growing for natural cosmetic ingredients that support wellness, hydration and skin barrier repair. This trend is closely tied to growing consumer interest in clean beauty, minimalist skincare and ethically sourced raw materials. While exact market data specific to nilotica shea butter is not yet available, it can be seen as a premium alternative in formulations, especially for sensitive skin. As more formulators explore alternatives to West African shea, nilotica has the potential to gain visibility within the wellness and clean skincare segment. However, its higher price, limited export volume, low market recognition and lack of efficacy studies remain key challenges to address.

Growing consumer inclination towards wellness and health

According to Euromonitor, wellness is one of the top 10 long-term trends shaping consumer behaviour. In this context, beauty is increasingly defined by skin health and emotional well-being. Products are expected to deliver results while being safe, transparent and sustainably sourced. Nilotica fits perfectly in the wellness and self-care segment. The dermocosmetics sector, which combines pharmaceutical-grade efficacy with cosmetic sensoriality, is growing rapidly and projected to reach a CAGR of 8.3% through 2027 in Europe.

In addition, nilotica shea butter contains bioactive compounds such as triterpenes and unsaponifiables, which are known for their regenerative and anti-inflammatory properties. These characteristics offer formulators a competitive advantage, especially for clean-label, minimalist and sensitive skin products. Laboratory tests have shown that nilotica can be used as a complementary ultraviolet (UV) protective ingredient suitable for sunscreen and anti-pollution skincare.

Many cosmetic brands are adopting sustainable and eco-friendly practices in their supply chains, driven in part by the European Green Deal and related regulations. Meanwhile, the wellness sector is projected to grow at an average rate of 10% per year until 2027. In this context, nilotica shea butter suppliers can take advantage of growing demand for clean, wellness-focused skincare by promoting sustainably sourced nilotica as a premium, high-performance ingredient.

Rising consumer awareness of the social and environmental impact of cosmetics

In addition to concerns about personal health, European consumers are increasingly focused on how cosmetics impact communities and the environment. This motivates many brands to look for suppliers who can tell a compelling story about their ingredients’ origins, production methods and social value. For nilotica shea butter, this presents a major opportunity to position East African sourcing as ethical, traceable and women-led.

Several factors make nilotica shea butter interesting for a marketing story, such as:

- Traditional use: Although they cannot make any medicinal claims, cosmetics manufacturers can use information on traditional medicinal uses of nilotica shea in Africa in their product descriptions and stories;

- Method of fractionation: Traditional acetone-based solvent fractionation does not meet organic certification criteria due to its use of a chemical solvent. Nilotica shea butter can be separated using dry fractionation techniques, which rely purely on temperature and mechanical processes. This method preserves the organic integrity of the product to meet EU organic certification standards;

- Artisanal production: Nilotica shea butter is often handcrafted using traditional methods, which adds a personal, natural character to the final product. Ethical brands are beginning to highlight this artisanal dimension, aligning with consumer desire for transparency and craftsmanship;

- Empowerment of women: Nilotica shea is mainly collected and processed by women in Uganda and South Sudan. In 2023, more than 3,000 women leaders were managing shea cooperatives across East Africa (CSJ Uganda Report, 2024). This has allowed brands to communicate strong social impact through partnerships with women-led groups; and,

- Environmental sustainability: Nilotica shea trees grow naturally in parklands and are wild-harvested, reducing pressure on land use. In 2023, over 1,250 hectares of shea parklands were preserved in Uganda, contributing to climate action by acting as carbon sinks.

Nilotica shea butter suppliers should take advantage of this trend by building compelling narratives around sustainable sourcing, social empowerment and environmental protection. East African producers of nilotica shea have a unique opportunity to communicate value beyond the ingredient itself and showcase traceability, cooperation with local communities and alignment with the Sustainable Development Goals (SDGs).

A leading example is the Savannah Fruits Company in West Africa, which offers fully traceable, certified shea butter and promotes contribution to biodiversity, women’s livelihoods and climate resilience. East African producers can learn from and adapt these practices to build competitive, responsible supply chains for nilotica shea butter in East Africa.

Video 1: The Savannah Fruits Company’s ‘BEYOND SHEA’ trailer

Source: The Savannah Fruits Company, 2020

Increasing popularity of natural ingredients to boost nilotica shea demand

As the natural beauty segment continues to mature, plant-based cosmetics have evolved from a trend to a standard in the beauty industry. Recent data shows that plant-based product claims in personal care grew by 23% from 2020 to 2024. At the same time, 60% of global consumers say they prefer products made with natural ingredients, proving that demand for plant-based skincare remains very strong.

Brands and consumers are also more aware of the environmental impact of ingredient production. Buyers now expect clear and simple explanations of the carbon footprint of natural ingredients, as well as how much carbon is released or saved during harvesting, drying, processing and transport. For nilotica shea butter suppliers, this means they must be able to explain clearly the sustainability of their own supply chain.

At the same time, many companies are interested in 'upcycled' ingredients, which are made from food or cosmetic waste. While nilotica shea is not a by-product, its value lies in protecting trees and helping communities keep shea parklands alive. Suppliers can position this narrative alongside sustainability credentials to reinforce nilotica’s relevance in the clean beauty space.

Demand for natural and organic cosmetics continues to rise in Europe, especially among younger consumers (millennials and Gen Z), driven by a growing preference for clean beauty and minimalist formulations.

Europe also maintains the highest number of products and companies certified under COSMOS Organic, the most widely used international standard for organic cosmetics. This reinforces consumer trust in natural-origin formulations, particularly in skincare, where 19% of global consumers cite ingredient formulation as a major purchase driver.

New cosmetic brands are launching natural products and natural ingredient-based portfolios to meet consumers' evolving needs. However, some conventional cosmetics brands use natural ingredients at low percentages to make certain marketing claims.

Figure 6: Example of a cosmetic brand with a focus on a 100% natural ingredients portfolio

Source: 100% Pure Cosmetics, 2025

Growth in digital channels creates opportunities for nilotica shea butter in cosmetics

The percentage of consumers who purchase cosmetics online continues to increase. In countries such as Poland (70%), Portugal (56%), Spain (53%) and France (49%), online cosmetics purchases now exceed the global average of 46%. This growing digital marketplace provides important opportunities for brands and ingredient suppliers alike. The online sales trend is even more advanced in Europe, where this segment is projected to account for 30% of total cosmetics revenue in 2025. Key markets such as Germany, France, the Netherlands and Spain are strong performers in this area.

For the shea butter sector, and particularly for premium products like nilotica shea butter, digital channels offer new ways to connect directly with niche buyers, ethical brands and conscious consumers. Online platforms enable exporters to share their story, promote traceability and highlight the sustainability and wellness benefits of their ingredients. These storytelling tools are especially important for building trust and awareness around high-performance natural ingredients.

In addition, digital commerce reduces entry barriers for new, small and medium-sized suppliers who may not yet have access to large distribution networks. Platforms, such as B2B marketplaces like Covalo and SpecialChem for ingredients and direct-to-consumer websites like Qogita, help promote visibility and engagement.

Figure 7: Example of a European digital cosmetics wholesaler platform (B2B channel)

Source: Qogita, 2025

Tips:

- Have a look at our CBI study on natural ingredient trends in the cosmetics sector for more insights on e-commerce and clean beauty growth.

- See our CBI study on buyer requirements for natural ingredients to learn more about certifications like COSMOS and Fairtrade. Ask buyers if certification is useful for your product and target market.

- Read our tips on going digital in the natural ingredients for cosmetics sector to understand how the use of digital tools can be an advantage when entering the European market.

- Be prepared to support any statements that you make with documentation. Increasingly, you also need to prove your policies on Corporate Social Responsibility (CSR).

- Check the website of the Global Shea Alliance for trade information, market trends and industry news. This organisation is dedicated to creating a sustainable shea industry worldwide.

ProFound – Advisers in Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research