The European market potential for vanilla extract

Vanilla extract is a popular natural ingredient used in food and beverages. Its rich aroma and distinctive taste work well in premium desserts, drinks and dairy products. Food and beverage manufacturers use extracts made from high-quality vanilla beans. Although natural vanilla extracts have to compete with artificial vanilla aromas, growing consumer demand for clean-label ingredients is creating a strong market for the natural product.

Contents of this page

1. Product description: vanilla extract

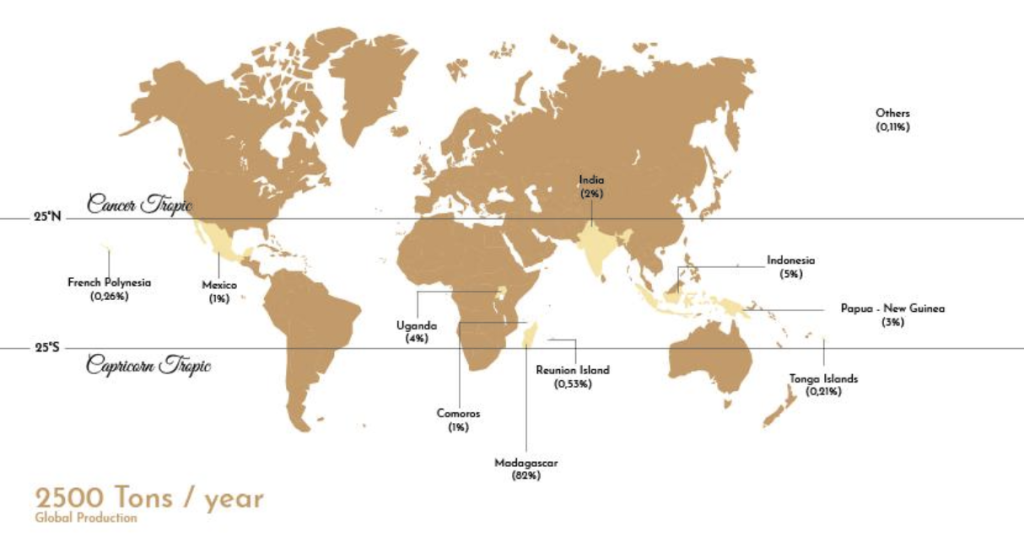

Vanilla extract is derived from vanilla beans, a valuable commodity that is grown in a limited number of regions around the world. Although it is native to Mexico, vanilla is now mainly grown in countries such as Madagascar, Indonesia, Mexico, Tahiti, Uganda, Tanzania and Papua New Guinea. Growing vanilla can be difficult, mainly because the plant has to be pollinated by hand.

Figure 1: Vanilla-growing regions

Source: World of Vanilla, 2024

There are several different varieties of vanilla bean. Each is grown in specific regions and each has its own specific flavour profile. The most widely cultivated variety is bourbon vanilla from Madagascar.

Table 1: Vanilla bean varieties

| Variety | Botanical name | Flavour profile | Main growing regions |

|---|---|---|---|

| Bourbon vanilla | Vanilla planifolia | Strong, sweet, creamy | Madagascar, Uganda, Indonesia, India, Mexico, Réunion, Comoros, Mayotte, Mauritius |

| Tahitian vanilla | Vanilla tahitensis | Floral, fruity | Tahiti, Papua New Guinea |

| West Indian/pompona vanilla | Vanilla pompona | Light, delicate | Caribbean, Central and South America |

Source: ProFound, 2025

Vanilla beans can be sorted by their moisture content. The amount of moisture in the beans affects the end product and how it is used. Beans with less moisture are often used to make extracts. Beans with more moisture are softer and are often used in high-quality and gourmet cookery.

Table 2: Moisture content and uses of vanilla

| Type | Moisture level (%) | Description |

|---|---|---|

| Very dry | 15-20 | Driest type, suitable for long storage |

| Red/rouge | 22-25 | Softer and more flexible |

| TK | 30 | Mainly used for processing into extracts |

| Gourmet | 35-38 | Most aromatic and flavourful, used in high-quality cookery |

Source: Native Vanilla, 2025

Supply chain and uses

Extract-grade vanilla comes mainly from the variety Vanilla tahitensis (Tahitian vanilla). That was originally grown in French Polynesia, but is now also widely farmed in Papua New Guinea and Indonesia. Another, less common, type, West Indian or pompona vanilla (V. pompona), is produced in the Caribbean and Central and South America. Extract-grade and West Indian vanilla is mostly exported to the United States, where vanilla extract is the dominant form on the market.

Vanilla extract is a concentrated liquid made by soaking vanilla beans in alcohol and water. Sometimes, heat is used to speed up the extraction process. Cold extraction is also possible, and that results in a higher-quality extract. This process extracts the flavour compounds from the beans – primarily one called vanillin – which are what give vanilla its distinctive aroma and taste. The quality of vanilla extract depends mainly on the type and quality of the beans used, as well as the extraction method.

In Europe, vanilla reaches the market in several forms:

- Whole or ground vanilla – Sold mainly as pods (beans). This is the most common trade form. Vanilla powder is also available, either made from ground pods alone or blended with sugar (vanilla sugar), starch or other ingredients.

- Vanilla extract – Usually sold in an alcoholic solution (at least 35% alcohol), although sometimes glycerol is used. Both pure and imitation extracts are widely used as flavourings in the food industry, and as fragrances in cosmetics.

Most of the processing of vanilla beans into vanilla extract is done in Europe. However, origin-based production of extract is growing. This presents a good opportunity for suppliers to move up the value chain and to retain more value in the country of origin. Producers like Kasana in Uganda and Goodness Vanilla in India are starting to process vanilla extract locally. This requires food-grade facilities, access to extraction agents, compliance with EU food safety laws and certifications such as HACCP or ISO 22000.

Vanilla extract is mainly used in bakery, dairy, confectionery, beverage and breakfast products.

- Bakery – Used in cakes, biscuits, muffins and pastries. Vanilla extract gives them a soft, sweet flavour that makes baked goods more appealing. For example, the German company Dr. Oetker includes vanilla in its baking ingredients and cake mixes. Vanilla is also sold directly to consumers for home baking.

- Dairy – Used in ice cream, yoghurt, custard and flavoured milk. Vanilla is the most popular ice cream flavour in Europe. Unilever, through its Magnum and Ben & Jerry’s brands, uses vanilla extract in many of its ice creams. Danone from France offers vanilla yoghurt under its Actimel and Activia brands. The Danish company Arla Foods also uses vanilla in yoghurt and dessert products.

- Confectionery – Helps improve the taste of chocolate, toffees, fudge and nougat. Vanilla is often used to give a smooth and rounded flavour. Large companies such as Mondelez, which owns the Milka and Toblerone brands, use vanilla in many of their chocolate products. Nestlé, based in Switzerland, uses vanilla in chocolate bars and seasonal sweets.

- Drinks – Added to flavoured coffees, ready-to-drink beverages and plant-based drinks like almond or oat milk. Nestlé, with its Nescafé and Starbucks ready-to-drink lines, offers vanilla-flavoured coffee. Alpro, part of Danone, makes vanilla-flavoured almond and soy milk. Oatly from Sweden uses vanilla in its oat-based drinks.

- Breakfast products – Used in cereals, granola, porridge and breakfast bars. Nestlé and General Mills offer vanilla-flavoured cereals under brands like Fitness. Weetabix in the UK includes vanilla in some of its breakfast cereals.

Figure 2: Examples of products in Europe containing natural vanilla extract

Source: ProFound, 2025

Trade data

Vanilla and its processed forms are traded internationally under different Harmonised System (HS) codes, depending on the product type and level of processing.

Table 3: Harmonised System (HS) codes for vanilla and vanilla extracts

| Product | Description | HS code | Remarks |

|---|---|---|---|

| Vanilla beans | Neither crushed nor ground | 090510 | Used to track trade in whole beans (pods), the most traditional form of vanilla. |

| Vanilla beans | Crushed or ground | 090520 | Covers trade in processed beans, often used in food service, retail powders and vanilla sugar blends. |

| Vanilla extract | Oleoresin | 13021905 | Covers concentrated vanilla extracts used widely in the food, beverage and fragrance industries; key for analysing industrial demand. |

Source: ProFound, 2025

Tips:

- Research the differences between exporting vanilla beans and vanilla extract. This includes processing, value-addition and export requirements. Choose the product type that best fits your capacity and market potential. Read the CBI study on vanilla, which provides valuable information on the export of vanilla beans.

- Learn about the main vanilla-consuming sectors in Europe, such as bakery, dairy and beverages. This can help you understand how your product will be used and what quality expectations buyers have. If you are already exporting to Europe, ask your client. Or check the website of companies such as Symrise.

- Familiarise yourself with European food safety regulations, especially if you plan to export vanilla extract. This includes rules on food-grade ethanol and hygiene standards. Make sure to check, as regulations are updated frequently.

- For information on vanilla pods, read CBI’s studies on exporting vanilla to Europe.

2. What makes Europe an interesting market for vanilla extract?

Europe offers strong and growing opportunities for vanilla extract. This is due to its large food and beverage industry, increasing demand for natural and organic ingredients and a desire for authenticity and transparency.

A strong food industry and steady imports drive demand for vanilla extract

The demand for vanilla extract in the European food and beverage market is strong and growing. Sales of vanilla extract in Europe reached €720 million in 2024. This market is predicted to grow by 4% annually and to reach a value of €1.07 billion by the end of 2034.

Europe’s huge food industry, with a turnover of over €1.2 trillion in 2024, makes it the largest manufacturing sector in the European Union (EU). This sector includes food and beverage production for retail, food service and industrial use. Because of its large size, Europe is one of the most attractive markets for exporters of vanilla extract from developing countries.

Source: Food and Drink Europe, 2025

After North America, Europe is the world’s second-largest market for natural food additives. In 2024 alone, the European natural food additive market was worth €574 million. It is also expected to continue growing by about 7% each year, reaching €1.05 billion by 2033. Vanilla will benefit from this development because of its long-established use in processed food segments like dairy, bakery and confectionery.

This strong industrial base is reflected in Europe’s steady demand for imported vanilla. Vanilla imports into the EU more than tripled between 2020 and 2024, from 1,177 tonnes to 3,561 tonnes (+203%). This surge was due mainly to growing demand from food and beverage manufacturers seeking natural flavourings. Tthere are short-term market fluctuations due to price volatility or supply issues. Still the long-term trend confirms that Europe remains a key global destination for vanilla exporters.

Source: ITC Trade Map, 2025

Clean-label trends and EU regulation are shaping ingredient choices

European consumers are becoming increasingly health-conscious and ingredient-aware. As part of this shift, clean-label products – those with a list of ingredients that people recognise – are gaining in popularity. Vanilla extract fits well within this trend, because it is a natural flavouring with high consumer familiarity and acceptance. Consumers are becoming more aware of what is in their food. 1 in 4 shoppers actively look for products that make claims like ‘no artificial colourants’, ‘free from preservatives’ and ‘no artificial sweeteners’.

EU rules – particularly Regulation (EC) No 1334/2008 (flavourings) – reinforce these expectations. That regulation provides a strict legal definition of ‘natural flavourings’. They must be derived from natural sources and processed using only physical, enzymatic or microbiological methods.

The same regulation also sets clear rules for labelling. Manufacturers can only use the term ‘natural vanilla flavouring’ if at least 95% of the flavouring component is derived from real vanilla beans. So synthetic vanillin and other artificial flavourings cannot be labelled as natural. They must be clearly listed on product packaging.

Brands that use synthetic flavourings must disclose this on labels. As clean-label awareness grows, more and more consumers are checking ingredient lists and challenging unclear flavour claims. For manufacturers, this creates extra pressure to shift towards more transparent, natural ingredients – such as real vanilla extract – which both comply with EU rules and meet consumer demand for trust, transparency and traceability.

One good example of how this regulation impacts product marketing is Oatly. That is a popular plant-based milk brand in Europe, mostly known for its oat drinks. On its vanilla-flavoured oat milk, the label lists ‘natural flavourings’. But the company also goes a step further to explain what this actually means. On its website, Oatly states: "Instead of natural vanilla flavouring, we use a natural flavouring with the taste of vanilla, so it’s not real vanilla". Oatly’s disclosure shows how consumers are asking more questions, and how companies are being prompted to clarify the origin and nature of their flavourings.

Figure 5: A popular plant-based milk alternative in Europe

Source: Oatly, 2025

Organic demand is rising, creating opportunities for certified vanilla extract

The value of the European organic food and beverage market reached €48.8 billion in 2023. In that year it recovered following a brief decline in 2022, when high inflation and reduced disposable incomes caused the first drop in organic sales since 2014. The increased sales of organic products are being driven by consumer demand for health, sustainability and transparency. The EU Farm to Fork Strategy, which is aiming for 25% of agricultural land to be organic by 2030, is further supporting the long-term growth of this segment.

Here are some key facts about the top five European organic markets:

- Germany is the leading consumer market. Organic retail sales there exceed €15 billion annually;

- France’s organic market is the next largest. It was valued at around €12 billion in 2023;

- Italy’s organic food market was valued at €3.9 billion in 2023. That was 5.2% more than in the previous year;

- Spain’s organic market is worth about €3 billion. It grew by around 6.2% in 2023;

- Denmark leads the world in organic spending per person, at more than €100 each year.

Within this expanding market, organic vanilla is positioned as a premium natural flavouring. For example, Yeo Valley (UK) includes organic vanilla extract and powder in its vanilla yoghurts and ice creams. That reinforces its clean-label credentials. Les 2 Vaches (France) uses certified organic milk from Normandy and real hand-harvested organic Madagascan vanilla in its stirred yoghurts, and it emphases both their quality and the ingredients’ ethical sourcing. In the plant‑based category, Provamel (Belgium) flavours its organic soya drink with an organic bourbon vanilla extract.

In the toddler category, Organix (UK) uses organic vanilla in its Cocoa & Vanilla Gruffalo Biscuits to deliver taste without artificial ingredients. Artisan ice-cream brands like Roskilly’s (UK) rely on organic vanilla in their rich, minimalist recipes with no gums or stabilisers. Andechser Natur (Germany) makes its mild organic vanilla yoghurt with real bourbon vanilla extract that is traceable to organic farms.

These examples show how organic vanilla extract enables brands across the dairy, plant-based and snack categories to deliver natural taste. It also higlights quality, storytelling and clean labelling. For exporters, supplying premium organic vanilla taps into this growing market.

Tips:

- Target buyers in western European countries, as they have the largest food-processing sectors. France and Germany are the most promising markets. Western European countries also have the largest organic food markets.

- Visit trade shows in Europe, like BIOFACH and Food Ingredients Europe, to meet European buyers.

- Read the CBI study What is the demand for natural food additives in the European market?. That will help you find more information about natural food additives and what makes Europe an interesting market for you.

- Read the CBI study on exporting vanilla to Europe for more information about market demand, trends and trade statistics for vanilla beans.

- Read the NEI Sustainability Report for 2024 to find out how suppliers of vanilla extracts communicate their sustainability efforts and achievements.

3. Which European countries offer the most opportunities for vanilla extract?

France is the biggest market, followed by the Netherlands. Spain and Belgium are growing the fastest. Demand in Germany is falling, while Italy prefers vanilla beans rather than extracts.

The figure below shows the import volumes of vanilla, crushed or ground, into Europe between 2020 and 2024. Overall, imports of processed vanilla (not extracts) have declined in the major European markets.

Source: ITC Trade Map, 2025

The table below provides a more detailed overview of the imports of vanilla oleoresin into European markets. It shows clear positive changes in both value and volume across the major markets.

Table 4: Import values and volumes of vanilla oleoresin into main European markets, 2020-2024

| Country | 2024 value (million €) | % change in value (2020–2024) | 2024 volume (metric tonnes) | % change in volume (2020–2024) |

|---|---|---|---|---|

| France | 7.9 | +75.9% | 504.9 | +1,677% |

| Netherlands | 3.4 | -24.6% | 66.3 | +88.2% |

| Germany | 1.8 | -46.1% | 29.7 | -14.8% |

| Spain | 0.1 | +153.1% | 8.7 | +385.0% |

| Belgium | 1.6 | +3,307% | 7.1 | +804.5% |

| Italy | 0.03 | -91.2% | 1.5 | +32.2% |

Source: ITC Trade Map, 2025

France

France is the second-largest EU consumer market, and also a leading hub for the vanilla trade. This is due largely to its fragrances and flavours industry, centred in the town of Grasse, and to major distribution through the port of Marseille. But French ground vanilla imports have declined sharply, to 178 tonnes in 2024 (-58% since 2020). France is still the biggest European importer of vanilla oleoresins. Their import value rose from €4.5 million in 2020 to €7.9 million in 2024 (+76%), and their volume jumped from 28 tonnes to 504 tonnes (+1,680%). This widening gap between volume and value growth reflects Indonesia’s increasing role in the supply of lower-priced vanilla extracts to Europe. Sourcing is highly concentrated: Indonesia (63%), Madagascar (35%) and Uganda (2%) accounted for almost all imports in 2024.

France is the strongest organic vanilla market in Europe. Its value is projected to grow from $30 million (USD) in 2024 to $184 million by 2035 – a sixfold increase driven by strong consumer demand for sustainably sourced, traceable vanilla products.

Major food manufacturers are driving this demand. Danone stands out as a leading player in France’s organic vanilla market due to its strong commitment to sustainability and organic sourcing. The company’s focus on quality and traceability positions it favourably with environmentally conscious consumers. That is backed up by well-established distribution channels and by brand loyalty that the firm has cultivated over many decades.

For exporters of organic vanilla extract, France offers the best opportunities in Europe. The combination of large import volumes, concentrated retail channels (Carrefour, Delhaize, Auchan, Intermarché) and strong consumer preference for organic products is driving demand for EU Organic-certified vanilla oleoresin.

Major French companies active in the vanilla sector include Robertet, which sources its Fair For Life-certified vanilla from Madagascar through a long-term partnership with a producers’ co-operative called ISOKITRA. Mane has been sourcing its vanilla from a Madagascan partner for the last 40 years. Other interesting companies include Naturex, Touton, Vanilla Fair, Max Daumin and Eurovanille.

The Netherlands

The Netherlands is a major trade and re-export hub for vanilla. Its ground vanilla imports reached 71 tonnes in 2024 (+58% since 2020). Dutch vanilla oleoresin imports were highly volatile between 2020 and 2024: their volumes increased by 88% overall, to 66.3 tonnes, but their value fell by 25% to €3.4 million. This widening gap between volume and value growth indicates falling unit prices. The cause is most likely oversupplying or a shift towards lower-priced extracts. Sourcing remains highly concentrated. Madagascar supplied 97% of Dutch imports in 2024, followed by Indonesia and Tanzania (2% combined).

The Netherlands is the leading destination for organic imports into the EU. Its total organic import volumes have increased by 17% in recent years. Organic vanilla is more and more popular in the Netherlands, where most vanilla-based consumer product launches now focus on ethical and sustainability claims.

For exporters, the Dutch market provides a strategic entry point into Europe’s organic vanilla sector. It is particularly attractive for suppliers who can demonstrate sustainable farming practices and chemical-free production methods. More and more European retailers are developing private-label products, including Dutch outlets like Albert Heijn and Jumbo. This creates partnership opportunities for suppliers of organic vanilla extract.

The Dutch Spice Association strongly supports sustainable sourcing. Leading importers have established the international Sustainable Spices Initiative, which is further reinforcing the market’s focus on ethical and organic ingredients. This industry commitment to sustainability makes the Netherlands particularly receptive to suppliers of organic-certified vanilla oleoresin.

Major Dutch companies active in the vanilla sector include Vanille BV. It specialises in gourmet bourbon beans from Madagascar, Papua New Guinea, Uganda and Tahiti. A short supply chain means that it is able to supply high-quality beans at competitive prices. Vanilla Point offers 100% Ugandan vanilla, grown using regenerative agriculture methods like intercropping, mixed farming and mulching. Other interesting players include Vanilla Venture, De Lange and DSM.

Germany

Germany is Europe’s largest consumer market and a major importer, manufacturer and re-exporter of food ingredients. However, its ground vanilla imports declined to 157 tonnes in 2024 (-30% since 2020). Vanilla oleoresin imports also contracted significantly. Their value fell from €3.37 million in 2020 to €1.82 million in 2024 (-46%), and their volume from 34.9 tonnes to 29.7 tonnes (-15%). A spike to 1,345 tonnes in 2022 was most likely caused by a one-off bulk shipment. Germany’s sourcing is extremely concentrated. Madagascar supplied 99.7% of its vanilla imports in 2024. Small amounts also came from South Africa and Sri Lanka.

Despite the decline in its overall vanilla oleoresin imports, Germany’s organic vanilla market is growing. Its value is projected to expand from $24 million in 2024 to $109.1 million by 2035. That represents more than a fourfold increase. Germany is the second-largest destination for organic imports in the EU, and its total organic import volumes have increased by 2% in recent years.

The marketing claims made in Germany by consumer products containing vanilla focus mainly on their sustainable, environmental, ethical and organic qualities. That positioning creates strong demand for certified organic vanilla extracts. For example, retailer REWE offers an own-brand organic vanilla yoghurt with ‘Bio’ certification and emphasising its natural vanilla flavour. This shows how German retailers reinforce expectations for certified organic vanilla ingredients throughout the supply chain.

Other major German companies active in the vanilla sector include ADM, which offers Fair For Life and Organic-certified vanilla. Although ADM is a US corporation, it has a subsidiary in Germany that is a member of the German Association of the Flavour Industry (DVAI). Symrise became the first flavour company to have its own vanilla operation in Madagascar, in 2006. Other interesting companies include Oleador, Glycklich Eis and Aust & Hachmann.

Spain

Spain has a large food industry, which was valued at €58 billion in 2023. The flavour and fragrance market there is expected to reach €11 billion by 2030. But the country’s imports of ground vanilla imports fell from 187 tonnes in 2020 to just 25 tonnes in 2024 (-87%). On the other hand, the value of its vanilla oleoresin imports rose from €57,042 in 2020 to €144,372 in 2024 (+153%). And their volume grew from 1.8 tonnes to 8.7 tonnes (+385%). This confirms a clear substitution effect in favour of concentrated vanilla oleoresins. Although Spain remains a smaller importer than France or the Netherlands, this consistent growth highlights its emergence as a fast-growing secondary market in southern Europe. Its sourcing is highly concentrated: Madagascar supplied 99% of Spain’s direct oleoresin imports in 2024.

Major Spanish companies active in the vanilla sector include Niaga Organics, which produces gourmet, Grade B and Grade C vanilla beans. It works directly with smallholder farmers in Sumatra (Indonesia), Papua New Guinea and Tahiti. Bidah Chaumel, a well-established importer and distributor of natural ingredients, offers vanilla in many different formats. Its certifications include Organic, ISO 9001, ISO 22716 and ISO 14001. Other interesting players are Lucta, Ventos, Delsa and La Vanille de Rose.

Belgium

Belgium is emerging as a niche hub for vanilla extracts in Europe, even as traditional imports decline. Imports of ground vanilla have fallen sharply, to 20 tonnes in 2024 (-85% since 2020). By contrast, imports of vanilla oleoresin rose steeply from less than 1 tonne in 2020 to 7.1 tonnes in 2024. In value terms, oleoresin imports climbed from minimal levels in 2020 to €1.6 million in 2024 (+3,307%), after peaking in 2022. This shift mirrors the pattern in Spain and indicates Belgium’s growing importance as a processing and redistribution centre for flavour houses. However, sourcing remains highly concentrated. Uganda accounted for 96% of vanilla oleoresin imports in 2024, meaning that Belgium is heavily reliant on a single African supplier.

Belgium is the third-largest EU destination for organic imports. Their total volume has increased by 13% in recent years. Vegetables, dairy products and fruits are the most popular organic products in Belgium. This is particularly relevant for suppliers of vanilla extract because vanilla is used a lot in dairy products. That creates strong indirect demand for organic vanilla extracts from dairy manufacturers and processors.

Key players in the Belgian vanilla sector include AVG, which supplies both powders and whole beans from Indonesia. Others are Madagascar Vanille, Vanillestokjes and Natural Spices (Organic, Fairtrade and Agriculture Biologique-certified).

Italy

Italy is the only major European market where imports of ground vanilla continue to rise. They went up from 16 tonnes in 2020 to 51 tonnes in 2024 (+219%). This growth reflects Italy’s culinary traditions and preference for natural ingredients in bakery goods, ice cream (gelato) and confectionery. By contrast, vanilla oleoresin remains a niche category. Imports reached just 1.5 tonnes in 2024, and their value dropped from €295,766 in 2020 to €25,910 (-91%). Although volumes grew modestly (+32%), the data indicates a reliance on trade with other EU countries rather than direct sourcing of oleoresin. Indonesia was the only notable developing country to supply Italy with vanilla in 2024.

The Italian organic food market was worth €5.4 billion in 2023. At-home consumption grew by 5% and away-from-home consumption by 18%. Modern distribution (hypermarkets and supermarkets) remains the main retail channel. It accounts for 58% of total organic sales. Private-label products represent 47.5% of organic sales value.

Italian consumers favour organic products mainly for health and safety reasons (27% consider them safer than conventional options). Environmental sustainability is also an important factor (23%). Italy’s strong organic market growth – particularly in the dairy, confectionery and artisanal gelato sectors, where vanilla is widely used – creates niche opportunities for suppliers of organic vanilla extract who target premium users.

Major Italian companies active in the vanilla sector include Carlo Sessa. It supplies vanilla extract from Mexico, vanilla paste from Germany and vanilla beans from Madagascar. Varesco Group offers vanilla beans in vacuum-packed formats ranging from 50 g to 1 kg+.

Tips:

- Read the CBI study 8 tips for finding buyers on the European natural food additives market. This will give you more information about how to find new buyers in Europe.

- Focus on gateway markets like the Netherlands and Germany. Their strong demand for premium functional ingredients and innovative food sectors make them ideal entry points into the EU.

4. Which trends offer opportunities or pose threats in the European vanilla extract market

Europe’s growing focus on health, sustainability and clean-label products is driving strong demand for natural vanilla. This is especially so in the high-protein dairy and snack segments. At the same time, European buyers require traceable, ethically sourced ingredients more often. They reward suppliers with strong certifications, transparent supply chains and clear origin stories. Clean-label and organic claims are opening up premium niches. At the same time, innovation in European vanilla cultivation shows local interest but remains limited in scale.

Protein-enriched dairy and snacks fuel demand for vanilla-flavoured products

The global market for protein snacks was valued at approximately €42.8 billion in 2023. That figure is projected to more than double by 2032, reaching €92.6 billion. As traditional protein bars and shakes begin to saturate the market, consumers are now looking for something different. They want novel, convenient formats (including high-protein yoghurts) that deliver nutritional benefits without sacrificing taste or label clarity.

Vanilla is one of the main flavours driving this shift. As a natural, familiar flavour, it plays a key role in creating high-protein formulations that appeal to health-conscious consumers. A recent Tasting Table review of 21 high-protein yoghurts showed that top brands like Chobani, Siggi’s, Icelandic Provisions and Oikos often rely on real vanilla or vanilla extract. Siggi’s uses Madagascar bourbon vanilla and a simple recipe. Icelandic Provisions’ vanilla skyr contain visible vanilla bean seeds for added authenticity.

Organic players are also tapping into this trend. Brands like Stonyfield and Whole Foods Market’s 365 Organic have introduced vanilla-flavoured, protein-rich lines. These combine functionality with ethical sourcing. Mainstream retailers like ALDI (Friendly Farms) have launched zero-sugar vanilla yoghurts to meet demand at accessible price points.

In Europe, this trend is spreading fast. In the UK alone, sales of high-protein yoghurt are expected to exceed €807 million in 2025. That represents an annual growth rate of 25%. Yoplait has launched its skyr in larger, family-sized formats, and vanilla is a top-performing flavour in France and Ireland. UK yoghurt sales rose by €206 million in 2024. Growth there is concentrated in the adult breakfast segment. That growth is being driven by creating new formats rather than offering different flavours.

Vanilla remains a flavour staple. Due to its broad consumer appeal, vanilla-flavoured yogurt is sold in 1 kg tubs, multipacks and drinkable form. This presents a clear opportunity for exporters of natural vanilla extract – especially those with organic or fair-trade certification – to serve a growing segment of Europe’s health-focused dairy market.

Figure 7: High protein vanilla-flavoured yoghurts in the European market

Source: Judy Moreno/Tasting Table, 2025

Tips:

- When targeting food manufacturers, consider obtaining certification that builds trust and adds value. Consider organic or Rainforest Alliance labels, for example, to appeal to premium yoghurt brands and health-conscious consumers. But follow specific buyer and market demand, and also take into account the cost of obtaining certifications.

- Demonstrate consistent quality and flavour by conducting regular tests on your vanilla. This is important because product formulators expect a stable vanillin content and flavour profile across batches in order to maintain product quality.

- To tap into this growing market, consider tailoring your marketing to B2C brands. You can find these companies at international trade shows like BIOFACH, Anuga, SIAL and Food Ingredients Europe.

Traceable and ethical vanilla supply chains attract premium buyers

European buyers increasingly want traceable, transparent and ethically sourced vanilla. The EU is seen as the global gold standard for food supply-chain traceability. It owes that status to strong regulation, monitoring and tighter rules, such as those set out in the Corporate Sustainability Due Diligence Directive. This is part of a broader effort to promote food security, ethical sourcing and supply-chain resilience.

In the UK, the government now publishes a Food Security Report once every three years. It has also set up a monitoring system to track agricultural supply trends and risks.

European buyers expect:

- Full visibility into where ingredients come from;

- Full details of how they are made;

- Verification that they meet environmental and ethical standards.

This is important because suppliers who can demonstrate traceable, transparent and ethical sourcing are more attractive to premium buyers and brands. This is especially true in the organic, fair trade and clean-label segments. One good example is Vanilla Fair, a company that works directly with 1,600 smallholder farmers in Madagascar.

Here is what it does well:

- Traceability communication – Vanilla Fair’s approach includes blockchain tracking, direct producer engagement and a highly transparent processing model. It outlines a 12-step curing process, from washing, sun-drying and sorting to classification and final packaging. That provides buyers with a clear picture of each stage of production.

- Stakeholder engagement – The company clearly defines the key stakeholders involved in its supply chain. They range from female pollinators and preparators to sorters and exporters.

- Certification sharing – Vanilla Fair holds an extensive list of certifications. They include FLOCERT, Ecocert, USDA Organic, Agriculture Biologique, Fairtrade, Rainforest Alliance, Halal and Ecovadis (which has awarded the company a sustainability excellence medal).

- Communication strategy – Vanilla Fair’s blog shares industry insights. For example, a guide to maximum residue limits (MRLs) for vanilla MRLs in the EU and the US. It also reports on its activities, such as a recent visit to Dubai’s agri-food sector.

By combining transparency, sustainability and clear storytelling, Vanilla Fair sets a strong benchmark for traceable vanilla supply chains.

Traceability is slowly becomes a basic expectation in the EU. Vanilla exporters who offer transparency, certification and compelling communication will be in a strong position to win buyer trust and access higher-value markets.

Tips:

- Check out the work that the Sustainable Vanilla Initiative is doing to promote a sustainable and fair vanilla supply chain across Africa.

- Think about how to communicate your traceability and transparency to European buyers. Be prepared to answer their questions. For example, how many farms do you work with? What you do to support their livelihoods? How are you protecting the environment across your operations? Exactly where do you source your vanilla? And who are all the different actors in your supply chain?

- Take photos of your operations, create stories around them and upload them to your website. That increases trust and shows the people behind your product.

Vanilla extract exporters are building a competitive advantage with farmer training

Suppliers of vanilla extract in developing countries have different ways of getting a competitive advantage. They can, for example, invest in farmer training programmes, extension services and smallholder support systems. These capacity-building initiatives strengthen their position by improving bean quality, ensuring consistency of supply and creating fully traceable supply chains. Factors like this make them valued partners for European buyers facing strict sustainability requirements.

For European buyers, sourcing from these suppliers hugely simplifies procurement. Rather than conducting extensive due diligence, managing complex certification processes or building their own farmer networks, buyers can instead partner with suppliers who have already made those investments. This makes those suppliers particularly attractive in the European market.

Several exporters of vanilla extract have already invested in farmer capacity building:

- Natural Vanilla (Sri Lanka) has built a network of more than 3,000 farmers, and it hopes to increase that to 25,000 across the island. It provides them with hands-on training in pollination and post-harvest techniques.

- Natural Extracts Industries Tanzania has built one of the region’s most sophisticated farmer support systems. It works with over 13,000 smallholder farmers across Tanzania and Uganda to supply organic and traceable vanilla under its own brand, Viva Vanilla.

- Esco Uganda has positioned itself as one of Uganda’s largest certified exporters of organic vanilla by investing heavily in farmer training to improve yields and quality.

- PT. Gudang Vanili Indonesia, despite only launching in 2020, has expanded rapidly by investing in integrated farming and processing operations.

For suppliers of vanilla extract, investments in farmer training and capacity building are a strategic business move that makes Europe’s quality-conscious, sustainability-focused market particularly attractive and profitable for them to serve.

Tip:

- Read how NEI Tanzania has developed its own vanilla extracts in collaboration with smallholder farmers in Uganda and Tanzania.

European innovation in vanilla cultivation offers opportunities and competition

European companies are now exploring the cultivation of controlled-environment vanilla. Combined with extract processing capabilities, this could enhance quality, resilience and traceability while also reducing reliance on imported vanilla extracts.

In France, Eurovanille operates a 1,000 m² experimental greenhouse that replicates tropical conditions. That is being used to develop more productive and disease-resistant varieties of vanilla. Working with research institutions such as CIRAD and INRAE, the firm is using genome sequencing to create climate-adapted plants. It is also innovating with tailor-made vanilla extracts and powders for the food industry. They are produced on-site, to strict specifications.

In Brittany (France), Prince de Bretagne growers have successfully adapted former tomato greenhouses for vanilla cultivation. This innovation takes advantage of the plant’s preference for stable temperatures and diffused light. Through a five-year exchange of knowledge with producers on Réunion and a partnership with the co-operative ProVanille, the firm is now producing small quantities of ‘Brittany vanilla’ (vanille de Bretagne).

Such greenhouse-grown vanilla faces limitations of scale and cost, however. Most of the world’s vanilla will continue to come from tropical countries. For that reason, European manufacturers are investing heavily in quality, sustainability and traceability in those countries, in order to secure their supply chains.

Givaudan, one of the world’s largest flavour and fragrance companies, has co-founded SOMAVA in Madagascar with partner Henri Fraise. This joint venture works directly with over 3,100 organic vanilla farmers across 31 villages. It supports reforestation projects and has operated carbon-neutrally since 2013. In June 2025, Givaudan announced that it had achieved Rainforest Alliance certification for its Madagascar vanilla supply. That has further strengthened its position in sustainable sourcing.

Tips:

- Clearly label your product ‘pure vanilla extract’, obtain organic or fair-trade certification and tell a compelling origin story. This positions your product as worth a premium, and also meets the growing demand for authenticity in flavour.

- Keep yourself up to date with trends in the European food industry by subscribing to newsletters like Food Navigator, FoodDrinksEurope and FoodIngredientsFirst.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research