Entering the European market for black cumin seed oil

As an exporter of black cumin seed oil targeting the European market for food additives, you must follow strict regulations. These cover food safety, traceability, labelling and contaminants. Buyers also expect additional guarantees, such as third-party certifications, reliable documentation and proof of consistent quality. Meeting these requirements is essential in order to access high-value market segments. Your main competitors include processor-exporters from India, Türkiye and Egypt who offer large volumes, diverse product formats and price flexibility.

Contents of this page

- What requirements and standards must black cumin seed oil meet to be allowed on the European market?

- Through what channels can you reach the European market for black cumin seed oil?

- What competition do you face on the European black cumin seed oil market?

- What are the prices of black cumin seed on the European market?

1. What requirements and standards must black cumin seed oil meet to be allowed on the European market?

As an exporter to Europe, you must ensure that your oil complies with the food safety and labelling requirements imposed by the European Union (EU). These rules exist to protect consumer health and to guarantee that products entering the EU market meet uniform safety, hygiene and quality standards. They cover food safety, contaminants, pesticide residues, packaging, additives and traceability. You need to understand how they apply specifically to oil-based food ingredients like your black cumin seed oil.

What are mandatory requirements?

The EU regulations are legal requirements that all exporters must meet before their products can enter the European market. Non-compliance can lead to shipment rejection, import bans or inclusion in the EU’s Rapid Alert System for Food and Feed.

Food safety

Food safety is a high priority in Europe. First of all, your black cumin seed oil must follow Regulation (EU) No. 2019/1381 (general food law). This gives a summary of the core principles of food traceability, risk analysis and safe production.

Other important laws include Regulation (EU) 2021/382 (food hygiene). This sets hygiene rules for the entire food chain, from production to export.

- Products must be handled, stored and processed in sanitary conditions;

- Facilities must add a HACCP (Hazard Analysis and Critical Control Points) system to keep an eye on and reduce the risk of microbial or chemical contamination;

- Exporters must maintain records of critical control points, cleaning routines, temperature logs and sanitation procedures.

Impurities, contaminants and pesticide residues

To enter the European market, you must obey laws that set strict limits on contaminants in your black cumin seed oil. For example, Regulation (EU) No 2023/915 (contaminants) limits the allowed levels of substances such as heavy metals (lead, arsenic, etc.), polycyclic hydrocarbons (PAHs) and aflatoxins. These contaminants can get in the product when it is planted (in soil, for example), during drying or in storage. To prove that you obey the limits, regular lab testing by an official provider is essential.

Regulation (EU) 2025/854 (pesticide residues) sets maximum residue limits (MRLs) for all food products imported into Europe. Black cumin seed oil must be tested to ensure that the MRLs for pesticides during seed cultivation are not exceeded.

Lastly, Regulation (EU) 2025/351 (food contact materials) governs food packaging. Containers and other packaging must not leach harmful substances into the oil during storage and transport. Your oil’s packaging must be food-grade and tested to ensure that it does not release plasticisers, metals or other contaminants.

Tip:

- Carry out batch-specific lab tests for pesticide residues and contaminants before export. Provide certificates of analysis (CoA) to buyers to show compliance.

Controls and non-compliance

The EU enforces strict border controls to ensure that imported food products meet safety standards. Shipments are routinely inspected for contaminants such as pesticide residues, environmental pollutants and natural toxins. If a shipment exceeds the legal limits for any of these substances, it may be rejected, detained or reported via the EU’s Rapid Alert System for Food and Feed (RASFF).

The table below shows recent RASFF notifications involving black cumin seed oil or related products. Small quantities of banned or excessive substances can result in the whole shipment being denied. These violations demonstrate how contaminants in raw black cumin seeds are directly transferred into the final oil product.

Table 1: RASFF alerts involving black cumin seed products

| Date | Hazard identified | Analytical result | Legal maximum | Type of violation |

|---|---|---|---|---|

| 28 Feb 2025 | Benzo(a)anthracene (PAH – environmental pollutant) | 5.2 µg/kg (ppb) | 2.0 µg/kg | Exceeded PAH limits |

| 28 Feb 2025 | Benzo(a)pyrene (PAH – environmental pollutant) | 24.7 µg/kg (ppb) | 10.0 µg/kg | Exceeded PAH limits |

| 23 Sep 2024 | Pyrrolizidine alkaloids (natural toxin) | 3,465.6 µg/kg (ppb) | 400 µg/kg | Over 8x the legal limit |

| 26 Jul 2024 | Chlorpyrifos (unauthorised pesticide) | 0.086 ± 0.043 mg/kg (ppm) | 0.01 mg/kg | Nearly 9x higher than the EU threshold |

Source: RASFF, 2025

If a specific country or region continues to not follow the rules, the EU may introduce stricter import conditions. These may include mandatory lab testing, temporary import restrictions or the suspension of imports. The New Official Controls Regulation also extends these controls to organic-certified products. This means that organic exporters still need to have inspections or testing.

Food additives

If black cumin seed oil is promoted as a food additive or preservative, it must follow Regulation (EU) No 1333/2008. That covers the following items:

- Definitions and permitted uses of food additives;

- Maximum usage levels in different food categories (knowing these limits allows you to advise potential buyers on compliant formulations and to help them avoid costly reformulation delays);

- Labelling rules for additive-containing foods;

- Pre-market approval procedures for new additives.

Annex I of Regulation (EU) No 1333/2008 includes the functional classes of additives. Given black cumin seed oil’s properties, its uses fall under the following headings.

- Preservatives – substances which prolong the shelf life of foods by protecting them against deterioration caused by micro-organisms, and/or which protect against the growth of pathogenic micro-organisms;

- Antioxidants – substances which prolong the shelf life of foods by protecting them against deterioration caused by oxidation, such as fat rancidity and colour changes.

Due to its high content of thymoquinone, black cumin seed oil exhibits both antioxidant and antimicrobial properties. That makes it an attractive option for natural preservation in clean-label food products.

In your product documentation, make clear whether the oil is for use as a cosmetic product or as an ingredient for food products. Most suppliers of black cumin seed oil use a technical data sheet (TDS) to tell others about their product’s intended end use: food, industrial, personal care or cosmetics. This classification affects the product’s regulatory status and labelling requirements.

Labelling

Labelling your products for export is mandatory. The label’s main purpose is to ensure traceability and safety during transport and storage. Use English for labelling unless your buyer has indicated otherwise. This information can usually be found in the technical data sheet. One buyer interviewed for this study, Sigma Oil Seeds, includes the following labelling information in its technical data sheet:

- Name of product

- Quantity

- Batch number/lot number

- Expiry date

- Certification

Mark all containers with a batch number and register each batch in a record-keeping system. This makes everything traceable in the event of food-safety audits or complaints. If you sell bulk oil to manufacturers, provide a digital label template and documentation package with a technical data sheet, safety data sheet and certificate of analysis so they can easily add it into their systems.

Tip:

- Read the CBI study about requirements for natural food additives to be allowed on the European market. This provides further information about the mandatory requirements you must comply with.

What additional requirements and certifications do many buyers expect?

Besides legal requirements, many European buyers have their own additional standards. These help them to check your reliability, quality and professionalism. Meeting these expectations increases your competitiveness and helps you to get long-term partnerships. The most common additional requirements relate to payment terms, complete product documentation, sustainability practices, proper packaging and relevant certifications.

Payment and delivery terms

Payment is one of the most important aspects of international trade. As an exporter of black cumin seed oil, you need to strike a balance between protecting your business and offering payment terms that are attractive to European buyers. Before agreeing to any payment option, consider the following factors:

- How reliable your buyer is;

- The size and value of the order;

- Your own cash flow and funding needs;

- Political or currency risks in your country or the buyer’s country.

Your goal is to minimise risk while staying competitive in the European market. One of the safest payment options in international trade is a letter of credit (LC). Issued by the buyer’s bank, this guarantees that you will be paid as long as you meet the shipping and documentation terms you have agreed with your buyer.

Tip:

- Watch this video from the International Trade Administration to understand what a letter of credit is.

Documentation

European buyers expect their suppliers to provide detailed information on the product they are selling and the company behind it. Some of the most important documents related to black cumin seed oil are:

- Safety data sheet (SDS) – Describes the oil’s physical, health and environmental hazards, along with handling, storage and transport precautions.

- Technical data sheet (TDS) – Summarises the product’s specifications and key technical properties, such as its appearance, processing method and shelf life.

- Certificate of analysis (CoA) – Provides lab test results for a specific batch, confirming quality parameters like thymoquinone content, acidity and the absence of contaminants. Some companies, like NHR Organic Oils, update this document regularly and make it publicly available on their website so that buyers always have up-to-date information.

One good example of the documentation you need to provide is given by O&3. It shares all the key documents for its cold-pressed black cumin seed oil on its product page. They include an allergen declaration, SDS, TDS, CoA, product marketing sheet and manufacturing flow. As a supplier, you should aim to offer the same level of documentation. Make sure that it is clearly labelled and downloadable. This increases trust and speeds up procurement decisions.

Tip:

- Use the CBI study on technical and safety data sheets to help you prepare these documents for your black cumin seed oil. That study also provides information and guidance on sending samples.

Sustainability

European buyers of black cumin seed oil are under growing pressure to meet sustainability and transparency standards. This trend is being driven by regulatory initiatives such as the European Green Deal and the Corporate Sustainability Due Diligence Directive (CSDDD), as well as by consumer demand for ethically sourced ingredients.

Although these EU policies do not legally apply to non-European suppliers, they do indirectly affect you as an exporter. If you supply black cumin seed oil to European buyers, you will be expected to demonstrate compliance with due-diligence frameworks. One top priority for buyers is the ability to trace black cumin seed oil back to its origin, with verified environmentally and socially responsible practices across the supply chain.

Buyers often assess the following items:

- Ethical sourcing of black cumin seeds (non-GMO, no overharvesting, biodiversity conservation, etc.);

- Fair and safe working conditions during harvesting, pressing and packaging;

- Environmentally friendly processing, including minimal waste and reduced emissions;

- Use of recyclable, food-grade packaging materials.

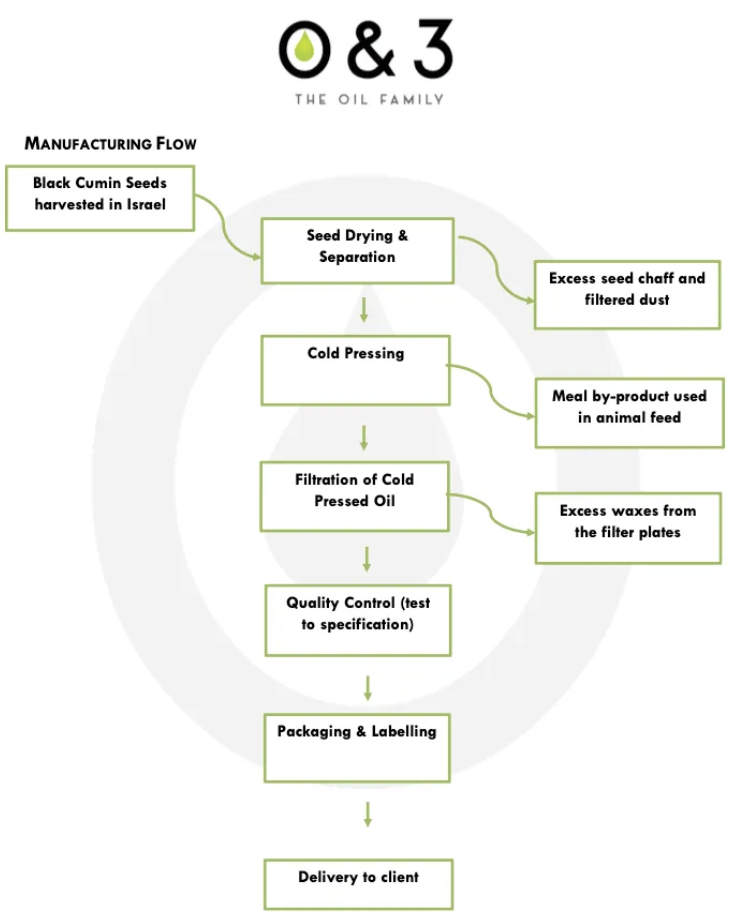

One example of good sustainability and traceability practices is the production flow for black cumin seed oil published by the UK-based company O&3.

Figure 1: O&3 black cumin seed oil manufacturing flow

Source: O&3, 2025

This system demonstrates:

- Efficient material use – Meal by-products from pressing are used in animal feed;

- Controlled waste disposal – Dust, seed chaff and waxes are removed responsibly;

- Cold pressing and filtration – They preserve the oil’s natural properties without using chemical solvents;

- Quality control and traceability – Batch-level specification checks before packaging;

- Clean packaging and labelling – They ensure food safety and traceability for the buyer.

By using this type of structured, low-waste production process, you enhance your sustainability profile and increase your appeal to European buyers.

Packaging requirements

Proper packaging is critical to preserving the quality and shelf life of black cumin seed oil during transport and storage. This oil is sensitive to light, oxygen and heat. Because of this, packaging must protect it from external factors that could lead to oxidation, rancidity or contamination. European buyers often have specific requirements based on their own product formats, processing infrastructure and storage conditions.

Your packaging must be:

- Food-grade;

- Clean and leakproof;

- UV protected, especially for long-distance shipping;

- Clearly labelled with all legally required information and batch traceability data.

Gustav Heess, one of the largest importers of vegetable oils in Europe, supplies black cumin seed oil in three formats.

Table 2: Standard packaging formats for black cumin seed oil

| Format | Volume | Typical buyers | Shelf life |

|---|---|---|---|

| IBC tank | 900 kg | Bulk processors or repackers | 6 months |

| Steel drum | 190 kg | Mid-size food and supplement makers | 18 months |

| Canister | 27 kg | Small-scale manufacturers, labs | 12 months |

Source: Gustav Heess, 2025

Each packaging format serves a different need.

- Intermediate bulk containers (IBCs) – Ideal for high-volume buyers with in-house bottling or blending capabilities, but have a shorter shelf life due to increased oxygen exposure once opened;

- Steel drums – Provide a balance between volume and product integrity, offering a longer shelf life in airtight conditions;

- Canisters – Suitable for small orders or high-turnover production lines. Easier to handle and store.

By aligning your packaging options with industry standards, you improve your chances of being selected by large-volume European buyers who expect consistent, durable and traceable packaging.

Tips:

- Offer at least two of the three standard formats (IBC, drum and canister), depending on order size and buyer type.

- Label each unit with the product name, batch code, net weight, 'best before' date, storage conditions, country of origin and certifier information.

- Consider using recycled and recyclable packaging materials. Environmental sustainability is becoming increasingly important for European buyers.

Certifications

Certifications are a valuable benefit for exporters of black cumin seed oil who want to access premium market segments in Europe. They help you build trust with buyers, demonstrate compliance with sustainability and ethical sourcing standards. They also make your product stand out in a competitive market.

The most relevant certification for black cumin seed is organic. To market black cumin seed oil as organic in the European Union, it must comply with the EU Organic Regulation (EU) 2018/848. This requires:

- Natural methods of pest and weed control;

- Organic soil and crop management practices;

- Full traceability throughout the supply chain;

- Use of approved extraction methods, such as cold pressing, steam or organic alcohol.

Oils extracted using hexane or other non-permitted chemical solvents cannot be certified as organic under EU rules. To be sold as EU Organic, your product must be certified by an EU-recognised control body.

Dutch importer Sigma Oil Seeds works exclusively with certified organic suppliers."The minimum base has to be that they need an organic certification," says Timo van Dorland, the company’s General Manager. Sigma does not finance certification, but it will share guidance on what suppliers need to do.

Besides organic, the following certifications may apply depending on your supply chain and market positioning.

- Vegan – Confirms that no animal-derived ingredients are used and that the product is not tested on animals. This is particularly relevant for plant-based or wellness brands.

- FairWild – This certification applies to products made from plants collected from their natural wild habitats rather than cultivated farms. It ensures that wild harvesting is done sustainably, without damaging ecosystems, and that the local communities who collect the plants receive fair payment. While most black cumin seed oil comes from cultivated crops, companies like Mina Sahar Saffron and Rumi Spice do source wild black cumin seed from Afghanistan.

- Soil Association Organic – A UK-specific organic standard that goes beyond EU minimums in some areas. This makes it especially important for suppliers of black cumin seed oil who are targeting the UK market. British buyers often prefer this certification because it represents a higher level of quality assurance.

Figure 2: Examples of niche certification labels relevant for black cumin seed oil

Source: Labelinfo, 2024

Including one or more of these certifications on your product or documentation can significantly improve your reliability with European buyers. This is especially true for those in the health, wellness and clean-label food segments.

What are the requirements for niche markets?

Niche markets such as the halal, kosher, organic and premium wellness segments offer higher margins and loyal customer bases. But they also require specific certifications and sourcing practices to meet specialised buyer expectations.

Halal and Kosher certification

There are over 25 million Muslims in Europe. Demand for Halal-certified, health-focused products is growing, especially in mainstream retail. Black cumin seed oil holds cultural significance in Islamic tradition and is commonly used in food, supplements and herbal medicine.

Obtaining Halal certification provides access to the €1.4 trillion global halal market. It can help exporters unlock both niche and mainstream sales channels. This is especially the case for plant-based meals, supplements and clean-label products. It also reassures buyers that your oil is produced without cross-contamination from non-permissible sources.

When seeking halal status, work with established bodies like HCE (Halal Certification Europe). This organisation has become a leading Halal certifier with an international client base and a reputation for market-leading customer service. Its certification is widely recognised by European buyers, which reduces the need for additional verification.

Tips:

- Kosher certification may also add value, particularly in regions with significant Jewish communities or for brands seeking broader religious compliance.

- Explore HCE’s e-learning curriculum to learn more about Halal certification and what is needed to acquire it.

2. Through what channels can you reach the European market for black cumin seed oil?

To access the European food additive industry with your black cumin seed oil, it is essential that you understand how the supply chain operates and who the key players are. Most food manufacturers source ingredients through trusted importers and distributors who can guarantee quality, compliance and fast delivery. Some niche manufacturers, especially in the flavour and functional food segment, may work directly with suppliers if they have a strong traceability and sustainability story in place. The most promising route for you as an exporter is to build long-term partnerships with importers who value transparency, quality and good documentation.

How is the end market segmented?

The European market for black cumin seed oil can be segmented by its main applications and the industries it serves:

- Nutraceuticals and supplements – Currently the largest market segment in Europe, driven by increasing awareness of black cumin seed oil’s potential health benefits. It usually supplies the end product in the form of capsules, gummies or a standalone oil for direct consumption;

- Cosmetics and personal care – This segment is growing due to rising consumer demand for natural and organic ingredients in skincare and haircare products. Black cumin seed oil is used in products like moisturisers, anti-ageing blends, hair conditioners and soaps;

- Food and beverages – Uses black cumin seed oil as a flavouring agent and a nutritional supplement in various products. The oil adds a distinct flavour to dishes and is also incorporated into functional foods for its potential health benefits.

Our analysis focuses on the food and beverages segment, and particularly its use of black cumin seed oil as a natural food additive. The table below shows the oil’s specific applications in this segment.

Table 3: Potential applications of black cumin seed oil in food manufacturing

| Application | Types of food | Key selling points |

|---|---|---|

| Oil blends and dressings | Cooking oils, salad dressings, speciality oil blends for retail brands | Clean-label alternative to synthetic antioxidants; omega-rich profile; distinctive spicy-hot flavour for ethnic products |

| Functional beverages | Ready-to-drink wellness shots, smoothie mixes, functional drink concentrates | Drop-in emulsified ingredient; established traditional uses; rich antioxidant profile for immune positioning |

| Bakery manufacturing | Industrial bread production, biscuit manufacturing and cake mixes | Extends shelf life; improves sensory qualities; omega-rich additive for clean-label products |

| Dairy and plant-based alternatives | Processed dairy products, plant-based milks and dairy desserts | Natural emulsification properties; antioxidant preservative effects; supports functional ingredient claims |

| Meat processing | Processed meats, sausages and ready-to-eat meals | Reduces lipid oxidation; maintains sensory quality; natural preservative alternative to synthetic additives |

| Supplement and fortified food production | Capsules, fortified snack bars, functional food formulations | Standardised bioactive compounds; established regulatory status; no novel food approval required |

Source: ProFound, 2025

Despite these potential uses, which are supported by scientific literature, it has been quite hard to find actual examples of commercial products on the market. This gap between research potential and market reality represents a good opportunity for early adopters in the European food industry.

Tip:

- Read CBI’s study on the European market potential for black cumin seed oil for more information about its potential applications in the food industry, as well as the scientific literature supporting these uses.

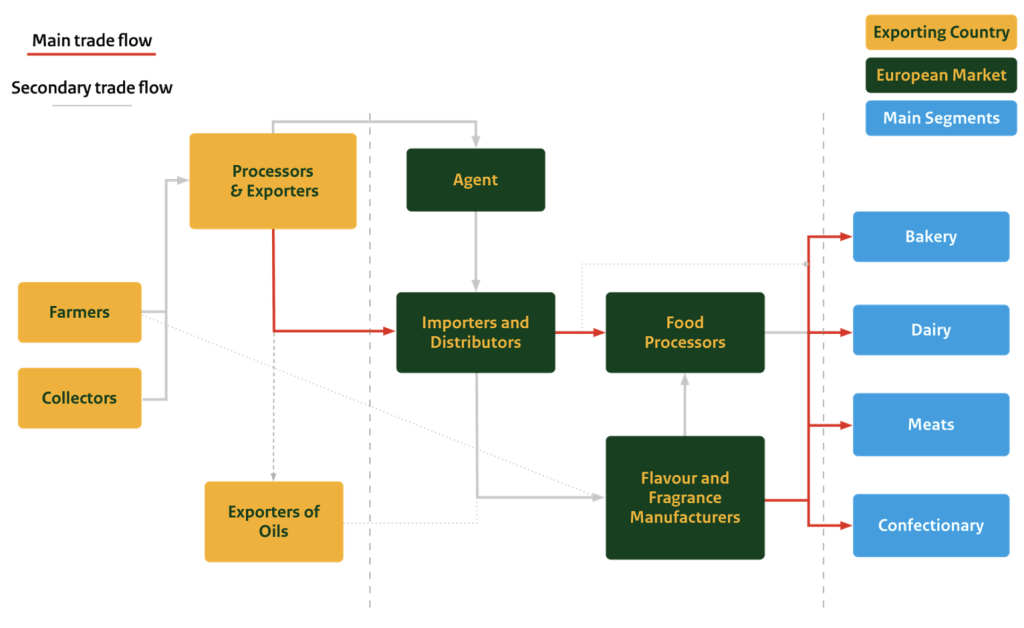

Through what channels does black cumin seed oil reach the end market?

In the food additives segment, processors and exporters typically supply oil to importers and distributors. They then supply food processors. These processors usually work with trusted importers and distributors. It is quite rare that they source raw materials directly themselves. Flavour and fragrance manufacturers often have a more direct line to suppliers. This is because they are particularly concerned about maintaining quality and traceable supply chains. This is because that makes them able to sell their oils for a higher price.

Figure 3. Main market channels for black cumin seed oil

Source: ProFound, 2025

Importers and distributors

Importers and distributors play a central role in the supply chain for black cumin seed oil as a food additive. Importers typically purchase large quantities of oil directly from processors in the country of origin, helping to lower costs through economies of scale and bulk purchasing. They maintain European warehouse stock in order to offer fast delivery and to shield food manufacturers from global market volatility. Distributors, on the other hand, usually buy from importers and focus on supplying a wide portfolio of oils to food processors and manufacturers across Europe.

Both importers and distributors handle all the necessary compliance requirements. This includes documentation, certification, labelling, packaging and food safety. Because they are price-sensitive and have access to a large global network of suppliers, importers and distributors often demand competitive prices.

To stand out from the competition, exporters can emphasise factors such as quality testing, added-value certifications like Kosher, Halal, Organic and Vegan or high thymoquinone content.

Importers and distributors specialising in black cumin seed oil include Gustav Heess, Vehgro, De Lange, Sigma Oil Seeds, Arista, O&3, All Organic Treasures, Henry Lamotte Oils and Oleador.

Flavour and fragrance manufacturers

These companies specialise in custom formulations for the food and beverage industry. They make use of black cumin seed oil for its functional and aromatic properties. Their strength lies in research and development (R&D) and in the technical application of knowledge. They often blend oils with other compounds to meet precise flavour or preservation goals.

To obtain strategic ingredients like black cumin seed oil, flavour and fragrance manufacturers often prefer working directly with trusted suppliers in the country of origin. Quality assurance, traceable supply chains and long-term relationships are vital for them. These manufacturers are adopting direct sourcing models that require detailed product documentation. This is due to stricter regulations in the EU with regard to transparency, traceability and social and environmental stewardship, .

Flavour and fragrance manufacturers include European Flavours and Fragrances Group, Fragrance Oils, Elixarome, Voegele and Givaudan.

What is the most interesting channel for you?

For suppliers of black cumin seed oil, importers and distributors are the most promising entry point into the European food additives market. These companies serve a broad base of food manufacturers across multiple sectors, from bakery to dairy and meat processing.

To succeed, exporters must offer more than just competitive pricing. Importers value traceability, reliability and compelling sustainability stories. For example, Gustav Heess has launched a fully traceable organic range called Heess Organics. Its products include argan oil that supports Berber women in North Africa, babassu oil from Brazil that supports over 300,000 families and jojoba oil from a 20-year collaboration with a local community in Argentina’s Arauco Desert.

Exporters who can demonstrate credible certifications, traceable origins and alignment with sustainability values are more likely to form long-term partnerships with European importers and to gain access to premium buyers.

3. What competition do you face on the European black cumin seed oil market?

Your main competitors are exporters from India, Türkiye, Egypt and Ethiopia. They all compete on volume, quality, certifications or thymoquinone levels. Black cumin seed oil also competes functionally with speciality oils like flaxseed and hemp seed in the antioxidant and anti-inflammatory markets.

Most black cumin seed oil entering the European market is traded under HS Code 151590 (fixed vegetable fats and oils, not chemically modified). That category excludes products like soya, olive, palm, coconut and sesame oil, but does include other speciality niche oils such as shea, baobab and argan.

As specific trade data for black cumin seed oil alone is not available, the dataset has been filtered to include countries that are known producers and exporters of this oil. The best-known producers include India, Morocco, Türkiye, Egypt, Ethiopia and Tunisia.

Table 4: Export value to Europe of HS code 151590 products from selected black cumin seed oil-producing countries

| Country | 2024 export value (million €) | % change (2020–2024) |

|---|---|---|

| India | 23,198 | -0.8% |

| Türkiye | 9,762 | +119.5% |

| Egypt | 2,268 | +484.0% |

| Ethiopia | 1,216 | +376.1% |

Source: ITC Trade Map, 2025

Which countries are you competing with?

India dominates vegetable-based oil exports and Türkiye is growing strongly. Egypt and Ethiopia are rising fast from a modest base. This dual view of the seed and oil trade can help exporters assess current competition and potential shifts in upstream investment and sourcing.

India

India is the world’s largest exporter of black cumin seed oil. That position builds on its ample Nigella sativa (kalonji) production and robust spice export industry. India exported HS 151590 oils worth €23 million to Europe in 2024, although the trend compared with 2020 is flat (–0.8%). Its top European markets included Italy (€6 million), Spain (€5.9 million) and the Netherlands (€1.9 million). As for whole cumin seeds (HS 090931), India is the dominant source. Its export values were €15 million to the UK, €10 million to the Netherlands and €7 million to Germany in 2024. This reflects the country’s strong, long-term trading relationship with Europe, across multiple spice categories.

India’s long tradition of using black cumin in cuisine and Ayurveda (a form of traditional medicine) underpins its thriving black seed oil sector. Between October 2023 and September 2024, it recorded 490 black seed oil export shipments by 133 exporters – a figure that indicates broad supplier capacity.

Türkiye

Türkiye is an emerging competitor in black cumin seed oil exports. Its growth is based on a combination of strong agricultural production and a strategic geographic position bridging Europe, Asia and the Middle East. Türkiye exported €9.7 million worth of HS 151590 oils to Europe in 2024, more than double their 2020 value of €4.4 million (+119%). Its main European buyers include Germany (€3.8 million), the UK (€1.5 million) and Spain (€1.4 million). Türkiye is also a significant cumin seed supplier under HS 090931, with €1.6 million in exports to France and growing demand in Germany, Portugal and Cyprus. This suggests strengthening spice trade relationships.

The Bucak district in Burdur province has become a production hub for Nigella sativa, recording a 120% increase in cultivation. Bucak’s oil contains up to 8% thymoquinone (double the global average), which makes it highly valued in global markets. Exports to the USA, UK and Russia generate US$5.5 million in added value. Türkiye is also pursuing geographical indication certification to boost recognition and pricing power for this premium oil.

Egypt

Egypt is a significant producer and exporter of black seed oil. Black cumin (‘habbat al baraka’) has been used there since ancient times. Egypt exported fixed vegetable oils (HS 151590) worth €2.3 million to Europe in 2024, a noticeable increase over previous years. Its cumin seed exports were largest, with €25 million worth shipped to Latvia. Over the past five years, it has also supplied Bulgaria, Italy, Spain and Sweden.

Modern Egyptian producers build on the country’s deep cultural and medicinal ties to black cumin by imposing rigorous quality standards. One leading brand, Sahara Glow, claims a 6–7% thymoquinone content in its cold-pressed oil (significantly above average) – a figure backed by third-party lab testing. Production typically involves the one-time cold pressing of seeds grown in the Nile Delta and desert fringes. That results in a dense, unfiltered oil with a strong natural aroma and high nutritional value.

Ethiopia

Ethiopia is positioning itself as a quality-led exporter of black cumin seed oil. This status is supported by high-altitude cultivation and preferential trade access to Europe. Ethiopia’s exports of fixed vegetable oils (HS 151590) to Europe reached €1.2 million in 2024, an increase of nearly 377% from 2020. Key European destinations include the Netherlands (€0.5 million), France (€0.2 million) and Italy (€0.2 million). Although modest, these figures reflect growing penetration of niche oils. Cumin seed exports remain small but steady, with France and Belgium being the main buyers. Ethiopian black cumin is grown at high altitudes, which contributes to its high thymoquinone content and premium positioning. While some oil is produced locally, buyers also import Ethiopian seeds for processing.

The Everything But Arms (EBA) scheme gives Ethiopia tariff-free, quota-free access to the EU, which enhances its competitiveness. Ethiopian producers like Hayat Cosmo Industry have gained visibility at trade fairs thanks to support from initiatives like the German Import Promotion Desk, and that in turn is building EU buyer interest.

What companies are you competing with?

Successful exporters in each source country display different competitive advantages. These range from India’s diverse product formats and certifications to Türkiye’s organic focus, Egypt’s high-thymoquinone positioning, Ethiopia’s emphasis on traceability, and Morocco and Tunisia’s premium niche strategies.

India

India’s black cumin seed oil exporters are highly diversified. As such, they offer a wide range of formats for food, nutraceutical and cosmetic uses. AG Organica Pvt Ltd supplies cold-pressed black cumin seed oil in bulk, using packaging formats like aluminium bottles and HDPE drums, and is known for exporting to leading international brands. Apex International offers a wide product range, including cold-pressed, expeller-pressed, capsules and gummies. it has a minimum order size of 100 kg and exports to over 18 countries. Veda Oils targets both the cosmetics and food industries, and it holds Kosher, Halal, VegeCert and GMP certifications. It supplies formats ranging from 0.1 kg to 25 kg, which means that it supports small businesses and large-scale manufacturers alike.

Türkiye

Türkiye’s black cumin seed oil exporters emphasise organic quality, sustainability and certification. Izmir Organic offers black cumin seed oil certified under EU Organic, NOP Organic, Kosher and Halal schemes. It supplies in 5 kg to 12.5 kg formats and works with over 300 organic farmers, although black seed oil is just one of many products in its catalogue. Ecodab Antalya exports to more than 40 countries and holds Ecocert Organic, ISO 9001:2015, HACCP and GMP certifications. Its oil is 100% pure and food-grade, and comes packaged in barrels or glass.

Egypt

Egyptian companies combine ancient tradition with modern lab verification to offer high-thymoquinone, cold-pressed black cumin seed oil. Sahara Glow is a premium brand known for single-press, unfiltered oil with thymoquinone levels of 2%, as verified by third-party labs. The company promotes seed origin (Nile Delta) and minimal processing as its unique selling points. Nefertiti supplies cold-pressed oil with ISO certification, a certificate of analysis (CoA) and a safety data sheet (SDS) to meet European buyer expectations. Spice Kingdom is a large-scale supplier with an extensive certification portfolio: Halal, BRC, ISO 22000, ISO 18001, ISO 17025, ISO 14001, Kosher, Sedex and Organic Certified. It sells black cumin seed oil alongside other spice and herb products, and it caters to both the food and supplement sectors.

Ethiopia

Ethiopian companies are building a reputation for high-quality, traceable black cumin seed oil from highland farms. Afiyah Oils is a long-established Ethiopian manufacturer and exporter, sourcing from the country’s highlands. It uses multiple quality-control steps, including classifying, de-stoning, sifting and metal detection, to ensure product purity. Hirut Export focuses on the supply of black cumin seeds to the European market, with 99% minimum purity, Sortex cleaning and packaging in the form of 25kg bags. While this firm does not export oil directly, it does often collaborate with local processors to deliver ready-to-use black cumin seed oil to European buyers. Chakka Origins uses a conservation-based model to source its black cumin seed oil from Ethiopia’s biosphere reserves, and is committed to implementing regenerative practices.

What products are you competing with?

In the European market, black cumin seed oil is often compared with other high-value oils that also offer antioxidant, anti-inflammatory or bioactive delivery benefits. These functional oils are used in food supplements, clean-label snacks and plant-based products. Below are the main categories of oil competing with black cumin seed oil, based on their functional properties rather than their botanical family.

- Antioxidant category – Rivals here are flaxseed, chia, evening primrose and safflower oils, which are commonly used in supplements and wellness products for their omega-3 and polyphenol content. A 2022 comparative study of cold-pressed oils ranked black cumin seed oil near the top for 'radical scavenging activity'. That is, its ability to neutralise free radicals that damage cells and contribute to ageing and disease. This antioxidant strength comes from its unique combination of thymoquinone, polyphenols and tocopherols (vitamin E), meaning that it is scientifically verified as a clean-label preservative and oxidative stabiliser.

- Anti-inflammatory category – In this therapeutic market, black cumin seed oil competes with calendula, hemp seed and argan oil. Research demonstrates that thymoquinone reduces inflammation-related enzyme activity and suppresses pro-inflammatory cytokines like IL-6, IL-12 and TNF-α. They are compounds that trigger redness, swelling and pain. While associated with cosmetic use, these anti-inflammatory properties also are relevant for food supplements and for functional foods targeting inflammation-related health conditions.

- Bioactive carrier-oil category – Here, black cumin seed oil competes with coconut oil, MCT oil and olive oil. Its lipophilic (fat-loving) nature enhances the absorption of thymoquinone and other beneficial compounds in the digestive tract more efficiently than water-based carriers. This delivery advantage makes it valuable for food and supplement applications requiring the transport of fat-soluble nutrients such as curcumin, CBD and vitamins A, D, E and K. That positions black cumin seed oil as both a functional ingredient and an effective carrier system.

4. What are the prices of black cumin seed on the European market?

Most black cumin seed oil available in the European market is certified organic and cold-pressed in order to target the food, wellness and supplement sectors. Prices vary widely depending on packaging size, certification, origin and thymoquinone content, with higher-quality or better-documented oils commanding a clear premium.

Table 5: Examples of black cumin seed oil prices on the European market

| Company | Origin | Price per kg | Volume | Price type | Key characteristics |

|---|---|---|---|---|---|

| Organic The Best | Egypt | €1,080.40 | 5 x 100ml (500ml) | Retail | Certified organic; amber glass packaging; premium extra virgin cold-pressed |

| Irish Apothecary | Israel | €234.00 | 50ml | Wholesale | Certified organic; wellness product for immune and digestive health |

| Alucia Organics | Egypt | €189.70 | 100ml | Retail | Certified organic; cold-pressed; Soil Association approved; cruelty-free |

| Fushi Wellbeing | Türkiye | €172.50 | 100ml | Retail | Organic; cold-pressed; 100% pure; harvest/manufacture dates; for skin and digestive health |

| Safah’s Natural | Ethiopia | €160.90 | 100ml | Retail | Cold-pressed; immune support; for hair and skin care |

| Go Native | Not stated | €122.40 | 50ml | Wholesale | Certified organic; vegan; cruelty-free; cold-pressed for cosmetic formulators |

| UK Loose Leaf Tea Company | Not stated | €109.08 | 195ml | Wholesale | Certified organic; cold-pressed; for food and skincare use |

| Biopurus UK | Not stated | €88.44 | 250ml | Retail | Soil Association certified; unrefined; food-grade; direct to consumer |

| Nature In Bottle | India | €16.64–€21.22 | Bulk (kg) | Wholesale | Certified organic; vegan; 100% natural; cold-pressed for health/wellness sector |

Source: ProFound, 2025

European buyers expect transparent pricing that reflects product quality and is supported by documentation such as a CoA showing the oil’s thymoquinone content. Many buyers also look for volume discounts or tiered pricing for repeat orders, as well as batch consistency to support end-product formulation. To justify premium prices, exporters need to provide clear value signals such as organic, FairWild or Halal certification, along with a compelling origin story aligned with buyer values.

Tip:

- Exporters who can combine competitive bulk pricing with lab-tested thymoquinone levels and clear documentation (SDS, TDS, CoA) are best positioned to appeal to both price-sensitive and quality-focused buyers.

ProFound – Advisers in Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research