Entering the European market for sweet potatoes

The potential market entry options for sweet potatoes in Europe have become diverse, with multiple market channels. At the same time, an increasing number of supply countries and extended seasons have reduced the available supply windows. To stand out in this competitive market, you should have an open mind towards integration with international partners and invest in differentiation and product quality.

Contents of this page

1. What requirements and certifications must sweet potatoes comply with to be allowed on the European market?

Fresh sweet potatoes must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant, which provides an overview of export requirements (use code 07142010 for fresh sweet potatoes).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental damage, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Fresh sweet potatoes containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals.

Note that retailers in several Member States, such as Germany, the Netherlands and Austria, use MRLs that are stricter than the MRLs laid down in European legislation.

Tips:

- Find out the MRLs that are relevant for sweet potatoes by consulting the EU Pesticide Database in which all harmonised MRLs can be found. You can search on your product (“0212020 Sweet Potatoes”) or pesticide used. The database shows the list of the MRLs associated to your product or pesticide.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they have additional requirements for MRLs and pesticide use.

- Reduce the amount of pesticides by applying Integrated Pest Management (IPM) in production. IPM is an agricultural pest control strategy that involves an integrated approach to prevent harmful organisms and keep the use of pesticides within acceptable levels. Read about Integrated Pest Management (IPM) on the website of the European Commission.

- Make sure that contamination of lead and cadmium in sweet potatoes remains below 0.10 mg/kg, according to the Regulation (EC) 1881/2006 setting maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

The regulation for the trade in plants and plant products from non-EU countries requires sweet potatoes to have a phytosanitary certificate before being brought into the European Union, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Implementing Regulation (EU) 2019/2072.

For roots and tubers such as sweet potatoes, an official statement is required that the consignment or lot does not contain more than 1% by net weight of soil and growing medium.

Tip:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate.

Maintain high quality standards

For sweet potatoes, there are no official quality requirements. Therefore, the minimum requirements of the General Marketing Standards of Regulation (EU) 543/2011 apply.

The general marketing standards state that products shall be:

- Intact and sound;

- clean, practically free of any visible foreign matter;

- practically free from pests;

- practically free from damage caused by pests affecting the flesh;

- free of abnormal external moisture;

- free of any foreign smell and/or taste.

The condition of the products must be such as to enable them:

- To withstand transport and handling;

- to arrive in satisfactory condition at the place of destination.

Europe almost exclusively requires class I sweet potatoes as a minimum. Products in this class must be of good quality and appearance, without abnormalities. For organic sweet potatoes, Class II may also be accepted, especially when it is from local agriculture. Although there is not a specific European guideline for different classes, as a reference you can also consult the United States standard for grades of sweet potatoes.

Control post-harvest process

To maintain good quality and a longer shelf life, you must dominate the curing process. This allows you to store the sweet potatoes. Curing sweet potatoes is common practice for long-distance suppliers, such as South Africa and the United States. Curing is usually done up to a week at a temperature of 28-30 degrees Celsius and at a humidity of 85%-95%. The curing process sets the skin and heals the wounds, but also turns the starch into sugars. Storage after curing is best done at 12-14 degrees Celsius.

Tips:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues.

- Make sure your sweet potatoes are well cured and preserved to ensure optimal freshness and taste. Supply chain logistics should not affect the product taste in any significant way.

Check product size and uniformity

Although there is no official standard for product size, most countries or suppliers differentiate between small, medium and larger sizes (see table 1). The size specifics remain irregular depending on the particular source and commercial brand. Sweet potatoes from Honduras and South Africa sometimes have a different size indication. Uniformity in size is often required.

For processing companies, the colour and dry matter can be of importance. For example, there must not be any change in colour during processing. And for making fries, dry matter content should be higher than usual, often well above 25%.

Table 1: Commonly used sizes for sweet potatoes and weight in grams

| Size | Weight |

| S | <150g |

| M | 150-300g |

| L1 | 300-450g |

| L2 | 450-600g |

| XL | 600-900g |

| G | 900-1500g |

Use high-quality packaging

The packaging for sweet potatoes varies from open-top boxes, boxes with flaps or telescopic boxes (with lid). All packaging boxes require high-quality cardboard.

Common packing includes for example:

- 6/15/18 kg open top carton, for example 40x30cm (6kg) or 60x40cm (18kg)

- 8 kg telescopic boxes

- 10 kg box with flap

For retailers, sweet potatoes may be re-packed in plastic flow packs or trays. Organic sweet potatoes also require recognisable packaging to distinguish them from the conventional sweet potatoes sold loose in the shop. An alternative for this could be laser marking.

Tips:

- Always discuss the specific requirements for size and packaging with your buyer.

- For other additional requirements, such as labelling, payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers.

What additional requirements do buyers often have?

Obtain commonly used certifications

Common certifications for fresh sweet potatoes are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. It is recommended to use management systems recognised by the Global Food Safety Initiative (GFSI).

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

Retailers can also impose their individual standards, such as Tesco Nurture and M&S Field to Fork. Especially larger retail chains in northern Europe are more prepared to buy your product if your compliance with social and sustainability standards is in order.

Tip:

- Implement at least one environmental and one social standard. See the Basket of standards of SIFAV Sustainability Initiative for Fruit and Vegetables.

European Green Deal

In the coming years, the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally friendly. It will ensure sustainable food production and address, for example, packaging and food waste. EU trade agreements with Honduras (Central America) and Brazil (Mercosur), both sweet potato suppliers, already include rules on trade and sustainable development, and other countries are expected to follow. For suppliers of fresh fruit and vegetables, it is important to get ahead of the increasing standards and try to be in the frontline of the developments.

What are the requirements for niche markets?

Use organic certification to increase product value

The demand for organic sweet potatoes is growing, although it is mainly fulfilled by European growers. Organic certification can be an interesting way to set your product apart and market it at a higher value.

To market organic products in Europe, you must use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Since January 2022, the new Regulation (EU) 2018/848 has been in force. This legislation includes new rules for group certifications, new approaches for dealing with suspected non-compliance and residues, and new rules at the EU borders for imported products. Inspection of organic products will become stricter in an effort to prevent fraud, and producers in third-world countries will have to comply with the same set of rules as those producing in the European Union.

Tips:

- Strive for residue-free sweet potatoes, and certify your production as organic if possible. It will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Download the actual list of control bodies and authorities to see which certifiers are active in your region

2. Through what channels can you get sweet potatoes on the European market?

Retail sales and food services are both important segments for sweet potatoes. There are several ways to get your sweet potatoes onto the European market. Your main challenge is to select the right import partner that fits your product and company profile.

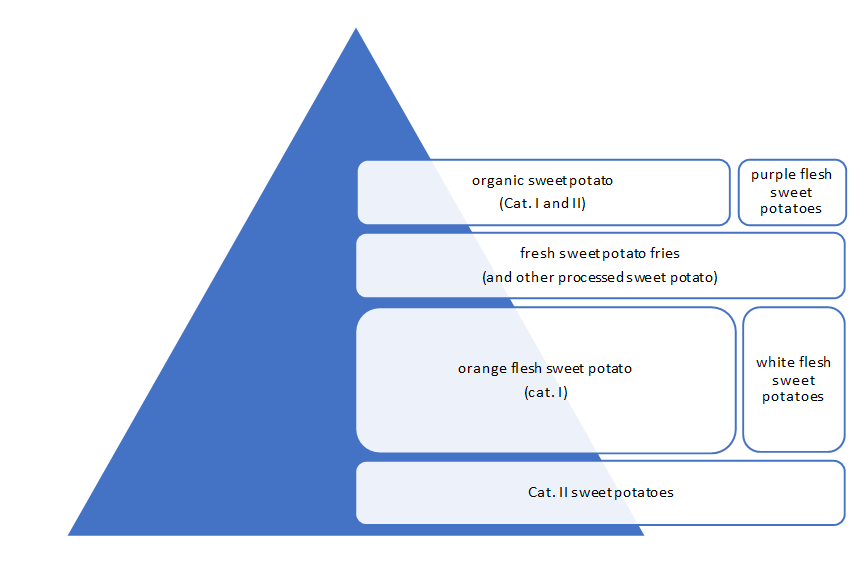

How is the end-market segmented?

Retail & food service

Fresh sweet potatoes mainly end up in the retail and the food service segment (restaurants). Food service is an important segment for sweet potatoes, because it is a relatively new and appealing product to use and ideal to replace regular potato fries. Besides the food service segment, a majority of supermarkets and fresh retailers have sweet potatoes in their assortment. Supermarkets focus on packaged or loose sweet potatoes, but also on freshly cut and other processed sweet potatoes.

Class I and II

The main segment consists of orange-fleshed sweet potato, mostly Class I quality. Class II sweet potatoes, except for second grade organic, are less in demand. When available, high-quality products will always have the preference.

Whole fresh or freshly processed

Besides whole sweet potatoes, you can also find freshly cut fries, and other products that have been freshly processed or frozen in Europe or in the country of origin. This is a growing segment, as sweet potatoes are transforming from being an exotic to a regular product. Freshly cut is a convenient category that is especially popular in northern European markets such as the United Kingdom and the Netherlands. But other markets tend to follow.

Organic segment

Sweet potatoes are more highly valued when they are certified organic – a niche segment that is gaining market share. According to industry professionals, the organic market share is somewhere around 5%. Maintaining quality is more difficult when cultivating organic sweet potatoes, and Class II is much more common in this segment when they are locally sourced.

Coloured varieties

Another niche segment are purple and white varieties. These varieties find the best opportunities in the ethnic market, food service industry or as an exotic specialty in conventional retail. Purple sweet potatoes are often higher priced due to their small-scale supply.

Figure 1: Market segments for sweet potatoes

Source: ICI Business

Tips:

- Optimise your margin with a high-quality product and increase your commercial chances with (at least) class I and nicely sorted sweet potatoes. Specialisation in niche varieties or organic sweet potatoes can be a good option if you are unable to compete in the main segment. Processing is only an option if you are price competitive with European and international potato processors.

- Find an overview of supermarkets on Wikipedia’s list of supermarket chains in Europe or the Top 10 Food Retailers in Europe in the Retail-Index.

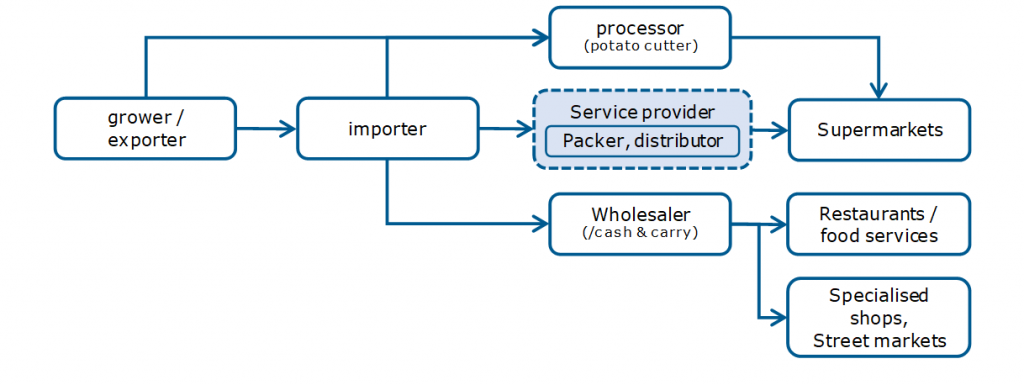

Through what channels does a product end up on the end-market?

The market channels for sweet potatoes are diverse, although most import is managed by established importers and companies with international partnerships. Service suppliers and larger importers fill in supermarket supply programmes. Ethnic and food service channels are supplied via wholesalers.

Figure 2: European market channels for fresh sweet potatoes

Source: ICI Business

Wide range of importers and international specialists

Importers play a central role in the distribution of sweet potatoes. They are familiar with all the different requirements of end clients and are able to distribute to different market channels, such as wholesalers and supermarkets.

The product category has become big enough for a broad selection of importing companies. Sweet potatoes are traded by companies that deal with exotic or ethnic vegetables as well as importers with broader assortments. They belong to the assortment of distributors of ethnic produce such as Tropifruit (UK), exotic specialists such as Trofi (DE/NL), BUD Holland and Bel Impex (NL), and importers with a wide range of fruit and vegetable importers such as Nature’s Pride (NL) and the Minor Weir Willes Group (UK).

There is even room for specialisation, such as the company SPOT, a joint venture between Farmhouse International in the Netherlands and a North Carolina sweet potato supplier. SPOT focuses on a year-round supply directly from farms in North Carolina (USA) and partner farms in other regions including Spain, Egypt, China, Brazil, Argentina and Honduras. Another US company, Farm Fresh Produce, has its own sales office in the Netherlands.

Investment not only comes from the USA, but also from other sources. Peruvian company La Calera established Pacific Produce Ltd in the UK to market several fresh produce brands, including sweet potatoes from Monty Farms in Honduras.

Service providers provide access to supermarkets

Successful suppliers to supermarkets often position themselves as service providers. They organise the supply chain according to the needs of their clients, from sourcing to (re-)packing and branding. Supermarkets have become an important channel for sweet potatoes. They usually work with supply programmes and want to buy as close to the source as possible. This gives them control and transparency in their supply chain. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider and supermarket require. Product consistency and year-round availability are preconditions for entering this channel.

For example, Bakker Barendrecht, part of Greenyard, supplies leading Dutch supermarket Albert Heijn with sweet potatoes, including convenient meal packages with fresh sweet potatoes and other vegetables.

Processors

Sweet potatoes are an ideal product for producers of fresh or frozen fries, ready-made meals and soups. For example, potato processing is a large industry in Europe and can be an interesting channel for sweet potatoes as well. Most potato processors are members of national associations such as Potato Processors’ Association (PPA) in the UK or Belgapom in Belgium. You can also find an overview of national associations and companies through the European Potato Processors’ Association (EUPPA).

Some food processors may have their own sourcing, although they often have a preference for nearby or local sources. There are already several sweet potato farmers in Europe, such as within the Belgian producer organisation BelOrta. But the local cultivation is still relatively small, which makes sweet potato processors an additional channel for exporters. For example, the company Sacoma in the UK provides a market for smallholder potato growers in Kenya and other African countries that includes fresh potatoes for processors and own-developed sweet potato products such as crisps.

Wholesalers (spot market)

The wholesale channel is crucial for gastronomic clients, a relatively big segment for sweet potatoes.

Traditional fruit wholesalers cover the spot market and move according to the fluctuations of the fresh trade. They supply specialised shops, street merchants, restaurants and hotel chains. Sometimes import and wholesale activities are combined, but a traditional wholesaler does not take many risks with importing long-distance products. Typical wholesale markets for sweet potatoes include New Spitalfields market in London and Rungis in Paris.

Non-specialised, “cash & carry” wholesalers, such as Metro, cater to a similar end-market (especially restaurants and catering). However, they depend more on the service of importing companies or have their own purchase centres. Just like supermarkets, they are able to work with long-term contracts.

Tip:

- Select the type of buyer that fits your company and product. There are many target groups to choose from, but each will have its own preferences. Retailers and their programmed supply will provide you with stability, but are most demanding in certification and compliance. The wholesale channel may provide the best opportunities for sweet potato varieties with superior taste for the ethnic and the food service segments.

What is the most interesting channel for you?

The European market has opened up for sweet potatoes, so there are multiple channels to explore for exporters. When choosing your preferred market, it is important to take into account the type, quality and volume you are supplying.

When you can offer a large volume and high-quality orange-fleshed sweet potatoes, you have a broad selection of importers that you can focus on. While gaining experience, you can prepare for the highly demanding supply programmes of supermarkets. Smaller volumes and specific varieties, such as white- and especially purple-fleshed sweet potatoes, can best be sold to wholesalers or importers that are specialised in exotic or ethnic vegetables.

If the appearance or the quality of your product is not sufficient for highly demanding market channels, the processing channel can be an alternative option. But the product must be fully usable and your price must be competitive.

Tips:

- Visit trade fairs to find buyers. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

- Find potential processors of sweet potatoes through the members of the European Potato Processors' Association (EUPPA).

3. What competition do you face on the European sweet potato market?

Sweet potatoes are available throughout the year thanks to a couple of strong producing countries with extended seasons and high-quality curing and storing technologies. Increasing competition from both non-European exporters and European famers calls for more quality and integration in the supply chain.

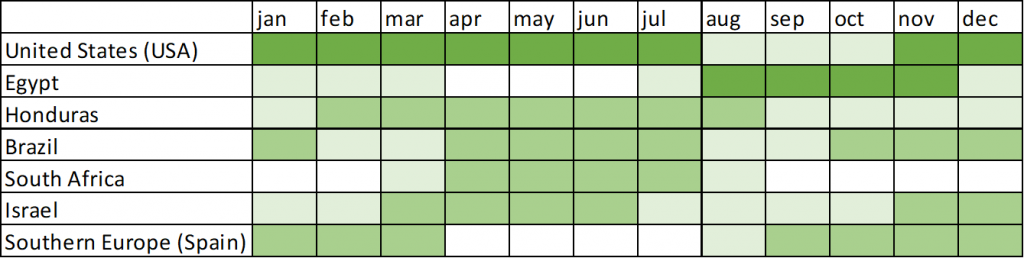

Which countries are you competing with?

The United States is the dominant supplier of sweet potatoes to Europe. The volumes from other countries are rising, in particular from Egypt. With the increasing number of supply countries and improving storage facilities, there are almost no remaining supply windows and the overall competition will become stronger.

*China would be the #3 supplier, but is mainly focused on processed sweet potatoes and therefore not included in figure 3 (see Developments and advances in sweet potato processing in China on Sweet Potato Knowledge Portal)

Figure 4: Indicative supply calendar for sweet potatoes to Europe

Source: ICI Business based on industry sources and supply data

United States: Leading in sweet potato technology and marketing

United States growers and promotion agencies have made a great effort to increase the sweet potato sales in Europe. They offer year-round availability with consistent quality. In the supply to Europe they have taken a dominant position. As a competitor, they are leading in technological development of cultivating, curing and storing sweet potatoes. Most of their sweet potatoes have orange flesh and Covington is one of the main varieties. The supply of red skin and white flesh mainly comes from Israel, Brazil, Honduras, China and Egypt.

After continuous growth, the import value from the United States stabilised in 2021 at around €160 million. The United States is experiencing increasing competition from other countries, in particular Egypt and Spain.

Not only a technological advantage, but also trade politics will influence the growth of American supply to Europe. In November 2020, the European Union imposed an additional import tax of 25% on many imports, including sweet potatoes, after a trade conflict with the United States. But this import tariff has been suspended since March 2021 under the new Biden administration. The normal import tariff for American sweet potatoes is 3%.

As a competing exporter, you can learn from the advanced technology in the United States. You should also monitor the trade between the EU and the USA. Trade barriers will significantly increase supply opportunities for other countries.

Egypt: Fulfilling a growing role in the sweet potato supply

The Egyptian sweet potato production has increased over the past years. In 2020 and 2021, the acreage increased by 20 to 30% annually according to different news sources. Much of the production is directed to the European market.

Egypt has become an important source for European importers. The export value to Europe before 2018 was only around €9 million. The value in 2021 reached nearly €60 million.

Growers in Egypt have altered their production from the traditional white variety to orange varieties such as Beauregard, which is well known in the EU market. There is even a number of suppliers with organically cultivated sweet potatoes.

The main advantage of Egypt is the proximity to the European market. Despite sharing a similar production season with Southern Europe, suppliers can still be competitive thanks to its close logistics route through southern Europe. The Egyptian sweet potato season starts mid-July and lasts beyond January. The country fills in a time when American farmers are mainly preparing for their next season.

South Africa: Increasing counter-seasonal competitor

The South African production of sweet potatoes is rising and farmers have set their eyes on Europe. Sweet potatoes are a nice addition to the existing export range of fresh fruit and vegetables, but in the current situation, the export to Europe is not even 5% of the production.

The locally preferred variety is the white-fleshed Blesbok. Orange-fleshed sweet potatoes such as Beauregard, Bellevue and Evangeline are produced for export to Europe. A small group of farmers have mastered the curing process and export sweet potatoes in bulk for repackaging by retailers in Europe. In 2021, Europe imported €13 million worth of South African sweet potatoes. This successful year placed them ahead of of Honduras and Brazil.

Despite growing expertise, there is no indication that South Africa will grow significantly as a competing force to Europe. Production volumes increased in recent years, but are now expected to decline due to rising production costs. According to FAOSTAT data, the total production increased from 65,000 tonnes in 2015 to roughly 89,000 tonnes in 2019. In the following year the production volume dropped to 83,000 tonnes. Increasing production costs and a lower European demand for South African sweet potatoes are expected to slow down production even further. Their supply window falls in the European spring and summer time (April-July), which is a less attractive time to sell due to a lower demand. But there are specific examples that support future growth. For example, in 2019, OTC Organics announced a partnership with South African Pro-Plum to grow organic sweet potatoes.

Honduras: One of the first to develop a year-round supply for export

The sweet potato production in Honduras had improved to export quality before the main growth of the European market happened. This has given Honduras an advantage over other countries in the region. With multiple harvests, the sweet potato industry tries to focus on a year-round supply of high-quality produce. Honduras is best known for its orange sweet potato, but there have been developments with white-fleshed sweet potato as well.

European import from Honduras has stabilised at around €10 million. With the increasing number of competitors in other countries, and overlap in seasons, there has been less chance for Honduras to achieve further growth.

Their advantage of having an almost year-round supply is somewhat reduced due to new suppliers in mainly Egypt and Spain and because of improved storage facilities that further extends the European season. Trade statistics show that most export to Europe takes place between February and August, as an additional or alternative to US exports. Honduran exporters can take advantage when focusing on superior quality and at times when a good supply from the USA is lacking.

Brazil: More demand expected from Europe

Brazil has an irregular export of sweet potatoes to Europe throughout the year, but overall, the supply to Europe is growing and Brazilian exporters expect a growing demand.

Due to the large internal market, Brazil is less dependent on the export markets. In the last three years (2019-2021) Europe imported an average of €6 million worth of sweet potatoes from Brazil. Trade is expected to be slightly less in 2022 due to a variety of issues.

First of all, export depends on a small number of European importers, mainly located in the Netherlands. These importers reduced their import due to rising production costs and recent quality issues in pack houses. This led to a 25% decline in export to Europe in the first six months of 2022.

Secondly, the country mainly competes with large-sized, red-purple skin and white flesh sweet potatoes. This Brazilian variety is a niche variety in Europe compared to the usual orange-fleshed sweet potatoes. It is often sold in a different segment or channel, such as the catering industry or ethnic market. Because of this, Brazil is a different competitor from the main suppliers. Brazil may become a stronger competitor once it increases the production of orange-fleshed potatoes, such as the newly introduced CIP BRS Nuti cultivar.

Peru

Sweet potato is a common product in Peru and locally known as ‘camote’. Peru is a minor, but growing supplier of sweet potatoes. The export is almost equally divided between the United States, Europe and regional markets. The European import value increased from a little over €0.6 million in 2017-2018 to €4.6 million in 2021. The Netherlands is the main destination in Europe with 95% of the volume.

Trade data seems to indicate that a large share of sweet potatoes is exported as a semi-processed product, including frozen, dehydrated and milled sweet potatoes. Several of the larger exporters do not only export fresh, but also processed sweet potatoes. According to Agrodata Peru the main exporter is GLM Foods, a company that sells natural flavours and additives.

Europe: Preference for growing local production

While new non-European supply countries are emerging, the production in Europe is also increasing. Spain and Portugal are the most significant producers. There is little official data on production volumes, but the total cultivation in southern Europe should amount to somewhere around 100,000 tonnes.

Southern Europe has the highest production, but the majority of northern countries has also started to produce small quantities of sweet potatoes. If there is domestic production, it will usually have the preference of local buyers. However, European farmers struggle to compete with the low-priced offers from outside Europe. Due to increasing competition, low prices and a shift in more lucrative crops, the 2022/2023 production in Spain could decline by 40%.

Tips:

- Use a good curing process and storage facilities to extend your season. If you are unable to supply year-round, try to find supply gaps in between the seasons of major suppliers.

- Invest in knowledge to improve cultivation practices to get your yield and product quality to a higher level and improve your competitive position. Find a number of documents and tips on crop management on the Sweetpotato Knowledge Portal.

Which companies are you competing with?

The companies that will be most competitive are those that are close to Europe or well-integrated with European supply chains.

Battleboro Produce: Integrated supply chain

There is an increasing level of integration in the fresh fruit and vegetable trade. This is also noticeable in the sweet potato sector. The US producer Battleboro Produce is a member of the American Sweet Potato Marketing Institute (ASPMI) and partial owner of Dutch company SPOT. This joint venture presents itself as a sweet potato specialist and can target the European market directly from the farm. With this, they have a competitive advantage over other farms and indirect trade channels.

All Fresh Egypt: Diverse offer close to Europe

While some companies specialise in sweet potatoes, other competitors diversify their products and use their proximity to the European market as a competitive advantage. Companies such as All Fresh in Egypt is one of those companies.

All Fresh works with external growers, but also has its own production of sweet potatoes and different kinds of fresh Herbs, fruits and vegetables. The company started with the cultivation of the popular Beauregard variety, but is testing other varieties such as Bellevue, Evangeline and Orleans. By extending its season for sweet potatoes and focusing on popular varieties, the company was able to surpass its own export target and export 8,000 tonnes in 2020/2021 and 5,000 tonnes in 2021/2022.

Tips:

- Define well your strengths as a company and your competitive advantage before entering the European market. Advantages in the sweet potato trade are, for example: year-round availability, product quality and proximity to the European market with low logistical costs.

- Test different sweet potato cultivars. Select those that grow well in your region, but also varieties with taste properties that are suitable for the European market. Work with experienced breeders and nurseries to get quality plants.

- Find companies in Europe to partner with. These can be importing companies, but with a growing local production in Europe you could also focus on growers and grower organisations. International cooperation increases product availability throughout the year.

Which products are you competing with?

Sweet potatoes have become a popular root vegetable next to regular potatoes. Their use is similar. Both are used for frying, cooking and mashing. Regular potatoes are still a cheaper option for consumers, but sweet potatoes provide a distinct and sweet taste that potatoes do not. Sweet potatoes can also be a replacement for pumpkins or carrots, for example in soup. Recent inflation and increasing production costs may force consumers to purchase the more affordable regular potatoes.

Future competition may also exist between different varieties of sweet potatoes, in which taste, usability and consumer experience will determine their success.

Tips:

- Stay up to date with varietal development and preferences. Inform with your European buyers what they are observing in their market.

- Choose the sweet potato variety that fits you best as a supplier. Do not only consider the market demand, but also your growth climate and local production circumstances. Compare the offer of different local and international seed suppliers.

4. What are the prices for sweet potatoes?

Prices for sweet potatoes mainly depend on the quality and the availability, although in 2020/2021, other issues played a role as well. A shortage in 2019 raised the prices for sweet potatoes, at least until the Spanish season started. In 2020, prices were still higher than average. The COVID-19 crisis and an additional 25% import tariff on US sweet potatoes between November 2020 and March 2021 contributed to the higher prices. Increasing competition and more available products are expected to keep prices on the low side in 2021/2022.

Based on available trade statistics, average sweet potato import prices between 2017 and 2021 were between €0.65 and €0.85 per kilo. Only Germany registered higher prices. This is likely because of a large share of re-exported sweet potatoes from the Netherlands and more expensive regional crops from Portugal and Spain (including organic).

In short supply these prices can go over €1/kg. Future prices are difficult to predict. The European demand is still growing, but a strong increase in production can still lead to an excess supply and lower prices. Prices are most stable in supply programmes. Spot trade prices fluctuate most.

Retail prices for sweet potatoes are normally between €2.50 and €4.50 per kilo. Organic sweet potatoes and specific varieties such as purple-fleshed sweet potatoes are generally 20% to 30% more expensive. The retail margin is the highest and prices to consumers are relatively stable, but these retail prices have little correlation with the trade prices.

The intermediary costs depend on the value that is added, such as re-packing or cutting. Importers usually aim for a profit of at least 8% on their sale value, but also deal with handling costs and additional charges such as inspection.

Tips:

- Read the FruiTrop Roots & Tubers review: Q1 2021 to see the price development for sweet potatoes and other root vegetables in the first quarter of 2021.

- Find a price history of sweet potatoes (“patate douce”) in France on the Market News Network of FranceAgriMer from producers, importers, wholesalers (“gros”) and retail (“détail”).

- Get regular market and price updates from the fruit and vegetables webpage of the Federal Agency for Agriculture and Food (BLE) in Germany (in German). Scroll down to the “Markt- und Preisbericht” (market and price news). The information is available and most extensive in German, but you can use the “Translation” function of your browser.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research