The European market potential for fresh peas

Fresh peas such as mangetout and sugar snaps are mainly consumed in northern Europe. The United Kingdom is the largest consumer market and the Netherlands is the principle import market for mainland Europe. Despite the interest in healthy, convenient and non-traditional vegetables, it is not easy to fulfil the demand for fresh peas. As a supplier, you must use sea freight to reduce your carbon footprint. At the same time, European retailers expect a fresh and socially-responsible product.

Contents of this page

1. Product description

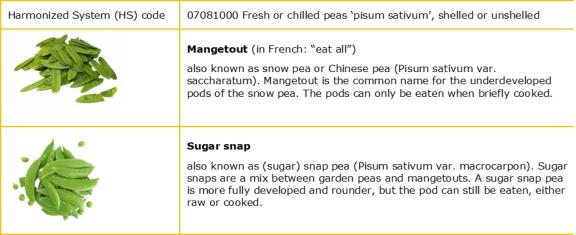

Fresh peas refer to the seeds or the seed pods of the Pisum sativum species. Preserved, shelled garden peas are the main consumed peas in Europe, but this study focuses principally on the main imported edible pea pods, which are mangetout and sugar snaps. The products are traded with HS code 07081000.

Figure 1: Types and HS code for the main imported fresh peas

Source images: Pixabay

2. What makes Europe an interesting market for fresh peas?

Europe depends on a foreign supply of sugar snaps and mangetout. The demand for these higher value vegetables saw a steady and gradual growth until 2022/2023. Europe will remain a dominant market for exotic peas. However, climate change and increasing import requirements will strongly influence volumes and prices.

Mangetout and sugar snaps are typical import products

Mangetout and sugar snap peas are seasonal and labour intensive products that require a warm climate. For that reason most of these peas are imported from countries outside of Europe.

Europe produces almost a million tonnes of fresh peas per year, but the local supply of young edible pea pods such as mangetout and sugar snaps is limited. There is mangetout and sugar snap production in Europe, such as in Italy, Portugal or during the summer in France and the United Kingdom. This production is seasonal and not sufficient to fulfil the European demand. Non-European fresh peas make up around 50% of the total fresh pea trade value (including garden peas), but for mangetout and sugar snaps this percentage will be much higher. From the €98 million imported fresh peas, practically all come from developing countries.

Practically all importers in Europe source fresh peas from several non-European countries year-round. They are especially interested in producing countries with long or extended seasons and suppliers that can fill potential gaps between different seasons.

Challenges in sourcing can become opportunities for suppliers

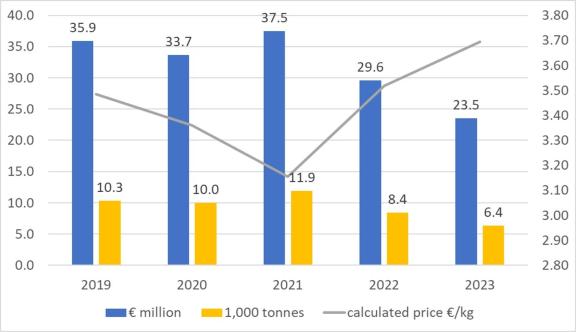

According to industry sources, Europe offers a niche market for fine vegetables but with a stable demand for fresh peas. While the demand is there, traders have noted big changes in the past three years. Recent trade figures showed a reduced volume and higher prices in 2023. The European import declined from 34 to 26 thousand tonnes from 2022 to 2023 (see figure 2). Sourcing challenges and increasing market standards have put pressure on imports. It has become very difficult to make market predictions.

Sourcing is a challenge: what does that mean for suppliers? The paragraphs below explain what type of suppliers can turn certain challenges into opportunities.

Opportunity for new supply countries and stable climates

Climate change and excessive rain affects the availability of sugar snaps and mangetout more often. Towards the end of 2023, adverse weather conditions delayed and reduced Kenyan production. In South America the El Niño phenomenon influences production volumes. Importers work with several countries of origin at the same time to limit supply risks. They look for suppliers in stable climates as well as new potential supply countries such as Rwanda or Morocco.

Opportunity for suppliers that can manage cold chains

Several European retailers are shifting away from air-freighted vegetables and demand sea freight or local production instead. It is important to offer sea freight, and also make sure that when your products arrive they are fresh. Suppliers that are able to control the cold chain from production to destination set themselves apart from suppliers that are less well organised.

Opportunity for suppliers close to Europe

Logistical routes may get disrupted, such as the route from East Africa through the Suez channel due to rebel conflicts. But shipping lines can also change their services, such as the direct line between Europe and Guatemala. Transit times become longer and sometimes more expensive. This provides opportunities for suppliers that are nearer to Europe such as Egypt and Morocco.

Opportunity for experienced and specialised growers

The costs of certification and compliance with European standards are high. There are increasing restrictions on crop protection products and retailers demand lower residue levels and social certifications. As a result, suppliers such as Guatemala are shifting their focus to North America. Some producers are also making a switch from fresh peas to more profitable crops such as blueberries. In short, fresh peas are being planted less. Experienced growers can take advantage by specialising further in pea production and by finding long-term alliances in the European market. Unfortunately, it also favours larger producers over smallholder farmers.

Figure 2: European imports of fresh peas from a non-European origin, 2019–2023, in 1,000 tonnes and €million

Sources: Eurostat and ITC Trade Map, calculations by ICI Business.

Europe is both demanding and important

Europe has a very strong position in the global trade value of fresh peas (all varieties). A large share are common garden peas or field peas, consumed without the pod. For more exotic varieties, European countries play an important role as well, in particular for developing country exporters. The United Kingdom and the Netherlands are among the top-3 buyers of fresh peas from developing countries. These imports often concern mangetout or sugar snaps.

Figure 3: Average annual import and export values of fresh peas (all varieties), 2019-2023, in € million

Source: ITC Trade Map

Tips:

- Compare target markets to see which is the best one for you. Evaluate the different requirements of buyers and do a proper cost-benefit calculation. Take into account the cost of production, certification and logistics. By diversifying your markets you can reduce risks, although steady partnerships can be more fruitful in the long term.

- Keep up to date with news on fresh peas, sugar snaps and mangetouts by following the publications on Freshplaza, FreshFruitPortal and Fruitnet.

3. Which European countries offer the most opportunities for fresh peas?

The United Kingdom is the main market for imported fresh peas such as sugar snaps and mangetout. The Netherlands and Belgium provide a hub to other European countries where consumption is high or growing, including Germany, France and the Scandinavian countries. Norway is often supplied directly from the origin country. In the United Kingdom and Scandinavia sugar snaps are the most popular, while the rest of northern Europe consumes slightly more mangetout peas.

United Kingdom: Leading importer of mangetout and sugar snaps

The United Kingdom (UK) was one of the first countries to import mangetout peas and especially sugar snaps. The UK market is a mature, well-developed market, directly supplied by producing countries.

Mangetout and sugar snaps have become standard products in the already diverse offer of fresh produce of British retailers. Almost all mangetout and sugar snaps are purchased directly from non-European suppliers. The main suppliers in 2023 included Kenya (€12.7 million) and Peru (€10.7 million). Meanwhile, Egyptian suppliers (€7.2 million) have overtaken the declining Guatemalan supply (€5.7 million). The total import value for fresh peas from a non-European country of origin was just over €40 million euros. This is a decline compared to the nearly €50 million in 2019, which is mainly due to the lower volumes from Guatemala and Zimbabwe. Despite of this, the UK is still the largest market in Europe.

The United Kingdom will remain a valuable market for non-European suppliers for several reasons. The local production of fresh mangetout and sugar snaps, which starts in June, is very limited. Since Brexit (Britain leaving the European Union), there has been a lack of local labour forces. Therefore, importers are eager to maintain their non-European supply sources. However, inflation may hamper the demand for exclusive vegetables that are more expensive than the more common vegetables.

Figure 5: British import of fresh peas from a non-European country of origin, 2019–2023, in 1,000 tonnes and € million

Source: ITC Trade Map, calculations by ICI Business.

Tips:

- Find wholesalers and see which kind of fresh peas are available via the trade directory of the New Spitalfields Market in London.

- Stay informed about the UK’s rules for importing and exporting fresh fruit and vegetables on GOV.UK. In general, the UK follows the same principles as the European Union, but be aware of changes between the two regions.

The Netherlands: Hub for Northern European markets

The Netherlands is a trade hub for many exotic fruit and vegetables, including mangetout and sugar snaps. Fresh peas need efficient logistics which the Netherlands can offer. The country is home to a large number of specialised trading companies and logistical service providers. Among these are, for example, Primeale United (previously Van Oers United BV), FV SeleQt (part of Farmhouse), BUD Holland and Nature’s Pride.

With a strong focus on trade, the Dutch import value of fresh peas varies from year to year. Imports declined in 2022 and 2023. The decline was stronger than in other European markets. Recent issues due to lower production volumes, stricter market requirements, and price increases have had a stronger influence in the Netherlands due to the fact that it serves as a trade hub. In the short term, you will see no big changes. Once the issues have been resolved and the demand in nearby countries can be better fulfilled, you can expect a gradual increase again.

A diverse group of supply countries covered a total Dutch import value of €23.5 million in 2023, with imports from Kenya (€7.5 million), Egypt (€4.6 million), Peru (€4.3 million), Guatemala (€3.1 million) and Zimbabwe (€2.9 million). The trade position of Dutch importers is important for foreign exporters, in particular for re-exports to Germany, Belgium and several Scandinavian countries. Scandinavian consumers are most fond of sugar snaps, similar to the UK. In Germany and the Benelux countries, there is a strong consumption of mangetout (snow peas).

With its efficient logistics and various marketing options, the Netherlands will try to maintain its key role in the European fresh pea market. This role also includes the responsibility of importing sustainable peas for European retailers.

Figure 6: Dutch imports of fresh peas with non-European origin, 2019–2023, in 1,000 tonnes and € million

Source: ITC Trade Map, calculations by ICI Business.

Tips:

- Find importers on the member site of the sector association Groenten Fruit Huis. You can find several exotic specialists such as BUD Holland and Yex, but there are many more that are not on this list.

- Connect with Dutch traders at relevant trade events and use their experience to get to know the market. Exotic specialists such as Nature’s Pride, Roveg and BUD Holland are well represented at the Fruit Logistica trade fair in Berlin or at Fruit Attraction in Madrid.

Germany: Focus on clean and healthy vegetables

In Germany, fresh pea pods are also called “Kaiserschote” (“Emperor pods” in English), referring to a time centuries ago when mangetout peas were food for the elite. Even today, the average German consumer still does not consider mangetout peas (as well as sugar snaps) a traditional vegetable. However, the name “Kaiserschote” remains suitable as it describes the sweetness and the significant amount of protein and vitamins. The large population in Germany and a growing attention for health provide opportunities for exporters that can supply fresh, pesticide-free peas.

In 2023, Germany had a total import value of €23.5 million, of which just over half was imported directly from non-European suppliers. The (re-)export was limited to €4.4 million. This makes Germany the second-largest destination in Europe for imported fresh peas.

Germany has a positive import growth of fresh peas. In 2019, direct non-European imports were worth 12.3 million euros – more than half of the total import value.

The main origins from outside Europe were Egypt (increasing because of the short distance), Kenya (declining due to Germany’s strict pest control), followed by Zimbabwe and Peru. However, Germany imported the highest value of sugar snaps and mangetout via the Netherlands, with €8.2 million in 2023. Dutch importers have good coverage in Germany and German traders often use the Netherlands for import.

Sugar snaps and mangetout are often available in the main supermarkets, but it is not yet standard in the vegetable assortment. German consumers are traditional and very conscious of origin and food safety. Nevertheless, among the 83 million inhabitants there is a significant group that is open to new vegetables.

In order for sugar snaps and mangetout to successfully keep growing, it is crucial to supply a clean, pest free product. Or even better: organic, to match the local quality expectations.

Tips:

- Take away potential concerns of German buyers and guarantee them a product with little pesticide residues. Use the Lidl standard of 33% of the legal European limit. Learn more about the German market and its specific requirements in the CBI study on exporting fresh fruit and vegetables to Germany.

- Find potential partners in Germany in the database Lieberanten.de (in German), for example by selecting suppliers of “Zuckererbsen” or “Zuckererbsenschoten”.

France: Multichannel opportunities

Fresh peas are a popular vegetable in the French cuisine, although edible pea pods such as sugar snaps are still somewhat of an exotic. The French market for exotic peas has a multichannel character.

France is by far the largest fresh pea producer in Europe with 270 thousand tonnes in 2023. These peas are typically shelled garden peas that are dried, canned or frozen. According to specialists the interest in mangetout and sugar snaps is increasing. These exotic peas, also sold as “pois gourmand” and “pois sucré”, are generally imported. The highest import value is from Kenya (€6.1 million in 2023). There is also some import from Zimbabwe, as well as lower-value peas from Egypt and Morocco. Spain and Italy are the main European suppliers of fresh pea pods.

Mangetout peas are more common in France than sugar snaps. Most supermarkets offer mangetout peas while sugar snaps are more of a specialty. This means the wholesale channel is also relevant for the marketing fresh peas to specialised shops and culinary outlets such as Asian restaurants.

Tips:

- Find wholesale buyers of fresh peas at the French wholesale markets such as the Rungis. A well-known retailer with a wide variety of fresh fruit and vegetables is Grand Frais.

- Give French consumers a reason to buy imported fresh peas. French consumers have a strong preference for local and seasonal vegetables. As a foreign supplier, try to differentiate in quality or social certification.

Norway: Part of a high Nordic consumption

Norway has a relatively high consumption per capita and a significant import from suppliers outside the European region. Sugar snaps are particularly popular in Norway, as well as in other Scandinavian countries. Sugar snaps are often consumed raw as a snack.

Norway consumes more imported sugar snaps (and mangetout) per capita than Germany (approximately 90 gram versus 6 gram per year). Only the UK consumes more per capita. However, the import in Norway has declined by half from 1,000 tonnes in 2019 to 500 tonnes in 2023. The Norwegian market is a mature market, but it struggles with the same challenges as the rest of Europe. Besides the higher price for sugar snaps, reduced purchasing power has also caused a lower consumption of fruits and vegetables in general according to Norwegian research. The supply mainly declined from Guatemala and Peru. Kenya remains the largest supplier with a value of around €1 million. Norwegian consumers can only rely on a very short season of locally grown sugar snaps in July and August, so the dependence on import will continue to exist.

Almost all Norwegian imports come directly from suppliers outside of Europe, such as Kenya, Guatemala, Egypt and Peru. Norway is part of the European Free Trade Association (EFTA) but not part of the European Union (EU). Therefore, there is more direct trade with producer countries of fresh peas. One of the principle service providers that facilitates the direct trade is Nature’s Pride, a Dutch fresh company that has been started up with capital and cooperation from the Norwegian distributor Bama Gruppen.

Tip:

- Make sure to offer different ways of presenting your product. Due to inflation, price may be an issue in most countries in Europe, but Norway is still a country with one of the highest purchasing powers. By sorting and packing your peas neatly, there is a better chance of getting a good price.

Belgium: Processor and re-exporter of fresh peas

Belgium is the biggest European market for fresh peas. Most of these are common garden peas from European farmers that are processed in Belgium, but there is also import of mangetout and sugar snaps. Belgian commerce is especially well connected to France, the Netherlands and Scandinavia.

Belgium has the highest import volume of fresh peas in the world: 112.7 thousand tonnes in 2023. This volume concerns mostly fresh garden peas for the processing industry (canning and freezing). Common peas are mainly imported from France.

A second business in Belgium is the import and re-export of the more exotic sugar snaps and mangetout peas. These pea pods generally have a non-European origin, coming from countries such as Egypt, Kenya and Ethiopia. Their total value was €2.4 million in 2023. Until 2019, Zimbabwe was becoming a significant supplier, but the interest in flown peas from Zimbabwe decreased to nearly zero.

Belgium is a good hub from which to supply the French and Dutch market, which are its main markets for fresh peas. High-value peas such as sugar snaps often find their way up north to Sweden, Belgian’s second export market for peas in terms of value.

Strong import companies such as Fair-Fruit (fair trade peas), SpecialFruit (exotic specialist) and Greenyard (fresh and frozen peas) will continue to reinforce Belgium’s position in fresh peas and other vegetables. Processing companies such as Ardo and Bonduelle (French) also contribute to the import and produce frozen pea pods.

Figure 7: Example of frozen sugar snap peas

Source: Ardo

Tip:

- Find a potential trade partner in Belgium by using the tool Find a Supplier on Belgianfruitsandvegetables.com.

4. Which trends offer opportunities or pose threats in the European fresh pea market?

There is a growing interest in healthy and exotic vegetables such as sugar snaps and mangetout. But as an exporter you must be able to offer them in a socially responsible way and anticipate an increasing demand for convenience products.

Interest in exotic vegetables, but socially responsible

The variety of vegetables in Europe is extensive. Besides the large volume of locally grown and seasonal vegetables there is also room for exotic types of vegetables such as sugar snaps and mangetout – but with an increasing focus on responsible sourcing.

A good number of consumers like buying things that are out of the ordinary, such as special vegetables to enrich their cooking for example. Food blogs, culinary professionals and retail marketing are positive drivers behind the consumption of more exclusive vegetables such as sugar snaps and mangetout. They can be consumed in hot dishes such as stir fry, but also fresh, in salads – this makes it a suitable vegetable year-round.

At the same time, consumers in Europe are increasingly concerned about the impact of their consumption on society and the environment. They want to feel good about the food they eat and local vegetables provide the most peace of mind.

To maintain the interest in imported fresh peas the produce must be sustainable and socially responsible. For example, the company Unispice (Uniespecies S.A.) in Guatemala is Fairtrade-certified and expects to be carbon neutral in 2025. The company received financial support from Oikocredit and IDH Farmfit Fund. They are active in Europe, North America and Japan.

Tip:

- Show social compliance through your actions and by following social standards. See the CBI study on entering the European market for fresh peas about different social and sustainable standards.

Increasing preference for sea freight to reduce CO2 footprint

Airfreight has been a common mode of transport for fresh sugar snaps and mangetout peas. Today, more and more retailers demand that these exotic vegetables be transported by sea or road to reduce CO2 emissions. This is typically a trend in northern European markets. The increasing costs associated with air freight have provided an additional push for the transition to sea freight.

Large supermarkets such as Lidl already phased out air-freighted fruit and vegetables in Sweden and the Netherlands. Since June 2023, the Dutch supermarket Albert Heijn has also been claiming that all unprocessed fruit and vegetables are imported by road or sea container. Moreover, half of their fresh fruit and vegetables are sourced within the Netherlands. Sustainable sourcing is the new key word. And since the COVID-19 pandemic, the preference for local products has been gaining momentum.

For exporters to Europe the importance of finding feasible sea freight routes is increasing. It also forces suppliers to manage a proper cold chain and storing conditions. This can be a challenge for suppliers. An additional advantage of sea-freighted peas is that they will be more affordable for European consumers, which can aid market growth.

You can also justify the long distance trade through other social or sustainable activities. For example, the Zimbabwean company Selby has a longstanding partnership with Albert Heijn. Together they have invested in better facilities for the community such as schooling and housing.

Local production vs. import

In Europe, there are several initiatives to grow sugar snaps and mangetout. For example, the Danish company Greenpeas produces sugar snaps both in Denmark and Portugal. Local peas have a lower carbon footprint and compete with imported peas during the summer months. However, as a result of weather conditions and high production costs, they cannot replace import. Most sugar snaps and mangetout peas continue to be imported.

Tips:

- Offer good logistical routes that reduce carbon footprint. Efficiency is important but avoid air-freight when possible.

- Check the BMT Cargo Handbook for information on how to handle fresh peas in terms of storage and transport. Read all about cooling and a controlled atmosphere, for example.

Increasing demand for convenience

The European market is in constant development to address the needs of the consumer. A good example is the growing interest in convenience products. European consumers, especially in the north such as the UK and the Netherlands, take less time for cooking. This is good news for fresh peas, because they are quick and easy to prepare.

Sugar snaps and mangetout peas can be blanched, steamed, cooked or stir fried. Sugar snaps can even be eaten raw, although not every consumer in Europe is aware of this. Fresh peas and pea pods are also pre-mixed and used in fresh meals to make them even more appealing and convenient. For example, British retailer Sainsbury’s offers several packaged mixes of mangetout with baby corn and stir-fry mixes (see figure 8). This way, sugar snaps and mangetout reach more and different consumers.

Fresh processing and packaging are important must-haves to profit from the growing interest in convenience products. To fulfil consumer satisfaction buyers often demand pea pods to be without strings and sometimes trimmed (cutting of the ends). Offering a wider variety of small vegetables and packaging options can also be a unique selling point for exporters to address the convenience trend.

Figure 8: Example of a retail stir-fry mix with mangetout peas

Source: Photo by alia per Open Food Facts under the Creative Commons Attribution-Share Alike 3.0 Unported license. (Original Image)

Tip:

- Think like a service provider and be prepared to offer your clients different options of packaged and processed peas.

Healthy diets require fresh vegetables

Consumers in Europe are becoming more aware of a healthy diet. Leguminous vegetables such as fresh peas can contribute to a healthy lifestyle.

Fresh peas are a good source of vitamins B and C and plant proteins. They provide an excellent option to a growing number of consumers that are looking for healthy food or vegetarian and vegan alternatives. Dried garden peas are already used often as a plant protein ingredient in many food products. Because of this, fresh companies in Europe are positive about the potential of fresh peas.

To keep the healthy reputation of fresh peas it will be crucial to guarantee a safe and pesticide-free product. Also an organic label, which is often associated with health, will help you gain support from consumers.

Tip:

- Read the CBI Trends in fresh fruit and vegetables to gain more insight into the fresh trends.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research