The European market potential for fresh melons

Europe produces melons in summer, but imports are needed in the off-season as well as just before and after the main season (shoulder season). This creates good opportunities for exporters from developing countries. Spain and the Netherlands are key trade hubs. Meanwhile, Germany, France and the United Kingdom are large end markets. Trends like healthy eating, households with fewer people and premium fruit help demand. To succeed, exporters need to offer good quality, flavour and reliable supply.

Contents of this page

1. Product description: fresh melons

Melons are a group of fruits in the Cucurbitaceae family. Two main species are important in the European market: the Citrullus lanatus (watermelon) and Cucumis melo, which includes varieties like Cantaloupe, Galia and Honeydew. Cucumis melo is traded under the HS code 08071900 (fresh melons, other than watermelon).

Main varieties

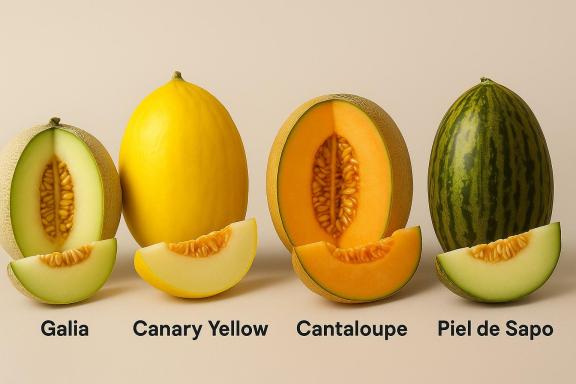

The following are the most common melon varieties in Europe:

- Cantaloupe (European and Charentais types): Cantaloupe melons are very popular throughout Europe, especially in France. There, the Charentais, a type of cantaloupe, is a traditional favourite;

- Galia melon: Galia is one of the most common melon varieties in Europe, particularly popular in Central Europe, northern France and parts of the UK. It is valued for its sweet flavour, and Spain is a major producer and exporter;

- Canary melon (Yellow melon): Canary melons are notable for their bright yellow skin and sweet, pale flesh. They are mainly available from summer through to mid-autumn. They are increasingly popular in European markets due to year-round imports;

- Piel de Sapo: This variety is also known as the ‘Santa Claus melon’ or ‘Christmas melon’. It is very popular in Spain, but has seen growing demand in France, Eastern Europe and beyond. It has green skin and sweet, white flesh.

Other common varieties are:

- Honeydew: Honeydew is known for its smooth, pale green skin and sweet, juicy flesh. This variety is widely available in Europe;

- Gaya: Gaya is a pale melon with green stripes. It is also called the ’Dino Egg melon’. The flesh is pale and sweet. This type of melon was introduced in Europe in 2017. It is becoming more popular, especially in Scandinavian, German and Eastern European markets;

- Little Planet: This is a snow-type melon, famous for its small size and green flesh. This flesh is crunchy, fruity, aromatic and sweet. It has sugar levels between 13 and 17 degrees Brix. Some growers in Spain are moving to increase the production of speciality melons like this, while decreasing the acreage dedicated to other varieties like Galia;

- Orange Candy melon: This is a small yellow melon with orange flesh. It is very sweet, and the flesh is firmer than other varieties;

- Kırkağaç: A Turkish variety which is gaining ground in Germany. It is known for its unique flavour and appearance. It is commonly sold in ethnic supermarkets.

Figure 1: Main melon varieties in Europe

Source: AI-generated by DALL-E

Forms and uses

Melons are sold mostly as whole fresh fruits in Europe, but they are also available in cut and pre-packed portions. Ready-to-eat fruit mixes are also getting more popular. Melons are eaten fresh, often as a snack or dessert. They are used in smoothies, fruit salads and summer dishes.

2. What makes Europe an interesting market for fresh melons?

Melon is a popular fruit amongst Europeans, especially in the summer season. Melon demand in Europe peaks in May to September, when consumers buy more fresh fruit. Even outside the summer season, melons are available in supermarkets throughout the year.

Although total fruit consumption in Europe has fallen slightly in recent years because of inflation, melons still show resilience, especially varieties like Galia and Cantaloupe.

The popularity of melon has grown partially because of consumers looking for convenient, healthy products. Ready-cut fruits are very common in supermarkets and convenience stores in Europe. Melons are often sold cut or as part of cut salad mixes.

Figure 2: Half Piel de Sapo melon in Spain and mixed cut melon in Germany

Source: GloballyCool

Europe imported about 1.05 million tonnes of melons in 2020. By 2024, the volume had fallen to 967,000 tonnes, after a small dip in 2022. Producers in Europe remained the largest on the market, delivering around 565,000 tonnes last year – almost 60% of total supply. Growers from developing countries held on to a strong position as well, exporting just over 400,000 tonnes and helping to cover seasonal shortages. Other regions contributed only a few dozen tonnes, so their impact on prices and availability was minimal.

European melon imports from developing countries decreased by only 0.6% on average. The main dip in imports was the result of the decrease of imports from other EU countries, mainly from Spain. This itself was the result of unfavourable weather conditions in 2022.

Source: UN Comtrade and Eurostat Comext (June 2025)

Europe relies on imports for melon supply during the off-season

Melons are popular in Europe, but they can only be sourced locally in the summer months. This means Europe needs to import fresh melons for a year-round supply.

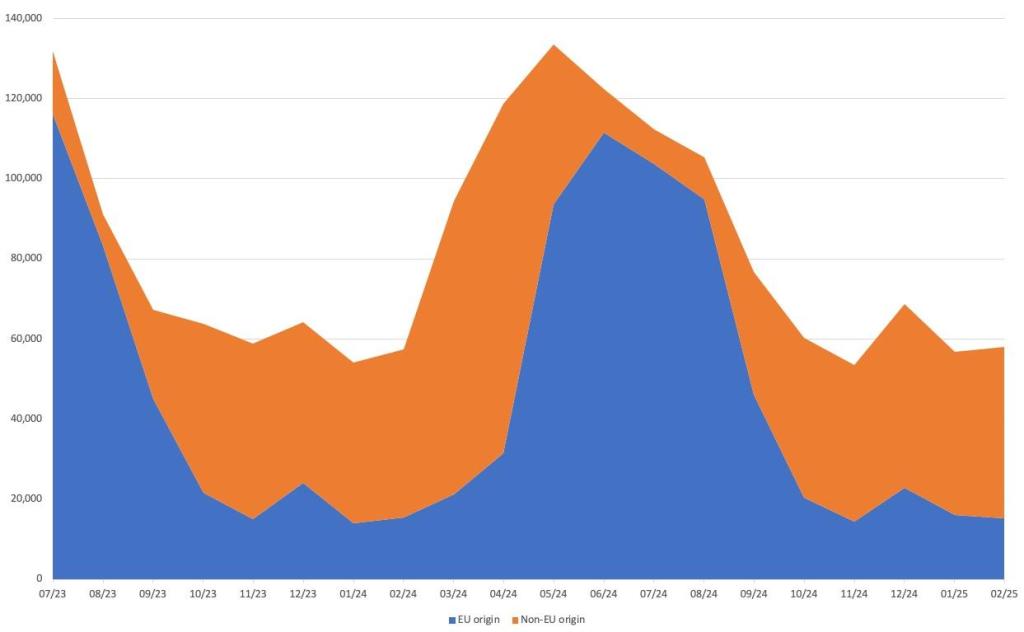

Melon demand in Europe peaks between March and September. Consumers tend to buy more fresh fruit during the warmer months. From May to August, European producers – mainly from Spain, Italy and France – account for 70–90% of melon imports. By September, this share drops to around 60%. Between October and April, Europe relies on external imports. This off-season period presents opportunities for exporters that can deliver consistent quality and reliable volumes.

Figure 4: European imports of fresh melon (in thousand €) per month (July 2023–February 2025), EU origin vs. non-EU origin

Source: GloballyCool, based on Trade Map statistics (May 2025)

Tips:

- Focus on entering the European market outside the summer season, between September and April;

- Read our tips for finding buyers and tips for doing business with European buyers of fresh fruit and vegetables.

3. Which European countries offer the most opportunities for fresh melons?

Spain and the Netherlands are the two main importers of fresh melons in Europe. Over the past five years, their imports from developing countries have grown. Both countries are important trade hubs. They buy melons and send them to other European markets. Spain also has significant local demand, especially when its own production is low. Germany, France and the United Kingdom are big end markets. These countries import melons mainly for local consumption and offer good opportunities for reliable exporters.

Source: UN Comtrade and Eurostat Comext (June 2025)

Netherlands: trade hub for fresh fruit and vegetables

The Netherlands was the biggest importer of fresh melons in Europe in 2024. It imported more than 186,000 tonnes. About 70% came from developing countries. The rest came from Europe. Dutch melon imports have gone down by 2% per year over the last five years. This is because imports from Europe dropped by more than 9% each year. Imports from developing countries stayed the same during this time.

Brazil was the main supplier. It sent around 102,000 tonnes of melons in 2024. The other big suppliers were Spain (29,000 tonnes), Honduras (23,000 tonnes) and Costa Rica (19,000 tonnes). Melon imports from Brazil grew by 4.5% each year between 2020 and 2024. Imports from Spain, Honduras and Costa Rica went down by 11%, 2% and 10% per year.

Spain’s imports have gone down because of lower melon production after 2022. This was caused by unfavourable weather conditions. Costa Rica also reduced its exports due to unfavourable weather conditions. Lower Honduran exports might be because of lower production too.

The Dutch company Global Producers imports melon from its own farms in Costa Rica to supply different markets in Europe. Even though there is demand from supermarket chains, the company expects a difficult season in 2025 due to storms.

Dutch imports of melons from Brazil grew because Europe does not produce melons in some months. Brazil is a strong and reliable supplier when European production is low, especially between October and March.

The Netherlands is mainly a trade hub for fruit in Europe. Brazil can send large volumes of melons, and it has good logistics. This makes Brazil a reliable partner. Dutch companies work closely with Brazilian producers to keep supply stable and get better prices through big volumes and frequent shipments.

The growth in Dutch melon imports from Brazil is mainly due to seasonal supply gaps in Europe. Dutch companies that import melons from developing countries directly include Triple Fruit, Staay Food Group and MG Fruit.

The Netherlands sends a lot of imported melons to other countries. In 2024, it was about 124,000 tonnes. However, some melons stay in the country for local use. On average, 34% of all melon imports are kept for Dutch consumers. This was about 63,000 tonnes in 2024.

In the Netherlands, fresh melons are mainly sold in retail chains like Albert Heijn and Jumbo. They are sold both as whole fresh fruit and pre-cut as convenience products. The Dutch mostly buy melons during the summer season.

Germany: key consumer market in Europe

Germany was the second-biggest importer of fresh melons in Europe in 2024. It imported almost 147,000 tonnes. Even though prices went up and consumers bought less fresh fruit and vegetables, melon imports still grew. Melon imports have gone up by 2.6% per year in the last five years. This shows that melons are still popular in Germany.

Spain was the top melon supplier to Germany in 2024, exporting about 70,000 tonnes. This is almost half of all melon imports. Spanish melon exports to Germany grew by 3.9% per year. The Netherlands was the second-largest supplier, exporting almost 43,000 tonnes. However, Dutch exports have dropped by 3.9% per year. Italy was third, with about 24,000 tonnes. Italian exports have grown fast, with an increase of 20.1% per year.

Germany is now the top market for Italian melons. This is because more people want small and medium yellow melons (Canary melons) from Italy. The Netherlands does not grow many melons. The melons it exports are re-exports. Many come from Brazil.

In Germany, people buy more melons when the weather is warm. Sales are highest in summer. But warm weather can start early, in April, and stay longer, into September. So, buyers often check the weather. They want to have melons ready in warm months. This creates opportunities for suppliers that can deliver melons in April, May, August and September.

Figure 6: Shelf with melons outside a mid-segment retailer in Germany on a hot day

Source: GloballyCool

In 2024, Germany imported 2,779 tonnes of melons from developing countries. This was less than in 2020, when imports were over 4,100 tonnes. One reason for the drop is that German buyers focused on sourcing melons through strong trade partners in the Netherlands. Higher prices (inflation) also meant people bought fewer imported fruits during the off-season.

Some importers still buy melons directly. One example is disFruta Fruchtimport, an importer from Duisburg. It imports melons directly from Uzbekistan.

In Germany, melons are found on shelves year-round, from discounters to high-end retailers. Melons are also popular in the catering industry. They are used for consumption and decoration. REWE, EDEKA, ALDI and Lidl are key retail chains.

Germany is a key market for organic products. However, organic melons are still scarce. They can mainly be found in organic retail chains like Alnatura and Denns Biomarkt.

France: stable demand for melons with strong seasonal focus

France is the third-largest importer of fresh melons in Europe. In 2024, it imported around 131,000 tonnes of melons. This is a decline from 175,000 tonnes in 2020, showing a yearly decrease of 7.3% over the last five years. Most of the decline came from lower intra-EU imports.

Despite this drop, France is still a strong melon consumer. This is thanks to both imports and large domestic production. In 2024, France produced over 300,000 tonnes of melons. The Charentais melon, a sweet and aromatic variety, is the most popular type in France. It is traditionally linked to the Charentes region. However, it is now grown in other areas, like the Provence and around Cavaillon. The French season runs from May to September, when domestic melons dominate the shelves.

French consumers have a strong preference for locally grown melons during peak season, valuing quality and sweetness. However, they are open to imported melons before the local season starts. This creates clear windows of opportunity for foreign suppliers early in the year.

Melon imports from developing countries decreased from 42,341 tonnes in 2020 to 34,382 tonnes in 2024, a drop of 5% per year. Imports from EU countries also dropped, from 133,000 to 96,000 tonnes. This is a decrease of 7.9% per year.

Most imported melons are sold before the French season starts. In summer, France uses local and Spanish melons. Most imports in spring (April–May) come from Morocco.

Spain is the biggest supplier of melons to France. In 2024, Spain sent about 89,000 tonnes to France. This was more than two-thirds of all melon imports. However, Spanish exports have dropped from 113,000 tonnes in 2020. This is a decrease of 5.9% per year.

Morocco is the second-biggest supplier, exporting about 32,000 tonnes in 2024. Moroccan exports have also dropped by 4.8% per year over the last five years.

Spain's lower exports are due to bad weather and long dry periods. These weather problems harm production and lead to smaller harvests. Morocco also has problems with water. Droughts and water shortages have made it hard to grow melons. Some farmers in Morocco now grow crops that need less water.

In terms of developing countries, after Morocco, Senegal stood out in 2020 with over 3,300 tonnes, but exports dropped sharply to 478 tonnes in 2024 (-30% per year). This decrease is also the result of extreme weather conditions in Senegal. Brazil and Honduras supply smaller but steady volumes (372 and 513 tonnes, respectively in 2024). Importers of melons from developing countries in France include AZ France and Laparra.

During the French season, France also exports melons. The French company Philibon supplies France and other European markets with Charentais melons from France, Senegal, Spain, Guadeloupe, Martinique and Morocco.

Outside the summer season, melons are available on the shelves of most French retailers. French consumers enjoy melons as a seasonal treat and as a year-round fruit, especially imported varieties that fill the supply gap before and after the domestic harvest. Key retail chains that offer melons in France include Carrefour, E.Leclerc and Intermarché. These supermarkets provide conventional and, to a lesser extent, organic melons.

Melons are also widely used in the catering and hospitality industry, where they are served fresh and used for decoration.

France has a well-established organic market. Demand for organic products is strong. However, organic melons are still a niche product. They are mainly available in specialised organic outlets like Biocoop and Naturalia. Supply is limited and often seasonal, creating opportunities for exporters that can offer certified organic melons during off-peak months.

United Kingdom: year-round importer and end-market

The United Kingdom depends entirely on imports for its fresh melon supply. In 2024, the United Kingdom imported about 126,000 tonnes of melons. This made it the fourth-largest melon importer in Europe. Imports have gone down since 2021, when the United Kingdom imported over 162,000 tonnes. This is a drop of 6.1% per year on average.

Melons are sold year-round in the United Kingdom. To meet demand, it buys melons from different countries in different seasons. Brazil was the main supplier in 2024, with around 61,000 tonnes. This represents 48% of all melon imports. Brazil is very important from September to March, when Spain has no melons. During this time, Brazil supplies 70–90% of British melon imports.

From May to August, the United Kingdom mostly buys from Spain. Spain sent around 42,000 tonnes in 2024, or 34% of yearly imports. Imports from Spain have dropped by 5% per year since 2020. Honduras and Costa Rica export melons from February to May. In 2024, Honduras sent 11,800 tonnes. Costa Rica sent 5,600 tonnes. This shows a clear supply system: Spain covers summer; Brazil and Central America supply in winter and spring.

A key player in this structure is Agricola Famosa. It is the largest melon producer in Brazil. It owns a UK-based subsidiary called Melon & Co, which it uses to import its own melons. This vertical integration makes Agricola Famosa more competitive, ensuring consistent supply and helping it maintain a strong market share in the United Kingdom. Other active British importers working with developing country suppliers include Minor, Weir & Willis and Dole UK.

Consumers in the United Kingdom like Honeydew, Piel de Sapo, Galia and Cantaloupe melons the most. Charentais and Dino melons are also becoming more popular, but are still a small part of the market.

Buyers in the United Kingdom care about quality and easy-to-use products. Many people choose ready-to-eat melons. This increases the demand for cut melon pieces, especially Cantaloupe and Honeydew. These two types are often sold in convenience packs.

British supermarkets dominate fresh melon distribution. Retailers like Tesco, Sainsbury’s and Morrisons need reliable and high-quality supply. This makes it a strategic market for exporters that can guarantee year-round volume and consistency. The organic segment is well-established in the UK. However, organic melons are still niche. They are mainly sold through speciality retailers such as Planet Organic and Whole Foods Market.

For new suppliers, the best opportunities can be found in the shoulder and off-seasons, especially from February to May when Spain and Brazil are not at their peak. Exporters that offer consistent quality during these windows are more likely to gain a foothold in this market.

Spain: major producer and growing off-season importer

Spain is both a major producer and a growing importer of fresh melons. In 2024, the country imported around 104,000 tonnes, up from 96,000 tonnes in 2020. This marks a moderate average yearly growth of 2.1% over the past five years. Unlike many other European markets, Spain's imports are shaped by its role as Europe’s largest melon grower, with a domestic production of 515,000 tonnes in 2024.

Spanish farmers grow and sell most melons during summer, from June to September. They supply Spain and other EU countries. Spain imports melons from other countries when it does not have its own to harvest. For example, melons from Morocco arrive in April and May, before Spain’s season starts. Brazil exports melons from October to March, during the winter. This seasonal sourcing helps maintain a year-round supply, for domestic consumption and for re-export to other European markets.

Spain has a strong cultural preference for fresh produce, and melons are widely consumed across the country. Most Spanish melons are sold in Spain. The Piel de Sapo melon is the favourite, and it is becoming more popular in other parts of Europe.

Figure 7: Piel de Sapo melon in a Spanish independent retail outlet, at the beginning of the European season

Source: GloballyCool

Spain grows a lot of melons. However, in recent years, bad weather has made growing harder. Regions like Murcia and La Mancha have had long droughts and very hot weather. Because of this, harvests have been smaller. Spain has had to import more melons to fill the gap and keep supply going. These problems have also meant that Spain has exported fewer melons. Countries like the Netherlands, France and the UK, which often buy Spanish melons, imported less from Spain.

In 2024, Spain imported 96,738 tonnes of melons from developing countries. This is more than in 2020, when it imported 91,127 tonnes. This is a 1.5% increase per year. Imports from other EU countries also grew, from 4,685 to 7,382 tonnes. Most of this increase happened in the last two years.

Brazil was the biggest supplier to Spain in 2024, exporting 71,364 tonnes. This represents an increase from 66,431 tonnes in 2020, or 1.8% more per year. Senegal was second, with 17,373 tonnes in 2024. Senegal's exports grew by 6.5% per year. Morocco was an important supplier in the early season. In 2023, it sent over 15,600 tonnes. However, this fell to 7,296 tonnes in 2024. This may be due to changes in farming or transport. Other melon suppliers to Spain include the Netherlands (3,326 tonnes), Portugal (2,304 tonnes) and France (1,068 tonnes).

Spanish companies are major producers and key exporters of melons to their European partners. To maintain year-round supply and meet client demand outside the local season, many Spanish exporters are expanding their sourcing strategies.

Spain may keep or increase its off-season imports because of climate problems. Suppliers from developing countries that can send melons in spring and winter have good chances in Spain. They can sell to the local Spanish market and other European countries through Spanish re-export. Some Spanish importers buying melons from developing countries are Frutas Bollo and Agroponiente.

In Spain, supermarkets are the most important outlets in the distribution of fresh melons. Leading retailers such as Mercadona, Carrefour and Eroski source locally grown and imported melons. This means they can offer consumers a year-round selection. These chains demand high-quality, traceable and reliable supply, especially during the off-season, when imports fill the gap.

Spain has a growing domestic market for fresh fruit. It also produces organic melons. Nevertheless, there are almost no organic melons in mainstream retail. Organic melons are typically only available in specialised retailers, such as Veritas.

Italy: strong domestic producer with growing import needs

Italy is a well-established producer of fresh melons. However, its import demand has increased in recent years. In 2024, Italy imported about 32,200 tonnes. This was a bit less than 33,400 tonnes in 2023, but more than 26,900 tonnes in 2022. This shows an increase, with imports rising by 3.5% per year since 2020.

Italy grows melons mainly from May to September, which meets most local demand. But it needs imports before and after this season, especially in spring and autumn. In 2024, Italy imported 7,775 tonnes from developing countries. This represents a drop from 11,300 tonnes in 2020, with a yearly decrease of 8.9%. Imports from other EU countries went up. They grew from 16,800 tonnes in 2020 to 24,469 tonnes in 2024, a 9.8% increase per year.

The Netherlands is now Italy’s top supplier. It exported over 10,280 tonnes in 2024, showing 14% annual growth. Spain is second, with 7,400 tonnes in 2024, up from 4,864 tonnes in 2020. This amounts to a yearly growth of 6%. France also exports to Italy, sending around 5,000 tonnes each year.

In terms of developing countries, Brazil is the biggest supplier. However, exports dropped from over 8,000 tonnes in 2020 to 3,313 tonnes in 2024. This is equal to a 20% drop per year. Costa Rica improved in 2024, sending 2,500 tonnes up from only 1,064 tonnes in 2022. Other suppliers like Senegal, Honduras and Belgium send smaller amounts. They help when Europe produces less.

The Italian market prefers high-quality, flavourful melons. Traditional varieties like Cantaloupe (netted) and Galia are the most important. There is growing interest in exotic and premium varieties, especially from well-branded or sustainably grown sources. Italian consumers still like to buy bigger melons. Italian production of smaller sizes is mostly for exports.

The country’s large retail sector, led by chains such as CONAD, CRAI and Coop, demands consistent quality and traceability. This means there is space for exporters that meet these standards. Traditional open markets also play a role in melon sales. This channel is more important for local production, but not so much for imported melons.

Tips:

- Visit the Fruit Logistica trade fair in Berlin to learn about different markets and meet possible buyers. Many potential buyers will exhibit. Take a look at the exhibitor list for details;

- Visit Fruit Attraction in Madrid if you want to enter the Spanish market. This trade show is very important there and is becoming more important in Europe;

- Read our study on the demand for fresh fruit and vegetables on the European market.

4. Which trends offer opportunities or pose threats in the European fresh melon market?

The European market for melons is changing. Consumers are more focused on health and quality, but they also face pressure from rising food prices. Melons cost more than staple fruits like apples and oranges. This means price has a big effect on demand. At the same time, buyers want new ways to grow the category, such as new varieties or smaller sizes that fit changing lifestyles. Extreme weather is reducing local production, creating opportunities for reliable exporters from developing countries.

Premium melons in a price-sensitive market

Consumers in Europe are increasingly aware of how to make healthy food choices. People want to buy more healthy foods and eat more fresh fruit and vegetables. However, since the price of fresh foods and vegetables has increased, it has become harder for less privileged people to access healthy food.

Melons are positioned as mid-priced to premium fruit in all main European markets, except in Italy, Spain, Greece and Portugal, while in season. Since increasing price pressure across Europe is limiting how much consumers spend, the margins for traditional melon varieties are small.

At the same time, people in the fruit business are looking for alternatives to bring movement to the category. They often do this by introducing new varieties that they market as premium, which allows for bigger margins. Varieties like the French Charentais, the Dino Egg melon and the Orange Candy are examples of new varieties that sell for higher prices. The trade volume of these varieties is still very small in comparison with the more well-known ones.

Companies that want to enter the European market with fresh melons need to be very efficient to compete with more common varieties, or they can focus on delivering more exotic varieties with excellent qualities. Les Domaines Export, based in Morocco, offers the Green Charentais melon, a premium variety known for its juicy, crunchy orange flesh and strong aroma. Grown in the Dakhla region, this melon is available from November to mid-May, outside the Spanish season.

Figure 8: Sugar Baby Matisse and Orange Candy melons in German retail

Source: GloballyCool

Good looks and flavour drive demand

Juiciness and sweetness are important criteria for consumers when buying melons. Poor-quality melons cause immediate problems, as consumers simply stop buying. This can damage the image of the origin and decrease your sales. The government of Almeria, an important melon-producing region in Spain, implemented a ‘No green cuts campaign’ to guarantee the right ripening degree of melons that leave the region. This campaign was a response to quality issues in past years caused by early harvesting.

Some companies might be tempted to cut melons early to extend shelf life. Shelf life is important, especially when shipping from outside Europe. However, the loss in flavour will decrease sales.

To improve shelf life and get quality melons with the expected flavour profile, it is important to follow good harvest and post-harvest practices, including having a solid cold chain. Melons are often left in the heat after harvesting. This exponentially decreases shelf life. Make sure your melons are cold-stored right after harvesting and that the cold chain is maintained until arrival at the destination.

The look of melons is very important. European consumers are very keen to buy perfect-looking fruit and vegetables. Harvest and post-harvesting practices play a key role in avoiding scarring.

In the short term, this trend will continue to push buyers to be strict on quality. Exporters that invest in better post-harvest care will have an advantage and grow their business. The quality of imported fruit has improved over the years, and this will likely continue. In the long term, the trend will continue, as consumers expect good flavour and appearance.

Smaller melons for smaller households

As European households continue to shrink and people opt for convenience products, fruit is getting smaller. This trend started with watermelon years ago, and has now moved on to other melons. Many consumers in Northern Europe live alone or have small families. This means big fruits go to waste before they are eaten. For this reason, consumers prefer smaller fruit. In Northern Europe today, consumers prefer melons no larger than 2 kg.

The preferred sizes for honeydew melons are around 1.6 kg per fruit (13 kg, size 8). For Cantaloupe and Galia melons, around 1 kg is preferred (10 kg size 10 or 11). This is not the case for Southern Europe, including Spain, Italy and Greece, where larger fruits are still preferred.

Exporters can benefit from this trend by including small-sized varieties in their offer. This may allow them to reach new buyers or expand their portfolio with current clients in Northern Europe.

Figure 9: Supermarket shelf with small melons

Source: GloballyCool

Climate change is affecting melon supply in Europe

In 2024, melon production in Europe dropped by 10% due to extreme weather events. These conditions caused problems with planting and harvesting. This led to lower yields and reduced quality. Climate-related challenges like these are making melon farming more difficult and unpredictable in Europe.

This situation creates challenges and opportunities for exporters from developing countries. With European production becoming less reliable, there is a growing demand for imported melons. Exporters that can provide consistent quality and supply may find new opportunities in the European market, especially at the beginning and end of the melon season in Spain.

However, it is important to note that climate change is a global issue. Exporters should also consider how changing weather patterns might affect their own production and take steps accordingly.

Some measures that producers in developing countries can take to mitigate the impact of climate change are:

- Tracking the weather: If you work with small-scale farmers, follow weather forecasts closely. Share this information with farmers so they can plan planting and harvesting at the right time;

- Improving irrigation systems: Install drip irrigation or water-saving systems to handle droughts and irregular rainfall;

- Looking for drought-resistant varieties: Stay up to date on new melon seed developments. Seed companies often release varieties that grow better in dry conditions. These can help reduce crop loss during drought. Even if you do not find the right variety immediately, keep checking for new options that suit your climate.

Tips:

- Differentiate your offer with new varieties and avoid competing with the biggest players;

- Focus on efficient production and logistics to keep prices competitive;

- Implement best practices when it comes to harvesting times. Avoid cutting melons too soon to maintain the desired sweetness;

- Read more about which trends offer opportunities on the European fresh fruit and vegetable market.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research