Entering the European market for preserved artichoke hearts

New producers that wish to enter the European market for preserved artichoke hearts need to check their products through regular laboratory tests. You may get an advantage if you offer high quality artichokes marinated in oil for the delicatessen market segment. It can also help if you can prove sustainable production through , for example, a social audit report or organic certification. The strongest competitors for suppliers of preserved artichoke hearts come from Peru, Italy and Spain.

Contents of this page

- What requirements and certifications must preserved artichoke hearts meet to be allowed on the European market?

- Through which channels can you get preserved artichoke hearts onto the European market?

- What competition do you face on the European market for preserved artichoke hearts?

- What are the prices of preserved artichoke hearts in the European market?

1. What requirements and certifications must preserved artichoke hearts meet to be allowed on the European market?

To sell preserved artichoke hearts in Europe, you need to meet food safety requirements. You must also label cans and jars with the correct ingredient and weight details. Importers need recognised food-safety certificates. Environmental and corporate sustainability certifications are becoming just as important. Organic and ethnic certification can open niche markets. This study focuses on the most important market requirements for preserved artichoke hearts. However, for a general overview, read the CBI study about buyer requirements for processed fruit and vegetables.

What are mandatory requirements?

Complying with the maximum levels for harmful contaminants is obligatory if you want to export to Europe. The most common reasons for preserved artichokes being withdrawn from the market are unauthorised and undeclared additives. The most important legal developments are the European Directives on Due Diligence and Corporative sustainability reporting. These directives state that all players in supply chains need to comply with set social and environmental requirements.

Use only approved additives and processing aids

Preserved artichokes need to comply with the EU additives regulation. The most common additives are citric acid (E330), which is used to acidify and prevent discolouration, and ascorbic acid (E300), which is used as an antioxidant. The use of sulphites is allowed but usually avoided. Using unauthorised additives or above-limit levels can lead to border rejection or product recalls. In 2024, the Rapid Alert System for Food and Feed reported two market withdrawals of preserved artichokes from Egypt. These were because of unlabelled and excessive sulphur dioxide content.

Make your own check list to assess contamination risks along the supply chain

You should regularly check the European Commission Regulation to see the maximum levels for specific contaminants. It is updated often.

Contaminants to check for are:

- Pesticide residues: the European Union maintains a list of pesticides that are authorised for use and sets maximum residue levels (MRLs);

- Microbiological contaminants: the European regulation on microbiological criteria for foodstuffs sets the limits for pathogenic micro-organisms;

- Tin: the limit for canned food is 200 mg/kg. This includes preserved artichokes;

- Process contaminants: if artichokes are chargrilled or smoked, they need to comply with polycyclic aromatic hydrocarbon (PAH) limits;

- Packaging contaminants: plastic materials need to be in line with the European Regulation on Plastic Food Contact Materials. You should pay attention to Bisphenol A (banned in 2024) and Phthalates.

Tip:

- Source raw artichokes from non-polluted areas, use food-grade packaging and get your product lab-tested so you comply with European requirements.

Label your packaging properly

Artichoke hearts are often packed for final consumers in cans or jars. That is why labelling needs to comply with the European Union Regulation on the provision of food information to consumers. This regulation defines nutrition, origin and allergen labelling, as well as the minimum font size for mandatory information. Retail packaging needs to be labelled in a language that is easily understood by consumers in the target country.

The labels on preserved artichoke hearts sold to consumers need to include:

- Accurate name of the food (for example, ‘Quartered Artichoke Hearts in Brine’);

- Net and drained weight;

- Lot number;

- Date of minimum durability (best before date, since it is ambient stable);

- Ingredient list (for example, artichokes, water, salt, citric acid, ascorbic acid, sunflower oil; the exact artichoke volume should be indicated in the ingredients list);

- Any additive, by name or E-number;

- Any allergen, such as sulphites (some marinated artichokes have wine vinegar as an ingredient, which may contain sulphites);

- Nutrition information.

Labels need to be in the official language of each country where the product is sold.

Check the levels of mineral oil hydrocarbons

Mineral Oil Saturated Hydrocarbons (MOSH) and Mineral Oil Aromatic Hydrocarbons (MOAH) are contaminants that can harm human health. No official limits have been set yet, but they are expected soon. Many European buyers check these levels. The proposed maximum MOAH level for food with a fat content below 4% is 0.5 mg/kg.

Tip:

- Read more about the transport and storage conditions for canned goods on the Cargo Handbook website.

Comply with the legislative requirements on sustainability

Some of the most relevant European laws and legislation regarding environmental and social sustainability have been made part of the European Green Deal (EGD). The EGD includes legislative changes. It has a timetable that explains when they will come into force. The most relevant specific legislations for preserved artichoke hearts are:

- Organic food regulation (all organic operators need to implement changes before October 2025);

- Sustainability labelling of food products (under discussion);

- Corporate Sustainability Due Diligence Directive (in force);

- Packaging and packaging waste(from January 2030);

- Corporative sustainability reporting (from 2027 for the fiscal year 2026 for listed SMEs and voluntary for non-listed SMEs);

- The EU Forced Labour Regulation (in force from December 2024);

- Empowering consumers for the green transition Directive (in force but to be applied from September 2026).

What additional requirements and certifications do buyers often have?

Besides mandatory requirements, food safety, quality and sustainability standards have become very important as well.

Meet specific quality requirements

There are no official European standards for preserved artichoke hearts. In most cases, buyer quality requirements are in line with the Codex Alimentarius Standard for Certain Canned Vegetables (PDF). Important quality indicators include the following:

- Cut style: common cut styles are whole hearts, quarters, halves, slices and bottoms. The Roman cut style includes the whole artichoke heart, with 4–8 cm of peeled stem attached.

- Size: if supplying cut hearts (quarters, slices or cubes), buyers may specify the exact cut size and size uniformity. Broken pieces larger or smaller than the defined size are considered defects. Whole hearts are also graded by size. Whole artichoke hearts are commonly graded by the number of pieces inside a drained packaging container. Very small sizes, usually below 3 cm, are sometimes marketed as ‘baby’ or ‘cocktail’ hearts.

- pH value: if the artichokes are in acidified brine, the most common target pH is 3.7–4.2. This is low enough to prevent botulism spores when combined with heat pasteurisation. If the pH is above 4.2, sterilisation is usually required.

- Fill and drained weight: the drained weight needs to match the declared amount. A tolerance may be set (for example, at least 98% of declared weight).

- Organoleptic characteristics: there are several sensory characteristics that can be used to describe the product. They usually include taste (typical for the preserved artichokes), colour (uniform yellow-white), texture (neither mushy nor woody) and brine clarity (not cloudy and without sediment).

- Ingredients and processing method: each ingredient must be specified in volume shares in line with the labelling legislation. Preserved artichokes are usually preserved in brine (sometimes called ‘natural’), marinated (with vinegar, oil, spices and flavourings) or in oil.

- Quality tolerances: buyers may set maximum allowed defects for parameters like texture, cut, blemishes, presence of bracts (modified hard outer leaves), size uniformity and foreign matter.

Offer safe and aseptic packaging

Most preserved artichoke hearts are imported into Europe in ready-to-use consumer packaging, either as cans or jars. Food service buyers usually require larger cans of 3 kg. Retail suppliers, meanwhile, will suggest the exact size of the can or jar. In practice, 390–400 g cans are the most common. Some suppliers now offer plastic stand-up or vacuum-sealed pouches, which reduce metal packaging costs.

For logistical purposes, your product specification should also include secondary packaging. This means you should describe how many cans or jars are inside the box and how many boxes are on the pallet. Bulk packaging is often labelled with the product name, producer details, country of origin, net and gross weight, manufacturing date, shelf life (commonly three years from the manufacturing date), batch code, storage and handling instructions.

Get food safety certified

Food safety certification is not obligatory under European legislation. But it has become a must for almost all European food importers. Most established European importers will refuse to work with you unless you provide some type of food safety certification. Besides certification, serious buyers will usually visit or audit your production facilities before buying your products.

Most European buyers will ask for a Global Food Safety Initiative (GFSI) recognised certification. For preserved artichoke hearts, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000).

Invest in sustainability

There is more and more demand for sustainably-sourced food in Europe. To help consumers make more ecological choices, more labelling systems are being developed. These include Eco Score, Eco Impact, Planet Score and Enviro Score. Along with requirements related to the environment, there is also more demand for more transparent and fair supply chains.

One way to show that you take care of your farmers and workers is to get Fairtrade, Fair for Life or Rainforest Alliance certified. Before investing in these certification schemes, it is best to check potential prices with European buyers. There are currently no Fairtrade certified preserved artichoke hearts on the European markets. It is much more common for buyers to request social audits such as SMETA (by SEDEX) or BSCI (by amfori).

Respect delivery terms

Initial transactions often use a Letter of Credit for security on both sides. Many European buyers will push for open account terms once trust is established, like 30 days after the Bill of Lading date or 30 days after arrival. Payment terms of 30 days are standard in the food trade in Western Europe. Importers sometimes agree to compromise; for example, a small discount for paying at sight or a mixed term (10% advance, 90% on 30 days).

Understand retail chain requests

Leading European retail chains usually have stricter requirements than the mandatory ones. Make sure that you can meet them. For example, Lidl requires IFS certification and most UK retailers ask for the AA BRCGS grade. Many retailers require stricter MRL limits and have zero tolerance for many types of pesticides. This means there should be no detectable residues of certain chemicals in the products.

European retailers want to know about products’ carbon footprints. For example, Dutch retail giant Ahold Delhaize has said that it will ask all suppliers to report their Scope 3 GHG emissions. This means preserved artichoke exporters could be asked to provide data on emissions from farming, processing and shipping.

Next to product quality and composition, retailers can ask for specific packaging and make logistical requests. This can include specific and non-common packaging sizes, a test on bar code readability, easy-open lids on jars or specific palletisation instructions.

Tips:

- Make sure your filling machines are calibrated. Perform drained weight tests in-house to comply with buyer requirements. If the drained weight or piece count is not in line with the contract, the buyer might demand a price reduction in line with the shortage, or they might reject the whole lot.

- Read the CBI’s Tips to Go Green and Tips to Become a Socially Responsible Supplier to learn more about increasing market sustainability requests.

- Read the CBI study on trends in the European processed fruit and vegetables market for an overview of developments regarding sustainability initiatives in the European market.

What are the requirements for niche markets?

Consider organic certification

To market preserved artichoke hearts as organic in Europe, the artichokes used in processing must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before you can put the European Union’s organic logo on the packaging. It is also required before you can use or logo of the standard holder, like Soil Association in the United Kingdom and Naturland in Germany.

If you want to produce and export preserved artichoke hearts to Europe, you need to be aware of important new rules that may affect your business. The new EU organic regulation came into force in October 2025. This regulation comes with over 20 secondary laws that regulate the production, control and trade of organic products in more detail. Some important laws to be aware include the organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Figure 1: An example of organic certified preserved artichoke hearts (EU organic and Agriculture Biologique – France)

Source: kaitlynella for Open Food Facts, licensed under CC BY-SA 3.0

Consider halal and kosher food certification

Islamic (halal) and Jewish dietary laws (kosher) set specific dietary restrictions. If you want to focus on Jewish or Islamic niche markets, you should consider implementing halal or kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation (by the Alliance for Product Quality in Africa project) to help you follow the new rules.

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through which channels can you get preserved artichoke hearts onto the European market?

If you want to reach European retailers, the best entry points are the contracted suppliers of private labels. They know about the technical and logistical requirements of European retail chains. To serve the food service industry or niche segments (for example, premium, organic or ethnic), independent specialised traders provide opportunities for certified suppliers.

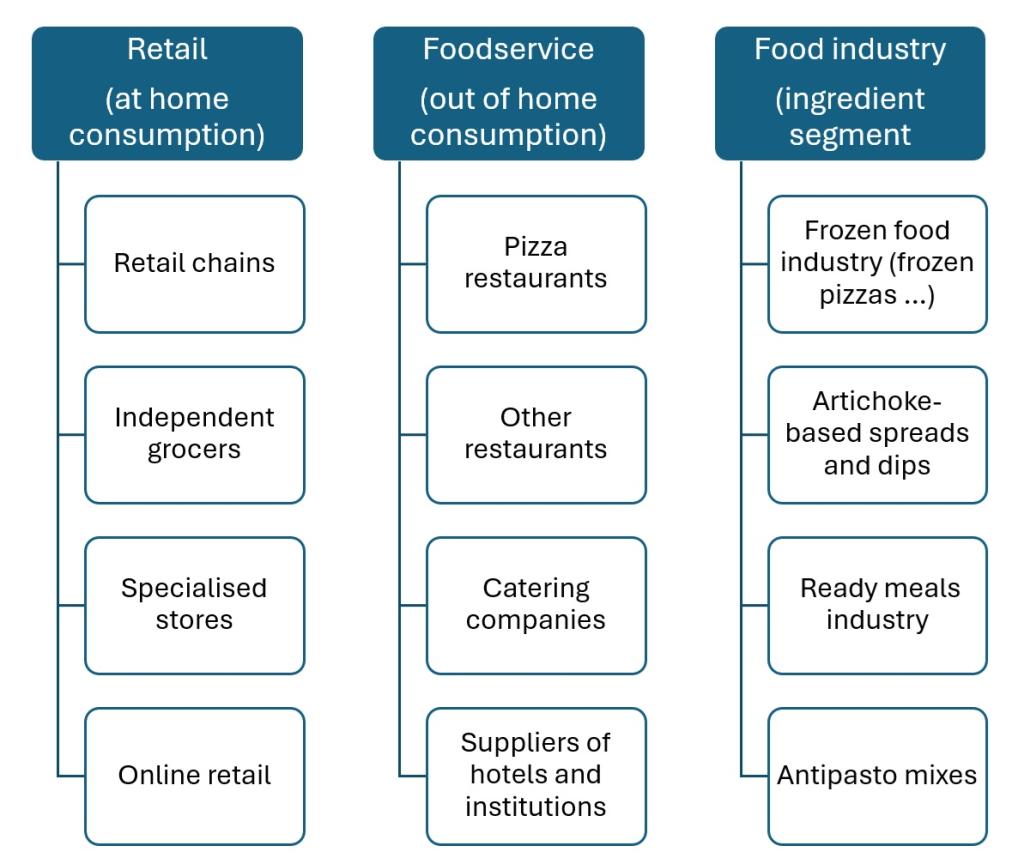

How is the end market segmented?

Most preserved artichoke hearts in Europe are sold through the retail segment. This is followed by food service users (restaurants, hotels and catering companies). The food industry, where preserved artichoke hearts are used as ingredients, makes up a relatively small share. However, artichoke spreads are becoming more common.

Figure 2: End-market segments for preserved artichoke hearts in Europe

Source: Autentika Global

Retail

The retail segment makes up about half of European sales of preserved artichoke hearts in volume. Most preserved artichoke hearts in the retail segment are sold under private labels. There are only a few independent brands on shelves. For example, Cynara, a major Spanish artichoke producer, often packs for private labels. However, it also has introduced its own branded lines. In Italy and Spain, consumers can find local branded specialities. This includes, for example, Roman-style artichokes with the stems, marinated in oil and herbs.

Sub-segments (points of sale) of the preserved artichoke hearts retail segment in Europe include the following.

- Retail chains – European retail chains are roughly divided into discounters (for example, Lidl, Aldi, Penny), and supermarkets and hypermarkets. Major chains in the largest markets include Carrefour and Leclerc in France, Mercadona and Alcampo in Spain, Edeka and REWE in Germany, Coop and Conad in Italy, Tesco and Sainsbury’s in the UK, and Albert Heijn and Jumbo in the Netherlands.

- Fine foods and delicatessen shops – many shops in these categories sell Mediterranean products, such as olive oil, dried pasta and antipasti/tapas mixes. Instead of brined artichokes, they tend to sell high-end products such as small packets of baby artichokes in oil or artichokes with a protected designation of origin.

- Specialised organic and health food shops – many organic shops that sell preserved artichokes are part of the specialised organic food retail chain, such as Alnatura (Germany), NaturaSi (Italy) and Naturalia (France). Some European drugstores also sell organic artichoke hearts, such as dm in Germany.

- Specialised ethnic supermarkets – these shops offer specific opportunities for entering the market without competing with the leading retail brands. The most relevant types of ethnic supermarkets for preserved artichoke hearts are Turkish and North African shops.

- Online retailers – specialised online retailers include general online retailers Ocado in the UK or more specialised gourmet retailers, such as Gourmet Point, Cortilia Viani and Bien Manger.

Food service

The food service segment represents a large portion of preserved artichoke use, especially in Mediterranean Europe. Restaurants, catering companies and hotels use artichoke hearts in many different dishes. This includes pizza and pasta, but also salads and antipasti platters. Pizza restaurants use a lot of preserved artichokes as toppings on pizzas.

This segment usually sources through specialised distributors rather than retail shops. These include Transgourmet (Germany), Zaino (the UK), Sligro (the Netherlands) and wholesale cash-and-carry outlets (for example, METRO/Makro).

Food service buyers need bulk packaging and consistency. Large tin cans (2.5–3 kg) are the usual format of choice for restaurants and catering kitchens.

Food industry

The food industry in Europe does not use many preserved artichoke hearts. It makes up around 10–20% of the total sales. The main users in this sub-segment are:

- Frozen pizza producers – the frozen pizza industry is the biggest user of preserved artichoke hearts. It has many producers, such as Dr. Oetker, Gustavo Gusto and Roncadin;

- Producers of spreads – growing demand for Mediterranean and plant-based food is driving frequent product launches in the spreads segment. Producers of spreads often position themselves in the delicatessen food segment, such as ortoCori and Agnoni. However, there are more and more private labels offering artichoke spreads and dips;

- Ready-made meals industry – producers of ready-made soups and ready-to-eat appetiser snacks use the largest quantities. Artichoke soup is not widely available throughout Europe, but it is more common in Spain and Italy. Examples of brands include Diquesi (Italy), Alimentis (Italy) and Anko (Spain);

Figure 3: Example of preserved artichoke spread (by Il Nutrimento)

Source: motw per Open Food Facts, licensed under CC BY-SA 3.0

Non-food industries

Non-food industries are not the focus of this study. It is however worth mentioning that artichoke extract is traditionally used as a tonic to aid digestion, improve bile production and regulate cholesterol. Artichoke leaf extracts contain sesquiterpene lactones (cynaropicrin), flavonoids (luteolin) and phenolic compounds. Artichoke extract is often made from the leaves of the artichoke plant, but it can also be produced from other parts.

Tips:

- Take part in the PLMA (Private Label Manufacturers Association) trade event in Amsterdam to meet retail buyers and contract packers.

- Consider getting halal certification if you want to target large catering firms in Germany, France or the UK. It can be a deciding factor for public procurement.

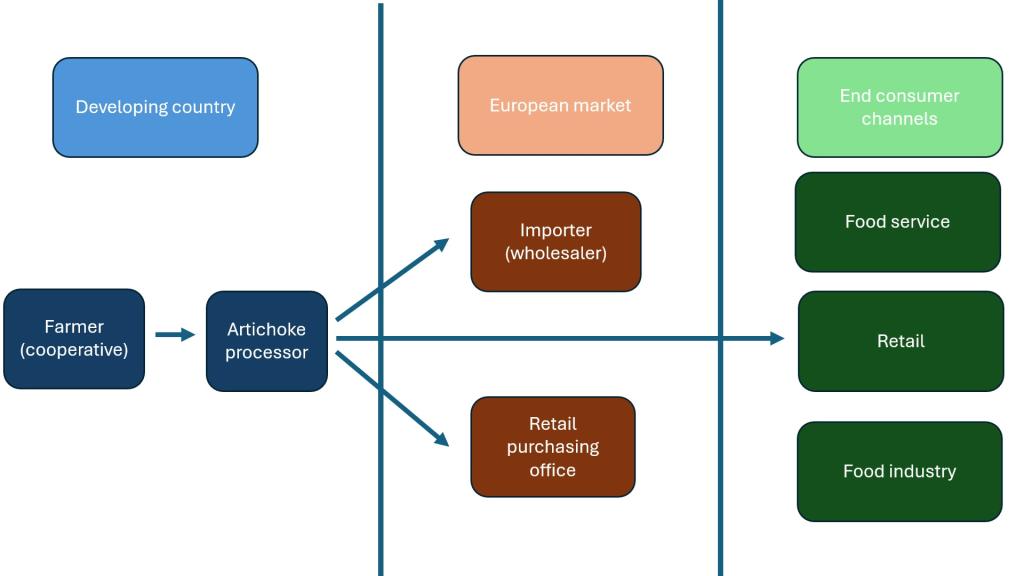

Through which channels does a product end up on the end market?

Specialised canned-food importers are the main gateway into Europe. These cover contract private-label suppliers, general wholesalers, Mediterranean-food traders and catering distributors. Big supermarket groups often import preserved artichoke hearts through central buying offices or dedicated subsidiaries.

Figure 4: European market channels for preserved artichoke hearts

Source: Autentika Global

Importers (Wholesalers)

Specialised importers of canned and preserved food are the main suppliers of the European retail and food service segments. Some importers are general processed fruit and vegetables traders. They can usually be classified into several broad categories:

- Contract private label suppliers – these companies are contracted by European supermarket chains. Examples include Henry Lamotte Food (Germany), IPOSEA (Italy) and INPA (Italy).

- General wholesalers – these companies may import products packed under their own brands, but they can also be involved in contract sourcing for supermarkets. Most of those companies trade in ambient, shelf-stable food. Examples are Agirda (France) and Clama (Germany).

- Importers that specialise in Mediterranean food – most of these parties import a wide range of food from countries around the Mediterranean. Mainly from Italy, Spain and Greece, but also from other regions, including Türkiye, North Africa and the Middle East. Examples include Damasgate (the UK) and Nergiz Großmarkt (Germany).

- Catering suppliers – these are importers that supply hotels, restaurants and establishments. Some of them also supply the food industry. Examples include JC Dudley (the UK) and Metro (Germany).

Retail chains

European retail chains often import preserved artichoke hearts directly from canning and vegetable processing companies. Sometimes, they select suppliers through competitive public procurement processes. This means the company with the best bid gets the annual contract. However, in the case of preserved artichoke hearts, they can contract reliable suppliers directly. Retail chains that import preserved artichokes without intermediaries include Edeka (Germany), REWE (Germany), Carrefour (Italy) and Mercadona (Spain).

Some retail chains (for example, Lidl and Intermarché) buy preserved artichoke hearts from a central purchasing location. Others may ask you to deliver products to different countries. Some independent retailers are supplied through specialised procurement companies, such as the Italian Consilia. To deal with logistical requests, some large processors have their own company subsidiaries in Europe, like the Peruvian Viru Group.

Brokers

The role of brokers in the trade of canned and preserved vegetables is weak. Most retail chains are interested in direct contracting. Brokers or agents may play a consulting role to explain importers’ technical needs and find matching suppliers.

Tip:

- Take part in hospitality trade fairs, such as Sirha in Lyon and Host in Milan, to find specialised suppliers of the foodservice segment.

What is the most interesting channel for you?

Specialised importers of canned and processed vegetables are the best channel if your logistics operations cannot serve retailers directly. Specialised importers are a good choice if you want to focus more on the food service segment. However, the most direct way to reach final consumers is to deal directly with the procurement departments or retail chains. But you will need to meet their quality, packaging and logistical requirements.

Specialised organic and ethic traders can be the best choice for smaller exporters. There is a greater chance of selling preserved artichoke hearts through this channel if you can offer more advanced organic certification. Examples are Naturland, KRAV, Demeter or Bio Suisse.

Tip:

- Study the exhibitor lists of large trade fairs, such as ANUGA, SIAL and Food Ingredients Europe, to find potential buyers for your preserved artichoke hearts.

3. What competition do you face on the European market for preserved artichoke hearts?

The European market for preserved artichoke hearts is highly concentrated. The main suppliers are Peru, Spain, Italy and Greece. Peru’s exports are mostly large-scale processors that supply the private labels of European retail chains. Spain and Italy focus on Mediterranean authenticity. Competing substitutes include frozen, fresh and other preserved vegetables.

Which countries are you competing with?

Most competition comes from Peru and internal European suppliers: Spain, Italy and Greece. Egypt is gaining market share at the fastest rate, helped by advanced processing and organic exports. The newest competitors are Tunisia and Türkiye. Countries that have potential but very small export quantities include Syria, Morocco and Lebanon.

Source: Autentika Global, Eurostat and ITC TradeMap, 2025

Peru, fully export-oriented production

Artichokes are not native to Peru, but the country has recognised their export potential and counter-season supply compared to Mediterranean countries. Over the last 30 years, Peru has become the main processed artichoke exporter, reaching over 43,000 tonnes in 2024. The main market for Peruvian preserved artichokes is the USA with a 56% share, followed by Spain (31%), France (4%) and Germany (4%). The fastest-growing market is Canada. Peruvian imports here increased from 450 tonnes in 2020 to 834 tonnes in 2025.

Artichokes are almost exclusively grown for processing in Peru. The consumption of fresh artichokes is very limited. Production is concentrated in highland and coastal regions, such as Cajamarca, La Libertad, Lima, Ayacucho and Ica. Peru’s strengths include its year-round production, relatively high yields and vertical integration with the Spanish supply chain. The Peruvian industry is very concentrated. There are only a few large-scale processors.

Peru’s preserved artichokes are positioned as quality yet affordable alternatives. Suppliers draw attention to food safety and consistency. Peru is known for baby artichoke quarters that are ideal for the food service. European importers value Peru’s ability to deliver large private-label orders for supermarkets. Supermarkets see them as a value option, while premium segments (delicatessen antipasti) still prefer Mediterranean origins. Peru is working to improve its image further by developing organic lines and highlighting varietal improvements.

Italy and Spain, artichoke processing with tradition

The main artichoke processors in Europe are Italy and Spain, followed by Greece. France and other countries in the south of Europe do very little industrial processing and depend on imports. European artichokes are seen as ‘authentically Mediterranean’. This is a strong selling point in gastronomic and health-food segments. The downside is that some price-sensitive buyers see these as too costly for bulk use, and so choose cheaper imports instead.

Italy produces 400,000 tons of artichokes on average. Most of its production is consumed and exported as fresh. Italian cultivation decreased by 25% in the last decade to 25,000 hectares in 2024. Important production regions include Puglia (43%), Sardinia (25%) and Sicily (15%). The Spinoso di Sardegna artichoke from Sardinia has a protected designation of origin. There are three types that have protected indications of origin: Brindisino from Puglia, Romanesco from Lazio and Paestum from Campania.

Italian consumers have a long tradition of preparing dishes with artichokes. They use them as toppings on pizzas and eat them as snacks, marinated in olive oil. To meet restaurant demand, Italians have developed a diverse artichoke processing industry. This includes large-scale processors with automated machines and semi-artisanal processors. These grill and marinate artichokes before packing.

Italy’s exports of processed artichokes goes up and down, depending on the harvest volume. In 2024, exports reached 14,500 tonnes, valued at €65 million. The main market for Italian preserved artichokes is France. It has an 18% export share, followed by Germany (17%), the USA (12%) and the United Kingdom (6%). The United States is a fast-growing market for Italian preserved artichokes. Imports have increased by 1,000 tonnes over the last five years.

Spain produces 220,000 tonnes of artichokes per year. Most of the production takes place in the south-east. Murcia is the main production region. Processing is concentrated along the Ebro valley in Navarra and La Rioja. Although Spain produces fewer fresh artichokes than Italy, the export quantities of processed artichokes are almost the same. This is because Spain imports significant quantities of preserved artichokes from Peru. Some companies, like Cynara and Viru, are vertically integrated with Peruvian companies and have production facilities in both countries.

Spanish consumers value domestically processed artichokes. Several brands highlight local origins. They use a protected geographical indication label for Tudela artichokes from Navarra and a protected designation of origin label for Alcachofa de Benicarló from the province of Castellón.

Spanish exports of preserved artichokes reached a peak of 22,000 tonnes in 2022 but decreased to 15,000 tonnes in 2024. This was the result of smaller harvests combined with price inflation and higher production costs. The main market for Spanish preserved artichokes is France. It has a 30% export share, followed by the United States (17%), Germany (12%) and Italy (9%). The fastest-growing market for Spanish export is Italy. Italian imports from Spain almost doubled over the last five years.

Egypt, a fast-growing exporter

Egypt is the world’s second-largest artichoke producer. It produced nearly 400,000 tonnes and is a fast-growing exporter of processed artichokes. Most artichokes are grown in the Nile Delta. The season runs from October through May. It overlaps with and extends beyond Europe’s season. Processing in Egypt has focused on frozen artichoke hearts and bottoms. But they have recently also expanded into canned and jarred artichokes.

Most of Egypt’s exports go to Europe. Egyptian exports of processed artichoke hearts to Europe increased from 2,000 tonnes in 2020 to over 3,000 tonnes in 2025. Egypt supplies final users directly with canned products, but it also supplements production in Italy and Spain. Germany is the leading European market for Egyptian preserved artichokes. It has a 30% share, followed by Italy (29%), Spain (18%), Greece (12%) and France (5%).

Tunisia, emerging supplier

Tunisia is a mid-sized artichoke producer. It has around 2,600 hectares dedicated to growing artichokes. Production is around 27,000 tonnes per year. The main growing area is the Medjerda Valley. Its well-drained soils produce high-quality artichokes over an eight-month season. Tunisian artichoke production is traditional: multiple smallholders harvest the Violet de Provence and other varieties that were introduced decades ago.

Tunisia’s processing profile is a blend of bulk ingredient supply and artisan finished products. Several Tunisian companies specialise in bulk processing and packing in brine-filled drums for export. The industry depends heavily on manual labour. Their semi-conserved artichokes are often canned or jarred by European packers. There are a few processors that pack artichokes in cans and process them for final retail sale. Some premium Tunisian brands (for example, Les Moulins Mahjoub) chargrill artichoke bottoms and pack them in olive oil, targeting gourmet markets.

In 2024, Tunisia exported 354 tonnes of preserved artichoke hearts to Europe. Most (66%) were exported to Italy, followed by France (16%), the Netherlands (5%), Austria (5%), Greece (5%) and Germany (2%).

Which companies are you competing with?

In the mainstream retail supermarket segment, the leading competitors come from Peru. These businesses are tightly linked to Spanish companies. In the delicatessen segment, the leading competitors are from Italy and Spain.

Danper Trujillo

Danper Trulillo is Peru’s largest artichoke exporter. It is responsible for about 40% of Peru’s shipments. Its success is built on vertical integration and scale. Danper cultivates artichokes across multiple regions in Peru. This means it can ensure year-round raw material supply. The company continuously invests in innovation. It works on new product forms to stay ahead of the competition. For example, artichoke pasta sauces and frozen grilled artichokes It packs canned and jarred artichoke hearts for European supermarket private labels and has a strong position in Spain.

Virú

Virú is another leading Peruvian exporter. It is known as a specialist in canned vegetables. It was the strongest Peruvian exporter to France in 2024. Virú’s strength is its product diversity and branding. Aside from plain artichoke hearts, Virú produces marinated artichoke antipasti, artichoke spreads and even artichoke-based ready meals. The company has a strong agricultural base in northern Peru and has mastered efficient processing. It uses both handcrafting (for delicate products) and automation to control costs. Virú is a vertically integrated company with representation in Spain (Virú Iberica).

The Real Green Food

The Real Green Food is the leading Spanish producer of preserved artichoke hearts. It has the highest processing capacity and the only two plants in Spain that run year-round. It also has high-speed production lines dedicated almost exclusively to artichoke hearts. It operates under two brand names specialised in artichoke processing and trade: Cynara and Gvtarra. Cynara also has a sourcing office in Peru. The company prides itself on innovation, with products like ready-to-eat marinated artichoke snacks and crisps.

Figure 6: Artichoke crisps (innovation by Cynara brand in Spain)

Source: thaialagata for Open Food Facts, licensed under CC BY-SA 3.0

Polli

Polli is one of several strong artichoke processors in Italy. It is widely regarded as having some of the largest processing capacities. The group runs four dedicated vegetable-preserve plants (Monsummano Terme, Rivoli, Lozzo Atestino and Ebol). Corporate data state that these factories process about 25,000 tonnes of vegetables per year and pack more than 110 million cans and glass jars. Polli is investing in new continuous-flow retorts, optical sorters and energy-saving utilities.

Green Hope

Green Hope is a leading Egyptian producer of preserved artichoke hearts. Its most important strength is the adoption of advanced machinery. It had the first fully automatic artichoke peeling and coring line in Egypt. This means efficiency and more uniform products. It reduces the traditional drawback of Egyptian artichokes (inconsistent trimming). By diversifying into value-added products (grilled, marinated), they have set themselves apart from competitors that mainly sell frozen or brine bulk products.

Tips:

- Visit the Spanish Artichoke Industry Association website to learn more about the Spanish artichoke sector.

- Visit leading European trade fairs, such as ANUGA, SIAL and Biofach (organic), to meet your competitors and potential clients.

Which products are you competing with?

Preserved artichoke hearts have a unique flavour and texture. They cannot be replaced by other products easily. However, most European consumers do not consume them regularly. This means that there are several alternatives on the production competition level:

- Frozen artichoke hearts – after defrosting, they can be grilled or preserved. Still, convenience is their weak point. They require a cold chain and they are time-consuming to prepare;

- Fresh artichokes – they are an original product for several artichoke meals. Still, for busy consumers, ready-to-eat preserved artichokes are more convenient;

- Grilled and preserved vegetables – some prepared vegetables are used as substitutes for artichokes in pizza toppings, such as jarred mushrooms. However, they have a bold flavour and cannot truly replace artichokes.

Tip:

- Remind buyers and consumers that preserved artichoke hearts have a unique tender texture and mild, nutty flavour that cannot be replaced by other products.

4. What are the prices of preserved artichoke hearts in the European market?

Preserved artichoke heart prices vary a lot. There are differences in packaging sizes, cut styles, brine ingredients, artichoke cultivars and more. The price of fresh artichokes is the most important factor. To illustrate, in Murcia in 2025, the prices of artichokes for industrial processing varied a lot, from 0.25 €/kg to 1.15 €/kg. Because only 18–20% of the fresh artichokes’ weight ends up as the trimmed heart, this equates to around €1.25 to €5 per kg of drained hearts.

There is no exact rule, but the highest prices are usually paid for preserved artichokes from Italy. This is followed by Spain and Peru as the cheapest suppliers.

The price breakdown below is a very rough indication, since so many different factors affect production costs. The example below is based on the calculation for the private-label, retail-packed artichoke hearts in brine in cans of 390 g gross weight and 240 g drained weight. Keep in mind that this type of product is the cheapest, and the retail price may be around €2 per can. However, prices of artichoke hearts in jars marinated in oil are much higher, up to over €5 per jar.

Table 1: Preserved artichokes in brine, retail price breakdown

| Export process steps | Type of price | Price breakdown | Artichoke price per kg (example) |

|---|---|---|---|

| Fresh artichokes | Raw material price | 17.5% | €0.35/can (assuming trimmed hearts cost approx. €1.50/kg) |

| Processing costs | Production costs | 35% | €0.70/can (assuming factory processing, brine, can and labour cost adds €0.35/can) |

| Export price | FOB price | 50% | €1/can (approximately €2.5/kg) |

| Import, shipping, handling and storing | CIF price | 52.5% | €1.05/can (approximately €2.7/kg) |

| Wholesale price | Wholesale price (value-added tax included) | 65% | €1.3/can |

| Retail sales of the final packed product | Retail price | 100% | €2/can |

Source: Autentika Global based on industry sources

Tip:

- Monitor final prices on the leading European retailers’ webpages.

Autentika Global carried out this study on behalf of the CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research