The European market potential for preserved artichoke hearts

Europe is the world’s largest market for preserved artichoke hearts. It makes up around 60% of all global imports. Demand is driven by deep Mediterranean culinary traditions, popularity of plant-based diets, health awareness and convenience trends. Imports reached over 41,000 tonnes in 2024. This was worth over €120 million in value. Italy and Spain lead production but rely on seasonal imports. Peru, Egypt and Tunisia are important developing-country suppliers. They are helped by cost advantages and seasonal windows. Sustainability, organic growth and innovation create further opportunities for exporters.

Contents of this page

1. Product description: preserved artichoke hearts

Preserved artichoke hearts are the canned or jarred globe artichoke buds (from Cynara scolymus plants). The buds are trimmed down to the tender ‘heart’ portion. These are packed in a preserving liquid and heat-treated to prevent spoilage.

On the European market, preserved artichoke hearts are available in several forms and pack styles. They can be cut as whole hearts or in pieces. Artichoke hearts can be packed in brine (salted water) or marinated with oils, herbs or spices before packaging.

Artichoke hearts packed in brine are usually used as an ingredient, especially in the Mediterranean region. Marinated artichoke hearts are often eaten as appetisers, paired with olives, cheeses and cured meats. Preserved artichokes are also processed into products like spreads and creams.

Artichoke processors use different equipment and technology. However, the common processing steps are given below:

- Harvesting: buds are cut from the plant when they are firm and before they open. They are sorted to remove any damaged or over-mature heads.

- Peeling, slicing and cutting: workers or machines remove the tough outer leaves and the stem. The artichoke is usually cut near the middle to separate the upper tough part from the tender lower part. After peeling, artichoke hearts can be sliced or cut into smaller sizes.

- Cooking/blanching: the artichoke hearts can be quickly blanched at lower temperatures (48–50°C) in water with acid before the final cook. This is done for some artichoke varieties to avoid temperature shock. Blanching deactivates enzymes, preserves colour and reduces microbial load. This improvies shelf life. Regular cooking is done at 70–100°C in hot water or steam. Afterwards, the hearts are cooled in clean water.

- Filling with brine/marinade: the prepared hearts are placed into clean cans or jars. A hot liquid is added; either a brine (often with citric acid) or oil and seasonings for marinated packs.

- Sealing: before sealing, the filled containers are often heated slightly or put into a vacuum chamber to remove air. The containers are then immediately sealed air-tight at about 80–85°C.

- Thermal processing: the sealed cans/jars undergo heat treatment to kill any harmful bacteria and ensure safe, shelf-stable products. Hearts with added acid (with a pH ≤4.3) are usually pasteurised at temperatures below 100°C. Low-acid hearts (with a pH ≥4.3) are sterilised at temperatures of 100°C and above. After cooking, containers are quickly cooled to room temperature.

This study covers general information on the preserved artichoke heart market in Europe that is of interest to producers in developing countries. When the study refers to ‘Europe’, it refers to the 27 member states of the European Union (EU), plus the United Kingdom, Switzerland, Norway, Iceland and Liechtenstein. ‘Developing countries’ are the countries listed as official development assistance recipients.

The combined nomenclature code 20059930 is used for statistical analysis (artichokes, prepared or preserved otherwise than by vinegar or acetic acid, excluding frozen).

2. What makes Europe an interesting market for preserved artichoke hearts?

The artichoke is a plant that is native to the Mediterranean area. It has a long history in the European culinary tradition. Although preserved artichoke hearts are now used worldwide, Europe is still the main user. Italian, Spanish and Greek cuisine use a lot of artichoke hearts. Some Italian dishes that use artichoke hearts, such as the pizza capricciosa, have gained international popularity.

Europe is the largest importer of preserved artichoke hearts. It accounts for around 60% of global trade. For example, in 2024, European countries imported more than 40,000 tonnes of preserved artichoke hearts. This is much higher than the USA, the second-largest importer with imports of 30,000 tonnes.

Source: Autentika Global, Eursotat and ITC TradeMap, 2025

Over the last five years, the European market for preserved artichoke hearts has increased in value at an average annual rate of 5% and 6%. In 2024, European imports of preserved artichoke hearts reached 41,000 tonnes, valued at over €120 million. These rates include internal European trade. The largest intra-European supplier is Italy. Peru is the main non-European supplier.

Imports from developing countries have grown by 3% every year over the last five years, reaching 17,000 tonnes. This is a value of more than €50 million. After inflation, which peaked in 2023, industry sources predict imports growing 4% over the next three years as supply chains stabilise.

Europe itself is a major producer of preserved artichoke hearts, thanks to the large Italian and Spanish fresh artichoke crops. Around 60% of harvested artichokes are preserved. Still, the harvest is not large enough to satisfy local demand. The European market depends heavily on imports. European buyers are willing to pay premium prices for quality preserved products. This is because they see artichoke hearts as a delicatessen product,

The main reasons why consumption is expected to increase are:

- Culinary tradition and the Mediterranean diet – artichoke hearts are central to the cuisines of Italy, Spain, France, Greece and more. European consumers appreciate artichoke hearts for their unique flavour and versatility. They can be used in salads, pastas and pizzas, or eaten as an antipasto;

- Plant-based diets – artichoke hearts are often used as tasty, meat-free ingredients;

- Health awareness – artichokes are known for their health benefits (high in fibre, vitamins and antioxidants, like cynarin);

- Food culture and variety – European food culture values variety and quality. Preserved artichoke hearts benefit from the general interest in gourmet and international foods. They are often sold alongside olives, sun-dried tomatoes and other antipasti. Artichokes are used in traditional recipes as well as in contemporary European gastronomy.

Source: Autentika Global, Eurostat and ITC TradeMap, 2025

Tip:

- Read the CBI study on the demand for processed fruit and vegetables. This helps you better understand the dynamics of the European preserved artichoke heart market.

3. Which European countries offer the most opportunities for artichoke hearts?

Spain, France and Germany are the largest exporters of preserved artichoke heart. Italy is the largest producer and exporter, so it only imports to supplement its own industry demand. The Netherlands is a trade hub, meaning there are plenty of possibilities to enter other European markets. The UK market’s demand for Mediterranean food is growing quickly.

Source: Autentika Global, Eurostat and ITC Trademap, 2025

The main European importer of preserved artichoke hearts in 2024 was Spain. It accounts for 26% of imports, followed by France (16%), Germany (14%), Italy (5%), the United Kingdom (4%) and the Netherlands (3%). Since 2020, imports to Poland have increased the most. The markets that have grown fastest since 2020 are Italy, Romania, Austria and Portugal.

The largest artichoke heart markets in Europe show different opportunities for exporters in developing countries:

- Spain and Italy are major producers, but they also rely on imports to supplement their domestic supplies, particularly for processing and re-export. Spain offers opportunities for South American exporters because there is no language barrier. Italy presents opportunities for price-competitive bulk exporters;

- The French market provides many opportunities for the high-end market segment. This is especially in the foodservice and delicatessen food segments;

- The German and UK markets are developing significant demand for Mediterranean food. Both markets have strong private labels and offer opportunities for direct supply to retail chains;

- The Netherlands acts as a key trade gateway, re-exporting a large share of its preserved artichoke hearts imports across Europe.

These countries import large volumes and are part of trends such as health-focused consumption, sustainability and plant-based nutrition. All of these create promising entry points for developing-country exporters.

Spain: Europe’s largest preserved artichoke hearts market with strong connections to Peru

Since 2020, Spanish imports of preserved artichoke hearts have increased at an annual rate of 6%. These imports reached 12,200 tonnes in 2025, valued at €31.5 million. Spain’s main supplier is Peru, it supplied 88% of the supply, followed by France (6%), Egypt (4%) and Italy (2%). Until recently, Peru was the only non-European supplier to Spain thanks to the connections of Spanish-Peruvian processors such as Virú, Cynara and Grupo Alsur. However, Egypt is gaining market share, increasing its export to Spain from nothing in 2021 to 540 tonnes in 2025.

Spain is a competitive market thanks to significant local production. Spanish exports are higher than imports and are around 20,000 tonnes. In 2024, Spain produced roughly 60,000 tonnes of preserved artichokes (net drained weight). Local consumption is estimated to be around 50,000 tonnes. Local production and imports from Peru occur mostly during the European winter months (November to April). Developing-country suppliers can fill off-season supply gaps in summer and offer competitive pricing.

Climate changes and an ageing farmer population threaten local production. It is expected that imports will increase over the next five years. High inflation has also moved consumers towards more affordable canned vegetables, as fresh artichoke prices have increased a lot. Developing-country exporters should monitor changing tastes. They should also look for innovative artichoke products beyond traditional uses, for example snacks and spreads). Sustainability is also becoming more important. Recyclable materials and lower carbon footprints are important to Spanish buyers.

Artichokes are central to Spanish cuisine. They are usually consumed during lunchtime, often as a snack (tapas). An example of this is artichokes with Serrano ham. They are also used as an ingredient in paellas or vegetable stews. Consumption of fresh and preserved artichokes together is about 3 kg per capita yearly. Food service consumption of preserved artichoke hearts is high. This is because Spain has one of the busiest eating out cultures in Europe.

Most artichoke hearts in the Spanish retail segment are sold in brine and in cans. Most canned artichoke hearts are sold through retail chains, such as Mercadona (Hacendado label), Carrefour (Classic and Extra labels) and Eroski. Tinned private labels are mostly imported from Peru. Jarred artichoke hearts are often of local origin, marinated with oil.

Figure 4: Artichoke hearts preserved with oil, imported from Peru (private label by Mercadona)

Source: Autentika Global

Jarred artichokes are often sold as premium products, often with a Protected Designation of Origin (PDO) label. Alcachofa de Benicarló and Alcachofa de Tudela are examples of artichoke hearts that have a PDO. Independent brands that sell PDO products include Gvtarrara (by The Real Green Food group), Leyenda (by Conservas Valerio), La Tudellana, Casa Medrano Organic Food (by Conservas Medrano), Carcar Selection (by MCA) and Cellorio.

Organic preserved artichoke hearts are slowly appearing on the market in Spain. According to industry sources, there is a need for organic products, but availability is relatively low. At the moment, fresh organic artichokes for processing are sourced from limited local production in the Navarra region, and there are hardly any imports. Emerging developing-country suppliers can find opportunities in this niche segment, which is in its early stages.

Figure 5: PDO ‘Alcachofa de Tudela’ artichoke hearts in Spain (preserved and packed in the Navarra region)

Source: Autentika Global

Tips:

- Adapt to Spanish tastes and timing to avoid high competition. Plan shipments for late spring and summer when domestic artichokes are off-season. Offer products in brine with lower acidity.

- Visit Alimentaria to meet potential importers and learn about buyers’ preferences.

France: Gourmet tradition and import reliance for artichoke hearts

France has a strong culinary tradition with artichokes. However, its market for preserved artichoke hearts relies heavily on imports. France produces around 20,000 tonnes of fresh artichokes per year, but the country does not process artichoke hearts. The last factory, owned by the Eureden group, closed in 2022. Locally produced artichokes are now only processed by freezing, by the Prince de Bretagne cooperative. This means the French market for processed artichoke hearts depends entirely on imports.

Over the past five years, French imports of preserved artichoke hearts have gone up and down between 8,000 and 9,000 tonnes. However, they decreased to 6,900 tonnes in 2024. This decrease was only temporary and caused by lower production in Spain, the leading supplier to France. In 2024, France imported 40% of its preserved artichoke hearts from Spain, followed by Italy (30%), Peru (23%), Germany (3%) and Egypt (2%). Tunisia is an emerging supplier, but supply is still small (less than 60 tonnes).

Underlying market drivers in France include a gastronomic appreciation for artichoke hearts, a shift towards convenience at home and artichokes’ health benefits. French chefs like to use tender artichoke hearts in starters and main dishes, such as Salade Niçoise and Artichokes à la Barigoule. With busy lifestyles, more consumers are choosing ready-to-use products. Preserved artichokes cut out the labour of trimming and cooking fresh ones.

Most volumes of artichokes are sold under the private labels of French retail chains such as E. Leclerc (Marque Repère and Notre Jardin labels), Carrefour (Carrefour Classic, Extra and Terre d’Italia labels), Intermarché (Saint Eloi and Bouton d'or Labels) and Auchan. Independent brands include Géant Vert, Rochefontaine, Gusti Amo (organic) and Kerets. The retail offer is growing. The variety of products now includes vacuum cooked (sous vide), grilled, marinated with oil and herbs and artichoke spreads.

Figure 6: Preserved artichoke bottoms, private label by Carrefour

Source: org-carrefour per Open Food Facts, under the Creative Commons Attribution-Share Alike 3.0 Unported license.

French importers often seek out products that can be marketed as gourmet or ‘authentic’. For instance, some brands highlight preserved artichokes prepared in the Italian (for example, Castelli and Florelli) or Spanish (for example, Don Gastronom) style to attract consumers. French gourmet retailers and food manufacturers may pay premium prices for top-grade artichoke hearts (for example, baby hearts in olive oil or grilled and marinated artichokes).

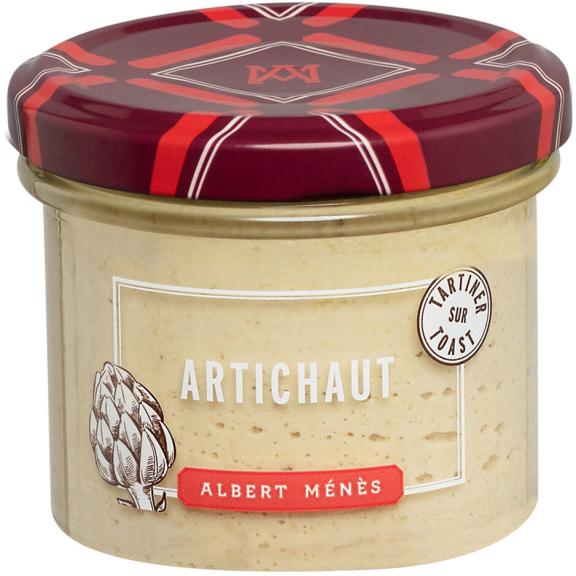

Figure 7: Artichoke spread by Albert Ménès

Source: org-albert-menes per Open Food Facts, under the Creative Commons Attribution-Share Alike 3.0 Unported license

Tips:

- Check the French Processed Food Association (Pact’Alim) member list to find potential buyers. Processors and traders of processed artichoke hearts can be found under the sub-sector of Canned Food Asso.

- Take part in SIAL Paris (a major food trade show) to network with French buyers.

- Make sure your French labels are compliant (in French, with metric units). Calculate nutritional information with the Nutri-Score system, which is widely accepted in France.

Germany: Health-conscious consumers embrace Mediterranean flavours

Historically, Germans have not been large artichoke eaters. However, that is changing. In recent years, the popularity of Italian and Mediterranean dishes (for example, pizza, pasta and antipasti platters) has introduced artichoke hearts to a broader audience. Supermarkets report steady sales of jarred artichoke hearts. They can often be found in the deli or canned vegetable aisle. Health consciousness is a big driver. German consumers appreciate that artichoke hearts are rich in fibre and vitamins but low in calories.

Since 2020, imports of processed artichoke hearts to Germany have gone up and down, around 7,000 tonnes. However, they decreased to 5,900 tonnes in 2025. This decrease appeared to be temporary, due to a combination of inflation and lower harvests in the main supplying countries. According to initial data from 2025, the German market for preserved artichoke hearts was recovering. It will probably go back up to the regular 7,000 tonnes. As the German market is relatively stable, new suppliers need to be aware of the existing competition.

The main supplier in 2024 was Italy. It had a 36% import share, followed by Peru (22%), Egypt (16%), Spain (11%) and the Netherlands (6%). Türkiye is the fastest growing supplier, but it still supplies relatively low volumes. Turkish exports to Germany increased from only 7 tonnes in 2020 to 100 tonnes in 2025. Egypt has a very strong presence in the German organic market. Aside from Spain and Italy, Egypt is virtually the only supplier of organic preserved artichoke hearts. The country exported nearly 100 tonnes in 2024.

The German retail market is mainly made up of store brands (for example, Rewe, Edeka, Lidl and Aldi). Many retailers are supplied through specialised distributors like Otto Frank and I.Schroeder. Some retailers (for example, Edeka, Rewe and Lidl) buy preserved and artichoke hearts directly from processing countries to be more competitive. This means they may be interested in direct import deals. Inflation-conscious consumers want cheaper private labels, which can be found in discounters like Lidl and Aldi.

Germany has several independent preserved artichoke heart brands, such as Feinkost Dittmann, Kattus (by Fuch Group) and Leverno (by Rila). Some of these brands specialise in Mediterranean food and highlight their high quality and specific origin, such as Krini and Ibero (by Rila). Several brands from Türkiye, the Middle East and North Africa are represented by the specialised ethnic importer Nergiz Großmarkt. Aside from jarred and canned artichokes, deli spreads made from artichokes are becoming more popular in Germany.

Figure 8: Artichoke spread (private label by German discounter Lidl)

Source: Autentika Global

Germany is the largest European market for organic preserved artichoke hearts. Imports from developing countries reached a peak of 144 tonnes in 2021. However, due to inflation they decreased to 100 tonnes in 2024. Organic preserved artichoke hearts are often sold under the private labels of the main German retail chains. However, they are also sold under independent brands and private labels of specialised organic retailers, such as Bio Markt, Alnatura, tegut, ebl-Naturkost, dm and Super Biomarkt.

Tips:

- Find preserved artichoke traders in Germany through the website of specialised German trade associations (Waren-Verein).

- Consider organic certification to enter the German market more easily. To increase your chances in the organic German market, choose an advanced certification scheme, such as Naturland or Demeter.

- Be ready to provide detailed product specifications, lab test results and a traceability story.

Italy: The heart of artichoke cuisine with seasonal gaps

Italy is the second largest European exporter of artichoke hearts after Spain, and the leading consumer. The annual consumption of fresh and preserved artichokes together is around 7 kg per person, much more than other Europeans. To meet market needs, Italy also imports preserved artichoke hearts. Over the past five years, imports to Italy have increased at an annual rate of 8%. They reached 2,300 tonnes in 2024, valued at €6.2 million. The leading supplier is Spain, which has a 43% share, followed by Egypt (39%) and Tunisia (10%).

Italian consumers are very familiar with artichoke hearts. They are a staple in Italian cuisine for starters and antipasti (for example, carciofini sott’olio), as pizza toppings (for example, pizza capricciosa) and in dishes where artichokes are the main ingredient (for example, Carciofi alla Romanaand Carciofi alla Giudia). Italian households often keep jars of artichoke hearts in the cupboard for quick use. The foodservice sector (restaurants, pizzerias) is a major buyer of preserved artichokes, usually in large cans.

Although Italy regularly imports preserved artichoke hearts, Peru, the leading European supplier, is not present on the Italian market. The main reason is that Italian retail labels actively market a ‘100% Italian’ or at least ‘Mediterranean origin’ message. There is also strong seasonality in imports. Most Italian imports come from Spain, when Murcia, Valencia and Navarra reach peak harvest season. Using a South American source would force a pack-front origin change and higher carbon footprint scores.

Figure 9: Private label of preserved artichoke hearts (by Coop)

Source: Autentika Global

Italy’s market for exporters is mainly about complementing local supply rather than replacing it. Opportunities include:

- Off-season supply: Italy’s main artichoke season runs roughly from November until April for fresh and processed artichokes. Some Italian canneries and importers will source out of season, filling the gap;

- Lower-cost bulk: some exporters export bulk preserved artichokes in drums, which Italian gourmet brands repack in extra-virgin olive oil;

- Organic and sustainable: there is small but growing demand for organic products in Italy. Exporters with certified organic artichoke hearts could find buyers among organic product distributors. Some Italian companies may also import artichokes to re-export or incorporate into mixed vegetable products.

Tips:

- Find potential partners at Tuttofood Milano, the largest food event in Italy.

- Find the right channel by niche opportunities, such as bulk-packed, blanched and acidulated niche varieties (similar to Italian ones) and pricing competitively.

The United Kingdom: Emerging taste for Mediterranean convenience

Imports of preserved artichoke hearts to the United Kingdom have fluctuated over the last five years because of inflation. In 2024, the United Kingdom imported 1,900 tonnes of preserved artichoke hearts, valued at more than €9 million. Italy dominates the supply to the UK. In 2024, the United Kingdom imported 62% of its preserved artichoke hearts from Italy, followed by Spain (26%), Peru (9%) and Greece (1%). Emerging suppliers include Egypt, Lebanon and Türkiye, although quantities are still very small.

Artichokes were not common in British cuisine for a long time. But their popularity has grown because people have been exposed to the Mediterranean diet, and are cooking international recipes more often at home. Several British celebrity chefs promote the Mediterranean diet, in which preserved artichoke hearts are often used. In the UK, artichoke hearts are considered a gourmet or speciality vegetable, and are often associated with Italian or Spanish cuisine.

Figure 10: Chargrilled artichokes (private label by Sainsbury’s)

Source: kiliweb with additional modifications by roboto-app for Open Food Facts, licensed under CC BY-SA 3.0

In the retail segment, most preserved artichoke hearts are sold under private labels. Many are of Italian origin, with labels like Tesco offering ‘A taste of Italy’ and ‘Italian Artichokes’), ASDA offering ‘Italian Baby Artichokes’, and Morrisons offering ‘Made in Italy, Quartered Artichokes’. Retailers have also introduced olive oil marinated and grilled artichoke antipasti, sometimes mixed with other ingredients such as olives, garlic and herbs. Cooks&Co and Epicure are independent brands, while Biona and Mr Organic are organic brands.

Companies that import foods for Italian delis or Spanish tapas restaurants constantly need to source ingredients like artichokes. However, approaching these companies may be difficult as some of them specialise in sourcing from single origins. Some examples include specialised importers of Italian food (for example, Carnevale or Salvo 1968) and Spanish food (for example, Brindisa). Still, some importers source artichoke hearts from several origins, such as Damas Gate and Harvey & Brockless.

Tips:

- Work with your importer or distributor to make sure your product gets noticed. This could mean investing in attractive packaging or even running small social media campaigns that target British food influencers.

- Get your product into a food awards competition like the Great Taste Awards. The UK market rewards marketing and visibility. Having the ‘Great Taste’ label on your packaging can make consumer trust you much more.

The Netherlands: Small consumption but large re-export

The Dutch market for preserved artichoke hearts is still developing. Annual consumption is probably around 300 tonnes. Still, the Netherlands presents opportunities for developing-country suppliers, as it exports over 70% of its imported volumes. Like most large European markets, there was a temporary decrease in imports due to inflation. There was a historical peak in imports of 2,900 tonnes in 2022, which then decreased to 1,100 tonnes in 2024.

In 2024, the Netherlands imported 36% of its preserved artichoke hearts from Spain, followed by Peru (24%), Italy (16%), Greece (8%), Germany (7%), Türkiye (2%) and Tunisia (2%). Greece and Türkiye are gaining market share in the Netherlands at the fastest rate. Greece increased its supply from 17 tonnes in 2020 to nearly 90 tonnes in 2025. There is a lot of trade of preserved artichoke hearts between Germany and the Netherlands. This is because some large German retailers have stores in both countries (Lidl and Aldi).

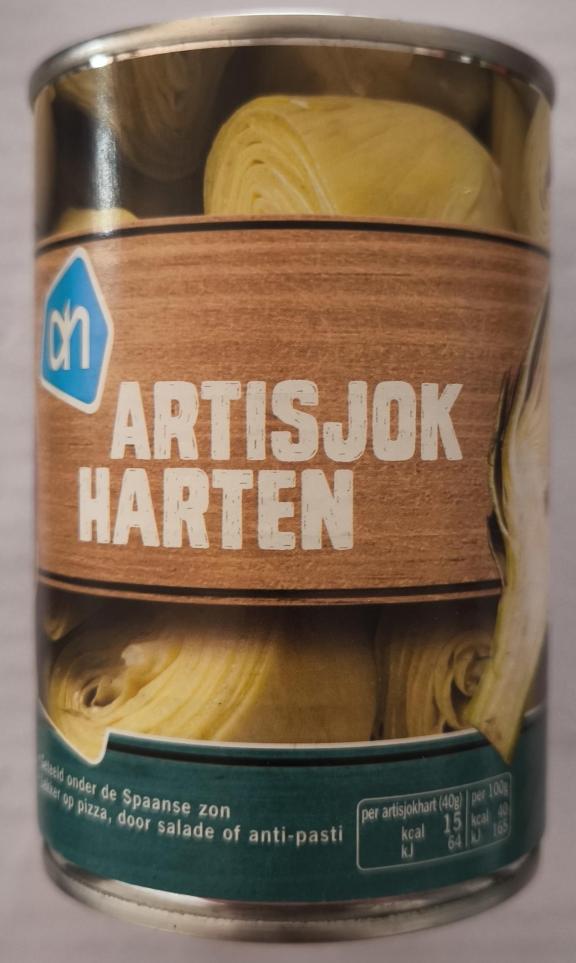

Figure 11: Private label canned artichoke hearts in brine of Spanish origin (by Albert Heijn)

Source: Autentika Global

The Dutch retail market for preserved artichoke hearts is dominated by the private labels of retail chains, such as Albert Heijn, Jumbo, Plus and the international discounters Lidl and Aldi. The presence of independent brands is very small, with only a few players like Gloe & Zeitz. Most commercial brands are imported from Italy (for example, Sacla), Spain (for example, the brand distributed by Alegre) and Greece (for example, Royal, distributed by Enrico Food). Higher-quality artichoke hearts are becoming more common, such as grilled or marinated in olive oil with spices.

Tips:

- Visit the PLMA (Private Label Manufacturing Association) trade show to meet the category managers of leading European retail chains.

- Be prepared to ship smaller mixed consignments for specialised Dutch importers to show your flexibility. They often put multiple canned products into a single container.

4. Which trends offer opportunities or pose threats to the European processed artichoke market?

Sustainability, innovation and global supply shifts are reshaping Europe’s preserved artichoke market. Demand for organic products is rising, led by Germany and France, while EU Farm-to-Fork targets drive greener farming. Developing country exporters, such as Egypt and Tunisia, benefit from seasonal advantages and lower costs. Technology (sous-vide, HPP, automation) boosts quality and efficiency, while circular solutions make use of artichoke waste. Mediterranean diets, vegan demand and convenience trends drive consumption. This makes sustainable, well-positioned suppliers attractive partners for European buyers.

Sustainability from the Farm-to-Fork strategy is influencing the European preserved artichoke market

Sustainable food is shifting from being niche to mainstream in Europe. Germany and France, the largest European organic food markets, have seen organic sales recover after a dip in 2022. Health and eco-conscious consumers are seeking organic preserved vegetables, driving double-digit growth in some segments. The EU’s policies push this further. As part of the Farm-to-Fork strategy, Europe wants to make 25% of its farmland organic by 2030, to encourage greener production.

The European organic preserved artichoke market is small but developing. Germany is the largest organic market for preserved artichoke hearts. Its imports are mainly from Italy, followed by Spain. The leading developing country supplier to Germany is Egypt, which exported nearly 100 tonnes in 2024. European producers in Italy and Spain are only developing organic artichoke cultivation slowly, due to higher costs and the limited supply of organic fresh artichokes. This opens the door for developing-country exporters that can get organic certification.

Investing in organic practices and unique local recipes can open high-end market opportunities, even for relatively small exporters. For example, Les Moulins Mahjoub is a family-run company in Tunisia. It focuses on organic farming and the hand-crafted preservation of Tunisian artichokes and other products. This commitment to quality has earned the company international acclaim for both taste and environmental care. As a result, the company’s artichoke preserves have found their way into premium markets across Europe and North America.

Beyond organic certification, sustainability covers the whole value chain. Pesticide residues and worker welfare (ethical trade) are key issues. New EU rules are tightening limits on agrochemicals and promoting safer alternatives. Another focus is the carbon footprint. According to a recent Italian study, producing 150 kg of preserved artichoke hearts can emit 335 kg of carbon dioxide. This means interest in lower-carbon practices – for example, using renewable energy in processing and optimising transport – is growing.

There is also innovation in waste reduction. Artichoke processing means that up to 80% of the vegetable is a by-product (outer leaves, stems). Instead of wasting this, companies extract valuable compounds (such as antioxidants for supplements) from by-products, and turn them into biomaterials. By taking a circular approach, artichoke waste can produce bioenergy, natural bio-stimulants and even inulin (a dietary fibre). This reduces waste and adds revenue streams, turning a problem into an opportunity.

Using recyclable glass jars or metal cans instead of plastics aligns with Europe’s attempts to reduce packaging waste. For example, Spain’s supermarkets have been under pressure to ensure that no produce is ‘dirty’. This means suppliers with poor practices may be dropped. There is also a reputational risk now that more consumers are looking at labels for origin and farming methods. Support programmes can help with training and certification, as seen in Peru, where technical assistance has helped small processors to achieve international food safety standards.

New technology innovations are improving the quality and taste of preserved artichokes

Vacuum-cooked, high-pressure and lightweight packs are reshaping Europe’s preserved artichoke market. These technologies are important because they extend shelf life, cut transport costs and help meet consumers’ clean-label expectations. Artichoke processing suppliers that master these processes can easily diversify into other lines. Similar technology upgrades can be used with other products, such as other vegetables (aseptic pouches), spreads (HPP processing) and ready meals (retort trays).

Figure 12: Sous-vide preserved artichoke hearts from Carrefour

Source: Autentika Global

The most important technological developments for processed artichoke markets are the following:

- Sous-vide mini-packs – sous-vide is a vacuum cooking technique with precise temperature and time control. Cooking artichokes using the sous-vide technique leads to better flavour and texture. Pre-cooked food in vacuum pouches is appearing on the European retail market and in offers for restaurants from reputable suppliers. Bonduelle’s 2025 foodservice catalogue introduced dedicated ‘sous-vide’ products, while Carrefour’s retail chain introduced a private label of sous-vide mini-packs.

- High Pressure Processing (HPP) – HPP is a non-thermal food preservation technique. It uses extremely high pressure to inactivate microorganisms and extend shelf life while maintaining food quality. Recently, HPP was promoted for low-acid vegetables, including preserved artichokes. The 2025 HPP Innovation Week highlighted artichoke spreads and antipasti as new uses.

- Factory automation – food processors in Europe are dealing with EU energy saving targets and staff shortages in European pack-houses. To face these challenges, processors are investing in automatic processing lines. For example, Italian equipment makers now sell robotic peelers that trim up to 24 artichokes per minute, ensuring uniformly-sized hearts for premium packs.

Mediterranean and vegan cuisines are becoming very popular in Europe

There are several reasons for increased interest in preserved artichoke consumption in Europe.

- The rise of the Mediterranean diet as the gold standard for healthy eating. This has popularised Mediterranean vegetables across the continent. Dishes that feature artichokes (for example, Italian antipasti, French Provençal stews and Spanish tapas) are now well-known in places like the United Kingdom, Germany and the Netherlands. Consumers associate artichokes with health and gourmet cuisine. Artichokes are often promoted as a ‘superfood’. They are rich in antioxidants and fibre, and fit into the healthy lifestyle promotion.

- Plant-based diets are increasingly popular too. More people are reducing their meat intake and looking for flavourful vegetables. There are currently around three million vegans in Europe. Artichoke hearts, with their meaty texture and distinctive taste, have found their way into vegan and vegetarian recipes. They make great meat-free toppings (for example, on vegan pizzas and in grain bowls) and ingredients for vegan spreads.

- The convenience factor also drives preserved artichoke consumption. Modern consumers like ready-to-eat or easy-to-use ingredients. This is especially true for young and busy professionals. A jar of marinated artichoke hearts offers instant flavour without the labour of cleaning and boiling fresh artichokes. This aligns with the general growth of convenience foods in Europe. Supermarkets report increased sales of jarred antipasto vegetables as a home cooking trend.

- The gastronomic culture in Europe prizes variety. Food enthusiasts are always looking for the next interesting ingredient. Artichoke hearts are both traditional and slightly exotic to people outside the Mediterranean area. In the United Kingdom, for example, Mediterranean restaurants and cooking shows have demystified artichokes for a broad audience. They have turned them from a special Italian ingredient into part of the regular offer of mainstream retail chains, such as Tesco.

Global supply shifts from European to global

The European artichoke supply chain is global. Italy and Spain are huge producers of fresh artichokes and process a lot domestically. However, they cannot meet the year-round demand. To fill the gaps, European importers turn to non-EU suppliers when local produce is off-season or more expensive. Extreme weather is also disrupting artichoke production in the Mediterranean. Unseasonal heatwaves, droughts and heavy rains affect yields and harvest timing. This has led to more imports from non-European countries.

Peru is now the largest non-European supplier of preserved artichoke hearts to Europe. This is because of its large cultivation in the Andes. Peru has lower labour and cultivation costs. This means their preserved artichokes are cheaper than the European ones, even if you include transport costs. Spanish growers have complained that imported Peruvian artichokes undercut local prices at the end of the season. North African suppliers are starting to compete with Peru to cut transport time, and source from Mediterranean regions.

Tunisia and Egypt are emerging markets. They may become key players soon, thanks to geography and lower production costs. They benefit from EU trade agreements and zero tariffs for preserved artichokes. North African countries also harvest counter-seasonally. For instance, Tunisia’s peak fresh artichoke season is October to May, and this complements Europe’s summer gap. Egypt has invested in advanced processing facilities and dominates frozen artichoke exports to Europe.

There has also been a shift in trade dynamics. The United Kingdom’s exit from the EU has led the UK to adjust its import tariffs and look more to global suppliers. This may create a more level playing field for non-EU exporters to the UK market. Fundamentally, the artichoke trade is no longer Euro-centric. It is a multi-origin system driven by year-round demand, cost factors and proactive trade policies.

Tips:

- Highlight your sustainable edge to align with the European market’s expectations. Use eco-friendly packaging, reduce waste (by finding uses for artichoke trimmings) and tell your product’s origin story. European buyers value processed artichoke suppliers who have a strong environmental and social profile.

- Track consumer trends and adapt. For instance, offer smaller jar sizes or lower-salt recipes if health trends demand it, or launch an organic line for markets like Germany. Align your product range with popular dietary approaches, whether they are keto, gourmet or budget-friendly options.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research