Entering the European market for desiccated coconut

Key elements for successful exports of desiccated coconut to Europe are food safety certifications, regular testing and ensuring the coconuts are white in colour and have a good flavour. Sustainable production and social responsibility standards are becoming increasingly important for European buyers. Suppliers from South-East Asia are strong competitors, with the Philippines and Indonesia playing major roles as suppliers. Processing is concentrated in a few areas of the Philippines and Indonesia, and most desiccated coconut is produced by very large companies.

Contents of this page

- What requirements and certifications must desiccated coconut comply with to be allowed on the European market?

- Through what channels can you get desiccated coconut on the European market?

- What competition do you face on the European desiccated coconut market? Where are your competitors located?

- What are the prices for desiccated coconut?

1. What requirements and certifications must desiccated coconut comply with to be allowed on the European market?

Our study on buyer requirements in the European processed fruit and vegetable market provides general information. The section below deals with specific details related to desiccated coconut.

What are mandatory requirements?

All food products sold in Europe must be safe. This includes desiccated coconut. Food products can only contain approved additives, and there are maximum levels for harmful contaminants, such as bacteria, viruses, pesticide residues and heavy metals. It should also be obvious from the labelling whether a food product contains allergens.

Certain plants and plant products entering the European Union must have a phytosanitary certificate. However, a phytosanitary certificate is not required for the following five fruits: pineapples, bananas, coconuts, durian and dates. This includes fresh and dried coconuts, whether or not shelled or peeled, according to Annex XII, Part C of Regulation (EU) 2019/2072.

The European safety authorities must approve additives if there are any present. Additives should comply with the specifications outlined in the Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008. Labels should make it obvious for consumers if the desiccated coconut contains sulphites, as these can cause allergies.

Contaminants control

Food contaminants are unwanted and harmful substances that can make people sick. The European Union places strict controls on contaminants in food, especially aflatoxins, as per the Regulation (EU) 2023/915. This regulation entered into force on 25 May 2023. Annex I lists the maximum levels of regulated contaminants.

Although it does not happen often, some of the main reasons for market withdrawal of desiccated coconut are salmonella contamination and excessive sulphite content.

In January 2020, desiccated coconut from Indonesia was removed from the Polish market because it contained two times more sulphites than the maximum allowed limit. In 2022, salmonella was detected in coconut meat imported into Germany from Vietnam via the Netherlands. Coconut meat is used to produce desiccated coconut. Salmonella and a high count of Escherichia coli were also reported in a 2020 shipment of frozen grated coconut imported to the United Kingdom from India.

Pesticide residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. The European Union regularly publishes a list of approved pesticides. This list is frequently updated. In 2022, the European Commission approved 27 new regulations in the form of new approvals, extensions, renewals, amendments and restrictions. Products that contain more pesticides than the limit or that contain unapproved pesticides will be withdrawn from the market.

However, excessive pesticide residues in desiccated coconuts is uncommon. Pesticides are applied to the palm tree leaves and the outer husk of the coconuts, so only small quantities can penetrate into the edible part. Still, many European importers will request a detailed pesticide test.

Microbiological contaminants

The most common type of microbiological contaminant present in desiccated coconut is salmonella. Contamination may occur due to insufficient distance between the husking and processing areas, infected water used in processing, dirty hands, dirty processing equipment, the presence of animals in processing facilities, infected workers, dirty packaging materials or storing facilities, or too high moisture contents (above 3%) in the final product.

Most European buyers will require a laboratory analysis to check for the presence of microbiological contaminants. The laboratory analysis must show a complete absence of salmonella. The presence of other microorganisms must be below certain limits and must be in line with the European regulation on microbiological criteria for foodstuffs or with national legislations.

Heavy metals

The European Union’s regulation on food contaminants sets restrictions for lead, cadmium, mercury and tin. Heavy metal residues may penetrate coconuts from the soil or from pesticides, but they are uncommon. Still, European buyers will often require tests to check for the presence of heavy metals.

Chlorate and perchlorate

One of the most recent changes in EU regulations concerns the maximum allowed level of chlorate. It is set at 0.05 mg/kg for most fruit and vegetables, including coconuts. Legislation on chlorate levels entered into force in June 2020. Chlorate is no longer approved as a pesticide, but it can come into contact with food when chlorinated water is used during processing. Another source may be the use of chlorinated detergents used to clean facilities and processing equipment.

Product composition

European authorities can reject desiccated coconut if the product contains undeclared or unauthorised materials, or if the levels of approved materials are too high. European consumers prefer desiccated coconut without any additives, although sulphites are widely used as preservatives.

If you soak coconut kernels in a solution of sodium metabisulphite, you should control the amount of preservatives and the soaking time. The maximum sulphur dioxide/sulphites content in dried coconut must be below 50 mg/kg. These substances are often used as a preservative in the production of desiccated coconut to prevent yellowing and extend the shelf life. Organic products must be free of preservatives.

Be aware that the use of citric acid as an antioxidant is not allowed in desiccated coconut, according to the European food additives regulation.

Packaging requirements

Desiccated coconut is typically packaged in a way that protects the quality and properties of the product, and to prevent contamination from external sources. Packaging used for desiccated coconut must protect the product’s organoleptic characteristics, protect the product from contamination and not pass on any odour, taste, colour or other foreign characteristics to the product.

The most common types of packaging for desiccated coconut are handmade paper bags with polythene sealed inside to prevent moisture penetration. The standard size of the bag is 25 kg, but 8 kg, 10 kg and 50 kg bags are also used. Packed products should be stored in a clean, cool and dry place with a room temperature of 26°C or lower. In normal storage conditions, the shelf life of desiccated coconut treated with sulphites should be twelve months, while the shelf life of organic products should be nine months.

Retail packaging includes plastic bags, carton packaging, plastic containers and foil bags. The exact size of retail packaging can vary, but it is typically much smaller than the bulk packaging for individual or family consumption. The bags are packed on Euro pallets (80 x 120 cm) and further transported in 20 ft (500 bags of 25 kg) or 40 ft (1,000 bags of 25 kg) containers.

Labelling requirements

For bulk export packaging, the product name ‘desiccated coconut’ is used, together with the name under which the product is sold in the country of sale. When applicable, the name may indicate the oil content, size and form of the product (such as fine, medium, coarse or chips) and the crop year. More detailed information can be given in accompanying documents, but the product name and storage instructions must be on the packaging. Other information, such as lot, producer name and address, can be replaced by an identification mark.

In the case of retail packaging, product labelling must comply with the EU regulation on the provision of food information to consumers. According to this regulation, the labelling must contain information on nutrition, origin and allergens and must be a minimum font size of 1.2 mm. Desiccated coconut is not included in the regulation’s allergen list, but sulphites must be indicated as potential allergens if they are used as preservatives. Retail packs must be labelled in a language that can be understood by consumers in the target country.

New European rules require you to label the origin of the product. For example, if the desiccated coconut is packaged in the Netherlands, the origin of the product must also be indicated. This can be done by indicating a specific country, by indicating ‘non-EU’, or by declaring that the ‘desiccated coconut does not originate from the Netherlands’.

Tips:

- Follow recommended good manufacturing practice schemes to meet the requirements of the European food safety legislation. Refer to the Codex Alimentarius for the Code of Hygienic Practice for desiccated coconut (PDF) and for low moisture food (PDF).

- Be sure to only perform laboratory tests in ISO/IEC 17025:2017 accredited laboratories.

- Store your desiccated coconut in cool and dry conditions away from direct sunlight.

- Consult the foodstuffs labelling and packaging advice from the European Union’s Access2Markets portal.

- Read our Organising Export tips to learn more about custom procedures, payment, logistics and documents used in the export of processed fruit and vegetables.

What additional requirements do buyers often have?

Quality requirements

Specific quality standards for desiccated coconut have not been officially defined by European authorities. European buyers often refer to two international standards. The first is the Standard for Desiccated Coconut published by Codex Alimentarius and the second is the Standard for Dehydrated Coconut Kernel Pieces by the United Nations Economic Commission for Europe (UNECE). Several producing countries have set their own standards, such as the Philippines, Malaysia, India and Sri Lanka. India is preparing a third revision of its standards (PDF).

The industry can use many different criteria for quality, but some of them, such as taste and odour, are subjective and cannot be easily determined by physical and chemical characteristics. The basic quality criteria for desiccated coconut can be found in Table 1.

Table 1: Common criteria defining the quality of desiccated coconut

|

Oil (fat) content |

Full-fat product contains ≥ 60% m/m of coconut oil Low-fat product contains < 60% m/m of coconut oil |

|

Colour |

Natural white to light creamy white |

|

Texture |

Characteristic of fine, granular coconut |

|

Form |

Pieces can be classified as:

Other forms include different cuts such as flakes, strips, chips, shreds, cubes and chunks. |

|

Flavour |

Characteristic of coconut, sweet and mild, free from off-flavours |

|

Odour |

Characteristic of coconut, mild and sweet, free from off-odours |

|

Moisture |

Maximum of 3% |

|

Ash |

Maximum of 2.5% |

|

Total acidity of the extracted oil |

≤ 0.3% m/m measured as lauric acid |

|

Quality classes (optional) |

Determined by the allowed percentage of defects. Desiccated coconut can be classified as ‘Extra’, ‘Class I’ and ‘Class II’. |

Food safety certification

Although EU legislation does not require food safety certification for desiccated coconut, be aware that almost all European food importers require it. Well-established European importers will not work with you if you cannot provide the food safety certification they want.

The majority of European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). The GFSI does not provide food safety certifications, but rather recognises a number of certification programmes that meet the GFSI benchmarking requirements. The most popular certification programmes recognised by GFSI for desiccated coconut are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Make sure to check what certifications are currently recognised in the latest version of the GFSI benchmarking requirements. Food certification systems are constantly changing. The European Union, the United Kingdom and the European Free Trade Association (EFTA) generally recognise the same food safety standards and certifications, so there are no major discrepancies in their requirements. However, certain retailers may prefer one certification over another, or demand additional certifications based on internal policies.

For example, British buyers often require BRCGS, while IFS is more common for German retailers. These preferences are sometimes historical. For example, IFS was initially developed as a joint venture of the French retail association FCD and the German retail association HDE. Note that food safety certification is only a basis for exports. Major buyers will usually visit production facilities before starting a business relationship.

Private safety and sustainability requests

Although most European retailers will support the certification schemes listed above, many will have additional requirements. Many supermarket chains will contractually oblige suppliers to meet comprehensive quality assurance requirements, including unannounced inspections at processing facilities.

One of the more recent trends is to ask for laboratory tests proving that specific pesticide residues do not exceed the maximum limits. Some buyers may provide a list of pesticides and a specific integrated pest management system that must be followed if you want to export to specific clients. This is the case for the baby food industry, for example.

Many importers will ask you to follow their own specific code of conduct. Most European retailers have their own code of conduct, such as Lidl (PDF), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Tips:

- Get food safety certifications. Select a certifying company carefully and consult with your preferred buyers about their certification preferences.

- Complete a self-assessment through the producer starter kit on the Amfori BSCI website.

What are the requirements for niche markets?

Organic desiccated coconut

European legislation specifies that you need to use organic production methods if you want to market your desiccated coconut as organic. Growing and processing facilities must be audited by an accredited certifier before you may put the EU organic logo on your products. This also applies for the logos of the certifying organisation, such as Soil Association in the United Kingdom and Naturland in Germany.

Organic farming in the European Union is expanding quickly, thanks to rising consumer interest. To address this, the EU implemented new legislation on organic produce in January 2022. This legislation strengthens the control system, boosting consumer trust in organic products and setting the same standard for local and imported organic products. Moreover, a wider range of products can now be marketed as organic under these guidelines.

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products has to be accompanied by an e-COI, as defined in the Annex of the Commission Regulation defining imports of organic products from third countries.

For countries such as Argentina, India and Tunisia, certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

One of the major concerns is the potential impact of climate change on the organic coconut production. Changes in rainfall patterns, temperature and the increase in pests and diseases can pose significant threats to organic coconut farms. This is because these farms rely on natural methods of pest control and disease management. While organic certifications can open up new markets and offer premium prices for coconut products, this also presents significant challenges and threats that need to be carefully managed.

Sustainability and Corporate Social Responsibility (CSR) certification

Firms have different requirements for social responsibility. Some companies will insist on following their code of conduct or another common standard such as the Sedex Members Ethical Trade Audit (SMETA). It provides a globally recognised way to assess responsible supply chain activities, including labour rights, health and safety, the environment and business ethics. Other alternatives include the Ethical Trading Initiative’s Base Code (ETI), amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and the BCorp certification.

The coconut sector is dominated by smallholder farmers who often face issues such as poverty, child labour and poor working conditions. Exporters should ensure that they are sourcing from suppliers who treat their workers fairly and provide decent working conditions. This includes paying fair wages, ensuring safe working conditions and respecting workers’ rights.

Fairtrade and Rainforest Alliance certifications are used for the sustainability certification of desiccated coconut, although this is far less widespread than for some other crops. Fairtrade International has developed a specific standard for oleaginous fruit and a standard for prepared and preserved fruit and vegetables for small-scale producer organisations, which includes dried coconut products.

A PETA Asia investigation in November 2022 has revealed that primate abuse is ongoing in Thailand’s coconut industry. The report disclosed evidence that chained monkeys are forced to spend long hours climbing tall trees and picking heavy coconuts. This report came after PETA Asia’s investigations in 2019 and 2020. Coconut exporters from Thailand might find themselves facing additional questions to guarantee that their products are obtained without forced monkey labour.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) require specific dietary restrictions. If you want to focus on the Jewish or Islamic ethnic niche markets, consider implementing Halal or Kosher certification schemes. There are several organisations that provide Kosher certification in Europe. For example, the Kosher London Beth Din (KLBD) provides guidelines on how to obtain the certification. Halal certification in Europe can be obtained via certifying bodies. For example, the Halal Certification Services (HCS) provides certification services.

Abey Marine (Pvt) Ltd is a leading manufacturer, exporter and supplier of organic desiccated coconut from Sri Lanka. The company’s products are both Halal and Kosher certified. Yes Eka Sampurna (CV. YES) is a desiccated coconut supplier from Indonesia that offers organic, Halal and Kosher certified products.

Tips:

- Get in touch with Proforest. It is currently working with Barry Callebaut, Nestlé and Proforest to develop a Sustainable Coconut Supplier Scorecard and a Sustainable Origins Assessment Template.

- Read our study on trends on the European processed fruit and vegetables market for an overview of the development of sustainability initiatives in the European market.

- Consult the Standards Map database for information on a wide range of sustainability labels and standards.

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH, as well as control bodies and authorities for equivalence.

- Keep up-to-date on changes in EU organic legislation on the European Commission’s Legislation for the organics sector page.

2. Through what channels can you get desiccated coconut on the European market?

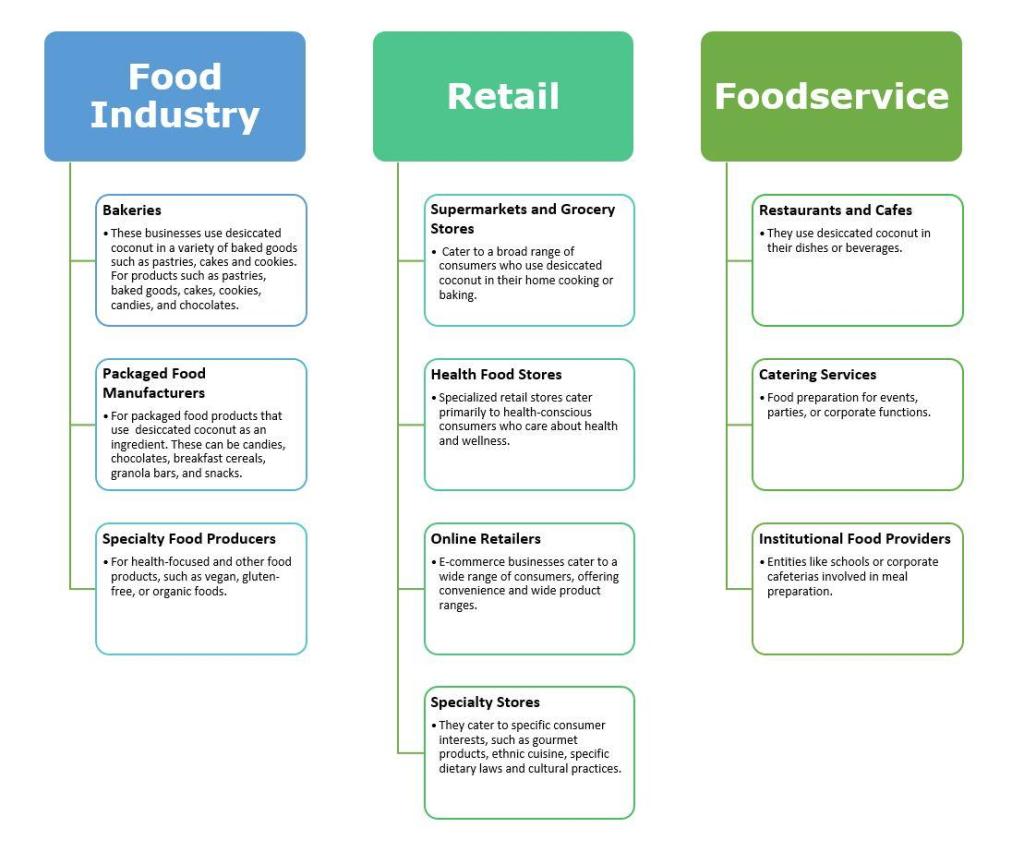

Most desiccated coconut in Europe is used by the food processing industry, but the share of retail products is growing, driven by plant-based and healthy snacking trends.

How is the end-market segmented?

Approximately 60% of all desiccated coconut imported into Europe is re-packaged and sold by retailers. The rest is used by the food processing industry and foodservice (Figure 1). The share of low-fat products in retail sales is increasing in order to reduce the calorie content of the product and make ‘front of pack’ labelling more attractive. Including an organic certification is also a trend in retail-packaged desiccated coconut.

Keep in mind that several retail alliances coordinate buying operations in Europe:

- Coopernic, which includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group

- Carrefour World Trade or CWT, which includes Carrefour, Système U, Match and Cora

- AgeCore, Colruyt, a cooperation on the level of national brands and private labels, which includes Conad, Eroski and Coop Switzerland

- European Marketing Distribution or EMD, Colruyt, a cooperation only on private label, which includes Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia

- Epic Partners, which includes Edeka, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica

Figure 1: End-market segments for desiccated coconut in Europe

Source: Autentika Global

Food Industry

The food industry segment is the main user of desiccated coconut:

- Packaged food manufacturers – These are the largest users of desiccated coconut as fillers for chocolate and candy bars. Desiccated coconut is also used as an ingredient in and topping for cakes. Leading chocolate producers in Europe include large multinationals like Mondelez, Nestlé, Mars, The Hershey Company, Ferrero and Lindt & Sprüngli. Every European country also has domestic chocolate producers that make their private label chocolate and confectionery coconut products. Examples from the leading markets include Tony’s Chocolonely (the Netherlands), Alfred Ritter and Bahlsen (Germany), Groupe Cémoi and Gerlinea (France), Baronie (Belgium) and Eurohansa (Poland).

- Bakery – This is one of the largest users of desiccated coconut in Europe. Many companies use desiccated coconut in products such as pastries, biscuits or cakes. Some of the large bakery groups on the European market are Finsbury Food Group, Associated British Foods, Le Duff, Aryzta, Jab Holding, Kingsmill and Lantmännen Unibake.

- Coconut snacks are offered as ingredients, for example home breakfast cereals and as ready-to-eat sweet treats. Some examples include Farmer’s Snack (coconut chips), Nurture Brands (coconut bars) and Alnatura (organic coconut chips).

- Other users of desiccated coconut include manufacturers of breakfast cereals, ice cream, savoury Asian dishes and food ingredients for the bakery and confectionery industry.

Retail

For direct home consumption, retailers mostly sell desiccated coconut in 100 g and 200 g bags. These retailers include supermarkets, specialty stores and health food stores. The product is also sold by retail outlets that sell finished products that contain desiccated coconut as an ingredient. These include bakeries, pastry shops and ice cream shops. It is not always easy to make a clear distinction between retail and industry users, because many European supermarkets also have in-store bakeries.

In most cases, retailers do not import desiccated coconut directly from developing countries. They are usually supplied via intermediaries, such as specialised distributors. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market.

Sub-segments of desiccated coconut in Europe include:

- Retail chains – The main trend in retail chains is the increasing share of private label products including desiccated coconut. Another trend is the introduction of innovative snacking products. Retail chains with the largest market shares in Europe are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn).

- Organic food shops – Some organic shops are part of specialised organic food retail chains. Their strongest market presence and market share is in Germany, but they are also present in other European countries. Organic desiccated coconut and coconut-based treats are also sold in combined food and drugstores, such as the dm and Rossmann.

- Ethnic shops – Ethnic shops provide specific opportunities for entering the market without having to compete with the leading retail brands. There is a strong presence of shops selling Asian related foods, including desiccated coconut.

- Ethical stores – This is a niche segment that provides opportunities for suppliers that are Fairtrade certified or have another ethical or sustainable certification. Sales of Fairtrade certified products are particularly strong in the United Kingdom, Switzerland and the Scandinavian countries.

- Online retail – sales are expected to continue to grow compared with previous years. Usually, leading online retailers are the same as the mortar-and-brick ones, but several have developed an online-only offer, such as Ocado in the United Kingdom, La Belle Vie in France and Picnic in the Netherlands.

Foodservice

The foodservice channel consists of hotels, restaurants and catering. It is usually supplied by specialised importers and wholesalers. This segment often uses unbranded bulk packaging of 1 kg, but other sizes are also used. Major driving forces in the foodservice channel in Europe are an interest in trying new cuisines and healthy food as well as simply enjoying food. The fastest-growing business types are likely to be new, healthier fast-food businesses, street food stalls, pop-up restaurants and international cuisines.

Restaurants have expanded their reach thanks to home delivery services and the use of applications such as Deliveroo, Uber Eats, Just Eat Takeaway and Glovo.

Tips:

- Diversify your offer to supply different market segments. Most coconut processing factories can offer a wide range of coconut products such as coconut milk, water or oil in addition to desiccated coconut. Desiccated coconut with a high fat content will also sell for better prices.

- Stay informed about developments in the bakery and snacks industry segment by reading the specialised market information on Bakery&Snacks and ConfectioneryNews.

- Watch a 2023 Deutsche Welle documentary for more insight on the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

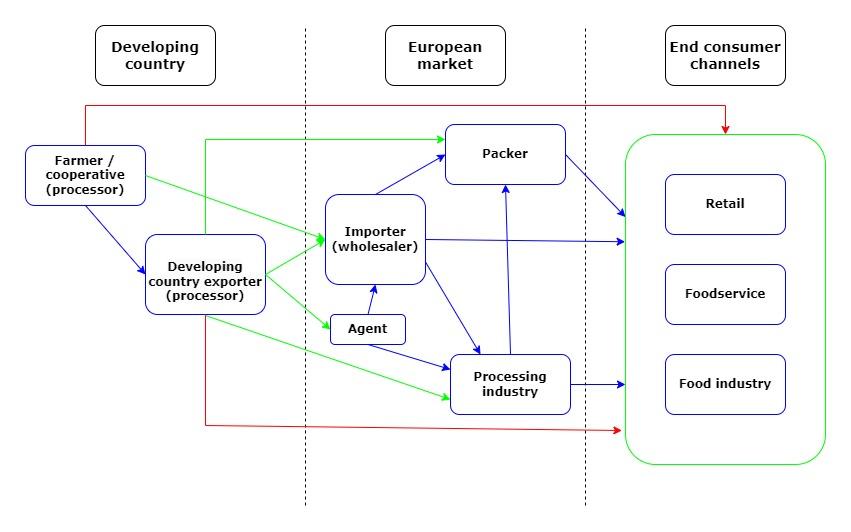

Through what channels can you get desiccated coconut on the European market?

Specialised importers, traders and agents dealing in food ingredients are the best point of contact for exporting desiccated coconut to the European market. This is specifically relevant for new suppliers, as supplying the retail segment directly requires a lot of quality-related and logistical investments. However, packaging for private labels and direct export to sweet snack producers can be an option for producers that are well-equipped and competitive in terms of price.

Figure 2: European market channels for desiccated coconut

Source: Autentika Global

Importers/wholesalers

In most cases, importers act as wholesalers and resell desiccated coconut to either food processors or packaging services. Some importers have packaging equipment, which means they can also supply the retail and foodservice channels directly.

The upstream requirements from retailers determine the supply chain’s dynamics from the top down, putting pressure on importers and food manufacturers. This forces prices down, but also brings more products to the market that have value-added qualities. Examples are sustainable, natural, organic and fair trade. Many importers develop their own codes of conduct and build long-lasting relationships with preferred suppliers.

Importers of desiccated coconut often also import other types of ingredients, such as dried fruit and edible nuts, so offering other products can increase your competitiveness. There are also desiccated coconut importers specialised in supplying to ethnic shops. Some of the notable desiccated coconut importers in Europe include: Catz International (the Netherlands), Theha (the Netherlands), August Töpfer & Co. (Germany), ReformKontor (Germany, organic), TM Duché & Sons (the United Kingdom) and Atlanta (Poland).

Food processors

Food processors are large buyers within the desiccated coconut market. Some buyers import ingredients directly, but most of them are supplied by importers and specialised wholesalers. Specific segments within the processed food channel are discussed in the previous chapter.

Tips:

- Work to establish long-term cooperation with well-established wholesalers. When possible, dealing with European processors directly will bring added value. Many confectionery companies, however, usually source desiccated coconut from well-established traders.

- Consult reports on opportunities to export desiccated coconut to individual European markets. The Department of Commerce of Sri Lanka periodically publishes these reports.

What is the most interesting channel for you?

Specialised importers are the best contact for exporting desiccated coconut to the European market. Importers usually have a good knowledge of the market, and they monitor the situation in the producing countries closely. They are your preferred contact, as they can give you timely information about market developments. They also provide practical advice for exports, which is especially interesting for new suppliers.

In addition to specialised importers, food ingredient suppliers are also an interesting channel to gain entry into this sector. In some cases, exporters from developing countries can supply to other segments directly as well. However, be aware that supplying to, for example, the retail segment, directly is very demanding and requires a lot of quality and logistical investments.

Tip:

- Read our tips on how to do business with European buyers of processed fruit and vegetables and on how to find buyers in the European market for processed fruit and vegetables.

3. What competition do you face on the European desiccated coconut market? Where are your competitors located?

The main competitors for desiccated coconut suppliers are the Philippines and Indonesia, followed by Sri Lanka, Malaysia, Vietnam and Ghana.

Source: Autentika Global, GTA, 2023

Philippines: leading coconut processor

The Philippines is the second-largest coconut producer in the world, producing 14.7 million tonnes in 2021. The largest coconut-producing regions in the country in 2022 were Davao Region, Northern Mindanao, Calabarzon and Zamboanga Peninsula. The coconut processing industry is one of the most important sectors in the Philippines. It provides employment for many people, including 2.5 million farmers. Some 3.6 million hectares of land are planted with coconut trees. Coconut makes up 25% to the country’s agricultural exports.

Virgin coconut oil is the leading value-added export product, followed by desiccated coconut and copra oil cake. Other important Philippine coconut products include coconut milk, coconut water, coconut shell charcoal and oleochemicals. The country approved the Philippine Coconut Industry Roadmap (PDF) in 2022. This plan paves the way for the use of a PHP75 billion fund to rehabilitate the coconut industry. The goal is to increase the coconut production by at least 9% in 2025. However, the plan is already behind schedule by more than a year.

The country has 21 medium-scale desiccated coconut processing plants operated by 19 companies, with an aggregate annual production capacity of 449,154 tonnes. Three companies operate two desiccated coconut processing plants, each in different locations.

The Philippines is the top producer and exporter of desiccated coconut and virgin coconut oil in the world. Over the last five years, the export of desiccated coconut increased at an annual growth rate of 5%. In 2022, Philippine exports of desiccated coconut reached 157,000 tonnes, with a value of €349 million. The main export destination was the United States, followed by the Netherlands and Canada.

Export of desiccated coconut to Europe represented a 32% share of the total exported quantities. The largest European market is the Netherlands (64%) followed by Germany (10%) and the United Kingdom (9%). Some small processors indirectly export their coconut products through brokers, such as Raco Commodities Phils. Large and traditional brokers have organised themselves as the Association of Coconut Brokers (ACBI).

The coconut sector in the Philippines is supported through activities of the Philippine Coconut Authority (PCA). The main challenges facing the industry include low productivity and an unorganised supply chain. Poverty among coconut farmers is also one of the highest in the agriculture sector.

Indonesia

Indonesia is the largest producer of coconuts in the world, with a production of 17 million tonnes in 2021. Most of the country’s coconuts are produced in the province of North Sulawesi. Indonesia is also a significant processor of coconuts and the second-largest exporter of desiccated coconut. Indonesian processors produce several other value-added coconut products, such as oil, milk or water. Indonesia is home to the International Coconut Community (ICC). The ICC currently has 20 coconut-producing member countries.

Over the last five years, the export of desiccated coconut from Indonesia increased at an annual rate of 0.3%. In 2022, Indonesian exports of desiccated coconut reached 110,000 tonnes, with a value of €141 million. The main export destination was Singapore, followed by Germany and the Russian Federation. Export to Europe represents a 23% share of the total exported quantities. In Europe, the largest market for Indonesian desiccated coconut is Germany (33%), followed by the Netherlands (14%) and the United Kingdom (12%).

Sri Lanka

Sri Lankan growers harvest around 3.1 billion coconuts per year, with 58% destined for household fresh consumption and 42% used by industry. The most important coconut products are desiccated coconut and coconut milk. The main sector support organisation is the Coconut Development Authority, which grants export certificates to exporters of all types of coconut products. Currently, there are nearly 70 processing facilities producing desiccated coconut in Sri Lanka. The annual production capacity of Sri Lanka is around 60,000 tonnes.

After a sharp drop in 2020, desiccated coconut production recovered to 33,000 tonnes in 2021. According to the Sri Lanka Development Authority, exports of desiccated coconut have increased significantly over the last several years, reaching 43,000 tonnes in 2022. This is a 21% increase compared to 2021, when the country exported 36,000 tonnes. The main reason for these increased exports was higher volumes of domestic production.

Around 23% of Sri Lanka’s exported desiccated coconut goes to European markets. Exports increased from almost 7,000 tonnes in 2018 to 10,000 tonnes in 2022, with a total worth of €22.3 million. The largest European market for Sri Lankan desiccated coconut is Spain (25%), followed by Germany (18%) and France (10%). Like other coconut-producing countries, Sri Lanka also has many old coconut trees, and there are several initiatives to renew plantations, including the use of dwarf varieties.

Malaysia

Malaysia is ranked fifth in the global export of desiccated coconut. The main coconut product in Malaysia is coconut oil. The three states with the largest area of coconut plantations are Sabah, Sarawak and Johor. Johor has the highest production, with more than 100,000 tonnes per year. Coconut is the fourth most important industrial crop in Malaysia, after palm oil, rice and rubber.

Although the country is a large producer of coconuts, it seems that the domestic production is not large enough. This means that processors are importing coconuts and copra from neighbouring countries. It also seems that significant quantities of desiccated coconut are re-exported. Malaysia regularly imports around 10,000 tonnes of desiccated coconut per year.

Exports of desiccated coconut from Malaysia fluctuated over the last five years. It reached 12,900 tonnes in 2022, worth €13.9 million. Europe is not the main destination for Malaysian desiccated coconut, as most exports go to Pakistan (23%), Singapore (23%) and Turkey (15%). In 2022, Malaysia exported 1,900 tonnes of desiccated coconut to Europe, with the United Kingdom being the main export destination (94%).

Vietnam

Vietnam is the world’s sixth-largest producer of coconuts and fourth-largest exporter of desiccated coconut. The Mekong Delta, particularly Ben Tre province, is the largest coconut-producing region in Vietnam. Ben Tre is often referred to as the ‘coconut capital’ of Vietnam, with over 72,000 hectares dedicated to coconut plantations. The country’s coconut production has been steadily increasing over the years.

The Vietnam Coconut Association (VCA) is the leading association in the local coconut industry. The VCA plays a crucial role in promoting the development of the industry and represents the interests of coconut farmers and processors. The VCA expects that within the next two years, the coconut industry will surpass the export milestone of $1 billion.

Vietnam exported 29,000 tonnes of desiccated coconut in 2022. Around 23% was exported to Egypt, followed by Thailand and South Africa. Vietnamese exports of desiccated coconut to Europe amounted to 1,200 tonnes in 2022, down from almost 2,000 tonnes in 2021. The main European market for desiccated coconut from Vietnam is Denmark (35%), followed by France (15%) and Italy (8%).

Ghana

Desiccated coconut exports from Ghana are relatively small compared to the leading processing countries, but the country managed to maintain a steady increase of exports to Europe. Traditionally, the main export destination for desiccated coconut from Ghana is the Dominican Republic. Ghana directly exported 352 tonnes to Europe in 2022.

The Ghanan government is trying to boost coconut production and exports, according to the Ghana Export Promotion Agency (GEPA). GEPA is currently strengthening the coconut sector by providing training programmes. There are two associations in Ghana that represent the coconut sector: the Coconut Farmers Association of Ghana (COFAG) and the Coconut Producers and Exporters Association of Ghana (COPEAG). The government has also added coconut to the National Tree Crop Development Authority (NTCDA), which was established in 2019. It also strives to develop and regulate the production, processing, marketing and export of coconut and other selected tree crops.

Tips:

- Learn from developing country exporters that already have a share of the European market, such as the Philippines, Indonesia, Sri Lanka, Malaysia, Vietnam and Costa Rica. It is especially important to check the strategies of emerging suppliers, such as Ghana and Dominical Republic.

- Consult freely available data on desiccated coconut exports from Sri Lanka and the domestic prices of desiccated coconut published by the country’s Coconut Development Authority.

- Monitor news from the coconut sector published by the Philippine Coconut Authority.

Which companies are you competing with?

Many producing, processing and exporting companies of desiccated coconut supply the European market. Each company has its own strategies for these exports. The examples listed below are illustrations of some of the leading exporters in the industry. Most of the competitors produce several other products and for many of them, coconut oil (crude and virgin) is the main export product.

Companies from the Philippines

Although the Philippines is the largest producer and exporter of desiccated coconut in the world, the number of processing companies is small. In 2023, there were 19 desiccated coconut manufacturers and exporters registered with the PCA. Most of the desiccated coconut is processed in ten facilities. The desiccated coconut processing plants were initially established to only produce desiccated coconut, but over time, the processing plants developed into integrated multi-product plants.

The most important desiccated coconut processing company in the Philippines is Franklin Baker. This is because of its capacity, its adoption of best practices, its use of modern equipment and its worldwide distribution network.

Franklin Baker is the world’s leading supplier of desiccated coconut products. The firm has three manufacturing plants with a desiccated coconut production capacity of 61,000 tonnes. The company buys coconuts from different provinces in Mindanao. The company accounts for a close to 50% share of total Philippine coconut exports to the United States. The company practices steam pasteurisation of all the nuts it processes. The company has extensive third-party certifications and accreditations for all its processing plants and products.

The Primex Group of Companies is one of the leading desiccated coconut manufacturers in the world. The two member companies that produce high-quality desiccated coconut are Primex Coco Products, with a capacity of 24,000 tonnes per year, and Primex Coco Davao, with an annual capacity of 26,000 tonnes. These two companies have an aggregate production capacity of 50,000 tonnes per year.

The Primex companies produce different variants of desiccated coconut, such as sweetened, toasted and sweetened toasted. It also produces various cuts, such as extra fine, fine and medium. Primex is very competitive on the European market and can reach multiple market segments because of the quality of its products and its large volumes. It also has several certifications: food safety (BRCGS), organic (EU and Naturland), Fairtrade, Kosher and Halal.

Peter Paul Philippines Corp, formerly a subsidiary of the US-based Peter Paul, is one of the largest firms producing desiccated coconut in the Philippines and in the world. The company has two desiccated coconut manufacturing plants, with a total capacity of 44,000 tonnes per year. One factory is in Candelaria and the second factory is in Sorsogon. Both have a capacity of 22,000 tonnes per year. The company produces regular, sweetened and toasted desiccated coconut, as well as toasted long chips.

Other large desiccated coconut producers and exporters include Superstar Coconut Products (capacity 48,000 tonnes per year), Celebes Coconut Corporation and Pacific Royal. For links to the websites of several other coconut processors, read our study on coconut water.

Companies from Indonesia

Indonesia has a larger number of smaller and medium-sized processors and exporters than the Philippines.

PT Global Coconut is one of the leading manufacturers of coconut products, located in the heart of the coconut plantations in North Sulawesi. Its processing plant is equipped with an ultra-modern and eco-friendly production facility with a peak operating capacity of 250,000 nuts per day. The company’s processing plant is Halal, ISO 22000, FSSC 22000 and KLBD Kosher-certified.

Indo Pacific Coconut claims to be the largest exporter of desiccated coconut from Indonesia. The company operates seven processing facilities, five of them specialised in desiccated coconut. They export to all continents and supply 300 clients. PT Sofi Agro Industries is a leading manufacturer and exporter of desiccated coconut, with a modern factory situated in Southeast Sulawesi.

Sambu Group is another large Indonesian desiccated coconut producer that manufactures high-fat and low-fat desiccated coconut. Its processing facilities are PT Pulau Sambu (Guntung) and PT Riau Sakti United Plantations. The company is well known among European importers and certified with different schemes, which allows it to reach various market segments.

There are several other desiccated coconut processors and traders from Indonesia, including Unicoconut, PT Harvard Cocopro, PT. Saudagar Antar Benua, GCO Indonesia and Sejati Coconut Industries.

Companies from Sri Lanka

A specific characteristic of the desiccated coconut export sector in Sri Lanka is the presence of a large number of small and medium-sized traders. Unlike the situation in the Philippines and Indonesia, where the largest processors are also the largest traders, many companies in Sri Lanka export but do not produce desiccated coconut.

One of the largest exporters of desiccated coconut from Sri Lanka is Adamjee Lukmanjee and Sons, a company specialised in the export of a wide range of coconut products. Other notable exporters are Silvermill Group and Stassen Group. CBL Natural Foods, which has been operating for over 20 years in Sri Lanka, produces certified organic, finely grated, and medium-sized grated desiccated coconut with no added sugar, flavour, colour, preservative and additives. The firm exports desiccated coconut to 45 countries.

Companies from other supplying countries

Examples of other desiccated coconut suppliers to Europe are:

- Malaysia: S&P Industries, Irfaz International, Erapoly, Karta International, Linaco, Kusuma

- Vietnam: Luong Quoi Coconut, Ben Tree Import Export (Betrimex), Long Uyen

- Ghana: HPW Fresh & Dry, Wad African Foods

Tip:

- Regularly visit leading European trade fairs to meet your competitors. Examples are Fruit Logistica, ANUGA, SIAL and FI Europe.

Which products are you competing with?

As desiccated coconut has a unique flavour and other sensory characteristics, there is no real substitute product. The only products that can provide a similar flavour are other coconut products, but many of them cannot be used as direct substitutes in the pastry and chocolate industry.

However, several other products are produced from the white coconut kernel and as such, they can be considered competitors. The main value-added product produced from coconut kernels is virgin coconut oil (VCO). An estimated 2 tonnes of desiccated coconut production capacity is lost for every tonne of VCO being produced. With more desiccated coconut factories converting part of their capacity into VCO production, this will have an increasing impact on the desiccated coconut output.

Tip:

- Read our study on fresh coconut to understand fresh product competition.

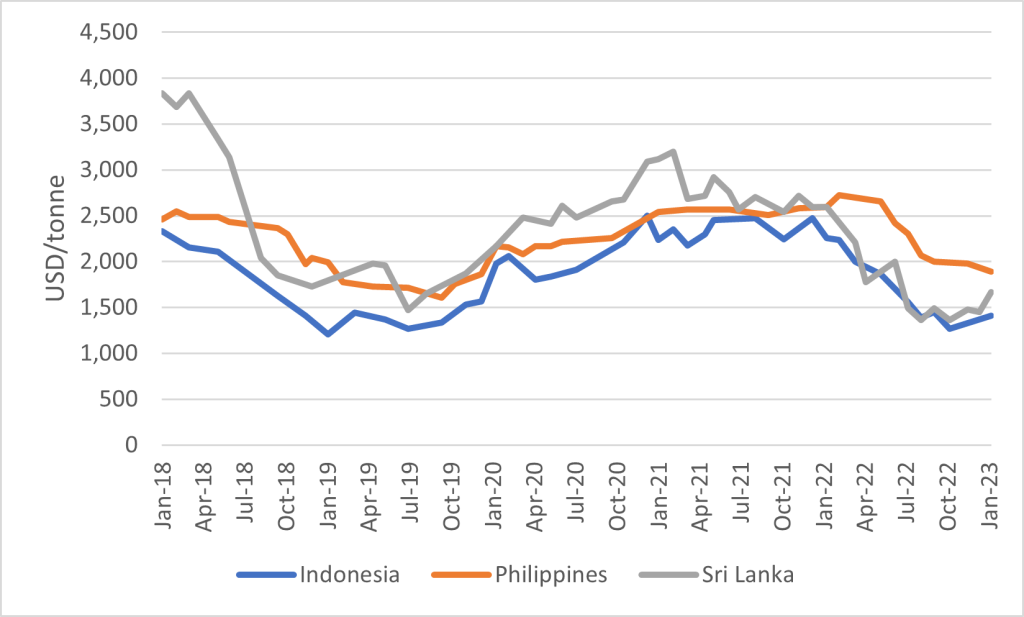

4. What are the prices for desiccated coconut?

Desiccated coconut is a commodity. Prices mostly depend on the situation in the main production countries and the balance between supply and demand. Particularly, the harvest season in the Philippines and Indonesia influences global price developments. When the crop underperforms in these countries, it usually bumps up prices unless stocks are already high.

Demand for coconut and coconut-derived products could continue to gradually increase in the coming years because of rising consumer concerns about the use of conventional dairy-based beverages and food products. The popularity of vegan and keto diets is also growing as a result of increased health awareness. This is especially the case among millennials. All of this could gradually lead to higher prices in the global market.

Demand in the desiccated coconut market improved by mid-2023, following a significant decrease in European demand from 2021 to 2022. The desiccated coconut market was also weighed down by high-priced inventory that was coupled with high shipping costs, but inventories were being lowered as sales improved in 2023. This prompted importers to start renewing their purchase orders as traders are expecting prices to pick up from the low levels seen in late 2022 and early 2023.

The price of Filipino desiccated coconut has been leading the market since early 2022. Presently, desiccated coconut from the Philippines fetches a higher price compared to desiccated coconut imported from Indonesia and Sri Lanka because of its premium quality, according to the country’s Department of Agriculture.

Coconut oil hit highs in February 2022, at over $2,300 CIF Rotterdam, before hitting a low of just over $1,000 in October 2022. This represents a fall of nearly 60% in just 8 months. Desiccated coconut prices have tracked that of coconut oil, falling from highs of around $2,800 FOB in February to just $1,400 in December 2022. This has had the unwanted consequence of reportedly delaying some planned mill expansions.

Figure 4: Average monthly export price of desiccated coconut, FOB, USD/tonnen

Source: Autentika Global, International Coconut Community

Very roughly, the cost, insurance and freight (CIF) price can be estimated at around 34% of the retail price. The best option to monitor prices is to compare your assortment with that of the largest competitors. The table below shows a very rough price breakdown.

Table 2: Desiccated coconut price breakdown

|

Steps in the export process |

Type of price |

Price breakdown |

Example (price related to 1 kg of desiccated coconut) |

|

Whole mature coconut collection (nine nuts) |

Farmer price |

13% |

€0.66 |

|

Processing and packing |

Wholesale domestic price |

26% |

€1.30 |

|

Truck transport to port, loading onto container |

FOB |

28% |

€1.40 |

|

Shipping and customs clearance |

CIF price |

34% |

€1.70 |

|

Intra-European distribution |

Wholesale and/or re-export price (including value-added tax) bulk packaging |

44% |

€2.20 |

|

Repacking and sales to retail |

Wholesale retail packaging |

60% |

€3.00 |

|

Retail sales of the final packed product |

Retail price (200 g pack) |

100% |

€5.00 |

Source: Autentika Global compilation based on industry sources

Note: The breakdown of the prices above is only intended for orientation and cannot be used as a precise indicator. Aspects that must be considered when considering prices are:

- The final retail price is not very relevant for this calculation because most of the desiccated coconut in Europe is used as an ingredient in the food processing industry.

- The FOB price for desiccated coconut (PDF) from Indonesia amounted to $1.50/kg (€1.40/kg) in July 2023. Keep in mind that FOB prices constantly fluctuate.

- The price of de-husked coconut in Indonesia (domestic, industry use, Sumatera) amounted to $140/tonne (€128/tonne) in July. The price paid to farmers for mature whole nuts varies from month to month and between countries.

- The average weight of a de-husked coconut is about 500 to 650 g. If we take the average weight of a de-husked coconut to be 575 g, then 1 tonne of de-husked coconuts would contain approximately 1740 coconuts. At a price of $140 per tonne, the price of a single de-husked coconut for industrial use in Indonesia would be approximately $0.08 (€0.073).

- Retail and other margins can vary considerably compared to the example above.

Tips:

- Monitor weekly and monthly prices of desiccated coconut from Indonesia, Philippines and Sri Lanka on the website of the International Coconut Community.

- Keep an eye on market supply and demand with free market updates from traders. Catz International gives free dried fruit market updates, and TM Duché & Sons also offers free news updates.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research