Entering the European market for canned beans

Europe buys canned beans that can meet food safety, traceability and low pesticide use requirements. Exporters must follow Hazard Analysis and Critical Control Points (HACCP), keep residues low and replace bisphenol A (BPA) linings by 2028. Importers and wholesalers still move up to 95% of sales, giving new suppliers the fastest entry point. The main competitors are European exporters like Italy and the Netherlands. Kenyan and Malagasy exporters show that consistent quality can win market share. Buyers welcome reliable producers with clear sustainability claims.

Contents of this page

1. What requirements and certifications must canned beans meet to be allowed on the European market?

What are the mandatory requirements?

To export canned beans to Europe, exporters must meet strict food safety standards and requirements. Canned beans are covered by the General Food Law, which governs food safety in the European Union (EU). This law focuses on food safety and traceability. Noncompliance may result in temporary import restrictions or tougher inspections. Suppliers must follow the principles of Hazard Analysis and Critical Control Points (HACCP).

Contaminant control in canned beans

Under European regulations, contaminants such as aflatoxins and lead, as well as microorganisms such as Salmonella, E. coli, and Listeria monocytogenes, must be absent or below certain limits. EU Regulation 2023/915 sets maximum levels for lead, cadmium and inorganic tin in food. For example, the allowable limit of lead contamination in pulse crops is 0.20 mg/kg wet weight.

Pesticide residues

Maximum residue levels (MRLs) set under Regulation (EC) No 396/2005 apply equally to dry beans that are later canned. The controversial herbicide glyphosate is often used for pre-harvest weed control and desiccation in pulse crops. It is still approved in the EU. The authorisation was renewed until 15 December 2033 by the Commission Implementing Regulation (EU) 2023/2660. The renewal was announced following a European Food Safety Authority (EFSA) report on glyphosate’s 2022-2023 re-evaluation.

The EU lets exporters sell canned beans if glyphosate levels stay below a MRL of 2.0 mg/kg on dried beans that go into the can. Glyphosate is the most commonly used herbicide in bean cultivation.

Organic rules forbid synthetic herbicides such as glyphosate. Inspectors normally treat any finding as a problem and are expected to start an investigation. For foods aimed at infants and young children, EU legislation also sets a maximum of 0.01 mg/kg for pesticides, glyphosate included.

Legal requirements

All products sold in the European Union, including canned beans and pulses, must be safe. This also applies to imported goods. Ingredients must be authorised. Hazardous pollutants, such as pesticide residues and high amounts of mycotoxins or preservatives, are prohibited. Labels must also clearly state whether items contain allergens. Cans and other packaging materials must be corrosion-resistant and free of pollutants such as cadmium.

Food safety

Microbiological contamination is not a frequent problem in the European market due to optimised processing lines and the sterilisation used in canned beans. However, physical and chemical contamination still occur.

Calcium disodium EDTA (E385), an additive used in canned beans and pulses, is an approved food additive in the EU at a maximum level of 250 mg/kg.

BPA's possible toxicity has been raised by various European Union member states, including Sweden, Denmark and France. In December 2024, the EU adopted Commission Regulation (EU) 2024/3190 on the use of BPA materials intended to come into contact with food. The regulation bans BPA and any other ‘hazardous’ bisphenols in all food-contact materials.

Because pulses are stored in an acidic brine, the regulation grants these packs the longest grace period. Producers and importers may still place BPA-lined cans for fruit or vegetables on the EU market until 20 January 2028. After that date, only BPA-free coatings are allowed. Any remaining stock of filled cans may be sold for 12 more months. After that, it must be destroyed. After the January 2028 deadline, EU border authorities will stop consignments packed in BPA-lined cans.

Tips:

- Read more about pesticides, contaminants and micro-organisms on the website of the European Commission. See the EU MRL database for maximum residue levels of pesticides and active substances in common dry beans.

- Reduce pesticide levels through integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- Read our study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

- To learn more about payment, delivery and other practical issues, read the CBI study on organising your export to Europe.

- Plan your switch away from BPA-lined cans. Test the new coating, update your compliance files and highlight the change in your marketing.

What additional requirements and certifications do buyers often have?

Quality requirements

The overall quality of canned beans is assessed on the basis of several factors. Some of the most important are:

- Colour, look and taste: these are some of the most important quality criteria for canned beans. Quality may be judged based on the number of defects in the beans, such as loose skin, colour differences, blemishes, the number of broken beans, and the presence of beans (in green beans) or pods (in other types of beans) in the can.

- Size: canned beans should all be the same size. Sizing is not required, but it is common.

- Cut: for green beans, there are various cuts, including short pieces, sliced lengthwise or diagonal.

- Brine: the composition and flavour of the brine or added sauce are also assessed throughout the testing process.

- Weight: there is a defined minimum drained weight for green beans. For other types of canned beans, the minimum drained weight is not defined.

Tip:

- Consult the Codex Alimentarius for practical guidelines to help you meet European food safety legislation requirements. For canned beans, relevant documents include: Guidelines Procedures for the Visual Inspection of Lots of Canned Foods for Unacceptable Defects, Standard for Certain Canned Vegetables, Code of Hygienic Practice for Canned Fruit and Vegetable Products, Code of Hygienic Practice for Low and Acidified Low-Acid Canned Foods and Code of Practice for the Prevention and Reduction of Inorganic Tin Contamination in Canned Foods.

Certifications as a guarantee

Food safety is a priority in all European food industries and food suppliers should expect customers to ask for certifications as an added guarantee. Global Food Safety Initiative (GFSI)-recognised food management systems and certifications are widely accepted throughout Europe.

Exporters that process beans (cleaning, drying, packaging) and want to become European suppliers need a recognised food safety management system. A minimum of one HACCP-based food safety management system must be in place.

The following types of certifications are accepted, depending on the supplier’s position in the supply chain (production, distribution or processing):

- GLOBALG.A.P. (for agricultural production);

- Food Safety System Certification (FSSC 22000/ISO 22000);

- BRCGS for food safety (British Retail Consortium);

- IFS Food Standard (International Featured Standard).

Labelling requirements

The European Union Regulation on food labelling protects consumers from misinformation. Allergens must be identified on the ingredient list. Allergen labelling requirements now extend to foods sold in bulk, including those served in restaurants and cafés.

Figure 1: Several variants of canned beans in a European supermarket

Source: Autentika Global

Canned lupin beans are also considered an allergen and must be labelled as such. Sulphites, used in the manufacture of canned beans, are also allergens. If sulphite levels are over 10 mg/kg or 10 mg/l, it must be labelled as a possible allergen.

Canned beans and pulses are often manufactured with sauces and seasonings. Some seasonings, such as celery, are possible allergens and must be labelled as such. Canned bean and pulse labels must also provide nutritional information.

European Green Deal requires sustainable trade

The European Green Deal is a set of new EU sustainability policies to make Europe the first climate-neutral continent by 2050. It will impact how resources are used and how greenhouse gas emissions are cut in the coming years.

The Farm to Fork Strategy is key to the European Green Deal. It aims to make food systems more equitable, healthy and ecologically friendly. It will ensure sustainable food production and address issues such as packaging and food waste. The new approach will prioritise crops with a low environmental impact. This will benefit pulses, which are known to fix nitrogen in the soil.

EU trade agreements already contain requirements for the sustainable development of economic, environmental and social elements of trade with the dry bean-supplying countries of Canada, Ukraine and Mexico. The EU recently added New Zealand and Chile to this list. Both new agreements contain legally binding trade and sustainable development chapters. This allows the EU to suspend benefits if a partner breaks important labour or climate promises. Canned food suppliers should be ready to meet higher standards and lead with technological advancements.

In December 2024, the Council approved the new Packaging and Packaging Waste Regulation (PPWR), which sets strict reuse and recyclability targets for metal cans and bans excessive packaging.

Tips:

- Check with buyers to learn which certification scheme applies to your target market.

- Read about social programmes and initiatives in the CBI study about buyer requirements for grains, pulses and oilseeds in Europe.

- Read about food certification schemes and the added value of products in specific target markets. Consult with your buyers about their certification needs and preferences and carefully select a certifying company.

What are the requirements for niche markets?

Organic certification

Certified organic canned beans are part of a growing niche sector. Pulses are becoming more popular as a healthy choice among vegan and health-conscious customers, who often prefer organic products for the same reason. Several specialised European purchasers, notably Tradin Organic and Rapunzel Naturkost, target this growing ecologically and socially responsible organic industry.

All organic goods imported into the EU must be accompanied by a certificate of inspection (COI) issued by an EU-accredited inspection authority. Inspections of organic products are being tightened to combat fraud. Foreign manufacturers are subject to the same laws as those in the European Union.

Tips:

- Organic is nice to have, but not a must-have. Do trials in this niche market first to find out if your business can compete. Starting organic production and getting certification can be expensive. To market organic products, your company must comply with the whole organic process. Read more about organic certification in the CBI study about buyer requirements for grains and pulses in Europe.

- Read about organic farming and the European guidelines on the European Union website for organic farming.

- Find specialised organic importers in the international directory of organic food wholesale & supply companies.

2. Through which channels can you get canned beans on the European market?

Compared to other areas of the fruit and vegetable processing market in Europe, canned beans are less widely used as ingredients.

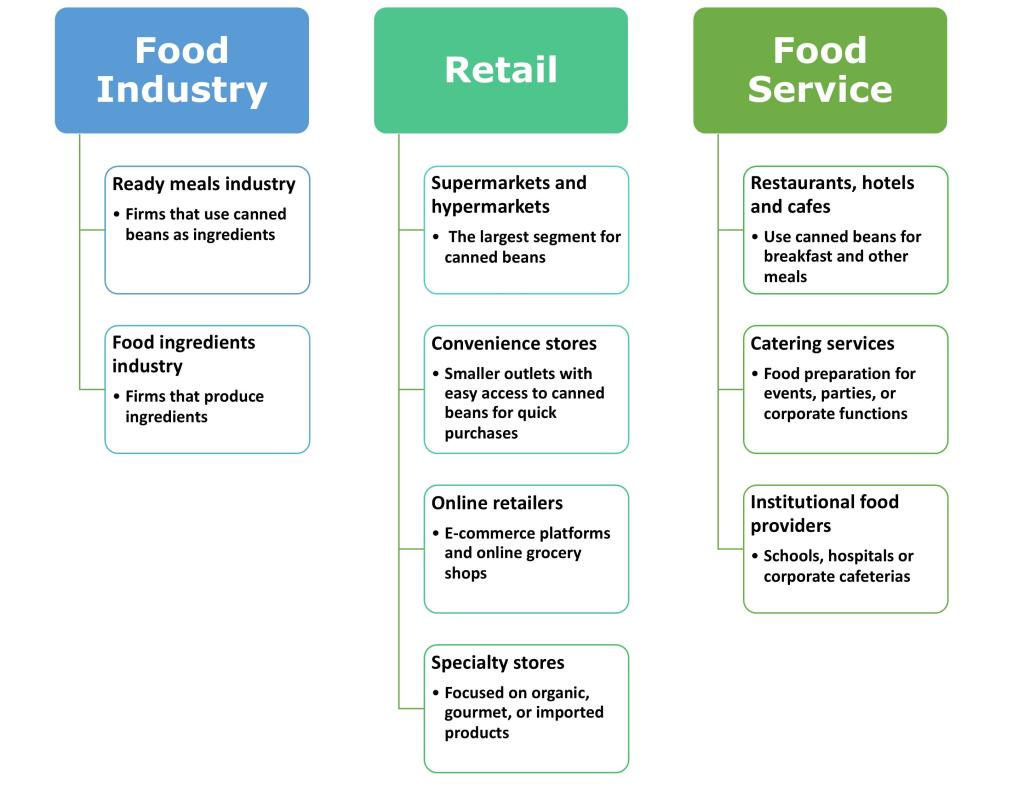

How is the end market segmented?

There are few exact figures for the volume of canned beans used in the food processing industry versus those sold directly via retail.

Figure 2: End-market segments for canned beans in Europe

Source: Autentika Global

Retail

Though some retailers purchase directly from exporters in developing countries, most transactions involve middlemen. National retail markets are often split between discounters and high-end segments. Key features defining the European retail food industry include consolidation, market saturation, intense competition and low pricing.

European countries all have their own dominant retail chains. Those with the highest market shares include Schwarz, ALDI, Carrefour, Tesco, REWE, EDEKA and E.Leclerc.

Industry

Two of the main uses of canned beans in the food processing industry are:

- Ready meals: this segment is a large consumer of canned beans, mostly for salads, soups and fresh and frozen meals;

- Meal components: a wide variety of canned beans are used as ingredients in products manufactured by other food sectors.

Food service

The hospitality and food service industry, which includes restaurants, hotels and catering companies, is typically supplied by specialised importers such as wholesalers. This industry usually requires custom packaging in the 1 to 5 kg range, which is distinct from retail and bulk packaging.

Tips:

- Follow developments in the European fruit and vegetable processing market via the news sections of the European Association of Fruit and Vegetable Processors (PROFEL) and Legume Hub websites.

- Find potential buyers in the canned products segment in the lists of exhibitors at specialised trade fairs such as Food and Drink Expo and the International Food & Drink Event.

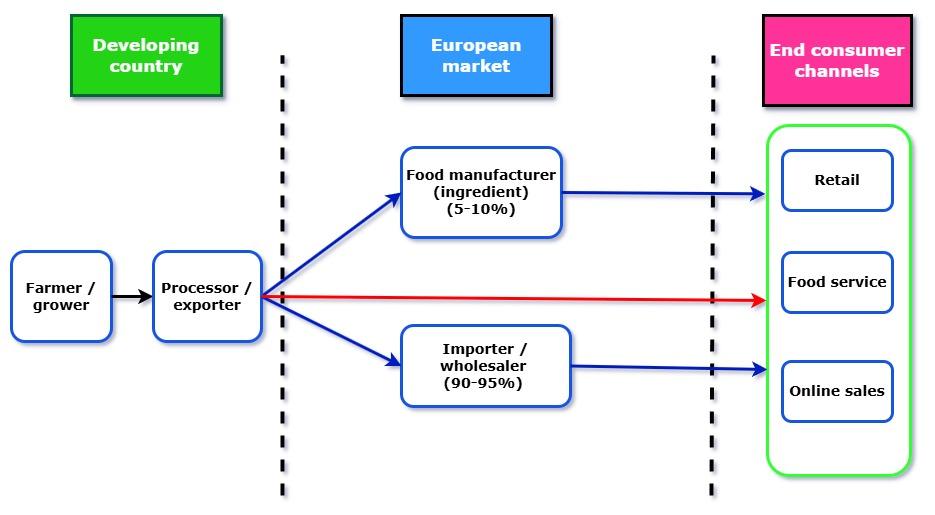

Through which channels does a product land on the end market?

The European food processing industry uses canned beans less than other vegetables in manufacturing food products. Large volumes of canned beans are either marketed directly in the retail market under importer brand names or private manufacturer labels. They are also sold directly to the food service segment. Importers are the single most important channel for exporters.

Figure 3: European market channels for canned beans

Source: Autentika Global

Importers/wholesalers

The most important and recommended channel for entering this market is through specialised importers. In retail, canned beans and pulses are often sold in 400 g cans. Exporters should get in touch with wholesalers that serve retail sectors directly to ensure consistent supply. The most popular distribution channels for suppliers from developing countries are specialised importers, such as for private labels or of ethnic products.

As consolidators and sourcing experts, importers and traders have a very strong position in specialised canned goods. Although in some situations suppliers can serve the retail market directly, without needing importers as middlemen, this is not common as the retail sector generally works with procurement procedures.

Canned bean importers in main European markets include Natco Foods, Gama, Goodies Foods, Indo-European Foods, SOP International, Clama, Kreyenhop & Kluge, Henry Lamotte, Opa Distribution and Agidra.

Food manufacturers (ingredients)

Compared to other areas of the European food processing market, canned beans are less widely used as ingredients. Most canned goods are sold either directly in the retail sector under an importer's brand or private label, or to the food service sector. Both canned kidney beans and canned green beans are examples of types of canned beans used by the sector.

Retail/food service

The European canned bean market is driven by the food service sector (restaurants, hotels and catering businesses), which makes up a sizeable share of the overall market. This market demands larger packaging, up to 5 litres, and standard grade rather than branded goods. In some circumstances, you can supply the food retail or food service markets directly, eliminating the need for an importer as a middleman.

The expanding European market for specific types of canned beans is an excellent business opportunity. Ethnic grocery stores sell a variety of foods from a range of countries, creating a growing customer base. Most of these retailers specialise in foods from a particular region, such as Asian, Arabic, Indian or Mediterranean.

The public sector is also a major food service customer and contracts suppliers through public procurements. Procedural constraints may make it difficult for suppliers to reach the food service sector directly. Instead, look for food service suppliers specialised in your specific market.

The leading food retail companies in Europe differ per country. The companies with the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, ALDI, EDEKA, E.Leclerc, METRO Group, REWE Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands).

Tip:

- Check the website of PROFEL, the European Association of Fruit and Vegetable Processors, for important information about the European processed fruit and vegetables market. The website provides links to the sites of its national member associations and local food processors and producers.

What is the most interesting channel for you?

The most important channel for you are importers/wholesalers. They control up to 95% of the market and are the logical main point of entry, especially for new suppliers to the European market. Importers/wholesalers can give developing country suppliers information about market trends and practical guidance about exports. Supplying the retail market directly is highly challenging and requires large investments in quality, quantity and logistics. Bigger canned bean exporters can consider submitting tenders for major discount food retailer procurements.

Tip:

- Identify your product’s main importers in large and fast-growing markets.

3. What competition do you face on the European canned beans market?

Which countries are you competing with?

Italy, the Netherlands and France are the main competitors for emerging suppliers of canned beans to Europe. In 2021, these three countries supplied around 80% of all canned beans to Europe. The canned bean market is dominated by European producing countries. Italy, the Netherlands, France and Belgium are the key competitors in the main markets.

Source: Autentika Global, ITC, 2025

In 2024, around 9% of all European canned bean imports came from developing countries. Kenya is the leading developing-country supplier to Europe, followed by Madagascar. Though small in comparison, Lebanon is a good example of an emerging competitor from a developing country.

* 2024 export data for Lebanon and Cameroon was not available in September 2025

Source: Autentika Global, ITC, 2025

Europe’s top 6 exporters: Dominant players in the canned beans market

Six European countries account for most canned bean exports to European buyers. In order of importance, these include Italy, the Netherlands, Belgium, France, Spain and the UK.

Italy alone accounts for more than half of all European canned bean exports and the market for these products is extremely concentrated in Europe. Both canned kidney beans and canned green beans are sourced mainly from Italy, making it the primary supplier in Europe and worldwide. Italy has a well-developed canning industry, buts its primary focus is on processing tomatoes.

In 2024, Italy exported 314,923 tonnes of canned beans to the European market, compared to 313,944 tonnes in 2020. The top Italian export destinations for canned beans were the UK (40%), Germany (21%) and Austria (8%). Italian exports grew by 0.1% annually between 2020 and 2024.

The Netherlands is the second-largest exporter of canned beans and a major re-exporter of canned beans in Europe. In 2024, the Netherlands exported 64,982 tonnes of canned beans to the European market, compared to 71,600 tonnes in 2020.

France is the third-largest exporter to Europe, thanks to its large domestic canning industry. This sector produces primarily for the domestic market, but for export as well. Canned peas account for a major share of these exports, followed by canned sweetcorn and canned green beans. Most French canned goods are exported to neighbouring European markets, including Germany, Belgium and Italy.

Kenya: The leading developing-country supplier of canned beans to Europe

Kenya has an excellent reputation for the production and export of canned green beans, which is one of the country’s specialisations. It is the major developing-country supplier of canned beans and pulses to France. France is the top European importer of canned beans from developing countries.

In 2024, Kenya exported 28,011 tonnes of canned beans to the European market, compared to 32,171 tonnes in 2020. The top Kenyan export destinations for canned beans are France (71%), Germany (20%), Belgium (6%) and the Netherlands (4%).

Suppliers from Kenya should be extra careful with pesticide use. The proportion of toxic pesticides used per hectare is much higher in Kenya than in Europe. Many Kenyan bean producers have switched to using biopesticides, especially when their end buyers are based in Europe or when the beans are destined for processed products that will go to Europe.

Madagascar and Lebanon: emerging suppliers

In 2024, Madagascar exported 8,023 tonnes of canned beans to the European market, compared to 9,907 tonnes in 2020. Madagascar’s top European export destination for canned beans is France (94%), followed by Belgium (4%) and Germany (1%).

In 2023, Lebanon exported 866 tonnes of canned beans to the European market, compared to 129 tonnes in 2020. The main export destination for Lebanese canned beans was the UK (55%), followed by France (20%) and Sweden (11%).

Tips:

- Find out which companies are the main importers of your products in major or rapidly expanding markets.

- If you export types of canned beans that are also cultivated in Europe, expect a lot of competition. Study how developing countries have brought other new products onto the European market to see what sets them apart.

- Consult sectoral groups and primary market information portals such as S&P Global Food and Agricultural Commodities for in-depth knowledge about the canned bean business and the export strategies of rapidly developing countries.

- Regularly attend major trade fairs in Europe, such as Anuga, SIAL and Food Ingredients, to network with buyers and other businesses in your industry.

Which companies are you competing with?

Major companies are often the best-known names in the global canning sector. Each has developed its own approach to exporting goods to the European market. The following are examples of companies that have been successful in supplying canned beans to the European market.

European competitors

The main European competitors are La Doria Group, HAK and Bonduelle. Others are Greenyard Group, Gecom Export Srl, Conserve Italia, Riberebro, Napolina, Pancrazio, La BIO IDEA, G’woon, Amaizin, Cassegrain, Raynal et Roquelaure, D’Aucy and Reflets de France.

La Dorla dominates the canned food industry in Italy, especially in tomato-based products, pasta sauces, preserved beans and other vegetables. It is a key supplier to mass-market stores in various overseas and global markets including the UK, Australia and Japan. Private-label items accounted for 93% of La Doria's 2024 annual revenues, through established ties with various stores globally.

HAK is a branded business operating in the plant-based food industry throughout northwest Europe. It markets foods for use as meals or meal components, including a variety of vegetables and beans packaged in jars and stand-up pouches.

Bonduelle dominates the global market for ready-to-eat vegetables, retailing under its brands Bonduelle, Cassegrain, Globus, Del Monte, Ready Pac Foods and Arctic Gardens.

Developing-country competitors

Kenya’s Njoro Canning Factory is an industry leader in the manufacture of a wide variety of high-quality foods and meal components. The list includes canned, frozen and dried fruits and vegetables, herbs and spices, tomato paste, jams and marmalades, sauces, pickles and relishes, bakery ingredients, and drinks. Njoro supplies canned green beans in several product ranges. It offers canned beans in tomato sauce under its KOL brand.

Premier Foods Limited (PFL) is another important canned bean supplier. It is well known for its Peptang brand that also features canned baked beans and canned beans in a curry mix. Another important Kenyan canned bean company is Trufoods with its Gilda label.

Kenyan canned beans exporter Meru Greens Horticulture organises smallholder farmers to produce beans and other vegetables for canning.

Madagascar exports small but distinctive volumes. Pioneering canner Codal Madagascar owns two production units in Antananarivo and Tamatave. It sells fair-trade and organic local produce in jars. The twin plants carry HACCP and ISO 9001 seals. Codal is certified Fair & Solidarity Trade by the National Association of Fair and Solidarity Trade (ANCESM) in Madagascar.

Though headquartered in France, Nodé Négoce operates throughout West Africa and Madagascar. Specialised in buying and reselling various food products, the company offers canned vegetables and tomato concentrates under the brands MaVie, Lalla, Adoua and Etalon.

Lebanon’s food makers are well-known for their flavourful canned beans. Flagship brand Al Wadi Al Akhdar has grown from three products in 1979 to around 200 today. It exports ISO 22000- and halal-certified canned foul medammas and fava beans to Europe and globally. The almost 100-year old Cortas Food sells many variants of canned white and fava beans. Diversified Gardenia Grain D’Or operates four factories and supplies canned beans to EU retail and HoReCa networks under BRCGS, halal and non-GMO seals.

Leading canned bean companies in other supplying countries

- China: Acroyali, Polofood, Kunyu, Sichuan Meining;

- Hungary: Észak Üvért, Foltin Globe, EKO Konzervipari;

- Poland: Gaston Group, Dawtona, Rolnik, Pudliszki;

- Türkiye: Korhan Pazarlama ve Dış Ticaret (Sera Food brand).

Tips:

- Be prepared for strong competition in the European canned bean market. You can learn from developing-country exporters that have found ways to enter the European market, such as those from Kenya, Madagascar, Lebanon and Mexico.

- You can find information about bean production and processing by developing-country suppliers on the websites of the Pan African Bean Research Alliance and Uludağ Fruit and Vegetable Products Exporters' Association.

Which products are you competing with?

Your main competition is with the categories of dried, frozen and fresh beans. European consumers have access to many varieties of dried beans and can purchase them in most retail chains and ethnic stores. Dried beans contain less sodium than canned beans. They cost less than canned beans but are also less convenient as they require soaking and boiling, adding to meal preparation time.

Another competitor is frozen beans, which are a relatively new trend. Frozen beans offer convenience comparable to canned beans. Canned beans can be stored at room temperature, while frozen beans must be stored in the freezer. Once canned beans have been opened, they have to be used within a few days or will go bad. By contrast, frozen beans allow for use of smaller portion sizes, as the remaining beans can be kept in the freezer for later use.

A drawback of frozen beans is that the product range is very limited in Europe. Green beans and soy beans are the main frozen bean products currently available. The range of fresh beans is also limited in the European market. Green beans and broad beans are the main bean varieties available fresh. They are quick to prepare, but do not offer the shelf life of canned beans.

Tips:

- Read the CBI studies on dried beans and frozen beans and vegetables to learn more about these industries and promotional tools used by suppliers.

- Collaborate with your industry partners to promote canned bean and pulse consumption. Examples of such alliances include the Global Pulse Confederation and Canned Food Alliance.

4. What are the prices of canned beans on the European market?

European retail prices of canned beans vary greatly depending on the production country, can type and size, bean variety and quality, and vendor. Compared to other products in the processed fruit and vegetable market, the packaging of canned foods makes them better suited to selling in retail facilities, which can speed entry into the retail segment.

Pre-cooking increases bean weight by around 2.5 times, which helps offset the costs of processing and canning beans. Private-label prices tend to be lower than those of manufacturer brands.

In 2025, canned beans retail in Europe at roughly €2.30 to €7.50 per kg. Discount private-label multipacks such as Tesco’s six-pack sell for around €2.30 per kg. Mainstream private labels in France sell for around €3.20 per kg. German price scans show most standard kidney bean products priced at €3 to €9 per kg. The higher end of this price range covers branded organic lines. For example, REWE was selling 250g cans of Bonduelle Bio Kidney beans for €2.29 (€9.16/kg) in July 2025.

This price indication is not useful to suppliers, as final prices differ widely from export prices. This is due to the addition of other expenses such as transportation, packaging, sales and profit margins. Below is an approximate price breakdown for canned beans.

Table 1: Price breakdown for canned beans (for an average 400 g package)

| Steps in export process | Type of price | Average share of retail price |

|---|---|---|

| Processing and canning | Producer | 30-40% |

| Handling and export packing | FOB or FCA | 42-45% |

| Shipment | CIF | 47-48% |

| Import, handling | Wholesale | 50-60% |

| Retail packing, handling and selling (value added tax included) | Retail | 100% |

Source: CBI

The export price of canned beans depends on the quality, variety and country of origin.

Margins and prices in the value chain depend on several factors, including:

- Origin (production country);

- Quality (varies from season to season and from country to country);

- Global demand versus global supply;

- Type of product and retailer pricing strategy. Retailers prefer to keep end-consumer prices stable for some canned fruit and vegetable products, even if import prices fluctuate.

Tip:

- The best way to understand pricing is to compare your offer with that of your largest competitors. Since price levels change over time and can vary across different stores, channels and countries, continue to monitor all these factors.

This study was carried out by M-Brain and updated by Autentika Global on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research