The European market potential for software testing services

Small IT businesses in developing countries have good opportunities in the European software testing market. European businesses are becoming more open to nearshore and offshore outsourcing as the need for high-quality, affordable testing services rises. Smaller providers with specialised skills, competitive pricing and flexible delivery models are in a good position to deal with the capacity gap. This is especially important because Europe has a shortage of qualified testing professionals.

Contents of this page

1. Product description: software testing

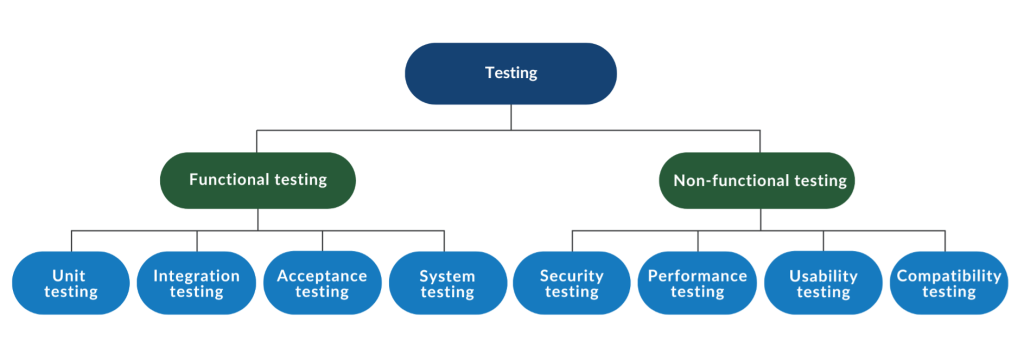

Software testing is the process of evaluating a software application or system. It helps identify and correct defects and ensure that the software meets pre-defined requirements (functional, non-functional and security). It also helps to check that it works as it should under various conditions. To find possible mistakes, performance issues, security threats and usability issues, the software must be tested under controlled conditions.

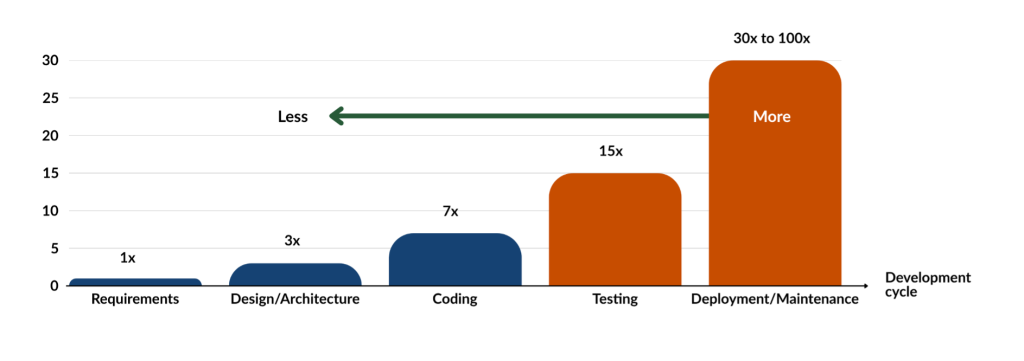

Both software developers and testers agree that it is better to start testing the systems at the earliest possible stages of the software development lifecycle (SDLC). Fixing an error in the deployment or maintenance phase is up to 30 times more expensive than addressing it as early as possible in the process.

Figure 1: The relative cost of defects at different stages of the SDLC

Source: Functionize, 2023

The main reasons why software testing is a crucial and integral part of the SDLC are that it ensures the software:

- Works as intended;

- Is secure;

- Meets quality standards.

Software testing helps detect errors early, reduces development costs, improves user experience (UX) and minimises the risk of failures after production. Without testing, software may be unreliable, unsafe, or non-compliant with standards and requirements.

Software testing follows the Software Testing Life Cycle (STLC), a systematic process that outlines how testing activities are planned, designed, executed and evaluated. The STLC consists of several well-defined phases that all contribute to the detection and prevention of defects throughout the SDLC. Software testing can be done either manually or automatically. Some types of tests are more suitable for manual execution, and others are more efficient when done automatically. Sometimes, manual and automated tests are combined to get the best results.

Figure 2: Types of software testing

Source: Globally Cool

2. What makes Europe an interesting market for software testing services?

Europe is the 2nd largest software testing market in the world, after the USA. The market for software testing services has been growing significantly in the past years. Europe is an attractive market for small IT companies from developing countries in software testing. This is because there is a high demand for quality assurance, cybersecurity concerns, shortage of local testing talent and growing acceptance of remote collaboration. European businesses are more often looking for cost-effective partners that offer specialised skills and added value, especially in sectors like finance, healthcare and e-commerce.

The European software testing market is growing significantly

The global software testing market was valued at €41.5 billion in 2025 and is expected to show a compound annual growth rate (CAGR) of 14.3% for 2025-2030. Various sources offer different figures depending on the scope and definitions of their research, but a CAGR of 5-15% seems most realistic. Overall, there is positive and steady growth expected for the software testing market in Europe.

Europe holds 27% of the outsourced software testing market. The largest markets in Europe are Germany, the United Kingdom (UK) and France. These markets create strong demand because sectors like healthcare and banking are highly regulated. Also, the GDPR has made many companies in the region choose specialised outsourced testing companies. For example, in 2024 the implementation of GDPR-compliant testing practices resulted in a 22% rise in demand for data-privacy testing tools.

Because of their larger pool of skilled testers and competitive rates, Poland, Romania and Ukraine are significant nearshore hubs for testing services. North America is expected to dominate the software testing market, but Europe is expected to stay number 2.

Digital transformation drives the demand for software testing services

Digital transformation is the process of changing an organisation’s operations and processes using digital tools and technologies. The goal of digital transformation is customer-driven innovation and improved efficiency. It is now changing many aspects of businesses, including operations, procedures and production.

The EU has made digital transformation a key priority. Through Europe's Digital Decade policy programme, the EU sets specific goals and targets for 2030. This includes specific targets for the digital transformation of businesses. Also, EU funding programmes are speeding up the digital transformation trend: for example, the Digital Europe Programme (DIGITAL) has a budget of over €8.1 billion and is focused on bringing digital technology to businesses, citizens and public administrations.

Companies are using more complex and connected digital technologies like cloud platforms, mobile apps, e-commerce systems, smart IoT devices and AI-driven tools to digitise their operations and processes. This growing complexity means more and more software must be tested carefully. The goal is to make sure it works well, stays secure, and performs reliably across different platforms and environments. Quality assurance is now a top priority for businesses because customers also expect fast, safe and smooth digital experiences.

Cloud migration accelerates the growth of the software testing market

European businesses are increasingly adopting cloud-first strategies. The widespread use of cloud computing is driving the demand for software testing services in Europe. It affects software testing in several ways:

- Frequent software updates, Continuous Integration/Continuous Delivery (CI/CD), agile methodologies and DevOps practices enable faster software release cycles. To keep software stable and reliable after every update, continuous testing is needed;

- Testing cloud applications is complex because they run in distributed, scalable and shared (multi-tenant) environments;

- Automated testing tools and test automation can be used in cloud environments. They can run tests across many systems at the same time. European companies often look for external partners with expertise in test automation to improve speed and reduce costs;

- Cloud computing comes with several security risks and related test requirements. Companies in Europe must comply with strict regulations that require proper security and compliance testing. Vulnerability scanning identifies system weaknesses and penetration testing simulates cyberattacks. In addition, configuration and access control audits verify that identity management is implemented correctly. Data protection and encryption testing ensure that sensitive information is secured. Compliance testing confirms that data handling meets regulatory obligations (like GDPR). Incident response and security monitoring validations assess the readiness of an organisation to detect, respond to and recover from security incidents.

Skills shortage in the software testing sector

European companies continue to struggle with a shortage in IT skills. There is a large gap between the number of software development jobs and the number of available software developers. In 2024, 58% of EU companies that recruited or tried to recruit ICT specialists had difficulties filling these vacancies. This shortage varies considerably across EU countries, from 21% in Montenegro to 72% in Germany.

*% of enterprises that have recruited or have tried to recruit ICT specialists.

Source: Eurostat, 2025

In 2024, 15% of all companies in the Netherlands were looking for ICT specialists. 63% of them had difficulties finding them. To fill the shortage, companies in Europe try to hire software developers from abroad. A cheaper option is to outsource software development tasks. Smaller ‘end-user’ companies in particular often outsource IT tasks locally. In turn, these local IT companies often look for nearshore or offshore outsourcing partners, like you.

In 2024, 72% of EU companies outsourced ICT functions to external suppliers. This percentage has been relatively stable since 2020. How much of this percentage is outsourced to offshore providers is unclear.

As in most areas of IT and software development, the software testing sector also has a shortage of skilled and experienced people. There are not enough testers in the market that have the required skills to do the job. The skills gap covers technical areas, domain knowledge, and knowledge of the relevance of new software testing technologies. According to a software testing expert, software testers should be good in 3 areas: testing, platform knowledge (tools) and domain knowledge. Good software testers are persons that are highly skilled in at least 2 out of the 3 areas. They are hard to find.

The demand for software testers has increased dramatically in the last 10 years. This was driven by the first wave of digital transformation (2015-2018), cloud technologies and the COVID-19 impact (2019-2021), and rapid development oftechnologies like the Internet of Things/Industrial Internet of Things (IoT/IIoT) and AI (2022-present). As the volume of software development and usage increases, systems are becoming more complex in both the consumer and business sectors. This drives the demand for comprehensive software testing. However, the supply cannot keep up with the current demand. Although exact numbers on the shortage of software testers in Europe are hard to find, the general trend of a shortage in tech talent is clear.

The sectors with the highest demand for software testers in Europe are banking, financial services and insurance (BFSI), healthcare, automotive and the public sector. These sectors handle sensitive and/or safety-critical data and face complex and strict EU regulations.

Tips:

- Find the right people. Consider hiring people who have the necessary qualities, but do not yet have the right requirements. You can train them on the job.

- Focus on employee retention. Invest in education, create a good work environment. In short: keep your employees happy and skilled.

Nearshoring versus offshoring

European companies prefer to outsource services to providers within the same country, a practice also known as domestic outsourcing or onshore outsourcing. When outsourcing abroad, they prefer providers in nearshore locations, because of proximity, language, cultural similarities, and minimal time difference. Software development projects (which include software testing) are often complex, long, and variable. This makes good communication between client and developer particularly important.

This is why most European companies that decide to work with software testers abroad prefer them to be part of their team. This means continuously communicating between the software developers and testers.

Traditionally, the buyer markets for software testing services are Western and Northern European countries. The most popular nearshoring locations for companies in these countries are Central and Eastern European (CEE) countries such as Poland, Bulgaria, and Romania. Not only do these countries offer the usual nearshoring benefits, but as they are members of the EU, contracts and payments are governed and protected by the same European legislation as in the buyer countries.

However, prices in nearshore countries are rising, partly driven by the shortage of software testers in these countries as well. This makes service providers in these countries less price competitive than offshore service providers. In turn, it makes European companies more open towards outsourcing to farther destinations. To avoid competition with CEE countries, you can choose to form subcontracting partnerships with these nearshoring providers.

Tips:

- Limit the possible disadvantages of being offshore. Provide excellent communication, availability in the required time zone, and good security and privacy measures.

- Differentiate yourself from onshore and nearshore providers to remain competitive. Emphasise how you are different in your marketing message. Do not compete only on price, but also analyse what other advantages you can offer, such as access to skills and specialised industry expertise.

- Partner with nearshore service providers, for example in CEE, that may be looking for ITO service providers with readily available resources.

3. Which European countries offer the most opportunities for software testing services?

The most promising European markets for software testing services are the UK, Germany, France, the Netherlands, the Nordic countries and Czechia. There are various factors you can look at if you want to find European countries with the most opportunities for software testing services, like:

- Market size and growth rate of the software testing sector;

- Shortage of software testing professionals;

- Level of cybersecurity regulations and requirements;

- Level of digital transformation and penetration of the latest technologies, and Industry 4.0;

- Openness to offshore outsourcing.

Figure 4: Selected promising European markets for software testing services

Source: Globally Cool

The UK, Germany and France are the largest markets for software testing in Europe. The Netherlands and Sweden are smaller but interesting markets. The Netherlands is known as a digital innovation hub in Europe. Sweden has a high digital maturity and is expected to produce 7.4 times more software than its local demand by 2030. Czechia is a smaller market but it has a relatively strong position in the global tech market.

It is important to understand that finding exact European market figures for software testing services is challenging. Software testing is not a standalone market category. It is linked to the software market, IT services and the software development industry. This means that when the software development industry grows, so does the demand for high-quality software testing.

Table 1: Market size and growth rate of the selected European software and software development markets

| Software market (revenue 2025) | Software market (CAGR 2025-2030) | Software development market (revenue 2025) | |

|---|---|---|---|

| Germany | €29.43 billion | 2.65% | €94.6 billion |

| UK | €34.82 billion | 4.83% | €53 billion |

| France | €16.43 billion | 2.56% | €11.5 billion |

| Netherlands | €9.47 billion | 2.93% | €42.6 billion |

| Nordic countries* | €15.46 billion | 2.67%** | €61.7 billion |

| Czechia | €1.74 billion | 3.55% | €11.1 billion |

*Denmark, Finland, Norway, and Sweden. **Average of the Nordic countries

Source: Combined statistics from Statista and IBISWorld, 2025

Germany: Largest economy in Europe

Germany is the largest economy in Europe, home to 19% of the EU’s population. The German economy is widely considered the stabilising force within the EU. The country’s main industries include the automotive, electrical, and chemical sectors. They increasingly rely on software to optimise production, improve products and remain competitive, a transformation referred to as Industrie 4.0. In the 2030 vision for industry 4.0, Germany focuses on 3 fields to successfully implement industry 4.0: autonomy, interoperability and sustainability.

Germany is home to some of Europe’s largest software companies, like SAP and Software AG. Nearly 100,000 companies operate in the German IT sector and about 50,000 in the software development sector. Germany had around 901,000 professional software developers in 2025. The revenue of the software market is expected to reach €29.43 billion in 2025. The market is expected to grow at a CAGR of 2.65%, reaching €33.65 billion in 2030.

As the German software market grows, so does the software testing market. The market growth is driven by:

- Digitisation, Industry 4.0 and advanced manufacturing initiatives;

- Cloud computing adoption;

- Increased demand for ICT security;

- Very strong ‘Mittelstand’, Germany’s small and medium-sized enterprises (SMEs) sector;

- Focus on innovation.

In August 2025, there were about 3,000 to 6,000 software testing roles open across Germany when combining listings from the biggest job platforms – Stepstone, Indeed and Glassdoor. This total includes many different job positions across various industries and cities.

Germany is traditionally not very open towards outsourcing, but the country made a big leap in accepting and adopting nearshore and offshore IT outsourcing practices. Germany’s generally firm corporate culture has softened in the past years.

There could be some language barriers when providing IT outsourcing services to Germany, as companies often prefer to work and collaborate in German. But this has been changing in recent years. English is now more widely accepted in nearshore and offshore outsourcing operations. In general, it is a good idea to have an intermediary in Germany to support and guide you and your potential clients.

United Kingdom: Largest software market in Europe

With a total revenue of €34.82 billion in 2025, the UK has the largest software market in Europe. It is expected to grow at a CAGR of 4.83% in 2025-2030. The UK software testing services market reached €1.27 billion in 2023. In 2018-2023, the market expanded faster than the overall technology sector and economy (CAGR of 4.2%). Software testing plays an important role in the UK’s tech hub. For 80% of UK tech leaders, software quality assurance was a top investment priority in 2024.

In the UK, there are about 188,000 businesses active in the ICT sector and 28,000 in software development. Around 849,000 professional software developers work in the UK.

Job listings for software testers or quality engineers in the UK have gone up by 25% since 2022. Based on job listings on the main UK job platforms like Adzuna, Totaljobs, Reed, Glassdoor, CV-Library and Indeed, in August 2025 there were an estimated 3,000-5,000 active software testing job openings. Roles include manual testers, quality assurance (QA) analysts, automation engineers and test leads across both permanent and contract positions. Industry reports suggest that the need for software testers is expected to grow significantly over the next 5 years.

UK’s capital city, London, is known as Europe’s fintech hub. The financial services sector is the largest source of revenue for software testing companies. Other prominent sectors driving demand for software testing include healthcare, gaming and retail.

Of all European markets, the UK is one of the most open to offshore outsourcing and the least cautious about doing business with developing countries. This openness is due to the nation’s cost-saving business culture and historical ties to many countries across the globe.

France: Another large European player

The revenue of the French software market is estimated at €16.43 billion in 2025. The market is expected to grow at a CAGR of 2.56%, reaching €18.7 billion by 2030.

As in many other European countries, the French software testing industry is driven by:

- Cloud computing and SaaS systems penetration;

- Digital transformation;

- AI development;

- Government initiatives (La French Tech and France 2030).

France has more than 56,000 businesses in the software development industry and about 533,000 professional software developers. Like most European countries, France also faces a skills shortage in software testing professionals.

A 2023 survey by CFTL (the French Software Testing Committee), with 531 respondents, found that software testing is considered most important in API/web services, web platforms, ERP and other types of enterprise applications, and mobile application development projects. Test automation is fully or partially implemented in a CI/CD process in most cases (67% of respondents). The most important non-functional test types are security, usability and performance.

France is generally a difficult market for ITO service providers, because offshore or nearshore IT outsourcing is less popular. However, if you speak French, the market entry barrier for offshore outsourcing is much lower.

The Netherlands: Innovative technology market

The Netherlands is an important IT hotspot. Over half of the Fortune 500 companies maintain IT operations in the Netherlands. The country ranks as the 10th best startup ecosystem globally and 6th in Europe. In 2023, there were over 87,000 businesses in the Dutch high-tech industry employing nearly 500,000 people. The Dutch software industry is a significant and growing sector within Europe. The software industry is projected to grow from €9.47 billion in 2025 to €10.97 billion in 2030, a CAGR of 2.93%.

The Netherlands is also at the forefront when it comes to the share of companies’ investment in intangible assets like software, data and website activities. In the EU, the country has one of the highest levels of digital technology adoption. Also, with 95% of Dutch companies using AI programmes, the Netherlands also leads in AI automation. As software, systems, automation and digitisation keep growing, the need for software testing increases as well.

The Netherlands also has a high density of tech talent relative to its population, thanks to competitive salaries, an attractive work-life balance and an advanced digital economy. However, they also have 26 job openings for every available tech worker. In 2024, 63.1% of Dutch recruiting companies faced issues with filling vacancies for ICT specialists. This shortage could drive many towards outsourcing solutions and it makes the country a particularly interesting market. Also, looking particularly at software testing, there is a high demand for software testers, QA engineers and test automation engineers.

Companies in the Netherlands are traditionally fairly open towards outsourcing. According to a 2025 Dutch IT sourcing study, 37% of survey respondents, consisting of top IT spending organisations, plan to increase IT spending on external providers over the next 2 years. This is a little less than in 2024 (a 6% drop), but it still shows that a large portion of the market is planning to expand its outsourcing activities.

The main drivers for outsourcing IT services are scalability to business needs and the desire to focus on core business functions. IT spending on external providers is expected to be the highest in the public sector (62% of respondents). In the financial services and manufacturing and chemicals sectors this is lower – 38% and 26%, respectively. When looking at nearshoring, 40% of respondents plan to increase nearshoring ITO activities. Language barriers are generally not an issue, as the Dutch are very proficient in English.

Nordic countries: Cluster of technological advancement

The Nordic markets, consisting of Denmark, Norway, Sweden and Finland, are a cluster of technologically advanced nations. These markets are seeing a growing demand for software testing services. This is a direct result of the region’s ongoing commitment to digital transformation. Across all sectors, from fintech to innovative healthcare and public services, new software and digital solutions are constantly being developed. Each solution requires careful testing to ensure reliability and security. Nordic companies are at the forefront of innovation, pioneering the development of advanced technologies like AI and (I)IoT.

The Nordic markets are smaller than the German, British, French or Dutch market; yet the significant IT talent shortage, in combination with their strong economies and openness towards outsourcing makes this region an interesting market to focus on. Also, the Nordic countries are leaders in digital adoption. They receive some of the highest software funding per person, and have strong access to capital and an active local tech industry.

Among the Nordic markets, Sweden generates the highest revenue in software and software development – €5.51 billion and €39.3 billion, respectively. The Swedish software market is also expected to show the strongest growth, a CAGR of 3.25% for 2025-2030. Looking at software testing in Sweden, a growing need for testing-related skills like test management and test automation is expected in the coming 3-5 years. Companies are also looking for experienced talent for testing positions.

Denmark has the second-largest software market among the Nordic countries. Enterprise software is the largest segment, with an estimated market volume of €1.59 billion in 2025. There is a strong demand for business software solutions in the country. The sector is a key contributor to Denmark’s digital economy.

Table 2: Market size and growth rate of the Nordic software markets and software development markets

| Software market (revenue 2025) | CAGR 2025-2030 | Software development market (revenue 2025) | CAGR 2020-2025 | |

|---|---|---|---|---|

| Sweden | €5.51 billion | 3.25% | €39.3 billion | 7.1% |

| Denmark | €3.76 billion | 2.94% | €5.6 billion | 3.5% |

| Finland | €3.2 billion | 2.48% | €9.1 billion | 6.2% |

| Norway | €2.99 billion | 1.99% | €7.7 billion | 8.2% |

Source: Combined statistics from Statista (2025) and IBISWorld (2025)

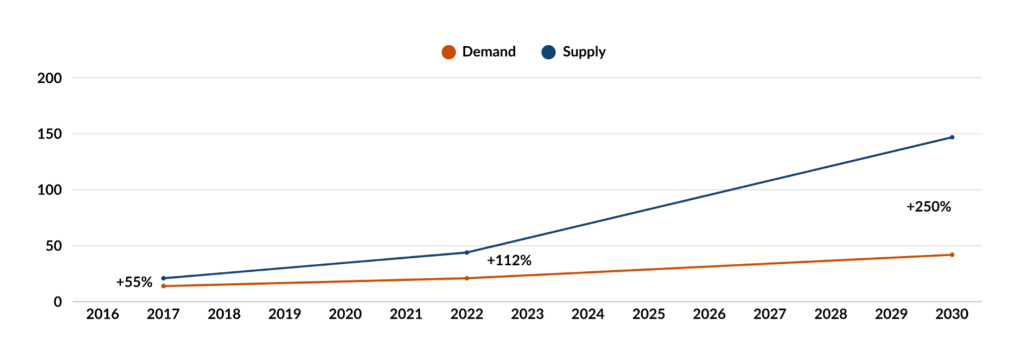

According to McKinsey & Company, software companies in the Nordic countries have experienced rapid growth, transforming the region into a net exporter of software. In 2022, Nordic software supply exceeded local consumption by 112%. If this trend continues, it could reach an output 3 to 4 times its local consumption by 2030. This growth has attracted investors, making the Nordic region Europe’s fastest-growing software funding hub. The increase in software development and export activity in the Nordic region suggests a growing need for software testing services.

Figure 5: Software supply and demand of Nordic countries (revenues in $ billion)*

*Supply is defined as the global revenues from software companies with Nordic headquarters or heritage. Demand is defined as revenues in the Nordics by software companies from across the globe.

Source: McKinsey & Company, 2024

Czechia: Large shortage of IT professionals

Czechia is a well-known nearshoring destination in CEE. It is a smaller country with a relatively strong position in the global tech market. Czechia has a good reputation as an ITO destination. The country has an educated and technically proficient talent pool, with strong expertise in software engineering and quality assurance. Czechia combines technical excellence, affordability and proximity to Western markets. This makes it an attractive outsourcing hub for software testing services for European clients looking for quality and reliability at a lower cost.

Czechia is also known as an innovative technology hub. In 2025, Czechia's startup scene grew, moving up 2 places to 30th in the world and third in Eastern Europe. The country has about 127,000 professional software developers (2023).

In 2024, 70% of Czech companies with IT vacancies struggled to fill its positions. After Germany, this was the highest rate of any EU country. Because of the shortage of IT and software testing professionals, the Czech IT market offers promising opportunities for specialised companies from developing countries. The best market entry channel is partnering with Czech IT companies.

The ICT sector in Czechia is showing steady growth. This positions the country as an important player in the European digital economy. In 2025, revenue in the Czech software market is estimated at €1.74 billion. By 2030 the market size is expected to reach €2.07 billion, with a CAGR of 3.55%. The IT services market size is projected to reach €5.60 billion in 2025. This market segment is expected to grow at a CAGR of 3.86%, reaching an estimated €6.78 billion by 2030.

Tips:

- Select your target market not only based on size, but also on cultural similarities, time zone differences, historical ties and shared languages.

- Use the member lists of relevant industry associations to identify potential buyers. You can also attend (online) industry events like EuroSTAR. Check out the list of Software Testing Conferences, and connect with online testing communities.

- Make sure you have access to skilled professionals, for example by working with universities, setting up training courses or centres, systematically collecting and analysing CVs, and having a partner network of companies and individuals.

- Emphasise your professional skills in your marketing, as well as the lower costs you offer. For more ideas, see our tips for finding buyers on the European outsourcing market.

4. Which trends offer opportunities or pose threats in the European software testing services market?

In Europe, the growing adoption of new technologies, digital transformation and automation is driving demand for professional software testing services. At the same time, emerging technologies like AI, machine learning (ML) and IoT offer significant opportunities for innovative testing solutions and service offerings.

Although you should stay up to date on the latest trends and techniques in software testing demand, you cannot tap into each trend. Focus on those that suit your business, skills, and expertise, and that may enhance growth.

Added value partners

In offshore software testing, you cannot only differentiate yourself from your competitors by focusing on cost, but also by the value you bring as a partner and the full range of services you provide.

An added value partner:

- Runs tests, finds bugs and sends reports;

- Learns the business and industry rules, so that testing fits real needs;

- Suggests smarter ways of working: automation, better QA processes, new tools and early problem detection;

- Can scale the team when projects grow or change;

- Facilitates clear communication to prevent misunderstandings and delays.

In short, an added-value partner becomes an integral part of the European team, helping to deliver high-quality software, lower costs, save time and work efficiently.

Strong growth in security testing

The digital threat landscape is changing fast in Europe. Cyberattacks are becoming more frequent, larger in scale and more sophisticated. To tackle this, new regulations such as the NIS2 Directive and Digital Operational Resilience Act (DORA) have been introduced. These regulations require organisations to carry out thorough security testing, particularly in sensitive industries like finance, energy and healthcare. Measures that follow for sensitive industries include regular automated scanning, managed vulnerability lifecycle, periodic and advanced penetration testing, and faster incident reporting and post-incident analysis.

The European security testing market is projected to grow at a strong CAGR of 23%, from a market size of €27.12 billion in 2025 to €75.16 billion in 2030. This growth is also driven by a rising demand for advanced techniques like Interactive Application Security Testing (IAST) and quantum-resistant cryptography testing.

Increased adoption of AI testing

Artificial intelligence (AI) is changing how software is being tested. AI makes the process much faster, more efficient, and way more accurate. AI-powered tools like automated test case generation, predictive bug detection and self-healing tests are quickly becoming standard in the industry. AI-driven testing can increase test coverage by up to 85%, cut testing costs by around 30%, and speed up bug reporting by up to 90%. By freeing up human testers, companies can concentrate on complex testing and higher-level analytical tasks.

AI-augmented software quality assurance has greater strategic value because of faster innovation, lower costs, higher software quality and improved customer satisfaction. In the end, it gives software testing companies a competitive advantage in the market.

The rise of test automation

Software development requires management of a large number of tests and repetitive tasks. Test automation has become an important part of the SDLC. It allows teams to work faster, more efficiently and with greater accuracy. Automating routine testing tasks enable developers to discover errors earlier, receive continuous feedback, shorten testing cycles and maintain high code quality throughout the process.

There are more advantages of test automation besides increased productivity. It also fits well with Agile methodologies and DevOps practices, making it possible to deliver updates more frequently and speed up release cycles. As software and systems become more complex, test automation is no longer just nice-to-have. It is essential for ensuring reliability, accuracy and competitiveness.

The global market for automated testing is projected to reach €17.65 billion in 2025, with a CAGR of 17.3%.

Green SQA is a Colombian company that provides quality assurance services for technological solutions. It offers a broad range of QA solutions, including functional and non-functional software testing, security testing, automated testing and ML model testing. The company has developed 2 codeless automated testing tools. By automating testing tasks, they can save time and money, detect errors faster, reuse the same automated tests across different projects, and increase accuracy.

Another trend is low-code and no-code testing tools. It allows testers to create automated tests without the need to write programming code like Java and Python. Instead, these tools use visual interfaces, drag-and-drop workflows, and record-and-playback features to help testers develop test cases. Some tools integrate AI to automatically create test scripts. Examples are Testim and Leapwork.

The benefit of low-code and no-code testing is that it accelerates the test automation process. Also, it reduces maintenance because many tools automatically update tests when the user interface changes. But there are also limitations: these tools usually offer less flexibility for complex and/or highly customised test cases.

Tips:

- For more information on low-code and no-code, read our article Six benefits of offering low and no code technology to the European market.

- Another trend to look out for is shift-left testing. In this approach, testing activities are moved earlier in the software development lifecycle (SDLC). The goal is to find and fix defects sooner, to improve software quality.

- Move fast and build your capabilities and capacity in software testing services.

- Closely follow the latest software testing trends. Trends in the software development industry directly influence the software testing industry. For information on ITO trends, see our study Which trends offer opportunities or pose threats on the European outsourcing market. Also look at Exporting software development services to Europe, to learn more about the European software development sector.

Globally Cool carried out this study on behalf of CBI in collaboration with Laszlo Klucs.

Please review our market information disclaimer.

Search

Enter search terms to find market research