Which trends offer opportunities or pose threats on the European outsourcing market?

The European outsourcing market is influenced by many different trends. General trends include demand for cybersecurity, rising use of artificial intelligence (AI), sustainability and increased interest of European SMEs in outsourcing. Other trends are also influencing the ways in which companies do business. Buyers are looking more and more for added value, flexibility, agile processes and access to skilled people.

Contents of this page

- The European outsourcing market is transforming

- AI-augmented software development

- Intelligent automation

- Sustainability and ESG

- Cybersecurity and regulatory compliance remain a top priority

- Strategic partnerships: Outsourcing providers as part of the buyer’s team

- Value over price

- Agile methodologies

- Customisation and flexibility

- SMEs are increasingly open towards outsourcing

1. The European outsourcing market is transforming

The European outsourcing market is changing. This change is driven by new business needs, technology advancement and buyer expectations. The shift from the current situation to what is expected in the near future is presented in table 1. The table highlights important changes. This includes a shift from working with a few suppliers to focusing on ecosystem-based collaboration. It also shows how technology (like AI) is becoming more important in outsourcing, as well as how businesses are placing more value on efficiency and agility.

Besides changing how companies work with outsourcing providers, these changes are making outsourcing services more accessible to small and medium-sized enterprises (SMEs). This creates new opportunities in the market.

Table 1: Sector transformation

| Current trends (2025) | Trends that shape the future | |

|---|---|---|

| Doing business |

|

|

| How you run your company |

|

|

| Your product or service |

|

|

| Economics |

|

|

Source: Globally Cool

2. AI-augmented software development

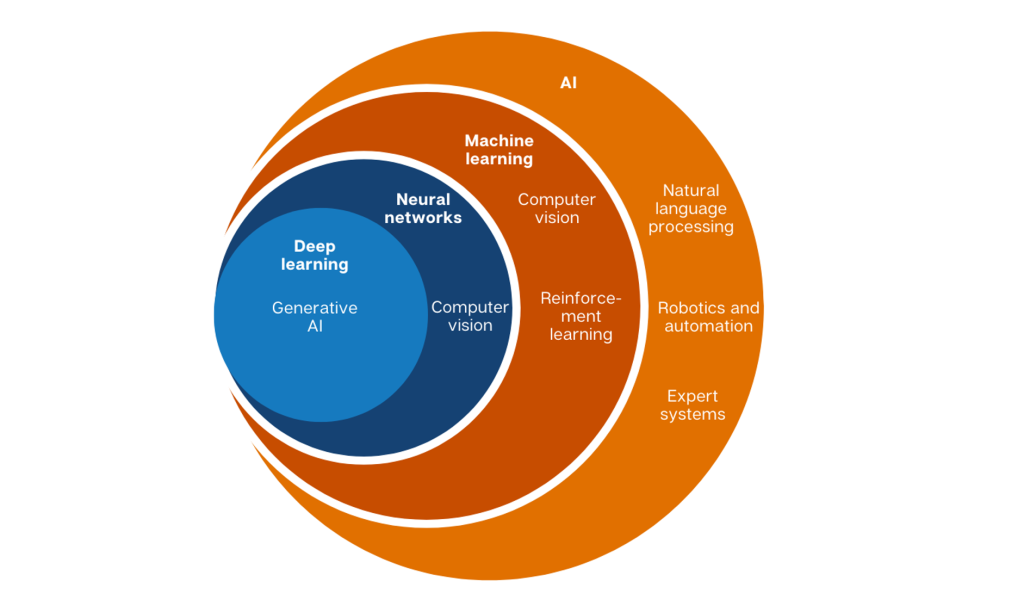

AI-augmented software development is one of the most important changes in technology. Large language models (LLMs) and other AI tools are already changing how developers work. They can speed up coding, take over repetitive tasks and improve testing, deployment and software maintenance. This means that projects progress faster, with fewer delays and errors. AI copilots (like GitHub Copilot and ChatGPT integrations) are becoming standard in outsourced teams, speeding up delivery and lowering costs.

The impact is not just about efficiency. AI tools give development teams more time to focus on tasks that require more creativity. These are tasks like system and user interface design or planning of new features. AI can also help with documentation and managing DevOps. These activities are often time-consuming but they are crucial to keeping projects on track.

AI-augmented software development offers opportunities. But you should also be aware that AI tools have their limitations in assisting with coding. A 2024 study from Purdue University found that about 52% of ChatGPT’s programming answers were incorrect. Another risk is vulnerability replication. For example, GitHub Copilot may advise insecure code in projects with insecure codebases. This creates more vulnerabilities. This is why you should be critical about the output generated by AI. Do not automatically assume everything is correct.

Looking ahead, Gartner’s Hype Cycle for Software Engineering study suggests that by 2027, 50% of enterprise software engineers will use AI-powered coding tools. They also expect technologies like AI-augmented software engineering to reach mainstream adoption in the short term. But AI systems do not have the capability to handle the entirety of software development processes by themselves; they need human input. This is not expected to change in the near future, because these tools are still in their early stages. They will need broader testing to prove their value. Although integrating AI into all stages of software development brings opportunities, it will not happen in the short term.

Looking ahead, some of the AI-related software development trends that will define the sector by 2030 are:

- AI-powered code review and security checks will be built directly into the development tools. AI assistants will identify vulnerabilities and suggest improvements;

- AI systems will be integrated directly into the SDLC;

- It will become more important for AI components in software to be free from bias. Just as privacy and security are crucial today, in the next 5 years AI components that are unbiased and aware of culture, identity and context will be a basic requirement.

For companies, the takeaway is clear: we cannot ignore these tools any longer. AI tools help software development teams improve productivity and efficiency, and this reduces costly errors. AI supports data-driven decision-making, assists in onboarding, and frees up time that can be used for tasks that require more creativity. But you should be aware of the limits of AI tools. All in all, AI-augmented software development can help ITO service providers in developing countries to stay competitive and offer innovative solutions to European buyers.

Figure 1: AI technologies

Source: Globally Cool

Redwerk is a Ukrainian software development company offering AI-augmented development services, including mobile app development, QA testing services, code review and SaaS development. In the area of AI-augmented development services, they have experience with:

- AI-assisted coding with reusable patterns;

- AI-powered code reviews with auto-correction;

- AI-augmented consulting for development;

- AI-augmented DevOps and CI/CD automation;

- AI-first SDLC management.

Tips:

- As with any new skill, learning to work with AI will require investment of time and effort. In the long run, however, these investments are very likely to pay off.

- Appoint an AI productivity team within your company. This team can explore how your business can benefit from the use of AI tools.

- Given the speed of developments in AI, you should regularly check sources to find new ways of using AI for your business. Useful sources include articles like The Impact of Generative AI on Tech Outsourcing Models and How to choose the Right AI Tools for Software Development Projects. You can also read our study on 6 tips to go digital in the outsourcing sector.

- For more information about AI, read our study Exporting artificial intelligence software development services to Europe.

3. Intelligent automation

Intelligent automation (IA) is becoming more popular in Europe. It combines robotic process automation (RPA) and artificial intelligence (AI).This lets companies do more than just automate basic tasks and repetitive work. With IA, complex, data intensive processes can be managed with minimal human effort.

RPA is based on rules, but AI adapts based on data and can improve over time. RPA is good at repeatable and programmable tasks, like copying data between systems, processing invoices and generating reports. On the other hand, AI recognises patterns, predicts trends, interprets text and analyses behaviour. Together, AI and RPA can create systems that not only perform tasks but also keep improving as they learn over time.

The advantages are clear. IA allows for more strategic and innovative work and ensures that processes run smoothly. IA is especially useful in industries like finance, healthcare and logistics where speed, accuracy and regulatory compliance are essential.

IA is also an important component of Industry 4.0. Industry 4.0 is about smart manufacturing, where, companies add new technologies like AI, cloud computing and Internet of Things (IoT) to their operations. With the help of IA, production can be automated and sensory data can be analysed. It can predict equipment failure and maintenance and improve quality control as well. IA also helps connect workflows across people, machines and digital platforms. This makes operations more robust and productive.

From a broader perspective, IA helps drive digital transformation across Europe. More organisations are modernising and digitising their operations. They need outsourcing partners who can integrate IA into existing systems and processes without disrupting business. For small and mid-size ITO providers, offering IA solutions and related software development services can be a good opportunity. They can position themselves as innovative partners who can help clients cut costs, strengthen operations and achieve long-term value.

Innora is a Ukrainian company that uses IA. It develops IA solutions by combining smart software, AI and RPA to automate processes. They serve clients in various industries like retail, financial services and manufacturing.

In the short term, AI and RPA are expected to merge into agentic automation and hyperautomation solutions. Agentic automation means that automation is driven by AI-powered bots. These are able to make decisions and take actions on their own. Hyperautomation focuses on automating every process in a company that can be automated. It involves using multiple automation tools (like AI, RPA and other technologies) to streamline operations and make it possible to run processes without human intervention.

In the long term, agentic automation will become more capable but still selective. Some routine decisions will be handled autonomously, and multi-agent systems will coordinate tasks. But broad autonomy will still be limited to specific domains. Hyperautomation will become bigger and cover entire processes. Companies will move from point automations to end-to-end automated pipelines, managing large business processes.

Tips:

- Build strategic partnerships with European technology companies that serve clients with a high volume of repetitive tasks and data-intensive processes. Work together with your partners and suggest IA solutions to improve efficiency, speed and accuracy. Position yourself as an IA implementation partner with AI integration capabilities.

- Learn about IA tools and platforms to stay competitive. Focus on niche, specialised market segments like credit scoring in Fintech or fraud detection in InsurTech.

4. Sustainability and ESG

When outsourcing, sustainability and responsible business practices are important for European companies. ITO and BPO providers entering the EU market are often expected to show their commitment to sustainability. Introducing sustainable practices can improve your competitiveness and help build trust with potential European clients.

ESG stands for environmental, social and governance. It is used to measure the sustainability and ethical impact of companies. ESG is often mentioned alongside sustainability and Corporate Social Responsibility (CSR). All the concepts are related and important. CSR and sustainability both cover the broader ideas and goals of social and environmental sustainability. But ESG is more concrete and offers a measurable approach. European clients more often choose partners who support their ESG goals.

European governments are also pushing for sustainable solutions. The European Green Deal is a roadmap for Europe to become a climate-neutral continent by 2050. As part of the Green Deal, the Corporate Sustainability Due Diligence Directive (CSDDD – EU 2024/1760) entered into force in July 2024. This directive requires larger companies to act in a sustainable and responsible way in their business practices and global supply chains. It sets rules for companies to identify and address problems that may harm human rights or the environment in their operations and subsidiaries, and amongst their business partners. This directive might indirectly affect smaller ITO/BPO providers through their buyers.

Also, in December 2024 the Forced Labour Regulation (FLR – EU 2024/3015) entered into force. It bans products from the EU market that are made with forced labour. The regulation applies to all products, including their components, regardless of their country of origin. Although these laws might not yet apply to you, it would be wise to familiarise yourself with them and be prepared for their implementation.

You can also improve your market position and credibility by following the key principles of voluntary sustainability standards. For example:

- ISO 26000: provides guidance on integrating social responsibility into business strategies;

- ISO 14001: sets criteria for an environmental management system (EMS), which you can achieve certification for.

You can strengthen your sustainable and socially responsible practices even more by becoming an Impact Sourcing and/or Fair Trade software supplier. Impact Sourcing is a socially responsible hiring practice, and Fair Trade Software is an industry-specific framework for ethical software development.

Video 1: 'Go home!' computers tell India start-up workers

Source: Reuters

Tips:

- Write your own sustainability policy. It does not have to be perfect, and you do not need to have an answer to all sustainability issues within your company or the sector. The most important point is that many buyers appreciate the fact that a provider has a CSR policy. It indicates that you understand what it means and that you are motivated.

- Consider implementing fair labour practices, using green solutions for environmental protection, and developing community involvement programmes.

- Read our studies about sustainability in the outsourcing sector: 7 tips on how to go green in the outsourcing sector and 7 tips on how to become more socially responsible in the outsourcing sector.

- For more information on how to build green software, visit the website of the Green Software Foundation.

5. Cybersecurity and regulatory compliance remain a top priority

As cyberthreats continue to increase, one of the most prominent trends in the outsourcing market is the growing demand for cybersecurity services and solutions.

The demand for cybersecurity is increasing, driven by the rising frequency and sophistication of cyberattacks across the region. According to ENISA, between July 2023 and June 2024, the EU experienced 11,079 reported cyber incidents. The most common threat type was DoS, DDoS, and RDoS, accounting for 46% of all cases.

In the long-term (2030), there are several emerging cybersecurity threats in the EU that are expected to have an impact, of which the top 5 include:

- Supply chain compromise of software dependencies;

- Skills shortage;

- Human error and exploited legacy systems within cyber-physical ecosystems;

- Exploitation of unpatched and out-of-date systems within the overwhelmed cross-sector tech ecosystem;

- Rise of digital surveillance authoritarianism/loss of privacy.

Another major factor contributing to the rising demand for cybersecurity in Europe is the introduction of new European regulations and directives. These include the Cyber Resilience Act (CRA), the NIS2 Directive, and Digital Operational Resilience Act (DORA). While these regulations aim to strengthen the overall cybersecurity across the EU, they also stimulate market expansion. Their implementation will demand scaling across multiple areas of cybersecurity,. This creates opportunities for growth within the sector.

As a result, European companies are increasingly turning to third-party providers for advanced cybersecurity services and solutions. This includes everything from managed security services to the development of cloud-based security platforms.

The EU is enforcing strict data privacy requirements (like the GDPR). This leads to European companies becoming more and more concerned about how their IT outsourcing partners are handling cybersecurity and data compliance. Buyers expect ITO partners to handle all personal/sensitive data and intellectual property in a compliant and secure manner. They should meet legal requirements and protect privacy. So, make sure you comply with EU regulations (like the GDPR), country-specific laws (like Germany’s BDSG), standards like ISO 27001 and industry-specific standards.

You should make sure that the products or services you deliver include solid security practices. You can do this by, among others:

- Implementing secure coding practices and standards;

- Using a secure development environment;

- Encrypting sensitive data;

- Implementing strong authentication and authorisation;

- Continuously scanning for vulnerabilities;

- Implementing security monitoring, logging, and auditing practices;

- Setting up a comprehensive incident response plan;

- Training employees about cybersecurity;

- Maintaining backup, recovery, and business continuity plans;

- Working with memory safe programming languages (see the section below);

One important trend in cybersecurity is the growing use of memory safe programming languages. For traditional languages (like C and C++), high performance, speed and efficiency are more important than security. This makes them sensitive to memory management vulnerabilities (such as buffer overflows and memory leaks), which are often used by attackers. As a result, European buyers often use memory safe languages, such as Rust, Go and Java. These languages offer strong security measures without sacrificing performance.

To improve code level security, recent software development trends encourage combining these languages with automated static analysis, fuzz testing and secure coding practices.

Also, by implementing privacy-focused solutions (such as data anonymisation, access controls and consent management) you can show buyers that you prioritise both security and data privacy. Besides reducing regulatory risks, doing this can help build trust with clients who rely on you to protect their sensitive data. Privacy-focused practices and memory safe languages allow organisations to reduce risks at code and data level.

One company focused on cybersecurity is DATAPROTECT. It is a Moroccan SME that has clients in different parts of the world, including Europe. The company offers managed security services (MSSP), offensive security services (using a DevSecOps methodology) and cyber defence solutions (like network, data, and host and endpoint security). The company holds various accreditations, like PCI QSA, PCI QPA and PCI CPSA. DATAPROTECT is also an Accredited Training Center (ATC) for certificate-based cybersecurity courses for the EC Council.

Outsourcing cybersecurity services also comes with different threats:

- Data breaches and leaks: sensitive client data handled by ITO service providers can be exposed through weak security controls, misconfigured cloud systems or insider misuse;

- Third-party vulnerabilities: cyberattackers may target offshore service providers, because they think they are an easier way to break into the client’s systems;

- Non-compliance with data protection laws: ITO service providers may mishandle data that crosses borders, violating GDPR;

- Changing compliance landscape: new regulations on AI use, data localisation and operational resilience increase the burden on ITO providers.

Tips:

- Communicate to your clients how seriously you take cybersecurity. Also, emphasise this in your marketing message. Do this in your general marketing (for example on your website and in advertisements) as well as your personalised marketing (when sending proposals).

- Highlight your commitment to data compliance and privacy as well, thereby demonstrating that your services align with GDPR requirements and other relevant regulations. Emphasise these compliance measures in all communications with clients.

- Consider offering services concerning cybersecurity like managed security services, cloud-based security platforms, or hiring out managed services providers.

- For more information about cybersecurity, read our study Exporting cyber security products and services to Europe.

6. Strategic partnerships: Outsourcing providers as part of the buyer’s team

The working relationship between buyers and providers of outsourcing services is changing. Buyers are more often moving towards hybrid models and ecosystem-based outsourcing. A good relationship is essential. In these outsourcing models, there is often a lead (strategic) partner and a group of specialised service providers, managed by the lead partner. Besides this, some buyers are entering into relationships with outsourcing providers to make them their research and development (R&D) partner.

From preferred suppliers to hybrid models, buyers in Europe are experimenting with dynamic hybrid models and ecosystem-based collaboration. Instead of selecting and working with one major supplier, they rely on one (or a few) strategic partners alongside a network of smaller, highly specialised service providers.

The advantage of this model is that it lowers the risk of becoming dependent on a single vendor. It also gives buyers access to specialised expertise and allows them to scale more easily in an environment where talent is scarce. Because service providers have to compete and collaborate at the same time, it inspires fresh ideas and innovation. It also makes the ecosystem more hardy if there is a geopolitical crisis or a supplier failure.

In Europe, compliance, security and sustainability are becoming more important. In a multi-vendor outsourcing setup, European companies often mix-and-match contract types and vendor responsibilities. One vendor might handle sensitive tasks to ensure GDPR compliance and data residency, while specialised ITO service providers focus on innovation and cloud migration. European companies are moving towards a multiple ITO service provider model. One of the reasons is that a single supplier cannot always cover innovation, compliance, security and sustainability all at once.

Outsourced teams are often treated like an extension of the clients’ own R&D department. European companies are experimenting with co-created solutions, MVPs, and even sharing IP rights. These hybrid models also bring new pricing models, like pay-per-feature and subscription-based access to people. The pay-per-feature pricing model is based on micro payments, tied to user stories or backlog items. This fits well with agile development methodologies.

Hybrid models have their downsides too. When responsibility is spread across multiple service providers, lines can become blurred. Processes may not always align, integration can be challenging, and governance gets more complicated. Many European buyers adopt Service Integration and Management (SIAM) frameworks. This is reinforced with shared KPIs, online collaboration platforms, and more often with DevOps practices. Usually there is still a lead vendor that coordinates inputs from the smaller providers so that the delivery feels seamless to the client.

AI is an important driver and enabler of hybrid outsourcing models. Buyers are building networks of specialised providers with various types of AI-related expertise. AI-powered governance tools help manage operational and management complexities. AI copilots boost productivity, while AI-based analytics support better decision-making.

Multi-vendor outsourcing relationships create opportunities for smaller, specialised ITO service providers from developing countries. In the past, it was very difficult for these providers to become a preferred supplier to a European company. Today smaller, highly specialised service providers have more business opportunities to participate in hybrid or ecosystem-based outsourcing models.

TJIP is a Dutch company that uses a multi-vendor outsourcing strategy. This approach has enabled them to deliver superior software products to their clients. The most important advantage is that it gives them the flexibility to manage business change, and the diversity of teams across the globe increases their capacity for innovation. For more information, check out their case study on multi-vendor outsourcing for the financial industry.

Table 2: Advantages and disadvantages of hybrid models

| Advantages of hybrid models | Disadvantages of hybrid models |

|---|---|

| Lowers dependency on a single vendor | Lines get blurred when dealing with multiple service providers |

| Gives access to specialised expertise | Integration is more difficult |

| Makes it easier to scale up operations | Governance gets more complicated |

| Inspires fresh ideas and inspiration among service providers | Processes do not always align |

| Makes the ecosystem more resilient |

Source: Globally Cool

Outsourcing providers as external R&D departments

Outsourcing partners are being seen and treated more and more as external R&D departments. This trend is largely due to the lack of available talent in many European countries.

New technical developments are creating possibilities for great progress, but it is hard to find the right people to work on them. Many European (start-up) companies have tried to hire talent themselves, to research and develop new ideas for their businesses, but they have often been unsuccessful. For this reason, they are increasingly interested in outsourcing. Companies are looking for outsourcing partners to serve as an extension of their R&D departments and come up with innovative solutions.

Imagine a scenario in which a buyer has decided to partner with you. Your buyer operates in the HealthTech industry and would like to develop an innovative telemedicine platform (AI augmented platform for the remote diagnosis and treatment of patients). The buyer lacks the in-house expertise and resources for extensive R&D in this field.

In this scenario, you are acting as an extended R&D department. You start by defining the vision, concept and broad requirements. Then, you conduct a thorough market analysis in which you assess current trends, competitor offerings, and emerging technologies related to telemedicine. You should also investigate regulatory requirements and user preferences.

Based on what you have learned, you identify key opportunities and challenges related to telemedicine. You then propose a range of innovative features and functionalities that could differentiate your buyer’s platform in the market.

Next, you start prototyping and testing various components of the telemedicine platform. You develop proof-of-concept models, MVPs (Minimum Viable Products), conduct usability studies, and fine-tune the user experience.

Throughout this process, there are continuous collaboration and feedback loops between you and your buyer. These loops provide insights based on domain knowledge and specific requirements, and you provide technical expertise and creative solutions.

As the project moves forward, you fine-tune the platform based on feedback and insights gained from testing. You make sure that the technology is scalable, secure, and compliant with industry standards.

Finally, you deliver a telemedicine platform that not only meets your buyer’s initial vision, but that also has innovative features that set it apart in the market. In this way, you have acted as a valuable R&D partner. You used the buyer’s expertise to drive innovation and enhance your buyer’s competitive edge in the healthcare industry. Other specialised service providers might be involved along the way, for example for UX/UI design and security testing.

In this scenario, success requires a combination of technical expertise, industry knowledge, and strong communication skills. Examples of such skills include:

Technical proficiency:

- Expertise in AI, data analytics, software development, including relevant programming languages, frameworks and technologies;

- Knowledge of technologies, protocols and best practices in telemedicine;

- Experience in developing platforms that are scalable, secure and compliant.

Innovation and creative problem-solving:

- Capacity for innovation;

- Creative problem-solving skills;

- Ability to translate technical concepts into understandable insights for the buyer, and the other way around;

- Openness to incorporating domain knowledge and specific requirements provided by the buyer into the development process.

Project management:

- Project management and collaboration skills;

- Communication skills regarding project status, potential challenges and proposed solutions;

- Assurance processes to ensure the platform is compliant and that it meets the required standards.

This trend is relatively new in the outsourcing industry. But it is predicted that it will grow significantly within the next 4 to 5 years. This is mainly due to the significant talent shortage in Europe and the fast development of technologies like AI.

Another reason this trend is growing is that it offers opportunities for European companies. When they see their competitors working with outsourcing partners as extensions of their R&D departments, they might decide to follow their example. But there are also risks associated with R&D outsourcing. For example: IP protection, loss of strategic control, quality and technical risks, and concerns about confidentiality and data security.

For data protection, some developing countries may not have solid data protection laws. Sometimes, they have them but do not fully enforce them. Also, smaller vendors often do not have the expertise or resources to fully comply with standards like GDPR or ISO 27001. Regarding IP protection, IP ownership is sometimes unclear: contracts may not clearly define who owns what. And sometimes contracts are not good enough because of weak or poorly drafted agreements. Even when there are contracts, enforcement can be difficult or costly in a different legal system.

If you think your company has the potential to act as an outsourced R&D department for your buyers, consider steering your company in that direction. There are opportunities for both ITO and BPO providers.

Tips:

- Invest in the relationships you have with your buyers. Examples could include proactive engagement, actively seeking feedback, and being a collaborative partner. Regularly ask buyers about their needs and offer innovative ideas and solutions to help them stay ahead in their industry.

- Understand your buyer’s business. Take the time to understand each buyer’s business, industry and specific needs. Go beyond surface-level knowledge, and delve into their strategic goals, difficulties and market challenges. Once you understand a buyer’s operations, you will be able to customise your services and solutions to align with the goals of that buyer. This will demonstrate to buyers that you are committed to their success.

- Build trust by consistently delivering high-quality services and meet or exceed agreed-upon deadlines. Maintain open and transparent communication channels, provide regular updates of your progress and address any concerns quickly.

- European companies prefer suppliers who can scale up when needed. Have a plan ready in case you need to scale up and attract new talent. Present this plan to current or potential buyers to show that you are prepared. In addition, do not forget about the talent you already have. Invest in your people.

- If you are aiming to become an R&D partner for your buyer, be sure to emphasise how you can contribute to the development of your buyer’s company. Illustrate your vision with real-life examples of how outsourcing providers have contributed to the business success of their buyers by coming up with new business ideas or improvements.

7. Value over price

In the ITO and BPO industry, experts are seeing a shift towards prioritising value over price. Buyers expect higher levels of service and are seeking suppliers who can meet these new standards more and more. Value is no longer just about the cost-quality trade-off. More and more often, value includes innovation, speed, ESG compliance and resilience. As a result, the industry is seeing a shake-out. Here companies that cannot meet these higher expectations face the prospect of losing their former buyers.

Another aspect of this trend is an increasing demand for niche talent. Buyers are looking for suppliers who can provide specialised expertise, industry-specific knowledge, and innovative solutions customised to their unique business needs. This change is in line with the trend in which generic outsourcing approaches are no longer sufficient to address complex challenges and achieve strategic objectives.

This shift is speeding up new commercial and delivery models, like:

- Outcome-based contracting (OBC): in OBC, payments are tied to the achievement of measurable outcomes;

- Talent-as-a-Service: an on-demand subscription model that gives companies access to skilled professionals. It offers flexibility by letting companies bring in experts for specific projects or timeframes;

- Innovation-as-a-Service: a model where companies obtain innovation-related services from external providers. These services are often delivered through subscription or contract-based arrangements;

- Micro-outsourcing for Minimum Viable Products (MVPs): a company brings in an external team to develop a basic, functional version of a product with only the core features needed to test the concept and gather feedback;

- AI-optimised staffing and team allocation.

Figure 2: Prioritising value over price

Source: Globally Cool

Tips:

- Talk about value, not just price. Do this in your marketing, as well as on your website.

- Show that you have specialised expertise. Talk about your niche capabilities, industry-specific knowledge, and ability to provide tailored solutions to your potential clients.

- Regularly ask your buyers how you can improve on quality, and make your own suggestions for quality improvement.

- Invest in your employees. Build and maintain a skilled workforce capable of delivering high-quality and innovative outcomes.

8. Agile methodologies

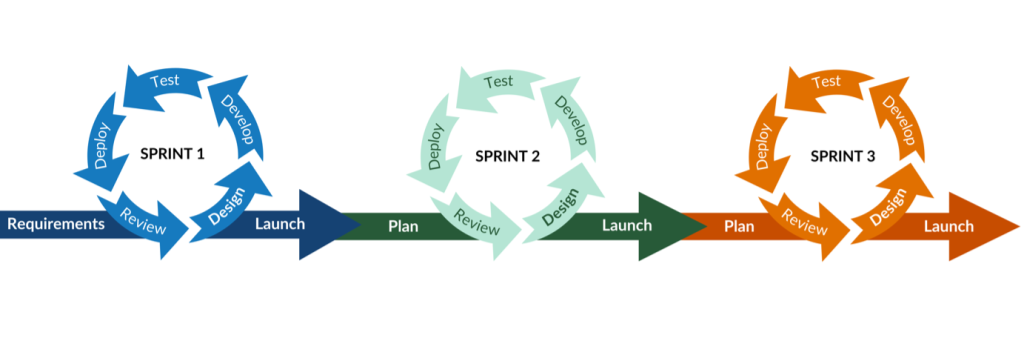

In recent years, Agile has become a standard practice in IT and software development. Many technology companies, European buyers and ITO service providers have adopted Agile methodologies. Agile is an iterative approach to project management. In this approach, work is divided into small cycles, called sprints or iterations. These methodologies promote flexibility, teamwork, customer collaboration and results. Developments in IT are occurring at such a rapid pace that both buyers and providers of outsourcing solutions must be flexible. According to the latest State of Agile Report, Scrum is the most popular Agile methodology.

Figure 3: A visualisation of Agile working

Source: Globally Cool

In the outsourcing sector, agile working involves bringing together people, processes, connectivity, technology, time, and place to find the best working method for a specific task. It highlights working within the guidelines of the task, whilst allowing flexibility in how it is performed. It involves finding the most appropriate and effective approach, breaking free from rigid boundaries to adapt and optimise the work process. Agile working encourages collaboration, adaptability, and leveraging technology to achieve desired outcomes.

In IT project management, many people have preferred the Waterfall model and fixed-price contract because they are easy to plan and control. These approaches offer predictability through detailed upfront schedules and requirement specifications, but they lack flexibility. Assumptions made early in the process sometimes prove inaccurate. Also, requirements often change, and risks are frequently discovered late in the process.

On the other hand, Agile methodologies promote flexibility. But estimating in Agile can be difficult because teams work in short iterations with an evolving scope and changing priorities. Agile estimation relies more on relative sizing, speed and continuous learning than on fixed upfront commitments.

The #NoEstimates movement questions the value of traditional estimation altogether and focuses on delivering value instead. Recent trends are improving the transparency and predictability of Agile estimation. AI and machine learning (ML) are used to predict effort more accurately and to automatically prioritise backlogs by analysing historical data. This approach combines estimation with business value and outcome-driven metrics.

AI is also starting to change Agile practices. It can analyse historical data, team capacity, activity patterns and unusual patterns. AI can support development teams to set realistic delivery goals by deciding which backlog items to work on first. It can also strengthen risk management by detecting early signs of delays, bottlenecks or quality concerns. This lets teams address problems before they escalate.

You can complement agile working by integrating DevOps practices. This streamlines collaboration between development and operations teams. DevOps focuses on automating and optimising processes (such as code integration, testing and deployment), which ensures faster and more reliable delivery. By combining the flexibility of Agile with DevOps’ emphasis on automation and continuous delivery, you can enhance efficiency and adapt quickly to changing requirements. According to the latest State of Agile Report, 42% of respondents use a hybrid model that includes Agile and DevOps, or other methodologies.

Tips:

- Implement agile methodologies and practices (for example Scrum or Kanban). Also implement related practices to support agile working. Use visual management tools (like Kanban boards) to track progress and visualise work. You should consider combining Agile with DevOps practices as well. To make an informed decision, read articles about this subject. For example, How Agile, CI/CD, and DevOps work together.

- Make your company’s culture one of collaboration and communication. Encourage open collaboration and effective communication amongst team members. Emphasise the importance of sharing ideas, feedback and progress updates regularly. Promote a supportive environment in which everyone feels comfortable contributing their insights and perspectives.

- Empower cross-functional teams. Form cross-functional teams with members from different disciplines or departments. These teams should have skills and expertise relevant to the project or task at hand. By bringing together individuals with different perspectives, you can create innovation, creativity and efficient problem-solving. Encourage team members to work together, share knowledge and take ownership of their tasks.

- Promote a mindset that embraces change, flexibility and adaptability. Agile working acknowledges that requirements and priorities may evolve, and plans may need adjustments along the way. Encourage teams to be responsive to changes, identify opportunities for improvement and adapt their strategies accordingly. This flexibility will give you continuous improvement and will ensure that the company remains responsive to evolving market dynamics.

- Promote a culture of continuous learning and improvement within the organisation. Encourage teams to reflect on their work, identify areas for enhancement and implement changes to optimise performance. Provide opportunities for professional development and skill-building to support the growth of team members. Foster a safe environment where mistakes are seen as learning opportunities, encouraging experimentation and innovation.

9. Customisation and flexibility

Customisation and flexibility are important to European buyers. They are some of the reasons buyers decide to outsource tasks instead of keeping them in house. The field of information technology is changing rapidly, with new technologies, methodologies and tools emerging on a regular basis. As a result, organisations need the flexibility to adapt to technological trends and incorporate customised solutions suited to their specific needs.

Companies more and more seek business partners that can offer tailored, modular and scalable software solutions. These solutions let them adapt quickly to changing business needs and technological advancements without having to rebuild entire systems.

One growing trend is the adoption of composable architectures. This type of architecture is built from modular and reusable components. It helps businesses to assemble and reconfigure technology components as needed. By breaking down business problems into smaller and clearer units of work, companies can react faster to change, adjust systems to new needs and innovate more quickly.

IBM illustrates the advantages of using composable architecture in different sectors. For example, in the finance sector fast customer onboarding is important. A bank that uses composable architecture can create a smooth onboarding process for its customers by combining reusable account services, identity verification APIs and compliance checks.

Providers that show adaptability, technological expertise and responsiveness to client-specific needs will have a competitive advantage in the European market.

Tips:

- Customise your services to meet the specific requirements of each buyer. Avoid a one-size-fits-all approach and demonstrate your flexibility in adapting to their unique needs.

- Be receptive to feedback and willing to make necessary adjustments to optimise processes, workflows and deliverables. The ability to provide customised solutions demonstrates your commitment to the buyer’s success.

10. SMEs are increasingly open towards outsourcing

In the European market, the outsourcing of IT and business processes has long been a practice used mainly by larger companies. For SMEs from emerging countries, however, larger companies are relatively difficult to target. This makes it harder for them to enter the European market.

There is good news: European SMEs are being more open to outsourcing. This is because they are realising more and more that outsourcing offers benefits. Small companies are less likely to have experienced employees, and outsourcing lets them access the best talent. Outsourcing helps SMEs overcome the talent shortage that still affects the European market. It lets them access the global talent pool without compromising on quality. The approach also offers flexibility and scalability. It means that SMEs can operate more efficiently, respond faster to market changes, and bring in specialised knowledge to fuel innovation.

According to a survey conducted by Clutch in 2022, 83% of all small US businesses reported that they would maintain or increase their spending on outsourced business processes in 2023. Industry experts consider these figures equally representative of the European market. In the UK, for example, growth of back-office outsourcing comes from companies of all sizes. 80% of small businesses and 89% of medium-sized businesses plan to start or increase outsourcing in 2025.

This outsourcing trend will create more demand for IT and business process outsourcing. It will make the European market more accessible to SMEs from emerging economies.

Tips:

- Highlight the benefits of outsourcing in your promotional materials, and particularly on your website. You can use examples from other SMEs that have benefited from your outsourcing services.

- Read the article Benefits of Outsourcing for Small Businesses to find ideas on how your company could provide such benefits for current or potential buyers.

- Consider profiling yourself as a company that can offer flexible services and that can be scaled to fit the unique needs and budgets of smaller companies. You can do this by offering personalised solutions.

- Read more about how to find buyers (including SMEs) in our study 9 tips for finding buyers on the European outsourcing market.

Globally Cool carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research