The European market potential for (Industrial) Internet of Things

Europe’s IoT market is growing quickly. Leading markets are Germany, the United Kingdom (UK) and France. Markets in the Netherlands, the Nordic countries, and Central and Eastern Europe (CEE) are growing fast. Convenience, improved lifestyle and rising digital literacy are driving consumer IoT growth. This includes smart homes, wearable technology, connected cars, and personal health and wellness solutions. IIoT adoption leads in overall spending and impact on industries like manufacturing, transportation and logistics, healthcare, retail and agriculture.

Contents of this page

1. Product description: Internet of Things

Internet of Things (IoT) refers to everyday physical devices (things) that are embedded with sensors, software and other technologies. These ‘things’ connect and exchange data with other devices and systems over the internet or other communication networks. This data can then be used to optimise processes, monitor environments and perform computations or mathematical calculations.

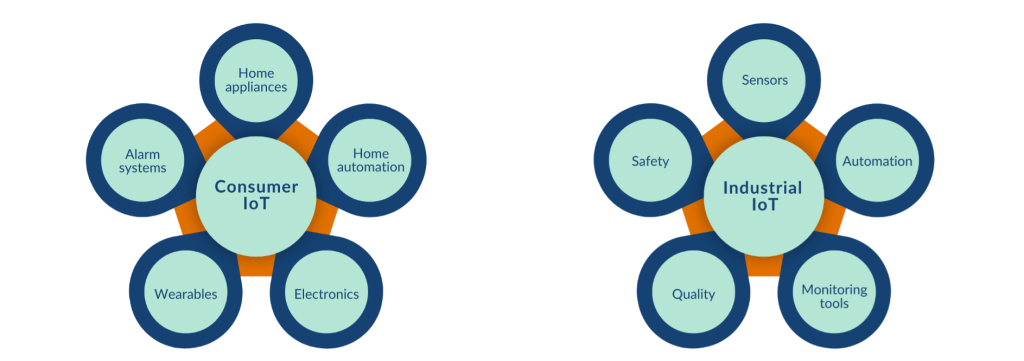

IoT can be divided into 2 categories: consumer IoT and Industrial IoT. Consumer IoT, often referred to simply as IoT, refers to devices for personal use. It is mostly used to improve consumers’ daily lives by, for example, making them safer, healthier, or simply more enjoyable. Examples of such devices are wearable health and fitness monitoring devices, home automation appliances, and connected vehicles.

Industrial IoT (IIoT) is a subset of IoT that specifically applies IoT technology to industrial settings. It involves the use of interconnected sensors, instruments and other devices networked together with industrial applications. IIoT focuses on productivity, efficiency, safety and decision-making in sectors like manufacturing, energy, logistics and healthcare. Examples are manufacturing equipment, robots, and 3D printers. IIoT is built for more demanding environments and needs more robust security. The IoT, on the other hand, involves less critical data and deals with smaller-scale networks.

Figure 1: IoT versus IIoT

Source: Globally Cool

When is a device ‘smart’?

When IoT devices are connected with other devices and able to operate interactively and autonomously without human intervention, they are considered ‘smart’. For example, a light that can be turned on with a smartphone or a thermostat that lets you control the temperature from somewhere else. When smart devices are linked to and integrated into everyday settings and tasks, these are smart environments. Examples of smart environments are smart homes, cities, manufacturing, and industries. Smart environments and devices can learn, operate autonomously, and offer expert advice.

IoT is closely associated with big data, 5G, artificial intelligence (AI), and machine learning (ML). IoT creates a lot of data. Big data technologies are used for storing and managing this data. 5G provides the high-speed, low-latency connectivity needed to transmit this data in real time. Finally, AI analyses this data to get insights, predict outcomes and make intelligent automation possible. This is transforming various industries, leading to increased automation, efficiency and innovative services.

What are IoT services?

There are many possible revenue streams and services for IoT. Small and medium-sized software development companies (SMEs) in developing countries targeting the European market should focus on high-value and scalable service offerings. Concentrate on areas where software talent can be used for your benefit without heavy upfront capital.

The most realistic services are:

- Custom IoT application development;

- Integration services (middleware, APIs and legacy systems);

- IoT platform customisation, updating and extension;

- IoT data processing and analytics.

Hardware remains the largest segment in Europe, but its share is slowly going down because software and services (especially IoT platforms, integration, analytics and managed services) are growing faster. The shift towards a software and service-led ecosystem shows a growing demand for cloud, AI-driven applications, edge computing and data monetisation across European industries.

2. What makes Europe an interesting market for IoT services?

Europe is the second-largest adopter of IoT after China. What makes Europe especially interesting, next to its growing market size, is that both consumer and industrial IoT offer opportunities. These opportunities can be found in many vertical industries. The growing market combined with skills shortages means there is extra room for outsourcing. Specialisation offers opportunities.

The European market continues to grow

As IoT becomes more mainstream, the related technology becomes cheaper. This makes it more accessible to people and companies worldwide. Due to the significant increase in the number of IoT devices, the IoT market continues to grow. Europe’s IoT market is expected to grow from €179 billion in 2025 to €258 billion by 2029, at an impressive CAGR of 9.62%.

According to IDC’s Worldwide Internet of Things Spending Guide, Western Europe, CEE, and the Middle East and Africa (MEA) will make up around a third of global IoT enterprise spending over the 2023-2028 period. Investments in the IoT technology ecosystem in the EMEA are expected to reach €244 billion by 2028. This mainly comes from Western Europe, whose spending is forecast to grow at an 11.2% CAGR in 2023-2028. This strong performance is because of the adoption of 5G networks all across Europe, advancements in edge computing and AI-powered data processing.

In 2025, there were about 20 billion active IoT devices in the world. This number is expected to be more than 40 billion in 2034. Approximately one-fifth of the devices will be located in Europe and one-third in China, Hong Kong, Taiwan and Macau.

Tip:

- Focus on software development, customisation, integration, analytics and UI/UX (user interface and user experience) for IoT platforms. Avoid device manufacturing or infrastructure services unless you have strong European partners.

Both consumer and industrial IoT offer opportunities

In 2025, consumer devices made up 60% of all IoT devices, with industrial devices accounting for the rest. This ratio is expected to remain the same in the coming years. This makes consumer IoT an interesting market for you, despite spending being higher in the IIoT market. In the coming years, consumers are expected to purchase more and more expensive connected things. In 2024, 71% of Europeans used IoT devices for private purposes. The use of IoT devices is highest in the Netherlands (95%), Norway (93%) and Iceland (91%). Nevertheless, industries will remain the greater spenders. 75% of European organisations plan to invest in IoT.

In 2034, an expected 33% of IoT device shipments will be cross-industry devices and 67% will be vertical-specific devices. Cross-industry devices are devices that are used in multiple industries mainly to save costs. These are devices such as building management systems, generic track-and-trace, office equipment and fleet vehicles. Vertical-specific devices are used in specific industries such as healthcare and manufacturing, to improve efficiency and accuracy. This highlights that specialisation offers opportunities.

The top-10 most adopted IoT use cases are:

- Process automation

- Quality control and management

- Energy monitoring

- Real-time inventory management

- Supply chain track and trace

- Operations planning and scheduling

- On-site facility track and trace

- Asset performance optimisation

- Remote asset monitoring

- Location tracking

Globally, in 2021-2024 the number of enterprises IoT use cases grew by 53%. 92% of them reported positive ROI – a 16.5% increase since 2021.

Tip:

- Beware that many IoT technologies are rapidly becoming commodities, like mobile applications and cloud computing did before, for example. This means you have a limited amount of time available to engage in new technologies, business models, and market segments.

There are many promising vertical industries

IoT is expected to affect all vertical European markets, but markets that have traditionally invested more in IT are leading. Promising vertical industries include:

Manufacturing and Industry 4.0

The manufacturing industry uses IoT for automation, predictive maintenance and optimisation of production processes. Research by McKinsey states that the manufacturing industry will account for the largest amount of potential economic value from IoT, growing to just over 25% in 2030. McKinsey believes that the greatest potential for value creation is in optimising operations. This makes day-to-day management of assets and people more efficient.

Healthcare and wellness

According to the same research, healthcare is the second largest industry. They represent around a sixth of the estimated IoT value in 2030. The value of IoT solutions within healthcare has increased, both among healthcare professionals and customers. IoT solutions are not only used by individual customers. They are also provided by insurance companies and governments to improve health and streamline the processes that patients go through. The COVID-19 pandemic sped up the use of IoT solutions in healthcare, as the world struggled with both virus containment and a safe return to the workplace.

Healthcare is more and more linked to big databases and doctors who offer medical advice with the help of AI. Smart health is a clear example of how IoT is linked with big data, AI/ML, and robotics. It also includes consumer wellness solutions, like wearable health and fitness monitoring devices.

Agriculture

Agriculture IoT is another interesting market. The global agriculture IoT market is expected to reach €46.3 billion by 2030, at a CAGR of 10.5% in 2025-2030. In the same period, the European agriculture IoT market is forecasted to grow at a CAGR of more than 8%.

The growth of the agriculture IoT market is fuelled by the growing utilisation of precision farming techniques, the increasing demand for automation, and the need for operational efficiency. Also, the expansion of 5G networks across Europe is improving connectivity in rural regions. This makes it easier to integrate IoT devices.

Retail and supply chain

Examples of how IoT is used in retail are inventory management, personalised shopping experiences and optimisation of supply chains. In 2024-2030, the European retail IoT market is expected to grow at a CAGR of 20.2%. Read more about the opportunities in the retail segment in our study on exporting retail tech services to Europe.

Besides these major markets, there are concrete business opportunities for IoT across all smart environments. For example, in transport and logistics, IoT is used to optimise the movement of goods. It can automate logistics and fleet tracking, make real-time shipment tracking possible and help maintain fleet health. In smart buildings, IoT improves energy efficiency with devices like sensors and smart meters. These devices continuously monitor energy consumption and environmental conditions. IoT lets automated control of systems optimise energy usage based on real-time data.

Tip:

- Specialise in a vertical sector, or even better, on a specific niche market segment within a vertical market. This will give you a competitive advantage. Examples of such niche market segments within vertical sectors are smart farming, smart villages, smart customer experiences and smart warehousing.

Skills shortages and lack of expertise

European companies continue to struggle with a shortage in IT skills. There is a large gap between the number of software development jobs and the number of available software developers. In 2024, 58% of EU companies that recruited or tried to recruit ICT specialists had difficulties filling these vacancies. This shortage varies considerably across EU countries, from 21% in Montenegro to 72% in Germany.

*% of enterprises that have recruited or have tried to recruit ICT specialists.

Source: Eurostat, 2025

In 2024, 15% of all companies in the Netherlands were looking for ICT specialists. 63% of them had difficulties finding them. To fill the shortage, companies in Europe try to hire software developers from abroad. A cheaper option is to outsource software development tasks. Smaller ‘end-user’ companies in particular often outsource IT tasks locally. In turn, these local IT companies often look for nearshore or offshore outsourcing partners, like you.

In 2024, 72% of EU companies outsourced ICT functions to external suppliers. This percentage has been relatively stable since 2020. How much of this percentage is outsourced to offshore providers is unclear.

At first, skills shortages were common for Western and Northern Europe. But they have now also become apparent in Central and Eastern European (CEE) nearshore destinations like Czechia. Because of this, CEE providers may need to subcontract outsourcing projects to offshore providers like you.

As IoT continues to expand, there is an increasing need for specialised developers and specialists.

The top-10 of must-have IoT skills are:

- AI/ML

- IoT hardware

- Node.js development

- API automation and testing

- Information security

- Big Data analytics

- Cloud computing

- Data management

- Problem-solving skills

- Communication

According to a 2023 EU-IoT skills study, Python, Javascript, Java and C/C++ are the most important programming languages for IoT development. These languages support programming across the entire IoT stack (like embedded devices, dashboards and other visualisations of an IoT application).

Tips:

- Build up IoT expertise and an IoT team in your company. Start by offering solutions first locally and regionally to get references and confidence in your capabilities.

- Keep your skills up-to-date. If possible, obtain certification and clearly communicate that you are certified in your marketing and client interactions. For more information about certification, see our study on entering the European market for IoT services.

Specialisation offers opportunities

IoT offers a lot of opportunities for service providers from developing countries, like you. Providing IoT services requires specialisation, including knowledge of hardware, sensors, network protocols and data analytics, as well as specialisation in your choice of IoT development platform. You will also need vertical market expertise, in sectors like precision agriculture and manufacturing. Vertical specialisation offers good opportunities, with 67% of IoT device shipments expected to be vertical-specific by 2034.

Your expertise, experience, and domain knowledge can be the deciding factor when European companies are selecting a supplier or partner.

Tips:

- Emphasise your expertise, experience, and domain knowledge in your marketing activities. Speak clearly about your choice of development platform(s), which one(s) you work with, and why.

- Look for European start-up companies that focus on IoT solutions to partner with. You can find them by taking part in industry events (like IoT Tech Expo) or by visiting IT-industry associations (like Tech UK).

3. Which European countries offer the most opportunities for IoT services?

Germany is Europe’s leading IoT revenue market and the third largest in the world. The UK is Europe’s second-largest market, followed by France. The Netherlands and the Nordic countries are interesting because of their growing markets and their openness to outsourcing. CEE countries like Poland offer partnership opportunities.

Figure 3: Selected promising European markets for IoT outsourcing services

Source: Globally Cool

Northern and Western European countries generally offer the most opportunities for you. Germany, the UK, France, the Nordic countries (Denmark, Norway, Sweden and Finland) and the Netherlands are especially promising. CEE countries like Poland also offer opportunities for you. Although CEE companies are traditionally your competitors, they also offer partnership opportunities because of growing prices and a shortage of skilled professionals.

Table 1: European countries that offer opportunities for IoT software development

| IoT market size in 2025 (in billion €) | Projected CAGR for 2025-2029 (in %) | EU enterprises with hard-to-fill vacancies for ICT specialists (% in 2024) | |

|---|---|---|---|

| Germany | 32.74 | 8.26 | 72.41 |

| UK | 19.79 | 9.63 | 84 |

| France | 18.38 | 7.27 | 61.77** |

| Netherlands | 7.80 | 9.85 | 63.10 |

| Nordic countries* | 3.87 | 11.19 | 44.35 |

| Poland | 5.96 | 12.06 | 32.25 |

*Averages of Denmark, Sweden, Norway and Finland combined.

**Data from 2022.

Source: Globally Cool, based on information from Statista, Eurostat, Hyve Managed Hosting IT and Tech Skills Gap Report 2024.

Germany: Europe’s IoT champion

Germany’s IoT market is expected to grow from €32.74 billion in 2025 to €44.94 billion in 2029, at a CAGR of 8.26%. That makes it the third-largest IoT revenue market in the world, behind the USA and China. The automotive sector leads, with a projected volume of €8.25 billion in 2025. This shows the success of the country’s Industrie 4.0 plan, which aims to modernise industries with new technologies to improve productivity and stay competitive.

A 2025 study of Bitkom shows that 71% of German manufacturing companies already use Industry 4.0 applications. The most-used technologies are digital marketplaces (53%), digital twins (48%) and IoT platforms (46%). Especially IoT and AI are seen as very important. Among the companies that have not yet adopted these technologies, 43% are planning or discussing the use of IoT platforms and 35% are considering the use of AI.

Finally, Germany has a well-established IoT ecosystem. Big industrial firms like Siemens, Bosch and Infineon are leading the way with smart sensors and cloud systems. On top of this, the country’s active startup scene and strong research base makes continuous innovation and growth in IoT possible.

Be aware that German companies are generally less open to offshore outsourcing than, for example, those in the UK and the Netherlands. But attitudes are changing as German businesses continue to face skills shortages and become more experienced in offshoring. In the EU, Germany has the most issues with filling vacancies for ICT specialists (72.4% in 2024). Also, Whitelane showed that 44% of German IT-spending organisations will increase nearshore outsourcing (2024) and 29% planned to use offshore resources (2023).

German companies often prefer to work and collaborate in German. This is why they prefer nearshoring when they do outsource. You can increase your chances of success in Germany by working together with a local strategic partner instead of approaching end users directly. Increase your chances of success in Germany by focusing on small/medium-sized software developers, specialised in IoT.

UK: Second-largest IoT market in Europe

The UK’s IoT market is expected to grow from €19.79 billion in 2025 to €28.57 billion in 2029, at a CAGR of 9.63%. The automotive sector leads, with a projected €5.17 billion in 2025. Consumer IoT devices are becoming more popular among British households, with a rise in smart home adoption.

The UK’s IoT market growth is supported by government programmes like Made Smarter Innovation. This programme funds projects using IoT, AI and robotics to modernise manufacturing, improve productivity and stay competitive. Better technology is also helping, like 5G, AI/ML and edge computing.

IoT adoption can be seen across many industries in the UK. For example, there is a growing consumer demand for smart home devices. 91% of Brits are aware of their smart home devices, although 67% doesn’t know much about it yet. The most-used smart home products in the UK are smart meters, smart voice-controlled speakers and smart home security cameras, sensors and alarms. In the healthcare sector, the National Health Service (NHS) gives their staff guidance on the health applications and potential benefits of IoT devices. IoT-enabled solutions like remote patient monitoring and smart medication dispensers are making patient care better.

With strong government support and a collaborative network of companies, researchers and tech providers, the UK is becoming a strong IoT market. To strengthen cybersecurity and build consumer trust, the government has introduced new security rules for IoT devices.

Of all European countries, the UK is the most open to offshore outsourcing and the least cautious about doing business with companies in developing countries. Their openness is influenced by their cost-saving business culture and their long-standing business and historic relations with many countries.

France: A large market where language matters

The IoT market in France is expected to grow from €18.38 billion in 2025 to €24.32 billion in 2029, at a CAGR of 7.27%. IIoT leads, with a projected €4.77 billion in 2025. The country has a strong focus on smart cities and a robust connectivity infrastructure.

France’s IoT market is growing thanks to its strong industrial base, government support and rapid digital transformation across sectors. Important industries like manufacturing, energy and transport are using IIoT to increase automation, improve efficiency and cut costs. Government plans like France 2030 and smart city projects are driving innovation in both the public and private sectors.

The push for sustainability and energy savings is also motivating businesses to start using smart monitoring and predictive maintenance. France has an active tech scene with startups, research centres and major companies working together on connected solutions. New technologies like 5G and LoRaWAN, along with a strong focus on cybersecurity, are speeding up the roll-out of IoT systems. A Lower Power Wide Area network like LoRaWAN is particularly interesting for IoT applications, as it is good for the battery life of the connected devices.

Although France has a large IoT market size, the French prefer to collaborate and work in their own language. Speaking French or finding a partner able to do so will increase your chances of success when entering the French market.

The Netherlands: Strong logistics and agricultural sectors

The IoT market in the Netherlands is expected to grow from €7.80 billion in 2025 to €11.36 billion in 2029, at a CAGR of 9.85%. The automotive sector leads, with a projected €2.05 billion in 2025. By 2030, IIoT will be the leading sector. The Netherlands has a strong focus on smart agriculture and sustainable energy solutions.

Growth in the Dutch market is supported by its strong logistics sector, advanced agricultural industry, and commitment to sustainability and digital innovation. As a major European trade hub, the country uses IoT for smart logistics, real-time tracking and port automation – especially in Rotterdam, which is one of the world’s busiest ports. In farming, IoT and sensors support precision agriculture, helping to save water, boost efficiency and reduce environmental impact.

Government programmes and smart city projects in places like Amsterdam and Eindhoven are driving adoption in transport, energy and environmental monitoring. Being the first country to have nationwide LoRa network coverage, the Netherlands also has excellent telecom networks with strong 5G coverage. Its culture of collaboration between startups, big companies and research groups encourages innovation in areas like AI-powered IoT and data-driven industrial automation.

Companies in the Netherlands are traditionally fairly open towards outsourcing. Language barriers for doing business in the Netherlands are generally low, as the Dutch are very skilled in English.

The Nordics: Most open to outsourcing

The combined Nordic IoT market is expected to grow from €15.49 billion in 2025 to €23.68 billion in 2029, at a CAGR of 11.19%. Market growth is helped by strong digital infrastructure, green goals and openness to new technology. Nordic countries are leaders in areas like clean energy, smart mobility and digital healthcare, which creates demand for advanced IoT solutions. Governments support this with funding and public-private partnerships that encourage the use of IoT in areas like energy grids, public transport and environmental monitoring.

Industries like manufacturing, shipping, mining and forestry are using IIoT to improve efficiency, make predictive maintenance possible and reduce risks, often in tough or remote conditions that need real-time data. With reliable high-speed internet, wide 5G coverage, and networks like NB-IoT and LoRaWAN, the Nordic countries have the tools for large-scale IoT use. They also have a strong focus on privacy and cybersecurity.

Sweden is the leading Nordic market. It is estimated to grow from €6.79 billion in 2025 to €9.75 billion in 2029 at a CAGR of 9.47%. Its automotive sector leads, with a projected €1.78 billion in 2025. Sweden has a progressive approach to sustainable technology and infrastructure.

Norway follows, with an IoT market that is projected to grow from €3.91 billion in 2025 to €6.56 billion in 2029 at an impressive CAGR of 13.85%. IIoT leads, with a projected €1.78 billion in 2025. IoT adoption is especially booming in Norway’s maritime industry. It uses smart sensors to optimise vessel operations and improve safety measures at sea.

Denmark’s IoT market is estimated to grow from €2.87 billion in 2025 to €4.67 billion in 2029 at a strong CAGR of 12.95%. IIoT leads, with a projected €0.8 billion in 2025. With a strong focus on renewable energy and sustainability, Denmark's market for IoT solutions in the green energy sector is performing especially well. The IoT market in Finland is expected to grow from €1.92 billion in 2025 to €2.70 billion in 2029, at a CAGR of 8.95%. IIoT leads, with a projected €0.5 billion in 2025.

The Nordic markets are very much open to outsourcing, which could make them interesting for you. Experts believe that the competition in Nordic markets will be less strong than in the UK, making them easier targets to consider.

Poland: Competition and opportunities

The IoT market in Poland is expected to grow from €5.96 billion in 2025 to €9.39 billion in 2029 at a strong CAGR of 12.06%. Poland’s IoT adoption is rising, with a growing number of industries using it to improve efficiency and productivity. The automotive sector leads, with a projected €1.55 billion in 2025.

The following sectors in Poland have a high demand for IIoT solutions:

- Manufacturing: Poland has well-developed automotive, food and chemical industries. These industries are more often investing in IoT sensors, line automation, Manufacturing Execution Systems (MES) and Supervisory Control and Data Acquisition (SCADA) systems for production monitoring;

- Energy: the energy sector is investing in the automation of electricity grids and OT cybersecurity;

- Transport and logistics: in Poland there is an increasing demand for IIoT solutions in railways (sensors on tracks), road infrastructure (traffic management systems), warehouses in e-commerce (automation) and logistic companies (IoT sensors for the supply chain and vehicle tracking).

Poland was previously mostly seen as a competitive destination. But CEE countries are faced with a talent shortage and companies are more often looking for offshore partners. This could be your company.

Tips:

- Determine which country to target by looking at your cultural similarities, diaspora, historical ties, and common languages. These factors will influence which countries are more suitable than others.

- Position yourself as a specialist, not a generalist. Choose 1 or 2 verticals and develop strong case studies, prototypes, or industry-tailored solutions as references.

- Identify which countries have the greatest demand for your particular expertise by seeing which specific IoT events they are hosting.

- Online IoT initiatives can help you find customers. Several European countries have launched or are launching national initiatives to stimulate industrial IoT implementation, which can have a positive effect on the industrial markets. These include PlattformIndustrie 4.0 in Germany and Smart Industry in the Netherlands. Initiatives like these often invite companies to participate, for example, via working groups with stakeholders.

- Look up the large-scale IoT pilots across Europe and check the EU’s Futurium platform, especially the ‘groups’ page. Also keep track of other new initiatives that can boost national markets for IoT services.

4. Which trends offer opportunities or pose threats in the European IoT services market?

The technology behind IoT is advancing rapidly, becoming faster, cheaper, and more efficient. Important trends in the European IoT services market are digital transformation, technology convergence and green IoT.

Digital transformation is accelerated

IoT is one of the main technologies enabling and driving digital transformation. The ability of devices to sense and transmit data brings companies great benefits, but would be impossible for humans to handle.

5G: Increasing connectivity

With its higher bandwidth, 5G allows more devices to be connected to the internet and they may also generate more data. It will allow more than 350,000 devices to be connected per square kilometre. This is 500 times more than comparable previous technologies. Because of this, 5G is considered one of the most important infrastructures to further develop IoT. Although 5G may not provide any direct opportunities by itself, it is necessary for the expansion of IoT.

A good example of the possibilities of 5G and IoT is the 5G RuralDorset project in the UK. In agriculture, these technologies increase efficiency and automation. In the project, Wessex Internet installed over 40 different 5G-enabled sensors across 3 farms. Together with a farm software provider, they tested the best ways to collect and visualise data for farmers. This helps farmers collect data more easily and efficiently. It helps them to make better-informed decisions on farm management.

In 2024, around 87% of the European population had 5G coverage, up from 80% at the end of 2023. The EU’s Digital Decade Policy programme wants universal access to 5G services with 100% coverage by 2030.

Small software development companies from developing countries that specialise in IoT development, like yours, do not need to be 5G network engineers. But you must know about the capabilities that 5G brings to IoT and how these capabilities impact software design, development and deployment. It impacts software architecture and design as well as the technology portfolio you should offer to clients.

Edge computing

The arrival of 5G has made edge computing possible. The reduction in cost and the increased computing power of IoT devices make it possible to process data collected on the edge (on the device itself, before sending over the data) and allow huge bandwidth savings. It also leads to greater compliance with privacy regulations, in many cases. This is because the data is collected and encrypted on the device itself, instead of sending out raw data.

With this technology, developers like you can build lightweight IoT applications that run on microcontrollers or edge devices. This requires specific skills and technology knowledge, including:

- Industrial edge devices and gateways: although you are not building hardware, you must understand the capabilities and limitations of common industrial edge hardware;

- Lightweight operating systems like Linux Distributions and real-time operating systems;

- Edge data management and processing like Mosquitto, NanoMQ and InfluxDB Edge/Telegraf;

- Edge AI/ML technologies like TensorFlow and ONNX Runtime;

- Hardware-specific AI optimisation tools.

Tip:

- Read more about the current status of the 5G network coverage in different European countries and regions on the website of the European 5G Observatory.

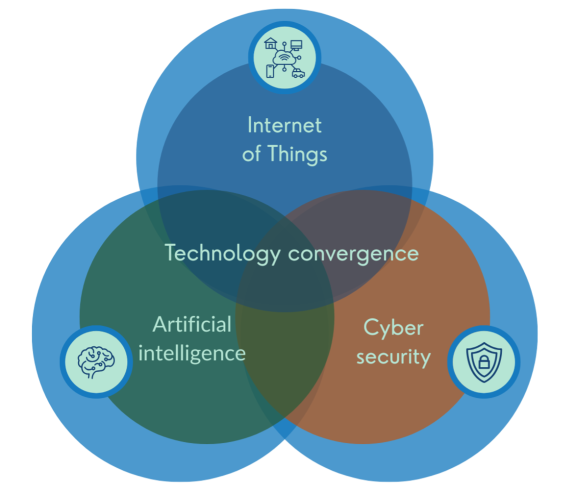

AI, IoT and cybersecurity technology convergence

AI, IoT and cybersecurity are more often coming together and this convergence is shaping the future of digital infrastructure, especially in business, industrial and critical environments.

Figure 4: Technology convergence

Source: Globally Cool

The reasons for this technology convergence include:

- AI empowers IoT: AI is crucial for making sense of the big volumes of data generated by IoT devices. It enables real-time analytics, predictive maintenance, anomaly detection and intelligent automation, and turns raw data into insights that people can act on;

- AI strengthens cybersecurity: AI and ML are more often used in cybersecurity to detect threats, recognise patterns, automate responses and adapt to evolving risks, especially in fast-moving IoT environments;

- Cybersecurity protects AI and IoT systems: more connected devices mean more chances for cyberattacks. As AI and IoT become embedded in critical systems (like manufacturing lines, healthcare, power grids), strong cybersecurity is needed to ensure trust, compliance and operational continuity.

But this convergence is not just about AI, IoT and cybersecurity anymore. Connectivity and other technologies like cloud, edge computing, blockchain and digital twins are also joining in to enable smarter and more reliable autonomous systems across industries.

For software developers like you, this technology convergence means working in a much more interconnected and complex environment. Instead of just building isolated apps, you must now think about data coming from physical devices, decisions powered by AI and built-in security. Systems often work across edge, cloud and on-device environments. This requires new design and deployment approaches.

An example of an SME from a developing country is Gurzu from Nepal. They create all sorts of innovative software solutions for international customers. Their services include GenAI solutions, mobile app development, IoT, and DevOps and cloud engineering. For example, this company worked as a technical partner to a client with an easy-to-use lifestyle application, so it built custom solutions for a wearable IoT platform.

Tips:

- For more information on AI, see our study about exporting AI software development services to Europe.

- For more information on cybersecurity, see our study about exporting cybersecurity products and services to Europe.

Sustainability: Green IoT

Sustainability is a key driver for IoT initiatives. This growth is strongly linked to new climate and sustainability laws. New legislation is always being developed in Europe, especially around the European Green Deal. This is Europe’s roadmap to become a climate-neutral continent by 2050. IoT plays an important role in the goals of the European Green Deal and the United Nations’ Sustainable Development Goals (SDG).

The shift towards sustainability is not only driven by policymakers. Customers, business partners and investors are also more often focused on sustainable products, services and business practices. To meet sustainability KPIs and comply with planned corporate sustainability regulations, more companies are turning to sustainability data management tools and IoT. These solutions enable automated sustainability data collection and reporting. For example, IoT sensors (like energy meters, water quality sensors and air pollution monitors) are important technologies that make automated reporting on sustainability possible.

Besides being a helpful tool for measuring and reporting on sustainability, IoT technologies can also be designed and managed in an environmentally friendly way. Green IoT combines IoT technology with sustainable practices. Its goal is to reduce the environmental impact of the connected devices themselves and to improve resource management and efficiency. This includes reducing energy consumption, using renewable energy sources and designing for easy recycling.

Tips:

- For more information on sustainability, see our 7 tips on how to go green in the outsourcing sector.

- For more information on trends, see our study on trends in the European outsourcing market and LORIOT’s article 10 IoT Trends Shaping the Future in 2025.

- Be aware of global threats that can impact the IoT market, like trade tensions in international markets. For example, US tariffs on specialised software tools and countermeasures from other markets have affected global IT supply chains. Make sure your business is prepared for market uncertainties.

Globally Cool carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research