Which trends offer opportunities or pose threats to the European fish and seafood market?

The European fish and seafood market faced serious challenges due to COVID-19. The global pandemic caused shifts both in European demand for imported fish and seafood and in the supply of seafood in producing countries. At the same time there are a number of notable trends unrelated to COVID-19 that continue to present opportunities and threats to the market. Learning to adapt your business to the new reality is an essential ingredient for success.

Contents of this page

- After initial struggles the food service sector sees light at the end of the tunnel

- Increased home consumption of prepacked fish products

- Rapid development of online sales to end consumers

- Increased competition from regional products

- Consumer distrust increases demand for assurance

- Sustainable certified fish and seafood continues to gain market share

- ‘Out-of-home market’ more committed to sustainable certified fish and seafood

- Storytelling: Purchases that empower

- Mislabeling creates unfair competition

- Rapid consolidation through mergers and acquisitions

Trends in the European fish and seafood market since the corona crisis

Since early 2020, COVID-19 has had a major global impact. The pandemic hit the European seafood market in early March. Initially, many businesses closed, food service shut down, travel became nearly impossible throughout Europe and most importers stopped purchasing. 2020’s expected growth was replaced by a sharp drop in turnover for the sector. To deal with the crisis, the industry is adapting to shifting market conditions and new trends are emerging. Learn from these trends to find your way into Europe’s market.

1. After initial struggles the food service sector sees light at the end of the tunnel

Social distancing and COVID-related closures of restaurants throughout Europe created a lot of uncertainty for food service businesses, despite any government support they might receive. Before COVID-19, in 2019, out-of-home consumption of processed seafood products in the food service sector in the EU was the highest level in more than ten years. However, due to COVID-19, the food service industry could no longer offer sit-down services causing a sharp decline in business. In 2020, this segment was no longer a key target market for your products.

The food service industry tried to adapt to venue closures or limited capacity by offering takeaway and delivery services, where normally they would not. Though these takeaways and deliveries only represented a small part of pre-COVID business for these restaurants, they provided an additional way for fish and seafood products to reach the end customer through the food service industry.

With second and third waves of COVID-19 hitting European countries, regulations are constantly being adjusted and it could be some time before restaurants re-open fully. However, there is light at the end of the tunnel. Europe wants 70% of its adult population to be fully vaccinated by summer 2021 and vaccinations are well underway. Terraces are open in most countries. In some countries restaurants are due to open for inside dining soon, and tourism is expected to pick up again in the summer months. Importers are expecting demand from the food service sector to increase substantially in the summer of 2021, which means new opportunities for exporting your seafood products.

Tips:

- Learn about how COVID-19 has impacted European seafood consumption in the CBI Trade Statistics and Outlook report.

- Find more information about how COVID-19 has disrupted the seafood market in Europe in our CBI-news article.

- Contact your buyers and ask them what they expect to happen in the coming months, so that you can prepare your business accordingly.

- Keep track of the progress of vaccinations in your buying markets, to understand what is happening in those countries and anticipate changes in demand for your products.

2. Increased home consumption of prepacked fish products

Retail has become and will continue to be a key marketing channel for seafood in Europe. During COVID-19 lockdowns, out-of-home seafood consumption was almost impossible. With restaurants and hotels closed, people were forced to cook at home. Seafood products mainly found their way to the consumer via retail and sales in this segment increased. Companies offered new ranges of seafood retail products targeted at homebound consumers. This provides your business with the opportunity to offer processed and value-added products, aligned to the needs of these consumers.

The sales of prepacked seafood products increased due to consumer preferences and new marketing. An increasing number of consumers are afraid that unpacked fish products are contaminated with the coronavirus, which means there has been a shift toward demand for prepacked products. Prepacked products are usually sold in sizes suitable for at-home cooking, where there is not always a lot of space to prepare seafood products. An increasing amount of European companies that were used to selling fresh whole fish at fish counters also started selling more seafood as prepacked products.

When the hospitality industry opens again, the frequency of at-home cooking of seafood is also expected to decrease. However, consumers will have experienced the possibilities of cooking fish at home and are likely to keep doing this more frequently than before the crisis. Therefore, retail will continue to become increasingly important.

Tips:

- Learn about how to deal with COVID-19 in the Fish and Seafood Sector and how to continue business in these difficult times in this CBI study.

- Offer your seafood products as prepacked portions, ready for use in European households. You can also provide unique ethnic recipes with your products to help consumers prepare their dish at home.

3. Rapid development of online sales to end consumers

As consumers become more accustomed to the “new reality”, many are turning to online retail, and there is much more focus on fortifying the delivery or pick-up system. The volumes of seafood sold through online sales increased significantly during the COVID-19 crisis and it looks like consumers are becoming more familiar with buying seafood on the internet. This means more and more of your buyers are selling their products on the internet, so your online visibility, too, is becoming more important.

There are companies that have professional web shops, like Schmidt Zeevis in the Netherlands and the Fish Society in the United Kingdom. Usually, these companies are already experienced in selling seafood products directly to the end consumer and have the logistics to deliver the fish in a certain area.

Other companies sell their fish products via social media like Twitter and Facebook, whereas they normally only sell their fish products to the hospitality industry or wholesale. DaySeaDay in the Netherlands, for example, sells seafood products via Facebook to end consumers in and around Urk (Netherlands).

Tips:

- Visit European web shops to learn more about their products and the way they sell them.

- Invent your own themed seafood boxes based on the unique selling point of your products and convince your buyer to include you in their range. Especially in North-western Europe, seafood is regularly sold as theme boxes online, such as a barbecue box, a smoked seafood box or a ready-to-eat fish box. For inspiration, check out this news item on the UK’s 8 best fish and seafood boxes for delicious shore to door deliveries.

- Increase your online visibility. Consider digital marketing through social media. Check out how Ecuadorian shrimp producer Acuamaya uses Facebook and LinkedIn to communicate with its customers.

- If you have content that can be used on social media, use it as a unique selling point to your buyer, especially if this buyer is also active in online sales. Tell the sustainability story of your products, share (local) recipes for product use or share the mission and vision of your family business. These topics could all be good examples of attractive video, picture or written content, if the content is of high quality.

4. Increased competition from regional products

After years of depending on imported seafood for European consumption, more products from local fisheries are finding their way to the European market. Reduced demand for seafood in Europe during the COVID-19 crisis also affected European seafood producers as exports declined. Initially as an effort to sell surpluses of locally produced seafood, more and more European countries are stimulating consumers to buy and consume regional seafood products. For your business, this trend means more competition from local, European seafood sources.

The Irish Food Board, for example, launched promotional campaigns in supermarkets, making Irish brown crab available for consumers. Dutch coastal areas are promoting fish from the regions, like Scheveninger vis, Zuidwester vis and Waddengoud. Project Dichtbijvangst is working with Dutch youth and food service entrepreneurs to increase enthusiasm for North Sea fish. Particularly in the beginning of the pandemic, markets and supermarkets were stimulated to focus on selling domestic seafood products, making it harder for other products to enter the market. Take a look at examples in France and the UK.

The European Union is not self-sufficient for the production of many seafood products, so it will continue to import some of your products from outside Europe. However, this trend is one to be aware of. It allows you to concentrate your efforts. By understanding the other products on offer to end consumers, you can better capitalise on the advantages you might have. The story of a romantic and sustainably produced product made by small-scale farmers may encourage purchases despite the product being imported.

Tips:

- Use price, freshness and flexibility in the sale of your products to compete with the current over-availability of seafood products in Europe, caused by the COVID-19 crisis. These components are still of high importance.

- Show your buyer that you are a reliable partner, now and in the future. Having a good relationship is particularly important in hard times.

- Work to your strengths. Understand that though some trends pose threats, others provide opportunities. Look to your business and align your marketing strategies to promote those areas of your business that are in line with current trends.

European fish and seafood market before the corona crisis

Consumer distrust in seafood is contributing to increasing buyer requirements for traceability and sustainability certification. At the same time, providing this type of assurance about the origin and responsible production of seafood, and communicating this through effective storytelling, can enable producers to ask a premium price for their fish and seafood products. Mergers and acquisitions pushed the industry’s growth in 2019 and the beginning of 2020. At the same time, bigger companies and international company groups drive hard price bargains. Together with negative trends, like mislabelling, this puts pressure on the bottom line of producers. Being aware of these trends can help you find your way into the European market.

5. Consumer distrust increases demand for assurance

Major issues in the seafood industry like food safety and human rights issues, also raised in the recent controversial Netflix documentary Seaspiracy, affect consumer trust in seafood. The COVID-19 pandemic did not only contribute to further distrust in seafood, but has also led to consumers placing greater emphasis on health and well-being, generating increasing interest in where their food comes from. As a result, mechanisms that provide assurance about the production process and origin of seafood become increasingly important. The traceability of seafood products is becoming a popular assurance mechanism in the seafood industry and buyers are increasingly asking for it.

More and more European buyers are now looking for suppliers that can provide traceability of their sourced products. At the same time, there is a big effort from regulators to improve seafood traceability as part of the fight against illegal fishing and irresponsible production practices. Traceability allows buyers to check the supply chain of your product from “sea to table” for wild-caught products or from “farm to fork” for aquaculture products. For European buyers, full traceability and transparency mean that documentation on all the steps of the supply chain is available, and that you are open and transparent in your communication about your company.

The SeaFresh group, which sources from farming operations in Honduras, Thailand and Vietnam, uses DNA TraceBack® technology to monitor and trace its shrimp supply chains. Lasse Hansen, CEO of Seafresh Group, says “the unprecedented levels of supply chain transparency [provided through DNA TraceBack®] help us convey more effectively to our customers and the consumer the care we take to meet the growing consumer expectations for top quality, sustainable and ethically sourced seafood products.”

UK’s John West launched the Trace Your Plate initiative which enables consumers to discover where their fish has been sourced from. They developed an online tracking tool which allows consumers to check their seafood products’ history and origin. The Sustainable Shrimp Partnership (SSP), launched by a group of major producers in Ecuador, launched a traceability web application based on blockchain technology. With this technology, buyers, retailers and consumers around the world can scan the QR code and discover how the product was grown and see key indicators on its safety.

- Explore whether your business is able to provide documentation on all steps in the supply chain.

- Use traceability in the sale of your products to outcompete businesses who are unable to do so.

- Check out how John West promoted their ability to provide sourcing information to consumers.

- Read CBI’s study on Digitalisation in the Seafood sector for exciting examples of how businesses use technologies like blockchain to communicate traceability.

6. Sustainable certified fish and seafood continues to gain market share

Another key mechanism to provide assurance for seafood is sustainability certification. Over the past 20 years, demand for sustainable seafood has grown across the world. Markets that demand sustainable seafood are estimated to exceed $11.5 billion in retail value.

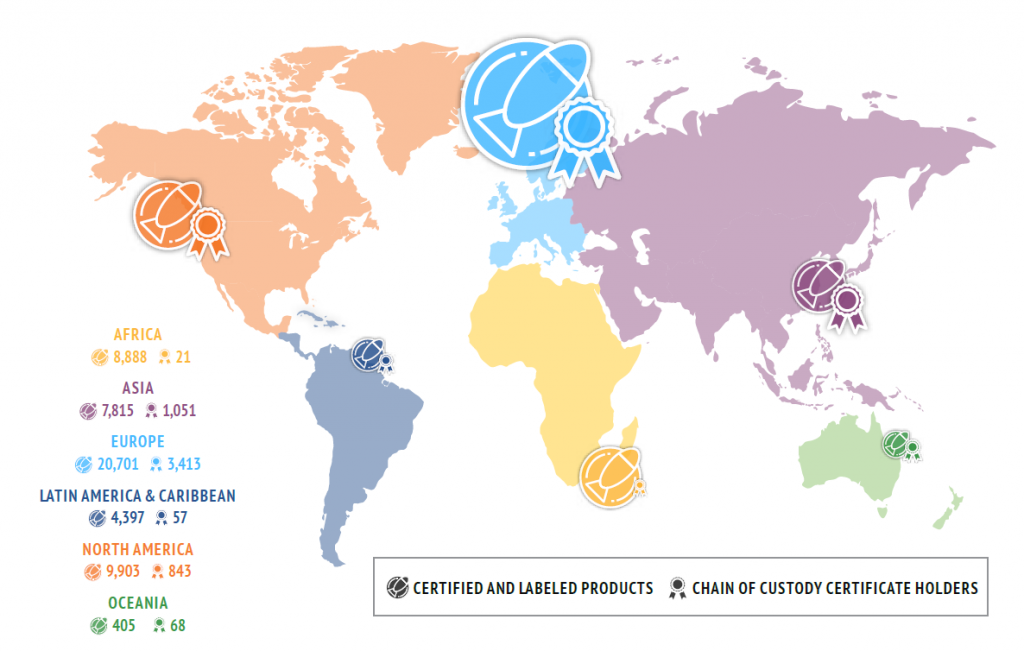

If you are an exporter focused on sustainable seafood products, then you have a huge opportunity to enter and do business on the European market. In fact, Europe is home to the biggest concentration of both certified products and chain of custody certificate holders. A chain of custody standard ensures that products from certified fisheries or farms are traceable and separated from non-certified products. According to a global benchmark made by the Seafood Certification and Ratings Collaboration in 2019, 20,701 products in Europe were certified and labelled, and there were 3,413 chain of custody holders (Figure 1). Sustainability certifications are especially sought after in the European retail sector, and are increasingly requested in other segments such as food service or in the processing sector. Therefore, as an exporter, it is worth looking into the sustainability trend as early as possible.

Figure 1: Distribution of certified and labelled products and chain of custody certificate holders

Source: Certification and Ratings Collaboration (2019)

There are many sustainability certifications out there, but the Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC) are currently still the main ones to which European retailers have committed for wild caught and aquaculture fish and seafood. According to the Certification and Ratings Collaboration, 4.6% of global seafood production is currently MSC-certified and 0.9% is ASC-certified.

MSC-certified products include whole fish and fish fillets, crustaceans (mainly cold water shrimp), and canned fish (mainly tuna). Increasingly, other products that include fish and seafood, such as pet food and shrimp crackers, are also sourcing sustainably certified fish and seafood. In 2019/2020, 14,640 MSC-certified seafood products were available on the European market and around 887,000 tonnes of MSC-certified seafood were sold on the European market, 13% more than in 2018/2019.

ASC was founded later than MSC but is growing fast. In January 2021, there were 1,336 ASC-certified farms, and another 238 in assessment. ASC currently manages standards for farmed salmon, pangasius, tilapia, shrimp, sea bass/sea bream/meagre, trout, bivalves, abalone, seriola/cobia, tropical marine fish and seaweed. In December 2020, 9,748 ASC-certified products were available on the European market, a 32% increase from December 2019.

A criticism of ASC and MSC is that their standards are not readily applicable for small-scale producers. Some small-scale producers lack the capacity to implement standards at the fishery or farm level and it is often too difficult to organise the farmers in such a way that ensures chain of custody. However, ASC and MSC are making their standards increasingly accessible to small-scale fisheries and aquaculture operations, making it easier and more affordable for small-scale producers to gain certification.

Although general consumer awareness about sustainability has played a role in the development of MSC and ASC, the main factor is the commitment that international retail groups have made at the corporate level. While their commitments originated from consumer demands in North-western Europe, or in some cases the United States, they now require their group companies in other markets to meet the same targets.

Over the last years the Global Sustainable Seafood Initiative (GSSI) worked on a benchmark system for sustainability certification. With their benchmarking tool, the GSSI assures that approved certifications, like MSC and ASC, are aligned with the FAO Code of Conduct for Responsible Fisheries, and are therefore the best to use. As a result more and more certification standards, such as Best Aquaculture Practices (BAP) and GLOBALG.A.P., are also GSSI recognized. As a result, we are seeing a gradual shift in retailers from a commitment to selling seafood with specific eco-labels such as ASC and MSC, to a commitment to selling seafood which is certified by any GSSI-benchmarked standards. This provides an opportunity for you as an exporter, as more seafood certifications schemes are accepted on the European market.

Once international retail groups introduce certifications to a new market, other food service and retail companies must offer certified products to remain competitive. A Belgian importer says: “Sustainably certified products are mostly demanded by retailers, so by the big supermarket chains. It starts from there, and then you see that industries that prepare dishes or portions for supermarkets are also forced to have MSC or ASC”. Within a couple of years, we expect that the majority of fish and seafood sold in European retail and institutional food service will be sustainably certified.

Ahold Delhaize, Europe’s fourth biggest retailer, with European supermarkets in the Netherlands, Belgium, Luxembourg, Czech Republic, Serbia, Romania and Greece, as well as the United States and Indonesia, is an example of a retail company that has made a group-wide commitment to sourcing sustainable seafood. On its website, Ahold Delhaize explains that they are working hard to make sure that all fish and seafood sold under their private label is sustainably sourced. If certification is not available for specific species (which is the case for certain species among the products they offer in Central and Southeastern Europe), they work with civil society partners like WWF to take a close and critical look at the supply chains of those products. Together, they ensure that Ahold Delhaize does not source seafood that has a negative effect on people or the environment.

Colruyt Group, a Belgian retail corporation that manages Colruyt supermarkets and other subsidiaries in Belgium, France and Luxembourg, has made a similar sustainability commitment, based on the use of ASC and MSC. Colruyt has opted to use the ASC standard for every fish it is available for and the MSC standard for every species that has this certification. If MSC is not available for a particular species, they ask a research institute to carry out an independent evaluation.

Seafood sustainability is also a growing political trend in Europe and is slowly being anchored in Europe’s future regulatory systems. The Farm to Fork Strategy is at the heart of the European Green Deal, which aims to make food systems fair, healthy and environmentally friendly. This means that over time the EU will become more strict about the use of socially and environmentally responsible production practises in the seafood that they import. For your business, this may mean different buyer requirements for your products, and stricter controls upon entering Europe.

Tips:

- If your aquaculture products are not already certified, follow ASC to understand certification requirements and options for support in getting certified. ASC shares a lot about the ASC standards, group certification, and the ASC improver programmes and publishes a monthly ASC certification update.

- If your wild caught products are not already certified, follow MSC to help you to understand the requirements of and potential for support for certification. MSC shares a lot about the MSC fishery certification guide and capacity building programme. Learn about the growth and market expansion in MSC's annual report 2018-2019 (page 32) to learn about MSC’s expansion from 2000 to 2019 and MSC’s annual report 2019-2020 for developments during the year that COVID-19 hit the global seafood market.

- Read the CBI Market Statistics and Outlook study for a greater understanding of regional differences in their consumption and import patterns.

- Ask your customer about their sustainability certification requirements. When possible, partner with the importer and gain their support in becoming certified. Check out what Ahold Delhaize says about the importance of sustainability for their fish and seafood assortment as an example of what will be required from a growing number of your potential partners.

- Do not look at certifications as a means to get a premium price for your product, look at it as a market access requirement for Europe’s retail market.

- Take a closer look at the Global Sustainable Seafood Initiative, their benchmark of sustainable seafood standards and the GSSI recognised standards. It will help you to decide which certification standards to consider when you want to access the European market.

7. ‘Out-of-home market’ more committed to sustainable certified fish and seafood

For quite some time, sustainability has been something that was mainly a requirement in the retail sector, where the product is marketed and sold directly to the consumer. In the retail market, a company’s reputation is more at risk. Wholesalers, selling to the food service sector, on the other hand, claimed that restaurant chefs did not care that much about sustainability and that the clients eating at the restaurant were not asking for it. They argued that the chef would say that sustainability is important, but the price is leading. Well, this is changing.

Typically, it takes about five years for a trend in retail to also gain traction in the ‘out-of-home’ sector. This has proved to be true for sustainable seafood. In North-western Europe, restaurant chefs are increasingly becoming aware that consumers want to know that what they eat is sustainable. Although it is a slow movement, in recent years, an increasing number of restaurants market themselves as only selling sustainable seafood.

Furthermore, the claims that restaurants in North-western Europe make about the sustainability of their seafood often goes beyond certification. In this area of Europe, restaurants often sell different kinds of fish than is stocked by their retail counterparts, some of which are not available certified. In those cases, restaurants tend to commit to only selling seafood that has a recommendation in a seafood guide, such as the Good Fish Guide.

The Netherlands-based Good Fish Foundation, the organisation behind the Good Fish Guide, works actively with restaurants and creates campaigns to convince consumers that it is possible to work exclusively with sustainable seafood. The Good Fish Foundation knows, from experience, that once the chefs are convinced and ask for sustainable fish and seafood, wholesalers will start to expand their offerings. A growing number of smaller fish and seafood wholesalers, like the Netherlands-based Ecoseafood, are specialised in selling sustainable seafood.

The Dutch specialised fish and seafood wholesaler Jan van As has made a Fish&Season assortment of seafood for the hospitality industry, retail and catering that is caught in the right season and uses sustainable fishing methods to promote the health of fish stocks. Their fish experts advise chefs about sustainable seafood that is in season. They provide practical tips for preparation and recommend high-quality, sustainable alternatives for the menu, while considering healthy profit margins and high quality. Because food businesses often change their menus with the seasons, they developed a menu assistance tool to help chefs adjust the menu.

The European Commission is also stimulating this trend. They recently launched Taste the Ocean, a social media campaign in which top chefs promote the consumption of sustainably caught or produced fish and seafood. The campaign promotes fish consumption and awareness amongst consumers about the importance of local, seasonal and sustainable consumption. Top chefs from nine EU countries share their recipes made with fish or shellfish from fisheries and aquaculture.

Wholesalers might also decide to sell more certified seafood as the prices of certified-sustainable fish and seafood come down to more or less the same level as their conventional competitors. We saw this happen during the 2018 price slump of Pacific white shrimp. Sligro, one of the largest Dutch wholesalers, suddenly requested that their shrimp supplier, Fisherman’s Choice, start supplying ASC-certified Pacific white shrimp only.

We believe that the growing trend of demanding more sustainable seafood in wholesale will spread in the same way as this trend has in retail. In a couple of years, the demand for sustainable seafood will have increased across the European wholesale market. Though this topic might not seem relevant to you if you do not currently supply retail, if you want to be ahead of your competitors, you had better start looking at how sustainable your fish and seafood is now.

Since COVID-19 closed much of the food service industry during the lockdown measures, and this sector is only just starting to reopen, it is uncertain what will happen and how it will recover. The trend towards more sustainable products in food service, however, is likely to continue. As mentioned before, there is an increasing demand from consumers for more sustainable products. This will support the continued development of the food service industry, towards an increased commitment to more sustainable fish and seafood.

Tips:

- Check whether your product is recommended as a responsible choice in the Good Fish Foundation’s Good Fish Guide in the Netherlands or the Marine Conservation’s Good Fish guide in the United Kingdom.

- Use Google Translate if you are trying to access a company website linked in this study and the website is not available in a language you are familiar with or turn on the auto translate function in your browser. Companies that you might be interested in may only have their websites translated into the languages that they use most often.

- Check the menu of Bagels & Beans, a Dutch franchise with over 80 locations who offer “Fish Tales” smoked salmon. Fish Tales is an origin story-based brand that was retail-focused but has entered food service.

- Check out Jan van As’ Fish&Season initiative, which helps chefs adjust their menus based on which seafood is in season and offers a partner program in which partners receive monthly procurement statistics that show how much sustainable seafood was purchased and receive personalised advice.

- Take a look at the European Commission’s Taste the Ocean campaign and how nine European chefs became Sustainable Seafood Ambassadors.

8. Storytelling: Purchases that empower

Consumer interest in the origin of food, how it is produced and its journey to their plates continues to rise. COVID-19 and the resulting consumer concern for health and well-being has only increased interest in the story behind your products. Whether it is a story about the health benefits of your products or the sustainability of your production methods. Particularly if your client is in retail and your packaging reaches the end consumer, your story adds value. These consumers have an appetite for authentic, healthy, and sustainable products. In a crowded marketplace, your story may allow you to attract more consumers to your product and increase your margins.

To tap into this trend, you must think about your product and the story that it tells. This story can be about the production practices used, the type of producers that are involved or even the health benefits of your products. Imagine the romantic image of a happy small-scale farmer who sustainably breeds tilapia. Imagine how seeing this image on a package appeals to the emotions of the end user, as they choose between one tilapia fillet and another.

There are several ways to develop a story around your product. You can do this together with your client, taking advantage of their intimate market knowledge. Or, you can collaborate with other producers in your area to develop a joint brand or a campaign for your products. It all starts with you looking at the unique selling points that exist in your company and the products that you sell.

Klaas Puul is a shrimp importer that works with their source companies and applies origin branding to one of its product lines (Figure 2). This company achieves product premiumisation by displaying the name of the country of origin and an image that represents that country on each package. On the packaging of shrimp from Guatemala, for example, the image features a volcano and temple. How romantic is that?

By setting its South American shrimp products apart from its Asian competitors, Klaas Puul may be able to sell the product at a slightly higher price, making it possible to source the higher priced products that come from this region. Without this effort, it is unlikely that their clients would be willing to pay a higher price for this product and would require Klaas Puul to source from cheaper origins. Klaas Puul, therefore, seeks out producers, like you, to develop these stories and bring products to market.

The One-by-One Indonesian tuna branding initiative, on the other hand, is made up of a group of Indonesian tuna exporters who have developed a joint production method-based brand (see Figure 3). This is another example of storytelling being successfully employed to conquer space in the market. This group of companies have a similar ambition and can achieve product premiumisation by uniting to position their products as a high-end brand in the market.

One-by-one tuna branding focuses on highlighting Indonesia’s long-standing tradition of pole- and line-caught skipjack and handline-caught yellowfin tuna. The brand website promises a product that is superb in quality and sustainable by tradition. Products sold under the brand are sold in a universal package, which shows the brand logo and slogan and carries a deep blue colour. It sets participating companies apart from other tuna producers.

The one-by-one Indonesian tuna website allows the visitor to read the story and commitments behind the brand, as well as find facts and figures, and suppliers that can sell the brand. In the website’s suppliers list, it becomes clear that 40 companies in Indonesia can supply this brand.

It is important to understand that the stories these companies tell about their products are true. This is not a fairy-tale. They have looked at the unique selling points of their producers and have tried to (simply) communicate this on the package. If you cannot guarantee that the story is true, it is better not to tell the story at all. Certifications are a way of providing evidence for your claims. The emergence of these brands is further evidence of the increasing importance of storytelling in branding and strengthens the growing trend of certified products gaining popularity.

Tips:

- Take inspiration from other companies successfully telling stories to create a brand identity.

- Develop a story around your brand when selling to the retail and wholesale market, in which the consumer sees your packaging. Even in the business to business (B2B) market, your brand’s story can give you an advantage over your competitors. Start telling your company’s story now. Though it is not a market entry requirement yet, it is a growing trend and is becoming increasingly important to the end user. Get ahead of your competitors.

- Check the Fish Tales brand, a major sustainable seafood brand in North-western Europe that also sources from the Maldives and Indonesia, which tells the story of the producers of the seafood in their product range on packaging and online.

- Check the Selva Shrimp brand, which tells the story of Vietnamese mangrove-friendly shrimp farming to set its product apart from other sustainable shrimp.

- Check out Acuamaya, an innovation-driven aquaculture company that promotes gender equality and is an important driver in the development of the sustainable shrimp industry of Guatemala.

- Check the website of German-Vietnamese seafood company Binca who tries to set its products apart through storytelling in online and offline communication materials.

9. Mislabeling creates unfair competition

North-western Europe is the primary market for fish fillets and peeled shrimp. These products are sensitive to malpractices such as the mislabelling of the quantity of added water through glazing and soaking. Although glazing and soaking both have their role to play in terms of moisture retention during processing and storage, both practices are also used to manipulate the price of the product. The more water in the product or around the product, the more water you sell rather than fish and shrimp. And as you know, water is cheaper.

European law neither prohibits the treatment of fish fillets and shrimp with phosphates, non-phosphates or salt, nor does it prohibit the use of glazing. You are, however, required to label it correctly on the final product. So, if you treat a product with phosphates and soak more than a certain percentage of water, European Union regulation requires you to note this on the package. The same goes for glazing. If you decide to glaze your product and add 20% water, you can only declare a net weight of 800 grams, not of 1000 grams.

A supplier rarely engages in proactive mislabelling; it is usually done at the request of the importer. The importer sometimes does it on demand of their client, usually a wholesaler. For the consumer, it is impossible to see the difference between two bags with the same specifications on the label but a different water quantity in the package. If these two packages have a different price, the customer will go for the cheaper option. If the price difference is due to mislabelling, this creates unfair competition.

This negative trend has the potential to cause serious damage to the reputation of producers who participate in these practices and places the producer who weighs their products honestly at a disadvantage. European importers and their clients who do not commit fraud with labelling are increasingly complaining about their competitors who do, showing that some companies have begun to resist this trend. Even though it might not be your idea to mislabel, if you fulfil these requests, you are not only committing fraud, you are also putting your reputation at risk.

Once your name is connected to these malpractices, it will be tough for you to get rid of the bad reputation. Although these practices may provide you with short-term economic gains, in the long run, once the market becomes better regulated or once consumer awareness prevents these practices from continuing, you will be in trouble.

Tips:

- Read more details about the issue of adding water to shrimp and how it negatively affects the industry.

- Openly communicate with your customer on the specifications of the product you are about to produce and write down the agreed details on specifications, treatment and glazing in the contract, so no misunderstanding can present itself when the product reaches the European customer.

- Find out whether malpractices happen with the products that you are selling. If they do, pay extra attention to your customer’s requests to avoid participating in fraud or other malpractices.

- Include the accuracy of your labeling into your brand story. This might make you a preferred supplier in your target market.

- Learn more about labelling requirements via this pocket guide to Europe’s fish and consumer label.

10. Rapid consolidation through mergers and acquisitions

The global trend of consolidation through mergers and acquisitions in the seafood industry can also be seen in Europe. The question is, what and who are driving it?

Traditionally, in the fish and seafood industry, global fishing industry players that invest in their target markets drive mergers and acquisitions. These strategic buyers see it as an opportunity to grow and consolidate. By purchasing distribution companies that sell to wholesale and retail markets, these companies hope to have better channels through which to sell their products. Also, they hope to improve their margins by controlling the whole supply chain. Currently, however, the financial industry is also displaying interest. Since the seafood sector does not yet have the consolidation levels you see in other protein sectors, there are a lot of opportunities for investment companies to acquire businesses.

This can benefit you: as companies merge or are acquired, all companies in the group often expand their portfolio of products, creating new potential buyers for you. Furthermore, some companies invest in the production sector to ensure access to raw materials. A potential downside for your business is that mergers and acquisitions can also increase a group’s bargaining power, putting pressure on your bottom line.

Maruha Nichiro, the world’s biggest seafood company, purchased Seafood Connection in 2013 to have better access to the European market, and then, through Seafood Connection, made other acquisitions such as Anova Seafood in the Netherlands in 2018 and Inlet Seafish in Spain in 2019.

Parlevliet & van der Plas acquired Deutsche See in 2018 to enter new and strategically important markets in Germany. Other prominent subsidiaries are Heiploeg group, German Seafrozen and Ouwehand visverwerking.

At the smaller end of the scale in mergers and acquisitions, in 2020, Dutch seafood importer and processor Klaas Puul was acquired by the British seafood wholesaler Sykes Seafood. By combining Sykes Seafood with Klaas Puul, they can now supply the retail and foodservice in Europe with a complete range of shrimp.

During the pandemic it has been challenging for companies to pursue mergers and acquisitions. However, as the world starts to recover, seafood executives predict a busy period for mergers and acquisitions is on the horizon. There are several reasons for this. COVID-19 has had a huge impact on the food service sector and many smaller companies in the fish and seafood industry are struggling. While food service is reopening, it is doing so at a greatly reduced capacity. It is likely that, as things begin to normalise, not all of the (small) companies will be able to recover from the economic impact. This may lead to smaller companies closing for business or being acquired by bigger players.

Access to cheap finance is another possible driver for more mergers and acquisitions. Low interest rates and abundant capital in combination with government-promised support for the industry could contribute to increased mergers and acquisitions in the future.

With retail sales high as a result of COVID-19 and less demand for whole fish, usually consumed in the food service industry, it is likely that financial investors and seafood industry players will be interested in gaining access to retail companies. They are likely to do so through consolidating the processing sector, where there are currently still many separate companies.

Tips:

- Find your way into bigger groups and aim to become a preferred supplier. This could give you access to a much more stable demand, allowing you to become less dependent on spot market selling.

- Subscribe to newsletters of the major seafood news media such as UndercurrentNews, Intrafish and Seafood Source to stay up to date about mergers and acquisitions, to make sure that you understand the latest market dynamics.

The study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Follow us for the latest updates

Search

Enter search terms to find market research