The German market potential for coffee

Germany is Europe’s largest green coffee importer. More than 90% of its coffee is sourced from producing countries. Although a lot is re-exported, most green coffee goes into Germany’s roasting industry. This industry is changing. With around 2,500 roasters, there are many opportunities for exporters. Germany also presents opportunities for direct trade in the speciality coffee sector. It is home to a growing base of consumers who want sustainable and certified coffee products.

Contents of this page

1. Country description: Germany

Germany is in the centre of Europe. It has borders with many other countries. These are Denmark, the Netherlands, Belgium, Luxembourg, France, Switzerland, Austria, Czech Republic and Poland. It plays a large role in Europe’s economy and politics. With a population of around 83 million, Germany is the largest country in Europe. Germany’s economy is the largest in the Eurozone. It is known for its industry. GDP per capita is around €41,000. This shows a high standard of living.

Germany is the main importer of green coffee in Europe. It is home to Neuman Kaffee Gruppe (NKG), the world’s largest coffee trader. A lot of this is re-exported to nearby countries. It has the second-largest roasting industry in Europe after Italy. The German coffee consumption market is split into two parts: discount supermarkets that sell cheap coffee and high-end speciality coffee.

Germans communicate directly. When talking business with Germans, small talk and social talk is usually minimal. Most German buyers prefer a clear, honest approach. When you try to sell your product to Germans, talk about the facts. Social talk usually comes later. Promoting products is usually to the point in German business culture.

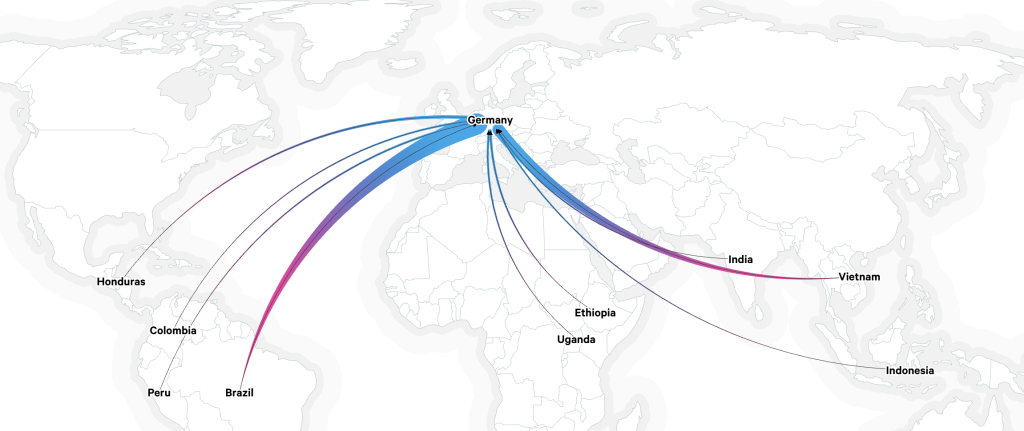

Figure 1 shows the largest green coffee trade flows to Germany. Larger arrows indicate larger trade flows.

Figure 1: Main green coffee export flows to Germany, 2022

Source: Resource Trade

Tips:

- Watch this SCA video for an overview of the German coffee market.

- Find more information on the Deutscher Kaffeeverband (German Coffee Association) website. The association publishes sector news and organises national events.

- Learn about the main European markets by reading CBI country studies. There are studies on the Spanish, Belgian, French and Swiss markets, as well as many others.

- Visit the website of the Port of Hamburg. It is Europe’s largest coffee port. You can learn about this key trade hub and discover potential coffee business partners.

- Use your browser’s translation function to read studies in your native language. Many resources are in German, so this will help you to understand information better. Visit the Google Support website for instructions on how to do this.

2. What makes Germany an interesting market for coffee?

Total import volumes of green coffee in Germany are likely to remain stable. Demand for higher-quality coffee keeps growing. The country re-exports about one-fifth of its imports directly. Around 90% of German adults drink coffee. This adds up to roughly 200 million cups daily. Brazil and Vietnam are Germany’s main suppliers.

Germany is Europe’s largest green coffee importer

In 2024, Germany imported just over 1 million tonnes of green coffee from producing countries (16.67 million 60 kg bags). This volume has been steady since 2020, besides a dip in 2023. In 2023, green coffee imports from producing countries fell to 859,000 tonnes. This dip was caused by a global coffee shortage. European companies used their large stocks to meet demand. Germany reduced its exports to other European countries.

Source: Eurostat, 2025

Germany’s green coffee demand is far higher than other European markets. Italy, Europe’s second-largest import market, imported 623,000 tonnes from producing countries in 2024.

Most green coffee beans arrive through the Port of Hamburg. Many large importers have their headquarters in Hamburg. This is also true of Neumann Kaffee Gruppe (NKG), the world's largest coffee trader. The ports of Bremen and Bremerhaven also handle large amounts of coffee. Ecom and Rehm & Co. are some of the largest German coffee traders.

As the largest importer in Europe, Germany offers exporters opportunities to sell beans of different levels of quality and places of origin. These beans are either roasted locally or re-exported to other markets.

German coffee imports are expected to remain stable in terms of volume in the coming years. In value, the German coffee market is expected to rise slightly. This is mainly caused by higher coffee prices and more demand for high-quality coffee.

Tips:

- For more information on exporting to Germany, visit the German Import Promotion Desk.

- Visit the German Coffee Association website for more information about the coffee industry in Germany. This association supports its members’ interests. Members include coffee traders, brokers, roasters, instant coffee producers and coffee equipment manufacturers.

- Read our study on trade statistics for coffee for more information about the European green coffee bean trade.

- Visit the websites of the Port of Hamburg and the ports of Bremen and Bremerhaven to learn more about the ports themselves and potential trade partners based there.

Germany is Europe’s largest trade hub

Germany is the largest European importer and green coffee trade hub. In 2023, 194,000 tonnes of green coffee were re-exported from there. Belgium is the second-largest trade hub. For comparison, Belgium imported 176,000 tonnes of green coffee in the same year.

Germany mainly re-exports green coffee to neighbouring countries: Poland (86,000 tonnes), Spain (32,000 tonnes), the Netherlands (17,000 tonnes) and the Czech Republic (16,000 tonnes).

Germany offers a very large consumption market

Germany is the fourth-largest coffee consumption market in the world, after the United States, Brazil and Japan. The German coffee market represents an estimated market value of €20 billion yearly. In value, the retail market represents one quarter; the out-of-home market represents three quarters. In terms of volume, it is the other way around: 75% of coffee is sold in retail, 25% is consumed out of home.

Nearly 89% of Germans drink coffee. This is a bit above France (86%), but below the Italians and the Spanish (95%). German coffee drinkers drink an average of 3.4 cups of coffee per day; around 200 million cups.

Germany’s yearly per capita coffee consumption is 5.4 kg on average. This is not the highest in Europe, but it is above the European average (5 kg). Germany has Europe's second-largest branded coffee shop market and Europe’s second-largest market for shops specifically focused on coffee, after the United Kingdom.

The three main reasons for Germans to drink coffee are:

- pleasure (60%);

- as part of a daily routine (55%);

- as a moment for personal relaxation (45%).

Filter coffee is the most popular. 47% of coffee drinkers consume filter coffee on a regular basis. This is followed by cappuccino (29%) and latte macchiato (22%).

Germany has a huge roasting industry

In 2023, Germany roasted 507,000 tonnes of coffee. This represents 22% of European coffee production. Germany has the second-largest roasting industry in Europe. Italy is first, with 556,500 tonnes. France is third, with 139,300 tonnes.

Germany sources most coffee from producing countries directly

In 2023, 91% of coffee imports came directly from producing countries. Brazil is by far the largest supplier of green coffee to Germany (341,000 tonnes). Vietnam (207,000 tonnes), Honduras (76,000 tonnes), Uganda (53,000 tonnes), Colombia (40,000 tonnes) and India (34,000 tonnes) are next.

Tips:

- Create a list of potential buyers before reaching out. You can find a list of roasters on the Coffee Insurrection website.

- Visit the Access2Markets website to analyse European and German trade dynamics and build your export strategy. By choosing Germany as your reporting country, you will be able to follow developments like the emergence of new suppliers and the decline of established ones.

- Visit the Frankfurt Coffee Festival and Coffee Week Berlin to expand your network in Germany.

3. Which coffees offer the most opportunities for the German market?

Germany is one of Europe’s largest speciality coffee markets, alongside the United Kingdom. German consumers value quality and sustainability. As a result, certified coffee products have a strong presence in the market. Rainforest Alliance, Fairtrade and organic are the main certifications. Many products have more than one certification.

Rainforest Alliance

Germany is the second-largest Rainforest Alliance-certified coffee importer in the world. In 2023, it imported 132,000 tonnes. This is 7% less than in 2022. Switzerland was the largest, importing 249,000 tonnes in 2023.

Many Germany-based coffee supply chain actors are Rainforest Alliance-certified. Some of the coffee they buy is Rainforest Alliance-certified. Among them are importers (Neumann Kaffee Gruppe (NKG) and List + Beisler). Examples of roasters are Tchibo and RÖSTfein. Retailers include Lidl and Kaufland, and coffee shops include McCafé and Caffe Bistrot.

Rainforest Alliance represents a very large share of coffee sales. Around one-third of all coffee sales in Germany are Rainforest Alliance-certified.

Fairtrade

Fairtrade coffee retail sales grew steadily between 2015 and 2021. In 2015, the value of retail coffee reached €357 million. In 2021, it rose to €541 million. According to Fairtrade Germany, Germany consumed 24,057 tonnes of Fairtrade-certified coffee in 2022. This is equal to about 5% of total coffee consumption. Germany is one of the five largest Fairtrade markets in the world. Tchibo and J.J. Darboven are the leading German roasting companies for Fairtrade coffee.

Organic

Based on Traces data, Germany is Europe’s largest market for organic-certified coffee. In 2023, Germany imported over 58,000 tonnes of organic green coffee. Germany’s main suppliers were Honduras (24,000 tonnes) and Peru (17,000 tonnes). Organic coffee imports grew by 17.3% in 2020. They remained stable until 2022. Organic coffee imports declined by 4.8% in 2023.

Source: Eurostat, 2025

Competition in the organic market is extreme. Germany is a significant destination for producers of organic-certified coffee. Examples of German traders of organic coffees include Bernhard Rothfos, InterAmerican Coffee, List + Beisler and Rehm & Co.

Multi-certified coffee

Germany is a large market for double-certified coffee. Most multi-certified coffee is Fairtrade organic-certified. According to Statista, about 72% of all Fairtrade-certified coffee was also organic-certified. This number has been stable since 2011, between 68% and 78%. 5% of all German coffee was Fairtrade-certified; around 4% of all coffee sales in Germany were Fairtrade organic-certified.

The largest German retailers sell Fairtrade organic coffee as part of their portfolio of brands. ALDI sells Fairtrade organic coffee under its brand Simply Nature. Lidl sells Fairtrade organic coffee under its brand Café del Mundo. REWE also sells Fairtrade organic coffee.

Company standards

Many large coffee companies have developed their own sustainability programmes. These are different from third-party certification. These standards are rarely audited by independent bodies. They are often less complex and transparent. Many large German traders have their own standards. Company sustainability programmes with a large German presence include:

- NKG Verified (Neumann Kaffee Gruppe);

- Coffee of the Future (Melitta);

- NKG Bloom;

- Ecom Sustainable Management Services.

There are no statistics available on what portion of German coffee imports complies with coffee standards. However, these company standards are growing globally. According to the Global Coffee Platform, 4.4% of all coffee sales complied with a company standard in 2020. In 2023, this was 21%.

Companies offer different shares of coffee that comply with specific standards. For instance, 1.5% of Melitta’s coffee complied with their company standard in 2023. Important standards also differ per producing country. In Brazil, Enveritas Green is the largest company standard. Enveritas certifies coffee for JDE Peet’s. Louis Dreyfus’ company standard is the second-largest.

Tips:

- Find potential business partners in Germany by checking this list of German organic coffee importers. For Rainforest Alliance, find German Rainforest Alliance-certified coffee brands.

- Look for potential buyers online if you supply certified coffee. For instance, you can find German importers of Fairtrade-certified coffee on the Fairtrade Germany website.

- Promote the sustainable and ethical aspects of your production process. Back these claims up with certification. Read our study on doing business with European coffee buyers for more tips on marketing and promoting your coffee.

- Before choosing a certification programme, make sure to check market demand and whether it will be cost-beneficial for your product. Always do this after discussing with your potential buyer.

- Find out which certification standards and company standards are important in your country. For many countries, you can find this in the Global Coffee Platform’s sustainability report. You can also visit certification bodies' websites.

Germany has a very large speciality coffee market

The German speciality coffee market is growing fast. In terms of size, the German speciality coffee market is similar to the United Kingdom, which is Europe’s largest speciality coffee market. More Germans want quality coffee. According to the Tchibo Kaffeereport, 16% of Germans drink less but higher quality coffee than before.

There are no exact numbers about the size of the German coffee market. According to experts, the German speciality coffee market is worth around €3.5 billion. This is around 17% of the total German market value, although it is much smaller in volume.

The German speciality coffee market has grown quickly in the past few years. The COVID-19 pandemic made it grow faster. Consumers were forced to stay at home, but still wanted good coffee. A sign of its growth is the number of cafés that offer speciality coffee. In Germany, speciality coffee is often bought in a specialised shop. 16% of Germans buy their coffee in a specialised shop. Germany has 490 speciality coffee cafés registered on European Coffee Trip. In 2021, there were 294 speciality coffee shops.

Roasters that offer speciality coffee include The Barn, Five Elephant and Flying Roasters. Importers active in this segment are Touton and Cafe Imports.

There is room for a lot of diversity in the German speciality coffee market. People active in the speciality coffee scene love new flavours. 35% of Germans like to try new types of coffee. This creates opportunities for producers that offer rare varieties or unique processing methods. This is especially true for specialised traders, micro roasters and their customers.

The German speciality coffee market is expected to keep growing. However, the current market is very uncertain. Germany faces an energy crisis, volatile coffee prices and global trade tensions. These could affect the speciality market.

Tips:

- Contact German speciality roasters directly. You can find them through several websites, such as Roastful and Coffee Insurrection.

- If you offer rare coffees, reach out to German speciality coffee traders or speciality coffee roasters that value innovation. German speciality coffee lovers are very interested in new flavours.

- Invest in cupping facilities, a lab and skilled Q-graders. By understanding the quality and value of your product better, you will learn how to communicate with buyers and be better positioned to get the right price.

- Visit the German Specialty Coffee Association (SCA) website for more information about Germany’s speciality coffee industry.

- Meet potential partners. Try to develop direct trade relationships with small traders and roasters at events like the Frankfurt Coffee Festival.

4. Which trends offer opportunities or pose threats in the German coffee market?

The European coffee market is changing. Most trends apply to the whole European region. These trends are described in our study on trends in the European coffee market. Some trends are stronger or more specific to Germany, which is why they are listed here.

Increasing demand for low-priced coffee

The German lower-end segment is growing. More Germans are choosing the cheapest options in supermarkets. About 74% of German coffee drinkers pay attention to buying coffee on sale. A quarter of Germans now choose budget brands, and 23% say they can no longer afford premium coffee. Two main reasons for the increasing demand for low-cost coffee are increasing poverty and inflation.

In 2023, about 17.3 million Germans were affected by poverty. This is 21% of the population. Poverty is relative. Poverty in Germany is different from poverty in many coffee-producing countries. Poverty is growing. It is caused by a stagnating economy and reduced social security. Germany has not seen significant economic growth in five years.

Increasing prices mean growth at the lower end of the coffee market. Consumers choose lower-end coffee more often so they can afford coffee. 69% of Germans think inflation will continue.

Increasing pressure on prices may affect coffee sustainability. It may mean that consumers do not want to pay for certified coffee. This is especially true of Fairtrade and organic coffee.

Simexco Daklak is a Vietnamese company tapping into this trend. The company mainly sells low-priced Robusta and supplies the German market. Tchibo is one of its clients. They communicate how they meet sustainability requirements, such as EUDR compliance, on their website.

Germany’s coffee roasting landscape is diversifying

Germany has a busy speciality coffee culture. Many small-scale roasters are stepping in to meet the increasing demand for speciality coffee. Germany is home to about 2,500 roasters. This means it has one of the highest numbers of coffee roasting businesses in Europe per capita. Roasters are very different in terms of size. Some speciality roasters do not have full-time staff members, while others employ thousands of people.

Small-scale roasters are the backbone of the speciality coffee industry. They cater to growing consumer demand for ethically sourced coffee and craft production. Many of them focus on direct trade with coffee farmers. Bonanza Coffee Roasters in Berlin, The Barn and Machhörndl Kaffee in Nuremberg are examples of famous roasters. Most small-scale roasters are located in major cities, such as Berlin, Hamburg, Munich and Frankfurt.

Many large roasters have also decided to tap into the speciality coffee market. For example, Melitta started the Melitta Manufaktur line. All their coffees have an SCA-rating of 80+.

The diversification of Germany’s speciality coffee sector means more options for speciality coffee suppliers. This trend offers opportunities for exporters with unknown varieties or unique processing methods. It also creates opportunities for storytelling and sustainable production.

Café Imports from Berlin, for example, offers many speciality coffees from women coffee producer groups. Codech from Guatemala is one of their suppliers. Female members are all farm holders who get a premium for their coffee. Half of this goes to healthcare programmes. Codech is also Fairtrade- and organic-certified.

Sales of whole bean coffee are surging

Germans are consuming more whole bean coffee. Whole beans comprise 46.6% of the market, compared to 43.3% for ground coffee. Over the last five years, whole bean sales have grown by 69%. At the same time, ground coffee and single-serve options have gone down by 20.2% and 24.7%, respectively. This shift shows consumers seek freshness and personalised coffee experiences at home. Young consumers are driving this trend. They want fresh, high-quality coffee. They are also more likely to buy speciality coffee.

This trend is mainly relevant for suppliers that offer roasted coffee to Germany. Coffee Annan and Roasted at Origin are suppliers of coffee roasted at origin that operate in the German market. Coffee Annan sells organic and non-organic coffees. One of their suppliers is Virunga Coffee from Congo. Roasted at Origin is a marketplace selling multiple brands. Both companies focus their marketing on sustainability and premium quality. Roasting at origin is a way to ensure a larger share of the added value, keeping the margin in the producing country.

Tips:

- Learn more about Berlin’s speciality coffee scene by listening to this podcast.

- Read our study on entering the German coffee market for more information on German importers and quality segments.

- Read our study on exporting roasted coffee to learn more about tapping into this market.

- Target the Gen Z market if you export roasted coffee. This market is expected to grow in size. Use storytelling to focus on your sustainability aspects and connection with the local area and farmers.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research