The French market potential for coffee

France is a large and mature coffee market with a long tradition of coffee consumption. The country holds an important position in European imports of green coffee, with a well-established coffee roasting industry. Sustainability and certification are major trends on the French coffee market. Given the widespread availability of certified coffee in France, certification may be a key entry requirement for coffee exporters. The specialty coffee market in France is taking shape, offering interesting opportunities to exporters offering high-quality coffees with unique stories.

Contents of this page

1. Country description

France is located in Western Europe. With a population of around 68 million people, it is one of the most populous countries in Europe. France’s economy is strong, ranking as the second largest in the Eurozone, after Germany. The French economy is highly diverse. In line with other Western countries, services account for the largest share of the economy. France has a GDP of €40.8 thousand per capita. This is comparable to the EU average.

France shares borders with Belgium, Luxembourg, Germany, Switzerland, Italy, Monaco, Andorra and Spain. Although French is the official language, regional dialects and minority languages also persist. Many French people speak few other languages. France is famous for its cuisine. Eating and drinking are very important in the French culture.

For many French people, drinking coffee is part of the everyday routine. Most French consumers prefer dark (or very) roasts, either filtered or espresso-based. Most coffee consumption is in the morning and the afternoon.

France imports many different kinds of coffee. Table 1 provides insight into the import levels in 2023.

Table 1: Imports of coffee into France from all over the world, 2023 (in tonnes)

| Product | HS code | Imports in 2023 |

| Green coffee beans, not decaffeinated | 090111 | 3,504,543 |

| Roasted coffee beans, not decaffeinated | 090121 | 893,071 |

| Green coffee beans, decaffeinated | 090112 | 70,454 |

| Roasted coffee beans, decaffeinated | 090122 | 34,455 |

| Coffee; husks and skins, coffee substitutes containing coffee in any proportion | 090190 | 10,525 |

Source: Eurostat

In 2023, France imported over 226 thousand tonnes of green coffee. This coffee was imported mainly from Brazil and Vietnam, the two largest producing countries. In addition to green coffee, France imported 893 tonnes of roasted coffee. Because only a very small share was roasted in producing countries, however, this study focuses on green-coffee imports.

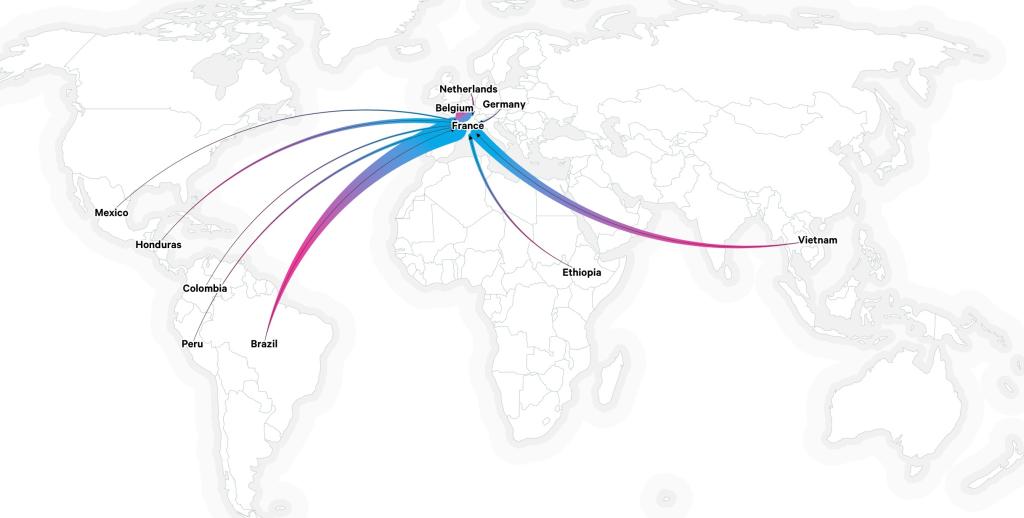

Figure 1 shows the largest green-coffee trade flows to France. Broader arrows indicate larger trade flows.

Figure 1: Main green-coffee export flows to France, 2022

Source: ResourceTrade

2. What makes France an interesting market for coffee?

France holds an important position in European imports of green coffee. The largest share of French imports is directly sourced from producing countries, offering interesting opportunities to coffee exporters. Besides being a large importer, France also has a large coffee-roasting industry. Roasted coffee exports have increased much over the years, indicating a constant demand for green coffees. Besides large multinational roasters, France also houses small and medium-sized roasters, often focusing on ethical value chains, high-end or specialty coffee.

France is Europe’s fifth-largest importer of green coffee

France imports around 150 thousand tonnes of green coffee each year from producing countries.

Source: Eurostat, 2024

In 2023, 67% (147 thousand tonnes) of all coffee imported to France was sourced directly from producing countries. Between 2019 and 2023, green-coffee imports to France (including re-exports) fluctuated between 229 thousand tonnes and 213 thousand tonnes.

Examples of coffee trading companies in France include the following:

- Maison P Jobin & Cie (part of the Neumann Kaffee Gruppe)

- Olivier Langlois (part of Group Sopex)

- Volcafe France (part of ED&F Man)

- Touton S.A.

- Belco (specialty-coffee importer)

The Port of Le Havre is the main entry point for green coffee in France.

The role of France as a trade hub in Europe is limited

France is the sixth-largest re-exporter of green coffee beans in Europe. In 2023, France accounted for only 1.8% of all European re-exports, with a volume amounting to 8,619 tonnes. As such, most French imports go to its domestic coffee-roasting industry.

Between 2019 and 2022, the re-exported volumes of green coffee grew from 4.2 thousand tonnes to 12.9 thousand tonnes. In 2023, export volumes declined to 8.6 thousand tonnes, due to decreases in coffee imports from other European countries as well. These declines were due mainly to decreased global production and high inflation rates.

In 2023, most green-coffee exports from France went to the following destinations:

- Germany (3.5 thousand tonnes)

- Belgium (2.0 thousand tonnes)

- The Netherlands (781 tonnes)

- Spain (690 tonnes)

France offers a large retail market

The French drink a lot of coffee, which is the second most-consumed drink after water. The French market for retail coffee has a value of €2.8 billion. In terms of volume, ground coffee dominates consumption in the French market, followed by single-serve coffees and whole beans. In terms of market value, single-serve coffees (mostly hard pods and soft pads) account for the largest share of retail sales.

Source: LSA, 2024

France has a very large market for coffee pods

Pods account for the largest share of the single-serve market. The French market for pods (hard capsules and soft pads combined) is very large. In 2022, ‘traditional coffee’ (ground coffee and whole beans combined) accounted for 66% of all coffee sold, with pods accounting for the remaining 34%. In terms of market value, the pod market represents 65% of the total retail-market value. This is far above the average of 39% in the European market as a whole.

The market leader in France is JDE Peet’s, with a market value of over €500 million. The company has a market share of 39%, with brands like L’OR, Grand’Mere, Senseo and Tassimo. Other large players include Lavazza (19% market share), private labels such as Carrefour, Auchan and E.Leclerc (14% market share) and Nestlé (12% market share).

The French coffee market is changing, but remains stable in terms of volume

In 2023, the value of the French retail coffee market rose by 10%. The main driver of this growth was inflation. Because the French coffee market is saturated, its volume is expected to remain stable. The same applies to its retail value. Although the demand for high-quality beans is likely to grow, the single-serve market is declining in volume.

Tips:

- Activate your browser's “Translation” function to make the studies available in your native language.

- Access EU Access2Markets to analyse European and French trade dynamics and build your export strategy. By selecting France as your reporting country, you can follow developments such as trade flows with established suppliers, the emergence of new suppliers and changing patterns in direct and indirect imports.

- See our study on Trade statistics for coffee for more detailed information about the European trade in green coffee beans.

- See the website of the French Coffee Union (Le Syndicat Français du Café) for more information about the French coffee industry.

3. Which coffees offer the most opportunities for the French market?

The French coffee market offers many opportunities. France is home to a growing market for specialty coffees. Although the market for certified coffee is growing, certification levels are still low in comparison to many Western and Northern European countries.

A growing specialty market in France

The share of specialty coffees in France has increased steadily in recent years, from 1–2% of the French coffee market in 2017 to about 4% in 2020. Although they are still a niche market, specialty coffees have great potential for growth. This potential is especially strong when reflecting the country’s well-established wine sector, with attention to elements such as origin, terroir, production and preparation methods. According to multiple experts, the speciality-coffee market is expected to continue growing.

Artisanal roasters, coffee enthusiasts and coffee festivals (such as Le Paris Café Festival and the Paris Coffee Show) play important roles in promoting specialty coffees and in expanding this segment in France. Artisanal roasters and specialty-coffee importers often use online blogs to tell the stories behind their specialty coffees and educate consumers about coffee origins. One example is the series of blogs posted by the importer Belco. The focus on origin is increasingly requiring exporters to highlight the uniqueness of their coffees in terms of quality and origin.

Examples of specialty coffee roasters in France are:

Other coffee players with a strong focus on specialty coffees include the brand Alter Eco, which imports fair-trade and ethical coffees, and the trader Belco, which focuses on high-quality coffees.

Tips:

- The European Coffee Trips website offers many specialty-coffee roasters. Explore how they position themselves. This can give you insight into how to promote your coffees to specialty-coffee buyers in France.

- Read more about the specialty-coffee culture in Toulouse on the Perfect Daily Grind website.

- See the national chapter of France of the Specialty Coffee Association (SCA) for more information about the French specialty-coffee market.

The demand for fair trade continues to grow

Fair trade (not to be confused with Fairtrade certification) is a movement that aims to promote better prices, decent working conditions and fair terms of trade for farmers and workers in coffee producing countries. It focuses on ensuring that small producers get a fair deal, enabling them to improve their lives and plan for their futures.

In 2023, fair trade in France grew by 6%. Coffee is a significant part of fair trade, representing 22.3% of the products in international fair-trade markets. It is nevertheless unclear whether and to what extent the demand for fair-trade coffee has grown. Any increase is driven largely by supermarkets, which are offering a growing assortment of fair-trade products.

French consumers buy their responsibly sourced products mainly in supermarkets (71%), followed by street markets (48%), directly from producers (26%) and at organic stores (25%). With a growing market, France offers opportunities for more fair-trade suppliers.

Tip:

- Search the website of the World Fair Trade Organization website for associated members in France. These organisations could become interesting buyers for you.

Organic coffee

France is Europe’s fourth-largest importer of organic green coffee. With a volume of 13,148 tonnes in 2023, it scored just below Sweden (13,270 tonnes). Germany (58,375 tonnes) and Belgium (29,522 tonnes) were the market leaders. Note that the share of re-exports is unclear. France’s imports of organic coffee increased between 2018 and 2020, but they remained stable between 2020 and 2023. The outlook for organic coffee is unclear.

Most of France’s imports of organic green coffee were sourced from Peru (4,917 tonnes in 2023), followed by Honduras (2,740 tonnes), Mexico (1,981 tonnes) and Ethiopia (1,120 tonnes). Almost all imports of organic decaffeinated coffee (343 tonnes in 2023) were sourced from Mexico. France imports hardly any roasted organic coffee from producing countries. Almost all imports of roasted organic coffee (2038 tonnes in 2023) came from the United Kingdom.

Méo is the market leader in organic coffee in France. Some of its organic coffees also have Fairtrade certification. The company focuses mainly on standard quality. Examples of French companies selling organic coffee include Clipper Tea coffees, Malongo, Ethiquable and Mister Bean. Starbucks also sells some organic coffee.

Tip:

- Find potential organic buyers through the l’Agence Bio website. You can filter on specialty stores, wholesalers, restaurants, large general stores and traders.

Fairtrade Max Havelaar France can offer a better price if buyers are interested

Fairtrade Max Havelaar France recorded a 4% growth in sales of products with the Fairtrade label in 2023. This includes all Fairtrade products, and not only coffee. The value of Fairtrade-coffee sales has increased by 12% since 2019. It is unclear whether this percentage has been corrected for inflation. In 2023, the French Fairtrade-coffee sales decreased by 3% in value (compared to an overall growth of 10% in market value). The outlook for Fairtrade Max Havelaar coffee is unclear.

Les Cafés Dagobert is an example of a French roaster that works a lot with Max Havelaar-certified coffee. In addition to its Max Havelaar certification, the company works with coffee certified by Fair for Life. All of the company’s coffee also certified organic.

Tip:

- Consult your buyers if you are thinking about getting Fairtrade certification. Although the certification could significantly increase your price, the requirements for certification and the associated audits are costly. Moreover, a very large share of coffee produced as Fairtrade is not sold as such. In 2019, 60% of all Fairtrade coffee was sold as regular coffee.

The demand for Rainforest Alliance-certified coffee in France is on the rise

France has a reasonably high demand for products with Rainforest Alliance (RA) certification, which account for 6% of its total imports. Not all RA-certified imports are used for consumption within the country; some are re-exported.

Figure 4 shows the share of RA-certified green-coffee imports for Europe’s largest importing countries. Although the share of RA-certified coffee in France is higher than it is amongst Italian and Spanish imports, it is much lower than the share of RA-certified imports in the Netherlands, Germany and Belgium.

Sources: Eurostat and Rainforest Alliance

French imports of coffee with RA certification rose in 2023, despite a declining global trend. Its imports of RA-certified coffee increased from 6.4 thousand tonnes in 2022 to 14.0 thousand tonnes in 2023. This was opposite the general trend globally, with RA-certified imports dropping by 11%. In the Netherlands, RA-certified imports decreased from 140 thousand tonnes in 2022 to 95 thousand tonnes in 2023. In Germany, they decreased from 142 thousand tonnes in 2022 to 132 thousand tonnes in 2023.

The general decrease RA-certified imports will make it more difficult for suppliers to sell their RA-certified coffees. Globally, the demand-to-supply ratio of RA-certified coffee is 61%. This means that more coffee is produced as certified than is sold as certified. In addition, a large share of all RA-certified coffee is sold as conventional coffee. In 2023, more suppliers were able to sell their RA-certified coffee to French buyers.

Because RA data were available only for 2022 and 2023, we could not make a proper trend analysis for the French market. It is unclear how French RA sales will develop in the coming years.

Tip:

- Visit the Rainforest Alliance website for a non-exhaustive list of retailers providing RA-certified coffee.

The French market for roasted coffee could offer opportunities

The share of coffee roasted at origin is relatively small in France. There are many good reasons for exporting, but also many good reasons for not exporting roasted coffee to Europe. These reasons are described in our studies on exporting roasted coffee to the European market.

An important share of the French imports of roasted-at-origin coffee is purchased through Alternative Café. This company provides a marketplace for companies that roast at origin, with a focus on the high-end segment. Only participants of the World Coffee Challenge can sell their coffees through Alternative Café.

Another example is the Brazilian 3 Curações, which sells its roasted coffee through the large French supermarket Carrefour.

The French sector of private-label coffee is growing. In general, European roasters tap into this market. It may nevertheless offer unseized opportunities for efficient private-label roasters as well.

4. Which trends offer opportunities or pose threats in the French coffee market?

In addition to the general trends that apply to the European coffee market, some trends specifically apply to the French market. The market for whole-bean coffee is growing rapidly, and the out-of-home market is slowly increasing. Although demand for certified coffees has stagnated in most European countries, this market is still growing in France, although not as rapidly as in the past.

The market for whole-bean coffee is growing

Even as the market volume for single-serve coffee and ground coffee is declining, the demand for whole-bean coffee has risen significantly in 2023. Figure 5 shows the growth in volume and value of coffee consumed in 2023, as compared to 2022.

Source: LSA, 2024

Whole-bean coffee is the only type that has grown in both volume and in value. According to LSA, the Méo brand has profited the most from this increase in demand, with a sales volume rising by 45% in the past year. Méo is a leader in the organic market, selling whole beans, ground coffee and single-serve coffee.

The French out-of-home segment is slowly recovering

Out-of-home coffee consumption is embedded in French culture. Before the COVID-19 pandemic, about 35% of consumers said they visit a coffee shop at least 4–5 times a week. During the pandemic these numbers decreased significantly due to lockdowns and other social distancing measures. Many coffee shops and cafés had to close their doors; it is estimated that French coffee establishments together lost about 40% in revenue over 2020 compared to 2019.

Despite the general revenue loss, the branded coffee shop market registered a growth of 2.5% in 2020, and reached a number of 3,639 outlets in that year. The largest coffee shops on the French market are McCafé, Starbucks and Columbus Café & Co.

About 68% of coffee consumers in France indicate that coffees prepared out-of-home by baristas add value to their purchases. Coffee quality is one of the most important out-of-home buying criteria in France. About 43% of consumers are willing to pay more for higher-quality coffees.

The out-of-home market has yet to recover from the COVID-19 pandemic. In 2018, the value of the French out-of-home market was €11.2 billion. It dropped to €8.3 in 2020, due mainly to the pandemic. In 2023, its market value was €9.3 billion, which is still 17% below the 2018 level. It is unclear how the out-of-home market will evolve in the coming years.

The demand for sustainability certification is slowly increasing

Over the years, sustainability labels such as Fairtrade, Rainforest Alliance and Organic have gained importance in France. Consumers are increasingly demanding sustainable coffees, which has resulted in a large, diverse range of certified coffees in supermarkets and in the out-of-home segment. You can read more about these certifications in the section ‘Which coffees offer the most opportunities in the French market?’

Tips:

- See our study on coffee trends to learn more about current trends on the European market.

- Promote the sustainable and ethical aspects of your production process and support these claims with certification. See our study on Doing business with European coffee buyers for more tips on marketing and promoting your coffee.

- Consult the website of the Global Coffee Platform to learn more about global sustainability efforts.

- Thinking about certifying your coffee? Before engaging in a certification programme, make sure to check that the label has sufficient demand in your target market and whether it will be cost-beneficial for your product, always in consultation with your potential buyer.

- Find potential business partners in France by checking the lists of Fairtrade-certified operators, French Rainforest Alliance-certified coffee brands, and French organic coffee importers.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research