The European market potential for chocolate

This study is about European imports of chocolate and other food containing cocoa (HS 1806) from developing countries, which keep growing over the years. This provides opportunity for value addition in origin countries to increase their export value. Digital changes are also making it possible for smaller, innovative chocolate makers to reach a wider audience without relying on large physical retail networks. This trend creates opportunities for cocoa-origin exporters through specialised online chocolate shops. Although European chocolate consumption is the highest in the world, there is an increasing demand for premium, high-quality, sustainable and ethically sourced chocolate. Cocoa-origin chocolatiers can stand out by focusing on ethical sourcing, sustainability and unique origin stories.

Contents of this page

1. Product description: chocolate

Chocolate is a popular and beloved sweet treat enjoyed worldwide for its rich flavour and smooth texture. It is made from cocoa beans and comes in various forms, including dark, milk and white chocolate. The Academy of Chocolate defines chocolate as a product that complies with specific quality standards: it contains only cocoa butter as fat, with no vegetable fats; has a minimum cocoa content of 60% for dark, 30% for milk and 30% cocoa butter for white chocolate; and it prioritises the quality, origin and processing of the cocoa beans.

Types of chocolate

Dark chocolate: This is made from cocoa solids, cocoa butter and sugar, which give it a rich, intense flavour and a slightly bitter taste compared to milk chocolate. The percentage of cocoa solids in dark chocolate differs, with higher percentages having a more intense flavour. Common types include bittersweet, semi-sweet and unsweetened chocolate. Bittersweet chocolate has a high cocoa content (70% or more), semi-sweet chocolate has a slightly lower cocoa content (60-70%) and unsweetened chocolate has pure cocoa solids and cocoa butter.

Milk chocolate: Invented by Swiss chocolatier Daniel Peter in 1875, milk chocolate is the most popular and widely consumed type of chocolate globally. Milk chocolate is made by combining cocoa solids, sugar, cocoa butter and milk ingredients, like milk powder or condensed milk. This blend creates a signature creamy texture and sweet, mild flavour, making it a favourite for consumers who enjoy a softer taste compared to the richness of dark chocolate.

White chocolate: This is made from cocoa butter, milk solids and sugar, but no cocoa solids. It has a sweet, creamy flavour without the characteristic chocolate taste.

Ruby chocolate: Introduced in 2017 by Barry Callebaut, ruby chocolate is a relatively new type of chocolate, recognised for its natural pink colour, which comes from specially processed cocoa beans. It has a fruity, berry-like flavour and a slight sour taste. Ruby chocolate melts like regular chocolate, which makes it easy to use in cooking and baking. It goes well with fruits like berries, nuts and even herbs like mint and basil.

Processes for making chocolate

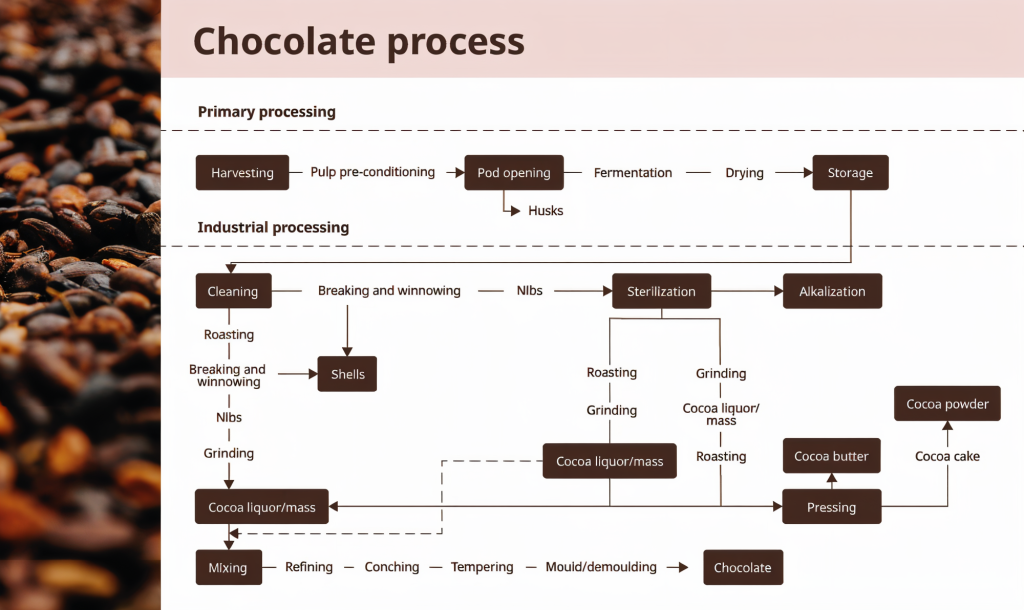

The process of making chocolate involves several steps, transforming cocoa beans into the delicious confection. Figure 1 gives an overview of the chocolate-making process. Depending on the chocolate type, cocoa liquor is mixed with ingredients like sugar, milk powder and more cocoa butter. The proportions differ based on the type of chocolate being made. The mixture undergoes “conching”: a heating and mixing process that develops flavour and creates a smooth texture. The final steps involve tempering the chocolate by cooling it to stabilise the cocoa butter crystals, resulting in a glossy appearance and proper “snap”. Once it has cooled and set, the chocolate is ready for packaging.

This process can be adjusted based on the chocolate type and manufacturer techniques. The final product's quality depends on factors like the cocoa bean variety, processing methods and ingredient quality.

Figure 1: Chocolate production process

Source: Goya et al. 2022, re-designed by Bart Wortel

Common cocoa varieties used for chocolate

Different types of cocoa are used to make chocolate and confectioneries. Manufacturers understand that harvest and post-harvest practices impact the cocoa bean quality, which affects chocolate products. The quality and characteristics of chocolate can differ significantly based on the type of cocoa bean being used.

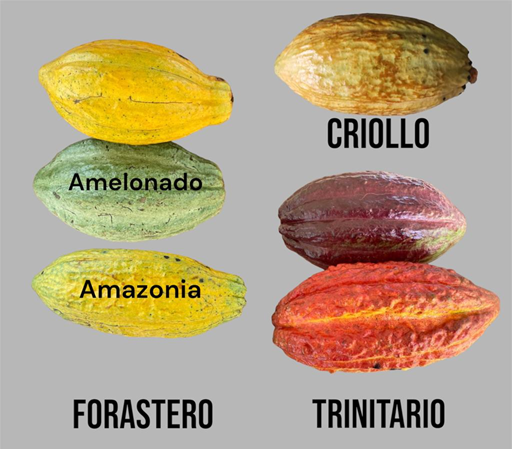

The three most common types of cocoa beans are Forastero, Criollo and Trinitario. Forastero accounts for around 80% of global production and it is mainly grown in Africa and the Americas. It grows faster and yields more than other varieties. These beans are known for their bitter taste and strong, earthy flavour. Notable Forastero varieties include Amelonado and Nacional. Nacional is grown to produce fine flavour cocoa in Ecuador.

Criollo is the original cocoa tree and it is primarily grown in Central America and Sri Lanka. Notable varieties include Chuao and Porcelana. Although it only represents about 5% of production and is less resilient, Criollo is valued for its aromatic, fruity flavour. Because it is quite rare, Criollo beans are often blended with other varieties in premium chocolates. Premium chocolates are high-quality chocolates that often come with a higher price tag because of their superior ingredients, craftsmanship and unique flavours.

Trinitario is a hybrid of Criollo and Forastero. It accounts for 10-15% of global production and it is grown in the Americas and Asia. Trinitario beans are recognised for their floral, fruity flavour, although some of them, like Cameroonian beans, are classified as bulk cocoa. Notable Trinitario varieties include Carenero and Sur del Lago.

The choice of cocoa bean significantly influences the flavour and quality of the chocolate produced. Premium chocolates often rely on high-quality beans like Criollo or Trinitario, while mass-produced chocolates typically use Forastero.

Figure 2: Common cocoa varieties

Source: Amonarmah Consults

Unique Harmonised System (HS) code

The HS code labels chocolate products for international trading, taxation and other procedures. HS codes (see Table 1) help customs authorities in different countries understand what is being imported or exported.

This study focuses on chocolate and other food containing cocoa. Our analysis involves data from EUROSTAT and the ITC TRADE MAP with HS code 1806 (chocolate and other food containing cocoa) and, where possible, sub-categories based on product weight (see the description in Table 1).

Table 1: The HS codes of specific chocolate products and their descriptions

| HS code | Product | Description |

|---|---|---|

| 180620 | Chocolate and other food preparations containing cocoa, in blocks, slabs or bars weighing > 2 kg or in liquid, paste, powder, granular or other bulk form. | Chocolate products in containers or direct packaging of content > 2 kg (excluding cocoa powder) |

| 180631 | Chocolate and other food preparations containing cocoa, in blocks, slabs or bars, weighing 2 kg or less, filled | Chocolate products weighing less than 2 kg, with fillings such as cream, nougat, fruit or other ingredients |

| 180632 | Chocolate and other food preparations containing cocoa, in blocks, slabs or bars, weighing 2 kg or less, not Filled | Solid chocolate products weighing less than 2 kg, without any internal fillings or layers |

| 180690 | Chocolate and other food preparations containing cocoa or cocoa preparations, not in bulk form | Chocolate or cocoa preparations not in bulk form, typically used for packaged products like chocolates or desserts |

Tips:

- Activate the “Translation” function in your browser to read the studies in your native language;

- Learn more about the types of chocolates as well as various word definitions regarding chocolate on the webpages of the National Confectioners Association and the Academy of Chocolate.

2. What makes Europe an interesting market for chocolate?

The chocolate confectionery market (including regular and speciality cocoa) in Europe is big and keeps growing. There is a strong preference for high-quality products that focus on sustainable and ethical trade practices. In Eastern Europe, this market is expected to be worth over €19.2 billion (USD 19.4 billion) in retail sales by the end of 2024. It is predicted to achieve a volume growth of 2.4% in compound annual growth rate (CAGR) over the next five years. In Western Europe, this market is expected to surpass €39 billion (USD 40 billion) in sales by the end of 2024, with a moderate volume growth of 0.5% CAGR during the same period.

Europeans are the world’s main chocolate importers

In 2023, European countries imported the most chocolate in the world (Figure 3). After the United States of America, the five biggest chocolate importers in the world were European countries: the United Kingdom, Germany, France, the Netherlands and Belgium. From 2022 to 2023, chocolate imports grew by 16%, 20%, 13%, 12% and 28% in the United Kingdom, Germany, France, Netherlands and Belgium respectively.

Source: ITC calculations based on UN COMTRADE and ITC statistics

European countries consume a lot of chocolate

Europeans consume 45% of the global chocolate supply. Despite the challenging economic climate, which is causing consumers to reduce their non-essential spending, many Europeans view chocolate as a small luxury that they do not want to give up easily. The average person worldwide consumes around 0.9 kg of chocolate per year, but Europeans go beyond this. For instance, Germany has a chocolate consumption of 11.9 kg per person, Ireland of 9.8 kg per person and Austria of 8.8 kg per person each year. The European chocolate market is expected to grow at a compound annual growth rate (CAGR) of 4.46% during the 2024-2030 period, to reach an estimated value of USD 61.42 billion by 2030.

Additionally, chocolate is culturally significant in Europe, where solid chocolate in the form of chocolate bars was first invented. From chocolate bars to pralines and truffles, Europe offers a wide range of chocolate treats. The popularity of chocolate is reflected in the countless chocolate shops, bakeries and cafés found across Europe. Chocolate plays a key role in European celebrations and traditions, such as Easter, where chocolate eggs are popular, and Christmas, with advent calendars filled with chocolate. European pastry and dessert culture also uses a lot of chocolate, which contributes to a growing demand for chocolate products. This means that Europe has a continued high demand for chocolate products.

European consumers also have refined tastes, with a strong preference for premium chocolate with a superior flavour and texture. The demand for luxury chocolate is driving the European premium chocolate market, which is expected to drive global growth to a CAGR of 8.7% from 2024 to 2034, reaching an estimated value of USD 12.86 billion by 2034.

Growing interest in the ethical production of cocoa

The European cocoa and chocolate market is experiencing a significant shift towards ethical consumption. This is driven by an increasing focus on sustainability and Fairtrade practices, which have become an important aspect of market dynamics. This change is driven by an increased awareness among consumers and industry players about the negative effects of unfair and unsustainable trading practices on our planet and its people.

A key factor in this shift to ethical consumption is the changing legal situation in Europe, where traceability and transparency are quickly becoming minimum requirements for market entry. The European Regulation on Deforestation-free Products (EUDR) and the Corporate Sustainability Due Diligence Directive (CSDDD) are notable examples.

The EU Regulation on Deforestation-free Products (EUDR) will ban imports of cocoa products into the European Union (EU) from land that was deforested after 31 December 2020. Although the EUDR was first set to begin in December 2024, it has been delayed until December 2025 for large companies and until June 2026 for small enterprises. The Corporate Sustainability Due Diligence Directive (CSDDD) came into effect in July 2024. It covers impact in the company’s own operations, subsidiaries and supply chains. Both the EUDR and the CSDDD mean that cocoa and chocolate companies need to make their practices more sustainable and transparent.

Consumer behaviour is also shifting towards more ethical choices, with 60% of consumers in 2020 showing a preference for sustainable products. This trend has continued to grow after the COVID-19 pandemic. According to Barry Callebaut’s Proprietary Consumer Research on chocolate trends for 2024 and beyond, over half of Western European consumers (approximately 51%) actively look for sustainably produced chocolate.

Consumer interest in the origins and quality of chocolate ingredients is driving the trend towards premium chocolate, which will be discussed in the next section. For instance, about 59% of European consumers see chocolate with a unique story as being more premium. They are interested in understanding where their chocolate comes from and how it is made. This demand for transparency and storytelling creates exciting opportunities for chocolate exporters who can show sustainable production practices from origin countries.

Consumer demand for premium chocolate is growing in Europe

There is a significant shift towards premium chocolate products in the European chocolate market. This is driven by changing consumer preferences and a rising demand for high-quality chocolate. This trend makes Europe a key player the in the global market expansion of premium chocolate. Projections indicate about 9% growth for the premium chocolate market between 2024 and 2034. Markets in Belgium and France are expected to experience strong growth. The growing consumer preference for premium chocolate products, such as single-origin, organic, handmade and artisan chocolates, is a key factor driving this growth.

Among premium chocolate products, single-origin products are especially popular because of their original flavours. These chocolates showcase the unique characteristics of their origin, which are influenced by factors such as the cocoa bean type, agricultural and climate conditions and post-harvest techniques. Notably, 75% of consumers believe that single-origin chocolate is both more premium and sustainable than standard varieties. This belief is making single-origin chocolate more mainstream, with retailers like Albert Heijn in the Netherlands, E-Leclerc in France and Waitrose in the UK offering private-label single-origin chocolate sourced from countries like Uganda, Peru, Costa Rica, Nicaragua, Ecuador, the Dominican Republic and Tanzania.

The demand for bean-to-bar chocolate is also rising in Europe. This approach, where chocolate makers supervise every step of the production process, is attractive to consumers who look for authenticity and quality. Leading European bean-to-bar players include Georgia Ramon (Germany), Heinde & Verre (Netherlands), Domori (Italy) and Zotter (Austria). Newer trends like farm-to-bar and tree-to-bar chocolate, which further focus on direct connections between cocoa farms and the final product, also appeal to consumers.

Several successful tree-to-bar brands have already accessed the market with their offer of high-quality bars with unique local flavour combinations. Fu Wan Chocolate is an example of this. This tree-to-bar maker from Taiwan offers a range of products with locally sourced ingredients or flavours, such as the Taiwan Tie-Guan-Yin Tea or Taiwan Kaoliang Liquor. Other examples include the Pure Chocolate Company's bar with local jerk seasoning and Menakao’s chocolate bar with Madagascan vanilla.

Storytelling has also become increasingly important in the chocolate market. European consumers want to know the story behind their chocolate. 59% of consumers believe that chocolate with a unique narrative is more premium. This interest goes beyond flavour to include the product's origin, production methods and ethical factors. Barry Callebaut's research indicates that 63% of Western European and 74% of Eastern European consumers want more information about the origin and ingredients of their chocolate. Brands like Ethiquable and Tony’s Chocolonely are making use of this trend by using packaging to tell the story of cocoa producers and cooperatives.

Concerns about health are another key driver of the demand for premium chocolate in Europe. Consumers believe that dark chocolate is healthier because of its higher cocoa content, with less or no sugar. Other consumers also believe plant-based chocolate confectionery is healthier because of dairy allergies or lactose intolerance. Many consumers also live a vegan lifestyle.

Lastly, there is an increasingly diverse range of chocolate bars with unique ingredients on the European market. Premium chocolate makers are experimenting with unique flavour combinations and ingredients, attracting adventurous consumers. The market is also experiencing a trend towards personalisation, with makers offering customisable products and experiences to appeal to individual preferences. Chocolate bars with flavour combinations that were once considered niche have now become mainstream. Examples include: Lavender & Caramel, Blueberry & Violet and Strawberry & Balsamic chocolate by Delicata and Hazelnut, Almond & Cranberry milk chocolate by Nestlé’s L’Atelier.

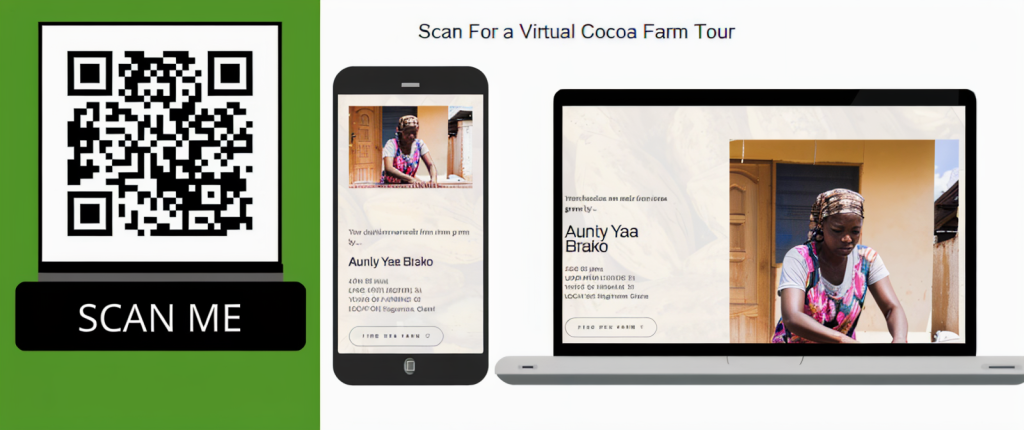

The increasing demand for premium chocolate creates significant opportunities for chocolate exporters who can offer unique, high-quality products with interesting stories. For instance, the Ghanaian craft chocolate maker Kabi Chocolate makes milk chocolate with plantain chips (Figure 4) to appeal to consumers’ demand for innovative flavours in premium chocolate. They have also developed a unique way to connect consumers to the source of their chocolate by including an art card with a QR code in their packaging (Figure 5). This code links to a video that explains the Ghanaian story behind their chocolate, including a virtual tour of the cocoa farms. This approach connects consumers directly to the source and it makes Kabi Chocolate stand out in the market.

Figure 4: Kabi milk chocolate with plantain chips

Source: Kabi Chocolate

Figure 5: Kabi Chocolate’s example of QR-enabled storytelling with their packaging

Source: Kabi Chocolate

Tips:

- Explore the possibility of adding value to your product. You can do this by specifying the characteristics of the cocoa beans grown in your area or on your farm (single-estate cocoa). These characteristics could be related to the product's flavour, the farmers' background, production and post-harvest methods or unique aspects about the surrounding nature and community. This will make your product more attractive to cocoa buyers. This applies especially to buyers interested in high-quality and unique cocoa;

- Use ITC Trade Map to analyse European trade dynamics and create your export strategy. By entering the product code (1806) and selecting a region or country, you can track trade flows with established suppliers, find newer suppliers and track shifts in import patterns.

3. Which European countries offer the most opportunities for chocolate?

The European chocolate market is diverse, ranging from premium and ethical chocolate demands in France to the growing e-commerce opportunities in Poland and from the shift towards premium products in UK to the established reputation of Belgian chocolate. Germany has Europe's largest chocolate manufacturing industry and the Netherlands has a sophisticated market with an increasing interest in unique and ethical products. This section explores the different market dynamics and opportunities for chocolate exporters. Each country is analysed for its unique characteristics, consumer preferences, market trends and possible growth areas.

France: A leader in premium and ethical chocolate

France continues to be a dominant player in the European chocolate market. It is particularly known for its focus on high-quality and premium products. French people eat an average of 12.5 kilograms of chocolate a year. France is the leading importer of chocolate and other food containing cocoa (HS 1806) from cocoa-origin countries (Figure 6). France’s strong food culture and a consumer base that increasingly values origin, ethics and unique flavours provides significant opportunities for chocolate exporters from cocoa-origin countries. French consumers are particularly interested in dark chocolate and craft products. About 30% of the chocolate consumed in France is dark chocolate, which is well above the European average. The growing preference for premium and ethically sourced chocolate opens doors for exporters who focus on sustainability.

Source: Amonarmah Consults; data from EUROSTAT

Exporters can make use of this trend by focusing on the unique characteristics of their cocoa, such as flavours related to origin and traditional processing methods. The Ivory Coast, a former French colony, is the major source of chocolate among cocoa-origin countries (Figure 7).

Source: Amonarmah Consults; data from EUROSTAT

The French confectionery and snack market is expected to grow by 3.48% each year until 2028. In 2024, it is expected to show a growth of 2.5% in volume; a growth projected to reach 3.1 billion kg by 2028. This expectation suggests that the growth of chocolate imports will also continue to increase. Finally, chocolate events, such as events like the Salon du Chocolat, offer another channel for exporters to promote their products directly to consumers and industry professionals. France’s focus on quality, exclusivity and ethical consumption makes it a prime market for premium cocoa exporters to explore.

Poland: Growing chocolate demand and e-commerce

Poland is the second-largest importer of chocolate and other food containing cocoa from cocoa-origin countries (Figure 6). The Ivory Coast is the top exporter to Poland (Figure 8). Since the 1990s, the Polish chocolate confectionery market has been growing steadily. Following the end of communism, revenue from confectionery has been increasing each year and is expected to go beyond USD 14 billion by 2029. In 2024, the average revenue from confectionery in Poland was projected to be about USD 236 per person. Chocolate consumption is 5.9 kg per person per year and is estimated to increase to 6.4 kg per person per year by 2028. These trends show possible opportunities for exporters from developing countries.

Source: Amonarmah Consults; data from EUROSTAT

Poland is also a great place for growth in online sales (e-commerce). Online shopping is becoming more popular and Poland is one of the fastest-growing e-commerce markets in Europe. Each year, more e-commerce stores are registered. Polish consumers are increasingly shopping online and around one in three Polish internet users purchase from international stores. They often look for products that are either cheaper or not available in Poland. The growing e-commerce sector in Poland offers a platform for chocolate makers from developing counties to reach consumers directly. This provides the advantage of skipping past traditional retail barriers and making direct-to-consumer sales possible through online marketplaces.

Interesting online chocolate shops include Planète Chocolat. They offer international gift delivery, including chocolate from Ecuador to Poland. Chocobakal is also a Polish online shop that offers a range of chocolates and confectionery products.

The United Kingdom: Premium opportunities amidst changing consumer behaviours

As of 2023, the United Kingdom (UK) was the third largest importer of chocolate and other food containing cocoa from cocoa-origin countries (Figure 6). The UK chocolate market offers a complicated but promising landscape for chocolate exporters. Despite a decline in the country’s chocolate sales volume in 2023, the market has seen strong value growth, with forecasts reaching £8.6 billion by 2029. This trend indicates a shift towards premium products.

Premium chocolate presents a significant opportunity, with 59% of chocolate consumers choosing premium products. Aspects such as unique flavours, ethical sourcing, craft production and clean labelling are key indicators of premium quality in the UK market. Innovation in flavours is also crucial, as there is strong interest in chocolate that combines multiple flavours, especially among younger consumers. While caramel and nuts are still popular flavours, flavours inspired by desserts and ice cream are emerging as trends.

Ethical and sustainable products are becoming more popular. Vegan claims are becoming more prominent in new launches. UK consumers, particularly those in the premium segment, are increasingly concerned about ethical sourcing. Health-conscious options are still niche, but they are growing in popularity. Dark chocolate, especially with 70% cocoa content, and products with high fibre or protein content are attracting more attention. While health regulations, such as HFSS (High in Fat, Sugar or Salt) restrictions, and changing consumer behaviours bring challenges, they also create opportunities for innovation. Exporters who offer premium, ethically sourced and possibly healthier options have a good opportunity to make use of the changing preferences of UK chocolate consumers.

Seasonal products and gifting opportunities are also important. Mintel’s Chocolate Confectionery Market Report for 2024 suggests that seasonal launches have gained a market share, with a premium focus on occasions like Easter. This trend fits with the gift-giving culture in the UK, where high-quality chocolates are often chosen as gifts.

Columbia was the top cocoa origin exporter of chocolate to the UK as of 2023 (Figure 9). This suggests an opportunity for other producing countries to add value at origin for export.

Source: Amonarmah Consults; data from EUROSTAT

Belgium: A chocolate powerhouse

Belgium is well-known for its chocolate. It has a strong chocolate industry that significantly contributes to its economy. The country produces an impressive 584,000 tonnes of bulk chocolate and cocoa-based products each year. Although Belgium is a major chocolate exporter, it is also a significant consumer and importer. It ranks as the fourth-largest importer of chocolate and other food containing cocoa from cocoa-origin countries (Figure 6). The Belgian chocolate market is expected to grow by 3.6% each year between 2024 and 2029. This suggests ongoing opportunities for both Belgian and international players.

The Belgian chocolate market has unique aspects that exporters should be aware of. The 'Belgian Chocolate Code', although not a legal requirement, is an industry standard followed by members of the Choprabisco Association. It defines 'Belgian chocolate' as chocolate for which the entire process of mixing, refining and conching takes place in Belgium. The market is dominated by multinational processors like Barry Callebaut, Cargill and Puratos, which account for over 90% of Belgian chocolate production. Other significant players include Mondelēz and Ferrero. Belgium imports chocolate mainly from Vietnam, followed by Mexico, Colombia and the Ivory Coast (Figure 10).

Although entering the Belgian chocolate market can be difficult because of its established reputation and dominant local players, there are opportunities for exporters who can offer high-quality, unique and ethically sourced products.

Source: Amonarmah Consults; data from EUROSTAT

Germany: Large chocolate market with unique demand characteristics

Germany has the largest chocolate manufacturing industry in Europe. A range of multinational chocolate manufacturers have their production facilities in Germany. Germany is the world’s top exporter of chocolate products worldwide (Figure 11) and so it also plays a major role in global exports. It is the fifth-largest importer of chocolate and other food containing cocoa from cocoa-origin countries (Figure 6). The main suppliers to Germany are the Ivory Coast, Columbia, Thailand, Mexico and Ghana (Figure 12).

Source: ITC calculations based on UN COMTRADE and ITC statistics

Source: Amonarmah Consults; data from EUROSTAT

The German chocolate market creates both challenges and opportunities for exporters. Despite rising cocoa prices, volume sales stabilised in 2023, showing a 0.8% increase after a drop in 2022. The market is expected to experience a value growth of 20% from 2024 to 2029, mainly due to rising chocolate prices.

The German market increasingly values premium chocolates. Characteristics that make chocolate appear premium to German consumers include brands with a long tradition, a high cocoa content and the use of sustainable ingredients. Examples of these brands are the Ritter Sport, Zotter and Fassbender & Rausch chocolate brands. Auro Chocolate (Philippines) and Fairafric (Ghana) are also examples of origin-made chocolate brands that are getting more popular in Germany.

Unique flavours are also a significant factor, with 47% of chocolate buyers indicating they would try a new product if it offered new flavours. Dark chocolate consumption also increased in 2024. Although health is a focus, Germans believe unhealthy foods are acceptable in moderation.

There is also a growing interest in vegan chocolate, particularly among younger consumers. About 23% of German chocolate buyers aged 16-34 would try a new chocolate product if it was vegan. However, vegan and vegetarian chocolate growth slowed down in 2024. This suggests that there is room for innovation in this category.

Unique textures appeal to German chocolate eaters, especially younger consumers. Blending two or more flavours together in one chocolate bar appeals to Germans aged 16-44. Chocolate is often bought spontaneously, which highlights the importance of attention-grabbing products. In terms of market leadership, Ferrero continues to dominate the chocolate confectionery market, while own-label brands and Mondelēz show strong growth. Packaging is becoming more innovative, with brands like Milka (Mondelēz) testing paper packaging.

Netherlands: A sophisticated chocolate market with growing opportunities for unique and ethical products

The Netherlands has a large cocoa market and chocolate industry. The country is the sixth-largest importer of chocolate and other food containing cocoa from cocoa-origin countries (Figure 6) including Mexico, Brazil, Malaysia, Nigeria and Ecuador (Figure 13). This diversity is reflected in the Dutch retail landscape, where even mainstream channels offer a wide range of chocolate products with different origins. This contributes to a growing consumer awareness of chocolate diversity and characteristics.

Dutch chocolate consumption blends traditional preferences with newer interests. While mainstream, affordable chocolate continues to be popular, there is a growing appreciation for premium, craft and ethically sourced products. Dutch consumers are known for their adventurous tastes. This openness to innovation is demonstrated by brands like Tony's Chocolonely. This brand combines unique flavours with a strong ethical mission focused on slave-free chocolate production.

Source: Amonarmah Consults; data from EUROSTAT

The Dutch confectionery market is expected to grow by 3.61% each year (CAGR 2024-2029). The Netherlands also offers opportunities for organic and Fairtrade chocolate products. Its organic retail sector is one of the only ones in Europe that expanded by 4.4% in 2022 compared to 0.9% in 2021. This growth is expected to continue. In contrast, many European countries experienced a decline. The growth experienced by the Dutch market can be partly connected to national initiatives. The market is also experiencing a slow shift towards more conscious consumption, driven by organisations like Into Choco and the Dutch FairChain Foundation. These organisations work to teach consumers about ethical chocolate consumption and support business models that ensure fair wealth distribution across the value chain.

Tips:

- There is a growing demand across European markets for premium, high-quality and ethically sourced chocolate. So, focus on unique qualities like single-origin cocoa, craft methods and sustainable practices to attract conscious consumers in countries like France, the UK and the Netherlands;

- Develop products that blend traditional and innovative flavours or include interesting textures. This strategy is effective in markets like Germany and the UK, where consumers enjoy experimenting with new chocolate experiences;

- With the rise of e-commerce, especially in Poland, you can invest in online platforms and digital marketing to showcase your products and brand story. This helps you skip past traditional retail barriers and improves brand control and customer relationships;

- Attend European chocolate trade fairs to showcase your products, network with industry professionals and understand market trends. It can be beneficial to work together with local chocolatiers, retailers or distributors, especially in Belgium, where local expertise helps with market entry.

4. Which trends offer opportunities or pose threats in the European chocolate market?

The European chocolate market is experiencing significant changes, driven by changing consumer preferences and technological developments. This section explores the key trends that are shaping the industry, including the rise in chocolate imports from developing countries, the growing demand for innovative and origin-specific flavours and the rapid increase in e-commerce as a distribution channel. These developments are creating new opportunities for both established players and newer brands in the chocolate sector. It is crucial for stakeholders who want to succeed in this changing market to understand these trends.

Increased importation of chocolate and other food preparations containing cocoa

The European chocolate import market shows promising opportunities for exporters from developing countries. The total import value of chocolate and other food containing cocoa, represented by HS code 1806, increased from approximately EUR 14 million in 2019 to nearly EUR 20 million in 2023 (Figure 14). This increase covers all subcategories (180620, 180631, 180632 and 180690), which suggests a strong and diverse market demand.

For exporters from developing countries, it is important to recognise that the European market has been very resilient. Even during the challenging year of 2020, import values remained stable and the market experienced fast growth after the COVID-19 pandemic. This resilience highlights the continuous appeal of chocolate products in Europe and the potential for continued market expansion.

Source: Amonarmah Consults; data from ITC TRADE MAP

Looking ahead, the European chocolate import market is expected to continue to grow. The demand for sustainable and ethically sourced products will continue to increase, as will continued interest in premium and craft chocolate. Health-conscious and functional chocolate products are also expected to become more popular.

Growing demand for chocolate and cocoa products from developing countries

While overall European imports of chocolate and cocoa products continue to increase, the proportion of imports from developing countries is also rising (Figure 15). Between 2019 and 2023, there was a consistent growth in imports of chocolate and cocoa products from developing countries, from about 90 thousand tonnes to nearly 120 thousand tonnes. This amounts to an increase of approximately 33% over five years. It reflects a growing preference in the European market for chocolate products sourced from developing countries.

Trade within the European Union (EU) experienced substantial growth from 2019 to 2022, peaking at around 3,750 thousand tonnes in 2022. However, there was a noticeable decline in 2023. EU imports from the rest of the world continued to be relatively stable, with a slight decline over the years. This suggests that while Europe continues to import chocolate from other developed countries, there is a slow shift towards increased imports from developing countries.

Source: Amonarmah Consults; data from EUROSTAT

Two main factors could be driving this trend. First, big chocolate companies are increasingly expanding their grinding facilities in cocoa-origin countries. Local governments of cocoa-origin countries are also encouraging a supportive environment to boost local processing and add value to their exports.

For instance, in the Ivory Coast, which is the leading cocoa producer, the government reduced export taxes on processed cocoa products for companies that expanded their facilities. Instead of a fixed rate of 14.6%, export taxes on cocoa butter were reduced to 11%, those on cocoa paste to 13.2% and those on cocoa powder to 9.6%. In Ghana, which is the second leading producer, there is a special area called the Ghana Free Zones, which allocated to processing companies. These companies receive benefits if they export at least 70% of their products, plus they are allowed to import raw materials and machinery without paying import taxes on these materials and machines. The private sector is also supporting local processors. For example, since 2018, GIZ has supported small factories in the Ivory Coast to process cocoa. These initiatives are also partly contributing to the increased share of chocolate products imported into Europe from developing countries.

Secondly, the sharp decline in trade within the EU from 2022 to 2023 may be partly connected to record-high cocoa bean prices in 2023. The high prices were driven by a supply shortage, influenced by factors such as climate change, the Russia-Ukraine war and an increasing demand for cocoa beans. The impact of rising cocoa bean prices has had a ripple effect, impacting both chocolate companies and consumers.

Other reasons are a growing interest in single-origin chocolate in Europe, which was explained earlier, low processing costs due to low labour costs and the need for large multinational companies to reduce their carbon emissions.

For chocolate and cocoa exporters from developing countries who are targeting the European market, this creates very encouraging opportunities:

- There is a clear and consistent increase in the demand for their products in the European market;

- The growth in imports from developing countries is stronger than the growth in imports from other sources (Figure 15), which suggests changes in preferences or supply chains;

Despite changes in trade within the EU, the demand for products from developing countries continues to be strong and growing.

These points suggest that this trend is likely driven by consumer preferences, rather than external economic factors.

Increased interest in chocolate with innovative flavours associated with origin

There is an increasingly diverse range of chocolate bars with unique ingredients on the European market. Chocolate bars with interesting flavour combinations have become mainstream. Examples include: Lavender & Caramel, Blueberry & Violet and Strawberry & Balsamic chocolate by Delicata and Hazelnut, Almond & Cranberry milk chocolate by Nestlé’s L’Atelier.

The origin of a chocolate product and the story around it are increasingly important in the craft chocolate segment. One way to position yourself in the European chocolate market is to combine your cocoa with innovative flavours associated with your origin.

Several successful chocolate brands have already successfully entered the market with their range of high-quality chocolate bars with unique local flavour combinations. Fu Wan Chocolate is an example of this. This chocolate maker from Taiwan offers a range of products with locally sourced ingredients or flavours. Examples include their chocolate with Taiwan Tie-Guan-Yin Tea or local Kaoliang Liquor. Other examples include the Pure Chocolate Company's bar with local jerk seasoning and Menakao’s chocolate bar with Madagascan vanilla.

E-commerce is growing Europe's chocolate market

Supermarkets and hypermarkets continue to dominate Europe's chocolate distribution, with nearly 80% of the market share in 2023, but online shopping is experiencing the most exciting developments. E-commerce has become the fastest-growing channel for chocolate confectionery, with projections suggesting an 18% value growth from 2024 to 2027.

This rise in online chocolate sales is driven by consumers' preference for convenience and Europe’s high internet usage rate, which was 89.7% of the population in 2022. The rise of e-commerce is reshaping the entire industry. Online platforms are making it possible for specialised chocolate shops to succeed.

This digital transformation is allowing smaller, innovative chocolate makers to reach wider audiences without wide physical retail networks. Ghanaian Decokraft, for instance, sells chocolate to the EU and other parts of the world through e-commerce. E-commerce is changing consumer behaviour, with more people willing to purchase premium chocolate online.

E-commerce is also driving innovation in packaging and delivery methods, with companies investing in temperature-controlled packaging and efficient logistics. As online sales become more popular, they are likely to drive further changes in the European chocolate market. The future of chocolate distribution in Europe appears to be a blend of established retail strength and innovative digital approaches, appealing to an increasingly diverse and discerning consumer base.

Mandatory sustainability regulations have become a key focus

Exporting chocolate to Europe requires meeting strict European Union sustainability regulations. Specifically, the EU Regulation on Deforestation-free Products (EUDR) and the Corporate Sustainability Due Diligence Directive (CSDDD). These measures aim to ensure that products are deforestation-free and meet high sustainability standards, to fit with the EU's goals of environmental preservation and ethical business practices.

The EUDR will be effective from December 2025 for large operators and from June 2026 for small businesses. It aims to stop the import of products linked to deforestation. It means that companies must ensure that cocoa and other regulated products do not come from land that was deforested after December 2020. Businesses must also provide geolocation data and show that they comply with sustainability requirements.

The CSDDD, which has been in effect since July 2024, requires businesses to implement due diligence processes that address any human rights violations and environmental impacts throughout their supply chains. The CSDDD will be phased in over a longer period. Companies with 5,000 employees and €1,500 million turnover will be impacted in 3 years. Companies with 3,000 employees and €900 million turnover will be impacted in 4 years. Companies with 1,000 employees and €450 million turnover will be impacted in 5 years. Companies must switch to ethical practices, promote the fair treatment of workers and farmers and make sure that their operations are environmentally sustainable.

Both of these regulations highlight the EU’s commitment to sustainable and responsible trade. For businesses that export chocolate, following these regulations does not only fulfil legal obligations but also fits with a growing consumer demand for ethically produced goods.

Tips:

- Explore current trends and developments in the European cocoa market by reading our study on Which trends offer opportunities or pose threats in the European cocoa market?

- For marketing and promotional tips, check out our study 10 tips on how to do business with European cocoa buyers;

- Increase your visibility with social media. Refer to Dame Cacao's series, which includes guides on:

- Visit the Cocoa of Excellence and Heirloom Cacao Preservation websites to learn about industry initiatives and awards that highlight cocoa diversity and quality. These can improve your storytelling and market appeal.

These tips are focused on chocolate, but they can be applied to cocoa products as well; - Visit the Cocoa of Excellence and Heirloom Cacao Preservation websites to learn about industry initiatives and awards that highlight cocoa diversity and quality. These can improve your storytelling and market appeal.

Amonarmah Consults carried out this study in partnership with Molgo Research and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research