Entering the European chocolate market

With growing concerns about protecting the planet and its people, it is becoming essential to follow mandatory sustainability standards to enter the European chocolate market. Consumers are also curious about how their food, including cocoa products, is sourced and produced. They are interested in cocoa products that are sustainably grown and prefer brands that offer clear traceability, from farm to finished product. Companies that welcome sustainable practices and ensure transparency in their cocoa supply chains are in a strong position to make use of this rising demand for ethically produced and environmentally responsible chocolate.

Contents of this page

1. What requirements and certifications must chocolate meet to be allowed on the European market?

In general, the requirements can be divided into:

- What are the mandatory requirements?

- What additional requirements and certifications do buyers often have?

- What are the requirements for niche markets?

What are the mandatory requirements?

You can only export chocolate to Europe if your company or business complies with strict European Union (EU) sustainability regulations. In the cocoa sector, two major regulations that drive sustainable change are the EU Regulation on Deforestation-free Products (EUDR) and the Corporate Sustainability Due Diligence Directive (CSDDD). These regulations aim to make sure that products that enter the EU market are deforestation-free and that companies in the supply chain meet thorough sustainability standards.

European Union Deforestation Regulation (EUDR)

The EU Regulation on Deforestation-free Products was officially adopted and entered into force on 29 June 2023.

It has 3 main goals:

- Stop products linked to deforestation from being sold in the EU;

- Reduce greenhouse gas emissions caused by deforestation by making sure products that enter the EU are deforestation-free, aiming for a yearly reduction of at least 32 million metric tonnes of carbon;

- Prevent global biodiversity loss.

The EUDR bans imports of cocoa products from land that was deforested after 31 December 2020 into the European Union (EU). All companies that import cocoa into the EU need to make sure their products did not cause deforestation. Companies must also provide data on the geolocation and legality of where their cocoa was grown.

The EUDR was set to apply from 30 December 2024. However, on 14 November 2024, the European Parliament approved a 12-month delay. It is now set for December 2025 for large operators and June 2026 for small and micro businesses. Large operators are companies with 250+ employees and over €50 million in annual turnover. Small businesses have fewer than 50 employees and an annual turnover below €10 million. Micro businesses typically have fewer than 10 employees and an annual turnover below €2 million.

The new timeline aims to ensure clear rules and stability and gives enough time for businesses to smoothly follow the regulation. It gives time for EU and non-EU countries, operators and traders to fully prepare for their due diligence obligations.

The EU Parliament also added a “no-risk” rating, which could mean that certain countries do not have to go through deforestation checks. The “no-risk” rating is part of the EU’s system for categorising countries based on their risk of deforestation. Countries are grouped as "high-risk," "standard-risk," or "low-risk" based on their deforestation record. A "no-risk" rating means that countries do not have to provide detailed information, such as geolocation data or harvest dates, for their exports. However, companies that source products from these countries must still provide basic proof of compliance if asked by EU authorities.

To qualify as "no-risk," a country must meet strict conditions:

- The country’s forest cover must remain stable or have grown since 1990;

- The country must actively support international agreements like the Paris Agreement and conventions protecting forests and human rights;

- The country must have transparent and strictly enforced forest conservation laws.

The EU will finalise and publish these risk categories before the new rules come into effect. For now, all countries are considered "standard-risk," meaning full due diligence is required for imports into the EU.

The Corporate Sustainability Due Diligence Directive (CSDDD)

On 24 April 2024, the European Parliament adopted the Corporate Sustainability Due Diligence Directive (CSDDD), a major regulation which aims to increase corporate accountability for human rights and environmental impact across global value chains. It entered into force on 25 July 2024. The CSDDD is also part of the European Union's wider strategy to encourage sustainable and responsible business practices, in line with the European Green Deal and the UN Sustainable Development Goals.

The CSDDD sets common sustainability standards for all EU member states and it applies to both EU-based companies and non-EU companies operating within the EU market. The CSDDD means that companies must implement due diligence processes to identify, prevent, lessen and account for negative impacts on human rights and the environment throughout their operations and supply chains.

The CSDDD will be phased in over a longer period. Companies with 5,000 employees and €1,500 million turnover will be impacted in 3 years. Companies with 3,000 employees and €900 million turnover will be impacted in 4 years. Companies with 1,000 employees and €450 million turnover will be impacted in 5 years. EU member states have two years to put the directive into national law, so that they can adapt to their local contexts while maintaining EU-wide standards.

For businesses that export chocolate to the EU to comply with the CSDDD, they need to set up codes of conduct on:

- business ethics;

- social responsibility, including the fair treatment of workers and farmers and ensuring living incomes;

- environmental responsibility, addressing issues such as carbon neutrality, biodiversity preservation and the prevention of deforestation.

These codes of conduct will act as guiding principles for business operations and will be important for businesses to show that they are following the CSDDD requirements. When the CSDDD comes into force, it is expected to significantly influence global supply chains and business practices by encouraging a more sustainable and equal approach to international trade and corporate operations.

Other mandatory requirements for chocolate

- General Food Safety: European Union regulations ensure the safety of chocolate entering the market. Exporters must follow the General Food Law (Regulation (EC) 178/2002). Hygiene standards, like those set out in Regulation (EU) 2017/625, are very important for maintaining food safety throughout the supply chain. These regulations aim to prevent contamination and ensure that only safe, high-quality cocoa products reach European consumers. Products from countries that repeatedly do not comply with these standards are put on a list that is included in the Annex of European Commission Implementing Regulation (EU) 2019/1793;

- Contaminants: Several contaminants are regulated in cocoa products, based on advice from the European Food Safety Authority (EFSA). These include heavy metals (like cadmium), pesticide residues, mycotoxins (like ochratoxin A), polycyclic aromatic hydrocarbons (PAHs), microbes and foreign matter;

- Extraction: Solvents Directive 2009/32/EC regulates the use of extraction solvents in food production. For cocoa, there is a maximum residue limit of 1 mg/kg of 2-methyloxolane in cocoa butter extraction. This solvent is commonly used in the production or fractionation of fats, oils or cocoa butter;

- Labelling requirements: Labelling rules make sure that consumers receive essential information;

- Packaging requirements: Although no specific chocolate packaging regulations exist, all food packaging must follow Regulation (EC) no. 1935/2004 on food contact materials;

- Payment and delivery terms: A proposed rule suggests a 30-day maximum for all food products. The EU's Access2Markets website provides detailed information about taxes, rules and other factors affecting trade, including specific details for chocolate (HS code 1806);

- Import tariff on chocolate: European countries have different import tariffs for chocolate depending on the producing country’s status in terms of the generalised system of preferences (GSP), economic partnership agreements (EPAs) or bilateral trade agreements. To see if your country falls under one of these schemes, consult the list of trade agreements on Access2Markets. The standard third country tariff applicable to chocolate imports is 8.30% + EA (Agricultural Component) MAX 18.70% + ADSZ (additional duty on sugar contents);

- Intellectual property rights: The EU, as a signatory to the TRIPS agreement, offers protection for various types of intellectual property that are relevant to cocoa producers. These include patents, trademarks and geographical indications, which can be very important for protecting unique cocoa varieties or processing methods. For example, the Trinidad and Tobago Fine Cocoa Company (TTFCC) has used IP rights to protect their brand and verify claims of origin and quality.

Tips:

- Activate the “Translation” function in your browser to make the studies available in your native language;

- For a complete overview of cocoa bean standards, check our study on Buyer requirements for cocoa. You can also find specific requirements on the European Commission's Access2Markets website;

- Learn how to maintain chocolate quality during transportation on the Transportation Information Service website;

- Go beyond legal requirements when designing your packaging. High-quality chocolates are often sold in smaller packages (50 to 100 grams). Read this article by the Chocolate Journalist for tips on creating attractive, premium packaging;

- For details on payment and delivery terms, see our study on Organising your cocoa export to Europe.

What additional requirements and certifications do buyers often have?

Food safety certification is not mandatory under European legislation. However, given the legal guidelines for food hygiene safety and traceability, distributors and importers will likely request extra food safety guarantees from you. A system based on Hazard analysis and critical control points (HACCP) is often a minimum standard required. Also, Good Manufacturing Practices (GMP) are the basic operational and environmental conditions required to produce safe foods.

Quality criteria

European buyers assess cocoa quality through various methods, including sensory evaluations (to check taste and aroma), chemical analyses and physical inspections (to evaluate bean size, shape and defects). It is very important that you meet these thorough standards to achieve a competitive edge on the European market. The guide Cocoa Beans: Chocolate & Cocoa Industry Quality Requirements provides recommendations on cocoa growing, post-harvest practices and quality evaluation methods that contribute to cocoa quality.

The quality requirements for cocoa beans are also explained in our study on European market requirements for cocoa beans: Quality criteria. Besides flavour, the quality of speciality cocoa is also related to the uniqueness and rareness of the origins of specific varieties.

Chocolate makers and cocoa traders often use different methods to assess cocoa quality. These methods are based on international cocoa standards such as:

- ISOs: Standards on classification and sampling for cocoa beans;

- The Fine Cacao and Chocolate Institute (FCCI): Check their website and contact FCCI for their sampling protocol and grading form;

- Heirloom Cacao Preservation’s genetic evaluation of cocoa to identify and value cocoa and its flavour;

- Equal Exchange/TCHO’s quality assessment and tasting guide to assess the quality of cocoa along the value chain.

In addition, a workgroup of the Cocoa of Excellence Programme, which is coordinated by The Alliance of Bioversity International and CIAT, has launched the International Standards for the Assessment of Cocoa Quality and Flavour website. Here, you can download the protocols on the quality standards.

The protocols outline how to: 1) sample cocoa beans; 2) check their physical quality; 3) process them into powder, liquor and chocolate; and 4) evaluate their flavour. These standards were created to help suppliers understand buyer assessments of quality and flavour diversity. This understanding helps suppliers to improve quality in their supply chain.

Supplier Code of Conduct

As a supplier, you may be affected by various codes of conduct that require you to commit to responsible business practices. This includes following local laws related to the environment and labour, as well as avoiding involvement in issues like corruption and child labour. Your buyer may also assess these factors during their audits (checks) of your company.

In addition to codes of conduct, European buyers will expect you to meet their standards regarding corporate social responsibility (CSR). It is very important that you comply with these expectations to maintain a positive relationship with your buyers and make sure your products meet market demands. Buyers may want you to comply with their own Code of Conduct or another one based on external initiatives, such as the Business Social Compliance Initiative (BSCI) or Sedex Members Ethical Trade Audit (SMETA). These standards are most commonly used by large-scale importers and retailers. Examples are the Barry Callebaut Supplier Code of Conduct, the Ofi Supplier Code of Conduct and the Cargill Supplier Code of Conduct.

Some examples of these codes of conduct from retailers are:

- Coop (Switzerland): Action, not words – sustainability at Coop;

- Ahold Delhaize (Netherlands/Belgium): Sustainable Retailing;

- Carrefour (France): Corporate Social Responsibility.

Examples of corporate social responsibility strategies from importers, cocoa processors and chocolate manufacturers are:

- Nestlé: Nestlé Cocoa Plan;

- Mars: Sustainable in a Generation Plan;

- Ferrero: Corporate Social Responsibility;

- Mondelez: Cocoa Life;

- Cargill: Cocoa Promise;

- Barry Callebaut: Forever Chocolate;

- Lindt & Sprüngli: The Farming Program;

- Olam: Cocoa Compass.

Sustainability certification

In the EU, buyers sometimes ask for certifications for voluntary programmes like Fairtrade or Rainforest Alliance. These certifications show that your chocolate and cocoa products are made responsibly, with fair work and care for the environment.

You can read the guide for farmers on how to get Rainforest Alliance certified. If you are an exporting company, read this guide for companies on how to get supply chain certification. In June 2020, the Rainforest Alliance published its new certification programme for companies.

Fairtrade standards also focus on how your business treats people in the supply chain. Once you have been certified by an independent third party, you can use a Fairtrade logo on your product.

Buyers may also require certification recognised by the Global Food Safety Initiative schemes, especially those like:

- British Retail Consortium Global Standards (BRC);

- International Featured Standards: Food (IFS);

- Food Safety System Certification (FSSC 22000).

For example, in addition to mandatory food safety requirements, Niche Cocoa Industry Limited, a Ghanaian chocolate company, holds key certifications across several areas. For food safety, they are certified with ISO 22000 and FSSC 22000 and follow HACCP protocols. For environmental and occupational health, they follow ISO 14000 and ISO 14001 standards. Locally, they follow Ghana's Food and Drug Authority (FDA) and Ghana Standards Authority (GSA) regulations. Additionally, sustainability certifications like Rainforest Alliance and Fairtrade confirm their commitment to fair wages, worker welfare and environmental protection. These certifications show their dedication to quality, sustainability and meeting both local and international standards and make them able to meet European market standards.

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative website to learn about the different food safety management systems, hygiene standards and certification schemes;

- Read this article about the importance of branding and packaging according to craft chocolate shops around the world;

- Think about making your own set of rules for how you do business. Buyers might not always ask for this. But it could be a good way to show them how you care about doing things right. It might also make you more noticeable when buyers are picking suppliers;

- Ask your buyers or possible buyers exactly what type of certification they require from you.

What are the requirements for niche markets?

If you're looking to enter a specific niche market, it is essential to meet the unique requirements set by individual buyers. These requirements can vary significantly from one buyer to another. By fulfilling these additional criteria, you can improve your value proposition and your chances of success in the market. Organic is a niche market for chocolate.

Organic

In order to market your chocolate as organic on the European market, it must comply with the European Union’s regulations on organic production and labelling. Getting the EU organic label is the minimum legal requirement for marketing organic chocolate in the EU.

To become organic certified, you can expect a yearly inspection and audit (check), which aims to make sure that you follow the rules on organic production and/or handling and processing. If you do not grow your own cocoa beans yourself, you must make sure that your suppliers are organic certified according to the EU regulation. Other raw materials used in your chocolate, such as sugar and dried fruit, must also be organic certified and comply with the EU regulation.

Note that all organic products imported into the EU must have the correct electronic Certificate of Inspection (COI). These COIs must be issued by control authorities before a shipment is sent. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. COIs can be completed using the European Commission’s electronic Trade Control and Expert System (TRACES).

In addition to organic certification, Demeter might be an interesting certification for your product. This certifies biodynamic farming; it is limited to small niche segments but is experiencing increased interest in markets like Germany and Switzerland.

Halal and Kosher

The European halal and kosher food and beverage market is growing quickly. These products are now valued not only for their religious importance but also for their cleanliness, reliability and health benefits. Countries like France are seeing halal products move beyond traditional shops into mainstream supermarkets and restaurants, which is further driving market growth. In the UK, retail chains such as Tesco, Sainsbury's, Marks & Spencer and Waitrose sell halal food, including confectionery. Niche Cocoa Industry Limited is making use of the growing demand by following religious and cultural compliance, such as halal and kosher certification.

To market your chocolate as halal or kosher in the EU, you need to meet the specific certification standards for these dietary laws. For halal certification, your products must avoid non-halal ingredients like alcohol or certain animal fats, and raw material suppliers should also be halal certified. Certification includes facility inspections and ingredient checks, often followed by regular audits. In Europe, several certification bodies oversee halal products. These include the Halal Monitoring Committee (HMC) in the UK, La Grande Mosquée de Paris in France and Halal Control (HC) in Germany.

For kosher certification, your products must exclude non-kosher ingredients and comply with strict production and ingredient handling processes. Certification involves inspecting facilities, equipment and packaging and a trusted kosher symbol is necessary for consumer trust. Organisations like the European Kosher Organisation can provide guidance.

Tips:

- Read this article (in Dutch) to understand the risks of not registering your chocolate in TRACES on time;

- If you are organic certified, consider visiting trade fairs for organic products. The largest in Europe is Biofach in Germany. Visit their website for details on exhibitions, seminars and events;

- Learn why some tree-to-bar makers choose not to get certified. For example, see page 12 of this report to find out why Marou opted against organic and Fairtrade certification;

- Use the EU’s list of recognised control bodies and authorities to ensure you work with an accredited certifier.

2. Through which channels can you get chocolates on the European market?

The European chocolate market is a complicated and changing ecosystem, with various channels for different consumer segments. Understanding these channels is crucial for any business looking to enter or expand in this market.

How is the end market segmented?

The European chocolate market can be divided into several distinct segments. These are the mass market segment, the premium segment, the organic and ethical segment and the artisanal and craft segment. The segments are based on quality, price and consumer preferences.

Mass market segment: This is the largest segment by volume. It includes affordable chocolates available in supermarkets and convenience stores. Brands focus on wide appeal and compete mainly on price, though this segment has seen slower growth compared to premium options.

Premium segment: This segment is growing significantly, with the global premium chocolate market generating USD 34.18 billion in 2023 and projected to grow at a CAGR of 9.26% from 2024 to 2033. It features higher-quality ingredients, such as single-origin cocoa and unique flavour combinations, and is sold in speciality stores and online. Growth is driven by consumer interest in quality and unique taste experiences.

Organic and ethical segment: This segment appeals to environmentally aware consumers, focusing on chocolates that are organic or Fairtrade certified. The growth of this segment reflects a wider trend toward ethical consumption and transparency in supply chains.

Artisanal and craft segment: Although it has a smaller market share, this segment is growing fast. It is characterised by small-batch production and unique flavours, and is often sold in boutique shops and farmers' markets. Events like Salon du Chocolat and Chocoa showcase these products, appealing to chocolate connoisseurs who are looking for local experiences.

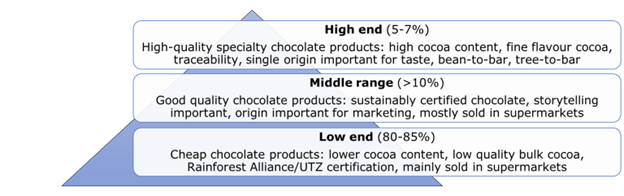

These segments can also be re-grouped in low-end, middle range and high-end segments (Figure 1).

Figure 1: Segmentation of the chocolate market based on quality

Source: ProFound

The low-end segment is for cheap chocolate, usually with lower cocoa content. Most of these products are produced by large chocolate manufacturers. Rainforest Alliance certification is common for this segment. Consumers buy the products as conventional chocolate brands or as private label chocolate in supermarkets. It is not as common for low-end chocolate to be made at the origin as it is for mid-range or premium products in European markets. This is because origin-made chocolates typically emphasise unique flavour profiles, sustainability or ethical practices, which fit more with mid-to-high-end market positioning.

Examples of multinational brands in the confectionery category (Figure 2) are KitKat, Smarties and Rolo (Nestlé), Mars, Snickers and M&M (Mars), Cadbury and Milka (Mondelēz), Kinder (Ferrero) and Reese’s (Hershey).

Figure 2: A selection of low-end segment chocolate made by multinational brands

Source: Photo by Denny Müller on Unsplash

The middle-range chocolate segment is characterised by products of higher quality, often made with certified cocoa. Storytelling plays a key role here, particularly focusing on the origin of the cocoa beans. Cocoa beans used for this segment are often sourced in bulk at mainstream quality. The final chocolate quality is influenced by the production process and the proportion of cocoa in the product, as well as the quality of non-cocoa ingredients used.

Examples of major brands in the middle-range segment (Table 4) include Lindt (Lindt & Sprüngli), Côte d’Or (Mondelēz), Ritter (Ritter Sport) and L’Atelier (Nestlé). Tony’s Chocolonely, a Dutch brand, is also a prominent player in this category.

Table 3: Examples of mid-range segment chocolates sold at Albert Heijn (Dutch retailer) in 2024

| Product | Retail price | Retail price per kg | Packaging |

|---|---|---|---|

| Lindt Excellence 70% dark (100 grams) | EUR 2.99 | EUR 29.90 |

|

| Côte d'Or L'original milk chocolate bar (200 grams) | EUR 3.29 | EUR 16.45 |

|

Source: Albert Heijn (September 2024), Photos: Long Run Sustainability

The high-end chocolate market focuses on premium chocolates made by small, specialised makers. These chocolates use fine-flavoured cocoa varieties like Criollo, Trinitario and sometimes Forastero. They stand out for their high cocoa content and the use of single-origin cocoa beans, which improve both the taste and traceability of the product. Single-origin cocoa ensures that buyers know exactly where the cocoa beans came from, unlike blended cocoa. Examples of high-end chocolates include bean-to-bar and tree-to-bar products, which emphasise quality, craftsmanship and unique flavour profiles.

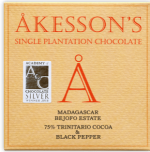

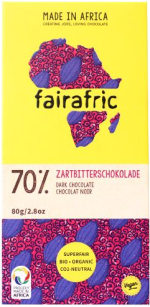

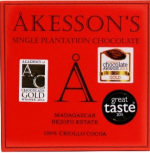

Examples of mid-range and high-end segment chocolates made at origin (Table 4) on the European market include Akesson's (in Madagascar, Brazil and Indonesia) and Fairafric (in Ghana). These can be found in shops such as Cocoa Runners and Violey.

Table 4: Examples of mid-range and high-end segment chocolates sold on the European market

| Product | Retail price | Retail price per kg | Packaging |

|---|---|---|---|

| 75% Trinitario cocoa & black pepper | EUR 6.45 | EUR 107.50 |

|

| Fairafric 70% organic dark chocolate | EUR 4.06 | EUR 50.75 |

|

| 100% Madagascar Criollo cocoa organic chocolate | EUR 6.90 | EUR 115.00 |

|

Fairafric 92% organic dark chocolate | EUR 4.06 | EUR 50.75 |

|

High-end products are mainly sold at chocolate events and in specialist shops. Examples of specialist webshops in Germany include Chocolats de Luxe, Feine Schokolade and Schoko und Rum.

Through which channels does chocolate end up on the end market?

Chocolate from cocoa-producing countries reaches the European market through several key channels. These involve different actors and processes.

Importing distributors

European chocolate distributors, such as ClearChox and High Five Company (the Netherlands), Club del Chocolate (Spain) and Cocoa Runners (the United Kingdom), specialise in high-quality chocolate. This is a common entry channel where distributors buy and sell various chocolate types, from bean-to-bar made in Europe to tree-to-bar made in origin countries. They have thorough market knowledge and a wide retail network, typically consisting of specialised shops. Importing distributors handle logistics, storage, marketing and customer support. They are ideal for accessing a wide network of specialised shops, as direct sales to these shops are uncommon due to small ordering quantities and frequent deliveries.

Integrated distributors

Integrated distributors operate with a registered company in a cocoa-producing country and a subsidiary in Europe. Examples include Meybol Cacao (Peru/Germany), MIA (Madagascar/UK) and Fairafric (Ghana/Germany). These companies coordinate cocoa production and chocolate making with importing and marketing activities in Europe, which makes efficient planning possible based on market demand. They also provide local distribution and customer support, making them ideal for companies with strong partners and existing market presence.

Private-label chocolate making

Some chocolate exporters enter the European market by producing chocolate for European brands. This requires exporters to follow the brand’s specifications for packaging and quality, alongside high food safety standards. Companies like Ecuatoriana de Chocolates (Ecuador) and Machu Picchu Foods (Peru) are examples of this model. Also, companies like Niche Cocoa Industry in Ghana make chocolate for MIA brands in the UK and Kanda chocolate in the USA. Private-label manufacturing makes scalability, reduced marketing costs and access to an existing consumer base possible, which makes it appealing for companies with strong processing capabilities and consistent quality.

What is the most interesting channel for you?

Most chocolate in Europe is made by European companies and sold in various shops and supermarkets. Chocolates from cocoa-producing countries, however, are not often found in these mainstream stores. Instead, they usually reach Europe through smaller or alternative markets. Companies entering Europe use different channels based on their product supply, business model and market connections to find the best way to reach customers. Below, we will show you the channels that are most interesting for you to explore.

Explore partnerships with local chocolate producers in your country who export to Europe

This channel involves chocolate manufacturers in your country who create finished products for the European market. This makes it possible to create greater value addition at the origin, which leads to higher returns for these countries. Examples of these companies include:

- Malagasy from Madagascar, known for its high-quality chocolate bars;

- Pacari from Ecuador, known for its organic tree-to-bar chocolates;

Menakao from Madagascar.

Find a European representative or an agent

Chocolate makers who are entering the European market benefit from partnering with local experts. Agents can help you to find and assess possible buyers and they represent exporters' interests and help with communication. Their fees typically include 5% to 10% commission on sales, excluding additional costs like listing or marketing fees.

In some cocoa-producing countries, processors work together with European-based representatives. These can be branches of the same company located in Europe or independent agents or sellers based in Europe. For example, Belgian-based Luker Chocolate Europe works with Colombian Casa Luker, while Dutch-based Cocoa Supply Company supports the Ecuadorian Cocoa Supply. Other examples are Meybol Cacao (Peru/Germany), MIA (Madagascar/UK) and Fairafric (Ghana/Germany).

Selling directly to large retailers or other specialised outlets in Europe is not common

Direct sales to European retailers or speciality shops are uncommon. Retailers prefer large brands with substantial production capacities. Smaller shops often find it uneconomical to import directly. Instead, they source from importing distributors like ClearChox and High Five Company (the Netherlands), who offer a wide range of products to choose from. Other examples of European chocolate shops include Schokov Shop (Austria), Chocolats De Luxe (Germany) and Craft Chocolate Shop (Netherlands).

Tips:

- Join award shows to boost your market visibility and test your products. Key events include the International Chocolate Awards, the Academy of Chocolate and the AVPA International Contest: Chocolates processed at Origin;

- Attend European trade fairs to connect with possible buyers. Notable events are Salon du Chocolat (France) and Chocoa (Netherlands). Fairs with a wider focus, like Biofach (Germany, for organic products), Nordic Organic Food Fair (Sweden) and the Speciality and Fine Food Fair (UK), are also worthwhile to check out, although they focus on various high-quality products, not just cocoa or chocolate. These events, either in person or online, can also help you understand European buyer preferences, such as origin, flavour and sustainability certifications;

- Build long-term relationships with representatives in Europe. This will make you more competitive, reduce market risks, improve product quality and help balance quality with price. For more insights, read our study on doing business with European cocoa buyers. Also, see our study on finding buyers on the European cocoa market for more tips on finding the right buyer for your cocoa beans.

3. What competition do you face on the European chocolate market?

The European chocolate market is highly competitive, with lots of cocoa-producing countries all competing for a market share. Key competitors include large multinational companies and established European chocolate makers. Other competitors are chocolate makers in top cocoa producing countries, as well as countries with better access to unique and high-quality raw materials. Processing in these countries is dominated by large multinational companies.

Which countries are you competing with?

Out of all the cocoa origins that export chocolate and other food containing cocoa (HS 1806) to Europe, the Ivory Coast is the largest exporter by far (Figure 4). They are followed by Colombia, Peru and Malaysia, which are also significant players in their regions, each with unique strengths like fine flavour cocoa, organic certifications and advanced processing capabilities.

Source: Amonarmah Consults; data from EUROSTAT

Ivory Coast is your biggest competitor

In 2023, the Ivory Coast exported about 48 million kilograms of chocolate and other food containing cocoa (HS 1806) to Europe. This highlights its dominance in cocoa production due to its favourable climate and strong farming tradition. The industry in the Ivory Coast is shifting towards sustainability and local chocolate production, which is encouraged by government support and rising demand within the country itself.

However, challenges like climate change and changing global cocoa prices bring risks to chocolate production and profits. Key players, including Cemoi Côte d'Ivoire and Societe Nouvelle Chocodi, are contributing to changing the value addition in the sector under the supervision of the Conseil du Café-Cacao.

Colombia is the largest Latin American cocoa-origin exporter

Colombia is the second-largest exporter of chocolate and other food containing cocoa (HS 1806), at 1.28 million kilograms, largely due to its fine flavour cocoa varieties, which come from particular regions like Tumaco. The country focuses on speciality and organic production, which is supported by the NATIONAL FEDERATION OF CACAOTEROS. This organisation promotes Colombian cocoa as high-quality and sustainable in international markets.

Despite these strengths, there are still challenges, including competition from well-established international brands and the continued impact of historical internal conflicts in key cocoa-growing regions. However, local chocolate makers are increasingly focusing on premium and speciality markets by making use of the country’s diverse cocoa varieties. Companies like Casa Luker highlight these unique qualities, helping Colombia to establish a reputation for premium cocoa. Also, there is a growing tourism industry, which offers opportunities to market Colombian chocolate through unique experiences.

Peru is third largest cocoa-origin exporter to Europe

Peru ranks third, exporting 1,026,794 kg of chocolate and other food containing cocoa (HS 1806) (Figure 4). The country is well-known for its organic and Fairtrade cocoa production. Government programmes and support from NGOs help farmers expand their farms. However, expanding cocoa farms can lead to deforestation, which harms the environment as well as cocoa and chocolate production in the future. Recently, Solidaridad has coordinated innovative pilot programmes to preserve forests and support small-scale cocoa producers. Peru also focuses strongly on fine cocoa, with local producers working to grow this specialised market. This gives chocolate makers in Peru an advantage in making and exporting speciality chocolate.

Chocolate makers in Peru are exploring new flavours and products to meet different consumer tastes. Peru's Cocoa and Chocolate Salon has become an important platform for showcasing Peruvian chocolate to international buyers. Therefore, Peruvian chocolate is recognised globally, opening doors for more exports. Machu Picchu Foods is a major Peruvian cocoa processor and chocolate manufacturer. The company focuses on high-quality cocoa products and serves international markets in over 40 countries. It encourages sustainability by working with farmers on ethical practices and supporting community initiatives, to position itself as a leader in Peru's cocoa industry.

Malaysia is the largest cocoa-origin exporter in Asia

Malaysia is the fourth largest cocoa-origin exporter of chocolate and other food containing cocoa (HS 1806) to Europe. At 873,723 kg, Malaysia is a significant player in the Asian cocoa market (Figure 4). The Malaysian Cocoa Board has been very important in developing the country's cocoa industry, focusing on improving quality and productivity.

Malaysia's strength lies in its cocoa processing capabilities. Also, there is a rising interest in locally made chocolate brands that focus on local flavours and ingredients. However, the industry in Malaysia strongly depends on cocoa imports, making it vulnerable to global supply chain disruptions. Malaysian chocolate makers are also working with the global halal market by offering certified products. For instance, Guan Chong Berhad, one of the largest chocolate makers in Asia, offers halal certified products.

Which companies are you competing with?

Chocolate exporters from developing countries face competition from both large multinational corporations and smaller, specialised European chocolate makers. Here's an overview of the key competitors:

Large multinational corporations

Barry Callebaut: Based in Switzerland, Barry Callebaut is the world's leading manufacturer of high-quality chocolate and cocoa products. They supply to many of the world's famous chocolate brands and are known for their innovation in chocolate production;

Mondelez International: This American multinational company owns several popular chocolate brands, including Cadbury, Toblerone and Milka. They have a strong presence in the European market and source cocoa from various developing countries;

Nestlé: Another Swiss giant, Nestlé produces a wide range of chocolate under brands like KitKat and Aero. They have a global sourcing network and a significant market share in Europe;

Ferrero: This Italian company, known for brands like Ferrero Rocher and Nutella, is one of the largest chocolate manufacturers in Europe. They have been increasing their focus on sustainable cocoa sourcing;

Lindt & Sprüngli: This is a Swiss company famous for its premium chocolate. They compete in the high-end chocolate market and have a strong presence across Europe.

European specialty chocolate makers

Valrhona: This is a French premium chocolate manufacturer known for its high-quality, single-origin chocolates. They work closely with cocoa producers in developing countries;

Chocolat Bonnat: This is another French chocolatier specialising in single-origin chocolates. They're known for their bean-to-bar approach and direct trade practices;

Domori: This is an Italian chocolate maker focused on preserving rare cocoa varieties. They work directly with cocoa farmers in several developing countries;

Original Beans: This is a Dutch chocolate maker with a strong focus on sustainability and conservation. They source directly from cocoa farmers in various countries.

Bean-to-Bar chocolate makers

There is also a growing movement of smaller, artisanal "bean-to-bar" chocolate makers across Europe. These companies often:

- source their cocoa beans directly from farmers in developing countries;

- focus on small-batch production;

- focus on the unique flavour profiles of single-origin cocoa.

Examples include Original Beans and Chocolatemakers in the Netherlands, Pump Street Chocolate in the UK and Friis-Holm in Denmark.

Private label manufacturers

Many European retailers have their own private label chocolate brands. These include:

- Bellarom (Lidl's chocolate brand);

- Choceur (Aldi's chocolate brand);

Tesco Finest (Tesco's premium chocolate range).

These private label brands often compete on price while still maintaining quality, which puts pressure on both multinational and artisanal chocolate makers.

Tips:

- To succeed as a chocolate exporter, it is essential to study your possible competitors. Analyse their business models, product offerings and highlighted characteristics, including their ingredients and origins. Research how they market their cocoa beans and relationships with cocoa-growing communities, as well as any awards they’ve received. Look at their websites for insights into their processing techniques and sustainability practices. Understanding these elements can help you find your unique selling point and make your product stand out on the market;

- Actively promote your company through your website and by participating in trade fairs;

- Discover more about fine cocoa-producing countries by exploring their profiles on the Make Mine Fine website, an initiative by the Fine Chocolate Industry Association.

Which products are you competing with?

Chocolate exporters from developing countries face competition from a range of products in the European market. These include traditional chocolate from established European manufacturers, as well as newer alternative and healthier options.

Traditional European chocolate

European chocolate makers are known for their high-quality products and skilled craftsmanship, which are supported by strong brand recognition and wide distribution networks. However, they can appear less exciting compared to origin chocolates, which offer unique flavours and a direct connection to the regions where the cocoa is grown. To stay competitive, European brands are using sustainable practices and exploring trends like single-origin and plant-based chocolates. These approaches open up opportunities to enter newer markets and create innovative products that fit with changing consumer preferences. Meanwhile, the rising popularity of origin chocolates, which appeal to consumers who are looking for authenticity and local sourcing, presents a growing challenge and also an opportunity for businesses like yours to stand out by focusing on these values.

Plant-based chocolate alternatives

The market for plant-based chocolate alternatives is growing quickly, driven by health, environmental and ethical concerns. Products like Vego bars and LoveRaw M:lk Choc Bars are gaining popularity. These alternatives offer dairy-free options but may miss out on the creamy texture of traditional milk chocolate. The plant-based chocolate market is expected to continue growing, which brings both a threat and an opportunity for innovation in the chocolate industry.

Tips:

- Focus on origin and uniqueness: Highlight specific cocoa varieties, terroir (crop environmental factors) and traditional production methods. This can set your product apart from mass-produced European chocolates and attract consumers who are interested in authenticity and exotic flavours;

- Focus on sustainability and ethical production: Many European consumers are concerned about the environmental and social impact of what they buy. Emphasise Fairtrade practices, sustainable farming and direct relationships with cocoa farmers to appeal to conscious buyers;

- Explore collaborations and co-branding: Partner with European chocolatiers or brands to create unique, limited-edition products. This way, you can make use of established distribution networks while showcasing the unique qualities of your cocoa.

4. What are the prices of chocolate on the European market?

The European chocolate market has experienced significant price changes in recent years. This analysis examines the current price trends, value chain breakdowns and future projections for the European chocolate market.

As of 2024, chocolate prices in Europe have seen a notable increase. This price rise is largely connected with the rising costs of cocoa. For instance, in April 2024, cocoa prices rose to a record high of USD 12,261 per tonne, marking an impressive 190% annual increase.

Price trends for chocolate in Europe over the past five years have shown a clear upward growth:

- 2019-2020: Prices stayed relatively stable, with only minor changes;

- 2021-2022: Notable increases began, largely driven by supply chain disruptions due to the COVID-19 pandemic;

- 2023-2024: Sharp price rises occurred due to record-breaking cocoa prices and wider inflationary pressures across the economy.

This is consistent with the analysis of the trend of the average price of all chocolate and other food containing cocoa (1806) imported into Europe (Figure 5 and Figure 6).

Source: Amonarmah Consults; data from ITC TRADE MAP

Note: Data is based on the import volumes and euro values of inward flows. The ratio of the euro value to the imported volumes gave the euro unit value.

Source: Amonarmah Consults; data from ITC TRADE MAP

Note: Data is based on the import volumes and euro values of inward flows. The ratio of the euro value to the imported volumes gave the euro unit value.

In addition to rising cocoa prices, sugar prices have also contributed to the increase in chocolate prices. The FAO Sugar Price Index experienced a notable increase in September, rising by 10.4% from August 2024 to average 125.7 points. This increase was mainly driven by concerns over fewer global supplies expected for the 2024/25 season, which could significantly impact chocolate production costs.

In the short-term outlook (1-3 years), chocolate prices are expected to continue to rise. They are likely stay high due to ongoing supply challenges and increasing transport costs. Market indicators suggest a strong trend, with projections pointing to a third consecutive cocoa supply deficit for the 2024-25 marketing year beginning in October 2024.

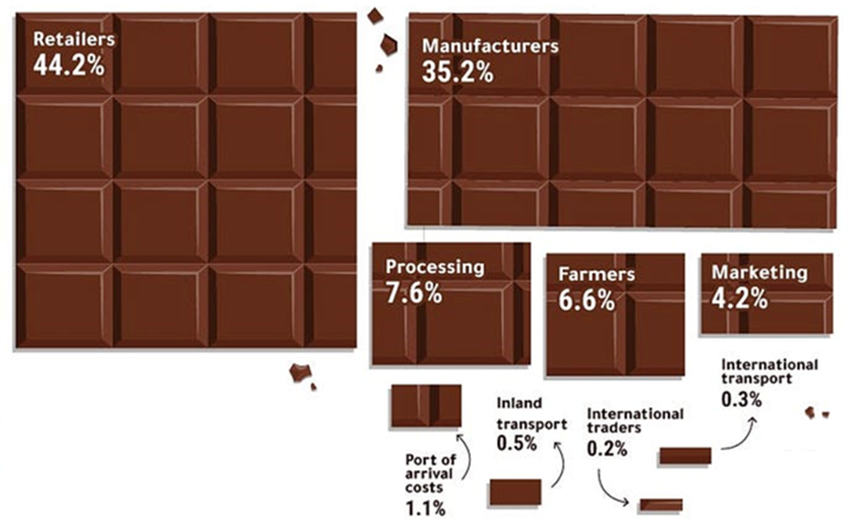

In the long term, the direction of the price remains uncertain, but several factors are likely to keep prices above historical averages. These include the ongoing impact of climate change on cocoa farming, rising demand from newer markets and an increasing industry focus on sustainable cocoa production methods. Meanwhile, the value distribution across the chocolate supply chain seems to remain unchanged (Figure 7). Most of the cost is passed on to consumers. Farmers are also not benefitting from high cocoa prices and rising chocolate prices. The chart below represents the rough value distribution in the chocolate supply chain based on industry reports. It is important to note that these percentages can differ depending on the product, brand and market segment.

Figure 7: Share of the value of chocolate among the value chain actors

Source: World Economic Forum

Tip:

- Visit the International Cocoa Organization (ICCO) website to get regular updates on cocoa prices, which heavily influence chocolate prices. Eurostat also offers consumer price indices for food products, including chocolate. Both websites offer free access to valuable information.

Amonarmah Consults carried out this study in partnership with Molgo Research and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research